5G Edge Cloud Network and Services Market Outlook:

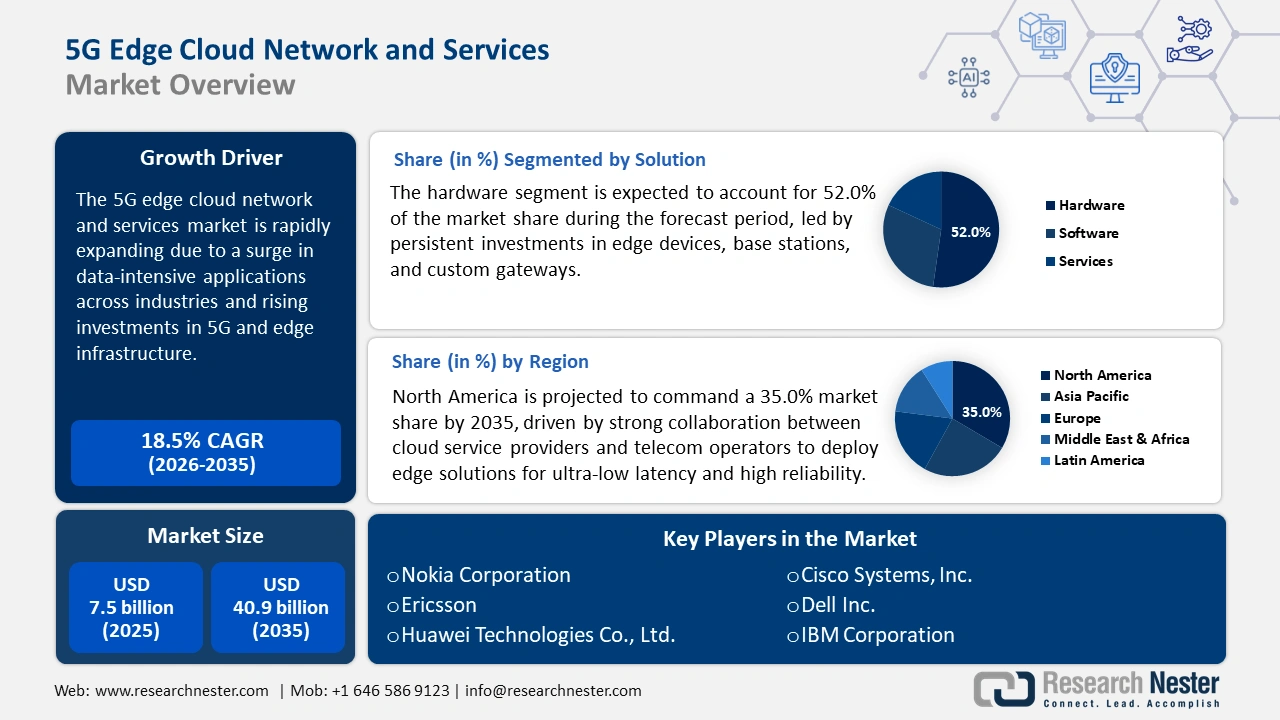

5G Edge Cloud Network and Services Market size is valued at USD 7.5 billion in 2025 and is projected to reach a valuation of USD 40.9 billion by the end of 2035, rising at a CAGR of 18.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of 5G edge cloud network and services is assessed at USD 8.9 billion.

The 5G edge cloud network and services market is experiencing steady growth, fueled by the commercial need for ultra-low-latency processing to enable next-generation enterprise applications. The primary opportunity is in the vast deployment of Multi-access Edge Compute (MEC) infrastructure, pushing computer resources towards the end-user. This design is essential for such applications as autonomous vehicles, smart factories, and live Augmented Reality (AR) experiences, which are unable to deal with network delays. For instance, in May 2025, American Tower officially opened its first Aggregation Edge Data Center in Raleigh, North Carolina. The facility is designed to extend cloud services closer to the network edge to accelerate the adoption of ultra-low-latency applications and 5G services for enterprises in the region.

Government-initiated initiatives to standardize and secure this precious infrastructure for use by the public sector drive market momentum. Regulatory bodies are providing funding and mandates to spur the deployment of more durable 5G/edge networks in urban and rural areas. This government-backed focus on network resilience and security creates a steady demand for standardized, secure vendor solutions. Furthermore, in December 2024, the US Federal Communications Commission finalized approval of the 5G Fund for Rural America, committing over $9 billion to extend low latency 5G networks and edge cloud capabilities to rural communities. Federal funding ensures edge-enabled public services like telemedicine and precision agriculture become mainstream. Government action guarantees an edge platform performance standard.

Key 5G Edge Cloud Network and Services Market Insights Summary:

Regional Insights:

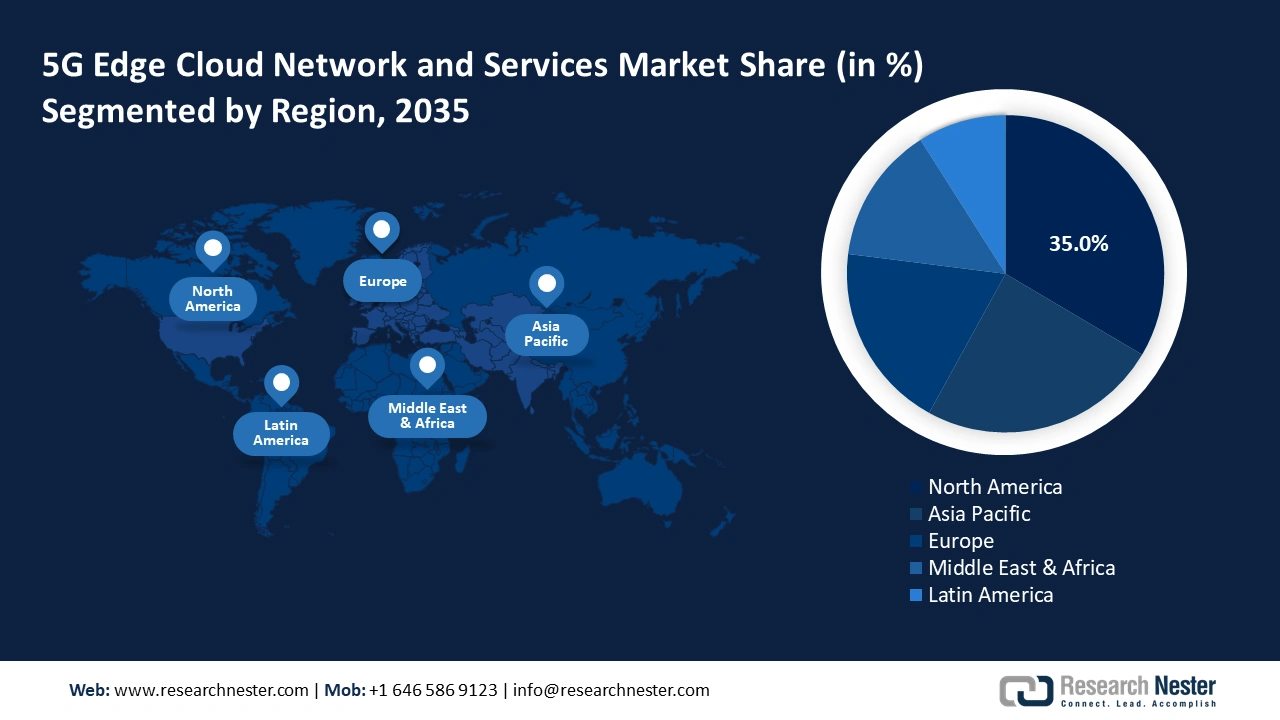

- North America 5G edge cloud network and services market is projected to command a 35% share by 2035, sustained because of early 5G deployments, massive hyperscaler spend, and strong enterprise demand for low-latency applications.

- Asia Pacific is expected to post a 15% CAGR from 2026 to 2035, expanding on account of large-scale infrastructure rollout and government-led smart city and digital initiatives.

Segment Insights:

- The hardware segment in the 5G Edge Cloud Network and Services Market is forecast to secure a 52% share by 2035, expanding driven by the need to pre-position computing capacity close to end-users for ultra-low-latency applications.

- The large enterprises segment is set to hold a 65% share through 2035, solidifying its dominance owing to escalating requirements for private 5G networks and custom MEC solutions.

Key Growth Trends:

- Acceleration of AI and IoT workloads at the edge

- Ultra-low-latency enterprise applications requirements

Major Challenges:

- Compliance with regulations and data sovereignty

- Standardization and interoperability of multi-vendor edge platforms

Key Players: Nokia Corporation, Ericsson, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Dell Technologies Inc., Hewlett Packard Enterprise (HPE), IBM Corporation, Amazon Web Services, Inc., Juniper Networks, Inc., Microsoft Corporation, Fujitsu Limited, NEC Corporation, NTT Corporation.

Global 5G Edge Cloud Network and Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.5 billion

- 2026 Market Size: USD 8.9 billion

- Projected Market Size: USD 40.9 billion by 2035

- Growth Forecasts: 18.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Indonesia, Vietnam, UAE, Saudi Arabia

Last updated on : 6 October, 2025

5G Edge Cloud Network and Services Market - Growth Drivers and Challenges

Growth Drivers

- Acceleration of AI and IoT workloads at the edge: The large-scale deployment of sophisticated AI and billions of IoT devices is a principal growth driver, necessitating local, real-time data processing. Edge cloud provides the necessary compute and storage locality to enable real-time AI/ML inferencing and data aggregation without having to upload data all the way back to distant core clouds. This blending enables next-gen business applications across industrial automation, security, and enterprise venue services. Enterprise customers expect end-to-end offerings powered by automation and AI-driven orchestration to be deployed seamlessly. For instance, in June 2025, Tata Consultancy Services (TCS) and Microsoft announced an expanded collaboration focused on building new AI-led solutions using platforms like Microsoft Copilot Studio and Azure AI Foundry. The partnership addresses the need for pre-integrated, full stacks at the edge.

- Ultra-low-latency enterprise applications requirements: Commercial deployment of mission-critical applications such as AR/VR remote expertise, autonomous navigation, and dynamic logistics relies heavily on the achievement of single-digit millisecond latency. 5G and MEC are the only two technologies available that can reliably meet this tight objective, transforming industries such as manufacturing and healthcare. This critical capability powers competitive edge for first-movers in high-performance digital business. In September 2025, Verizon announced it would be the first wireless carrier to offer the new AI-powered Meta Ray-Ban Display glasses. This follows the existing strategic partnership between the two companies, which has previously explored leveraging Verizon's 5G Mobile Edge Compute infrastructure for applications like XR cloud rendering and low-latency streaming

- Strategic telco-hyperscaler collaboration models: The expansion of the market is increasingly driven by strategic, collaborative solutions between mobile network operators and top public cloud providers (hyperscalers). These partnerships combine the telcos' access to spectrum and networks with the hyperscalers' cloud infrastructure and developer ecosystems. The shared model accelerates the rollout of private 5G networks and distributed cloud regions to enter markets more rapidly and grow more aggressively. The market is accelerating growth in shared cloud roll-outs, and there is mutual risk and reward. For instance, Canalys had indicated in August 2025 that telco-hyperscaler collaborations are propelling edge cloud partnerships for 5G private networks and low-latency services at a rapid rate, in partnership with the leading global operators.

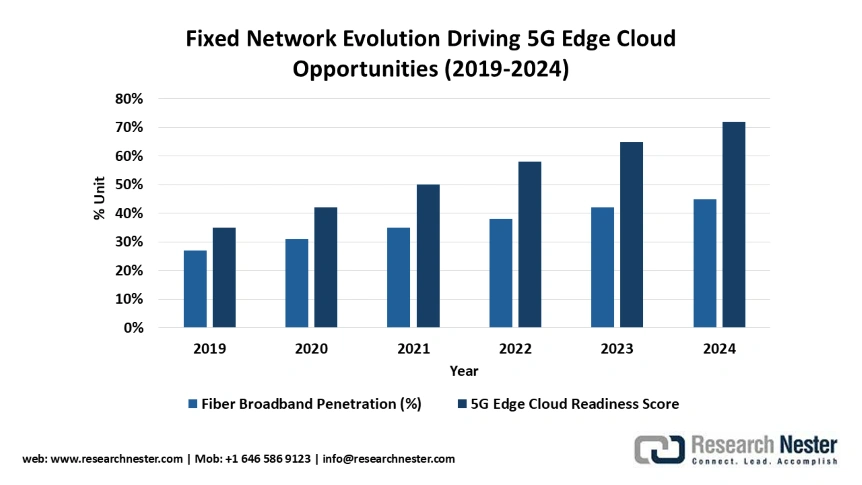

Fixed Network Evolution Driving 5G Edge Cloud Opportunities (2019-2024)

The steady growth of fiber broadband in countries, increasing from 27% to 45% of fixed subscriptions between 2019 to 2024, provides critical infrastructure for 5G edge cloud network deployment by ensuring reliable backhaul connectivity. This expanding fiber footprint enables hybrid architectures where 5G wireless access combines with fiber backhaul to deliver low-latency edge computing services to urban and suburban areas.

Source: OECD

5G Edge Cloud Infrastructure Readiness & Market Opportunities

|

Infrastructure Component |

Market Status |

Edge Cloud Service Enablement |

Growth Driver |

|

Fiber Backbone Networks |

44.6% OECD penetration; 4 countries >80% fiber adoption |

Enables ultra-low latency edge computing and network slicing |

Critical for data-intensive applications (AR/VR, autonomous systems) |

|

5G Mobile Infrastructure |

33% of mobile subscriptions; 48% YoY growth |

Supports mobile edge computing and distributed cloud services |

Drives demand for edge-native applications and network APIs |

|

Fixed Wireless Access (FWA) |

5.8% OECD fixed broadband; 17% annual growth |

Extends edge coverage to underserved/rural markets |

Cost-effective solution for last-mile edge connectivity |

Source: OECD

Challenges

- Compliance with regulations and data sovereignty: The decentralized nature of the 5G edge cloud ensures that it is challenging to adhere to the regulations, particularly where data sovereignty, privacy, and national security concerns regarding infrastructure management are involved. This fractured regulatory environment poses a significant technical and regulatory hurdle to the development of truly global, but compliant, edge solutions. Governments worldwide are increasingly insisting that significant public sector information and services be hosted within local or acceptable geographic boundaries. For instance, in July 2024, Germany made agreements with domestic telcos requiring the removal of all Huawei/ZTE equipment from 5G core networks by 2026 to secure the 5G edge ecosystem and ensure technology sovereignty for public services security. These steps require immediate vendor supply chain and network architecture adjustments.

- Standardization and interoperability of multi-vendor edge platforms: One of the technical challenges of primary importance is the lack of shared standards for hosting and managing services on the enormous quantity of vendor-specific 5G network stacks and clouds. Lack of interoperability prevents mass enterprise adoption and constrains edge application scalability generalized over to a wider number of instances, increasing integration costs. This is recognized at the government level, with the European Commission's ICT Standardizations Rolling Plan in August 2025 indicating harmonized reference frameworks to have in place interoperable cloud-edge networks for the public services and European critical infrastructure. Vendors are anticipated to make open architecture their priority to solve this challenge.

5G Edge Cloud Network and Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.5% |

|

Base Year Market Size (2025) |

USD 7.5 billion |

|

Forecast Year Market Size (2035) |

USD 40.9 billion |

|

Regional Scope |

|

5G Edge Cloud Network and Services Market Segmentation:

Solution Segment Analysis

The hardware segment is expected to account for 52% of the 5G edge cloud network and services market share during the forecast period, remaining the predominant physical layer required for distributed edge computing installations. The segment includes the critical infrastructure components like purpose-built servers, network gear, accelerators, and edge data center buildouts at or near the bottom of the 5G tower base stations. The requirement for pre-positioning computer capacity close to end-users for ultra-low latency applications drives the capital investment in hardware. This strategic physical build-out is key to growth in the market, as exemplified in the build-out of carrier-neutral infrastructure. For instance, in January 2025, EdgeConneX completed a major buildout of edge data centers across North America and Europe, mainly targeting 5G/MEC integrations and distributed CDN infrastructure for hyperscale workloads.

Enterprise Size Segment Analysis

The large enterprises segment is anticipated to hold 65% of market share through 2035, consolidating its lead with the forthcoming, high-volume needs for private 5G networks and custom Multi-access Edge Compute (MEC) solutions. These companies possess the capital and operational maturity to hand to fund massive investment in dedicated, secure edge infrastructure to facilitate industrial automation and real-time data processing. Their high-performance and high-hold demands on sensitive data make them first-order consumers of managed edge services. This can be simply seen in terms of enterprise focus, where in August 2025, Canalys recorded a steep increase in telco-hyperscaler partnerships for edge cloud that are enabling 5G private networks and low-latency applications. Major business projects usually comprise several sites, where a scalable, centrally managed distributed architecture is needed.

Industry Segment Analysis

The automotive industry segment is projected to account for 49% of the 5G edge cloud network and services market by 2035, driven by the sector's stringent requirement for low-latency and high-reliability networks that have the capability of serving use cases like autonomous driving, V2X communication, and intelligent manufacturing. Edge cloud provides the essential real-time processing feature required to enable safety and functionality for mission-critical automotive applications. The mass of sensor data generated by connected manufacturing and cars demands localized computing. This strategic industry focus generates special software and hardware combinations. For example, in November 2024, Dell and SK Telecom announced an MEC-in-a-box appliance integration for telco networks that could deploy 5G edge cloud slices at deployment speeds for vertical enterprise use cases like manufacturing and logistics.

Our in-depth analysis of the 5G edge cloud network and services market includes the following segments:

|

Segment |

Subsegments |

|

Solution |

|

|

Enterprise Size |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G Edge Cloud Network and Services Market - Regional Analysis

North America Market Insights

North America 5G edge cloud network and services market is predicted to maintain a 35% market share during the forecast period due to early 5G deployments, massive hyperscaler spend, and robust enterprise demand for low-latency applications. The region is characterized by aggressive spectrum acquisitions and intense competition between MNOs and cloud vendors to expand their Multi-access Edge Compute (MEC) presence. Strategic partnerships are critical to drive MEC availability extension and enable new AR/VR, IoT, and private 5G revenue streams. The market benefits from huge private and public capital investments in digital infrastructure protection.

The U.S. remains the hub of North America, marked by spectrum deals valued at multi-billions of dollars and a clear federal policy to secure and push 5G edge infrastructure. Enterprise adoption is strong in top sectors like manufacturing, defense, and health. Competition drives widespread M&A to pool spectrum and expand edge coverage. For example, in September 2025, SpaceX announced the acquisition of EchoStar's AWS-4/H-Block spectrum licenses valued at up to $17 billion, granting Starlink broad mid-band spectrum to launch a 'Direct to Cell' satellite/5G hybrid service. This strategic move is expected to significantly impact on the competitive landscape of the telecommunications industry.

Canada market is exhibiting steady growth, driven by federal initiatives towards enhanced digital infrastructure resilience and to promote the use of edge/AI solutions for public protection and critical national functions. The market focuses on the procurement of key 5G/edge platforms under strong reliability and data residency policies. Innovation is aided by the government through testbed facilities for researchers and SMEs. Canada's Innovation, Science, and Economic Development Ministry proceeded with its Digital Infrastructure Resilience Strategy in September 2025 and released a new policy requesting secure hybrid cloud-edge and 5G platforms. The framework directly influences the buying of cloud services.

APAC Market Insights

Asia Pacific 5G edge cloud network and services market is expected to register a staggering CAGR of 15% from 2026 to 2035, backed by the significant scale of infrastructure rollout and strong government initiatives for smart city and Digital India. The region is actively implementing edge cloud coverage to address the requirements of high-density urban and vast rural populations. This explosive growth is a result of the region's intent to leverage 5G and edge for social and economic development. The market opportunity is tremendous for vendors providing ultra-low-latency solutions for traffic management, industrial automation, and municipal services at scale.

China market is characterized by robust, mass-scale rollout and deep embedding of 5G edge cloud in industrial, transport, and municipal surveillance spaces, fueled to a large extent by national five-year plans. The demand is fueled by huge national targets for end-to-end 5G and edge cloud penetration across all provinces with AI computing support. In December 2024, for example, China's Set Sail 5G Action Plan imposed milestones for the widespread cloud-edge integration and 1 billion+ 5G subscriptions. These edge nodes are predicted to link public e-government, educational, and transportation applications to AI computation in pilot cities across the country.

The market in India is gaining momentum, headed by the massive scale of its Digital India and Smart Cities Initiatives, requiring 5G and edge installs for traffic, electricity, and city surveillance. The expansion at the core is driven by public-sector edge node installations and fiber deployment to connect the countryside. This has been reasonably supported by the December 2024 Ministry of Communications highlight of mobile subscriber expansion to 1.16 billion, necessitating a major infrastructure upgrade. The market demands low-cost, highly scalable technology that is able to serve large public applications. The foundation infrastructure is laid well since India's Digital India and Smart Cities Mission have integrated 5G and edge deployments for municipal, energy, and traffic management in June 2025.

Europe Market Insights

Europe 5G edge cloud network and services market is forecasted to continue growth between 2026 and 2035, driven by ambitious nation-wide initiatives to secure networks and boost digital sovereignty, aligned with clear public sector use case design. Market demand is driven by the requirement for low-latency services in critical infrastructure, healthcare, and manufacturing, aligned to the EU and country-level security standards. European hyperscalers and carriers are expanding their jointly operated regional edge cloud footprint. The region is highly interested in developing Open RAN and other multiple supply chain possibilities to achieve edge connectivity resiliency.

Germany market is driven by stringent national security needs that require the removal of high-risk vendor equipment from core networks and considerable federal investment in edge/cloud renewal. Strong demand exists for secure, containerized edge solutions across public transport, policing, and smart city services. The August 2025 BMI report on the National Cloud and Edge Security program of Germany substantiated new investment in 5G edge pilots across public transport as well as regional administration business processes. This investment reflects Germany's emphasis on robust and secure digital infrastructure.

The UK market is expanding rapidly, with 5G national standalone by 2030 under national plans and requirements that new public infrastructure must be 5G/edge capable. Growth targets digital health, transport, and Open RAN-based edge deployments, underpinned by full government funding for innovation hubs. The continued need for digital infrastructure upgrade is legislated. The UK Wireless Infrastructure Strategy, published in April 2023, formally required all new significant public infrastructure, schools, hospitals, and civic centers to include edge- and 5G-enabled networks in the design stage. This is followed by public and private consortia funding streams to underpin real-time innovation.

Key 5G Edge Cloud Network and Services Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The 5G edge cloud network and services market is characterized by intense strategic competition between two camps: Telco Leaders (Ericsson, Nokia, Huawei) and Hyperscale Cloud Providers (AWS, Microsoft, Google). Telcos bring their network presence and pooled spectrum while hyperscalers leverage their vast cloud platforms and developer communities. Strategic integrations are an impetus for market capability aggregation. Furthermore, in March 2025, Qualcomm acquired Edge Impulse, a leading-edge AI development platform, to move quickly with 5G+edge AI and IoT on mobile, industrial, and automotive. Competition is focused on building end-to-end integrated, managed services and proprietary software/hardware stacks.

Strategic co-innovation and partnership models are differentiating factors, driving market consolidation and accelerating deployment of specialized edge use cases. Joint ventures are rapidly evolving industry-specific solutions that combine network slicing, low-latency connectivity, and cloud computing for immediate enterprise benefit. This critical collaboration is exemplified in February 2024, when Nokia, A1 Austria, and Microsoft conducted a first-of-a-kind 5G edge cloud network slicing proof of concept. This successful proof of concept demonstrated dynamic, cloud-native network deployment for enterprise clients, delivering fast, secure, and isolated streams of data at the edge on multi-vendor platforms.

Here are some leading companies in the 5G edge cloud network and services market:

|

Company Name |

Country |

Market Share (%) |

|

Nokia Corporation |

Finland |

14.6 |

|

Ericsson |

Sweden |

13.4 |

|

Huawei Technologies Co., Ltd. |

China |

12.0 |

|

Cisco Systems, Inc. |

U.S. |

11.1 |

|

Dell Technologies Inc. |

U.S. |

9.5 |

|

Hewlett Packard Enterprise (HPE) |

U.S. |

xx |

|

IBM Corporation |

U.S. |

xx |

|

Amazon Web Services, Inc. |

U.S. |

xx |

|

Juniper Networks, Inc. |

U.S. |

xx |

|

Microsoft Corporation |

U.S. |

xx |

|

Fujitsu Limited |

Japan |

xx |

|

NEC Corporation |

Japan |

xx |

|

NTT Corporation |

Japan |

xx |

Below are the areas covered for each company in the 5G edge cloud network and services market:

Recent Developments

- In September 2025, Tata Consultancy Services (TCS) and Qualcomm announced a partnership to establish a co-innovation lab in Bengaluru, India, focused on edge AI solutions. This initiative aims to accelerate the deployment of advanced AI applications at the edge for enterprise customers.

- In February 2025, Mavenir and EdgeQ partnered to develop software-defined 4G and 5G small cells. The collaboration combines EdgeQ's advanced 5G chipsets with Mavenir's software expertise to accelerate the deployment of advanced wireless solutions for enterprise and telecommunications customers.

- In October 2024, Google Cloud and Vodafone announced they are leveraging Generative AI through platforms like Vertex AI to optimize Vodafone’s network lifecycle management and customer experience. This collaboration was also featured at Google Cloud's Next conference in April 2025.

- Report ID: 3758

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G Edge Cloud Network and Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.