Managed Security Services Market Outlook:

Managed Security Services Market size was over USD 39.83 billion in 2025 and is anticipated to cross USD 138.84 billion by 2035, witnessing more than 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of managed security services is assessed at USD 44.6 billion.

The primary factor for market growth is the rising penetration of internet services and technological solutions in businesses. This is expected to increase the utilization rate of managed security services for keeping enterprises up-to-date with security issues, audits, and maintenance while preventing data thefts, breaches, cybercrime, and other cyber-related issues. A recent report that was published in 2022 stated that more than 90% of organizations and businesses around the world were calculated to be using some sort of digital initiative in their processes.

In the recent period, managed security services have been adopted by various enterprises as these solutions aid in the protection of corporate internet assets, password files, and confidential data. As a result, managed security services have been opted among organizations of all sizes which in turn is expected to expand the market size during the forecast period. Moreover, companies over the world are investing in network protection for securing their data which results in a higher adoption rate of managed security services in the next few years. Various advantages of managed security services such as its cheap and efficient security solution for customer and client businesses to help them secure their sensitive information and prevent data theft is anticipated to bolster its adoption rate in the assessment period. In addition to the aforementioned factors, the rapid escalation in cases of cybercrimes, hacking, phishing, thefts, and other crimes is estimated to drive the global managed security services market. Furthermore, the growing utilization rate of mobiles, IoT (Internet of Things) devices, and electronic products at workplaces along with the increase in electronic data worldwide are projected to create a positive outlook for the growth of the managed security services market.

Key Managed Security Services Market Insights Summary:

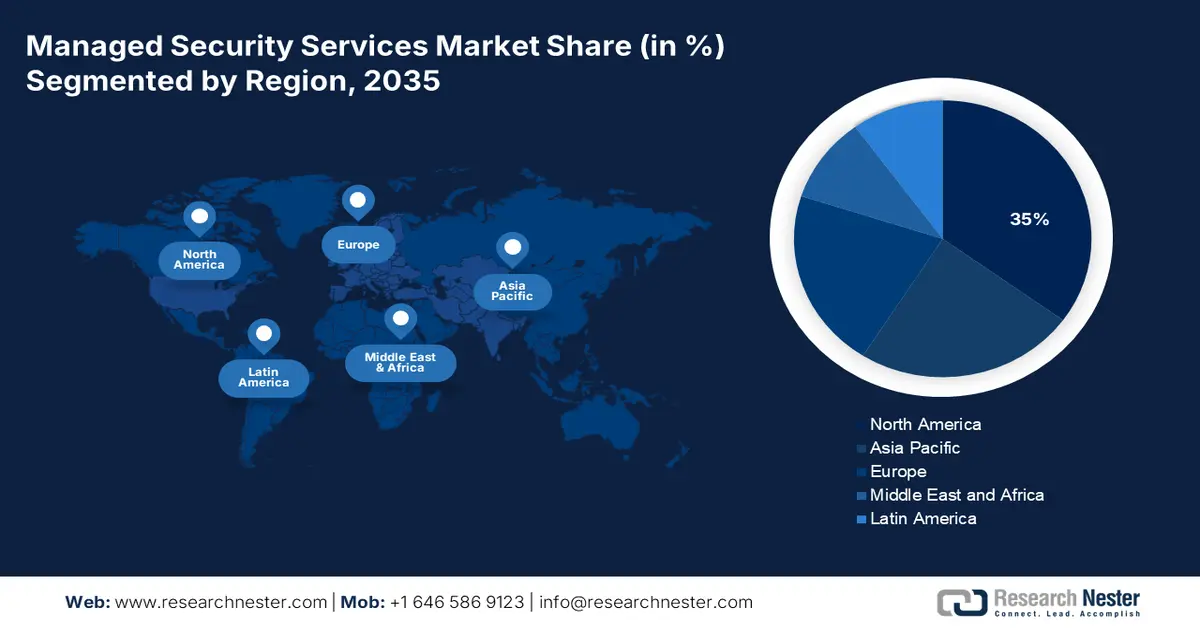

Regional Highlights:

- North America managed security services market is predicted to capture 35% share by 2035, driven by increasing security breaches and investments in cloud-based security solutions.

- Asia Pacific market will secure 24% share by 2035, fueled by developing businesses requiring advanced data protection solutions.

Segment Insights:

- The cloud segment in the managed security services market is projected to hold a 55% share by 2035, driven by increasing cloud adoption and demand for secure, scalable data protection.

- The bfsi segment in the managed security services market market will capture a 31% share, fueled by increasing cyber threats and the need for advanced security, 2026-2035.

Key Growth Trends:

- Growing Cases of Cyber Attacks and Cyber-Related Crimes

- Rising Amount of Data Being Produced Everyday

Major Challenges:

- Growing Cases of Cyber Attacks and Cyber-Related Crimes

- Rising Amount of Data Being Produced Everyday

Key Players: IBM, SecureWorks, Inc., Verizon, Trustwave Holdings, Inc., Broadcom Inc., AT&T Inc., BAE Systems, CIPHER, Accenture, NTT Limited, Field Effect Software Inc.

Global Managed Security Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.83 billion

- 2026 Market Size: USD 44.6 billion

- Projected Market Size: USD 138.84 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Managed Security Services Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Cases of Cyber Attacks and Cyber-Related Crimes As organizations are being digitized nowadays, the number of cyberattacks, data thefts, phishing, hacking, identity theft, and other cyber-related crimes has grown considerably. As a result, businesses are opting for advanced solutions such as managed security services for protecting their vital documents, passwords, files, and other personal items of the enterprises. Therefore, with the increased number of cyberattacks occurring across the businesses present in the world, the adoption rate of managed security services is also anticipated to rise subsequently bringing favorable opportunities for market growth. For instance, it was calculated that in 2021, almost 86% of the organizations present in the world were affected by a successful cyberattack, which is an increase from 80% in 2020, and 70% of organizations in 2015. Also, it has been projected that by the end of 2023, approximately 95 cybercrime cases are estimated to occur per hour across the world, which is equivalent to 35 billion accounts.

-

Rising Amount of Data Being Produced Everyday With the growing number of enterprises across the world, the amount of data being generated daily is also rising. This is generating the need for efficient solutions that could work and manage in the core network, secure confidential data, and introduce tight security for data protection. This aspect is estimated to bring in the need for managed security services for proper management and security of data being generated by the companies and aid in expanding the global market size during the forecast period. According to estimates, around 2.5 quintillion bytes of data were produced every day in 2021 worldwide.

-

Rapid Product Launches and Technological Advancement in Cyber Security Services by Key Players – Key players working in the field are working together to bring in technological advancement in cyber security services for better protection of data being produced by the companies. As a result, they are launching products and services to refine the managed security services in the corporate offices. For instance, recently, Intel, a global semiconductor chip manufacturer has launched the 6th-generation of vPro Chips. These powerful chips are made to revolutionize 'authentication security' by utilizing multiple levels and methods of authentication. It has up to 2.5 times the performance, 3 times the battery life, and 30 times the graphic performance of a system over a five-year-old system.

-

Rising Penetration of the Internet and Internet Users – According to data, it was revealed that 63% of the global population used the internet by the first quarter of 2022.

-

High Usage of Internet of Things (IoT) -Â \Globally, about 8 billion Internet of Things (IoT) devices are expected to exist in 2020, almost tripling to more than 28 billion IoT devices in 2030.

-

Boost in the Information Technology (IT) Industry - It was calculated that in the year 2020, the global IT industry generated more than USD 5 trillion.

Challenges

- Lack of Capital Resources The implementation of managed security services in businesses requires a high amount of investment. This factor is expected to lower the adoption rate of the solution in enterprises with less amount of funds. Hence, this factor is anticipated to hamper the market growth during the forecast period.

- Unavailability of Skilled IT Professionals

- Reluctance and Trust Issues on Third-Party Applications

Managed Security Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 39.83 billion |

|

Forecast Year Market Size (2035) |

USD 138.84 billion |

|

Regional Scope |

|

Managed Security Services Market Segmentation:

Deployment Mode Segment Analysis

Cloud segment is poised to hold managed security services market share of more than 55% by 2035, due to rising adoption of cloud computing by companies around the world as well as the increased amount of data being stored in the cloud owing to its great advantages. For instance, in the year 2021, more than 65% of global enterprise infrastructure was cloud-based. Also, the numerous advantages of cloud solutions such as efficiency in managing data and effectiveness in storing a big amount of data for storing and protection from cyber threats are propelling enterprises to opt for cloud services for proper data management. Technologically advanced cloud solutions are very much effective in improving the managed security services and reducing the chances of cyberattacks and cyber-crimes in the long run which in turn, is anticipated to bring lucrative growth opportunities in revenue generation of the segment.

End User Segment Analysis

BFSI segment is expected to capture managed security services market share of over 31% by 2035. The BFSI vertical is the major source of highly confidential information for customers about their financial data, user IDs, passwords, and other personal information. As a result, they require advanced solutions for the protection of these resources and critical information. Also, BFSI is mostly attacked by phishing attacks which are aimed at stealing login credentials, and DDoS attacks for sabotaging online payments. As managed security services are imperative for these types of financial institutions for improving the customer experience and protecting their customers against the consequences of a breach in security, the rapid growth of BFSI is anticipated to increase the growth of the segment.

Our in-depth analysis of the global market includes the following segments:

|

By Deployment Mode |

|

|

By Solution Type |

|

|

By Security Type |

|

|

By Enterprise Size |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Managed Security Services Market Regional Analysis:

North American Market Insights

In managed security services market, North America region is estimated to capture over 35% revenue share by 2035, owing to increasing cases of a security breach, higher dependence of enterprises on cloud-based applications, and increasing investments by players in security solutions. In 2020, over 1000 cases of data breaches were reported in the United States, with over 155 million people being affected by data exposure. Furthermore, region comprises the United States and Canada which have the most number of managed security services vendors with the most advanced infrastructure and high technological adoption in businesses. Also, the rising governing initiatives to protect critical infrastructure, systems, and data against ever-evolving cyberattacks are considered to positively contribute to market growth.

APAC Market Insights

In managed security services market, Asia Pacific region is anticipated to hold revenue share of more than 24% by 2035, due to presence of developing businesses and enterprises which require advanced solutions for data and information protection. In addition, the high investment made by the government and key players operating in the research and development sector for the development of advanced managed security services to eliminate the chances of data thefts, cyberattacks, hacking, phishing, and other cybercrimes is estimated to create a positive outlook for robust revenue generation of the market. Furthermore, emerging economies, such as China and India are increasingly investing in IT infrastructure, which is expected to provide untapped business opportunities for market players.

Europe Market Insights

European segment is expected to capture remarkable share by the end of 2035, due to rising awareness about cybercrimes and their solutions, European countries are opting for managed security services for the protection of confidential data and important information which in turn is anticipated to increase the revenue generation for market growth. Also, the increasing internet penetration, security breaches, and sophisticated cyberattacks are estimated to bring lucrative growth opportunities for market growth.

Managed Security Services Market Players:

- IBM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SecureWorks, Inc.

- Verizon

- Trustwave Holdings, Inc.

- Broadcom Inc.

- AT&T Inc.

- BAE Systems

- CIPHER

- Accenture

- NTT Limited

- Field Effect Software Inc.

Recent Developments

-

Field Effect Software Inc., a global cyber security company specializing in providing intelligence-grade protection for SMEs, announced a new partnership with UK-based IT security reseller and managed service provider, RS22, to enable best-in-class cyber security protection for businesses to defend and stay ahead of disrupting cyberattacks.

-

To help organizations create a unified security approach and manage their hybrid cloud security strategy, IBM announced new and enhanced services that bring together cloud-native, IBM, and third-party resources.

- Report ID: 4130

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Managed Security Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.