Transitional Housing Services Market Outlook:

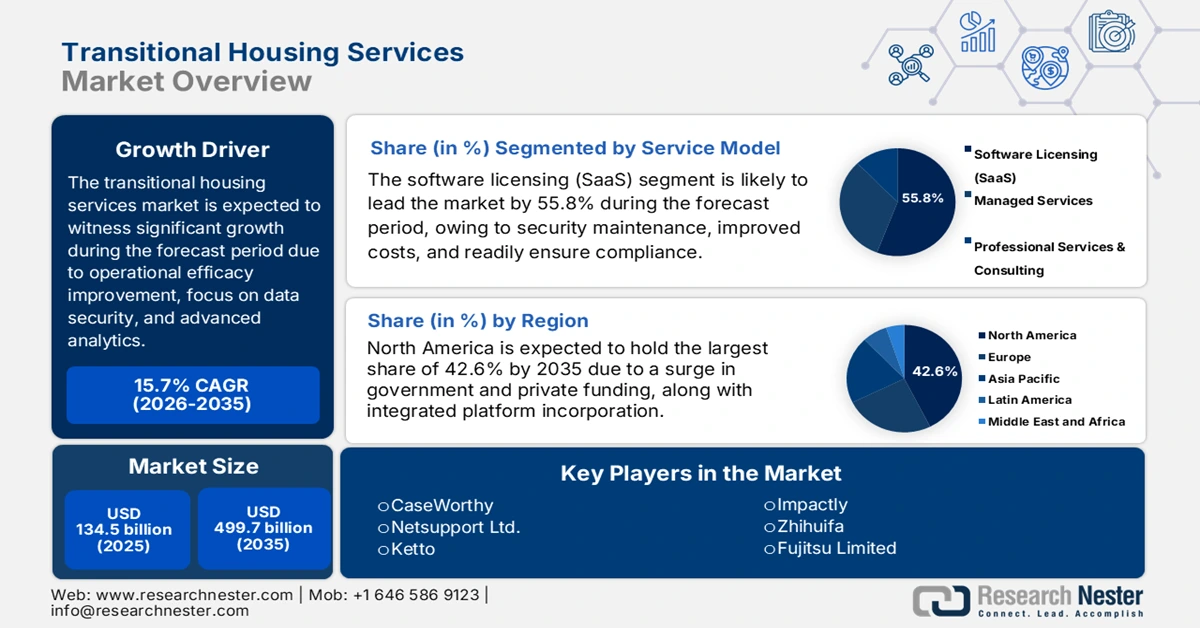

Transitional Housing Services Market size was over USD 134.5 billion in 2025 and is estimated to reach USD 499.7 billion by the end of 2035, expanding at a CAGR of 15.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of transitional housing services is estimated at USD 155.6 billion.

The international transitional housing services market is witnessing a suitable transformation, rising from a peripheral support function to a centralized tactical pillar. This shift is fueled by the urgent demand to optimize operational efficacy, thereby demonstrating tangible social impact and enhancing service delivery for the vulnerable population. According to an article published by the NCSES in August 2022, 54% non-imputed firms have adopted cloud computing for digitalizing business functions. Meanwhile, 6.1% is the adoption rate among advanced technologies, including touchscreens, with robotics and artificial intelligence constituting 3% incorporation rate. Additionally, with this adoption, there has been a surge in employment rates by 25.4% for touchscreens and 10% for robotics, thereby bolstering the market’s exposure globally.

Cloud Computing and Digitalization for Single-Unit Firms and Firms by Size Class (2022)

|

All Firms |

Single-Unit Firms |

||||

|

Employment Size |

Digitalization |

Cloud Computing |

Employment Size |

Digitalization |

Cloud Computing |

|

1-4 |

64.5% |

40.5% |

1-4 |

64.5% |

40.5% |

|

5-9 |

71.9% |

47.2% |

5-9 |

71.9% |

47.2% |

|

10-19 |

77.0% |

52.2% |

10-19 |

77.0% |

52.2% |

|

20-49 |

80.0% |

55.8% |

20-49 |

80.5% |

55.7% |

|

50-99 |

84.9% |

61.7% |

50-99 |

84.5% |

61.8% |

|

100-249 |

86.5% |

63.2% |

100-249 |

86.0% |

63.5% |

|

250-499 |

86.3% |

62.9% |

250-499 |

86.2% |

63.65 |

|

500-999 |

83.9% |

58.8% |

500-999 |

84.7% |

63.7% |

|

1,000 or more |

79.1% |

54.6% |

1,000 or more |

81.9% |

61.2% |

Source: NCSES

Moreover, the integrated platforms adoption, compliance and data security prioritization, and the utilization of innovative analytics for impact measurement are also boosting the transitional housing services market globally. As per an article published by the World Economic Forum in January 2025, 71% of global cyber leaders believe that small-scale organizations are no longer witnessing suitable security against an increase in cyber risks. Therefore, this denotes a huge demand for the market across different organizations. Besides, as stated in the June 2025 PIB Government data report, there has been an increase in internet connections in India from 25.1 crore to 96.9 crore in 2024, which is also positively impacting the market.

Key Transitional Housing Services Market Insights Summary:

Regional Highlights:

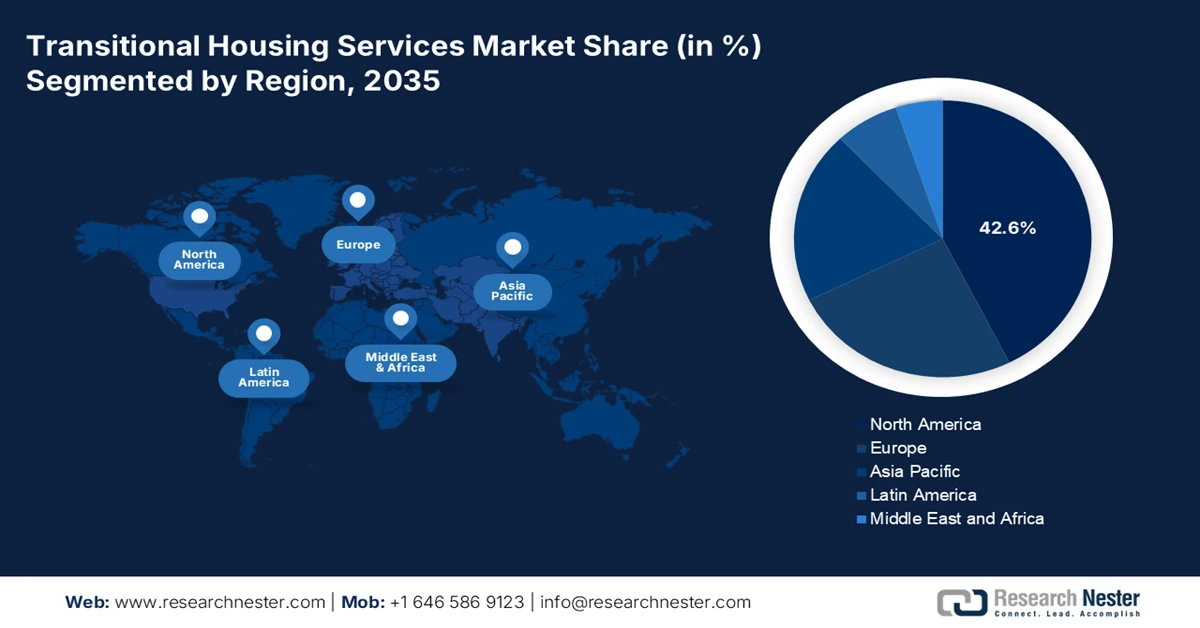

- North America in the transitional housing services market is anticipated to command a 42.6% share by 2035, supported by substantial private and government funding that accelerates digitalized social facilities and strengthens ICT ecosystems.

- Asia Pacific is expected to be the fastest-growing region by 2035, underpinned by extensive Smart City initiatives, increasing public-service digitalization, and rapid urbanization.

Segment Insights:

- The software licensing (SaaS) segment in the transitional housing services market is poised to capture a 55.8% share by 2035, reinforced by rising demand for security, cost optimization, and compliance within subscription-based cloud ecosystems.

- The digital management platforms segment is projected to secure the second-highest share by 2035, propelled by the transition from paper-based systems to integrated data platforms that streamline operations and performance tracking.

Key Growth Trends:

- Demand for operational efficiency

- Governmental digitalization mandate provision

Major Challenges:

- Data integration, privacy, and security complexities

- Digital resistance and literacy to organizational modification

Key Players: Salesforce.org (U.S.), Apricot Solutions (by Social Solutions) (U.S.), BitsforShelters (U.S.), ClientTrack (by Eccovia Solutions) (U.S.), CommunityOS (Australia), HMIS Custom Solutions (India), ShelterTech Solutions (Germany), Connectivity for Good Inc. (U.S.), Housing Data Analytics Ltd. (U.K.), Social Sector Systems (Canada), CiviCore (U.S.), CaseWorthy (U.S.), Netsupport Ltd. (U.K.), Ketto (India), Impactly (Australia), Zhihuifa (China), Fujitsu Limited (Japan), Samsung SDS (South Korea), Sistematica S.p.A. (Italy), MySejahtera (Government-Backed) (Malaysia).

Global Transitional Housing Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 134.5 billion

- 2026 Market Size: USD 155.6 billion

- Projected Market Size: USD 499.7 billion by 2035

- Growth Forecasts: 15.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Canada

- Emerging Countries: India, South Korea, Australia, Brazil, Singapore

Last updated on : 17 November, 2025

Transitional Housing Services Market - Growth Drivers and Challenges

Growth Drivers

- Demand for operational efficiency: The transitional housing services market is continuously facing effective resource constraints, owing to which there is a huge need for cloud-based platforms. The purpose is to diminish administrative overhead, cater to people, and automate tasks with currently available resources. For instance, according to an article published by the ITA in January 2024, the digital economy in Ireland is valued at USD 50 billion, accounting for 13% of the gross domestic product (GDP). This is extremely suitable for ensuring operational efficiency, especially across different organizations.

- Governmental digitalization mandate provision: Public funders across different nations are increasingly demanding data-based and standardized reporting on program outcomes, along with client progress, which is also uplifting the transitional housing services market. As per the 2025 OECD data report, the digital government index for digitalized design accounts for 0.09, which is followed by 0.1 for data-based public sector and government as a platform, 0.09 for open by default, 0.1 for user-driven, and 0.07 for proactiveness. Besides, there exist other countries as well, with differences in the index valuation, thus denoting an optimistic outlook for the overall market.

Country-wise Digital Government Index (2023)

|

Countries/Components |

Digital by Design |

Data-Driven Public Sector |

Government as a Platform |

Open by Default |

User-Driven |

Procativeness |

|

Korea |

0.16 |

0.16 |

0.15 |

0.14 |

0.15 |

0.15 |

|

Denmark |

0.14 |

0.13 |

0.14 |

0.13 |

0.11 |

0.13 |

|

UK |

0.15 |

0.1 |

0.11 |

0.11 |

0.15 |

0.14 |

|

Norway |

0.12 |

0.14 |

0.13 |

0.09 |

0.14 |

0.12 |

|

Australia |

0.16 |

0.12 |

0.12 |

0.07 |

0.13 |

0.12 |

|

Estonia |

0.11 |

0.15 |

0.11 |

0.10 |

0.10 |

0.14 |

- Increased push for digital equity: The recognition aspect that internet accessibility is considered a fundamental social determinant has resulted in governmental subsidy programs. This has readily uplifted the device and connectivity accessibility as a core component in the transitional housing services market. According to the December 2023 OECD article, the internet accessibility for setting policy priorities by the end of 2028 caters to 59% of primary, lower secondary, and upper secondary nations, along with 48% of VET countries. Therefore, based on this driver, there is a huge push for digital equity suitable for the market’s growth.

Challenges

- Data integration, privacy, and security complexities: Housing providers handle critical personal data, making strong compliance and cybersecurity with regulations, such as GDPR. However, maintaining and integrating enterprise-based security is financially and technically essential for small-scale organizations. Therefore, a parallel change is the system integration, which is causing a hindrance in the transitional housing services market globally. Providers frequently utilize legacy systems for case management, finances, and fundraising without initiating communication, thus developing data silos.

- Digital resistance and literacy to organizational modification: The rapid implementation of the newest technology is considered a human challenge, in comparison to a technical one in the transitional housing services market. Staff at different levels might lack the digital literacy requirement to utilize new systems successfully, resulting in low adoption and frustration. Moreover, there exists significant cultural resistance to ensuring mobility from familiar to data-based digitalized workflows. This modification demands ongoing and wide-ranging training, which requires resources and time that are already present, thus creating a gap in the market’s development.

Transitional Housing Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.7% |

|

Base Year Market Size (2025) |

USD 134.5 billion |

|

Forecast Year Market Size (2035) |

USD 499.7 billion |

|

Regional Scope |

|

Transitional Housing Services Market Segmentation:

Service Model Segment Analysis

The software licensing (SaaS) segment in the transitional housing services market is anticipated to garner the highest share of 55.8% by the end of 2035. The segment’s growth is highly attributed to maintaining security, optimizing expenses, and ensuring compliance by catering to subscription-based deals for cloud-specific software. According to an article published by Invest India in March 2022, the SaaS ecosystem in India is expected to increase between 4% to 5%, amounting to USD 50 billion to USD 70 billion in revenue opportunity by the end of 2030. This growth is poised to positively impact software delivery, licensing, and cloud computing, which in turn bolsters the overall segment.

Solution Type Segment Analysis

The digital management platforms segment in the transitional housing services market is projected to cater to the second-highest share during the predicted period. The segment’s growth is driven by the existence of case management CRM for service plans and tracking resident intake, operational analytics for generating performance dashboards, and donor and grant management software for compliance and fundraising. The segment’s growth is fueled by a fundamental transition from paper-specific records to integrated data systems. This has readily compelled providers to incorporate sophisticated platforms that can streamline regular operations and aggregate data to prove their impact.

Deployment Segment Analysis

Cloud-based segment in the transitional housing services market is predicted to constitute the third-highest share by the end of the forecast duration. The segment’s development is propelled by IT and severe budget constraints of non-profit housing providers. In addition, cloud-specific SaaS solutions eradicate large-scale upfront hardware expenses, successfully replacing them with predictable and manageable subscription fees. In addition, these provide remote accessibility, which is essential for field staff and automatic updates that ensure compliance and security with inherent scalability and internal IT overhead.

Our in-depth analysis of the transitional housing services market includes the following segments:

|

Segment |

Subsegments |

|

Service Model |

|

|

Solution Type |

|

|

Deployment |

|

|

End user |

|

|

Organization Size |

|

|

Housing Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transitional Housing Services Market - Regional Analysis

North America Market Insights

North America in the transitional housing services market is anticipated to account for the largest share, 42.6%, by the end of 2035. The market’s growth in the region is largely attributed to private and government funding for digitalized social facilities, early adoption of integrated technology platforms for cloud computing and digitalization, and strict data reporting mandates. According to an article published by the U.S. Department of State in January 2025, the CHIPS and Science Act has significantly allocated USD 500 million to the International Technology Security and Innovation (ITSI) Fund to ensure telecommunication networks. The U.S. is poised to utilize this fund and operate with partners to apply regulatory frameworks for gaining ICT ecosystems and create a suitable environment for trustworthy vendors.

Digitalization and Cloud Computing Prevalence Across Different Industries

|

Industry Type |

Digitalization |

Cloud Computing |

|

Utilities |

63.4% |

30.2% |

|

Nondurable Manufacturing |

79.4% |

48.7% |

|

Durable Manufacturing |

79.1% |

45.8% |

|

Wholesale Trade |

73.6% |

48.5% |

|

Retail Trade |

59.6% |

34.5% |

|

Information |

83.4% |

65.6% |

|

Professional, Scientific, and Technical Services |

80.6% |

60.7% |

|

Enterprises and Companies Management |

76.3% |

45.7% |

Source: NCSES

The transitional housing services market in the U.S. is growing significantly, owing to the presence of a federal mandate for data-based performance, a tactical push for digital equity through the Affordable Connectivity Program (ACP), along with the device and connectivity management integration. As per an article published by the CSIS in January 2025, the federal expenditure on cloud, with an estimated USD 17 billion valuation as of 2024, is projected to reach USD 20 billion, while the overall federal IT expenditure has successfully reached over USD 130 billion. Besides, the U.S. Government Accountability Office (GAO) stated a surge in federal data usage by more than 30 times within 10 years, thus making it suitable for the market.

The transitional housing services market in Canada is also growing due to effective federal and provincial partnerships, a focus on outcome-based funding, and generous investment in developing integrated supportive housing units. According to an article published by the Government of Canada in April 2025, the Canada Safety and Security Program (CSSP) has provided USD 996,666 for enhancing the country’s preparedness against emerging infectious diseases through the regional Food Inspection Agency. Therefore, this denotes a huge growth opportunity for the market in the country by ensuring point-of-need testing.

APAC Market Insights

Asia Pacific in the transitional housing services market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by a huge government-based Smart City initiative, an increase in public service digitalization, and rapid urbanization. Countries, such as India and China, are generously investing in digital public infrastructure, comprising technology solutions for cost-effective housing management. As per the 2025 RIS article, 1.4 billion people are authenticated with digital identity, USD 280 billion monthly UPI transactions take place, and 8.5 billion documents are issued on Digilocker. Therefore, with such developments, there is a huge growth opportunity for the market in the region.

The transitional housing services market in China is gaining increased exposure, owing to the Ministry of Housing and Urban-Rural Development (MOHURD) leveraging IoT and big data in the public rental housing management as well as social welfare programs. According to an article published by NLM in October 2023, the country’s urbanization level, which is fueled by large-scale industrialization, has reached 65.2% by the end of 2022. This has created a surge in economic growth and caused urban ecology to face critical environmental problems, thus denoting an optimistic outlook for the overall market’s growth.

The transitional housing services market in India is also growing due to the existence of the Pradhan Mantri Awas Yojana - Urban (PMAY-U), which has aimed to offer housing for the overall population. This seems to be possible by the robust technology component through the AWAAS Soft and MIS platforms for governance. As stated in the September 2025 PIB Government article, of the 4.9 crore houses targeted to be developed, 2.8 crore have been readily completed. In addition, an overall 2,68,480 landless beneficiaries have significantly been sanctioned houses, particularly under the PMAY-G, thus bolstering the market’s exposure in the country.

Europe Market Insights

Europe in the transitional housing services market is projected to grow steadily by the end of the forecast timeline. The market’s upliftment in the region is driven by the presence of robust data protection, along with a growth emphasis on digitalized inclusion as the ultimate social policy. According to an article published by the Republic of Slovenia in February 2025, the Ministry of the Economy has offered suitable support for 23 digitalized transformation projects, and EUR 43.8 million has been successfully co-financed by the Europe Union. This project is a part of the Recovery and Resilience Plan (RRP) in the region, based on which the market is continuously uplifting.

The transitional housing services market in Germany is gaining increased traction, owing to the federal government’s Digital Strategy approach, which has prioritized municipal service digitalization, comprising housing and social welfare. Besides, as per the February 2023 CESifo article, the country’s e-government development index caters to 0.7 in online service, 0.9 in human capital, 0.8 in telecom infrastructure, and 0.87 in overall e-government development as of 2022. Meanwhile, contributions initiated by the Urban Development and Building (BBSR) and the Federal Ministry for Housing are also driving the market in the country.

The transitional housing services market in the UK is also growing due to local authorities utilizing standardized data systems, such as the Homelessness Case Level Collection (H-CLIC), to identify detailed outcomes. This particular mandate possesses the capability to report, capture, and manage the complicated data to the central government. Additionally, this significantly contributes to gaining continuous funding and compliance, which directly uplifts the market’s growth and vendor opportunities in the country.

Key Transitional Housing Services Market Players:

- Salesforce.org (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apricot Solutions (by Social Solutions) (U.S.)

- BitsforShelters (U.S.)

- ClientTrack (by Eccovia Solutions) (U.S.)

- CommunityOS (Australia)

- HMIS Custom Solutions (India)

- ShelterTech Solutions (Germany)

- Connectivity for Good Inc. (U.S.)

- Housing Data Analytics Ltd. (U.K.)

- Social Sector Systems (Canada)

- CiviCore (U.S.)

- CaseWorthy (U.S.)

- Netsupport Ltd. (U.K.)

- Ketto (India)

- Impactly (Australia)

- Zhihuifa (China)

- Fujitsu Limited (Japan)

- Samsung SDS (South Korea)

- Sistematica S.p.A. (Italy)

- MySejahtera (Government-Backed) (Malaysia)

- Salesforce significantly offers a notable cloud-based CRM platform, which is tailored for non-profits. This has enabled transitional housing providers to manage grants, client cases, and donor relationships in a unified system. Besides, as per its 2025 annual report, the organization generated USD 37.9 billion in revenue, denoting a 9.0% year-over-year (YoY) increase, along with USD 63.4 billion in remaining performance obligation, and USD 13.1 billion in operating cash flow.

- Apricot Solutions provides a special case management software that assists housing agencies in tracking program performance, services, and client progress with strong reporting tools. It is comprehensively implemented for its ability to standardize data collection and ensure compliance with funder mandates, along with optimizing service delivery efficiency.

- BitsforShelters readily focuses on offering connectivity solutions and integrated hardware services, including managed devices and secured Wi-Fi networks, particularly for shelter environments. Besides, the company caters to the severe challenge of digital equity by ensuring both staff and residents have secured and reliable accessibility to crucial management systems and online resources.

- ClientTrack (by Eccovia Solutions) significantly delivers an enterprise-level and comprehensive platform for effectively coordinating care across human, health, and housing services by facilitating the Housing First approach. The firm’s contribution enables collaboration and complex data sharing between various service providers to develop a support network for vulnerable individuals.

- CommunityOS makes the provision of a cloud-based and flexible platform, effectively designed for community service organizations, such as those present in transitional housing, for managing projects, funding obligations, and clients. The organization has made a remarkable impact in Australia by assisting firms to streamline compliance reporting and successfully measure their social return on investment.

Here is a list of key players operating in the global market:

The competitive landscape for the transitional housing services market is highly fragmented, which features specialized government-based digital initiatives, large-scale technology consultancies, and specialized software firms. Notable players such as Social Solutions and Salesforce Organization deliberately dominate through strong cloud-based platforms that provide a wide range of case analytics and management. Besides, in February 2024, Blue Cross and Blue Shield declared their provision of USD 12 million for more than 5 years to community organizations. The purpose is to assist in funding new temporary and permanent housing in Illinois, thereby making it suitable for the transitional housing services market growth.

Corporate Landscape of the Transitional Housing Services Market:

Recent Developments

- In October 2025, Portakabin successfully launched the advanced transitional housing model, with the objective of providing families in the UK with space, and cater to an affordable, scalable, and high-quality solution to address the country’s temporary accommodation issue.

- In January 2024, the Corporation for Supportive Housing, along with Lt. Gov. Suzanne Crouch, notified four teams for supportive housing to implement housing developments in different communities in Indiana.

- In November 2023, Vancouver Coastal Health announced that the latest integrated transitional healthcare and housing service will be readily supporting people with complicated mental health, housing demand, and overall health challenges.

- Report ID: 8244

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.