Wireline Logging Services Market Outlook:

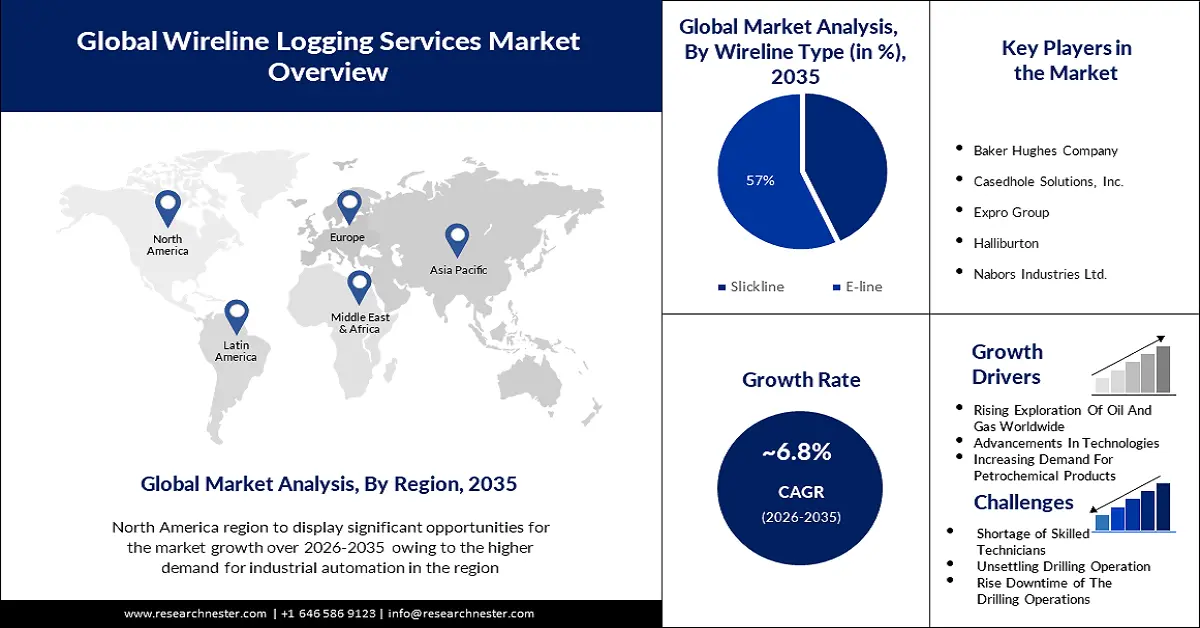

Wireline Logging Services Market size was valued at USD 26.89 billion in 2025 and is set to exceed USD 51.92 billion by 2035, expanding at over 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireline logging services is estimated at USD 28.54 billion.

Increasing exploration of oil and gas fields will primarily drive the market and will take the market to the expected CAGR. The world’s verified oil reserves total 1,757 billion bbl, emerging from 1,735 billion bbl a year prior, as stated in the Oil & Gas Journal’s yearly analysis. International proven natural gas reserves are now calculated at 7,456 tcf, emerging from 7,297 tcf surveyed last year. The released reserve figures depend on survey answers and official updates submitted by each country, which are not given yearly in many cases.

Another factor that will drive the wireline logging services market by the end of 2036 is the rising application of petrochemical products across the globe. In 2020, petrochemicals accounted for more than 16 percent of the oil requirement in the OECD. In 2021, the market worth of petrochemicals touched 556 billion U.S. dollars. The production potential of petrochemicals across the globe touched around 2.3 billion metric tons in 2021. By 2030, it is projected to increase substantially, with China, India, and Iran the countries with the biggest petrochemical potential additions released or planned. China alone makes strategies to add a potential of 134 million metric tons yearly, controlling the market in the medium term. The petrochemical industry shifts raw materials from oil refining and gas processing into an extensive range of materials. These comprise plastics, synthetic fibers, fertilizers, pastes, dyes, detergents, and synthetic paints and coatings.

Key Wireline Logging Services Market Insights Summary:

Regional Highlights:

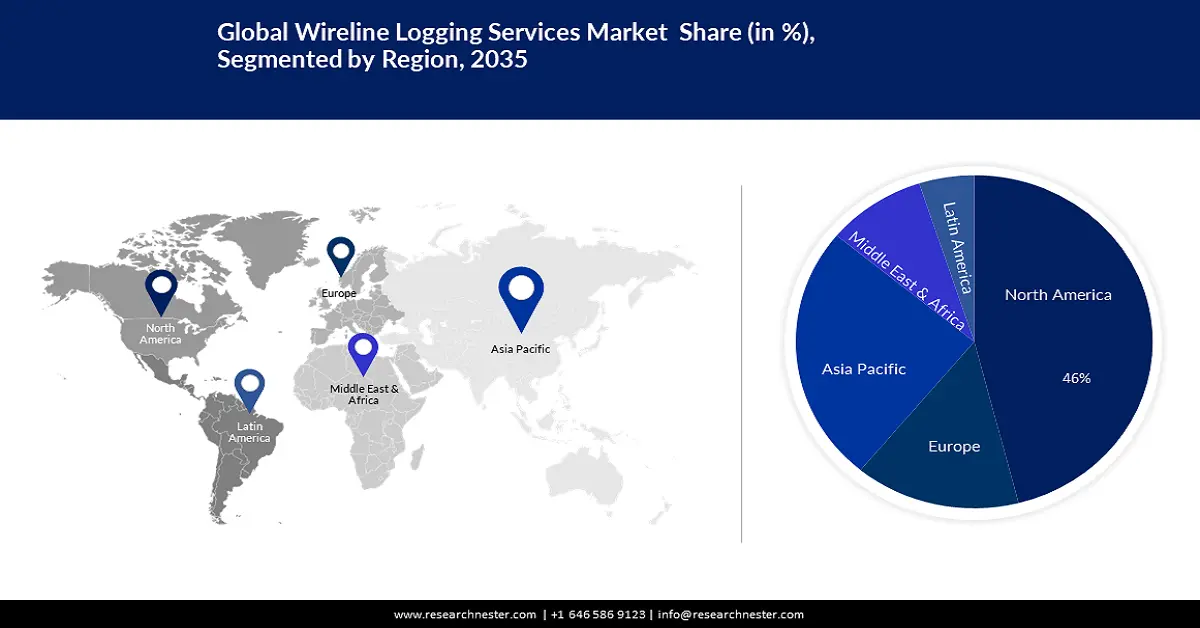

- North America wireline logging services market will hold more than 46% share by 2035, driven by rapid revenue generation in U.S. exploration activities.

- Asia Pacific market will secure the second largest share by 2035, fueled by increasing petrochemical production.

Segment Insights:

- The cased hole (hole type) segment in the wireline logging services market is projected to achieve a 79% share by 2035, driven by its use in production problem recognition and reservoir optimization.

- The e-line segment in the wireline logging services market is expected to hold a 57% share by 2035, driven by ongoing exploration for new oil and gas fields and its affordability.

Key Growth Trends:

- The Technological Improvements in The Field of Well-Logging

- Increasing Industrialization and Urbanization

Major Challenges:

- The Issue with The Unconventional Oil and Gas Logging Process

- Unsettling Drilling Operations

Key Players: Baker Hughes Company, Casedhole Solutions, Inc., Expro Group, Halliburton, Nabors Industries Ltd., OiLSERV, SLB, Superior Energy Services., Probe Global Ltd., Pioneer Energy Services Corp., Inpex Corporation, Japan Petroleum Exploration Co. Ltd., Kanto Natural Gas Development Co. Ltd., Mitsubishi Gas Chemical Company.

Global Wireline Logging Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.89 billion

- 2026 Market Size: USD 28.54 billion

- Projected Market Size: USD 51.92 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Middle East & Africa

- Dominating Countries: United States, China, Russia, United Kingdom, Germany

- Emerging Countries: China, India, Brazil, Mexico, United Arab Emirates

Last updated on : 16 September, 2025

Wireline Logging Services Market Growth Drivers and Challenges:

Growth Drivers

- The Technological Improvements in The Field of Well-Logging - Current modifications in logging and formation assessment comprise a new through-casing impedance tool; HPHT equipment; while-drilling guiding extension and electrode impedance, wireline and while-drilling resistivity logging; establishment testing; production logging; LWD acoustic, nuclear, and seismic-while-drilling; and a movable NMR probe. Receiving the highest recovery reason is perhaps an unexpressed success metric for any oil organization. It not only modifies the financial value of the organization but also shows its technical mastery. Yet the industry is poised around a dismal median of 30% recovery factor. Multiple offering technologies have a large impact on recovery factors comprising 3D/4D seismic, horizontal drilling, geo-steering, hydraulic fracturing, intelligent fulfillment, digital centering, machine learning, and digitalization.

- Increasing Industrialization and Urbanization - Industrialization transformed how companies throughout the country function and how professionals in many industries work. It still has a lasting influence on how organizations generate goods today and has benefits and challenges. Learning about this transformation can help determine if an industrial occupation appeals to your abilities, preferences, and objectives. Most industries buy electricity from electric utilities or personal power producers. Additionally, some industrial facilities also produce electricity for their use implementing fuels that they buy and/or the remnants from their industrial techniques. For instance, many paper mills have united heat and power plants that may burn purchased natural gas or coal and black liquor generated in their mills to technique heat and produce electricity.

- Increased Exploration and Production Activity Across the World - Seismic data is accumulated through a special wing called “Geophysical services” in the form of 2D/3D surveys completed by ONGC’s survey party/vessels/tools (in-house) along with through agreement hiring by survey contracts. A similar technique is fitting for bore-hole seismic/wire-line logging through a different arm called “Logging services”. The entire Logging database is caught in the EPINET platform which is attainable around the company for timely and efficient decision making. A devoted R&D institute for Logging services and accommodates field-particular formation assessment and Reservoir Characterization issues of assets and basins.

Challenges

- The Issue with The Unconventional Oil and Gas Logging Process- At present, the growth of unconventional oil and gas logging process is mostly focused on assessment techniques of tight oil and medium to shallow shale gas, comprising a "seven properties" assessment (lithology, physical properties, electrical properties, oil and gas taking property, frangibility, hydrocarbon production characteristics, and stress anisotropy) and “three qualities” assessment (source rock quality, reservoir quality, and engineering quality), etc. The recent national reserve stipulations need that the associative error of estimated porosity should not be greater than 8%. This precision need is curated for traditional oil and gas reservoirs. Definitely, for unconventional oil and gas reservoirs with a primary porosity range of 3% to 10%, it is not simple to match this need, restricted by factors like the precision of fundamental logging information and core experiment assessment technology, and this issue requires to be solved with high-accuracy logging technology and unconventional reservoir experiment assessment technology.

- Unsettling Drilling Operations

- Rise Downtime of The Drilling Operations

Wireline Logging Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 26.89 billion |

|

Forecast Year Market Size (2035) |

USD 51.92 billion |

|

Regional Scope |

|

Wireline Logging Services Market Segmentation:

Wireline Segment Analysis

The E-line segment is expected to hold 57% share of the global wireline logging services market by 2035. Being the most mature logging process, the E-line segment is projected to pursue its share presently, as the exploration for new oil and gas fields is still on in many countries for more production. The international oil production was documented as 88,391 thousand barrels daily. International oil production is estimated to be 93.9 million barrels per day in 2022. The technique will prove to be the most affordable manner to generate oil and gas from the reserves, specifically at this time when the organizations have to spend attentively in the upstream sector. Other than events surrounding the international economic crisis in the late 2000s and 2020, oil production continuously accelerated yearly for the past two decades. In the same way, international oil consumption only reduced in 2008, 2009, and 2020, but has otherwise accelerated to a higher level year after year. Oil and oil products stay valuable commodities as most conveyance fuels are petroleum-depended and oil is a major raw component for the chemicals industry. Japan will remain dedicated to its public support for oil and gas upstream growths although more selectively, following the newest dedication made by the G7 energy ministers, an executive at the Ministry of Economy, Trade and Industry told S&P Global Commodity Insights on May 30, 2023.

Hole Type Segment Analysis

The cased hole type will dominate the wireline logging services market by the end of 2035 and will hold around 79% revenue share. This growth will be noticed due to its association with recognizing and tackling production problems, like water or gas breakthroughs, and maximizing reservoir execution. In December 2020, Saudi Arabia's national oil organization Saudi Aramco made four oil and gas explorations in the Al-Reesh oilfield, northwest of the city of Dhahran. The freshly established reserves were calculated to have non-traditional oil of 11,956 bpd potential and 4.8 million standard cubic feet of natural gas. The growth strategy for the oil reserve is projected to be prepared within a year.

Our in-depth analysis of the global wireline logging services market includes the following segments:

|

Wireline Type |

|

|

Hole Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireline Logging Services Market Regional Analysis:

North American Market Insights

The wireline logging services market will encounter the greatest surge in the North America region and hold a share of almost 46% by the end of 2035. This growth can be noticed due to the rapid revenue generation in U.S. exploration and production activities. Moreover, the US-based Chord Energy Corporation is the chief personal oil & gas exploration organization in North America (by reserves). The organization recorded profits of USD 1,580 million for the economic year ended December 2021 (FY2021), a surge of 45.8% as related to FY2020. Chord Energy Corporation is a personal exploration and production organization that concentrates on the acquirement and growth of unconventional oil and natural gas resources. It concentrates on exploiting substantial resource possibilities relying on the Bakken and Three Forks formations in the Williston Basin, US. The functioning revenue of the organization was USD 809.4 million in FY2021.

APAC Market Insights

The APAC region will encounter a significant surge during the forecast period and grab the position of second largest in the wireline logging services market owing to the increasing production of petrochemical products. China has long been the world's largest polymer and synthetic fiber importer, attribution to the similar of almost 3 mb/d in feedstock terms, or 3% of international oil consumption, in 2019 and 2020. Now, its earlier suppliers are under burden after current surges in Chinese production, specifically during 2023. Petrochemical activity and associated oil demand fell in other regions, comprising the Middle East and the rest of Asia. Shipments of intermediate and final petrochemical products were reduced by almost 30% from these parts of the globe at the time of the first nine months of 2023 in comparison with the same period in 2019.

Wireline Logging Services Market Players:

- Baker Hughes Company

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Casedhole Solutions, Inc.

- Expro Group

- Halliburton

- Nabors Industries Ltd.

- OiLSERV

- SLB

- Superior Energy Services.

- Probe Global Ltd.

- Pioneer Energy Services Corp.

Recent Developments

- Probe Global Ltd. a foremost provider of logging and reservoir monitoring technology for the international oil, gas, and geothermal sectors, declared the choice of different new leadership additions.

- Interactive Network Technologies, Inc. declared it has connected the SLB Digital Platform Partner Program. Connecting with the program signifies the IVAAP advanced data visualization platform will be attainable to clients through the DELFI™ digital E&P platform from SLB. IVAAP applications will be unified with the DELFI platform and the OSDU™ Data Platform. This assists in solving the challenge of stockpiling, arranging, migrating, and attaining subsurface data, providing resilience in the utilization of the customers’ information between applications and domains.

- Report ID: 5593

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireline Logging Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.