Lithium-ion Battery Market Outlook:

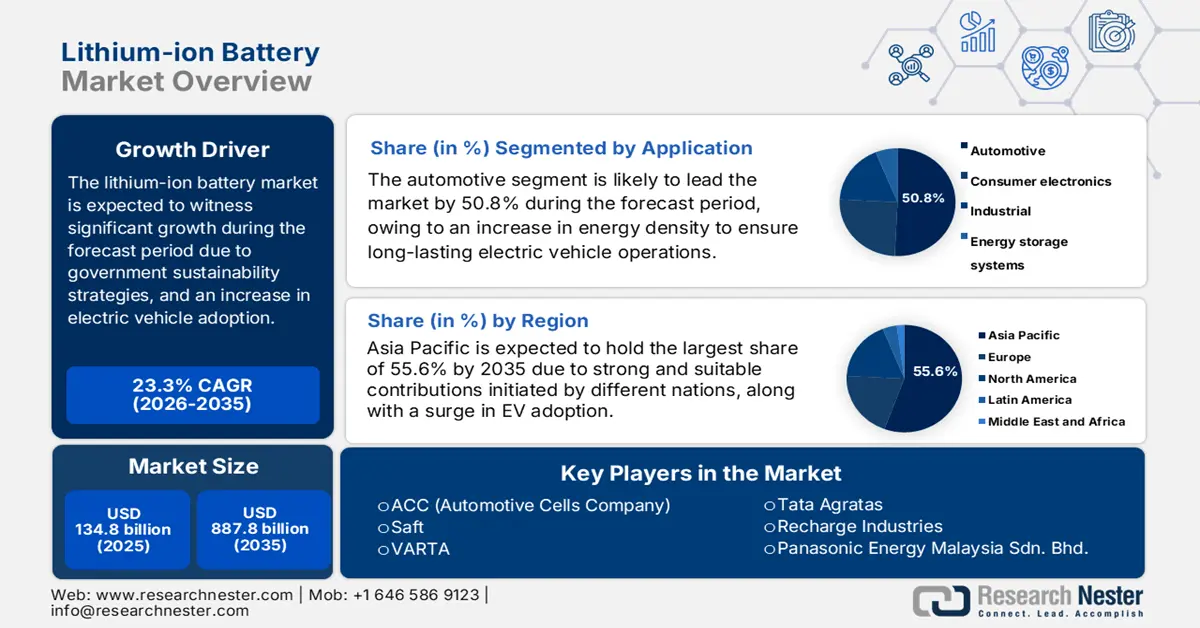

Lithium-ion Battery Market size was over USD 134.8 billion in 2025 and is estimated to reach USD 887.8 billion by the end of 2035, expanding at a CAGR of 23.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of lithium-ion battery is assessed at USD 166.2 billion.

The international lithium-ion battery market is currently experiencing increased growth, which is significantly fueled by governmental sustainability initiatives, renewable energy storage, and a surge in electric vehicle adoption. According to an article published by OECD in 2025, electric car sales readily topped 17 million globally as of 2024, denoting an increase by over 25%. In addition, within the same year, 3.5 million cars were sold in comparison to 2023. Besides, China readily maintained its lead, with an increase in electric car sales by 11 million. Likewise, there has been an upsurge in sales by almost 40% and reached 1.3 million globally, which is close to the U.S.’s sales of 1.6 million electric vehicles. By the end of 2024, the electric car fleet have successfully reached nearly 58 million, which is 4% of the overall passenger car fleet, thereby making it suitable for the market’s growth.

Furthermore, the aspects of chemistry diversification, expansion of Gigafactory, the presence of circular and recycling economy, as well as energy storage systems are other drivers bolstering the market’s growth globally. As per an article published by the IEA Organization in 2025, the battery demand in the energy industry for both storage applications and electric vehicle batteries has reached the 1 TWh milestone as of 2024. This particular demand is largely driven by the growth in electric vehicle sales, since the electric vehicle batteries grew more than 950 GWh, which is 25% more than in 2023. Moreover, in comparison to 2023, the industry was particularly adopted by electric trucks, denoting a 75% growth as of 2024, and effectively reached 3% of international electric vehicle battery demand. Therefore, with continuous growth in battery demand, there is a huge growth opportunity for the market across different regions.

Key Lithium-ion Battery Market Insights Summary:

Regional Highlights:

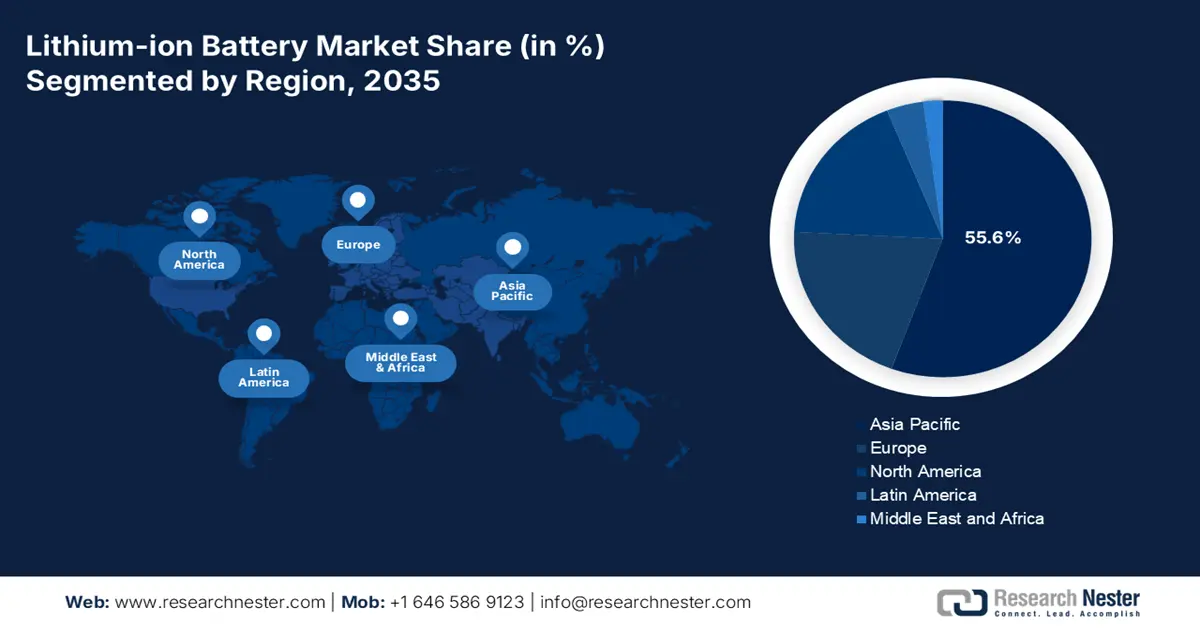

- Asia Pacific in the lithium-ion battery market is projected to account for a commanding 55.6% share by 2035, reinforced by China’s vertically integrated supply chain, strong grid-scale storage deployment, and accelerating electric vehicle adoption across key economies.

- North America is poised to register the fastest growth through 2035, supported by expanding domestic battery supply chain investments, rising grid-scale energy storage installations, and surging electric and hybrid vehicle demand.

Segment Insights:

- The automotive sub-segment under the application category in the lithium-ion battery market is expected to secure a leading 50.8% share by 2035, attributed to its high energy density enabling long-range electric vehicles and driving the shift toward efficient, low-emission transportation.

- The >100 kWh capacity segment is projected to hold the second-largest share by 2035, aligned with its suitability for long-range electric vehicles and utility-scale energy storage applications supporting zero-emission and grid-balancing initiatives.

Key Growth Trends:

- Focus on governmental regulations and incentives

- Integration of renewable energy

Major Challenges:

- Supply chain volatility in raw materials

- Environmental and recycling concerns

Key Players: SK On, CALB, EVE Energy, Gotion High-Tech, Envision AESC.SVOLT, Samsung SDI, LG Energy Solution.

Global Lithium-ion Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 134.8 billion

- 2026 Market Size: USD 166.2 billion

- Projected Market Size: USD 878.8 billion by 2035

- Growth Forecasts: 23.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: India, Indonesia, Vietnam, Thailand, Brazil

Last updated on : 6 January, 2026

Lithium-ion Battery Market - Growth Drivers and Challenges

Growth Drivers

- Focus on governmental regulations and incentives: The presence of administrative bodies, with the provision of generous funding opportunities, is suitable for driving the lithium-ion battery market internationally. According to a data report published by the Niti Government in March 2023, the utilization of advanced chemistry cells is projected to bolster India’s economy strongly, with an economic internal rate of return of 24%. Besides, LG provided USD 151 million as a federal stimulus grant to significantly finance 50% of the USD 303 million facility. Additionally, the organization also offered USD 125 million as state tax credits, with the ultimate condition of significantly employing almost 300 people, thereby making it suitable for boosting the market internationally.

- Integration of renewable energy: The worldwide expansion of renewable generation capacity is projected to more than double by the end of 2030, demanding large-scale storage, which in turn is suitable for boosting the market globally. As stated in an article published by the IEA Organization in 2025, internationally, renewable power capacity is expected to increase by nearly 4,600 GW between 2025 and 2030. Besides, there has been a growth in distributed solar PV and utility-scale, demonstrating almost 80% of global renewable electricity capacity expansion. In addition, based on this, the cumulative onshore wind capacity is also expected to increase by 45% between 2025 and 2030, thus denoting an optimistic outlook for the overall market’s growth and expansion.

- Increase in technological innovation: The presence of innovative electrolytes, silicon anodes, and solid-state batteries readily promises increased energy safety and density, which positively impacts the lithium-ion battery market. As per an article published by the IEA Organization in 2026, the international battery market is rapidly advancing, as there has been a rise in demand and electric car sales rising by 25%, and yearly battery demand surpassing 1 TWh, which is regarded as a historic milestone. Meanwhile, the average price of a battery pack for a battery-based electric car has reduced below USD 100 per kilowatt hour, which is a common key threshold for competing on expenses with traditional models. Therefore, with this rise in battery deployment, the market is gradually gaining increased exposure.

Challenges

- Supply chain volatility in raw materials: The market depends heavily on critical minerals such as lithium, cobalt, nickel, and graphite. The supply of these materials is geographically concentrated, with cobalt in the Democratic Republic of Congo, lithium in South America’s Lithium Triangle, and nickel in Indonesia. This concentration exposes the industry to geopolitical risks, trade restrictions, and environmental concerns. For instance, cobalt mining has faced scrutiny due to child labor and unsafe practices, while lithium extraction raises water scarcity issues in arid regions. Demand is projected to outpace supply, with global lithium demand expected to triple by 2030. Moreover, the aspect of price volatility directly impacts battery costs, making electric vehicle affordability uncertain, thus negatively impacting the overall market.

- Environmental and recycling concerns: While the lithium-ion battery market enables clean energy, its production and disposal pose environmental risks. Mining lithium consumes vast amounts of water, often in regions already facing scarcity. Nickel and cobalt extraction can lead to toxic waste and ecosystem damage. At the end of life, improper disposal of batteries risks soil and water contamination due to heavy metals. Recycling infrastructure remains underdeveloped, with fewer lithium-ion batteries currently recycled globally. This creates a looming waste management crisis as EV adoption accelerates. Recycling technologies are complex and costly, requiring specialized processes to recover valuable materials like lithium, cobalt, and nickel. Governments are beginning to mandate recycling targets, such as Europe’s Battery Regulation, requiring minimum recycled content in new batteries by 2030, but compliance will require significant investment.

Lithium-ion Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.3% |

|

Base Year Market Size (2025) |

USD 134.8 billion |

|

Forecast Year Market Size (2035) |

USD 887.8 billion |

|

Regional Scope |

|

Lithium-ion Battery Market Segmentation:

Application Segment Analysis

The automotive sub-segment, which is part of the application segment, is projected to garner the largest share of 50.8% in the market by the end of 2035. The sub-segment’s upliftment is highly propelled by its high energy density that enables long-lasting electric vehicles, effectively supports innovative features, such as start and stop systems, provides superior efficiency, and diminishes emissions, which is readily driving the sector’s transition towards high-performance and sustainable transportation. According to an article published by the IBEF Organization in October 2025, there has been a rise in automobile exports in India by 19% as of 2025 to more than 5.3 million units. Besides, the country has produced 3,10,34,174 passenger vehicles, along with quadricycles, two-wheelers, three-wheelers, and commercial vehicles, thus increasing the market’s demand internationally.

Capacity Segment Analysis

Based on the capacity, the >100 kWh segment in the lithium-ion battery market is expected to hold the second-largest share by the end of the forecast period. The segment’s growth is highly driven by being suitable for long-range electric vehicles, offering extended mileage and improved performance, which aligns with consumer expectations and government mandates for zero-emission transport. In grid applications, >100 kWh packs are deployed in utility-scale energy storage projects to balance renewable integration, stabilize power supply, and provide backup during peak demand. The segment benefits from falling battery costs, advancements in cathode chemistries (NMC, LFP), and improvements in battery management systems that enhance safety and efficiency. Governments worldwide are investing heavily in large-scale storage projects, such as the U.S. DOE’s multi-billion-dollar funding for advanced battery supply chains and Europe’s Green Deal initiatives, further accelerating adoption.

Cell Type Segment Analysis

The prismatic sub-segment, part of the cell type segment, is predicted to account for the third-largest share in the market during the stipulated timeline. The sub-segment’s development is extremely fueled by the aspect of offering better space utilization, enabling manufacturers to pack more energy into limited volumes, an advantage for electric vehicles and grid storage systems. Their rigid aluminum or steel casing improves mechanical stability and safety, reducing risks of swelling and leakage. Automakers, particularly in Asia and Europe, increasingly prefer prismatic formats for electric vehicles, as they allow flexible module configurations and efficient thermal management. The format is also widely adopted in energy storage systems, where high-capacity, durable cells are required for long-duration performance, thus suitable for boosting the market’s growth.

Our in-depth analysis of the lithium-ion battery market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Capacity |

|

|

Cell Type |

|

|

Component |

|

|

Product Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium-ion Battery Market - Regional Analysis

APAC Market Insights

The Asia Pacific lithium-ion battery market is anticipated to garner the highest share of 55.6% by the end of 2035. The market’s upliftment in the region is highly propelled by robust contributions from India, South Korea, and Japan, along with China’s integrated grid-scale storage, rapid electric vehicle adoption, and supply chain. According to an article published by the EIA Government in May 2025, the country imported nearly 12 million short tons of processed and raw battery minerals. This accounts for 44% of interregional trade, and exports nearly 11 million short tons of battery materials, components, and packs, or 58% of interregional trade as of 2023. In addition, the country also domestically produced an estimated 18%, which is 33,000 short tons, of the global mined lithium as of 2023, and regional organizations also control 25% of the international lithium mining capacity, thus suitable for bolstering the market’s exposure.

The market in China is growing significantly due to pack integration, cell manufacturing, precursor chemicals, refining, and end-to-end scale across mining. As per an article published by the English Government in December 2025, the overall output of lithium-ion batteries has exceeded 580 GWh between January and October. In addition, the output of lithium-ion batteries utilized for customer products surpassed 84 GWh, and the installed capacity of power batteries for the newest energy vehicles (NEVs) in at nearly 224 GWh in the first 10 months. Moreover, there has been a boom in the country’s lithium-ion battery sector, which came amid the rising consumer demand for NEVs. Regarding this, between January to November, 5.0 million units of new energy passenger cars have been sold through retail channels in the nation, increasing by 100.1%, thus denoting an optimistic outlook for the market.

The lithium-ion battery market in India is also growing due to chemical processing, robust localization of battery manufacturing, grid modernization, and a surge in electric vehicle adoption. As stated in an article published by WRI India Organization in May 2025, the overall industry is continuously experiencing rapid growth, with a yearly demand projected to increase from 10.8 GWh as of 2022 to 160.3 GWh by the end of 2030. Besides, to diminish this dependency, the country is ramping up the localized lithium-ion battery manufacturing capacity, which is projected to reach 150 GWh yearly by 2030, readily supported by private sector investments and governmental incentives. Furthermore, the domestic manufacturing of these batteries has also reached 18 GWh in 2023, therefore making it suitable for uplifting the market.

North America Market Insights

North America lithium-ion battery market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled, owing to domestic supply chain investments, grid-scale storage facilities, and an increase in the demand for electric vehicles. According to an article published by the EIA Government in August 2024, there has been an increase in battery electric vehicles (BEVs), plug-in hybrid electric vehicles, and hybrid vehicles in the U.S. from 17.8% to 18.7% as of 2024. Additionally, there has been a slight upsurge in the hybrid and electric vehicle market share, which is primarily fueled by hybrid electric vehicle sales, which increased by 30.7% year-over-year (YoY). Meanwhile, hybrid sales catered to 8.6% of the overall light-duty market within the same year and surged to 9.6%, thereby making it suitable for boosting the market in the region.

The lithium-ion battery market in the U.S. is gaining increased traction due to policy support, federal funding, electric vehicle adoption, grid-scale storage, and safety and standards. As per an article published by the National Energy Technology Laboratory in October 2022, the Biden-Harris Administration, through the U.S. Department of Energy (DOE), declared that 20 companies received USD 2.8 billion to develop and expand commercial-scale infrastructures across 12 states to process and extract graphite, lithium, and other battery-specific materials. In addition, the federal investment has been predicted to be matched by recipients to leverage an overall USD 9 billion to bolster regional production, pertaining to clean energy technology, support governmental objectives, and create standard-paying employment opportunities, thus denoting an optimistic outlook for the overall market.

The lithium-ion battery market in Canada is also developing, owing to governmental investments, critical minerals strategy, sustainability, innovation, and international opportunity. As stated in an article published by the Government of Canada in October 2025, the Minister of Energy and Natural Resources declared a generous investment of more than USD 22 million under the Energy Innovation Program (EIP) to support 8 projects for assisting in accelerating battery advancement and production capacities across the country. Besides, in March 2025, the Government of Canada has readily partnered with Frontier Lithium Inc. to successfully make expansion in the production of tactical battery materials. Additionally, with the launch of the country’s first-ever Critical Minerals Strategy in 2023, the government has initiated suitable investments and overcome gaps to achieve standard processing facilities and mines, which positively impacts the market’s development.

8 Projects funded under the Battery Industry Acceleration Call in Canada (2025)

|

Project Name |

Company Name |

Location |

Fund Amount (USD) |

|

Qualification and Increased Production Efficiency of NOVONIX All-Dry, Zero-Waste Cathode Active Materials |

NOVONIX Battery Technology Solutions Inc. |

Bedford, Nova Scotia |

5,000,000 |

|

Scaling of Advanced Manufacturing Platform for Production of Coated Current Collectors |

Calumix Technologies Inc |

London, Ontario |

4,545,000 |

|

Advancing Electrified Mobility with Next-Generation Ultrahigh-Capacity Cylindrical Cells |

Flex-Ion Battery Innovation Center |

Windsor, Ontario |

3,319,640 |

|

Tin-based anode materials for lithium-ion and sodium-ion batteries |

Nanode Battery Technologies |

Edmonton, Alberta |

1,500,000 |

|

Méthode novatrice de production de SiOx pour batteries en continu |

HPQ Silicon Inc. |

Montreal, Quebec |

3,000,000 |

|

Power Capability Enhancement of 21700 cell designs |

E-One Moli Energy (Canada) Ltd |

Maple Ridge, British Columbia |

1,620,314 |

|

Enhanced low temperature performance of INR21700-P45B cells |

E-One Moli Energy (Canada) Ltd |

Maple Ridge, British Columbia |

1,067,499 |

|

Made-in-Canada Ultra High-Power Li-ion 21700 Cylindrical Battery Cells |

NanoXplore Inc. |

Saint-Laurent, Quebec |

2,750,000 |

Source: Government of Canada

Europe Market Insights

Europe lithium-ion battery market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by the rapid build-out of energy storage, regional mandates, and robust decarbonization policies. According to an article published by the Europe Commission in 2025, the region readily accounted for 17% of the international demand for batteries, which is expected to increase 14 times by the end of 2030. As stated in the April 2022 Eurobat Organization data report, a household photovoltaic+ battery system has the tendency to increase self-consumed electricity from almost 30% without storage facilities to nearly 60% to 70%. Besides, grid-scale storage integration, along with electric vehicle penetration support are also responsible for bolstering the market in the overall region.

Germany market is gaining increased traction due to the provision of large-scale Gigafactory investments, a dense supplier ecosystem, and automotive leadership. As per an article published by OECD in October 2025, small and medium-sized enterprises cater to 95% of enterprises in cleantech-based manufacturing industries across the overall region, and deliberately contribute to only 17% to export, which is far below the 37% average across all industries. Besides, Horizon Europe, with its budget of EUR 95.5 billion, is effectively leading the overall regional commitment to advancement with a suitable focus on sustainability and climate. Moreover, CEFIC and ECHA guidance on sustainable circularity and chemicals further tend to reinforce the country’s competitive position, which aligns with industrial policy with environmental objectives.

The lithium-ion battery market in France is also growing due to sustainable chemical processes, targeted funding for battery materials, recycling mandates, and the presence of robust circular economy strategies. As per an article published by OECD in June 2025, renewable energies readily play an increasing role in the national energy mix, effectively accounting for 13.3% of the overall energy supply and 27.1% of electricity as of 2023. Meanwhile, the country has successfully set itself to enhance its material productivity by 30% by 2030, resulting in production increasing the value from a few primary raw materials. Moreover, the non-metallic minerals extraction accounted for 62% of the regional extraction as of 2023 and 5.8 tons per person. Therefore, all these factors are gradually catering to the market’s upliftment in the overall country.

Key Lithium-ion Battery Market Players:

- CATL (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BYD (China)

- LG Energy Solution (South Korea)

- Panasonic Energy (Japan)

- Samsung SDI (South Korea)

- SK On (South Korea)

- CALB (China)

- EVE Energy (China)

- Gotion High-Tech (China)

- Envision AESC (Japan/UK)

- Farasis Energy (China)

- SVOLT (China)

- Northvolt (Sweden)

- ACC (Automotive Cells Company) (France)

- Saft (France)

- VARTA (Germany)

- Tesla (U.S.)

- Tata Agratas (India)

- Recharge Industries (Australia)

- Panasonic Energy Malaysia Sdn. Bhd. (Malaysia)

- CATL remains the global leader in EV batteries, holding the highest market share with standard storage installations. Its dominance stems from large-scale production, cost efficiency, and partnerships with major automakers worldwide, making it the benchmark for innovation and supply chain integration.

- BYD ranks second globally in the market share, installing massive storage facilities. Unlike CATL, BYD integrates battery production with its own EV manufacturing, giving it a competitive edge in vertical integration and rapid deployment of LFP chemistry.

- LG Energy Solution targets the majority of the global market share by 2025, supported by partnerships with Tesla, GM, and Hyundai. The company invests heavily in research and development for next-generation chemistries such as lithium-sulfur and bipolar batteries, while expanding U.S. and European gigafactory capacity to diversify away from China.

- Panasonic Energy remains a key supplier to Tesla and other OEMs, focusing on advanced cylindrical formats. While its global share has declined compared to CATL and LG, Panasonic’s strength lies in high-performance cells and long-standing relationships with premium EV manufacturers.

- Samsung SDI maintains a strong presence in premium EVs and energy storage, with steady growth in prismatic and pouch cell formats. The company emphasizes safety and high energy density, positioning itself as a reliable supplier for European automakers and ESS projects despite intense competition from CATL and LG.

Here is a list of key players operating in the global market:

The market is concentrated, with China’s CATL and BYD leading global EV battery share, followed by South Korea’s LG Energy Solution, Samsung SDI, and SK On, and Japan’s Panasonic, each scaling capacity, vertical integration, and long-term OEM contracts. European challengers like Northvolt and ACC are localizing supply chains and recycling to meet EU sustainability targets in mining. Strategic initiatives include gigafactory buildouts, cathode/anode precursor investments, recycling partnerships, and chemistry diversification (LFP/NMC) to balance cost, safety, and performance, thus tightening competition while improving resilience across regions. Besides, in June 2024, Toshiba Corporation and Sojitz Corporation of Japan, along with Brazil’s CBMM, completed the development of a cutting-edge lithium-ion battery that utilizes niobium titanium oxide (NTO) in the anode, thereby making it suitable for uplifting the market globally.

Corporate Landscape of the Market:

Recent Developments

- In February 2025, Clarios has effectively gained the one-million 12-volt lithium-ion battery production milestone, with the suitable supports from its international network, which has underscored its pivotal role as an innovator in low voltage energy storage technologies.

- In August 2024, Neuron Energy successfully completed its Series A funding round, raising Rs. 20 crores from tactical investors, which includes the Capri Global Family and Chona Family Office.

- Report ID: 1313

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium-ion Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.