Automotive Electronics Market Outlook:

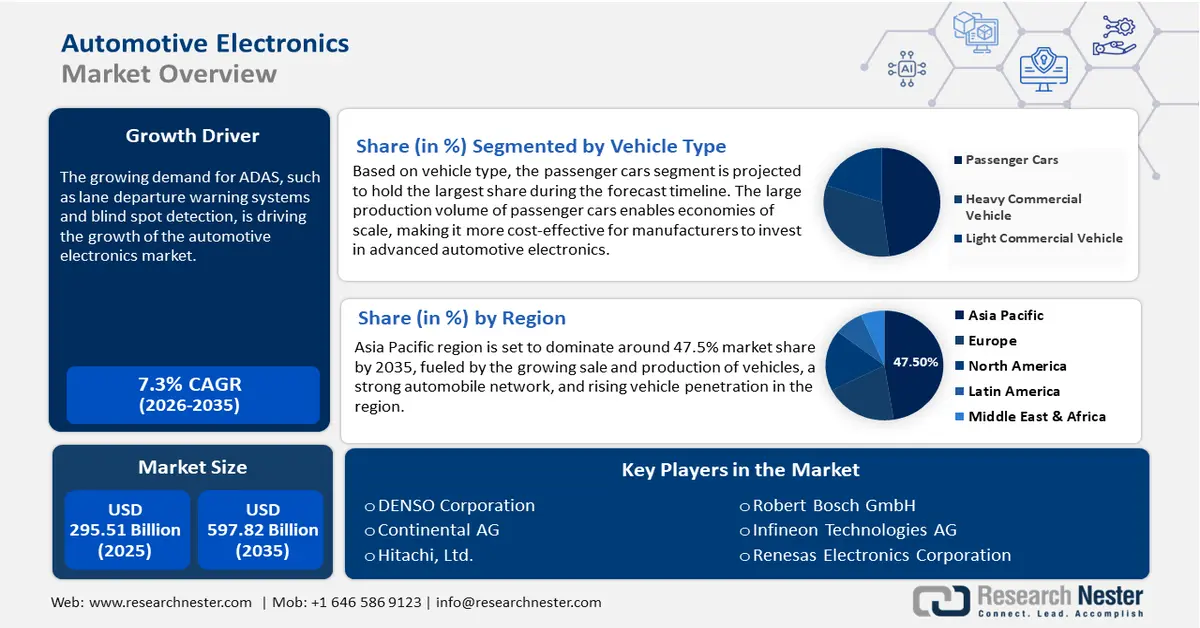

Automotive Electronics Market size was valued at USD 295.51 Billion in 2025 and is set to exceed USD 597.82 Billion by 2035, registering over 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive electronics is estimated at USD 314.93 Billion.

The growth of the market can be attributed to the increasing demand for automotive electronics systems, which are effectively contributing to enhanced vehicle safety worldwide. For instance, it is projected that electronic systems are anticipated to account for almost 50% of the total price of a new car by 2030. Besides this, the significantly rising adoption of electric vehicles and hybrid electric vehicles, along with an upsurge in the demand for infotainment features, is also propelling the growth of the global automotive electronics over the projected timeframe.

In addition to these, factors that are believed to fuel the market growth of automotive electronics include the rise in the demand for autonomous vehicles, proliferating automotive production, and the surging integration of highly advanced safety systems such as emergency call systems, automatic emergency braking, and lane departure warning systems to lower the road crashes. Electronic parts that are used in automobiles are utilized to be controlled digitally for most of the car’s operations, along with an embedded system that is used in the telematics, music system, radio, anti-lock braking system, parking ability, and safety airbags. With the recent advancements in automotive electronic control units as well as surging investment in research and development, the demand for automotive electronics is on the rise among automobile users, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive electronics market during the forecast period. For instance, the European Union (EU) invested of more than USD 58 billion in automotive research and development, in 2020. Additionally, the growing replacement of mechanical devices by electrical devices is also predicted to present the potential for market expansion over the projected period.

Key Automotive Electronics Market Insights Summary:

Regional Highlights:

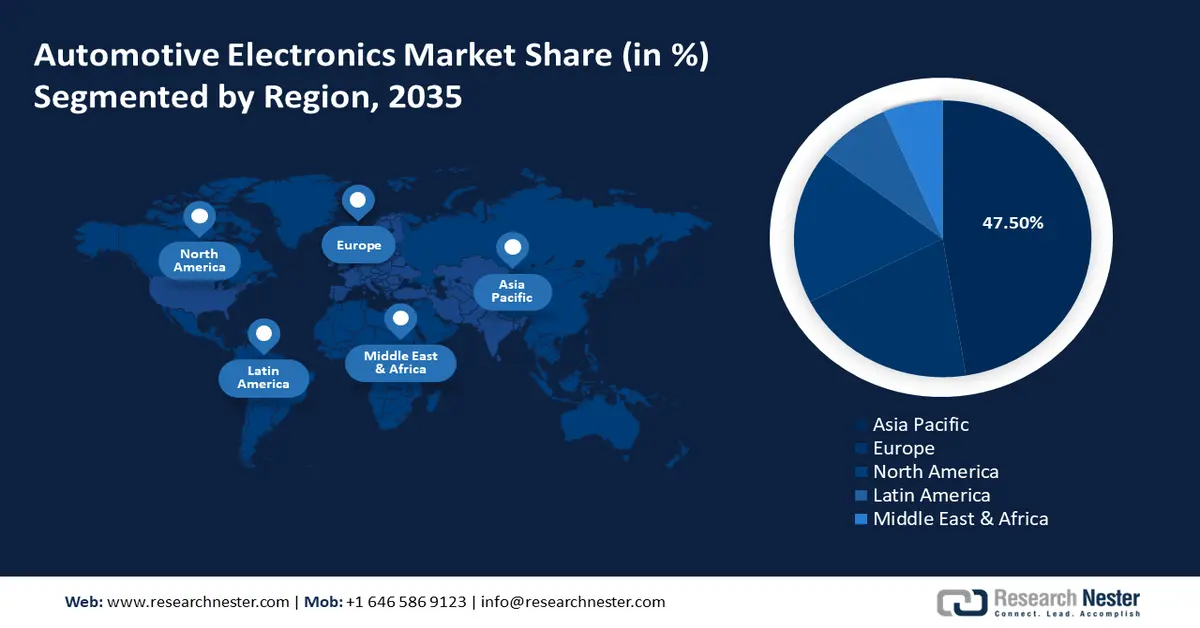

- Asia Pacific automotive electronics market is predicted to capture 47.5% share by 2035, fueled by the growing sale and production of vehicles, a strong automobile network, and rising vehicle penetration in the region.

- Europe market will register notable CAGR during 2026-2035, attributed to the presence of major automotive manufacturers and the rising awareness of safety and security features in vehicles.

Segment Insights:

- The passenger car (vehicle type) segment in the automotive electronics market is anticipated to capture the largest share by 2035, driven by increasing global sales and production of passenger cars.

- The powertrain electronics segment in the automotive electronics market is projected to hold a significant share by 2035, driven by heavy investments in R&D and electrification trends in the automotive sector.

Key Growth Trends:

- An Upsurge in the Number of Road Accidents

- Worldwide Proliferation of Electric Vehicles

Major Challenges:

- High Production Cost of Electric Vehicles

- Lower Penetration of Electronic Systems in Developing Countries

Key Players: VALEO, DENSO Corporation, Robert Bosch GmbH, Continental AG, Visteon Corporation, Infineon Technologies AG, HELLA GmbH & Co. KGaA, Hitachi, Ltd., Renesas Electronics Corporation, Texas Instruments Incorporated.

Global Automotive Electronics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 295.51 Billion

- 2026 Market Size: USD 314.93 Billion

- Projected Market Size: USD 597.82 Billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Automotive Electronics Market Growth Drivers and Challenges:

Growth Drivers

-

An Upsurge in the Number of Road Accidents – Road accidents have surged the demand for vehicle safety with the evolution of cars. Safety features such as airbags and others help to reduce the fatality risk. The automotive electronics market is expected to escalate with the rising number of road crashes so that they can be curbed. As per the World Health Organization’s Global Status Report on road safety 2018 edition, annually more than 1.2 million deaths were occurred as of road traffic crashes throughout the world.

-

Worldwide Proliferation of Electric Vehicles – Recent years have seen a tremendous hike in the demand for and sale of electric vehicles. Passenger electric vehicles are now becoming incredibly popular as of their enhanced range, increased model availability, and improved performance. Thus, the increasing demand for electric vehicle is another major factor that is estimated to boost market growth over the forecast years. For instance, China’s stock of light-duty plug-in vehicles had reached roughly 7.8 million units by the end of 2021.

- Growing Use of Advanced Driver Assistance Systems – For instance, advanced driver assistance systems were projected to be in use in more than 1 billion cars worldwide at the end of 2020.

- Rising Number of Electronic Control Unit (ECU) – For instance, as per 2020 data, nowadays vehicles may have more than 100 ECUs, for controlling functions that range from essential to comfort, to security and access.

- Increasing Demand for Anti-Braking Systems – For instance, in the United States, all cars sold from September 1, 2012, are now required to have an ABS system.

Challenges

-

High Production Cost of Electric Vehicles – The dynamically rising demand for electric vehicles is also increasing the demand for advanced driver assistance systems, along with the higher cost of lithium-ion batteries, as well as software that is being used in vehicles. These all factors are subsequently increasing the production cost of electric vehicles, which is estimated to hamper the growth of the market during the forecast period.

-

Lower Penetration of Electronic Systems in Developing Countries

- Complicated Software Designs

Automotive Electronics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 295.51 Billion |

|

Forecast Year Market Size (2035) |

USD 597.82 Billion |

|

Regional Scope |

|

Automotive Electronics Market Segmentation:

Vehicle Type Segment Analysis

The global automotive electronics market is segmented and analyzed for demand and supply by vehicle type into light commercial vehicle, heavy commercial vehicle, and passenger car. Out of the three types of segments, the passenger car segment is anticipated to garner the largest revenue by the end of 2035. The growth of the segment can be attributed to the growing demand for cars along with the surge in the sale of passenger cars worldwide. For instance, it was found that more than 55 million units of passenger cars were sold globally in the year 2021, showing an increase of nearly 4% from 2020. Moreover, the massive surge in the production of passenger cars is another key factor that is anticipated to accelerate the market growth of automotive electronics throughout the forecast period.

Application Segment Analysis

The global automotive electronics market is also segmented and analyzed for demand and supply by application into body electronics, advanced driver assistance system (ADAS), safety systems, infotainment, powertrain electronics, and others. Amongst these segments, the powertrain electronics segment is expected to garner a significant share over the forecast period. Powertrain electronics are key components such as the engine, gearbox, and transmission that help the vehicle move by supplying and managing electric power. Therefore, automotive manufacturers are spending huge amounts on research and development of more efficient automotive powertrain electronics. Besides this, simultaneous electrification in the automotive industry is also boosting the expansion of the power electronics segment. This, as a result, is projected to create several opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Application |

|

|

By Vehicle Type |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Electronics Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is set to dominate around 47.5% market share by 2035, fueled by the growing sale and production of vehicles, a strong automobile network, and rising vehicle penetration in the region. For instance, in India, the auto industry produced around 22,933,000 vehicles from April 2021 to March 2022. As for burgeoning electronic component manufacturing operations, nations such as Taiwan, Malaysia, South Korea, and Thailand have considerably contributed to the market expansion in the region. Further, the presence of a strong automobile network in the region, and the rapidly growing penetration of vehicles, are also anticipated to contribute to the market growth in the region. In addition, the surge in the proportion of technologically advanced manufacturing units is also anticipated to boost the market growth during the forecast period.

Europe Market Insights

Furthermore, the Europe automotive electronics market is also estimated to display notable market growth by the end of 2035. The growth of the market can be attributed to the existence of major automotive manufacturers such as Skoda, BMW, Volkswagen, and so on in the region. In addition to this, the growing awareness regarding the safety and security features in a vehicle, and the massively rising count of prominent automobile assembly and engine production factories are some further significant factors that are projected to accelerate the automotive electronics market in the region over the projected time frame. For instance, in Europe, there are approximately 306 automotive manufacturing and engine manufacturing plants that manufacture passenger cars, light commercial vehicles, heavy-duty vehicles, buses, and engines.

Automotive Electronics Market Players:

- VALEO

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DENSO Corporation

- Robert Bosch GmbH

- Continental AG

- Visteon Corporation

- Infineon Technologies AG

- HELLA GmbH & Co. KGaA

- Hitachi, Ltd.

- Renesas Electronics Corporation

- Texas Instruments Incorporated

Recent Developments

-

VALEO signed an agreement with the Atomic Energy Commission (CEA) and the French Alternative Energies to conduct advanced research in power electronics to prepare for upcoming electric mobility.

-

DENSO Corporation is ready to provide electrification components to Toyota and Subaru’s all-new, all-electric bZ4X and SOLTERRA.

- Report ID: 4472

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Electronics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.