IoT Solutions and Services Market Outlook:

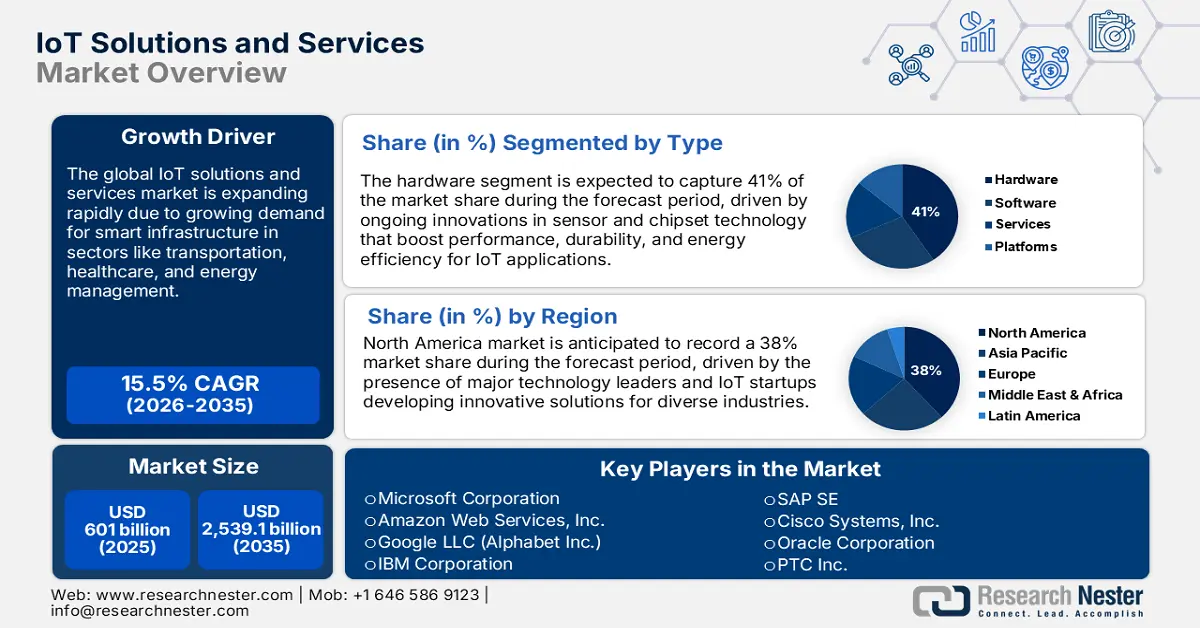

IoT Solutions and Services Market size is valued at USD 601 billion in 2025 and is projected to reach a valuation of USD 2,539.1 billion by the end of 2035, rising at a CAGR of 15.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of IoT solutions and services is estimated at USD 694.1 billion.

The global IoT solutions and services market is expanding rapidly as organizations implement connected device technology to enhance operation efficiency and enable real-time data analysis. Market leaders such as Microsoft Corporation, Amazon Web Services, Google Cloud, and SAP are advancing the trend with integrated IoT platforms that utilize artificial intelligence, cloud computing, and edge processing capabilities. For example, Synaptics launched the Astra platform, an extremely scalable IoT solution that integrates AI capabilities for exceptional edge computing performance, in December 2024, marking a significant shift in the industry's focus on smart IoT devices. Policies from governments worldwide spur development through investment in infrastructure improvements and the building of cybersecurity environments to defend against emerging threats, while facilitating secure IoT systems across various industries.

Strategic partnerships and technology convergence drive market expansion as companies develop end-to-end IoT ecosystems by leveraging advanced analytics and automation capabilities to streamline business operations. Companies partner to develop scalable platforms that are integratable with existing enterprise systems and provide strong security capabilities required by regulated industries. Microsoft Corporation made available the General Availability of Windows Server IoT 2025 with next-generation multilayer security, hybrid cloud flexibility, and AI-powered performance capabilities in November 2024. Government support for uptake is being expedited through funding schemes that are integrated in approach, from city smart programs to the regulatory framework for IoT implementation, with assurances of safeguarding data across different application domains.

Key IoT Solutions and Services Market Insights Summary:

Regional Highlights:

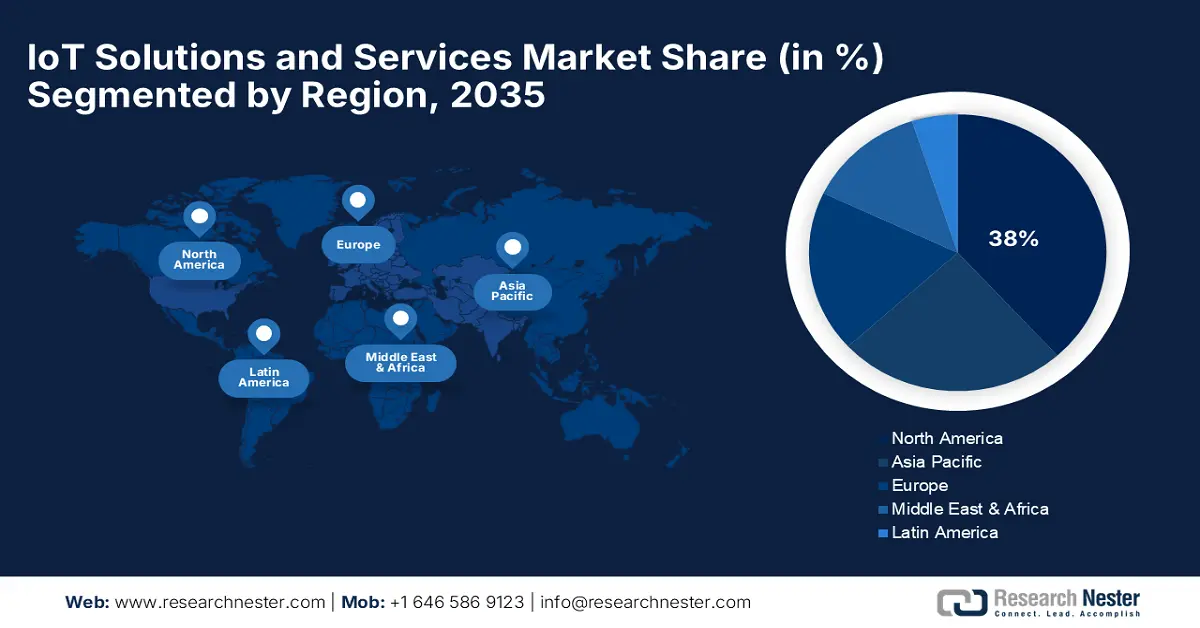

- North America IoT solutions and services market is anticipated to hold a 38% share during the forecast period, driven by advanced telecommunication infrastructure, strong venture capital inflow, and stringent regulatory frameworks fostering IoT adoption.

- Asia Pacific is projected to register a CAGR of 11% through the forecast period, owing to growing industrialization, urbanization, and government spending on smart infrastructure development.

Segment Insights:

- The hardware segment of the IoT solutions and services market is projected to capture 41% share by 2035, propelled by the foundational demand for sensors, connectivity modules, gateways, and edge computing devices.

- The industrial automation segment is anticipated to account for 30% of the market through 2035, owing to widespread adoption of IoT technology for manufacturing optimization, predictive maintenance, supply chain management, and quality control.

Key Growth Trends:

- AI-powered analytics and automation transform industrial processes

- Edge computing integration expands real-time processing capabilities

Major Challenges:

- Cyber threats and data protection regime compliance

- Interoperability and standards fragmentation barriers

Key Players: Microsoft Corporation, Amazon Web Services, Inc., Google LLC (Alphabet Inc.), IBM Corporation, SAP SE, Cisco Systems, Inc., Oracle Corporation, PTC Inc., Samsung SDS Co., Ltd., Tata Consultancy Services Limited

Global IoT Solutions and Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 601 billion

- 2026 Market Size: USD694.1 billion

- Projected Market Size: USD 2,539.1 billion by 2035

- Growth Forecasts: 145.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Mexico

Last updated on : 12 September, 2025

IoT Solutions and Services Market - Growth Drivers and Challenges

Growth Drivers

- AI-powered analytics and automation transform industrial processes: The deep integration of artificial intelligence enables IoT systems to offer predictive analytics, autonomous fault detection, and informed decision-making in the transport, healthcare, and manufacturing sectors. AI-powered IoT platforms process enormous volumes of sensor data to identify patterns, predict equipment failure, and optimize operational efficiency at low maintenance costs. Microsoft Corporation enhanced digital manufacturing operations in July 2023 with industrial IoT solutions, enabling end-to-end digital transformation for manufacturing companies. The company's Azure IoT provides three fundamental approaches, including asset monitoring, process optimization, and predictive maintenance, with the capabilities of edge computing.

- Edge computing integration expands real-time processing capabilities: The integration of edge computing with IoT infrastructure enables organizations to process valuable data closer to where it is generated, reducing latency and improving response times for mission-critical workloads. Edge IoT platforms enable real-time decision-making, enhance security through local data processing, and minimize bandwidth requirements with persistent connectivity to centralized cloud resources. For example, Microsoft Corporation introduced Azure IoT Edge Computing capabilities in August 2024 by including IoT Hub support for deploying Azure services natively on IoT devices as containers. The platform enables the deployment of various IoT edge modules as needed and implements the proper business logic for each respective business department.

- Industrial automation and smart infrastructure deployment expansion: Growing adoption of Industry 4.0 principles and smart infrastructure development generates tremendous demand for end-to-end IoT solutions across the manufacturing, energy, transportation, and urban planning sectors. Companies implement IoT technologies to enable predictive maintenance, optimize supply chains, enhance energy efficiency, and automate quality control systems, thereby improving operational efficiency. In February 2023, Fujitsu Limited partnered with Deutsche Bank Park's digital center, Arena of IoT, to implement sustainable stadium management through AI and IoT integration. The project incorporates the implementation of sensors, AI platforms, and an IoT Operations Cockpit to automate irrigation processes, as well as to demonstrate the practical application of AI in various use cases.

China's National IoT and 5G Infrastructure Deployment

|

Infrastructure Category |

Metric |

Value |

Strategic Significance |

|

5G Network Build-out |

Total 5G Base Stations (as of Nov) |

4.191 million |

Forms the high-speed, low-latency backbone for real-time IoT applications and massive machine-type communications |

|

5G Network Penetration |

% of Total Mobile Base Stations |

33.2% |

Demonstrates a committed transition to advanced network infrastructure, prioritizing next-generation connectivity |

|

Cellular IoT Adoption |

Cellular IoT End-Users |

2.642 billion |

Indicates massive scale in industrial and commercial IoT deployment, connecting sensors and machines across sectors |

|

IoT Network Dominance |

% of Total Mobile Network Connections |

59.6% |

Shows IoT connections now surpass mobile phone users, highlighting China's pivot to an IoT-driven digital economy |

|

Satellite Internet Progress |

Key Milestones |

Successful launch of high-orbit satellite + two groups of low-orbit Qianfan Constellation satellites |

Expands IoT connectivity to remote and maritime areas, creating a comprehensive, integrated space-ground network |

Source: CNNIC

Projected Global Growth of Active IoT Devices

Source: World Bank

Challenges

- Cyber threats and data protection regime compliance: The deployment of IoT devices is doubling, posing increasing attack surfaces that put organizations at risk of sophisticated cyberattacks, including device tampering, data breaches, and network intrusion attacks. Most devices connected lack robust security features, making them vulnerable to exploitation, while the requirement for regulatory compliance complicates the deployment and management of operating systems. In August 2023, the Federal Communications Commission proposed a voluntary cybersecurity labeling program for Internet of Things (IoT) devices, providing consumers with transparent information about the cybersecurity features and practices of connected devices. The Commission's action addresses growing concerns about IoT device security vulnerabilities and promotes marketplace incentives for enhanced cybersecurity practices.

- Interoperability and standards fragmentation barriers: The diverse range of IoT platforms, protocols, and communication standards creates significant integration hurdles that complicate large-scale deployment and limit system interoperability between vendors and technologies. It is challenging for companies to integrate products from different manufacturers, ensuring a secure exchange of data and single-pane-of-glass management capabilities within their IoT infrastructure. In July 2023, the U.S. National Institute of Standards and Technology (NIST) published IoT Advisory Board Privacy Recommendations, developing in-depth policies for data sharing by third parties and the utilization of IoT device data. The framework addresses the increased interconnectivity and functionality of IoT devices, which pose significant privacy risks while establishing trust through open policies.

IoT Solutions and Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 601 billion |

|

Forecast Year Market Size (2035) |

USD 2,539.1 billion |

|

Regional Scope |

|

IoT Solutions and Services Market Segmentation:

Type Segment Analysis

The hardware segment is expected to capture 41% of the IoT solutions and services market share during the forecast period, driven by the foundational demand for sensors, connectivity modules, gateways, and edge computing devices that form the basis of all IoT implementations. Hardware elements enable data collection, device-to-device communication, and local processing capabilities necessary for IoT system functionality in various markets, including industrial automation, smart cities, and consumer electronics. For example, Panasonic Corporation demonstrated innovative Industrial IoT and asset tracking technology in October 2024 with the use of the Panasonic Logiscend system at IoT Expo, with the latest tracking technology from IIoT devices and RFID to improve material flow and asset tracking. The Logiscend solution features seamless integration with existing infrastructure, providing disruptive insights to optimize inventory management and enhance material flow with dynamic scalability.

Application Segment Analysis

The industrial automation segment is anticipated to account for 30% of the market through 2035, driven by widespread adoption of IoT technology for manufacturing optimization, predictive maintenance, supply chain management, and quality control. Industrial IoT solutions enable real-time monitoring, automated decision-making, and detailed data analytics, thereby improving operational efficiency, reducing costs, and enhancing product quality. In September 2024, Hitachi, Ltd. shipped cutting-edge industrial IoT solutions through a three-step process of creating IoT value, supporting infrastructure with the Empower data platform, and emphasizing the results of action. Enterprise-class Empower platform provides Analytics as a Service support for data acquisition, mapping, modeling, and cataloging while enabling complete control over information for complete IIoT infrastructure value.

Connectivity Segment Analysis

The cellular segment is projected to dominate with a 45% market share by 2035, driven by the widespread coverage of cellular networks, enhanced security functionality, and ubiquitous coverage catering to diversified IoT applications across various geographic regions. Cellular connectivity offers a reliable and scalable communication infrastructure for both fixed and mobile IoT devices, featuring built-in security mechanisms and network management features. For example, Cisco Systems, Inc. launched an IoT as a Service solution offering building blocks for monetizable IoT services on 3G, LTE, and 5G SA networks in September 2023. The service offers an end-to-end converged core network with distributed edge deployment, governed by Cisco IoT Control Center, and facilitates seamless inter-generational transition.

Our in-depth analysis of the IoT solutions and services market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Connectivity |

|

|

Data Analysis and Security |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IoT Solutions and Services Market - Regional Analysis

North America Market Insights

North America IoT solutions and services market is anticipated to record a 38% market share during the forecast period, with the region being a hotspot for IoT solutions and services adoption across different sectors. The region boasts considerable telecommunication infrastructure, a high inflow of venture capital, and a stringent regulatory environment that is conducive to IoT development, with proper data security and cybersecurity safeguards in place. Large technology companies drive global IoT innovation through research spending, platform development, and strategic acquisitions, thereby augmenting their technological capacity. Strong research universities, state programs for funding, and entrepreneurial ecosystems enable favorable conditions for IoT innovation and monetization while stimulating cooperation among technology providers and end-user organizations.

The U.S. leads the worldwide development of IoT solutions and services through high levels of government support, intense private investment, and innovative regulatory frameworks that stimulate innovation while ensuring the ethical application of these technologies. U.S.-based technology giants, including Microsoft Corporation, Amazon Web Services Inc., and IBM Corporation, lead platform innovation in supporting enterprise clients across various industries. In October 2024, the U.S. National Institute of Standards and Technology (NIST) released broad-ranging IoT Advisory Board recommendations urging the federal government to develop a national IoT strategy and a National Coordination Office for IoT technologies. Federal programs target prioritizing the safeguarding of critical infrastructure, urban planning with smart cities, and cybersecurity measures ensuring secure IoT deployment while promoting innovation across industry sectors.

Canada IoT solutions and services market demonstrates steady growth through technology research and commercialization in the major economic sectors by way of government initiatives. The Government of Canada and provincial governments heavily invest in human capital for co-working IoT research centers and business-led co-working projects, which further reinforce Canada's position as a leader in global IoT development. In February 2025, the Government of Canada launched Canada's Digital Ambition 2023-24 strategy, detailing the joint management of services, information, data, and cybersecurity, including IoT deployments. The three-year enterprise-level plan addresses digital modernization issues while adopting outcome-based approaches to creating new digital services, considering the strategic themes behind IoT integration and cybersecurity frameworks, and emphasizing the delivery of secure and current digital services.

APAC Market Insights

Asia Pacific IoT solutions and services market is projected to record a CAGR of 11% during the forecast period, driven by growing industrialization, urbanization, and government spending on the construction of smart infrastructure. The governments in the region launch comprehensive digitization strategies that include support for IoT implementation in manufacturing, transportation, healthcare, and smart cities through funding programs and policy interventions. The region is underpinned by large-scale manufacturing operations, expanding consumer electronics markets, and increasing cross-border trading requirements, creating high demand for IoT solutions. The growing emphasis on sustainability, energy efficiency, and environmental monitoring is spurring widespread IoT adoption for smart grid operations, renewable energy integration, and pollution control systems that support regional development objectives.

China is rapidly solidifying its position as a leader in IoT adoption, due to massive government investment and careful policy initiatives that enable local technology development and industrial modernization goals. The nation's nationwide investment policy emphasizes the construction of smart cities, automation within industries, and environmental protection, alongside strengthening domestic enterprises through favorable policy climates and large-scale funding initiatives. For example, China Government in 2023 launched a 3-year Action Plan for Building New Internet of Things Infrastructure, establishing initial IoT infrastructure in major domestic cities by the end of 2023. The Industrial Internet Innovation and Development Action Plan 2021-2023 outlines eleven priority tasks, including standardization and the development of bespoke IIoT identification systems, as well as enhancing IIoT security with an emphasis on product innovation in fundamental technologies such as 5G and time-sensitive networking.

India market for IoT solutions and services is experiencing remarkable growth, driven by government-led digital transformation projects and broad-based technology adoption plans across various economic sectors. The government fosters IoT growth through national digitization programs, startup initiatives, and regulatory frameworks that support innovation while addressing concerns related to data security and operational security. In February 2024, the Government of India accelerated the Digital India program with the Centre of Excellence for IoT and AI scheme, conceptualized by MeitY and NASSCOM in coordination with state governments. The program promotes the growth of deep-tech start-ups with funding, incubation, mentoring support, and enterprise linkage. The Centre of Excellence in Intelligent IoT Sensors drives sensor development for intelligent IoT systems, enabling India to become a leader in IoT technology.

Europe Market Insights

Europe industry is projected to experience sustained growth during the forecast period, driven by extensive regulatory standards, high research spending, and strategic priorities for data protection and responsible development of technology. Europe prioritizes responsible IoT deployments, comprehensive compliance obligations, and human-centered technology solutions, thereby enhancing innovation and economic competitiveness through strategic digital transformation initiatives. European companies invest heavily in IoT R&D, collaborating with research institutions and universities to develop responsible technology solutions that comply with regulatory norms, such as the GDPR and cybersecurity directives. Strong manufacturing capabilities, premier telecom infrastructure, and a multi-industrial base provide favorable platforms for the adoption of IoT solutions in the automotive, aerospace, energy, healthcare, and smart cities industries.

The IoT solutions and services market in the UK exhibits robust growth, with detailed government support for technology innovation and innovative regulatory approaches that strike a balance between encouraging innovation and ensuring data protection and cybersecurity. British companies leverage robust research capabilities and partnerships with overseas players to develop advanced IoT solutions for both local and global markets. In April 2024, UK Government implemented a consumer connectable product security regime via the Product Security and Telecommunications Infrastructure (PSTI) Act, mandating manufacturers to comply with baseline security standards. The Act mandates that every consumer IoT device will attain world-leading security safeguards on the basis of the UK Code of Practice for Consumer IoT Security, making the UK the global leader in IoT security regulations.

The IoT solutions and services market in Germany is driven by high-level manufacturing capacity, the availability of a powerful automotive sector, and comprehensive governmental support for IoT technology research in all industrial sectors and infrastructure rejuvenation programs. German companies combine traditional engineering expertise with innovative IoT capabilities to build pioneering solutions that address Industry 4.0 requirements and sustainability objectives in different industrial domains. In 2024, the Federal German Government, as part of the broader Gigabit Strategy 2030, took actions to accelerate network expansion by approving the TK-NABEG draft bill and engaging with the EU Gigabit Infrastructure Act (GIA). Existing legislation, such as the original DigiNetzG, requires publicly funded transport projects and municipalities creating new residential areas to include provisions for laying passive fiber-optic network infrastructure.

Key IoT Solutions and Services Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services, Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- SAP SE

- Cisco Systems, Inc.

- Oracle Corporation

- PTC Inc.

- Samsung SDS Co., Ltd.

- Tata Consultancy Services Limited

The IoT solutions and services market is characterized by intense competition from established technology players, such as Microsoft Corporation, Amazon Web Services Inc., Google LLC, IBM Corporation, and SAP SE, as well as specialized IoT platform vendors catering to different application domains. Companies compete on account of continuous platform innovation, strategic partnerships, provision as a full service, and aggressive acquisition strategies that improve technological capabilities and market reach. Market leaders invest heavily in research and development and collaborate with system integrators and technology firms through strategic alliances to fuel customer adoption and enhance implementation success rates. Asia companies, such as Samsung SDS Co., Ltd., Tata Consultancy Services Limited, and Fujitsu Limited, utilize local knowledge and specialist skills to drive global IoT ecosystem development.

Market leaders continue to launch advanced products and form strategic partnerships to enhance their technological capabilities and consolidate their competitive positions in rapidly evolving IoT markets. At its Think 2024 conference, IBM announced enhancements to its WatsonX AI and data platform, including expanded generative AI capabilities based on open-source Granite models and new AI assistants, such as WatsonX Code Assistant for Enterprise Java Applications and WatsonX Assistant for Z. The company also updated watsonx.data with features such as Data Gate for watsonx and watsonx.data Intelligence, and outlined a strategy to integrate IoT and edge data directly into the watsonx ecosystem for analysis rather than using a separate platform.

Here are some leading companies in the IoT solutions and services market:

Recent Developments

- In May 2025, PTC Inc. achieved recognition as Outright Leading Industrial IoT Platform in QKS SPARK Matrix report with ThingWorx platform demonstrating significant enhancements in asset management, operational efficiency, quality assurance, and secure data access. The platform features advanced AI and analytics for data capture, visualization, and forecasting enabling proactive decision-making while merging real-time connectivity, edge-to-cloud orchestration, and AI-driven insights into unified IIoT platform.

- In February 2025, Cisco Systems, Inc. announced comprehensive solutions enabling service providers to deliver artificial intelligence connectivity through Agile Services Networking architecture. The platform handles increased AI application data volume and variety while enabling service providers to monetize AI traffic services.

- Report ID: 8100

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IoT Solutions and Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.