Video Doorbell Market Outlook:

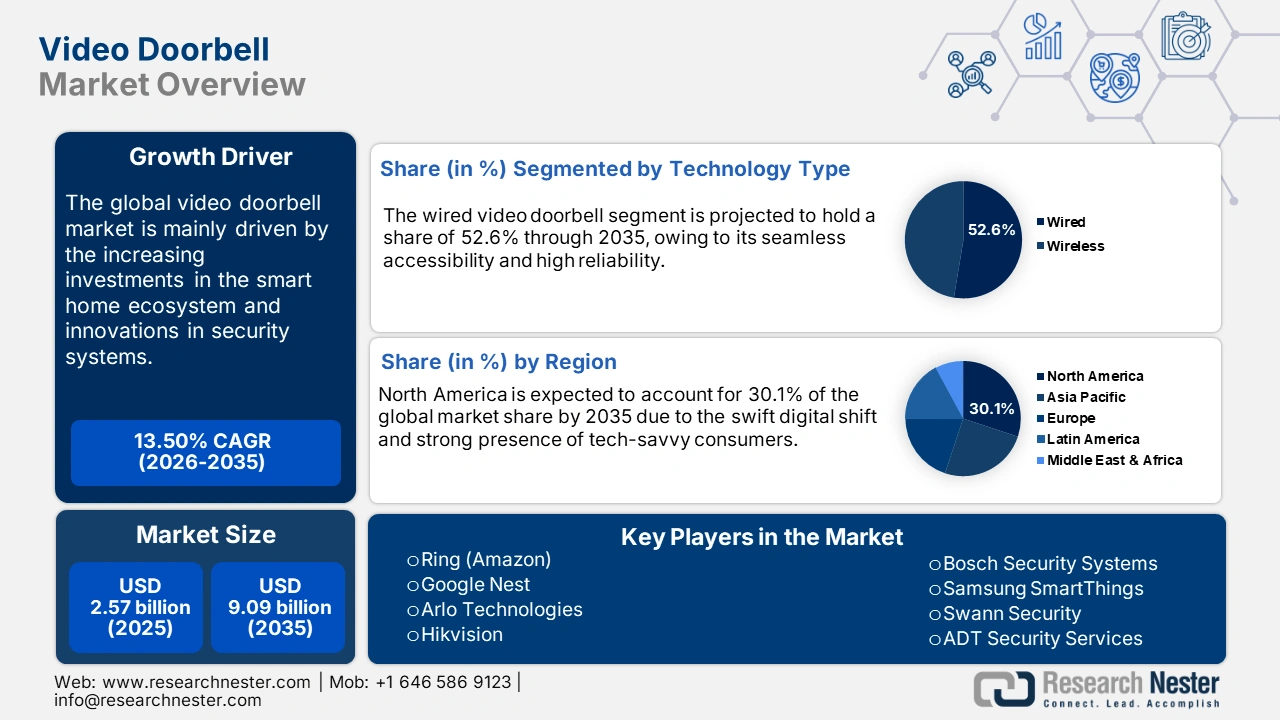

Video Doorbell Market size was USD 2.57 billion in 2025 and is estimated to reach USD 9.09 billion by the end of 2035, expanding at a CAGR of 13.50% during the forecast period, i.e., 2026-2035. In 2026, the industry size of video doorbell is estimated at USD 2.91 billion.

The global video doorbell business is expected to offer fruitful opportunities for collaboration across its robust supply chain, which comprises raw material sourcing, component manufacturing, assembly, and distribution. The main electronic components, such as CMOS sensors, semiconductors, and wireless communication modules, are estimated to be largely sourced from leading manufacturing hubs in Asia, including China, South Korea, and Taiwan. Assembly operations are concentrated in cost-efficient manufacturing markets such as China, Mexico, and Vietnam, which aids in streamlining the production before global distribution. The U.S. and Europe are estimated to remain primary importers of finished video doorbell products, owing to the strong presence of tech-savvy consumers.

The market for video doorbells is undergoing revitalized growth, fueled by advances in technology and consumer demands. One of the main trends is the addition of artificial intelligence and machine learning to enable features like facial recognition, object detection, and smart alerts that mitigate false alarms and enhance security. Unsurprisingly, wired and battery-operated, wireless models are also rising in popularity as they are easy to install and use, particularly for renters and older homes where there is no existing wiring. There is also a strong push toward interoperability with several major smart home platforms such as Amazon Alexa, Google Home, and Apple HomeKit, along with emerging standards like Matter that will ease usability and improve ecosystem integration.

Key Video Doorbell Market Insights Summary:

Regional Highlights:

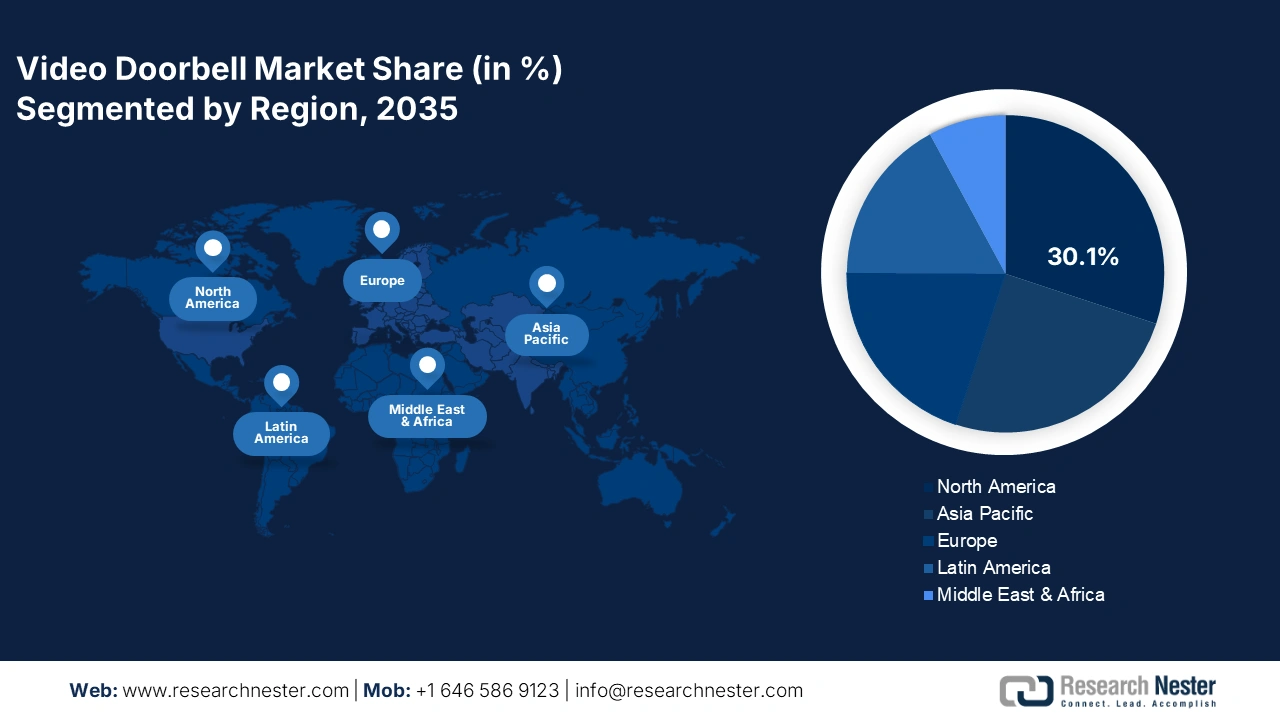

- The North America video doorbell market is anticipated to secure a 30.1% revenue share by 2035, spurred by favorable government funding, expanding wireless connectivity, and stringent security regulations.

- The Asia Pacific region is forecast to exhibit a 13.1% CAGR from 2026 to 2035, propelled by rapid urbanization, rising disposable incomes, and government-led smart city initiatives.

Segment Insights:

- The residential segment of the video doorbell market is projected to account for 55.5% share by 2035, propelled by the rising popularity of smart home technologies and increasing security concerns.

- The wired video doorbells segment is expected to hold 52.6% share during the forecast period, owing to their reliable connectivity and lower susceptibility to cybersecurity vulnerabilities.

Key Growth Trends:

- Rising demand for smart home ecosystem

- Infrastructure development initiatives

Major Challenges:

- High prices of video doorbells

- Limited infrastructure readiness

Key Players: Ring (Amazon), Google Nest, Arlo Technologies, Hikvision, Bosch Security Systems, Samsung SmartThings, Swann Security, ADT Security Services, 2GIG Technologies (Nortek), TP-Link, Tplink Kasa, Videofied (Johnson Controls), Hikvision Australia, iBall (India), AxxonSoft (Malaysia).

Global Video Doorbell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.57 billion

- 2026 Market Size: USD 2.91 billion

- Projected Market Size: USD 9.09 billion by 2035

- Growth Forecasts: 13.50% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Australia, Canada, France

Last updated on : 3 October, 2025

Video Doorbell Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for smart home ecosystem: The smart home shift is expected to drive the sales of video doorbells during the projected period. The integration of IoT technologies with security systems is anticipated to fuel the adoption of smart doorbells in the years ahead. Consumers are increasing investments in advanced home solutions that connect and offer efficiency and convenience, which are also contributing to the overall market growth. North America and Europe are leading the smart home ecosystem trends and attracting video doorbell manufacturers for investments.

- Infrastructure development initiatives: The rise in infrastructure development activities and smart city projects is set to accelerate the demand for advanced home security solutions, including video doorbells, during the foreseeable period. The government initiatives supporting integrated video surveillance and access control systems are poised to offer high-earning opportunities for video doorbell manufacturers in the years ahead. This creates a favorable environment for the adoption of video doorbells not only in single-family homes, but also in both multifamily homes and commercial properties. Commercial building infrastructure projects frequently include top-tier security systems built into the project, and these are expected to drive growth in the category too.

- Increasing demand for home security and safety: The heightened consumer awareness of home security is a key factor driving the video doorbell market. Increasing concerns about burglary, theft, and package theft among homeowners compel them to search for effective home monitoring solutions that permit real-time access from anywhere and at any time. Video doorbells, in particular, are a good approach to view and talk to a visitor without having to open the door. The chance to send alerts and for the consumer to index live video footage of the front entry/area from their smartphone also appeals to consumers who are gadget-savvy. The increasing selection of single-family households and smart homes further contributes to the newly derived demand.

Infrastructure Investment: Current Trends vs. Investment Need (USD Trillions)

|

Year |

Current Trends (USD Trillions) |

Investment Need (USD Trillions) |

|

2007 |

1.8 |

1.8 |

|

2012 |

~2.0 |

~2.0 |

|

2017 |

~2.5 |

~2.9 |

|

2022 |

~2.7 |

~3.3 |

|

2027 |

~3.1 |

~3.7 |

|

2032 |

~3.4 |

~4.1 |

|

2037 |

~3.7 |

~4.5 |

|

2042 |

~3.9 |

~4.7 |

Source: Global Infrastructure Outlook

Security System Usage and Market Insights in U.S. Households (2023-2025)

|

Metric |

Value/Details |

|

Total U.S. households using security systems |

~94 million |

|

Percentage of homes with at least one security camera |

Over 50% |

|

Increase in security camera usage |

Significant growth from 2023 to 2024 |

|

Primary motivation for home alarm system use |

Presence of children in the home |

|

Leading home alarm brands |

ADT (29%), Ring Alarm (28%) |

|

Projected new home alarm system installations in 2025 |

Over 13 million households |

Source: SafeHome.org

Interest in Home Security Purchases in the Next 12 Months by Device Type and User Group

|

Type of device |

Percent of homeowners |

Percent of renters |

Percent of all non-users |

|

Some type of security product |

50% |

54% |

51% |

|

Home security cameras |

26% |

26% |

26% |

|

Video doorbells |

24% |

27% |

25% |

|

Home alarm system |

10% |

11% |

10% |

|

Access control system |

7% |

7% |

7% |

|

Professional monitoring |

6% |

7% |

6% |

|

None of the above |

50% |

46% |

49% |

Source: SafeHome.org

Challenges

- High prices of video doorbells: The high costs of video doorbells are expected to limit their sales in price-sensitive markets in the coming years. Consumers with low spending power are hesitating to invest in advanced doorbells. The durability, low maintenance, and cost-effectiveness of conventional doorbells are challenging the sales of video doorbells in these markets.

- Limited infrastructure readiness: The limited availability of wireless connectivity networks is hampering the adoption of video doorbells in underdeveloped regions. Poor broadband penetration and fluctuations in electricity supply are also contributing to the decreasing sales of video doorbells. The low budgets of the governments for digital transformation and infrastructure development are set to hinder the overall market growth during the foreseeable period.

Video Doorbell Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.50% |

|

Base Year Market Size (2025) |

USD 2.57 billion |

|

Forecast Year Market Size (2035) |

USD 9.09 billion |

|

Regional Scope |

|

Video Doorbell Market Segmentation:

Application Segment Analysis

The residential segment is anticipated to hold 55.5% of the video doorbell market share by 2035. Developed countries are driving a high demand for advanced video doorbells owing to easy accessibility to advanced technologies. The public initiatives promoting energy efficiency and digitalization are expected to increase the sales of smart residential video doorbells during the foreseeable period. The growing popularity of smart home technologies and rising security concerns are accelerating the adoption of digital video doorbells in the residential sector. Additionally, video doorbell products can be integrated with device access control and convenient smart home products, allowing for comfort and safety. The preference for wireless, battery-operated systems also contributes to market growth.

Technology Type Segment Analysis

The wired video doorbells are expected to account for 52.6% of the market share throughout the forecast period. These video doorbells are most sought after owing to reliable connectivity and uninterrupted power supply. The commercial structures are anticipated to dominate the sales of wired video doorbells in the years ahead. As per the analysis by the Federal Communications Commission (FCC), wired systems are more reliable as their chances of encountering cybersecurity vulnerabilities are less compared to wireless alternatives. This boosts trust and wired video doorbell adoption in enterprise and government facilities.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Technology Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Video Doorbell Market - Regional Analysis

North America Market Insights

The North America video doorbell market is expected to capture 30.1% of the global revenue share through 2035. The smart home trends and rising investments in ICT solutions are set to increase the production and commercialization of video doorbells in the coming years. The expansion of wireless connectivity networks in the region is also contributing to the increasing sales of digital video doorbells. The favorable government funding and strict security regulations are accelerating the use of smart video doorbells in both commercial and residential settings. The digitalization trends are likely to promote the use of advanced video doorbells in the years ahead. Public investments in ICT and security initiatives are further backing the overall market growth.

The U.S. smart home space is one of the most mature globally, due to heightened consumer understanding and a strong home security culture. Convenience immediately following the rollout of innovative technologies like AI, IoT, and cloud-based video surveillance has further strengthened interest in video doorbells. The convenience (and market share) of brands like Ring, Nest, and ADT, with their availability of products, has established a large consumer base. Traditional shopping habits plus an uptick in online shopping have fueled concerns around package theft as people continue to purchase more items online and have frequently added video doorbell installations.

Canada is experiencing steady growth in the adoption of smart home technology, largely due to rising concerns around property crime and safety. Improved broadband connectivity and the availability of cheaper wireless models have expanded the marketplace for video doorbells. Government incentives for energy efficiency and connected homes have also aided in the demand for the smart security category. Due to harsh weather, particularly in certain Canadian geography, there is demand for video doorbells with weatherproof and durable construction, as well as built-in technology. Overall, Canada is an emerging, high-growth, high-potential market with urban mergers rather than suburbs to drive growth.

APAC Market Insights

The Asia Pacific video doorbell market is projected to increase at a CAGR of 13.1% from 2026 to 2035. Rapid urbanization and rising demand for smart home solutions are expected to propel the sales of digital video doorbells in the years ahead. Increasing disposable incomes, expanding middle-class populations, and growing awareness of home security technologies are contributing significantly to market growth across countries like China, India, Japan, and South Korea. Additionally, government initiatives promoting smart city development and digital infrastructure are creating a favorable ecosystem for connected home devices. Local manufacturers are also entering the market with competitively priced, feature-rich models tailored to regional preferences, further accelerating adoption.

In India, the video doorbell sector is relatively new in the lifecycle stage, largely due to urbanization, increasing middle-class salaries, and smart cities initiated by the government. The demand for more accessible security alternatives in apartment buildings and gated communities is contributing to this trend. Companies are starting to offer lower-cost models in India, targeting the Indian market and the increasing multilingual population of users, as well as consumers who are mobile-enabled. The increasing e-commerce and food delivery market has sparked some concern over security at the front door.

China leads the world in surveillance technology and smart products, including video doorbells. High population density in urban environments and a strong culture of technology adoption are driving consumers into integrated home security systems. Chinese leaders such as Xiaomi and Hikvision are aggressively expanding their offerings in the smart home category, especially at attractive price points. Governmental support of smart city and home security initiatives facilitates a favorable public policy environment, fueling demand.

Europe Market Insights

European region is expected to grow as a result of a convergence of safety concerns, the adoption of smart homes, and the broad acceptance of digital infrastructure by governments. Demand for connected devices and connected home ecosystems is growing across Europe, but particularly in Germany, France, the Netherlands, and, of course, the UK. Consumers want safety solutions that are also privacy-compliant and GDPR compliant, which is driving demand for more advanced secure video doorbells. Other drivers of demand include urbanization, single-person households, and e-commerce, which has increased the risk of package theft and, hence, demand for video doorbells.

France market has grown due to increased worries of home intrusion and consumer acceptance of digital home solutions. In France, government policy has taken a proactive role in supporting energy-efficient and smart housing. Consumers have shown greater favor to products that address privacy policy concerns, data security, and compliance with EU law, such as GDPR. Both local and international brands have introduced competition, which has increased product availability and driven product pricing lower. Smart doorbells have entered the homes of French homeowners as a component of the greater home automation network.

The video doorbell market in Germany is experiencing strong growth and is supported by several factors. Technology has progressed with the introduction of AI-enabled video doorbells that presently have facial recognition and real-time notifications to improve security and convenience for homeowners. Urbanization and greater disposable income have led to a demand for smart home technology, which includes video doorbells, especially in larger cities such as Berlin, Munich, and Frankfurt. Improved broadband infrastructure and the use of 5G networks has improved the reliability and performance of devices, even further promoting the use of video doorbells and smart home products.

Key Video Doorbell Market Players:

- Ring (Amazon)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google Nest

- Arlo Technologies

- Hikvision

- Bosch Security Systems

- Samsung SmartThings

- Swann Security

- ADT Security Services

- 2GIG Technologies (Nortek)

- TP-Link

- Tplink Kasa

- Videofied (Johnson Controls)

- Hikvision Australia

- iBall (India)

- AxxonSoft (Malaysia)

The leading companies in the market are investing heavily in R&D activities to develop innovative solutions and boost their position in the competitive landscape. The big players are also entering into strategic collaborations with high-tech companies to enhance their product portfolios. They are employing organic and inorganic marketing strategies such as new product launches, mergers & acquisitions, partnerships & collaborations, and global expansions to increase their market reach. Many industry giants are entering into high-potential economies to earn high profits from untapped opportunities.

Below are the areas covered for each company in the video doorbell market:

Recent Developments

- In October 2022, Google LLC introduced the second generation of its battery-powered Nest Doorbell, with upgraded AI-based person detection and package alerting. Around a 10.4% increase was registered in Google Nest device activations globally.

- In February 2021, Amazon’s Ring announced the launch of the Video Doorbell Pro 2 with improved 3D motion detection and enhanced HDR video quality. Radar is used by Ring Video Doorbell Pro 2 to improve object detection. By choosing distance criteria, homeowners can personalize the parts of their property they wish to keep an eye on.

- Report ID: 4993

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Video Doorbell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.