Wireless Gamepad Market Outlook:

Wireless Gamepad Market size was over USD 5.9 billion in 2025 and is estimated to reach USD 10.4 billion by the end of 2035, expanding at a CAGR of 6.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of wireless gamepad is estimated at USD 6.2 billion.

The international wireless gamepad market is currently witnessing an effective transformation, revolutionizing from a peripheral accessory for suitable consoles into the central interface for a wide-ranging digital entertainment spectrum. The cloud gaming services' proliferation, high-performance mobile devices, and an increase in customer demand for multi-platform and seamless experiences. According to an article published by NLM in February 2022, the total global audience for esports accounts for over 70%, categorized between 16 to 34 years of age. In addition, 19% belongs to the 35 to 44 years of age group, thereby enhancing the massive demand of the market across different regions and countries.

Furthermore, the huge installed base of smartphones, innovation in connectivity standards, and an expansion in the PC gaming segment are also driving the wireless gamepad market globally. Additionally, as per an article published by the CMA in July 2024, the Google Play Store is the largest application store on Android devices, accounting for 90% to 100% of native app downloads, which is also positively impacting the market. Besides, the comprehensive incorporation of strong Wi-Fi 6/6E and low-latency Bluetooth 5.x ensures a satisfactory wireless gaming experience. These technological optimizations are making wireless performance almost indistinguishable from wired connections, thus bolstering the market’s upliftment worldwide.

Performance Metrics for IEEE 802.11 Wi-Fi Standards (2022)

|

Metric Type |

802.1 lb |

802.1 lg |

802.1 ln |

802.1 l ac |

802.1 l ax |

|

Maximum data rate |

11 Mbps |

54 Mbps |

600 Mbps |

1.3 Gbps |

9.6 Gbps |

|

Frequency Band |

2.4 GHz |

2.4 GHz |

2.4 GHz / 5 GHz |

5 GHz |

2.4 GHz / 5 GHz |

|

Channel Bandwidth |

20 MHz |

20 MHz |

20/40 MHz |

20/40/80/160 MHz |

20/40/80/160 MHz |

|

MIMO Support |

No |

No |

Yes (up to 4x4) |

Yes (up to 8x8) |

Yes (up to 8x8) |

|

t No No Yes (up to 4x4) Yes (up to 8x8) Yes (up to 8x8) S |

1 |

1 |

1-4 |

1-8 |

1-8 |

|

Range |

100-150 m |

100-150 m |

150-250 m |

250-400 m |

250-400 m |

|

Latency |

High |

High |

Medium |

Low |

Low |

|

Interference Handling |

Basic |

Basic |

Improved |

Advanced |

Advanced |

Source: IJIRT

Key Wireless Gamepad Market Insights Summary:

Regional Insights:

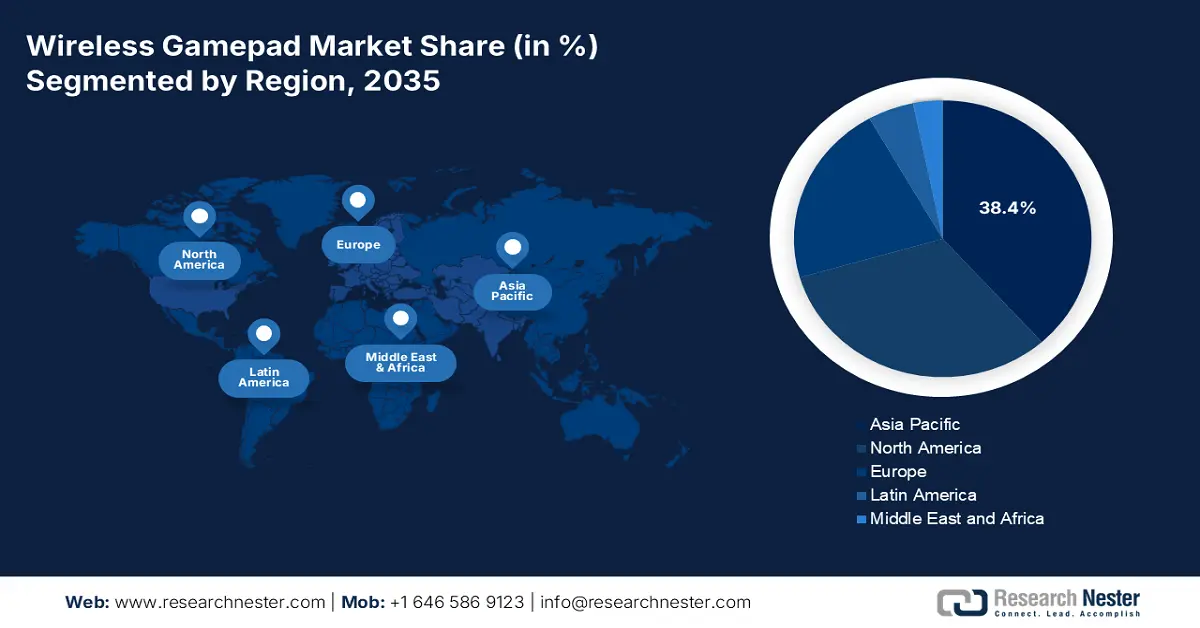

- Asia Pacific is anticipated to hold the highest share of 38.4% by 2035, impelled by a tech-savvy youth population, growth in game development, and increasing broadband and smartphone penetration in the wireless gamepad market.

- Europe is predicted to emerge as the fastest-growing region during the forecast period, fueled by rising consumer purchasing power and a robust gaming culture.

Segment Insights:

- Online segment is projected to account for 58.7% share by 2035, owing to massive product selection, price transparency, and unparalleled convenience in the wireless gamepad market.

- Bluetooth segment is expected to hold the second-largest share during the forecast period, driven by cable-free connectivity, portability, and a clutter-free gaming experience.

Key Growth Trends:

- Rise in subscription models

- Sustainability in electronic trends

Major Challenges:

- Intense market saturation and price pressure

- Compatibility issues and technological fragmentation

Key Players: Microsoft Corporation (U.S.), Nintendo Co., Ltd. (Japan), Logitech International S.A. (Switzerland), Razer Inc. (U.S.), SCUF Gaming (Corsair) (U.S.), Turtle Beach Corporation (U.S.), Thrustmaster (Guillemot Corporation) (France), 8BitDo (China), Nacon (France), PDP (Performance Designed Products) (U.S.), HORI (Japan), PowerA (U.S.), ASTRO Gaming (Logitech) (U.S.), SEGA (Japan), Betop (China), GameSir (China), Mad Catz (U.S.), HyperX (HP Inc.) (U.S.), Cooler Master (Taiwan).

Global Wireless Gamepad Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 10.4 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 4 November, 2025

Wireless Gamepad Market - Growth Drivers and Challenges

Growth Drivers

- Rise in subscription models: The aspect of subscribing to gaming hardware is increasing, which is positively uplifting the wireless gamepad market across different nations. According to an article published by the EUR Research Information Portal IN January 2025, game subscriptions during Christmas topped among 39% of customers in comparison to game gift requests, while 22% demanded physical video games. Besides, subscription-based services enhanced the platform performance, eventually enhancing the console revenue by 121.5% in the PlayStation case, and 65.9% in the Xbox case, thereby making it suitable for boosting the overall market.

- Sustainability in electronic trends: Reflecting wide-ranging consumer electronic trends, there is an increase in the requirement for sustainable products, which is also driving the wireless gamepad market internationally. Besides, as per an article published by the MDPI in July 2024, the latest renewable energy sources and cooling technologies are required and rapidly adopted to diminish the present greenhouse gas emission of 200 grams of carbon dioxide, along with 2.5 kWh per GB 6G network energy consumption. Therefore, with such developments, sustainability can be integrated, thus ensuring a green economy in wireless gamepads.

- Comprehensive digital ecosystem: Digitalized infrastructure and technology highly depend on raw materials, disposal and production of devices, and energy demands, which positively caters to the wireless gamepad market. As per a data report published by the UNCTAD Organization in July 2024, the digital devices utilization and production, along with information and communication technology, and data centers, account for approximately 6% to 12% of the international electricity usage. Meanwhile, yearly smartphone shipments have successfully doubled, leading to 1.2 billion in 2023, and Internet of Things (IoT) devices have surged 2.5 times in 2023, and are projected to hit 39 billion by the end of 2029.

Challenges

- Intense market saturation and price pressure: The wireless gamepad market is significantly bifurcated between a flood of low-cost generic alternatives and premium first-party controllers. This has squeezed profit margins and created intense price pressure for the majority of established brands. Besides, consumers in emerging nations are effectively price-sensitive, frequently adopting the cheapest functional option, instead of investing in advanced features. This saturation deliberately makes it challenging for the newest entries to achieve a foothold and pressure key players to compete on price in specific segments, potentially causing a hindrance in innovation.

- Compatibility issues and technological fragmentation: The absence of a universal connectivity standard has created an uneven user experience in the wireless gamepad market globally. Console-based manufacturers utilize proprietary wireless protocols that readily lock consumers into the ecosystem, while compatibility is required in the case of televisions, smartphones, and PCs, which depend on a mixture of proprietary dongles and Bluetooth. This frequently results in feature disparity, wherein progressive functionalities, such as haptic triggers, are lost when a controller is utilized on a non-native platform.

Wireless Gamepad Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 10.4 billion |

|

Regional Scope |

|

Wireless Gamepad Market Segmentation:

Distribution Channel Segment Analysis

The online segment in the wireless gamepad market is anticipated to garner the largest share of 58.7% by the end of 2035. The segment’s growth is highly attributed to its massive product selection, price transparency, and unparalleled convenience. Besides, specialized tech retailers and e-commerce firms provide customers direct accessibility to an overall spectrum of options, from niche to first-party controllers, and high-performance models from third-party brands. Further, this particular channel is essential for achieving the actual gaming demographic, which is heavily influenced and digitally native by online reviews, targeted digital advertising, and influencer endorsements.

Connectivity Segment Analysis

The Bluetooth segment in the wireless gamepad market is predicted to cater to the second-largest share during the forecast duration. The segment’s growth is driven by its provision of a cable-free and convenient connection, along with ensuring portability and a clutter-free gaming experience. For instance, as per an article published by the Telecommunication Engineering Center and the India Council of Agricultural Research in 2024, Bluetooth low-energy (BLE) devices readily operate in the unlicensed 2.4 GHz ISM band. The traditional Bluetooth utilizes 79: 1-MHz-wide channels, while BLE utilizes 40: 2-MHz-wide channels, owing to which there is a huge growth opportunity for the segment in the market.

Application/Compatibility Segment Analysis

The console gaming segment in the wireless gamepad market is expected to account for the third-largest share by the end of the projected timeline. The segment’s development is fueled by its importance in enabling freedom of movement, diminishing clutter, and has emerged to comprise immersive features, such as adaptive triggers and haptic feedback. As per an article published by the Pew Research Center Organization in May 2024, 85% of teens in the U.S. play video games, and 41% play at least once a day. In addition, more than half of the teens in the country play these games to gain increased problem-solving skills, thus catering to the segment’s growth.

Our in-depth analysis of the wireless gamepad market includes the following segments:

|

Segment |

Subsegments |

|

Distribution Channel |

|

|

Connectivity |

|

|

Application/Compatibility |

|

|

Price Point |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Gamepad Market - Regional Analysis

APAC Market Insights

Asia Pacific in the wireless gamepad market is anticipated to account for the highest share of 38.4% by the end of 2035. The market’s growth in the region is highly attributed to the presence of the tech-savvy and massive youth population, a boom in the regional game development sector, and a rapid increase in broadband and smartphone penetration. According to an article published by FutureCFO in March 2025, the mobile gaming revenue in Southeast Asia has increased, accounting for USD 6.0 billion. Additionally, the Gaming Growth Unlocked report constituted 38% of mobile gaming revenue in overall Asia as of 2024, denoting a 21% surge from the previous 2 years. Moreover, as per the December 2024 ORF Organization article, the online gaming industry in India recorded a 28% growth, which is projected to account for INR 33,243 crore (approximately USD 3.7 million).

The wireless gamepad market in China is gaining increased exposure, owing to the aspect of an undisputed leader in both manufacturing and consumption of wireless gamepads. Besides, the Ministry of Industry and Information Technology (MIIT) in the country reported continuous growth in the electronics information manufacturing industry. In this regard, as per the July 2025 SCIO Government data report, the value-added output in the majority of organizations increased by 11.1% on a year-over-year (YoY) basis as of 2025. During the same period, the combined revenue rose by 9.4%, resulting in 6.4 trillion yuan (USD 907.1 billion), thus boosting the market.

The wireless gamepad market in South Korea is also growing, driven by world-leading internet speeds and an advanced esports culture. The government has proactively promoted this industry, with companies, such as the Korea Creative Content Agency, backing esports events and game developments. As per the December 2023 published ITA article, the gaming industry in the country has been estimated to account for USD 17.6 billion as of 2022, and it is considered one of the top-four highest-gaming economy. Meanwhile, an increase in video and card games export and import sourcing is also responsible for boosting the overall market in the country and in the region.

Video and Card Games 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

China |

USD 26 billion |

USD 455 million |

|

Japan |

USD 2.7 billion |

USD 2.8 billion |

|

Vietnam |

USD 1.5 billion |

USD 326 million |

|

Malaysia |

USD 725 million |

USD 68.3 million |

|

South Korea |

USD 285 million |

USD 426 million |

|

India |

USD 55.8 million |

USD 64.2 million |

|

Hong Kong |

USD 377 million |

USD 1.0 billion |

|

Thailand |

USD 44.3 million |

USD 84.3 million |

Source: OEC

Europe Market Insights

Europe in the wireless gamepad market is predicted to emerge as the fastest-growing region during the projected timeline. The market’s exposure in the region is propelled by an increase in consumer purchasing power, as well as a robust and established gaming culture. According to a data report published by the ITA in May 2025, an estimated 6 in 10 people in Germany play video games, with 48% constituting female gamers, while 78% are almost 18 years of age, and 58% usually range between 6 to 69 years old. Besides, as stated in the October 2023 Europe Commission article, the video games sector in the region readily generated €23.48 billion in revenue as of 2022, which denotes a huge growth opportunity for the market.

The wireless gamepad market in the UK is gaining increased traction, owing to the aspect of increased consumer engagement and a developed technology ecosystem. As stated in the June 2022 CIC article, over 60% of adults in the country, aged more than 16 years, and 91% of 3 to 15-year-olds play games on consoles, smartphones, and desktops. Additionally, among children between 8 to 17 years, video games denote a positive mood for 58%, 59% feel good about themselves, and 60% experience less lonely, thereby effectively proliferating the market’s upliftment in the overall country.

The wireless gamepad market in Germany is also boosting due to the customer base and the economic strength that significantly values technical innovation and excellence. As per the May 2025 ITA article, mobile gaming has the highest player base in the country, with almost 24.6 million players. In addition, it has been estimated that 27% of the population utilizes their smartphones for playing games. Meanwhile, consoles are the second-most utilized gaming platform in the country with 18.7 million players, accounting for 23% of the population, thereby readily bolstering the market’s upliftment.

North America Market Insights

North America in the wireless gamepad market is projected to grow steadily by the end of the forecast duration. The market’s upliftment is highly fueled by an increase in consumer expenditure, early advanced technologies integration, and the presence of mature gaming ecosystem. According to a data report published by the ITA in 2025, more than 190 million people in the overall region play video games, and 78% of households in the U.S. have been recorded to play almost 1 gaming device over the past 12 months. Therefore, based on these statistical values, there is a huge demand and growth opportunity for the market in the region to gain exposure.

The wireless gamepad market in the U.S. is growing significantly, owing to a rise in disposable income, along with the existence of a strong digital infrastructure. In addition, the effortless implementation of gamepads across different platforms, which is driven by the cloud gaming growth, is also propelling the market’s development in the country. As per the 2025 ITA data report, the video game industry in the country readily supported over 350,000 job opportunities, which contributed USD 66 billion to the gross domestic product (GDP). Besides, according to the December 2023 BEA Government report, there has been a 6.3% growth in the digital economy, and a 1.9% growth in the country’s actual GDP, which is also positively impacting the market.

The wireless gamepad market in Canada is also experiencing growth due to government support, with an increased focus on domestic game development and the digital economy. In addition, a surge in the need for gamepads in the hybrid work-and-entertainment home environment is also boosting the market’s exposure. Meanwhile, as per an article published by the Government of Canada in August 2025, the USD 3.2 billion Universal Broadband Fund readily supports increased internet-speed projects throughout the country. The funding comprises nearly USD 50 million for mobile internet projects, and almost USD 750 million for high-impact and large projects, thus suitable for the market’s growth.

Key Wireless Gamepad Market Players:

- Sony Interactive Entertainment (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation (U.S.)

- Nintendo Co., Ltd. (Japan)

- Logitech International S.A. (Switzerland)

- Razer Inc. (U.S.)

- SCUF Gaming (Corsair) (U.S.)

- Turtle Beach Corporation (U.S.)

- Thrustmaster (Guillemot Corporation) (France)

- 8BitDo (China)

- Nacon (France)

- PDP (Performance Designed Products) (U.S.)

- HORI (Japan)

- PowerA (U.S.)

- ASTRO Gaming (Logitech) (U.S.)

- SEGA (Japan)

- Betop (China)

- GameSir (China)

- Mad Catz (U.S.)

- HyperX (HP Inc.) (U.S.)

- Cooler Master (Taiwan)

- Sony Interactive Entertainment is one of the market leaders, well-known for adaptive trigger technologies and pioneering advanced haptic feedback in its DualSense controller. The company’s dominance is significantly rooted in the hugely installed PlayStation ecosystem base, fueling both premium features and first-party sales for the overall sector. Based on these developments, the company’s stock acquisition sales amounted to USD 613,500 by the end of 2024, as stated in its annual report.

- Microsoft Co., Ltd.’s exclusive product, Xbox Wireless Controller, is readily celebrated for its comprehensive cross-platform compatibility and exceptional ergonomics, making it the standard factor for cloud gaming and PC. The firm has strengthened its position in the market through in-depth integration with its Windows operating system, subscription services, and Xbox hardware.

- Nintendo Co., Ltd. is consistently differentiating its products through unconventional and innovative controller designs, including the motion-controlled Joy-Con, which has effectively prioritized unusual gameplay experiences. This approach of hardware-software adoption has developed a family-friendly and distinct market, insulated from direct competition with other console manufacturers. Besides, according to its 2024 annual report, the organization’s net sales accounted for ¥1,671,865 million, along with ¥528,941 operational profit, thus uplifting the overall development.

- Logitech International S.A. is considered the dominating force in the third-party as well as PC peripheral market, providing a comprehensive range of dependable wireless gamepads, recognized for their value and durability. The organization has leveraged its extended international retail distribution and robust brand reputation in computer accessories to gain the budget-conscious and mainstream gamer segments.

- Razer Inc. effectively targets professional esports and high-performance segments with its wireless gamepads, which are readily differentiated by personalized components, sophisticated software integration, and high-precision components. The firm has successfully cultivated a premium brand identity synonymous with rivalry gaming, permitting it to command an increased price point.

Here is a list of key players operating in the global market:

The global wireless gamepad market is a tiered and dynamic competitive field, wherein the top tier is readily dominated by the vertically integrating Big Three console manufacturers, such as Nintendo, Microsoft, and Sony. Below them, specialized third-party players, including SCUF, Razer, and Logitech, effectively compete on premium features, customization, and performance, targeting professional esports and the enthusiast PC segments. Besides, in August 2024, HP Inc. introduced its newest gaming gear from HyperX and OMEN, with a focus on customization to another level, permitting gamers to make desktops future-ready and fine-tune aesthetics with OMEN components, which positively caters to the wireless gamepad market internationally.

Corporate Landscape of the Wireless Gamepad Market:

Recent Developments

- In August 2025, Qualcomm Technologies, Inc. declared an outstanding processor, which is the Qualcomm Dragonwing Q-6690, comprising ultra-wideband, Bluetooth 6.0, Wi-Fi 7, and 5G for supporting superior global connectivity and proximity-aware experiences.

- In January 2025, Samsung Electronics Co. Ltd. notified its newest Lifestyle, OLED, MICRO LED, and QLED display lineups to successfully tick of the artificial intelligence (A0) screen era through the launch of cutting-edge AI-based processor to redefine smart display capabilities.

- In September 2024, Logitech G successfully launched a significant lineup of 18 advanced products and released its latest partnerships, displaying evolution in gaming, including the RACING SERIES, SIM racing family, low-profile G915 series, and cutting-edge pro series mouse and keyboard at the Logi Play 2024.

- Report ID: 8213

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Gamepad Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.