Video as a Service Market Outlook:

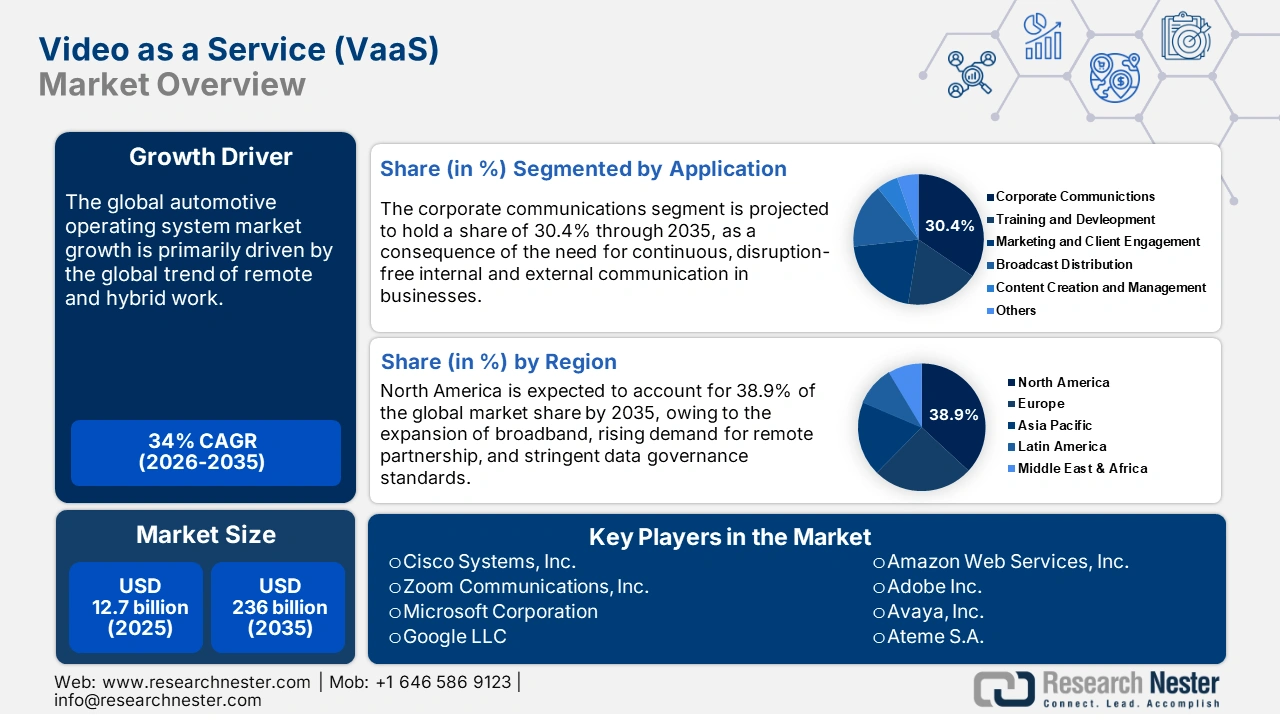

Video as a Service Market size was valued at USD 12.7 billion in 2025 and is projected to reach USD 236 billion by the end of 2035, rising at a CAGR of 34% during the forecast period, i.e., 2026-2035. In 2026, the industry size of video as a service is assessed at USD 17.2 billion.

The global trend of remote and hybrid work in corporations is expected to fuel the video as a service (VaaS) market growth during the forecast period. VaaS platforms play a crucial role in managing tasks and responsibilities in remote and hybrid work environments by delivering point-to-point capabilities for video conferencing. As per the report by the U.S. Federal Reserve Board, published in June 2025, employers are allowing employees to work from home 2.3 days in week. In addition, remote job postings that indicate demand for remote work in organizations increased to 10% in September 2024. With rising engagement of employees in remote or hybrid work, the demand for VaaS tools is likely to increase in organizations.

The growing upstream material costs that are evidenced by elevated Producer Price Index (PPI) figures for IT and audiovisual equipment are expected to have a significant influence on the growth of the VaaS market. Moreover, the Consumer Price Index (CPI) for video streaming and media services indicates a steady growth of adoption of the VaaS solutions by consumers despite inflationary pressure. As reported by the U.S. Bureau of Labor Statistics in September 2025, the median price change for cable, satellite, and live streaming services stood at 0.20% in August 2025.

Key Video as a Service (VaaS) Market Insights Summary:

Regional Highlights:

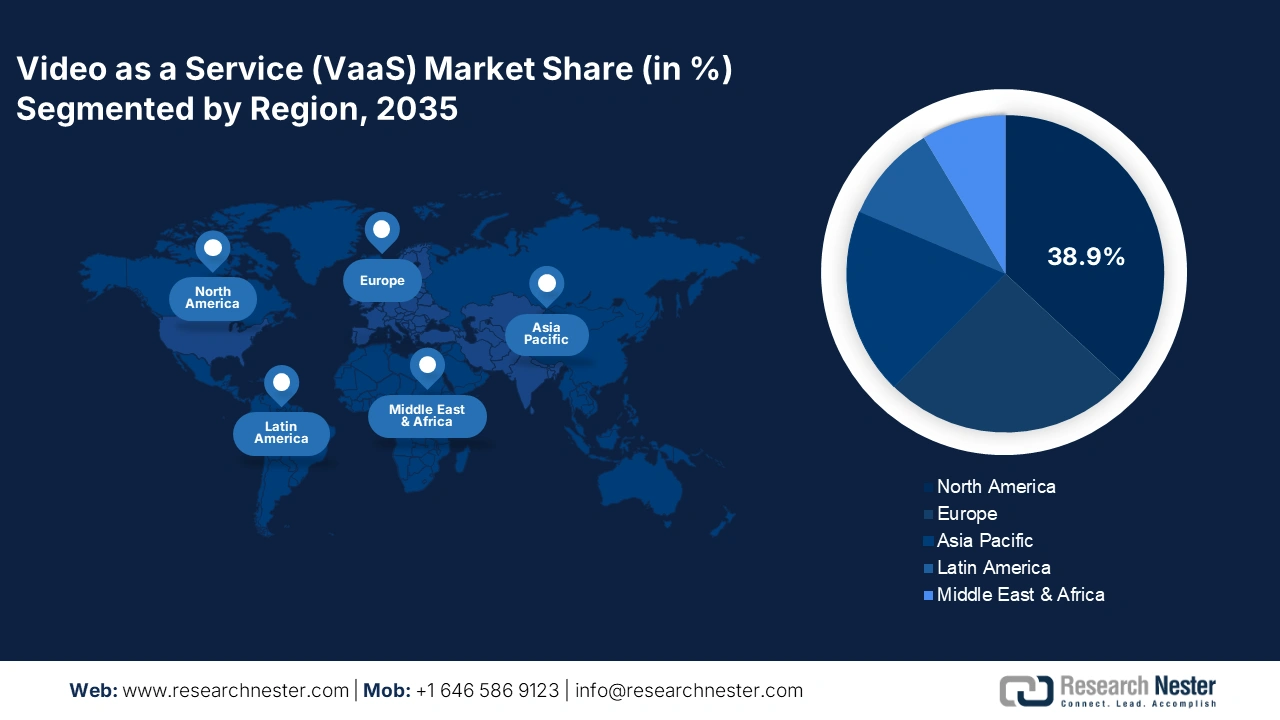

- By 2035, North America is anticipated to secure a 38.9% share in the Video as a Service Market, attributable to the expansion of broadband connectivity and stricter data governance standards.

- The Asia Pacific region is set to grow rapidly through 2026–2035, fueled by increasing digital transformation across industries and widespread mobile-network accessibility.

Segment Insights:

- The corporate communications segment in the Video as a Service Market is expected to achieve a 30.4% share by 2035, spurred by rising demand for seamless internal and external business communication.

- The hybrid cloud segment is projected to command a substantial revenue share by 2035, supported by its ability to provide enhanced flexibility, security, and cost efficiency.

Key Growth Trends:

- The advancement of artificial intelligence (AI) and machine learning (ML) technologies

- Rapid expansion of 5G infrastructure

Major Challenges:

- Lack of development of network infrastructure in developing economies

- Regulatory pressure:

Key Players: Cisco Systems, Inc., Zoom Communications, Inc., Microsoft Corporation, Google LLC, Amazon Web Services, Inc., Adobe Inc., Avaya, Inc., Ateme S.A., Synamedia Ltd., Telstra Corporation Limited, Samsung SDS Co., Ltd., Zoho Corporation Pvt. Ltd., LG U+ Corp., TM One (Telekom Malaysia), Sony Semiconductor Solutions.

Global Video as a Service (VaaS) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.7 billion

- 2026 Market Size: USD 17.2 billion

- Projected Market Size: USD 236 billion by 2035

- Growth Forecasts: 34% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, Indonesia, South Korea, United Arab Emirates

Last updated on : 6 October, 2025

Video as a Service Market - Growth Drivers and Challenges

Growth Drivers

- The advancement of artificial intelligence (AI) and machine learning (ML) technologies: The integration of AI and ML technologies in VaaS platform is boosting the market growth by allowing for video summarization. The technologies are automating the process of content analysis, contextual adaptation, real-time processing, and customization, increasing the overall value of VaaS tools. Companies are also investing in the development of AI and ML-enabled VaaS platforms. In July 2025, Phenomenal AI launched its very first text-to-video AI platform. The platform is integrated with AI and ML to allow users to create stunning, professional-grade videos based on prompts.

- Rapid expansion of 5G infrastructure: With the rapid expansion of 5G infrastructure encompassing access network and user equipment, the video as a service market growth is expected to be accelerated. Robust 5G networks are standardizing video streaming with improved speed and mobile connectivity. In November 2024, the Press Information Bureau of India revealed that 5G networks are expected to carry 80% of mobile connectivity by 2030, indicating a crucial role in the enhancement of future connectivity.

- Rising cloud adoption by SMEs: The adoption of cost-effective and flexible video communication solutions is at its peak in small and medium-sized enterprises globally. This indicates a likelihood of a rising adoption of VaaS platforms in SMEs. As per the report by the European Commission, published in December 2023, around 59% of the medium-sized businesses in Europe adopted cloud platforms in 2023, whereas the ratio was 53% in 2021. Similarly, the adoption of cloud services in small businesses increased by 3.8%, reflecting a total proportion of 41.7%. VaaS solutions delivered over the cloud provide on-demand flexibility, easier deployment, and improved integration with other SaaS platforms.

Challenges

- Lack of development of network infrastructure in developing economies: Infrastructure disparity is one of the key challenges that can hamper the growth of the VaaS market in emerging and rural regions, as the performance of all the VaaS solutions heavily relies on high-speed, low-latency internet connectivity. In September 2023, the International Telecommunication Union (ITU) disclosed that around 2.6 million of the worldwide population did not have access to the internet in 2023. This is expected to limit the scalability of VaaS solutions, especially in the use of bandwidth-intensive applications, such a cloud-based video conferencing, playing high-definition videos, streaming AR or VR in real-time, and many more.

- Regulatory pressure: Laws related to data privacy and regulatory guidelines regarding content management limit the expansion of the video as a service platform significantly. It is necessary for the VaaS providers to ensure adherence to content regulations specific to different markets. Data protection regulations also obligate the service providers to take proper measures for data privacy and protection from third-party members. Similarly, regulatory guidelines for advertising, modernization of content, and advertising over VaaS solutions are expected to complicate the business operations of service providers further.

Video as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

34% |

|

Base Year Market Size (2025) |

USD 12.7 billion |

|

Forecast Year Market Size (2035) |

USD 236 billion |

|

Regional Scope |

|

Video as a Service Market Segmentation:

Application Segment Analysis

The corporate communications segment is projected to acquire a market share of 30.4% by the end of 2035 as a consequence of the need for continuous, disruption-free internal and external communication in businesses, even in remote working settings. Businesses are integrating VaaS solutions for a variety of purposes, including organizing virtual training, executive messaging, and ensuring global team collaboration. Technology companies are also consistent in the development of VaaS solutions that can efficiently be used in corporations. The need for cost reduction in corporations is also expected to influence the further dominance of the segment in the upcoming business years.

Cloud Deployment Mode Segment Analysis

The hybrid cloud segment is projected to hold a significant revenue share by 2035 on account of its capability to offer flexibility, security, and cost efficiency. As reported by the Carnegie Endowment for International Peace in August 2023, the parliament of India approved the Digital Personal Data Protection (DPDP) Act 2023. As per the Center for Internet Security (CIS) in June 2025, organizations are allowed by the deployment of hybrid cloud to maintain improved security over crucial business data and processes.

Vertical Segment Analysis

The education segment is anticipated to account for a remarkable revenue share during the forecast timeline, with the growth of online learning. As revealed by the World Economic Forum in January 2022, more than 20 million of the global population got enrolled in online learning. VaaS solutions allow educators to use visual content to teach learners in remote settings. Companies globally are increasingly investing in the development of VaaS solutions that can be used for educational purposes. For instance, in September 2021, a leading IT company, AVEVA, launched AVEVA Unified Learning. The VaaS solution is incorporated with generic and custom experimental training modules.

Our in-depth analysis of the video as a service market includes the following segments:

|

Segments |

Subsegments |

|

Application |

|

|

Cloud Deployment Mode |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Video as a Service Market - Regional Analysis

North America Market Insights

North America is expected to account for the largest share of 38.9% by the end of 2035, owing to the expansion of broadband, rising demand for remote partnership, and stringent data governance standards. As reported by the Bureau of Labor Statistics in November 2024, around 22.7% of employees accomplish some of their work from home, and 10.9% of the employed individuals are permanently working from their own residences in the U.S. The growth of the subscription-based streaming platforms across the region is also influencing the further growth of the market. North America is the domicile region of the majority of the businesses offering VaaS solutions globally, indicating stable growth of the market.

The U.S. VaaS market is expected to witness significant growth, owing to the expansion of broadband services, cybersecurity initiatives, and enterprise virtualization. A financial grant of USD 48.2 billion and USD 41.5 billion for broadband and broadband equity access and deployment, respectively, was approved by the U.S. National Telecommunications and Information Administration in 2022. Similarly, the Federal Communications Commission authorized 368 organizations for a financial incentive of USD 18 million for the expansion of broadband services in rural areas in October 2023. These collective efforts of policy incentives and security requirements position the country as the most advanced and opportunity-rich market for VaaS globally.

The VaaS market in Canada is projected to witness a robust CAGR throughout the forecast timeline, owing to the widespread use of smartphones and the rapidly expanding internet connectivity across the country. As disclosed by the Government of Canada in September 2025, 90% of the households across the country are connected to high-speed internet, while the target is to make 100% the national population connected to the internet by 2030. The well-developed cloud infrastructure across Canada is also expected to fuel the market growth. This is likely to help in deploying VaaS Solutions cost-effectively, which can increase the profit margin in businesses.

Europe Market Insights

The Europe video as a service (VaaS) market is projected to account for a remarkable revenue share by the end of 2035, with rapid adoption of cloud solutions. There is a significant investment gap worth USD 1.3 trillion in the EU and U.S. ICT and cloud-related sectors, indicating the viability of raising funds for VaaS solutions for businesses. Regulatory investments in the AI and ML technologies is expected to accelerate the development of the VaaS solutions that can cater to the need for personalized video streaming, conferencing, and other experiences of the users. As revealed by the CBI in June 2025, the AI market is growing at a fast pace in Europe and is expected to be valued at USD 59.9 billion by the end of 2025.

The VaaS market in Germany is projected to experience a robust CAGR during the forecast period, driven by a high rate of remote and hybrid work. Businesses in the healthcare, retail, and automotive sectors in Germany are focused on business process digitalization, indicating a likelihood of adopting VaaS solutions. Improving internet connectivity across the country through the rapid deployment of 5G infrastructure is also expected to accelerate the adoption of VaaS solutions in enterprises. According to the report by the Germany Trade & Invest (GTAI), the telecommunication & connectivity industry invested around USD 15.9 billion, the majority was directed towards the expansion of networks and new technologies, including 5G.

France is anticipated to emerge as an expanding VaaS market at an extensive CAGR between 2026 and 2025, on account of the growing craze for on-demand video content among the younger population. Regulatory policies for digital transformation also influence firms to adopt VasS solutions. France complies with the EU regulation, and thus, the need to meet regulatory needs related to data privacy is expected to make the government encourage the integration of VaaS solutions in businesses. Continuous adoption of different cloud solutions and the development of 5G infrastructure across the country are also expected to boost the adoption of VaaS platforms across healthcare, automotive, retail, finance, and other industries.

Asia Pacific Market Insights

The VaaS market in the Asia Pacific is expanding rapidly due to rising digital transformation across sectors such as education, healthcare, finance, and government. As reported by the Asian Development Bank, 74.4% of the adults in the region are using mobile money, while 98.7% of the population is covered by the mobile network or ICT. The expansion of affordable smartphones and high-speed internet access is driving video adoption among SMEs and rural companies. Regional cloud providers are launching domestic VaaS offerings to meet compliance and language requirements. Additionally, the market in APAC is driven by public-private initiatives promoting smart cities and digital literacy.

The China VaaS market is experiencing substantial growth owing to strong government support and a rapidly digitizing enterprise ecosystem. As per the brief of the minister of industry and information technology, reported by the State Council Information Office in July 2024, the penetration of digital research & development and design tools in the key industrial businesses reached 80.1%, while the numerical control rate in key industrial processes is at 62.9%. The rapid development of AI technology in China is expected to accelerate the advancement of VaaS solutions. As reported by CAN Corporation in June 2025, Beijing intends to make its AI a USD 100 billion industry and build over USD 1 trillion of additional value in other industries. AI-integrated VaaS Solutions can curate targeted advertisements that can align with the viewing experiences of the potential audience.

With the shift to remote and hybrid work, the demand for VaaS solutions is steadily increasing in India. The rising prevalence of gig workers in India also indicates the probability of an increasing use of the VaaS solutions. As reported by the Press Information Bureau in November 2024, the count of gig workers is projected to reach 23.5 million by 2030. The use of VaaS solutions is becoming more convenient with the rapid expansion of 5G infrastructure.

Key Video as a Service Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zoom Communications, Inc.

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Adobe Inc.

- Avaya, Inc.

- Ateme S.A.

- Synamedia Ltd.

- Telstra Corporation Limited

- Samsung SDS Co., Ltd

- Zoho Corporation Pvt. Ltd.

- LG U+ Corp.

- TM One (Telekom Malaysia)

- Sony Semiconductor Solutions

The video as a service (VaaS) market highly competitive, led by U.S.-based tech giants such as Cisco, Zoom, Microsoft, and AWS, investing in strong cloud infrastructure and enterprise collaboration tools. European players such as Synamedia prioritize advanced video delivery solutions suited for broadcasting requirements. In regions such as Australia and South Korea, telecom companies use VaaS into their service portfolios to enhance network value. The core growth strategies consist of AI-driven features, hybrid cloud use, regulatory alignment, and telecom alliances to broaden access and reliability.

Below is the list of the key players dominating in the video as a service (VaaS) market:

Recent Developments

- In May 2025, Airtel launched a fraud detection solution compatible with a large pool of VaaS platforms. The solution is capable of finding and blocking malicious websites across VaaS solutions.

- In April 2025, AWS reported the integration of its Amazon Q Business index with Zoom’s AI Companion, enabling users to pull context-aware information from enterprise systems like Salesforce and SharePoint directly within Zoom meetings. This collaboration improves the VaaS experience by embedding AI-driven workflow insights, reducing context-switching, and improving user efficiency.

- In March 2025, Cisco introduced a software upgrade for its Rooms devices, integrating Apple AirPlay compatibility, USB content camera support, and blending with Zoom Conference Room Connector features. These improvements are targeted to optimize hybrid meeting experiences, increase device interoperability, and provide smooth room-based content sharing.

- Report ID: 3877

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Video as a Service (VaaS) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.