IT Services Market Outlook:

IT Services Market size was valued at USD 1.9 trillion in 2025 and is projected to reach USD 4.7 trillion by the end of 2035, rising at a CAGR of 9.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of IT services is assessed at USD 2.08 trillion.

The IT services market is a key component of the modern economy, which is defined by significant scale and consistent growth. As per the U.S. Bureau of Labor Statistics data, the overall employment in information technology is expected to grow rapidly. About 317,700 vacancies are projected each year due to the employment growth and the need to replace the workers leaving the occupations. The World Economic Forum identifies cloud computing as a critical enabler for industry transformation, a trend that compels organizations to engage service providers for migration, management, and optimization of these complex environments. This shift highlights a fundamental change for businesses allocating technology expenditure, moving from capital-intensive on-premise infrastructure to operational spending on flexible, service-based models.

The key demand driver for these services is the requirement for enhanced cybersecurity and data-driven operations. Federal guidelines such as FFIEC continuously highlight the robust cybersecurity controls and resilience for financial institutions, creating a sustained demand for the requirement for management security and resilience across regulated industries. Furthermore, the strategic integration of artificial intelligence and data analytics into business functions is a growing priority. Significant public investment in AI research fuels the long-term strategic importance of these technologies. Enterprises are consequently seeking partners who can provide the expert guidance and implementation services which is necessary to utilize AI for operational efficiency and competitive differentiation, ensuring a continued expansion of the IT services segment.

Key IT Services Market Insights Summary:

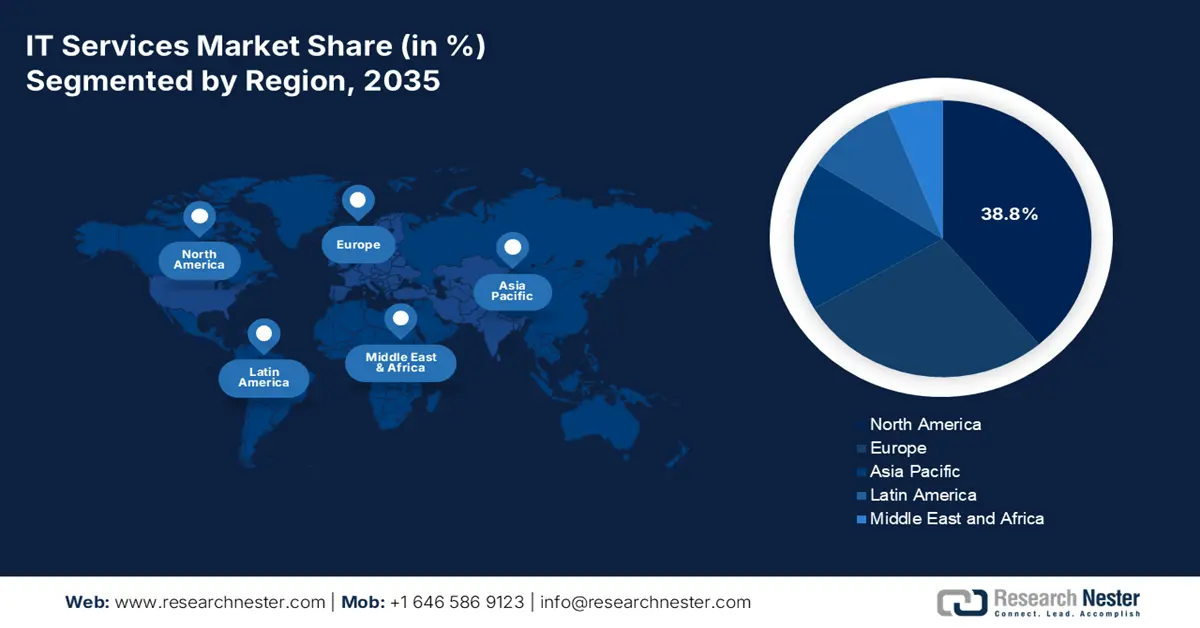

Regional Insights:

- North America is expected to command a 38.8% share of the IT services market iby 2035, supported by escalating federal technology spending and modernization initiatives.

- Asia Pacific is poised to expand rapidly through 2026–2035, anticipated to grow at a 9.5% CAGR owing to accelerating digitalization and pro-technology government programs.

Segment Insights:

- The Cloud segment is projected to secure a 65.6% share by 2035 in the IT services market, bolstered by rising investments in scalable architectures and remote-work-centric digital transformation.

- Large Enterprises are expected to maintain the dominant share through 2026–2035 as their complex global operations necessitate extensive, integrated IT modernization efforts.

Key Growth Trends:

- Federal mandates for modernization and cybersecurity

- Strategic investments in AI

Major Challenges:

- Cultural shift from product to service mindset

- Building and scaling a sustainable sales model

Key Players: Accenture (Ireland), IBM (USA),TCS (India), Infosys (India), Capgemini (France), Cognizant (USA), Wipro (India), DXC Technology (USA), HCLTech (India), NTT Data (Japan), Atos (France), Fujitsu (Japan), Deloitte (USA), PwC (USA), Kyndryl (USA), NEC Corporation (Japan), SAP (Germany), Genpact (USA), LTIMindtree (India),Samsung SDS (South Korea)

Global IT Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.14 billion

- 2026 Market Size: USD 2.08 trillion

- Projected Market Size: USD 1.62 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Brazil, Indonesia, Vietnam, UAE, South Korea

Last updated on : 24 November, 2025

IT Services Market - Growth Drivers and Challenges

Growth Drivers

- Federal mandates for modernization and cybersecurity: The ongoing implementation of the Executive Order on Improving the Nation's Cybersecurity, among other policies, by the U.S. Federal Government is the main factor that is driving demand upward. This situation pushes federal agencies and their contractors to upgrade their old systems and implement zero-trust architectures. This further represents, for IT service providers, a multi-billion dollar, non-discretionary market for security assessments, cloud migration, and managed detection and response services. The Cybersecurity and Infrastructure Security Agency (CISA) of the Department of Homeland Security is very active in publishing standards and securing resources, thus making cybersecurity in the public sector a very attractive and fast-growing sector driven by policy for the qualified firms.

- Strategic investments in AI: Governments are making a massive strategic investment in recognizing its economic and strategic importance. The Center of Strategic and International Studies data in October 2024 has depicted that the actual AI R&D spending in 2024 reached USD 8 billion. This demand fuels the IT services beyond pure research, including data engineering, model deployment, and building the underlying cloud and high-performance computing infrastructure. Service providers with AI integration and MLOps capabilities are positioned to support both public institutions and private companies seeking to leverage these national AI initiatives for competitive advantage.

NSCAI Recommendation vs. Actual AI R&D Investment

|

Year |

NSCAI Recommendation (USD billion) |

Actual Spending (USD billion) |

|

2020 |

1.1 |

1.4 |

|

2021 |

1.5 |

2.4 |

|

2022 |

2 |

2.9 |

|

2023 |

4 |

3.1 |

|

2024 |

8 |

3 |

|

2025 |

16 |

3.3 |

Source: CSIS October 2025

- Accelerated cloud adoption across government: The federal cloud computing strategy, which includes initiatives such as FeDRAMP, mandates a Cloud Smart approach, surging the migration of the government workloads to the cloud. This is not a one-time migration but a continuous cycle of optimization, security, and application modernization. Roughly 94% of companies are using cloud services for cost management, data portability, and workload optimization as per the SQ Magazine report released in July 2025. This creates a long-term and high-value market for IT service providers specializing in cloud migration, cost management, and developing secure, cloud-native applications for the public sector. The necessity for specific knowledge to navigate the intricate regulatory frameworks, such as FedRAMP for permitted cloud services, adds to this ongoing demand.

Challenges

- Cultural shift from product to service mindset: Manufacturers built on transactional, product-centric models, while the IT service thrives on long-term, relationship-based contracts and agile methodologies. This cultural pivot is profoundly challenging. Companies such as Siemens, despite its success, had to completely restructure its sales, support, and customer success departments as part of a ten-year restructuring to combine its product business with its software and service arms. This is a shift from selling a device to selling an ongoing outcome in guaranteed uptime, which requires a different corporate DNA that many traditional firms find difficult to adopt and leading to internal friction and slow adoption is service-based practices.

- Building and scaling a sustainable sales model: Typically, manufacturers' sales teams know how to sell capital equipment, but they are not familiar with a multi-year subscription service with different commission structures and sales cycles. Retraining or hiring a new sales force is costly and takes a lot of time. Philips dealt with this problem by separating its digital platform into a separate business unit with a specialized sales force focused on selling data and analytics subscriptions to hospitals. If a company does not have such a deliberate and separate go-to-market strategy, the service offering is merged with the traditional product sales machinery, thus losing the attention and expertise required to be able to scale successfully in a new IT services market.

IT Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 1.9 trillion |

|

Forecast Year Market Size (2035) |

USD 4.7 trillion |

|

Regional Scope |

|

IT Services Market Segmentation:

Deployment Segment Analysis

Cloud segment is dominating IT services market and is expected to hold the share value of 65.6% by 2035. The segment is fueled by the unparalleled scalability, cost efficiency, and facilitation of remote work models. Organizations are reshaping from on-premise systems to cloud-based models by choosing public, private, and hybrid cloud solutions. This transformation surges the agility and access to advanced services such as AI and analytics. Further, the shift is fundamentally driven by the IT spending and service delivery. The growth of this trend is the significant adoption and investment. The Flexera report from March 2025 has depicted that one-third (33%) of organizations are actively spending more than USD 12 million on the public cloud. This massive investment highlights the critical role of cloud technology in the modern digital transformation.

Organization Size Segment Analysis

Large enterprises hold the largest share of the IT services market over the forecast period. This dominance is due to their complex, global operations and substantial budgets for digital transformation. These kinds of organizations are engaged in multi-year, multi-vendor projects comprising enterprise-wide ERP modernization, global cybersecurity implementation, and large-scale data analytics initiatives. Their demand is for highly advanced, integrated service portfolios that have the potential to restructure the whole business's core functions. The data from the U.S. Census Bureau's Annual Business Survey reveals the critical role of IT intensity in larger firms. Therefore, these technological advantages ensure large enterprises are the primary drivers for the IT service industry, as they invest heavily in maintaining a competitive edge and operational efficiency.

Service Segment Analysis

By 2035, professional service is expected to hold the maximum share in the IT services Market. The segment is fueled by the rising digital transformation. It is different from regular managed services as it includes high-value consulting, system integration, and custom solution development. The main reason for this dominance is the essential requirement of experts to support the adoption of complicated technologies such as Generative AI and cloud platforms. Organizations use these experts both for the actual implementation and the creation of strategic roadmaps that make technology serve business goals. This demand for strategic, project-oriented work ensures Professional Services commands the largest revenue share, as it is the essential catalyst for all subsequent IT investments.

Our in-depth analysis of the IT services market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IT Services Market - Regional Analysis

North America Market Insights

During the projected time period 2026 to 2035, North America is expected to dominate the IT services market and is expected to hold the share of 38.8% by 2035. The dominance is mainly due to the advanced technologies and substantial federal spending. The U.S. Bipartisan Infrastructure Law and the U.S. CHIPS and Science Act are channeling billions into modernization, which directly influences the demand for cybersecurity, cloud, and data analytics services. The U.S. Department of the Treasury in March 2022 indicated that the public cloud services in technological research and consulting firm spending increased from USD 220 billion to USD 411 billion from 2016 to 2021. This increased spending in cloud surges the demand for integration, migration, and managed services.

The IT services market in the U.S. is driven by federal mandates and massive public investment in infrastructure and technology. The U.S. National Cybersecurity Strategy's mandate for cybersecurity modernization pushes the agencies and government contractors to implement zero-trust architectures, which raises the requirement for specialist security services. Government initiatives actively focusing to expand the digital infrastructure and implement cybersecurity regulations, which further boost the IT services market. This environment surges the competitive landscape of IT service providers as they innovate and capitalize on the advanced and trending technologies, such as AI and data analytics. According to the Select USD July 2022 report, the employee count in the IT and software sector was over 2.5 million employees in mid-2024. Further, in 2023 the foreign direct investment to the industry reached USD 102.8 billion, directly reinforcing the structure and long-term expansion of the IT services market.

Canada’s IT services market is driven by the significant public investments in digital infrastructure and a strategic focus on securing critical systems during the forecast period. The government is actively investing billions in AI research and computing capacity to accelerate the demand. The Strategic Innovation Fund continues to allocate capital towards technology and digital adoption projects across industries. Further active mergers and acquisitions boost the organization's expansion and continue to expand the market. For example, the IT Solutions Consulting announced the acquisition of PACE Technical and entered the Canada market, marking their first expansion. On the other hand, modernization of public services in various industries creates a robust market for cloud migration, cybersecurity, and custom software development, making Canada a place for steady growth aligned with national security and economic priorities.

APAC Market Insights

Asia Pacific is expected to be the fastest-growing IT services market during the forecast timeline and is projected to grow at a CAGR of 9.5%. The market is driven by rapid digitalization, a booming digital native population, and supportive government policies. Digital initiatives such as Digital India and Made in China are boosting the demand, and they are the key drivers for the market expansion. A surge in AI adoption is a vital trend with the government in Japan, as the government actively promotes the AI integration in business and public services. The demand for cybersecurity is driven by a rapid cloud-first approach, with small and medium enterprises leaping from legacy systems.

According to the SEADS data in February 2025, the digital economy in Southeast Asia is expanding at an extraordinary pace, transforming societies and economies across the region. Further, the region’s gross domestic product was USD 3.6 trillion in 2022, making ASEAN ranks as the world’s fifth-largest economy and is projected to become the fourth largest by 2030. This data stimulates the IT services market as the digital economy highly requires components such as consulting, integration, application development, managed services, and support.

China is leading the IT services market and is propelled by the state-led digital sovereignty and massive domestic investment in strategic technologies. Government initiatives are prioritizing the development of local cloud infrastructure, industrial AI, and a secure software ecosystem. According to the People’s Republic of China data in October 2024, the value-added services, such as software and information technology services, grew by 10.1% during the first three quarters in 2024. This data reflects a sustained demand for the policy-driven momentum behind the sector’s expansion and its focus on technology self-reliance. Further, the Index of Services Production of information transmission, software, and information technology services, rising by 11.4% is itself a core component of the IT services sector.

In India the IT services market is characterized by its rising domestic digitalization and its established role in the world’s IT service backend. The demand for IT services in the country is based on the unified digital public infrastructure, including UPI and Aadhaar. This, combined with a globally competitive talent pool, fuels the export and local growth. As per the Ministry of External Affairs data in the March 2023 report, it is indicated that the tech industry in India earned USD 226 billion during the fiscal year 2022. This demonstrates how the need for internal digitization is fueled by the growing digital transformation and vital contribution to the country's economy.

Europe Market Insights

Europe is actively growing in the IT services market and is defined by robust regulatory compliance, which is a strong push for digital sovereignty and significant EU-level funding driving modernization. The key drivers of the market are the active cloud adoption and the regulations such as the Digital Operational Resilience Act, creating a high demand for compliance and cybersecurity. Furthermore, the green digital transition is the major trend with investments channeled via the EU Recovery and Resilience Facility. According to the Eurostat data in 2025, nearly 80% of the population is expected to have basic digital skills by 2030. A large volume of digitally capable workforce is growing to increase the IT adoption across industries and fuel the IT services market growth.

UK is expected to hold the highest revenue share in Europe during the forecast period and is highly driven by the financial sectors and proactive regulatory agenda. The UK’s Financial Conduct Authority is the key driver actively integrating strong operational resilience regulations that pushes the financial institutions to invest heavily in cloud infrastructure and advanced cybersecurity. The OEC data in 2023 depicts that the UK has imported nearly 1.35 billion office software from Microsoft Corporation, which directly demands the integration and deployment services. Further, the expanding software usage boosts the managed services and support contracts. Adoption of software accelerates the digital transformation, and consumption drives the cloud adoption, increasing the demand for SMEs and emerging markets.

Germany is expected to maintain a leading position in the IT services market in Europe in the expected timeline. The IT services market is mainly fueled by the robust manufacturing base and strategic government initiatives, which are aimed at Industry 4.0 and digital sovereignty. The OEC 2023 data states that Germany is the leading importer of the office software from Microsoft Corporation and has imported worth USD 3.96 billion. This data depicts that companies in Germany are highly investing in the Microsoft ecosystem, moreover ths is not a one time cost but a commitment that requires continuous spending on expert services to implement, customize, manage, and secure the software.

Key IT Services Market Players:

- Accenture (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM (USA)

- TCS (India)

- Infosys (India)

- Capgemini (France)

- Cognizant (USA)

- Wipro (India)

- DXC Technology (USA)

- HCLTech (India)

- NTT Data (Japan)

- Atos (France)

- Fujitsu (Japan)

- Deloitte (USA)

- PwC (USA)

- Kyndryl (USA)

- NEC Corporation (Japan)

- SAP (Germany)

- Genpact (USA)

- LTIMindtree (India)

- Samsung SDS (South Korea)

- In the IT services market, Accenture has established itself as a global leader in digital transformation, using its deep industry knowledge and extensive cloud partnerships. The company is embedding Gen AI into enterprise operations via its AI Navigator platform. The company mainly aims to automate the complex process and personalize customer experience, to position Accenture at the forefront of IT consulting and technology implementation.

- IBM is a foundational player in the IT services market and its legacy strength towards a hybrid cloud and AI-centric future, mainly via its IBM Consulting division. The company’s strategy is deeply fueled by its own technology stack, including the Watsonx AI platform and Red Hat OpenShift. In 2024, IBM generated USD 62.8 billion in revenue, which is a rise of 3% at constant currency, and USD 12.7 billion in free cash flow.

- TCS is the giant of the global IT services market, combining the massive scale with an unyielding focus on research and development through its Co-Innovation Network. The company is brilliant in providing end-to-end IT solutions, starting from application development and maintenance to enterprise cloud transformation. TCS has kept its position as the second most valuable global IT services brand with a brand value of USD 19.2 billion in 2024.

- Infosys is one of the significant contributors in the IT services market. and is distinguished by its AI-first product, Infosys Topaz. There are a huge number of AI use cases and pre-trained models providing clients generative AI capabilities to speed up business transformation. Along with this, the company offers the Infosys Cobalt cloud ecosystem, which is a collection of services and solutions that support enterprises in renewing and speeding up their cloud journey.

- Capgemini has carved a niche as a leader in the data-driven and intelligent industry transformation. the company’s Get the Future You Want strategy is powered by its deep investment in the key strategic domains, such as data & AI. Capgemini offers comprehensive IT services that help clients connect data, implement sustainable business practices, and build adaptive digital cores for a rapidly evolving technological environment.

Here is a list of key players operating in the global IT services market:

The global IT services market is intensely competitive and is defined by the lead in generative AI. Players such as IBM and Accenture are using their deep enterprise relationships, while the tech players in India compete based on scale and cost efficiency. The current strategic playbook is based on the deep alliances with cloud hyperscalers to co-develop AI solutions, acquiring niche firms specializing in AI, cybersecurity, and cloud platforms to rapidly fill the capability gaps and launch new AI service lines and platforms. For example, in October 2025, TCS acquired US-based ListEngage to boost the salesforce practice and agentic AI capabilities. This focus on AI-enabled transformation, which is coupled with industry-specific solutions and geographic expansion into new markets, is the primary component for market share and relevance.

Corporate Landscape of the IT Services Market:

Recent Developments

- In November 2025, Thomson Reuters has announced its launch of Agentic AI solutions to transform tax, audit, and accounting workflows. The launch represents technology-driven service innovation within enterprise IT and professional services, particularly targeting tax, audit, and accounting workflows.

- In August 2025, Wipro has announced the acquisition of HARMAN’s Digital Transformation Solutions (DTS) business unit, deepening engineering innovation and R&D excellence.

- In April 2025, Infosys acquired the leading cybersecurity services provider, The Missing Link. The main aim of this acquisition is to strengthen Infosys’s cybersecurity and cloud capabilities across Australia, Bangalore, India, and Sydney.

- Report ID: 8264

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IT Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.