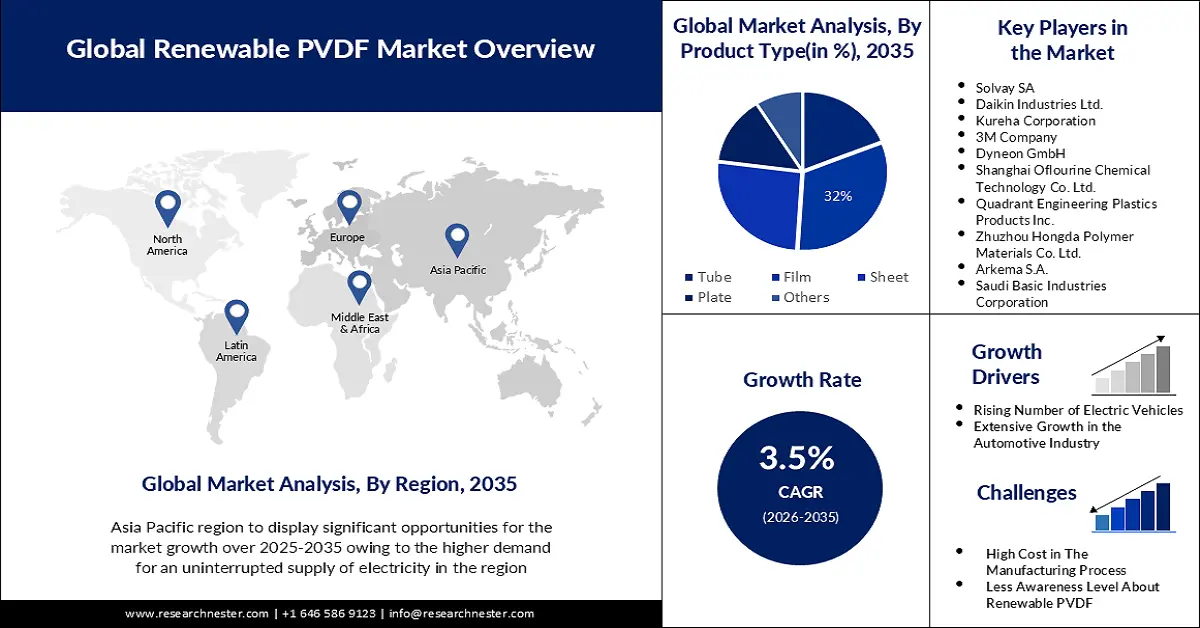

Renewable PVDF Market Outlook:

Renewable PVDF Market size was valued at USD 3.08 billion in 2025 and is expected to reach USD 4.34 billion by 2035, registering around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of renewable PVDF is evaluated at USD 3.18 billion.

The primary reason for the global market growth during the forecast period is the rising number of electric cars running on the roads of the world. The increase in the demand for electric vehicles has paved the way for the lithium-ion battery production growth which in turn is anticipated to escalate the utilization rate of renewable PVDF and create favorable opportunities for market growth during the forecast period. According to the statistics revealed by the International Energy Agency (IEA), global electric vehicle sales nearly doubled to 6.6 million in 2020, which brought the total number of electric cars on worldwide roads to 16.5 million.

Polyvinylidene fluoride (PVDF) is considered to be a thermoplastic fluoropolymer with the advantages such as high inertness and stability. Usually, renewable PVDF is used for easy processing in molding, extrusion, and compounding as thermoplastic polymers. Owing to its other benefits such as chemical resistance toward chlorine, bromine, iodine, and other acids at high temperatures, along with its ability to be injected, molded, or welded, renewable PVDF is commonly used in chemical, semiconductor, medical, and defense industries. All these factors couple up to bring new opportunities for market growth during the upcoming years.

Key Renewable PVDF Market Insights Summary:

Regional Highlights:

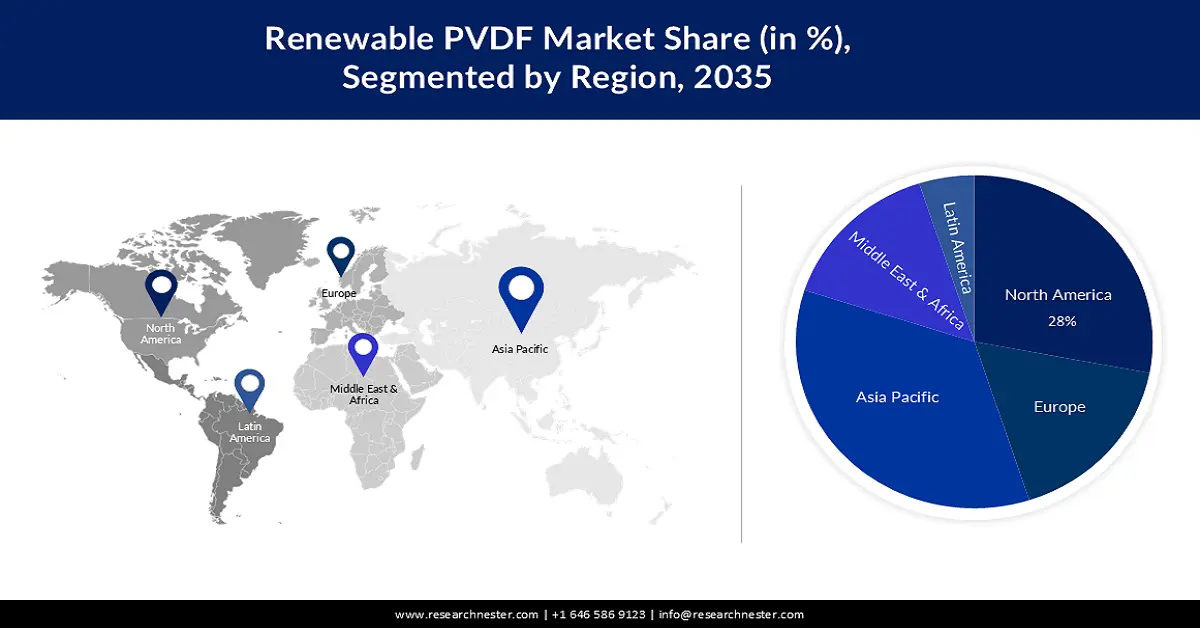

- Asia Pacific renewable PVDF market will dominate over 35% share by 2035, driven by demand for smart electronics and construction activity.

- North America market will secure 24% share by 2035, attributed to innovative product development and lithium-ion battery applications.

Segment Insights:

- The film (renewable pvdf) segment in the renewable pvdf market is expected to capture a 32% share by 2035, driven by the high demand for easy-to-handle, moldable, and robust PVDF films.

- The automotive segment in the renewable pvdf market is anticipated to achieve a 29% share by 2035, driven by the growing global vehicle demand requiring lithium-ion batteries.

Key Growth Trends:

- Extensive Growth in the Automotive Industry

- The Surge in the Aerospace and Defense Industry

Major Challenges:

- Requirement of a High Cost in The Manufacturing Process

- Less Awareness Level About Renewable PVDF

Key Players: Solvay SA, Daikin Industries Ltd., Kureha Corporation, 3M Company, Dyneon GmbH, Shanghai Oflourine Chemical Technology Co. Ltd., Quadrant Engineering Plastics Products Inc., Zhuzhou Hongda Polymer Materials Co. Ltd., Arkema S.A., Saudi Basic Industries Corporation.

Global Renewable PVDF Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.08 billion

- 2026 Market Size: USD 3.18 billion

- Projected Market Size: USD 4.34 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Renewable PVDF Market Growth Drivers and Challenges:

Growth Drivers

- Extensive Growth in the Automotive Industry – With the rising automotive industry, the usage of lithium-ion batteries is expected to considerably grow. Lithium-ion batteries for automotive applications require PVDF for binding electrodes. Therefore, the surge in the automotive industry along with the increasing demand for automobiles is expected to escalate the demand for renewable PVDF. Recently, it has been calculated that the global automotive industry manufacturing industry amounted to almost USD 3 trillion by the end of 2021.

- The Surge in the Aerospace and Defense Industry – Renewable PVDF has been used in the aerospace and military industries which is beneficial for protecting equipment from stress, moisture, chemicals, and vibrations. Thus, with the increase in the aerospace and defense industry, it is projected to create favorable opportunities for market growth during the assessment period. As per the recent analysis, it has been estimated that the aerospace and defense industry was valued at almost USD 720 billion in 2021, which is an increase of 4% from the previous years.

- Growth in the Electrical and Electronics Industry – Owing to the various advantages such as low thermal conductivity, flexibility, and lightweight, renewable PVDF has found its application in wires and cables of various commercial, industrial, and consumer electrical and electronic products. Thus, with the rapid expansion of the electrical and electronics industry, it is estimated to create a positive outlook for the global renewable PVDF market to grow during the forecast period. As per the recent statistics, it has been revealed that the revenue generation of the consumer electronics sector is expected to stand at USD 1,030 billion by the end of 2023 and is further expected to grow with almost 3% CAGR value.

- Increased Investment in the Research & Development (R&D) Sector – As per the World Bank, the Research and Development expenditure accounted for 2.63% of total GDP in 2020. This was a rise from 2.13% of the total GDP in 2017.

Challenges

- Requirement of a High Cost in The Manufacturing Process – During the initial stage, a high amount of investment is required to manufacture renewable PVDF as it requires top-notch technology along with high-quality materials. As a result, there is a limited supply of renewable PVDF owing to the insufficient fund. All these factors couple up to increase the cost of renewable PVDF and impose a major roadblock to the market’s growth.

- Less Awareness Level About Renewable PVDF

- Rising Stringent Government Rules

Renewable PVDF Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 3.08 billion |

|

Forecast Year Market Size (2035) |

USD 4.34 billion |

|

Regional Scope |

|

Renewable PVDF Market Segmentation:

Product Type Segment Analysis

The global renewable PVDF market is segmented and analyzed for demand and supply by product type into film, tube, sheet, plate, and others. Out of the three types, the film segment is estimated to gain the largest market share of about 32% in the year 2035. One of the primary reasons for the expansion of the segment in the upcoming years is the rising need for easy-to-handle forms of renewable PVDF which could be molded, welded, and inserted very easily. Furthermore, the high demand for renewable PVDF films from the end-use industries such as automotive, construction, electronics, and others is also anticipated to bring further growth opportunities for segment growth during the forecast period. Other advantages of films such as ease to manufacture and handling, cost-effectiveness, flexibility, and robustness are also some of the benefits which are anticipated to create a positive outlook in the upcoming years.

End-user Segment Analysis

The market is also segmented and analyzed for demand and supply by end-user into automotive, chemical, pharmaceutical, construction, semiconductor, aerospace & defense, water treatment, and others. Amongst these three segments, the automotive segment is expected to garner a significant share of around 29% in the year 2035. The major factor that is attributed to segment growth is the rising demand and production of vehicles by the global population for individualized transportation and rising living standards. As per recent statistics, it has been revealed that there were almost 1.4 billion vehicles on the earth in 2022. As vehicles need lithium-ion batteries, the need for renewable PVDF is also expected to increase, thus aiding the expansion of the segment size during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Renewable PVDF Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to account for largest revenue share of 35% by 2035, on the back of the increasing demand for smart gadgets and other smart electronic devices in India and China, and rising consumer base of renewable PVDF in the region. Apart from these, growing construction activities and rising energy demand are also predicted to drive the region’s market growth in the future. Electricity consumption per capita reached 860 kWh in 2020, around two-thirds of the Asian average. Owing to the Covid-19 crisis, total energy consumption fell by 3.4% in 2020 to 908 Mtoe.

North American Market Insights

The North American renewable PVDF market is estimated to be the second largest, registering a share of about 24% by the end of 2035, which can be credited to the growing development of innovative products and the strong presence of lithium-ion battery manufacturers in the region. Furthermore, the rapid increase in hydropower, wind & solar ocean energy, which are providing commercial & industrial, residential, and consumer electrical needs is expected to increase the utilization rate of renewable PVDF for insulation in the next few years. In addition to the other factors, the rising investment by the regulatory bodies of the region to use renewable PVDF owing to its advantages such as weather durability, dirt resistance, chemical resistance, prolonged reflectivity, and smoke resistance. Thus, it is anticipated to increase the awareness level and help in the expansion of the market size during the forecast period.

Europe Market Insights

Europe region is set to witness significant growth till 2035. The rising focus on the adoption of renewable energy such as solar panels and wind turbines in the region for the protection of the environment which requires renewable PVDF for their construction is considered to be the primary factor for market expansion in Europe during the assessment period. In addition, the presence of a well-established chemical processing and automotive industry along with the strong focus on sustainability and environmental regulations are other factors that are projected to bring favorable opportunities for robust revenue generation in the future.

Renewable PVDF Market Players:

- Solvay SA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Daikin Industries Ltd.

- Kureha Corporation

- 3M Company

- Dyneon GmbH

- Shanghai Oflourine Chemical Technology Co. Ltd.

- Quadrant Engineering Plastics Products Inc.

- Zhuzhou Hongda Polymer Materials Co. Ltd.

- Arkema S.A.

- Saudi Basic Industries Corporation

Recent Developments

- Solvay reinforced its leadership in the lithium-ion battery market by more than doubling the production capacity of high-performance polymer SOLEF PVDF at its production site in the city of Changhsu in China.

- Arkema S.A. has launched its new sustainable Kynar PVDF range. These new grades will claim 100% renewable and sustainable.

- Report ID: 3488

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Renewable PVDF Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.