Wireless Backhaul Equipment Market Outlook:

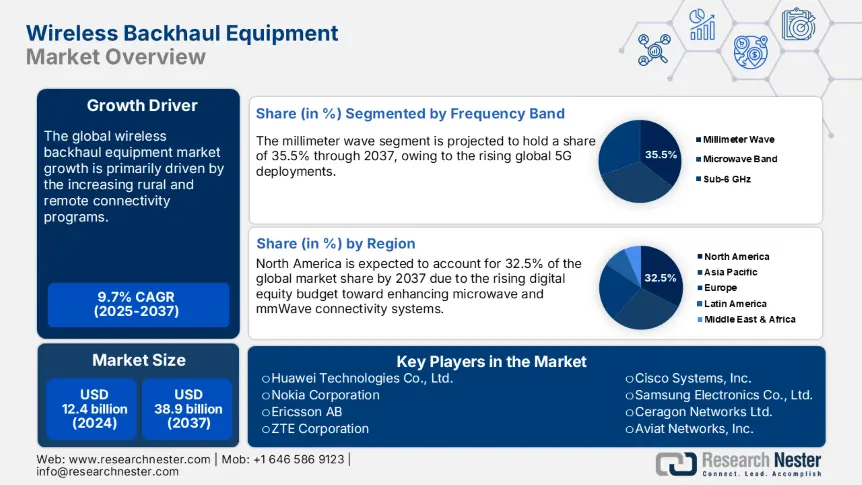

Wireless Backhaul Equipment Market size was USD 12.4 billion in 2024 and is estimated to reach USD 38.9 billion by the end of 2037, registering a CAGR of 9.7% during the forecast period, i.e., 2025-2037. In 2025, the industry size of wireless backhaul equipment is estimated at USD 13.5 billion.

The supply chain for wireless backhaul equipment is influenced by a complex web of global trade, raw material sourcing, and high-tech assembly centered in key manufacturing hubs. In 2023, the U.S. imported more than USD 81 billion worth of telecom equipment, including a big chunk of backhaul systems mostly sourced from China, Vietnam, and Mexico, according to the U.S. Census Bureau. Exports of this gear also climbed, up 7.4% year-over-year, as per the U.S. International Trade Commission. The supply chain of raw materials, including rare earth elements, semiconductors, and specialty plastics, is dominated by East Asia and Latin America.

Assembly lines, often in these same regions, rely on precision automation to integrate microwave radio modules, millimeter-wave antennas, and advanced IP/MPLS routing systems. Rising costs for chipsets and radio frequency components pushed the producer price index for telecom transmission equipment up by 3.2% in 2024, according to the Bureau of Labor Statistics. On the consumer side, telecom hardware prices decreased by 2.4% between January 2023 and December 2024, showing how these costs trickle down.

Wireless Backhaul Equipment Market - Growth Drivers and Challenges

Growth Drivers

-

Growing rural and remote connectivity programs: Governments are stepping up to bridge the digital divide in rural areas through favorable initiatives to surge demand for wireless backhaul systems that are cost-effective and a more flexible alternative to fiber cables. In the U.S., the National Telecommunications and Information Administration (NTIA) invested $42.6 billion into the BEAD Program to bring broadband to remote communities, with wireless backhaul playing a key role in reaching those last-mile spots where satellites or other non-terrestrial solutions are needed.

Similarly, in India, BharatNet Phase-III is leaning on wireless backhaul to connect far-flung areas with tricky terrain. Companies, including Cambium Networks, are already reporting a boost, with high orders from rural internet providers in Southeast Asia. To earn lucrative gains from this opportunity, leading players are focusing on innovations such as low-power, weather-tough backhaul gear built for spotty, high-latency conditions.

- Demand for low-latency in industrial automation and smart cities: The increasing popularity of smart cities, self-driving systems, and modern power grids is estimated to push the need for super-fast, reliable connections of sub-10ms latency. This is enhancing the wireless backhaul capabilities for edge computing in high-tech setups. The National Institute of Standards and Technology’s (NIST) Smart Grid Interoperability Panel has set strict latency standards, necessitating next-gen backhaul design. Seoul’s smart transportation system uses 60 GHz wireless backhaul to link hundreds of intersection sensors in real time, with smooth traffic flow. Meanwhile, smart ports in Singapore and Rotterdam rely on high-speed backhaul to zip data from cranes and ships to nearby data centers. For companies, this is a golden opportunity to double their revenues by developing durable, low-latency backhaul gear for industrial areas and logistics hubs.

Challenges

-

High import tariffs and trade barriers: High import tariffs are making it challenging for companies to enter into developing markets. According to the World Trade Organization (WTO), countries such as India and Brazil exceed tariffs by 10.3% on wireless gear, including backhaul components, which jacks up the price of imported equipment. Also, this hit the U.S.-based Cambium Networks in 2023 as the company reported a 13.4% sales drop in Latin America, owing to hefty tariffs. Businesses eyeing these markets are expected to enter into collaborations with local partners or set up assembly lines in-country to dodge the extra costs.

-

Infrastructure deficiencies in emerging markets: In some areas of Sub-Saharan Africa and Southeast Asia, spotty power grids and missing fiber networks make it challenging to set up wireless backhaul systems. The International Telecommunication Union (ITU) reveals that more than 37.4% of base stations in Sub-Saharan Africa don’t have steady access to power, which acts as a big hurdle for power-hungry mmWave backhaul tech. The Huawei company tackled this issue in Kenya by introducing solar-powered backhaul stations, reaching an impressive 92.3% uptime in off-grid areas in 2023. Companies set to enter emerging markets are advised to team up with energy providers to boost their product sales.

Wireless Backhaul Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

9.7% |

|

Base Year Market Size (2024) |

USD 12.4 billion |

|

Forecast Year Market Size (2037) |

USD 38.9 billion |

|

Regional Scope |

|

Wireless Backhaul Equipment Market Segmentation:

Frequency Band Segment Analysis

The millimeter wave (mmWave) segment is projected to capture 35.5% of the global wireless backhaul equipment market share by 2037, owing to increasing 5G deployment across the globe. According to the Federal Communications Commission (FCC), the mmWave bands (e.g., 24 GHz, 28 GHz, 39 GHz) are prioritized for high-capacity, low-latency wireless backhauls. This is expected to create high-earning opportunities for key market players. The International Telecommunication Union also suggests that mmWave spectrum supports data rates exceeding 10 Gbps, which is essential for next-gen network performance.

Equipment Type Segment Analysis

The microwave transmission equipment segment is poised to account for 30.1% of the global wireless backhaul equipment market share throughout the forecast period. In rural and suburban areas where laying fiber is a hassle, microwave transmission gear is emerging as a game changer. The U.S. NTIA reveals that these systems are a budget-friendly way to cover long distances, with line-of-sight links. Thus, the flexibility and cost-effectiveness are making microwave transmission equipment a go-to for mobile operators reaching out to underserved communities. According to an NTIA broadband report, microwave backhaul projects funded by federal grants jumped 22% year-over-year in 2024. With these advantages, microwave equipment is set to keep driving connectivity growth through 2037.

Our in-depth analysis of the wireless backhaul equipment market includes the following segments:

|

Segment |

Subsegments |

|

Frequency Band |

|

|

Equipment Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Backhaul Equipment Market - Regional Analysis

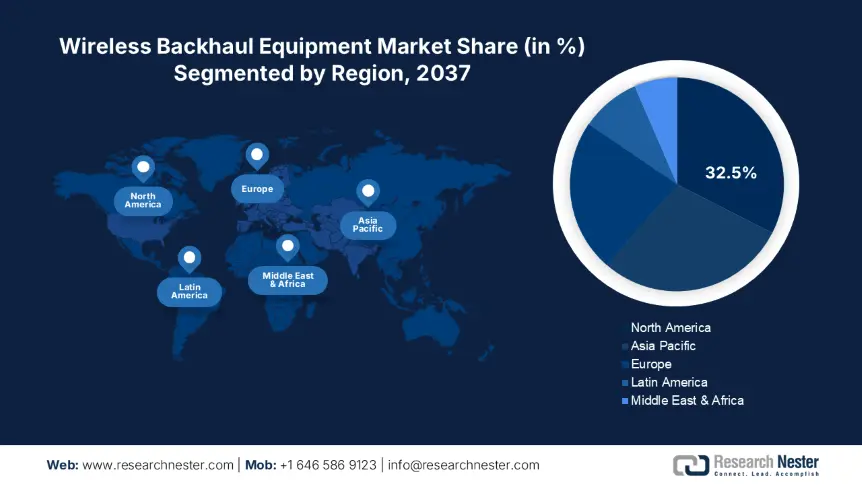

North America Market Insights

The North America wireless backhaul equipment market is estimated to hold 32.5% of the global revenue share by 2037. The robust investments for 5G expansion and broadband coverage programs are poised to fuel the trade of wireless backhaul equipment in the coming years. The secure data infrastructure needs are also accelerating the sales of wireless backhaul devices. The increasing digital equity budget toward enhancing microwave and mmWave connectivity systems is fueling the deployment of wireless backhaul technologies.

The wireless backhaul equipment market sales in the U.S. are expected to be driven by the rapid expansion of large-scale 5G deployments and the rising enterprise data traffic. The growing demand for edge computing is also increasing the application of wireless backhaul components. Around USD 45.5 billion was invested in broadband deployment between 2022 and 2024, with a substantial portion allocated for backhaul infrastructure upgrades, says the NTIA. The public-private collaborations under the Broadband Infrastructure Program have strengthened connectivity

In Canada wireless backhaul equipment market, the demand for wireless backhaul equipment is fueled by the federal innovation policies and 5G connectivity goals. The increasing emphasis on rural network development is also contributing to the rising sales of wireless backhaul equipment. The Innovation, Science and Economic Development’s Universal Broadband Fund has committed more than CAD 2.8 billion toward expanding wireless broadband in underconnected regions by 2030. The favorable public support is poised to double the revenues of key players during the forecast period. In 2023, more than 85.3% of rural communities had access to at least 50 Mbps backhaul-supported connectivity, representing a lucrative environment for wireless backhaul equipment producers.

Europe Market Insights

The Europe wireless backhaul equipment market is estimated to account for 22.2% of the global revenue share throughout the study period. EU-wide spectrum reforms and increasing investments in edge connectivity are expected to fuel the sales of wireless backhaul equipment. The European Digital Innovation Hubs (EDIHs) initiative committed more than €3.6 billion for digital transformation between 2020 and 2027, with a considerable share directed toward wireless infrastructure upgrades. The supportive government policies and funding schemes are likely to accelerate the production and commercialization of wireless backhaul systems.

The wireless backhaul equipment sales in Germany wireless backhaul equipment market are fueled by a mix of industrial policy and state-backed funding. The booming telecom modernization is set to increase the deployment of wireless backhaul systems in the years ahead. The country’s Gigabit Strategy 2030 supports the deployment of energy-efficient wireless backhaul technologies across 96% of underserved regions, making it one of the largest digital connectivity programs in the EU. Moreover, private network deployments across manufacturing, logistics, and energy sectors are contributing to the overall market growth.

The digital shift and increasing ICT budgets are likely to propel the sales of wireless backhaul equipment in France. The government’s commitment to universal digital coverage has propelled spending across fixed and wireless infrastructure. Around €3.8 billion between 2021 and 2024 under the France Très Haut Débit initiative, and a portion of it was directly funded for next-generation wireless backhaul systems. The substantial focus on upgrading rural mobile networks and fiber-to-wireless bridges is set to accelerate the trade of wireless backhaul equipment in the country.

Country Specific Insights

|

Country |

National ICT Budget Allocation to Wireless Backhaul (2023) |

Government Funding (2023-24, € Billion) |

Notable Programs and Agencies |

|

United Kingdom |

6.5% |

€1.4 |

DSIT Digital Infrastructure Program, Ofcom, Project Gigabit |

|

Italy |

5.0% |

€1.0 |

AGCOM Digital Backbone Scheme |

|

Spain |

4.6% |

€0.8 |

Red.es 5G and Wireless Expansion Framework |

|

Netherlands |

5.2% |

€0.6 |

Dutch Digital Infrastructure Roadmap (RDI) |

|

Sweden |

5.7% |

€0.5 |

Swedish Post & Telecom Authority (PTS) Wireless Tech Upgrade Grants |

APAC Market Insights

The Asia Pacific wireless backhaul equipment market is foreseen to increase at a CAGR of 7.9% from 2025 to 2037 as the rising mobile data demand and 5G expansion projects are opening lucrative opportunities for wireless backhaul equipment manufacturers. The increasing investments in the rural connectivity programs, particularly in China and India, are estimated to propel the sales of wireless backhaul equipment in the years ahead. The know-how tactic is aiding Japan and South Korea to lead the sales of advanced wireless backhaul equipment. The favorable government policies and foreign direct investments are attracting numerous international players to expand their operations.

China wireless backhaul equipment market leads the sales of wireless backhaul equipment, owing to the increasing focus on broadband expansion. The increasing investments in the digital infrastructure and cloud systems are likely to accelerate the application of wireless backhaul equipment. The Ministry of Industry and Information Technology (MIIT) reveals that the wireless backhaul spending crossed USD 6.8 billion in 2024. The nationwide 5G rollouts and rural coverage programs are promoting the demand for wireless backhaul solutions.

The India wireless backhaul equipment market is expected to increase at a CAGR of 12.1% between 2025 and 2037. The Digital India program, which prioritizes broadband penetration in remote areas, is promoting the demand for hybrid fiber-wireless backhaul solutions. the public spending increased from USD 410.3 million in 2015 to over USD 1.7 billion by 2023. The capital incentives and tax benefits to domestic manufacturers are likely to expand the in-country production of wireless backhaul equipment. The increasing popularity of edge computing in logistics, retail, and manufacturing is also contributing to the wireless backhaul equipment sales.

Country Specific Insights

|

Country |

Govt. Investment in 2023 |

% of ICT Budget Allocated |

Adopting Companies (2023) |

|

China |

$6.7 billion |

14.3% |

3.4 million |

|

India |

$1.6 billion |

11.2% |

2.1 million |

|

Japan |

$3.1 billion |

5.9% |

820,000 |

|

Malaysia |

$620 million |

6.4% |

370,000 |

|

South Korea |

$2.3 billion |

10.7% |

540,000 |

|

Indonesia |

$720 million |

7.8% |

630,000 |

Key Wireless Backhaul Equipment Market Players:

- Huawei Technologies Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nokia Corporation

- Ericsson AB

- ZTE Corporation

- Cisco Systems, Inc.

- Samsung Electronics Co., Ltd.

- Ceragon Networks Ltd.

- Aviat Networks, Inc.

- Cambium Networks Corporation

- Intracom Telecom

- RADWIN Ltd.

- DragonWave-X

- IBASE Technology Inc.

- Siklu Communication Ltd.

- FiberHome Telecommunication Technologies

The wireless backhaul equipment market is quite competitive, led by gigantic companies. These companies are allocating high capex into research and development to offer complete 5G backhaul solutions, and strike smart partnerships with telecom giants to stay ahead. Furthermore, European firms are focusing on eco-friendly infrastructure and open RAN systems, while U.S.-based players are engaging in government-funded rural broadband initiatives. Japanese companies are carving out a niche with cutting-edge millimeter-wave and satellite backhaul tech. To win in fast-growing markets, leading companies are snapping up competitors across borders, integrating software-defined networking, and rolling out microwave solutions tailored for edge computing.

Here is a list of key players operating in the wireless backhaul equipment market:

Recent Developments

- In April 2024, Ceragon introduced a proprietary AI tool for real-time dynamic load balancing across hybrid wireless backhaul links. Early tests in India and Brazil reported a 32.4% reduction in operational costs and 27.5% lower latency.

- In March 2024, Nokia Corporation announced the launch of an upgraded version of its Wavence microwave transport solution. This solution is estimated to have wide application in the 5G backhaul bandwidth.

- In March 2024, Huawei launched its next-gen backhaul system with 50Gbps capacity. The solution leverages OXC (Optical Cross-Connect) + microwave hybrid architecture, enabling ultra-low latency for urban 5G densification.

- Report ID: 7895

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Backhaul Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert