Mobile and Wireless Backhaul Market Outlook:

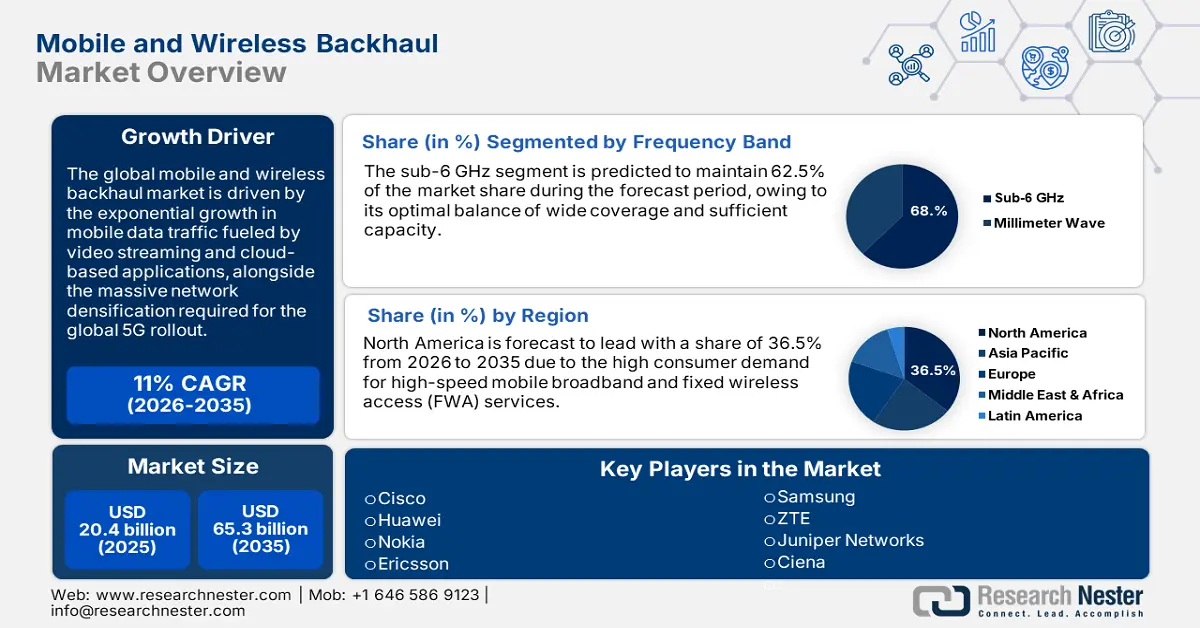

Mobile and Wireless Backhaul Market size was USD 20.4 billion in 2025 and is projected to reach a valuation of USD 65.3 billion by the end of 2035, rising at a CAGR of 11% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mobile and wireless backhaul is assessed at USD 23 billion.

The constant rollout of 5G networks across the globe and the increase in mobile data are influencing the mobile and wireless backhaul market expansion. The growth is also fueled by the spread of connected devices, with estimates that active IoT devices will reach more than 40.6 billion by 2034. The constant need for perfect connectivity and high-bandwidth use cases, including augmented reality and cloud gaming, is stressing the current backhaul infrastructure, driving constant upgrades and the use of sophisticated technologies such as millimeter-wave and fiber optics.

The mobile and wireless backhaul market direction is also influenced by the growing use of artificial intelligence and advanced security capabilities in backhaul gear. Among the opportunities is the ability to offer elastic, high-capacity, and low-latency solutions that are able to handle the evolving needs of next-generation mobile services. In a major innovation, Huawei launched its end-to-end X-Haul solution at MWC 2025, a solution that enables IP, microwave, and optical transport, which will allow operators to construct flexible end-to-end 5G networks for any deployment environment, from dense metro to rural deployments.

Key Mobile and Wireless Backhaul Market Insights Summary:

Regional Insights:

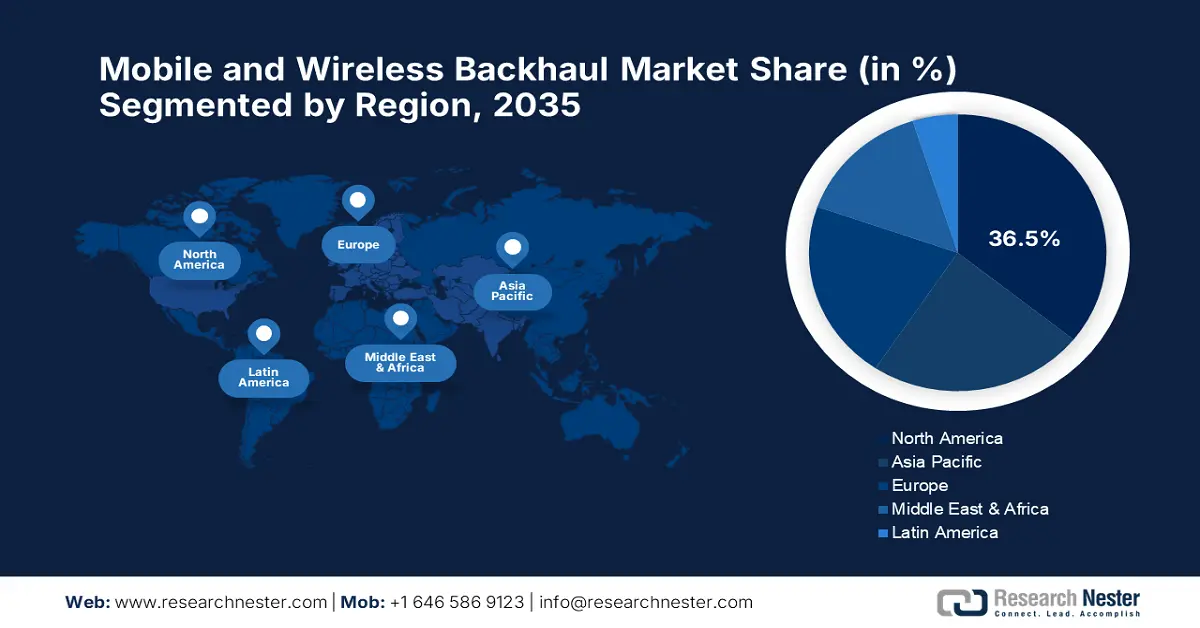

- North America is anticipated to command a 36.5% share by 2035 in the mobile and wireless backhaul market, underpinned by robust 5G adoption and significant operator investments in network modernization owing to early large-scale deployment commitments.

- Europe is projected to expand steadily from 2026–2035, sustaining its backhaul advancement momentum as operators intensify urban network densification and upgrade capacity to support 5G enterprise applications, impelled by continuous technological development focus.

Segment Insights:

- The sub-6 GHz band is forecast to hold a leading 62.5% share during 2026–2035 in the mobile and wireless backhaul market, reinforced by its broad-area coverage capabilities and foundational role in nationwide 4G and early 5G deployments propelled by hybrid backhaul strategy integration.

- The microwave segment is set to capture a 45.0% share by 2035, emerging as a core backhaul element as operators prioritize cost-efficient, rapidly deployable solutions, supported by continuous innovation in multi-band and multi-directional microwave technologies encouraged by next-generation equipment advancements.

Key Growth Trends:

- 5G network proliferation across the globe

- AI-based network optimization

Major Challenges:

- Providing secure, high-performance protection for mission-critical networks

- Requirement for multi-vendor interoperability

Key Players: Huawei, Nokia, Ericsson, Samsung, ZTE, Juniper Networks, Ciena, Telstra, Maxis.

Global Mobile and Wireless Backhaul Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.4 billion

- 2026 Market Size: USD 23 billion

- Projected Market Size: USD 65.3 billion by 2035

- Growth Forecasts: 11%

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 19 August, 2025

Mobile and Wireless Backhaul Market - Growth Drivers and Challenges

Growth Drivers

- 5G network proliferation across the globe: Global deployment of 5G networks is the main driver for the mobile and wireless backhaul market. The massive bandwidth and sub-zero latency demand of 5G necessitate a full replacement of the transport infrastructure from cell sites to the core. In a stark demonstration of this opportunity, initial rollouts have achieved 5G speeds of up to 10 gigabits per second, many orders of magnitude faster than 4G. This staggering performance boost is driving broad demand, with predictions anticipating 5G connections around the world to exceed 5.5 billion by 2030. This acceleration of connectivity underscores the requirement for scalable and resilient backhaul solutions.

- AI-based network optimization: Growing complexity in 5G networks is fueling the use of artificial intelligence to automate and maximize backhaul processes. Artificial intelligence-powered solutions are able to dynamically allocate spectrum, traffic manage, and anticipate network problems, resulting in stark efficiency and user experience improvements. In October 2024, Huawei introduced an AI-driven spectrum management solution for its mobile backhaul products. The technology dynamically optimizes spectrum resource allocation on the network and assists operators in dealing with the dynamic and often unpredictable nature of 5G traffic in real-time.

- Closing the digital divide with wireless technology: Wireless backhaul solutions also serve the critical role of taking high-speed mobile broadband services into rural and underpenetrated communities where it is not economically or logistically viable to install fibers. In October 2024, NEC installed its microwave backhaul systems in several Southeast Asian nations, enabling 5G services to penetrate these markets. Initiatives like these, which capitalize on wireless backhaul's cost-effectiveness and rapid deployment capabilities, are critical in solving the global digital divide and opening new market opportunities.

Challenges

- Providing secure, high-performance protection for mission-critical networks: With mobile backhaul networks increasingly integral to the provision of core services, keeping them safe from a constantly changing threat landscape is the utmost concern. The networks are increasingly being targeted by cyberattacks, necessitating an added layer of embedded security. To mitigate this, Cisco introduced new security features into its wireless backhaul offerings in June 2025. The new features are particularly intended to protect mission-critical network segments in industrial and enterprise settings, upholding the integrity and availability of sensitive data carried on wireless links.

- Requirement for multi-vendor interoperability: The expense and complexity of installing and upgrading 5G networks are driving interest in open, interoperable multi-vendor backhaul solutions that allow operators to employ equipment from multiple vendors. This avoids vendor lock-in and encourages a more competitive and innovative marketplace. In a significant move toward addressing this challenge, Ericsson spearheaded an interoperable multi-vendor wireless backhaul ecosystem in April 2024. The action aims to minimize the expense and complexity of network upgrades, thereby driving 5G network expansions worldwide.

Mobile and Wireless Backhaul Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11% |

|

Base Year Market Size (2025) |

USD 20.4 billion |

|

Forecast Year Market Size (2035) |

USD 65.3 billion |

|

Regional Scope |

|

Mobile and Wireless Backhaul Market Segmentation:

Frequency Band Segment Analysis

The sub-6 GHz band is predicted to hold a commanding 62.5% mobile and wireless backhaul market share during the forecast period, leveraging its higher capacity and coverage. The band supports the basis for current 4G services and the initial wave of 5G deployments, facilitating the broad-area coverage necessary for mobile broadband service at a national scale. The dominance of the segment is also supported by its role as a central component of hybrid backhaul planning. In January 2025, ZTE partnered with Bitel, a Peruvian telecoms provider, to enhance its 4G network, constructed above sub-6 GHz spectrum. The effort not only enhanced the capacity and reduced the latency of the current network but also provided a solid foundation for the operator's subsequent launch of 5G services, demonstrating the long-term strategic value of the sub-6 GHz band in mobile network development.

Technology Segment Analysis

The microwave segment is expected to hold a 45.0% mobile and wireless backhaul market share by 2035, becoming a key component of mobile and wireless backhaul infrastructure. Its popularity stems from its demonstrated reliability, affordability, and deployment speed, particularly where there is no easy access to fiber. The segment leadership is also supported by innovation from the top equipment providers. In March 2023, Huawei launched its next-generation microwave hub site backhaul equipment, which enables multi-band and multi-directional transmission from a single antenna. The innovation conserves tower space consumption and streamlines the deployment process, providing operators with greater flexibility and efficiency to scale the 5G-Advanced backhaul network. Such innovation means microwave technology will remain a competitive and valuable asset to the backhaul toolkit for the foreseeable future.

Deployment Model Segment Analysis

The Fixed Wireless Access (FWA) segment is predicted to record a robust CAGR of 13% by 2035, as it increasingly emerges as a budget-friendly option for the delivery of last-mile broadband connectivity. FWA leverages the existing mobile network infrastructure to deliver high-speed internet to the home and office, posing a resilient alternative to wired technologies such as fiber and cable. Expansion in this segment is further fueled by emerging technologies such as Integrated Access and Backhaul (IAB), which further streamlines deployment.

In March 2025, Samsung remained committed to marketing its IAB technology as a primary solution for facilitating 5G coverage. By supporting wireless backhaul in locations where fiber is absent, IAB enables operators to get to market more quickly and affordably with their 5G networks, delivering high-speed FWA service to more subscribers and aiding the closing of the digital divide in underpenetrated markets.

Our in-depth analysis of the global mobile and wireless backhaul market includes the following segments:

|

Segments |

Subsegments |

|

Frequency Band |

|

|

Technology |

|

|

Deployment Model |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile and Wireless Backhaul Market - Regional Analysis

North America Market Insights

North America is anticipated to maintain a 36.5% market share through the forecast period, as it is a global market leader in the mobile and wireless backhaul market. This is fueled by early and aggressive adoption of 5G networks in the region, strong demand for mobile data by consumers, and huge current investment in network upgrades by dominant operators. Highly competitive and innovative equipment vendor and service provider ecosystems ensure the availability of backhaul technology and usage in North America.

The U.S. sector is characterized by a heavy emphasis on cutting-edge software and AI, enabling network flexibility and efficiency. In June 2024, Cisco completed a significant build-out of mobile backhaul infrastructure for multiple North American operators, rolling out cutting-edge software-defined networking (SDN) and AI-driven traffic optimization. The development is enabling operators to manage their 5G services more flexibly, dynamically respond to shifting traffic patterns, and build the foundation for future network innovations such as network slicing and edge computing.

Canada is also investing heavily in its telecommunication infrastructure, with a strong focus on leveraging the latest software and AI to improve network performance and efficiency. Just like in the U.S., the Canada market recognizes the necessity of dynamic network management to maximize 5G services and pave the way for next-generation capabilities like network slicing and edge computing. An example of such a government initiative is the Connect to Innovate program, launched by Innovation, Science and Economic Development Canada (ISED). The program provides funding to upgrade and expand broadband internet availability in rural and remote communities, often resulting in the implementation of advanced network technologies.

Europe Market Insights

Europe is anticipated to record a steady mobile and wireless backhaul market expansion from 2026 to 2035, driven by the sustained expansion of 5G services and ambitious network densification in cities. European operators are heavily investing in faster backhaul upgrades to meet the increasing capacity requirements of 5G and enable new enterprise applications. The competitive market environment and technology development focus in the region are driving a vibrant market for next-generation backhaul solutions, from high-capacity microwave radios to advanced IP/MPLS platforms.

Germany mobile and wireless backhaul market is predicted to garner stable growth owing to a particular focus on leveraging the latest technology to deliver superior 5G services. The country is a test bed for the next-generation backhaul technologies, particularly in the millimeter-wave band. The promise is also evident in the rapid build-out of 5G, with over 80% of German households having 5G coverage in 2024. Furthermore, the number of 5G base stations has increased dramatically, to over 85,000 in mid-2023, evidencing the rapid rate of adoption and network build-out.

The UK mobile and wireless backhaul market is driven by the aggressive pace of mobile operators upgrading and expanding their backhaul infrastructure to support their nationwide 5G rollout. It calls for massive spending on high-capacity routers and next-generation optical transport platforms. In June 2024, leading vendors like Juniper Networks and Ciena joined forces to help UK operators with these essential solutions. This ongoing cycle of network upgrades guarantees ongoing demand for high-end backhaul equipment and services in the competitive UK market.

APAC Market Insights

Asia Pacific mobile and wireless backhaul market is likely to record a strong CAGR of 13% between 2026 and 2035. This growth is being driven by massive 5G network investments, especially in China and India, the fast pace of economic digitalization, and the enormous size of the customer base. Governments in the region are driving mobile broadband expansion aggressively, and this is generating a huge and long-term demand for a variety of backhaul solutions to connect millions of new cell sites.

China leads the mobile and wireless backhaul market, not merely in the size of its deployments, but in the development of sophisticated, end-to-end network solutions. Chinese manufacturers excel in innovation, creating end-to-end product platforms that can cater to the diverse backhaul requirements of future-generation 5G networks. Huawei's March 2025 launch of its X-Haul product, with multi-transport technologies supported, is a prime example, allowing operators to build extremely flexible and efficient 5G networks.

India mobile and wireless backhaul market is observing growth as India's telecom operators are vying with one another to densify their networks before the mass deployment of 5G services. This monumental task involves a significant overhaul of the existing backhaul infrastructure to handle the anticipated data traffic boom. In March 2025, Nokia launched a big partnership with Indian telecom operators to upgrade their IP backhaul networks by installing its new IP/MPLS products and applying AI-based optimization to deliver an enhanced mobile experience on the subcontinent.

Key Mobile and Wireless Backhaul Market Players:

- Cisco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huawei

- Nokia

- Ericsson

- Samsung

- ZTE

- Juniper Networks

- Ciena

- Telstra

- Maxis

The global mobile and wireless backhaul market is a technology-centric, extremely competitive market dominated by a handful of major telecommunication network equipment vendors. Cisco, Huawei, Nokia, Ericsson, Samsung, and NEC Corporation are the key players fiercely competing based on technology innovation, product performance, and the ability to provide end-to-end, complete solutions that meet the advanced requirements of the mobile operators. The market is characterized by a continuous cycle of innovation, with vendors competing to develop the next-generation, higher-capacity, more efficient, and intelligent backhaul technologies.

A strategic step that highlights the competitive dynamics includes a fundamental shift where cooperation and flexibility are as important as raw product performance in acquiring and retaining customers. For instance, AT&T signed a deal in December 2023 with Ericsson to purchase up to USD 14 billion of telecommunications gear, aimed at supporting 70% of its wireless network traffic on Open RAN platforms by the end of 2026. This dynamic industry is anticipated to continue to evolve as new technologies and collaborations shape the future of connectivity.

Here are some leading companies in the mobile and wireless backhaul market:

Recent Developments

- In June 2025, Cisco introduced its Ultra-Reliable Wireless Backhaul (URWB) technology, designed to deliver fiber-like performance with ultra-low latency and seamless, "make-before-break" handoffs. This innovation is aimed at mission-critical applications in industrial and enterprise environments, providing robust wireless connectivity where wired solutions are impractical or too costly to deploy.

- In July 2024, Ericsson announced a successful trial of W-band spectrum for mobile backhaul, which effectively doubled the available high-frequency transport capacity. This advancement is critical for supporting the increased bandwidth demands of 5G and future 6G networks, enabling more efficient and higher-capacity data transmission between cell sites and the core network.

- Report ID: 8002

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile and Wireless Backhaul Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.