Wireless Broadband in Public Safety Market Outlook:

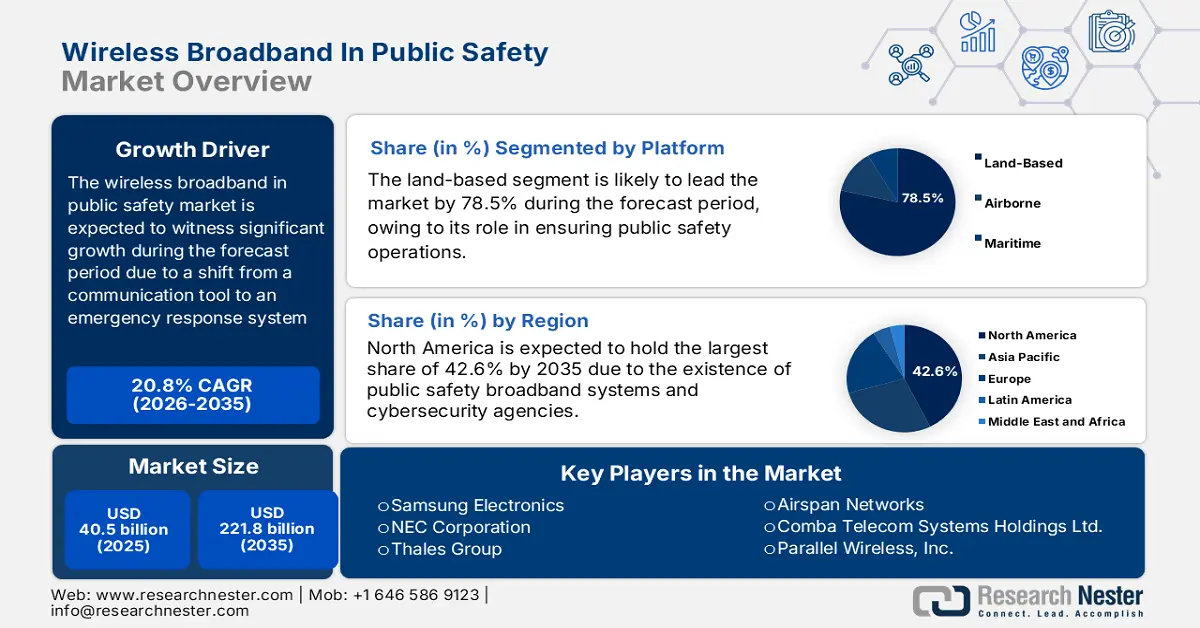

Wireless Broadband in Public Safety Market size was over USD 40.5 billion in 2025 and is estimated to reach USD 221.8 billion by the end of 2035, expanding at a CAGR of 20.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of wireless broadband in public safety is assessed at USD 48.9 billion.

The worldwide wireless broadband in public safety market is currently undergoing a profound transformation, readily evolving from a supplementary communication tool into the ultimate system for emergency response. The rollout of 5G networks and network slicing, along with artificial intelligence (AI) and video analytics integration, are responsible for driving the overall market. According to an article published by NLM in May 2024, it is expected that with the international 5G networks implementation by the end of 2030, the data transfer speed will surge by a 1000 times factor, with reduced network energy consumption. Therefore, this denotes a huge growth opportunity for the market across different countries.

Furthermore, as per a data report published by the State of Broadband in 2024, there has been an increase in internet users to 5.4 billion as of 2023, as well as 5.5 billion by the end of 2024. Despite this, still 2.6 billion people remain offline, with approximately 38% of the international population residing with mobile broadband coverage and not utilizing it, while 5% of the population are devoid of mobile broadband. Besides, the rise in rapid-response and deployable solutions and LMR, along with broadband convergence are also responsible for the wireless broadband in public safety market. According to the March 2024 UCA report, the UCA LMR system effectively supports more than 44,000 portable and mobile radios, along with 285 radio dispatch consoles in 4 different regions and network connectivity to 4 redundant data centers, as well as 175 communication sites state-wide.

Individuals Utilizing the Internet Across Different Regions and Country Grouping (2023)

|

Regions and Country Grouping |

Percentage |

|

Different Regions |

|

|

World |

67% |

|

Africa |

37% |

|

America |

87% |

|

Arab States |

69% |

|

Asia Pacific |

66% |

|

CIS |

89% |

|

Europe |

91% |

|

Different Country Grouping |

|

|

Low-income |

27% |

|

Lower-middle-income |

55% |

|

Upper-middle-income |

81% |

|

High-income |

93% |

|

LCDs |

35% |

Source: The State of Broadband

Key Wireless Broadband in Public Safety Market Insights Summary:

Regional Insights:

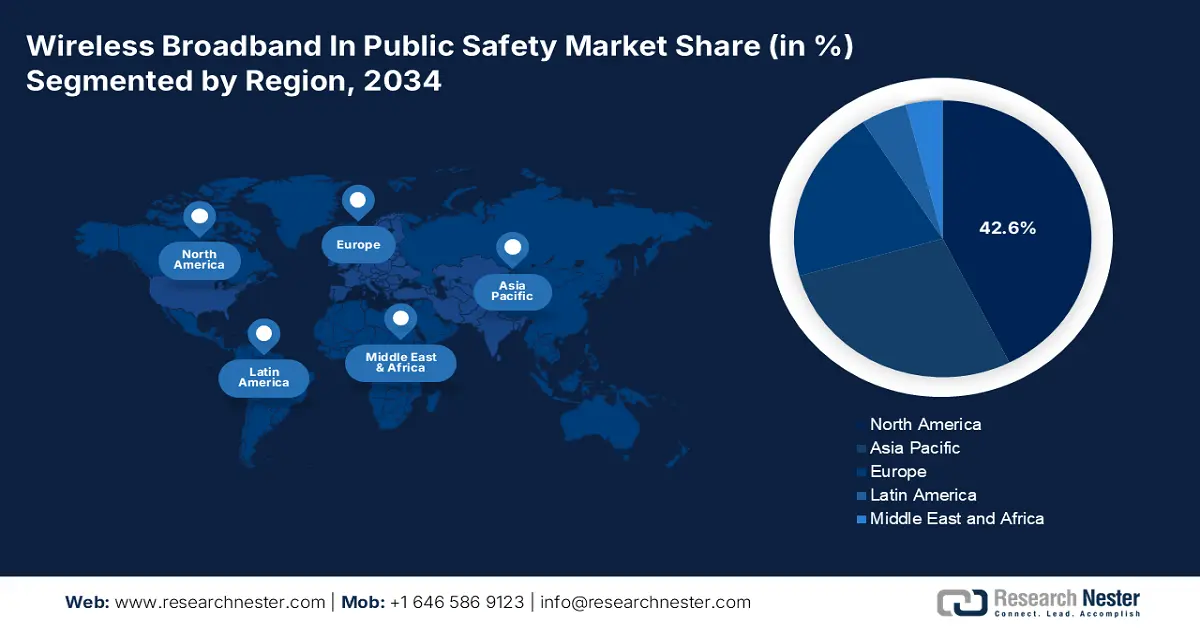

- By 2035, North America in the wireless broadband in public safety market is expected to secure a 42.6% share, sustained by the strong domestic public safety broadband ecosystem and expanding 5G penetration.

- Europe is projected to emerge rapidly by 2035, bolstered by the mandate for interoperable public safety communications.

Segment Insights:

- The land-based segment in the wireless broadband in public safety market is set to command a 78.5% share by 2035, reinforced by its role as the foundational infrastructure enabling deployable systems and fixed sites for first responders.

- The professional services segment is projected to attain the second-largest share by 2035, sustained by the rising complexity of managing mission-critical networks and expanding needs for specialized integration and cybersecurity support.

Key Growth Trends:

- Smart city development

- Increased frequency and natural disaster severity

Major Challenges:

- Budgetary constraints and increased capital spending

- Legacy system and interoperability integration

Key Players: Motorola Solutions Inc. (U.S.),Ericsson (Sweden),Nokia Corporation (Finland),Huawei Technologies Co., Ltd. (China),AT&T Inc. (FirstNet Authority) (U.S.),L3Harris Technologies, Inc. (U.S.),Cisco Systems, Inc. (U.S.),ZTE Corporation (China),Juniper Networks, Inc. (U.S.),Samsung Electronics (South Korea),NEC Corporation (Japan),Thales Group (France),Hytera Communications Corporation Ltd. (China),Bittium (Finland),Airspan Networks (U.S.),Comba Telecom Systems Holdings Ltd. (China),Parallel Wireless, Inc. (U.S.),Ceragon Networks Ltd. (Israel),Fujitsu Limited (Japan),Telstra Corporation Limited (Australia).

Global Wireless Broadband in Public Safety Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 40.5 billion

- 2026 Market Size: USD 48.9 billion

- Projected Market Size: USD 221.8 billion by 2035

- Growth Forecasts: 20.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Australia, Brazil, United Arab Emirates

Last updated on : 4 November, 2025

Wireless Broadband in Public Safety Market - Growth Drivers and Challenges

Growth Drivers

- Smart city development: The aspect of international investments in smart city projects is effectively associated with public safety, which is rapidly uplifting the wireless broadband in public safety market globally. According to an article published by NLM in May 2022, the successful completion of small- and medium-sized smart city can tend to increase the available dividend by 2.5 to 3 times for urban development, which is beneficial for sustainable development. Besides, the June 2025 PIB report indicated that in India, 94% of the total 8,067 projects have been accomplished under the Smart Cities Mission, with an investment of ₹1.6 lakh crore, which significantly contributes to the market growth.

- Increased frequency and natural disaster severity: The concept of climate modification is resulting in increased critical natural disasters, which has highlighted the demand for interoperable and resilient communication systems in the wireless broadband in public safety market. For instance, as stated in the February 2025 World Wildlife Organization article, a hurricane is a product of the evaporation of ocean waters of more than 80 degrees Fahrenheit. This creates moist and warm air that rises into the atmosphere, further creating natural disasters, owing to which there is a huge demand for investment in redundant and hardened broadband networks.

- National network projects and government mandates: These are the foremost catalysts in the wireless broadband in public safety market, which are not merely market influencers but state-backed and foundational drivers. Besides, by offering billions in funding and dedicated spectrum, these initiatives develop a non-negotiable need for compliant service, device, and infrastructure. This government-based push effectively de-risks investment for network operators and manufacturers, thereby guaranteeing a high-value and long-lasting market. Moreover, these governmental projects significantly establish a nationwide and standardized framework that compels agencies to shift from legacy systems, thus ensuring technological modernization and sustained growth.

Fiber Connections in Overall Fixed Broadband Across Different Countries Uplifting the Wireless Broadband In Public Safety Market (2024)

|

Countries |

Prevalence |

|

Iceland |

90.9% |

|

Korea |

90.0% |

|

Spain |

88.3% |

|

Lithuania |

80.3% |

|

Japan |

79.2% |

|

Latvia |

78.3% |

|

Sweden |

77.7% |

|

Norway |

73.6% |

Source: OECD

Challenges

- Budgetary constraints and increased capital spending: The deployment of a nationwide and dedicated public safety broadband demands immense capital spending for network facilities, site hardening, and spectrum acquisition. For many municipalities and governments, especially in developing economies, this has been displayed as a critical financial gap in the wireless broadband in public safety market. Besides, competitive budgetary priorities frequently scale down or cause delays in these projects. Additionally, the overall expense of ownership expands beyond rollout to operational spending for cybersecurity, upgradation, and maintenance. Therefore, this creates a long-lasting fiscal burden, negatively impacting the market’s development.

- Legacy system and interoperability integration: A paramount operational challenge in the wireless broadband in public safety market is ensuring seamless interoperability between the newest broadband networks and existing LMR systems. The majority of public safety agencies have made investment initiatives in LMR, which effectively remains highly dependable for voice communication. Besides, the rip and replace approach is neither desirable nor feasible; instead, complicated integration is essential to permit cross-system communication between old and new devices, along with agencies. This readily involves deploying and developing innovative interfaces and gateways, which can be costly and technically challenging.

Wireless Broadband in Public Safety Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.8% |

|

Base Year Market Size (2025) |

USD 40.5 billion |

|

Forecast Year Market Size (2035) |

USD 221.8 billion |

|

Regional Scope |

|

Wireless Broadband in Public Safety Market Segmentation:

Platform Segment Analysis

The land-based segment in the wireless broadband in public safety market is anticipated to garner the largest share of 78.5% by the end of 2035. The segment’s growth is highly attributed to its pivotal role as the foundational facility for overall public safety operations. This comprises deployable systems and fixed sites, such as cell towers, Vehicle-Mounted rovers, and Cell-on-Wheels (COWs), providing severe connectivity for first responders. Moreover, the segment is also driven by ongoing and huge investments in terrestrial and national broadband networks, such as the UK’s Emergency Services Network (ESN) and the U.S.’s FirstNet, readily prioritizing interoperability, reliability, and coverage.

Service Segment Analysis

The professional services segment in the wireless broadband in public safety market is expected to account for the second-largest share during the projected period. The segment’s growth is fueled by the severe complexity of maintaining and deploying mission-critical networks. In addition, this is also fueled by the demand for specialized expertise in system integration, ongoing technical support, and network design. Besides, as agencies shift from legacy and land mobile radio to 4G and 5G broadband, they need expanded consulting to provide seamless cybersecurity and interoperability. Moreover, the lifecycle pertaining to these networks requires continuous testing, managed services, and optimization to effectively guarantee the always-on dependability requirement for public safety.

Technology Segment Analysis

The 5G segment in the wireless broadband in public safety market is predicted to cater to the third-largest share by the end of the forecast period. The segment’s development is driven by its importance in the ability to provide rapid speed, great capacity, and lowered latency, which ensures the latest applications and readily transforms industries. For instance, as per an article published by Asia Pacific Management Review in December 2024, the first-ever 5G service was launched in South Korea in 2019, and comprised 32 million subscribers by the end of 2023, accounting for 39% of total mobile subscribers. Besides, 5G generated socio-economic impacts, totaling KRW 30.3 trillion (USD 23.3 billion) as of 2025.

Our in-depth analysis of the wireless broadband in public safety market includes the following segments:

|

Segment |

Subsegments |

|

Platform |

|

|

Service |

|

|

Technology |

|

|

End user |

|

|

Infrastructure |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Broadband in Public Safety Market - Regional Analysis

North America Market Insights

North America in the wireless broadband in public safety market is projected to account for the largest share of 42.6% by the end of 2035. The market’s growth in the region is fueled by the presence of a domestic public safety broadband ecosystem, with the Cybersecurity and Infrastructure Security Agency (CISA) emphasizing the actual demand for resilient and secure communication for security and driving investment directly. According to an article published by 5G Americas Organization in April 2025, Canada and the U.S. jointly account for over 182 million 5G connections, which represents almost 20% year-over-year (YoY) growth. Therefore, this puts the entire region at the 5G penetration forefront, suitable for boosting the market.

The wireless broadband in public safety market in the U.S. is growing significantly, owing to the extension of the FirstNet network, tactical evolution for ultra-reliable low-latency communication (URLLC), and network slicing for supporting cutting-edge applications. Besides, as stated in the May 2025 NTIA article, over 90 applications have been received by the Department of Commerce's National Telecommunications and Information Administration (NTIA). This resulted in requesting USD 3 billion in federal funding as well as proposing over USD 1.3 billion in private investment to ensure innovative and wireless equipment support in the country.

The wireless broadband in public safety market in Canada is also growing due to the cellular and wireless cellphone utilization, successful establishment of a standard national public safety broadband network (NPSBN), along with the aspect of learning from models, such as FirstNet, increasing focus on remote and rural connectivity, provincial governmental strategies, and a pivotal role played by the Canada Wireless Telecommunications Association (CWTA). As per an article published by the Government of Canada in December 2024, the Ministry of Innovation, Science, and Industry declared an investment of USD 45 million, as part of a USD 66 million project. This is led by the Centre of Excellence in Next Generation Networks (CENGN) to effectively support innovative 5G testbeds and create 5G-based application technologies.

Cellular and Wireless 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

Mexico |

USD 553 million |

USD 156 million |

|

Canada |

USD 235 million |

USD 62.4 million |

|

Costa Rica |

USD 191 million |

USD 918,000 |

|

Panama |

USD 33.1 million |

- |

|

Bahamas |

USD 8.0 million |

- |

|

Dominican Republic |

USD 45.3 million |

USD 7.7 million |

Source: OEC

Europe Market Insights

Europe in the wireless broadband in public safety market is considered to emerge as the fastest-growing region during the projected period. The market’s exposure in the region is propelled by the mandate for interoperable public safety communications, which are exemplified by the Broadway project. In addition, this commercially procures pan-domestic mobile systems for respondents, and it is effectively supported by the Europe Union’s Horizon 2020 research fund, which directly uplifts the market growth. Besides, the phased shift from current terrestrial trunked radio (TETRA) systems to standard 4G and 5G broadband networks which is fueled by the demand for high-speed applications.

The wireless broadband in public safety market in Germany is gaining increased traction, owing to the continuous national enhancement and rollout of the BOS Digital Radio network, the presence of the Federal Ministry of the Interior and Community (BMI) mandate for secure and strong communication facilities, and increased focus on cybersecurity and network resilience. Besides, as per an article published by the ITA in May 2025, the country comprises more than 500 operational data facilities, and based on this, the revenue is predicted to extend to USD 25.3 billion by the end of 2029, catering to a 6.2% growth rate, thereby making it suitable for bolstering the market growth.

The wireless broadband in public safety market in the UK is also developing due to the requirement to resolve the long-lasting deployment of the Emergency Services Network (ESN), the aspect of operational necessity to successfully replace the aging Airwave service, and leveraging commercial 4G and 5G network operators through optimized Mobile Virtual Private Network (MVPN). According to the April 2023 UK Government article, the widespread incorporation of 5G services in the country is projected to account for £159 billion in terms of productivity advantages by the end of 2035, which deliberately uplifts the overall market.

APAC Market Insights

Asia Pacific in the wireless broadband in public safety market is projected to grow steadily by the end of the forecast duration. The market’s upliftment is driven by the presence of a huge government-based smart city strategies, which accelerate investments in advanced communication facilities. In addition, the leapfrogging of legacy land mobile radio systems favors 5G networks, especially in developing countries is also boosting the market in the region. Besides, South Korea and Japan are deliberately focusing on adopting innovative technologies, such as AI-centric video analytics, as well as drone-based surveillance, into their present communication frameworks.

The wireless broadband in public safety market in China is developing, owing to the government’s role in public safety broadband, which has fueled its extended Safe City approach, along with the deployment of dedicated public safety communication endpoints. This huge scale is orchestrated by domestic initiatives and backed by the Ministry of Industry and Information Technology (MIIT). According to the September 2024 ITIF data report, the information technology production in the country will successfully increase, in comparison to the U.S., projecting to reach almost 80% of the U.S. levels, with an investment of USD 400,000 on research and development, thus skyrocketing the market’s development.

The wireless broadband in public safety market in India is also growing due to the government's undertaking generous investments in ensuring public safety communications and increased focus on modernizing state police forces. As per the December 2024 PIB Government article, the Telecommunication Act, 2023, successfully replaced the 140-year-old Legacy Telegraph and Wireless Acts, and rolled out 5G service by effectively covering over 99% districts by readily installing 4.6 lakh 5G base transceiver stations, which creates a positive impact on the overall market in the country.

Key Wireless Broadband in Public Safety Market Players:

- Motorola Solutions Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ericsson (Sweden)

- Nokia Corporation (Finland)

- Huawei Technologies Co., Ltd. (China)

- AT&T Inc. (FirstNet Authority) (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- ZTE Corporation (China)

- Juniper Networks, Inc. (U.S.)

- Samsung Electronics (South Korea)

- NEC Corporation (Japan)

- Thales Group (France)

- Hytera Communications Corporation Ltd. (China)

- Bittium (Finland)

- Airspan Networks (U.S.)

- Comba Telecom Systems Holdings Ltd. (China)

- Parallel Wireless, Inc. (U.S.)

- Ceragon Networks Ltd. (Israel)

- Fujitsu Limited (Japan)

- Telstra Corporation Limited (Australia)

- Motorola Solutions Inc. is one of the most dominating international leaders in public safety communications, offering an integrated ecosystem of mission-critical devices, control center software, and land mobile radio (LMR). The firm is also considered a notable partner in major national networks for supplying broadband services and initiating agency relationships. Besides, as per its 2024 annual report, the firm’s net sales amounted to USD 6.9 billion, which represented 64% of consolidated sales in terms of technology, while USD 3.9 billion and 36% catering to the software and services segment.

- Ericsson is considered the premier infrastructure provider that supplies radio access networks (RAN) and the core network technology, underpinning domestic public safety broadband systems internationally. The organization’s expertise in 5G network is crucial for developing prioritized, reliable, and secure virtual networks dedicated to first responder communications.

- Nokia Corporation is one of the leading suppliers of end-to-end network solutions for public safety, specializing in compact base stations for rapid-response and deployable scenarios. In this 2024 annual report, which was published in March 2025, its net sales in quarter 2 amounted to EUR 4,546 million, along with a 43.4% gross margin, and expenses for research and development accounting for EUR 1,161 million.

- Huawei Technologies Co., Ltd. is regarded as the international provider of 5G network devices and infrastructure, playing an effective role in deploying public safety communication systems, especially within China and other developing economies. The firm readily offers end-to-end solutions to support Safe City strategies that can integrate video surveillance, IoT, and broadband.

- AT&T Inc. is the selective network operator in the U.S. for FirstNet, developing and administering the high-speed and nationwide broadband network dedicated to public safety entities. The organization’s core contribution caters to providing first responders with prioritized service, dedicated spectrum, and preemption capabilities to offer suitable communication during congested durations.

Here is a list of key players operating in the global market:

The international wireless broadband in public safety market is extremely consolidated, and effectively led by the U.S.-based firms, such as Motorola Solutions, along with infrastructure organizations, including Nokia and Ericsson. These organizations have readily leveraged end-to-end ecosystem control from the core network to devices. Besides, the competitive intensity is driven by tactical partnerships with relentless research and development, along with public safety agencies, with a focus on 5G core technologies. For instance, in October 2024, Ericsson unveiled seven 5G software products, which have been designed to deliberately empower CSPs with high-performing networks. These progressions are projected to elevate performance, drive revenue growth, and enhance user experience, which is suitable for positively impacting the overall market globally.

Corporate Landscape of the Wireless Broadband In Public Safety Market:

Recent Developments

News

- In June 2024, Nokia and Telefónica jointly signed an agreement to bolster the integration of network APIs by effectively leveraging 5G SA capabilities to provide support to developers in creating use cases for industrial customers, enterprise, and consumers.

- In February 2024, AT&T, along with Ericsson, declared the commencement of deploying Ericsson Cloud RAN technology on AT&T’s commercial 5G network, with the intention of accelerating the C-band deployment and continuing to virtualize network services.

- In February 2024, Kyndryl notified the international tactical alliance with Hewlett Packard Enterprise (HPE) to collectively develop and deliver 5G and LTE private wireless services to consumers internationally.

- Report ID: 8211

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Broadband in Public Safety Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.