Payroll and HR Solutions & Services Market Outlook:

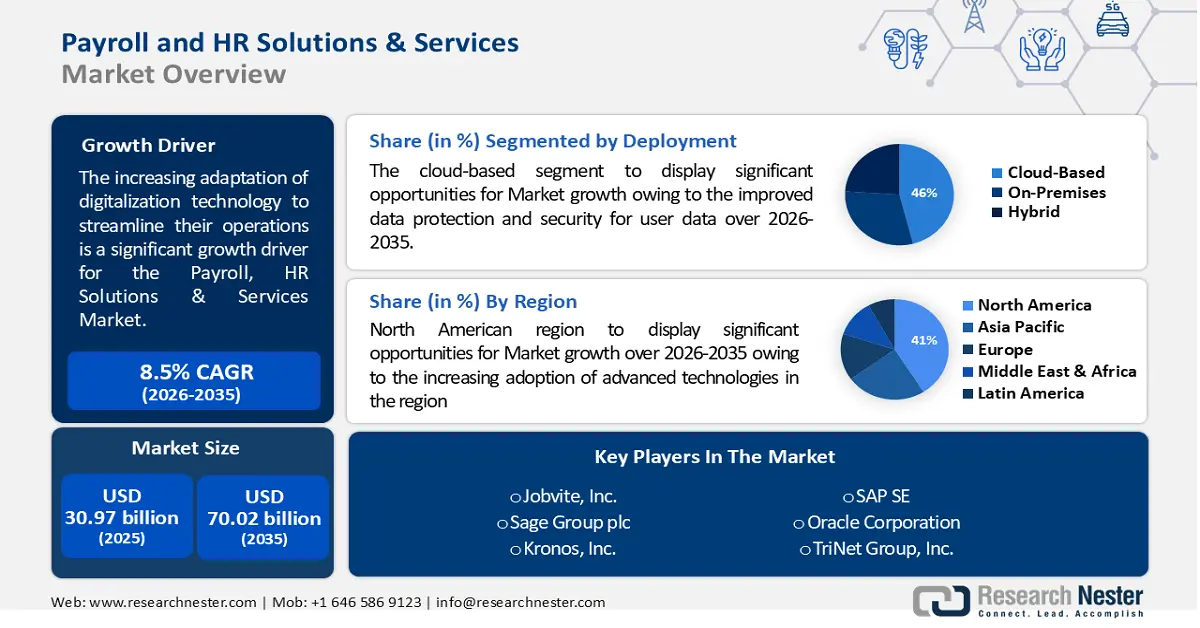

Payroll and HR Solutions & Services Market size was valued at USD 30.97 Billion in 2025 and is expected to reach USD 70.02 Billion by 2035, registering around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of payroll and HR solutions & services is evaluated at USD 33.34 Billion.

and the growth is propelled by the increasing adaptation of digitization technology by several businesses to streamline their operations and improve their efficiency, as about 89% of the companies have already adopted the digital-first in their business strategy or are either planning to do so. This acts as a surge in the growing demand for cloud-based HR solutions that offer automation, and improved accessibility for employees as well as the HR personnel.

For instance, according to a report, 91% of businesses are mainly engaged in a form of digital initiative, and about 87% of senior business leaders say digitalization is a priority for their business.

Furthermore, the modern workforce is highly diverse and has an extremely shifting expectation. HR solutions that cater to these needs, such as mobile access, and talent management tools, are in high demand. Furthermore, the rise of SMEs has created a large market segment, seeking a cost-effective and scalable HR solution.

Key Payroll, HR Solutions, and Services Market Insights Summary:

Regional Highlights:

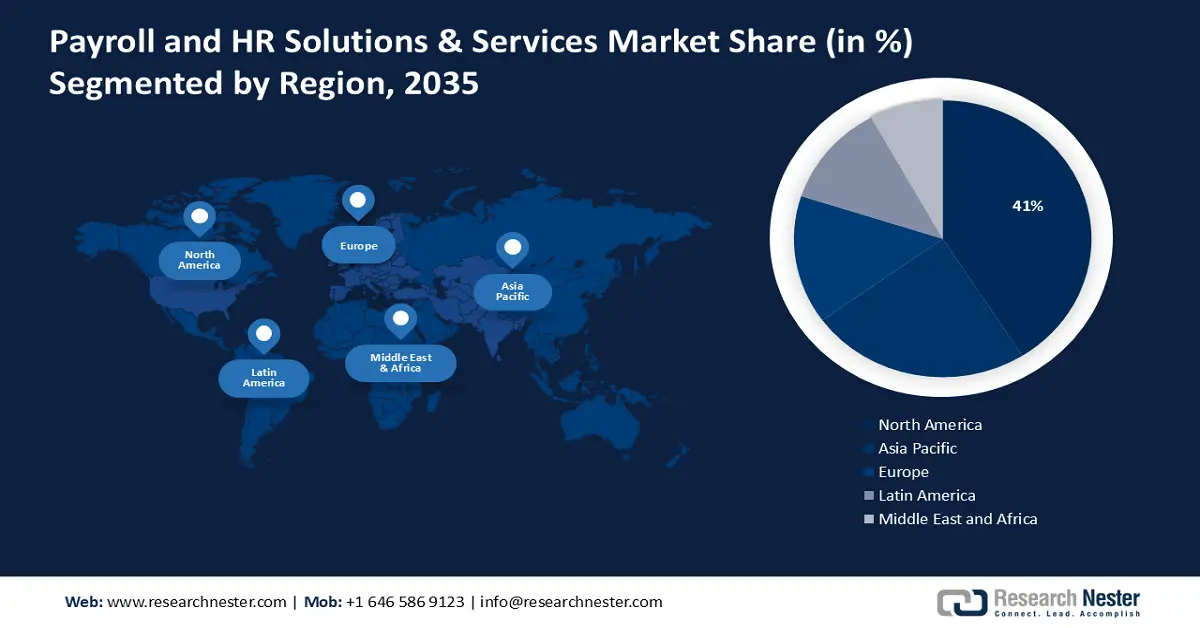

- North America’s payroll and HR solutions & services market will dominate over 41% share by 2035, driven by workplace digitalization and automation adoption.

- Asia Pacific market will secure the second largest share by 2035, attributed to rising demand for remote and hybrid work setups.

Segment Insights:

- The cloud-based segment in the payroll and hr solutions & services market market will capture a significant 46% share, driven by improved data protection and security provided by cloud infrastructure, forecast year 2035.

- The software segment in the payroll and hr solutions & services market is expected to secure a noteworthy share by 2035, driven by its ability to provide streamlined workflows, integration with other systems, and enhanced user experience.

Key Growth Trends:

- Growing adoption of Artificial Intelligence & Machine learning

- Increasing demand for payroll and HR solutions and services

Major Challenges:

- Limited user acceptance and uptake

- Lack of awareness about payroll and HR solutions and services

Key Players: Automatic Data Processing, Inc. (ADP), Jobvite, Inc., Sage Group plc, Kronos, Inc., SAP SE, Oracle Corporation, TriNet Group, Inc., Paychex, Inc., Paycom, Paycor, Inc., Paylocity, TMF Group B.V., Ultimate Software Group, Inc., Ramco Systems Ltd., Mannet, BambooHR, Intuit, Orange HRM.

Global Payroll, HR Solutions, and Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.97 Billion

- 2026 Market Size: USD 33.34 Billion

- Projected Market Size: USD 70.02 Billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Payroll and HR Solutions & Services Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption of Artificial Intelligence & Machine learning: the usage of Artificial Intelligence (AI) and Machine learning, and several other options such as IoT, computer vision, blockchain, and analytics are increasing. About 97% of the executives are using AI specifically to revolutionize at least one aspect of their supply chain operations, which ranges from solving inventory management issues to reducing trade expenses.

- Increasing demand for payroll and HR solutions and services: This helps to manage the workforce along with automated management processes, automatic updates, reduction of errors while resolving various issues, and several other time-saving features. It was observed that, worldwide, there were more than 3 billion employed people in 2022.

- Increase in the number of SMEs: Escalating the implementation of IT by SMEs and automation of HR processes through various software, solutions, and services. In 2021, there were approximately 332 million SMEs worldwide.

Challenges

- Limited user acceptance and uptake: Payroll and HR solutions require the users to adopt their new systems and processes. This can be counted as a restraining factor for some businesses, as it can take time and effort to get users to adopt the new systems and processes. It is also important to provide proper training and support to ensure that the systems are used effectively and are accepted.

- Lack of awareness about payroll and HR solutions and services

- High cost involved in the adoption of automation technologies

Payroll and HR Solutions & Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 30.97 Billion |

|

Forecast Year Market Size (2035) |

USD 70.02 Billion |

|

Regional Scope |

|

Payroll and HR Solutions & Services Market Segmentation:

Deployment Segment Analysis

Cloud-based segment in the payroll and HR solutions & services market is estimated to gain a robust revenue share of 46% in the coming years owing to the improved data protection and security for user data which is managed and stored by the software. The data is stored on secured and remote servers and can ensure greater privacy and security from data breaches and losses. According to a survey in March 2022, more than 720 IT professionals were surveyed all over the globe using online questionnaires, and about 80% of the organization's data is stored in cloud-based storage.

Enterprises Segment Analysis

The small and medium enterprises segment in payroll and HR solutions & services market is set to garner a notable share shortly and is likely to remain the second largest segment in the enterprises of market as these are handled by staff with limited know-how of technical systems and processes. Cloud-based payroll and HR systems can provide solutions that are easier to use and navigate, taking away the need to invest in specialized staff with specific abilities and knowledge. This can be a significant growth driver for the market, as it provides a solution for many businesses facing the challenges of lack of expertise and resources.

Solutions Segment Analysis

The Software segment is estimated to hold a noteworthy share as it provides enhanced connectivity along with the integration of several other systems and platforms, such as accounting and financial systems. This can enable businesses to benefit from a streamlined workflow and improved data sharing. These capabilities can also reduce costs and complexity associated with data integration and exchange. Furthermore, Software-based solutions also provide a user-friendly and streamlined experience, with clear navigation and interactive features. This can lead to increased user satisfaction and adoption.

Our in-depth analysis of the global market includes the following segments:

|

Deployment |

|

|

Enterprises |

|

|

Solutions |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Payroll and HR Solutions & Services Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 41% by 2035, propelled by the increasing adoption of advanced technologies in workplace management. In the forecasted period, businesses are planning to integrate several advanced automation for about 28%, 3D printing at 26%, augmented or virtual reality at 27%, and blockchain technology at 25% to enhance efficiency, traceability, security, and data protection.

APAC Market Insights

The Asia Pacific payroll and HR solutions & services market is estimated to be the second largest, during the forecast period led by the increase in the demand for remote work along with hybrid work cultures, in which more employees are opting for these remote jobs, and this is fueling the demand for HR solutions and services. According to a report, the global volume of job searches that use the “remote” filter on one of the leading business and employment-focused social media platforms has increased by about 60% from the start of March. Moreover, in Asia-Pacific, the applications for remote jobs are growing as well, showing the increasing demand for remote work among job seekers.

Payroll and HR Solutions & Services Market Players:

- Intuit, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Automatic Data Processing, Inc. (ADP)

- Jobvite, Inc.

- Sage Group plc

- Kronos, Inc.

- SAP SE

- Oracle Corporation

- TriNet Group, Inc.

- Paychex, Inc.

- Paycom

- Paycor, Inc.

- Paylocity

- TMF Group B.V.

- Ultimate Software Group, Inc.

- Ramco Systems Ltd.

Recent Developments

- CoffeeMug.ai, in April 2022, launched a talent solution platform for their higher-level hiring. This platform scans millions of public profiles that are available on the internet and layers them along with the analysis from, Coffee Mug’s data pool mainly to drive senior-level hiring for their clientele.

- Oracle Corp., launched SaaS (Software as a Service) payroll solutions, which will enable the organization to easily configure the payroll for meeting both international and local pay rules in a single system.

- Report ID: 4342

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Payroll, HR Solutions, and Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.