Digital Transformation Consulting Services Market Outlook:

Digital Transformation Consulting Services Market was valued at USD 692.3 billion in 2025 and is poised to reach USD 2589.1 billion by 2035, rising at a CAGR of 14.1% during the forecast period from 2026-2035. In 2026, the industry size of digital transformation consulting services is assessed at USD 789.9 billion.

The increasing trend of customer-centric strategies and experience-driven digital transformation is reshaping how enterprises operate and sustain in a rapidly digitalizing world. In today’s hyper-competitive markets, businesses are under high pressure to provide seamless, personalized, and omnichannel experiences. This necessitates redesigning customer journeys, including real-time analytics, and developing experience-led platforms, often with the help of consultants. For instance, in June 2025, EY launched EYStudio+, a platform that brings together design, data, marketing, and technology teams to provide connected end-to-end consumer experiences, showcasing how consulting firms are bolstering innovation and promoting market growth.

Key Digital Transformation Consulting Services Market Insights Summary:

Regional Highlights:

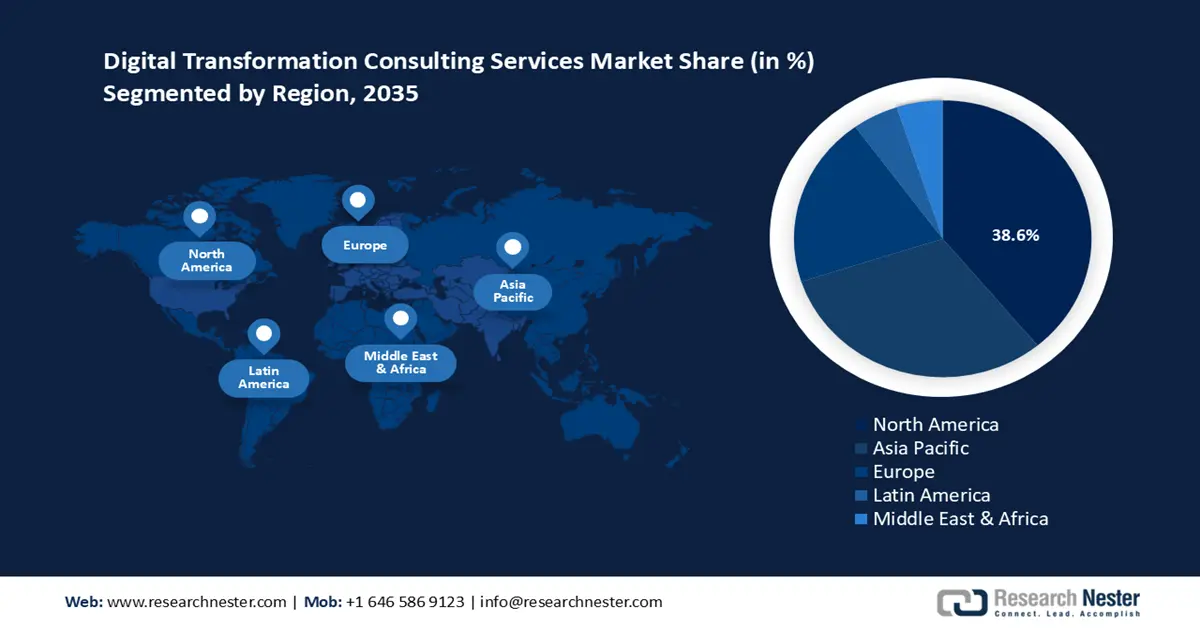

- By 2035, North America is projected to secure a 38.6% revenue share in the Digital Transformation Consulting Services Market, upheld by accelerating digital transformation across major sectors.

- The APAC region is set to expand at the fastest pace through 2026–2035, reinforced by nationwide digitalization initiatives in emerging economies.

Segment Insights:

- By 2035, the online service segment in the Digital Transformation Consulting Services Market is anticipated to capture a 65.3% revenue share, supported by the surging adoption of cloud computing.

- The healthcare segment is projected to command a 40.3% revenue share by 2035, strengthened by the increasing integration of digital solutions to enhance patient outcomes.

Key Growth Trends:

- Advent of quantum computing and rising demand for future-proof business models

- 5 G-driven market innovation in remote work

Major Challenges:

- Talent shortage and skills gap in emerging technologies

- High implementation costs and ROI uncertainty

Key Players: Accenture, IBM, Tata Consultancy Services (TCS), Capgemini, Cognizant Technology Solutions, Deloitte, PwC (PricewaterhouseCoopers), KPMG, Infosys, Wipro, HCL Technologies, SAP, NTT Data, Atos, DXC Technology.

Global Digital Transformation Consulting Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 692.3 billion

- 2026 Market Size: USD 789.9 billion

- Projected Market Size: USD 2589.1 billion by 2035

- Growth Forecasts: 14.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 3 October, 2025

Digital Transformation Consulting Services Market - Growth Drivers and Challenges

Growth Drivers

- Advent of quantum computing and rising demand for future-proof business models: The early adoption of quantum computing has transformed industries such as financial services, manufacturing, and retail. In financial services, the advent of quantum computing will enable faster risk assessments and considerably improve fraud detection. The digital transformation consultants are preparing businesses for the changes induced by quantum computing. For instance, IBM and D-Wave are working with major financial institutions to test quantum applications.

- 5 G-driven market innovation in remote work: The 5G technology revolution has altered the business models, especially in remote work consulting. Due to the faster speeds offered, 5G has enabled high-performance remote collaboration tools. For instance, telemedicine is benefiting from 5G’s ability to stream high-definition video for consultations. Additionally, trends within multiple regional sectors indicate that a greater percentage of firms are implementing remote collaboration tools in sectors such as healthcare and telecommunications.

- Rising regulatory, cybersecurity, data privacy & security pressures: Regulatory compliance, cybersecurity, and data privacy concerns are expected to propel demand for consulting. As digital adoption booms, so do risks associated with cyber threats, regulatory violations, and data misuse. Thus, enterprises are seeking consulting services to strengthen security frameworks, guarantee compliance with global and regional regulations, and manage emerging risks from AI and data-intensive operations. For instance, in July 2025, PwC UK launched a new array of services, Assurance for AI, aimed at offering independent checks and related solutions for AI systems. This initiative grants formal assurance over critical AI controls and is distinct from PwC’s advisory services, which cover AI risk management, governance, and system validation. This reflects how consulting firms are positioning themselves to address clients’ dual need for digital innovation and regulatory security.

Challenges

- Talent shortage and skills gap in emerging technologies: The market is impaired by the talent shortage and skill gaps in assimilating with rapidly emerging technologies such as AI, ML, and quantum computing. The shortage of skilled professionals has created a gap in the market in the seamless implementation of advanced tech. Additionally, project timelines tend to be delayed due to the dearth of skilled talent.

- High implementation costs and ROI uncertainty: Digital transformation demands large-scale investments in cloud migration, AI integration, cybersecurity, and data management. For many enterprises, mainly mid-sized firms, these costs can be prohibitive due to tighter budgets. Beyond upfront spending, hidden expenses such as system integration, training, and maintenance can add to the financial burden. A further complication is the uncertainty about return on investment (ROI). Not all digital initiatives immediately result in measurable business value, leading a few organizations to delay or scale back their consulting engagements. For consulting firms, this poses the challenge of transparently demonstrating business outcomes and the cost-effectiveness of their strategies.

Digital Transformation Consulting Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.1% |

|

Base Year Market Size (2025) |

USD 692.3 billion |

|

Forecast Year Market Size (2035) |

USD 2589.1 billion |

|

Regional Scope |

|

Digital Transformation Consulting Services Market Segmentation:

Type Segment Analysis

The online service segment is poised to account for a dominant revenue share of 65.3% by the end of 2035. A key facet supporting the segment’s expansion is the surging adoption of cloud computing across various regional markets. Another characteristic is the rising opportunity for vendors to provide businesses with tools for data storage, remote collaboration, and automation, allowing firms to bolster customer experiences. By the end of 2035, the online services segment is poised to maintain its steady growth due to its cost-effectiveness.

Application Segment Analysis

The healthcare segment is projected to hold a 40.3% revenue share by the end of 2035. A major driver that supports the greater opportunity for application in the healthcare sector is the increasing integration of digital solutions to improve patient outcomes. Additionally, the integration of Electronic Health Records (EHR) has contributed to the transformation of healthcare sectors across regional markets. Additionally, with a growing percentage of healthcare providers digitizing the patient care processes, the demand for digital consultants have risen. The growing opportunity of application in the healthcare sector of digital transformation consulting services is the shift towards personalized medicine, which is set to ensure the sustained expansion throughout the forecast timeline.

End user Segment Analysis

The large enterprises segment is a dominant end user of the digital transformation consulting services market, driven by their need to advance complex, outdated systems, increase global operations, and stay competitive in a fast-evolving digital landscape. These enterprises often lead in trying out advanced technologies such as AI, cloud, and data analytics, as they have the resources to invest in large-scale transformation programs. These firms play a critical role in helping them ease out processes, manage risk, and align digital initiatives with long-term business goals. For instance, in June 2025, Capgemini and Dai-ichi Life Holdings signed a multi-year agreement to build a Global Capability Center (GCC) in India, for fast-tracking Dai-ichi Life Group’s digital transformation worldwide.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Service Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Transformation Consulting Services Market - Regional Analysis

North America Market Insights

The North America digital transformation consulting services market is poised to maintain a leading revenue share of 38.6% by the end of 2035. The regional market is poised to maintain its leading share due to the digital transformation across notable sectors, which has driven the demand for consulting services. Additionally, the increasing emphasis on cybersecurity and data privacy has driven the demand for consulting services to assist in ESG disclosure. Another regional trend has been the rising percentage of enterprises continuously shifting their workloads to multi-cloud environments.

The U.S. market is poised to maintain a considerable revenue share in the regional market. The market’s expansion is attributed to the U.S. establishing itself as a premier market for the deployment of technologies such as AI and blockchain. Additionally, major industries have steadily shifted to digitalization, requiring consulting services to assist in the transition. Moreover, the U.S. has experienced greater investments in 5G infrastructure, with more than USD 9 billion allocated for the expansion under FCC grants. The improved 5G infrastructure is expected to improve the deployment of online consulting services.

Asia Pacific Market Insights

The APAC digital transformation consulting services market is expanding at the fastest rate during the forecast period. Key macroeconomic indicators of the regional market include the ongoing digitalization efforts in the emerging economies of APAC. Governments across APAC have been proactive in continuous investments in nationwide digitalization, which has created an opportunity to offer digital transformation consulting services. Major nation-wide initiatives are the Digital India initiative and the China Belt and Road initiative, which are poised to drive a greater demand for consulting services.

The China digital transformation consulting services sector is favorably impacted by the rapid technological advancements. The market is leveraging its dominance in manufacturing and surging investments in smart cities to foster digital transformation across varied sectors. The Made in China 2025 initiative is anticipated to upgrade domestic industries through digitization and AI automation. Additionally, the changing regulatory landscape in China, characterized by the data localization laws, presents a booming requirement for consulting services.

Europe Market Insights

The Europe digital transformation consulting services market is poised to expand during the forecast timeline, supported by a greater demand for cloud solutions and cybersecurity across notable sectors. A key driver of the regional market is the rising demand for digital transformation solutions in energy management and solutions. In 2024, the European Commission reported that more than 41.17% of businesses in the EU have integrated AI-based solutions to bolster supply chain management. Such measures are expected to drive a greater demand for consulting services.

The Germany market is expected to expand its revenue share during the forecast timeline. The demand for digital transformation consulting services is projected to increase in Germany against the backdrop of the Industry 4.0 transition, where automation and smart factories are being increasingly adopted. Moreover, the Digital Strategy 2025 of Germany focuses on to make the country a leader in digital innovation through the integration of cutting-edge technology such as AI, IoT, and 5G to the existing industrial infrastructure. This trend creates a lucrative ecosystem for the proliferation of consultancy services to assist an enterprise’s digital transformation.

Key Digital Transformation Consulting Services Market Players:

- Accenture

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM

- Tata Consultancy Services (TCS)

- Capgemini

- Cognizant Technology Solutions

- Deloitte

- PwC (PricewaterhouseCoopers)

- KPMG

- Infosys

- Wipro

- HCL Technologies

- SAP

- NTT Data

- Atos

- DXC Technology

The global market is poised to remain competitive during the forecast period. Leading players such as Accenture, IBM, and Tata Consultancy Services are poised to maintain their revenue share by the end of 2035, barring minuscule changes. These companies lead the market share due to the strategic initiatives in AI and data analytics.

Here is a list of key players operating in the market:

Recent Developments

- In July 2025, French consulting/IT-services major Capgemini announced its plan to acquire WNS, a business process outsourcing and digital business services firm, for about USD 3.3 billion. The rationale is to enhance Capgemini’s capabilities in Agentic AI and Generative AI for business process transformation, accelerate its digital consulting footprint, and strengthen its presence, especially in the U.S. market.

- In April 2025, Spanish technology consultancy Izertis acquired UK-based May Business Consulting (MBC), a firm specializing in digital transformation, electronic payments, banking solutions, change management, and operations with a strong focus on the financial sector. The integration was announced during the presentation of Izertis’ 2024 financial results, where the company reported revenues of USD 161.3 million and a normalized EBITDA of USD 24.18 million, marking continued uninterrupted growth.

- Report ID: 3834

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Transformation Consulting Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.