Wireless Sensor Tags Market Outlook:

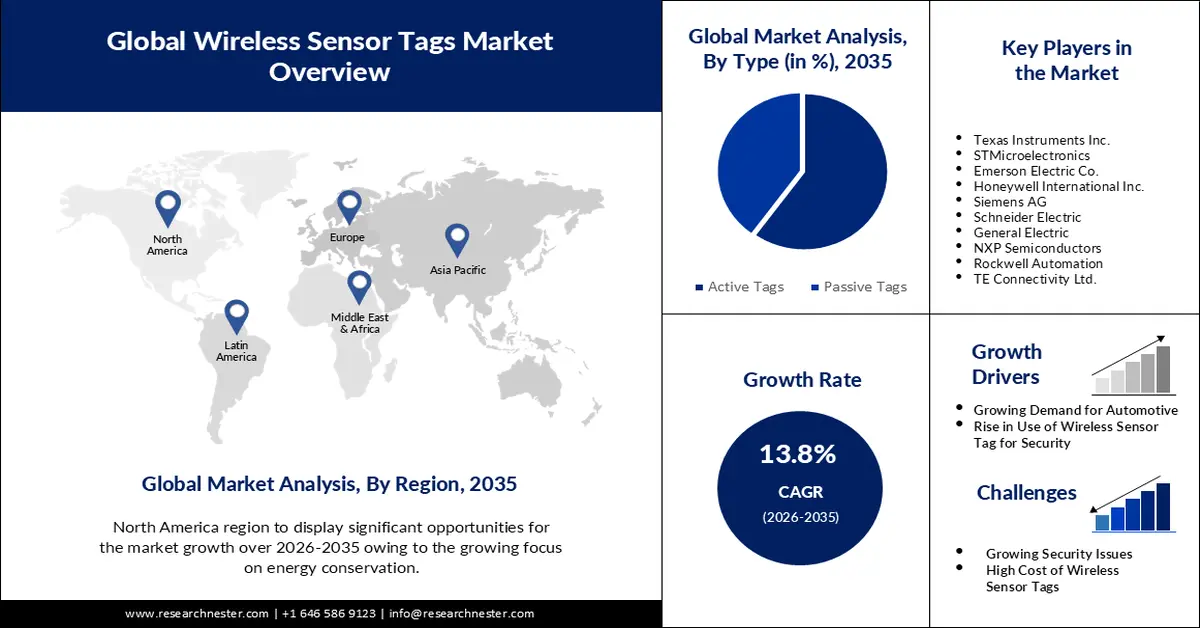

Wireless Sensor Tags Market size was over USD 8 billion in 2025 and is poised to exceed USD 29.14 billion by 2035, witnessing over 13.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of wireless sensor tags is estimated at USD 8.99 billion.

This growth of the market could be encouraged by the growing adoption of smartphones. Currently, in 2023, there are about 5 billion smartphone users. This means that approximately 85% of the population globally uses smartphones. Hence, the demand for wireless sensor tags is anticipated to expand. Motion, open or close events, temperature, humidity, soil moisture, and water leaks are all monitored and recorded using wireless sensor tags. Therefore, smartphones connect the user to the events in the physical world including, temperature, humidity, and motion.

Additionally, the surge in government initiatives for smart cities is also anticipated to boost the wireless sensor tags market demand. The main initiative of the government is reducing the energy consumed by buildings, hence further promoting smart buildings and homes. There are several methods, including smart design and intelligent technologies, to drastically cut energy use in buildings. Buildings absorb a significant amount of the generated electricity, especially since it has become simple to purchase inexpensive electrical appliances or other electronic equipment such as computers, and more. Heat, ventilation, and air conditioning (HVAC) equipment in particular are the main causes of rising consumption. Therefore, sensing is essential in buildings so that the proper actions to cut consumption may be taken. Hence, the demand for wireless sensor tags is on the rise.

Key Wireless Sensor Tags Market Insights Summary:

Regional Highlights:

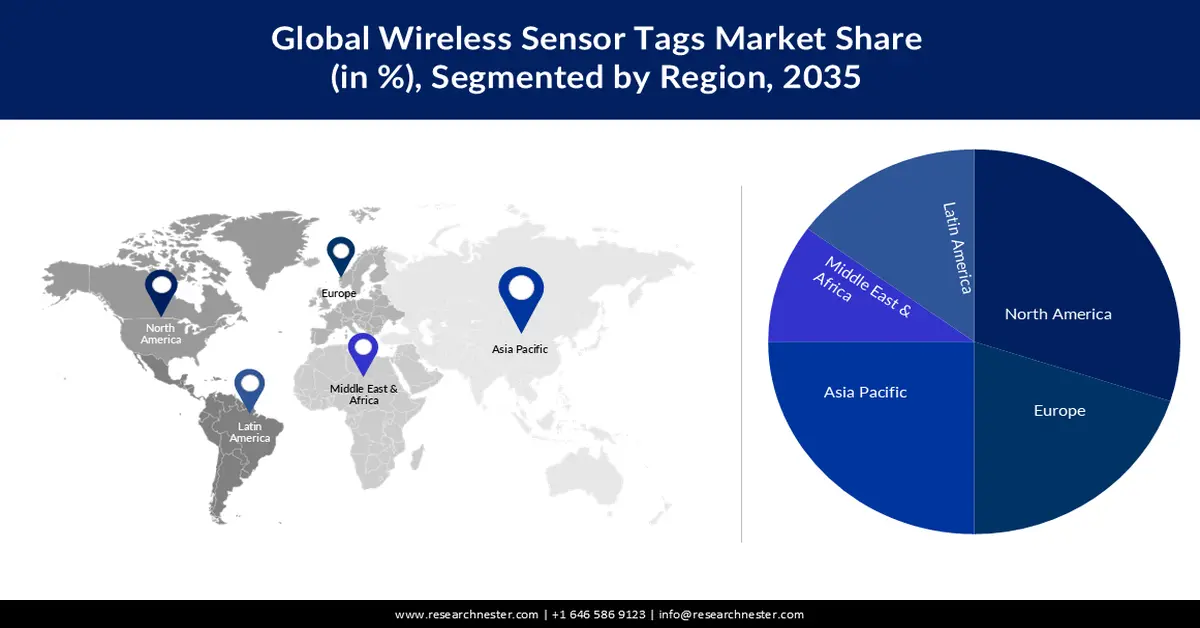

- North America is expected to command the majority revenue share by 2035, fueled by greater emphasis on energy conservation, rising environmental monitoring needs, and expanding investments in IoT technologies.

- Asia Pacific is projected to exhibit substantial growth through 2035, underpinned by strong economic expansion in developing nations, accelerating EV adoption, and supportive government policies promoting safety, automation, and environmental monitoring.

Segment Insights:

- Medical segment is projected to generate the highest revenue by 2035, propelled by the accelerating digitization of healthcare and the expanding use of sensor-enabled systems for real-time patient monitoring.

- The active tags segment is anticipated to experience notable growth through 2035, supported by their extended read range and growing deployment across logistics, automotive, manufacturing, remote monitoring, and IT asset management applications.

Key Growth Trends:

- Growing Demand for Automotive

- Rise in the Use of Wireless Sensor Tags for Security

Major Challenges:

- Growing Security Issues

- High Cost of Wireless Sensor Tags

Key Players: Texas Instruments Inc., STMicroelectronics, Emerson Electric Co., Honeywell International Inc., Siemens AG, Schneider Electric, General Electric, NXP Semiconductors, Rockwell Automation, TE Connectivity Ltd.

Global Wireless Sensor Tags Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8 billion

- 2026 Market Size: USD 8.99 billion

- Projected Market Size: USD 29.14 billion by 2035

- Growth Forecasts: 13.8%

Key Regional Dynamics:

- Largest Region: North America (Majority share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 25 November, 2025

Wireless Sensor Tags Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand for Automotive In 2022, there were about 66 million cars sold globally, up from roughly 65 million in 2021. Modern automotive electronics include automotive car sensors since they offer the vehicle's control systems vital data. The efficiency of the car is measured and monitored by these sensors, which also track important characteristics including pressure, temperature, and speed.

- Rise in the Use of Wireless Sensor Tags for Security There are sensors on doorways in stores that send and receive a weak magnetic field. Vibration takes place when an active anti-theft tag - one that has not been demagnetized - enters this area, and the sensor would detect the variations in the magnetic waves and trigger an alarm.

- Surge in the Importance of Water One of the most essential supplies in metropolitan settings is water, along with power. Distribution of water needs to be efficient and controlled, from providing home consumers to public facilities including public parks. In essence, these distribution systems lack intelligence. For instance, it may be challenging to assess the system in enough to identify a distribution pipe leak, particularly if the leak is not immediately visible (as in the case of underground pipes). A more trustworthy fault detection system has been made possible by advanced sensors. Hence, the wireless sensor tags market revenue is estimated to surge.

Challenges

- Growing Security Issues - Security risks including hacking or unauthorized access might affect WSNs. This is particularly troublesome since it could lead to sensitive data leaking into unauthorized hands when it is transmitted or stored over the network. Hence, the adoption of sensor tags is also anticipated to hinder.

- High Cost of Wireless Sensor Tags

- Inefficient in Remote Areas

Wireless Sensor Tags Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.8% |

|

Base Year Market Size (2025) |

USD 8 billion |

|

Forecast Year Market Size (2035) |

USD 29.14 billion |

|

Regional Scope |

|

Wireless Sensor Tags Market Segmentation:

Application Segment Analysis

Wireless sensor tags market from the medical segment is expected to generate the highest revenue by the end of 2035. The use of sensor technology in healthcare is becoming more prevalent in recent years with the introduction of broad digitization and the conversion of medical facilities to digital platforms for several purposes. For instance, sensors are currently utilized to detect patient movement and check vital signs. Life-sustaining implants and other medical devices are made smarter and are better able to track the patient's condition in real time owing to sensor technology. Hence, the adoption of wireless sensor tags in this sector is growing.

Type Segment Analysis

The active tags segment in the wireless sensor tags market is poised to have significant growth over the forecast period. Even though they are much more expensive the adoption rate of these tags is the highest since it offers a much longer read range. In addition to shipping and logistics, active tags are frequently used in the automotive industry, manufacturing, health and medical, building and construction, mineral extraction, remote monitoring, and IT asset management.

Our in-depth analysis of the global wireless sensor tags market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Sensor Tags Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate majority revenue share by 2035, backed by a growing focus on energy conservation. About 98 quadrillion British thermal units (Btu) or 16% of the world's total primary energy consumption of 604 quadrillion Btu were consumed in the United States in 2021. Hence, the demand for wireless sensor tags is growing in this region since it is necessary to minimize the impact on the environment. Also, there has been growing water pollution in this region. Hence to keep track of the pollution being spread in water the demand for wireless sensors is growing. Furthermore, the growing investment in IoT technology has expanded, influencing the growth in market revenue in this region.

APAC Market Insights

The Asia Pacific wireless sensor tags market is projected to have significant growth over the forecast period. It is expanding more quickly than the other regions owing to the existence of developing nations such as China and India, which have enormous economic potential. Moreover, there has been a surge in electric vehicles in this region which has further opened various opportunities for the growth of the market in this region. Additionally, the Asia Pacific region is a significant customer of wireless sensors owing to favorable government policies supporting passenger safety, industrial automation, environmental monitoring, and more.

Wireless Sensor Tags Market Players:

- Texas Instruments Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- STMicroelectronics

- Emerson Electric Co.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric

- General Electric

- NXP Semiconductors

- Rockwell Automation

- TE Connectivity Ltd.

Recent Developments

- A new accelerometer from Honeywell International, Inc. was announced; it is compact, tough, and reasonably priced while offering outstanding performance and durability. The MV60 micro-electro-mechanical system (MEMS) accelerometer is designed for aerospace and defense but also has potential usage for industrial and maritime applications that need high-precision, navigation-grade accelerometers that are tiny, lightweight, and require little power to function.

- For the manufacturing sector to complete its digital transition, Siemens AG has announced the release of private industrial 5G user equipment. A variety of customer segments that rely on reliable communication infrastructure, such as intralogistics, autonomous machines, industrial edge, remote diagnostics, augmented reality, assisted work, wireless backhaul, edge computing, and mobile equipment, may derive long-term benefits from the applications on industrial 5G.

- Report ID: 5061

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Sensor Tags Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.