Breast Biopsy Devices Market Outlook:

Breast Biopsy Devices Market size was valued at USD 2.7 billion in 2025 and is projected to reach USD 4.5 billion by the end of 2035, rising at a CAGR of 5.8 % during the forecast period, i.e., 2026-2035. In 2026, the industry size of breast biopsy devices is estimated at USD 2.9 billion.

The extensive growth in the market is readily facilitated by the growing burden of breast cancer, advancements in biopsy technologies, and a growing focus on early detection and precision medicine. As per the August 2025 WHO article, breast cancer resulted in around 670,000 deaths across all nations in 2022, wherein it was most common in 157 nations out of 185 in the same year. The report further stated that 0.5% to 1% men also witness breast cancer, thereby positively influencing market growth.

Furthermore, the existence of payers' pricing, such as insurance, government monetary support, is making these procedures more accessible and reliable. A study by NIH in June 2022 compared breast biopsy rates in women aged above 50 with BRCA1/2 mutations to the general population, which found that among 330 high-risk women, biopsy rates were 2.7 times higher, and positive biopsy rates were 13.2 times higher than matched controls. Therefore, these findings highlight the need for intensified surveillance in older BRCA mutation carriers, creating encouraging opportunities for pioneers around the world.

Key Breast Biopsy Devices Market Insights Summary:

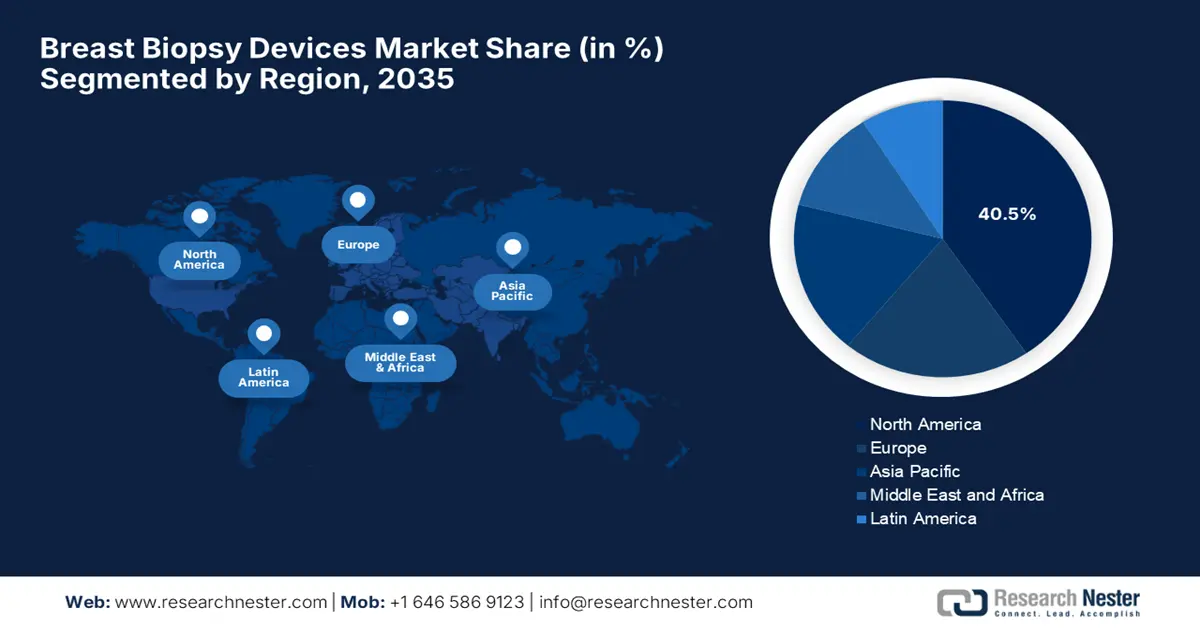

Regional Highlights:

- North America is projected to hold a 40.5% share by 2035 in the breast biopsy devices market, impelled by supportive healthcare policies and widespread adoption of advanced technologies.

- Asia Pacific is expected to witness the fastest growth from 2026 to 2035, owing to rapidly expanding populations and healthcare systems.

Segment Insights:

- Early Cancer Detection segment is projected to account for 60.5% share by 2035, propelled by worldwide initiatives promoting regular mammography screening and raising public awareness.

- Ultrasound-Guided Biopsy segment is anticipated to hold a 45.6% share by 2035, owing to its real-time imaging capabilities, cost-effectiveness, and high efficacy in visualizing dense breast tissues.

Key Growth Trends:

- Increased awareness and adoption

- Continued discoveries in biopsy technologies

Major Challenges:

- Expensive biopsy devices

- Regulatory and reimbursement obstacles

Key Players: Hologic, Inc., Danaher Corporation (C.R. Bard / Bard Biopsy), BD (Becton, Dickinson and Company), Argon Medical Devices, Inc., Medtronic plc, Cook Medical LLC, Siemens Healthineers AG, GE HealthCare, Planmed Oy, Sterylab S.r.l., CareFusion Corporation (BD), Intact Medical Corporation, SOMATEX Medical Technologies GmbH, Scion Medical Technologies, LLC, Remington Medical

Global Breast Biopsy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.7 billion

- 2026 Market Size: USD 2.9 billion

- Projected Market Size: USD 4.5 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 16 September, 2025

Breast Biopsy Devices Market - Growth Drivers and Challenges

Growth Drivers

- Increased awareness and adoption: There has been a surging adoption and awareness of breast cancer screening, which is continuously driving business in the market. In October 2022, Apollo Proton Cancer Centre announced that it had launched the Drive Away Breast Cancer campaign to raise awareness about breast cancer across India. The firm further highlighted that the initiative spanned 120 days 18,000 km bike journey by Ms. Logeshwari and Mr. Pream, traveling through 24 states, 3 union territories, and Nepal on a Royal Enfield Himalayan with a collective goal of making the country a cancer-free nation.

- Continued discoveries in biopsy technologies: The market is readily benefiting from ongoing innovations such as vacuum-assisted biopsy, 3D stereotactic guidance, and liquid biopsy integration, which are significantly enhancing precision. In November 2024, Mammotome introduced the AutoCore Single Insertion Core Biopsy System, which marks the first automated spring-loaded core needle device designed to enhance breast biopsy procedures.

- Government screening programs: Governments across different developing nations, such as the U.S., Canada, and Europe, are proactively promoting breast cancer screening programs, thereby supporting the overall market growth. For instance, in September 2024 CDC reported that the U.S. Preventive Services Task Force recommends that women aged 40 to 74 get a mammogram every two years. It also stated that mammograms are the primary screening tool, able to find cancer before symptoms appear and reduce mortality.

Top 10 Countries by Breast Cancer Incidence in Women (2022)

|

Country |

New Cases (Women) |

Age-Standardized Rate (ASR) per 100,000 |

|

China |

357,161 |

33.0 |

|

U.S. |

274,375 |

95.9 |

|

India |

192,020 |

26.6 |

|

Brazil |

94,728 |

63.1 |

|

Japan |

91,916 |

74.4 |

|

Russia |

78,839 |

57.7 |

|

Germany |

74,016 |

77.0 |

|

Indonesia |

66,271 |

41.8 |

|

France (metropolitan) |

65,659 |

105.4 |

|

U.K. |

58,756 |

94.0 |

Source: WCRF

Recent Product Innovations and Expansion Features in Biopsy Technologies

|

Year |

Company |

Product |

Expansion Feature |

|

2024 |

Mammotome |

LumiMARK Biopsy Site Marker |

A new line of 3D, self-expanding markers is clearly visible from all angles under multiple imaging modalities |

|

2023 |

Argon Medical |

SuperCore Advantage |

Designed to provide a superior volume of tissue sample per core to aid in diagnosis |

|

2023 |

TransMed7 |

Concorde US & ST Platforms |

Fully automated, vacuum-assisted devices offering both forward and shielded side-coring |

Source: Company Official Press Releases

Challenges

- Expensive biopsy devices: The market faces considerable hurdles in terms of their exacerbated costs. The advanced technologies, such as automated spring-loaded systems and vacuum-assisted devices, often cause extremely high manufacturing and maintenance costs, making it challenging for small-scale firms. Therefore, this aspect limits accessibility, especially in developing nations, thereby restricting market penetration.

- Regulatory and reimbursement obstacles: The existence of strict regulatory approvals and limited reimbursement policies in certain nations can create an ultimate delay in the introduction of new biopsy devices. In addition, the aspect of inconsistent insurance coverage and reimbursements can create hesitation among both healthcare providers and consumers to adopt innovative technologies, thereby impacting market growth.

Breast Biopsy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 2.7 billion |

|

Forecast Year Market Size (2035) |

USD 4.5 billion |

|

Regional Scope |

|

Breast Biopsy Devices Market Segmentation:

Application Segment Analysis

Based on the application early cancer detection segment is predicted to garner the largest revenue share of 60.5% in the market during the forecast timeline. The dominance of this subtype is attributable to the worldwide initiatives that are proactively promoting regular mammography screening and raising public awareness. Besides, this has received huge support from prominent organizations such as the CDC, which is highly essential for improving survival rates, thereby directly fueling the demand for diagnostic biopsies.

Guidance Technique Segment Analysis

In terms of guidance technique ultrasound ultrasound-guided biopsy segment is expected to hold a share of 45.6% in the market by the end of 2035. The real-time imaging capabilities, cost-effectiveness, and high efficacy in visualizing dense breast tissues are the key factors behind the leadership. In March 2025, GE HealthCare announced that it had launched the AI-powered Invenia ABUS Premium, which is a 3D automated breast ultrasound system designed to improve cancer detection in women with dense breasts that enables faster, more accurate scans, hence denoting a wider segment scope.

Product Segment Analysis

Based on the product vacuum-assisted biopsy devices segment is anticipated to grow at a considerable rate, with a share of 35.4% in the market during the discussed timeframe. The growth in the segment originates from their clinical superiority in obtaining larger and higher-quality tissue samples with a single insertion. For instance, in January 2025, Timberland Medical Centre in Malaysia reported that it had performed its first Vacuum-Assisted Breast Biopsy, which is a minimally invasive procedure that allows for precise tissue sampling from breast lesions with minimal patient discomfort.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Guidance Technique |

|

|

Product |

|

|

End user |

|

|

Biopsy Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Breast Biopsy Devices Market - Regional Analysis

North America Market Insights

North America is anticipated to hold the largest revenue share of 40.5% in the breast biopsy devices market during the analyzed tenure. Supportive healthcare policies and widespread use of advanced technologies are the key factors behind this leadership. This can be testified by GE HealthCare in April 2025 stated that it is showcasing its latest breast cancer detection innovations at the 2025 Society of Breast Imaging Symposium, which includes the Pristina Via mammography system that remarkably enhances diagnostic accuracy and patient comfort. The company is also distributing DeepHealth’s SmartMammo, which is an AI-powered tool designed to improve radiology efficiency and accuracy in breast cancer screening.

The U.S. is augmenting its leadership in the breast biopsy devices market on account of increasing healthcare expenditure, favorable reimbursement policies, and strong government support for cancer research. As per the February 2025 NIH article, the breast cancer screening in the country led to a cost of approximately USD 11 billion on a yearly basis, wherein only about 37% of eligible women were screened each year. Besides, the projections based on different screening guidelines show that total national screening costs could range widely from USD 8 billion to USD 30 billion, depending on various factors.

Canada's breast biopsy devices market is also continuously growing, backed by universal coverage, a strong focus on preventive care, and continued innovations in this field. For instance, in August 2023, iCAD, Inc. announced that Health Canada had granted a device license for its ProFound Risk 2.0, which is an AI-powered breast cancer risk assessment tool. The company further stated that the product is designed for use with both 2D and 3D mammography and provides accurate predictions, hence strengthening the country’s position in this field.

Mammography Utilization in the U.S. (Women ages 50-74 in 2022)

|

Group |

% Who Had Mammogram in Past 2 Years |

|

Overall |

77% |

|

By Race/Ethnicity |

|

|

- Black or African American |

83% |

|

- White |

77% |

|

- Asian, Native Hawaiian, Pacific Islander |

77% |

|

- Hispanic or Latino |

74% |

|

- American Indian or Alaska Native |

62% |

|

By Income |

|

|

- <$15,000 |

63% |

|

- $15,000 to <$35,000 |

69% |

|

- $35,000 to <$50,000 |

75% |

|

- $50,000 to <$75,000 |

78% |

|

- ≥$75,000 |

83% |

|

Insurance Status |

|

|

- With insurance |

74% |

|

- Without insurance |

37% |

Source: KFF

APAC Market Insights

Asia Pacific is identified as the fastest-growing region in the breast biopsy devices market over the analyzed tenure from 2026 to 2035. The region’s upliftment in this field is effectively attributable to the rapidly growing populations and healthcare systems. Besides, the prominent countries across this region are increasingly adopting advanced screening technologies such as digital mammography and AI-driven risk assessment tools to improve early detection rates. Furthermore, the government and private sector entities are constantly putting efforts into expanding screening programs and promoting education.

China is solidifying its position in the regional breast biopsy devices market owing to the increasing investments and public health campaigns. As per the NIH clinical study published in February 2024, a meta-analysis involving 10.72 million women across 35 studies revealed that population-based breast cancer screening in the country displayed a shows lower cancer detection rates but a higher proportion of early-stage detection when compared to opportunistic screening. Furthermore, the combined BUS+MAM group showed a CDR of 3.29% and an early-stage detection rate of 88.18%.

There is a huge exposure for the breast biopsy devices market in India, efficiently backed by government initiatives and NGO programs promoting mammography and clinical breast exams. In February 2025, MoHFW reported that over 14 crore (140 million) women have been screened for breast cancer at Ayushman Aarogya Mandirs, wherein 289 oncology drugs are being provided at up to 50% discount through AMRIT Pharmacies, saving approximately ₹6,567 crore (USD 791 million) for 5.8 crore (58 million) patients, hence suitable for standard market growth.

Ayushman Arogya Mandirs Operationalized by State (as of July 2024)

|

State |

Ayushman Arogya Mandirs Operationalized |

|

Uttar Pradesh |

22,457 |

|

Kerala |

6,961 |

|

Maharashtra |

11,684 |

|

Tamil Nadu |

8,246 |

|

West Bengal |

13,376 |

|

Gujarat |

10,529 |

Source: MoHFW

Europe Market Insights

Europe is maintaining steady progression in the breast biopsy devices market, highly driven by the massive consumer pool and increasing awareness about early detection. The region also benefits from the presence of central countries, each contributing to a greater potential to capitalize. For instance, in January 2025, Aiosyn reported that its Aiosyn Mitosis Breast is the first AI-powered mitosis detection solution, have received CE mark certification under the region’s In Vitro Diagnostic Regulation, marking a significant milestone in breast cancer diagnostics.

The U.K. is gaining enhanced recognition in the regional breast biopsy devices market owing to the increased public awareness and government support for breast cancer screening programs. In February 2025, the country’s government launched an AI trial called EDITH that involved nearly 700,000 women nationwide to test artificial intelligence tools that are designed to detect breast cancer earlier and more accurately. Besides, this will be conducted across 30 NHS screening sites, which are equipped with advanced AI technologies to assist radiologists.

Germany is maintaining its strong position in the market, extensively supported by its well-established healthcare infrastructure and proactive administrative efforts to strengthen the country’s cancer care. In February 2025, Mammotome and Sirius Medical, together, announced that they had entered into an exclusive partnership to distribute the Sirius Pintuition System across the country, which aims to enhance breast cancer surgical outcomes by providing surgeons with advanced tools for precise tumor localization.

Key Breast Biopsy Devices Market Players:

- Hologic, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danaher Corporation (C.R. Bard / Bard Biopsy)

- BD (Becton, Dickinson and Company)

- Argon Medical Devices, Inc.

- Medtronic plc

- Cook Medical LLC

- Siemens Healthineers AG

- GE HealthCare

- Planmed Oy

- Sterylab S.r.l.

- CareFusion Corporation (BD)

- Intact Medical Corporation

- SOMATEX Medical Technologies GmbH

- Scion Medical Technologies, LLC

- Remington Medical

The global market is moderately consolidated with a combination of both established and emerging entities. The central pioneers, such as Hologic, Danaher, and BD, are dominating in terms of exclusive product portfolios and strong distribution networks. On the other hand, firms are also focusing on technological innovations and R&D investments. Furthermore, the mutually profitable collaborations and acquisitions are remarkably driving clinical adoption to meet the rising demand.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, NeoGenomics notified that it has launched NEO PanTracer LBx, which is a ctDNA-based liquid biopsy test for comprehensive genomic profiling of advanced solid tumors, especially designed for cases where tissue samples are limited or unavailable.

- In April 2024, Single Pass Inc. received the U.S. FDA approval for its Kronos biopsy closure device, a Class II medical device that is designed to cauterize and seal biopsy tracts to prevent post-procedure bleeding.

- Report ID: 8106

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Breast Biopsy Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.