Fluoropolymer Coating Market Outlook:

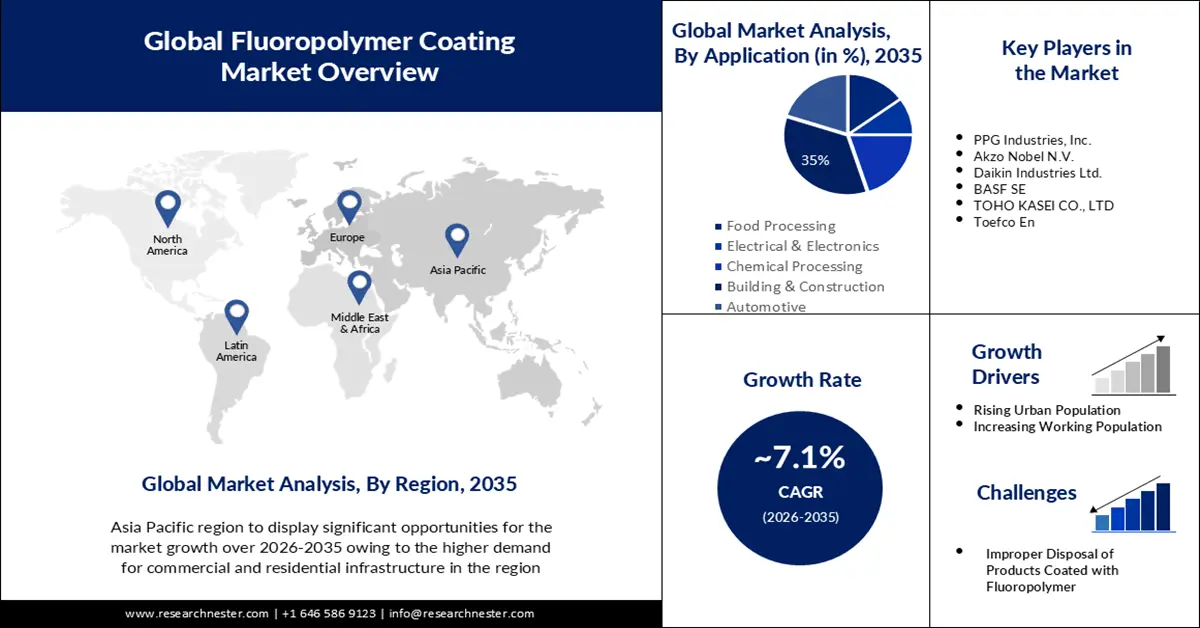

Fluoropolymer Coating Market size was over USD 3.17 billion in 2025 and is anticipated to cross USD 6.29 billion by 2035, growing at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fluoropolymer coating is assessed at USD 3.37 billion.

The market growth is due to increasing demand for fluoropolymer coatings in the food sector. Additionally, high-performance fluoropolymers are essential for use in food and beverage industry applications to provide a safe and effective manufacturing environment. For instance, fluoropolymers play an important role in extending the life of various items such as flexible plastic food packaging. According to research, flexible plastic packaging makes up more than 28% of total global packaging.

Other factors that are expected to drive the growth of the fluoropolymer coatings market include its increasing use in paints. Fluoropolymer coatings help improve the longevity of paints, sealants, and adhesives with their desirable combination of weather ability, corrosion resistance, chemical inertness, flame retardancy, non-stick properties, and low friction. Such as fluoropolymer coatings have high dielectric constants. It can extend both the paint interval and the life of the exterior paint.

Key Fluoropolymer Coating Market Insights Summary:

Regional Highlights:

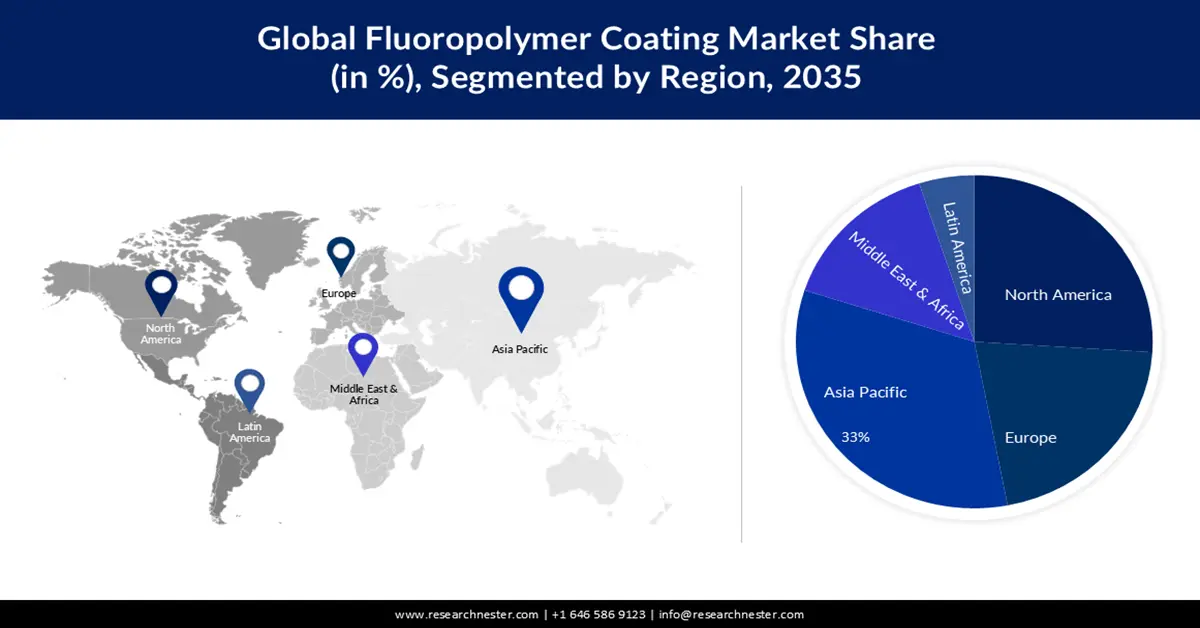

- Asia Pacific fluoropolymer coating market will secure around 33% share by 2035, attributed to high infrastructure demand in populous nations like China and India.

Segment Insights:

- The building & construction segment in the fluoropolymer coating market market will capture a 35% share, driven by increasing urbanization and demand for new construction and renovations, forecast period 2026-2035.

Key Growth Trends:

- Urban Population Growth

- Growing Renewable Energy Industry

Major Challenges:

- Strict Environmental Policies and Regulations

- Improper Disposal of Products Coated with Fluoropolymer

Key Players: Arkema S.A., PPG Industries, Inc., Akzo Nobel N.V., BASF SE, TOHO KASEI CO., LTD, Toefco En.

Global Fluoropolymer Coating Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.17 billion

- 2026 Market Size: USD 3.37 billion

- Projected Market Size: USD 6.29 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

Fluoropolymer Coating Market Growth Drivers and Challenges:

Growth Drivers

- Urban Population Growth – As the population grows, the demand for residential and non-residential buildings is expected to increase. In addition, as cities expand, demand for affordable housing, integrated transportation networks, and other infrastructure, basic services, and jobs increases. By 2021, about 55% of the world's population will live in urban areas, and this proportion is expected to rise to almost 68% by 2050.

- Growing Renewable Energy Industry – Increased investment in renewable energy sources is one of the trends boosting the construction industry. In 2022, India recorded the highest year-over-year increase in renewable energy with over nine of her units.

- Growing Workforce – The size of the working-age population has a significant impact on the labor market and the economy. Moreover, they bring economic growth potential and are expected to drive fluoropolymer coating market growth. Africa's working-age population is expected to grow by more than 20% by 2035.

- Growing Interest in Eco-friendly Products – The desire to protect the environment is a major reason why customers choose sustainable products and brands. Additionally, consumers of all generations, from baby boomers to Gen Z, are willing to spend more on sustainable items. Data show that the number of global web searches for sustainable products has increased by 70% over the past five years.

- High Demand in Iron and Steel Production Units - One of the key factors boosting interest in fluoropolymer coatings is the rise in the use of these coatings on iron and steel goods. Due to its superior insulating qualities, fluoropolymer coatings are utilized to insulate iron and steel items. A total of 662.8 million tonnes of crude steel were produced between January and April of 2021, a rise of 13.7% as compared to last year.

Challenges

- Strict Environmental Policies and Regulations - Several regulatory organizations in North America, Europe, and MEA enforce strict rules to manage the negative consequences of solvent-based coatings, which are made of volatile compounds and can negatively impact the environment. Strict laws influence the use of the popular fluoropolymer known as polytetrafluoroethylene (PTFE). Thus, the price of using and purchasing fluoropolymer coatings has gone up owing to the necessity to adhere to numerous laws.

- Improper Disposal of Products Coated with Fluoropolymer

- High Cost of Few Fluoropolymer Resins

Fluoropolymer Coating Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 3.17 billion |

|

Forecast Year Market Size (2035) |

USD 6.29 billion |

|

Regional Scope |

|

Fluoropolymer Coating Market Segmentation:

Application Segment Analysis

The building & construction segment in the fluoropolymer coating market is set to witness the largest revenue share of 35% by the end of 2035. The growth of this segment is due to increasing urbanization. Economic expansion has led to an increase in skyscraper development in many large and medium-sized cities. Lower mortgage rates and a shift in housing preference towards larger apartments have increased demand for new construction and home renovations in all developing regions. The World Bank estimates that by 2045, an additional 6 billion people will live in cities around the world.

Type Segment Analysis

Fluoropolymer coating market from the polyvinylidene fluoride segment is poised to observe a noteworthy revenue in the predicted period. Polyvinylidene fluoride (PVDF) is a semi-crystalline thermoplastic fluoropolymer used primarily in applications requiring high purity and resistance to solvents, acids, and hydrocarbons. Moreover, the adoption rate of renewable PVDF is high, which is expected to drive the growth of the segment in the market. PVDF is used in the chemical, architectural coatings, electronics, and aerospace industries

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fluoropolymer Coating Market Regional Analysis:

APAC Market Insights

The Asian Pacific fluoropolymer coating market is projected to hold the largest market share of 33% by the end of 2035. The growth of the market can be attributed majorly to the rising demand for infrastructure in countries such as China, India, and Japan. With the help of infrastructure, individuals can obtain the services they desire and need, including power for heating, cooking, and lighting, as well as water and sanitary facilities. The titans of the developing world are China and India, with more than a third of the world's population. Therefore, infrastructure is in high demand and will continue to rise, especially as cities become more populated in developing regions. According to data, Asia will be home to more than 5 of the top 10 megacities by 2025.

Europe Market Insights

The European fluoropolymer coating market is set to grow substantially during the time period between 2026-2035. The growth of the market can be attributed majorly to the increasing application of fluoropolymers in the region. They are used in transportation, chemical and powder, cookware, electronics, food and pharmaceuticals, textiles and architecture, medical use, renewable energy, and other industries. Further, fluoropolymers are employed in a variety of medical applications as they function well and extend the operational lifetime of medical equipment such as filters, pumps, catheters, and guide wires. In addition, there is a considerable market for commercial vehicles such as large trucks as well as for agriculture and construction equipment.

Fluoropolymer Coating Market Players:

- Arkema S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries, Inc.

- Akzo Nobel N.V.

- BASF SE

- TOHO KASEI CO., LTD

- Toefco En

Recent Developments

- Arkema S.A. acquired Ashland’s Performance Adhesives business with the aim of being a leader In Specialty Materials by 2024 and concentrating on developing high-performance, and sustainable solutions. Ashland provides a range of high-performance adhesive solutions for industrial applications with a high level of added value.

- PPG Industries, Inc. introduced PPG ENVIROCRON LUM coating, which is the first commercial retroreflective Powder coating in the industry. The patent-pending coating is designed to enhance visibility at night and in dimly lit areas. The coating comes in several colors and is perfect for use on a broad range of objects, including guardrails, bicycles, scooters, safety gear, tools, tenons, and shopping carts.

- Report ID: 3881

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fluoropolymer Coating Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.