Biopsy Devices Market Outlook:

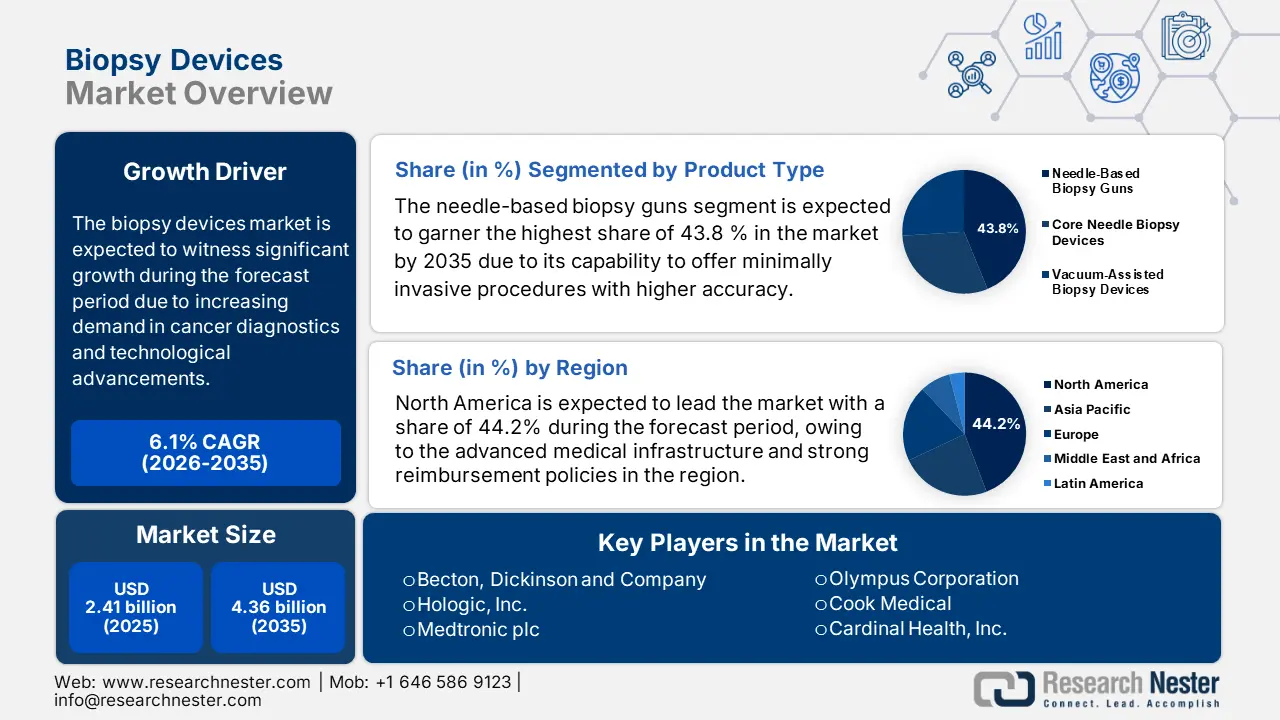

Biopsy Devices Market size was over USD 2.41 billion in 2025 and is projected to reach USD 4.36 billion by 2035, growing at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biopsy devices is assessed at USD 2.54 billion.

The market has gained immense expansion opportunities and exposure due to the rising burden of cancer cases, technological advancements, and proceeding diagnostic facilities. There is a surge in the need for biopsy devices due to their large patient pool. According to a WHO report published in 2023, the cancer cases are anticipated to rise by 47.6% from 2020 to 2040, reaching 31 million new cases per year. This global incidence necessitates the demand for advanced biopsy devices. Besides, in 2024, the U.S. NCI reported more than 3 million cancer diagnostics in a year in the U.S. alone. Hence, this is the evidence for increased scope augmenting business in this sector.

Furthermore, the developing nations such as Asia and Africa are at the forefront in the demand for diagnostic devices, aiming to improve healthcare access and raise awareness for early detection of carcinoma to mitigate complications in the long run. Additionally, the research activities are fueling factors of expansion in the industry, with NIH assigned USD 6.7 billion for cancer diagnostics for both liquid biopsy and AI-based pathology. In this regard, the Europe Commission’s Horizon program in 2024 has allocated €1.3 billion to precision medicine tools, such as minimally invasive biopsy devices. Thus, these factors significantly contribute to the market expansion by 2035.

Key Biopsy Devices Market Insights Summary:

Regional Highlights:

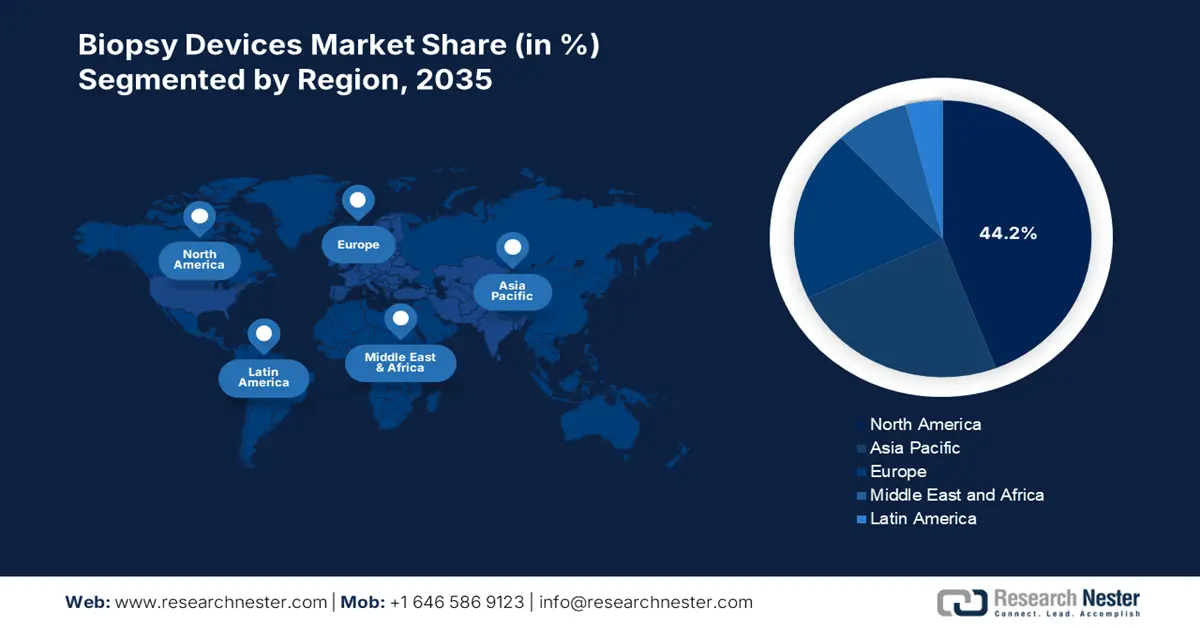

- North America biopsy devices market will hold around 44.20% share by 2035, driven by advanced medical infrastructure and strong reimbursement policies.

Segment Insights:

- The needle-based biopsy guns segment in the biopsy devices market is projected to achieve a 43.80% share by 2035, fueled by the capability of these devices to offer minimally invasive procedures with higher accuracy, increasing patient preference.

- The breast biopsy segment in the biopsy devices market is projected for considerable growth over 2026-2035, influenced by increasing instances of breast cancer and government-backed mammography programs driving demand for early diagnosis.

Key Growth Trends:

- Improved government expenditures

- Technological advancements

Major Challenges:

- Budget restraints in developing nations

Key Players: Becton, Dickinson and Company (BD), Hologic, Inc., Medtronic plc, Olympus Corporation, Cook Medical, Cardinal Health, Inc. and other.

Global Biopsy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.41 billion

- 2026 Market Size: USD 2.54 billion

- Projected Market Size: USD 4.36 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Biopsy Devices Market Growth Drivers and Challenges:

Growth Drivers

- Improved government expenditures: One of the main driving factors of the biopsy devices market is improved government expenditures and health insurance spending for diagnostic measures. For instance, in 2023, Medicare disbursement for these devices reached USD 1.3 billion, which is estimated to be USD 450 to USD 9300 per biopsy. Furthermore, the developing nations such as India and Brazil are focusing on expanded insurance coverage to accelerate market demand.

- Technological advancements: Another significant factor driving business in the market is the technological advancements in biopsy devices. For instance, in 2024, the U.S. FDA reported that Intuitive Surgical’s Ion platform increased efficacy by 40% with robotic biopsy systems. Besides, NIH in 2024 reported that Guardant Health and Freenome comprise an approved liquid biopsy test that grew at 18.4% CAGR, drawing interest from global manufacturers. Hence, this denotes a positive outlook for market growth.

Historical Patient Growth and Its Impact on Biopsy Device Market Expansion

The biopsy devices market is witnessing notable growth, remarkably influenced by the increasing burden of cancer cases and evolving diagnostic procedures over the last decade. Besides, there has been an increasing cancer screening and expanding medical access across diverse nations. Key trends shaping the industry landscape include increased investments by leading companies such as BD, Hologic, and Medtronic, and the development of vacuum-assisted, liquid biopsy, and AI-based systems, which reflect lucrative growth opportunities.

Biopsy Procedures Growth 2010-2020

|

Country |

2010(Million Procedures) |

2020 (Million Procedures) |

|

U.S. |

8.3 |

12.9 |

|

Germany |

3.2 |

5.1 |

|

France |

2.5 |

3.9 |

|

Spain |

1.6 |

2.8 |

|

Australia |

1.2 |

1.7 |

|

Japan |

4.8 |

7.5 |

|

India |

2.9 |

6.8 |

|

China |

6.1 |

14.6 |

(Sources: WHO, NIH SEER, EU Cancer Registry, National Health Commissions of China & India)

Strategies Strengthening Market Positions in Biopsy Devices

Global manufacturers leveraging biopsy devices have opted for several strategies to strengthen their market positions across the world. Consequential trends emphasized by the players include exclusive product launches, such as Mammotome launched the DualCore Dual Stage Core Biopsy System, aiming to improve biopsy efficiency and accuracy. Besides, the favorable regulatory approvals, such as Limaca Medical, gained U.S FDA clearance for the Precision GI Endoscopic Ultrasound Biopsy Device, enabling an enhanced product portfolio. Additionally, collaborations and geographic expansions are anticipated to strengthen the market positions notably.

These strategies have significantly influenced the current market landscape:

|

Company |

Key Strategy |

Impact |

|

Mammotome |

Product Innovation (DualCore System) |

Enhanced biopsy efficiency and accuracy |

|

Limaca Medical |

FDA Clearance (Precision GI Device) |

Expanded product offerings and market reach |

|

Becton Dickinson |

Strategic Partnership (Camtech Health) |

Development of innovative diagnostic solutions |

|

Hologic |

Geographic Expansion (Asia-Pacific) |

Access to emerging markets with growing demand |

Challenge

- Budget restraints in developing nations: Affordability is one of the major barriers restricting the growth in the biopsy devices market. Additionally, these costs are further exacerbated by operational costs for the maintenance of advanced biopsy devices. Due to this surge in costs in 2021, a study was conducted that found that the surgical skin biopsy equipment was available in only 25% of health facilities in emerging countries. These high expenses hinder the manufacturer's interest, especially from price-sensitive regions, and create health disparities among patients who are at heightened need.

Biopsy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 2.41 billion |

|

Forecast Year Market Size (2035) |

USD 4.36 billion |

|

Regional Scope |

|

Biopsy Devices Market Segmentation:

Product Type Segment Analysis

The needle-based biopsy guns segment is expected to garner the highest share of 43.8 % in the biopsy devices market by the end of 2035. The dominance of the segment is subject to the capability of these devices to offer minimally invasive procedures with higher accuracy, thereby resulting in higher patient preference and adoption. Besides, as there is a fast-rising prevalence of cancer cases across the world, the demand for needle-based biopsy gun also rises allowing the market to expand more.

Application Segment Analysis

The breast biopsy segment is projected to grow at a considerable rate in the biopsy devices market during the forecast period. The growth in the segment is attributable to the increasing instances of breast cancer among women across the world, which drives the demand for early diagnosis. Besides the government-backed initiatives, such as mammography programs increase biopsy procedures. Moreover, VAB and stereotactic-guided biopsies are the gold standards for breast lesions thereby augmenting segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biopsy Devices Market Regional Analysis:

North America Market Insights

The North America biopsy devices market is projected to register the highest share of 44.2% during the forecast period. The region benefits from an advanced medical infrastructure and strong reimbursement policies. Domestic players in the country are leveraging their biopsy devices with enhanced accuracy due to the higher instances of cancer cases. For instance, in 2023, it is reported that the U.S. market generated USD 785 million, highlighting the exceptional demand. Hence, such factors act as a positive outlook for market development, attracting the interest of global players to invest in such advanced medical equipment.

There is a huge opportunity for the market in Canada, significantly influenced by public and private investments and ongoing research on cancer detection devices. For instance, in 2023, Canada assigned a considerable amount of USD 3.4 billion, which is 8.5% of its federal healthcare budget, for cancer-associated treatments, reflecting growing awareness. Besides, provincial healthcare spending grew by 19% from 2021 to 2024, which benefited more than 200,000 patients in a year. Furthermore, organizations such as Medicines Canada and BioteCanada offer policies in support of cancer research, indicating a robust market for biopsy devices in the country.

Asia Pacific Market Insights

The Asia Pacific region houses a substantial number of patients with a higher occurrence of cancer, and advancements in medical technologies boost business in the region. Besides, growing medical investments by governing bodies across the region are fostering a favorable market growth in the region. Countries such as China and Japan are leading the industry with a large consumer base for diagnostic procedures. Furthermore, India, Malaysia, and South Korea are also experiencing rapid market expansion due to improving medical infrastructure and rising awareness of early detection, further contributing to market growth in the Asia Pacific.

China is a global leader in the biopsy devices market. The growth in the region is mainly offered by needle-based biopsy guns due to their enhanced efficacy in cancer detection. Besides the government’s support with increased healthcare expenditure and growing patient population also contributes to the market expansion in the country. Additionally, the presence of key market players and their collaborations position China as a strong player in the market.

Biopsy Devices Market Players:

- Becton, Dickinson and Company (BD)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hologic, Inc.

- Medtronic plc

- Olympus Corporation

- Cook Medical

- Cardinal Health, Inc.

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Danaher Corporation

- Leica Biosystems

- Argon Medical Devices, Inc.

- B. Braun Melsungen AG

- TransMed7, LLC

- MDxHealth SA

- INRAD, Inc.

- Scion Medical Technologies LLC

- SmartTarget Ltd.

- Gallini Srl

- Cook Medical LLC

- DTR Medical

Companies emphasizing biopsy devices are experiencing intensified competition due to their heightened demand. Leading firms such as Becton, Dickinson and Company, Hologic, Inc., and Medtronic plc leverage several revenue-making opportunities such as product transformations, enhanced product portfolios, and strategic acquisitions to strengthen their presence in the global market landscape. For instance, BD acquired C.R. Bard, aiming to reinforce in the biopsy needle sector. Besides, the companies are readily investing in research and development with a collective goal to integrate artificial intelligence and robotics into biopsy devices, aiming to improve patient outcomes, denoting a positive market landscape.

Some of the prominent players are listed below:

Recent Developments

- In February 2025, Hologic, Inc. launched its Affirm Contrast Biopsy Software, which received CE marking in Europe, enabling radiologists to target and acquire tissue samples using contrast-enhanced mammography, improving diagnostic workflows for challenging breast lesions.

- In March 2024, Medtronic introduced a Fusion Biopsy System integrating robotic assistance and AI-enhanced imaging for prostate biopsy procedures, which demonstrated a 20% improvement in diagnostic accuracy over conventional methods.

- Report ID: 2565

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biopsy Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.