Vacuum Assisted Biopsy Devices Market Outlook:

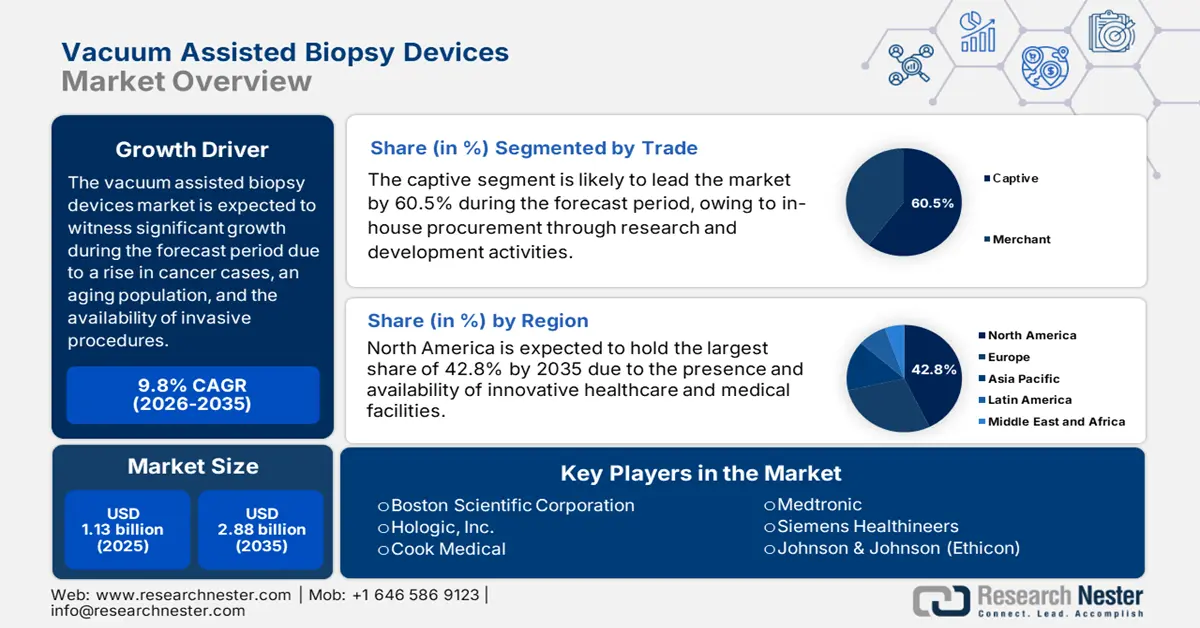

Vacuum Assisted Biopsy Devices Market size was over USD 1.13 billion in 2025 and is poised to exceed USD 2.88 billion by 2035, witnessing over 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vacuum assisted biopsy devices is estimated at USD 1.23 billion.

The market growth is fueled by the increasing incidences of different types of cancers, including liver, prostate, lung, and breast, along with innovation in diagnostic-based technologies, and a shift towards adopting minimally invasive procedures. For instance, the cancer burden in India is anticipated to increase from 26.8 million in 2021 to 30.2 million in 2025, based on disability-adjusted life years (DALYs). This effectively highlights and strengthens the patient pool in the country, which in turn, is the primary driver responsible for uplifting and expanding the market across nations.

Moreover, the consumer price index (CPI) and producer price index (PPI) are other factors bolstering the market internationally. For instance, in January 2025, the CPI for medical care supplies was 419.2, an escalation from 397.8 in January 2023, marking an estimated 5.5% increase. This ensures high out-of-pocket expenses, which are readily driving the market growth globally. Meanwhile, in February 2025, the U.S. PPI for medical supplies and equipment manufacturing was 138.2, denoting a 2.6% increase from the previous year when the index was 134.6. This trend constitutes a rise in the production cost, which is attributed to factors including supply chain disruptions, labor costs, and enhanced raw material prices.

Key Vacuum Assisted Biopsy Devices Market Insights Summary:

Regional Highlights:

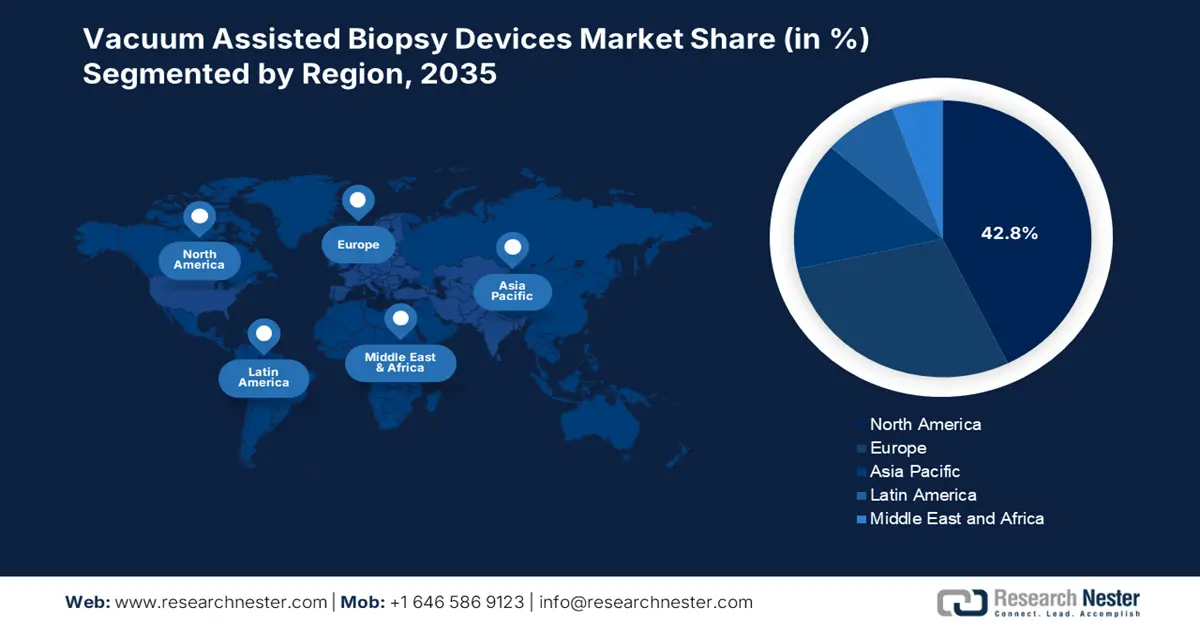

- North America leads the Vacuum Assisted Biopsy Devices Market with a 42.8% share, driven by rising incidence of chronic disorders, increasing population, and strong health and medical infrastructures, fostering robust growth through 2026–2035.

- Europe's Vacuum Assisted Biopsy Devices Market holds a substantial share with strong growth projected through 2026–2035, attributed to government regulations promoting early cancer detection and increased research and development initiatives.

Segment Insights:

- The Automotive Segment is expected to achieve a 50.8% share by 2035, driven by demand for accurate quality control in automotive applications.

- The Captive Segment is expected to capture a 60.50% share by 2035, driven by healthcare institutions opting for in-house procurement to ensure quality.

Key Growth Trends:

- Government expenditure

- Technological innovation through FDA approval

Major Challenges:

- High device pricing

- Regulatory barriers and supply chain constraints

- Key Players: Boston Scientific Corporation, Hologic, Inc., Cook Medical, Medtronic.

Global Vacuum Assisted Biopsy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.13 billion

- 2026 Market Size: USD 1.23 billion

- Projected Market Size: USD 2.88 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Vacuum Assisted Biopsy Devices Market Growth Drivers and Challenges:

Growth Drivers

- Government expenditure: The aspect of government-specific spending effectively impacts the requirement for vacuum assisted biopsy devices. For instance, the Medicare reimbursement policies in the U.S. ensure a direct impact on the implementation of such technologies. However, an analytical study on Medicare repayment trends displayed a decrease in hematology procedural compensation that included biopsy services. The gross facility price was reduced by 98.2% and the non-facility price by 97.5%. These declining rates deterred healthcare professionals from utilizing biopsy technologies, which were replaced with cost-effective diagnostics, thus driving the market.

- Technological innovation through FDA approval: Advancement in biopsy devices and technologies through administrative approvals is another driver amplifying the market globally. For instance, the U.S. FDA accepted the Mammotome Elite Biopsy System in 2023, which is a tetherless single-insertion device that comprises the presence of TruVac vacuum technology. This kind of innovation ensures the availability of high-quality tissue samples from a single insertion. In addition, this enhances the patient comfort as well as procedural efficiency, suitable to increase vacuum assisted biopsy devices adoption.

Key Market Dynamics for Historical Patient Growth

There has been a notable development of the vacuum assisted biopsy devices market between 2014 and 2024. Factors such as non-invasive procedures adoption, increased awareness about cancer disorders, and cutting-edge diagnostic technologies are readily responsible for the growth. Besides, in the U.S., the number of such devices boosted from an estimated 1.4 million in 2014 to 2.1 million in 2024, which reflected approximately 4.5% growth rate over these ten years. Besides, the enhanced patient pool across nations also positively impacts the market, thus generating significant revenue opportunities for suppliers and manufacturers.

The following table denotes historical patient growth in the past ten years across different countries:

|

Country |

2014 Procedures (millions) |

2024 Procedures (millions) |

CAGR (%) |

|

USA |

1.21 |

1.82 |

4.3% |

|

Germany |

0.82 |

1.21 |

4.6% |

|

France |

0.63 |

0.94 |

4.1% |

|

Spain |

0.51 |

0.77 |

4.4% |

|

Australia |

0.42 |

0.63 |

4.9% |

|

Japan |

0.33 |

0.44 |

2.1% |

|

India |

0.21 |

0.51 |

6.5% |

|

China |

0.54 |

1.02 |

7.3% |

Key Feasibility Models for Vacuum-Assisted Biopsy Devices Market Expansion

The presence of tactical models for extending the vacuum assisted biopsy devices market highly depends on market-specific adaptations, regulatory approaches, and effective partnerships. For instance, in 2023, BD partnered with the foremost hospital chains in India, which resulted in a 12.2% increase in the revenue structure between 2022 and 2024. Likewise, established local manufacturing facilities in China enabled organizations to diminish costs and enhance market penetration. Therefore, all these models constitute the essentiality of aligning regulatory environments with local healthcare systems to uplift market growth and accessibility.

Strategic Models Revenue Impact 2014-2024

|

Region |

Strategy Implemented |

Revenue Impact (USD) |

|

India |

Partnership with local healthcare providers |

USD 15.2 million |

|

China |

Establishment of local manufacturing facilities |

USD 20.3 million |

|

USA |

Expansion of product portfolio through acquisitions |

USD 25.8 million |

|

Europe |

Implementation of reimbursement policies |

USD 30.2 million |

Challenges

- High device pricing: The benefit of utilizing vacuum assisted biopsy devices results in a huge financial burden in comparison to conventional biopsy methods, negatively impacting the global market. For instance, the price of a few vacuum assisted biopsy devices, such as ultrasonography-based is estimated to be USD 706.3, and core needle biopsy (CNB) is USD 233.3. Besides, this high-cost aspect in India has resulted in poor reimbursement policies, thereby posing a significant barrier for the market in the country.

- Regulatory barriers and supply chain constraints: The availability and presence of strict regulations pose the possibility of delaying the market entry. For instance, the Medical Device Regulation (MDR) in the Europe Union has enhanced the regulatory burden, which necessitates data management and clinical trials and eventually hinders the market adoption. Besides, the infrastructure and sustainable investments, especially in low- and middle-income nations, impede the implementation and distribution of such devices, thus hindering the overall market growth and expansion.

Vacuum Assisted Biopsy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 1.13 billion |

|

Forecast Year Market Size (2035) |

USD 2.88 billion |

|

Regional Scope |

|

Vacuum Assisted Biopsy Devices Market Segmentation:

Trade (Captive, Merchant)

Based on trade, the captive segment is poised to hold the largest share of 60.5% in the vacuum assisted biopsy devices market by the end of 2035. The presence of healthcare and research institutions opting for in-house procurement to ensure quality and reduce external suppliers’ dependency is fueling the segment’s growth and expansion. In addition, manufacturers confine device usability to their proprietary imaging consumables, thereby ensuring frequent revenue return from replaced accessories and parts. For instance, Hologic’s ATEC system solely operates with its Suros biopsy needles, creating USD 1.5 billion yearly revenue from consumables alone.

Application (Automotive, Consumer Electronics, Semiconductors)

Based on the application, the automotive segment is expected to account for a considerable share of 50.8% in the vacuum assisted biopsy devices market during the forecast period. In the automotive sector, the adoption of vacuum assisted biopsy devices is attributed to the demand for accurate quality control and material testing. According to the 2022 World Health Organization report, approximately 22 million new cancer cases were recorded, with 9.8 million deaths, thereby facilitating the necessity of early detection and the need for progressive diagnostics tools to overcome them. Therefore, the adoption of these devices by the industry denotes the safety and reliability of materials utilized for vehicle manufacturing.

Our in-depth analysis of the global market includes the following segments:

|

Trade |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vacuum Assisted Biopsy Devices Market Regional Analysis:

North America Market Analysis

North America is projected to account for the largest share of 42.8% in the vacuum assisted biopsy devices market by the end of the forecast timeline. Factors such as a rise in the incidence of chronic disorders, an increase in the overall population, Mediclaim facilities, and robust health and medical infrastructures are readily responsible for the market upliftment in the region. Besides, the U.S. and Canada are two main countries in the region to experiencing increasing market exposure through the latest product approval and acceptance from governmental and administrative organizations.

The vacuum assisted biopsy devices market in the U.S. is gaining increased traction owing to the rising prevalence of cancer cases. As stated by the America Cancer Society, approximately 281,565 new cases were diagnosed in the country, which ultimately resulted in a high demand for vacuum assisted biopsy devices. However, to combat this, Medicare provided USD 815 million to provide biopsy-specific treatment solutions, which further catered to a 15.5% increase and enhanced the market accessibility in the country. Besides, the country is more patient-centric, due to which the adoption of such devices is continuously growing.

The vacuum assisted biopsy devices market in Canada is significantly growing owing to factors including innovative diagnostic tools and increasing investments initiated by governments and regulatory bodies. As per the Health Canada report, the country allocated almost 8.5% of its overall healthcare budget to provide funds for advanced medical devices and systems that include biopsy equipment for facilitating technologies. In addition, the Ontario Ministry of Health enhanced its public health spending by 19% between 2021 and 2024, which effectively benefited more than 200,050 patients every year, thereby creating a prolific opportunity for the market upliftment.

Europe Regional Market Size & Growth

The Europe region is expected to account for a share of 28.7% in the vacuum assisted biopsy devices market during the forecast period. This growth is attributed to countries such as the UK, France, and Germany leading their way in implementing such devices. Besides, government regulations are involved in the promotion of cancer detection at an early stage through extensive research to ensure market expansion throughout the region. For instance, the Europe Union made a significant fund allocation of €2.7 billion to ensure increased research and development activities for creating awareness among the population.

The market in the UK is highly driven by strong healthcare and medical funding and detection methods to combat cancer diseases. According to the National Health Service report, an estimated 8.3% of the country’s national medical budget was assigned as an investment for the availability of advanced medical devices in 2023, denoting a rise from 6.8% back in 2020. This has been possible since the country has effective diagnostic capabilities and long-term healthcare expenditure costs, by highlighting early disease detection. Moreover, the government has made noteworthy investments in research for cancer and diagnostic equipment, with an emphasis on cutting-edge medical devices.

The vacuum assisted biopsy devices market in Germany is gaining more exposure since it is one of the largest countries, with the increased requirement of precision medicine. In 2024, the country’s expenditure on such devices increased to €5 billion, which is a surge of 12.5% since 2021. This growth is fueled by the presence of advanced healthcare systems that readily invest in medical-based technologies for treatment and diagnostic purposes, especially in the field of oncology. Besides, the Federal Ministry of Health plays a pivotal role in promoting private and government sector investment in healthcare advancements, thus suitable for the market development in the country.

Key Vacuum Assisted Biopsy Devices Market Players:

- Becton, Dickinson and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific Corporation

- Hologic, Inc.

- Cook Medical

- Medtronic

- Siemens Healthineers

- Johnson & Johnson (Ethicon)

- Stryker Corporation

- Cook Group

- GE Healthcare

- KARL STORZ GmbH

- Medi-Globe Group

- Biocomposites

The vacuum assisted biopsy devices market is highly competitive owing to the presence of organizations that are making constant efforts to capture a greater share of the existing market. Their focus on launching high-precision and minimally invasive devices to increase patient comfort is effectively driving the market growth internationally. In addition, collaborations and strategic partnerships are also prevalent, along with investments to expand their geographic presence in the market. Moreover, industry players are engaged in implementing artificial intelligence in biopsy devices and systems to remain ahead of technological innovation, thereby suitable for boosting the market.

Here is a list of key players operating in the global market:

Recent Developments

- In November 2024, Mammotome announced the launch of the AutoCore system, which is the latest automatic spring-loaded core needle device to streamline ultrasound-based biopsies by diminishing procedural steps and allowing one-handed operation.

- In March 2023, Hologic unveiled its Eviva biopsy needle along with an unconventional biopsy guidance system to offer heightened precision and modernized workflows for both breast and soft tissue biopsy procedures.

- Report ID: 7677

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.