Urology Devices Market Outlook:

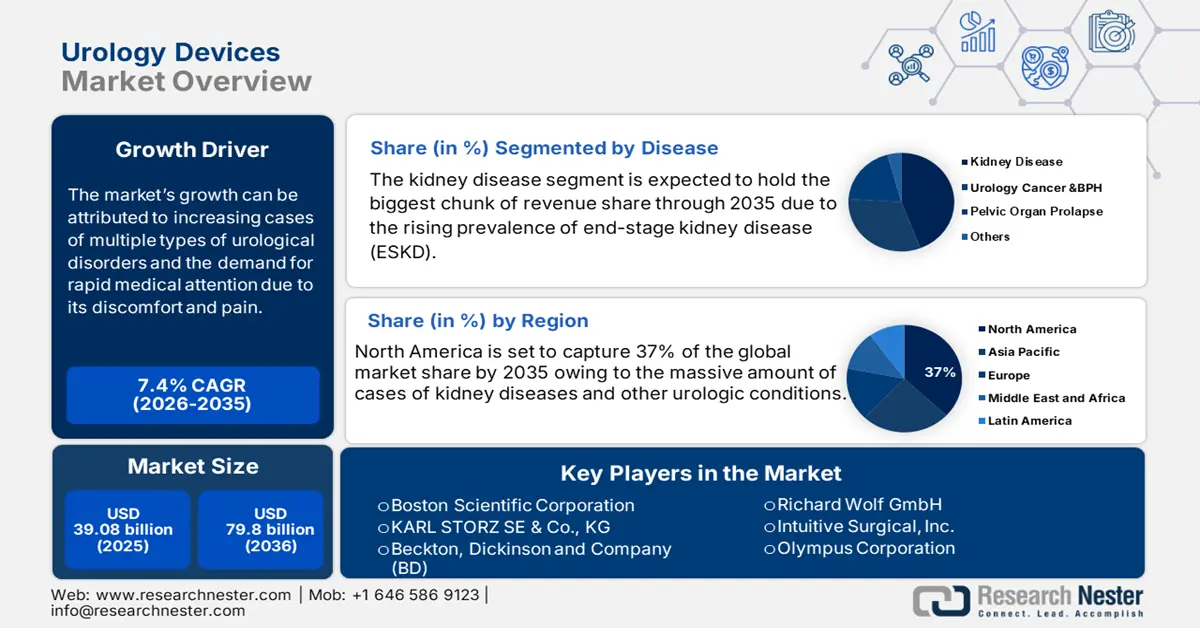

Urology Devices Market size was valued at USD 39.08 billion in 2025 and is expected to reach USD 79.8 billion by 2035, registering around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of urology devices is evaluated at USD 41.68 billion.

The growth of the market is primarily attributed to the rising prevalence of several kinds of urologic conditions across the globe, these diseases require quick medical attention owing to the discomfort and pain they cause. It is observed, more than 8 million people seek medical attention for urinary tract infections (UTIs) every year. In their lifetime, about 62% of women and 13% of men are estimated to experience at least one UTI in the United States.

Urology devices are medical devices that are used to diagnose various urologic disorders. They are technologically advanced to help treat several urologic conditions, including urinary tract infection (UTI), kidney disease, urethral cancer, urinary incontinence, urolithiasis, and others. Though the conditions such as UTIs and urinary incontinence seem not so hazardous disease, still these diseases have a huge influence on a large portion of the mass, especially elderly people, therefore, the rising prevalence of the geriatric population is fueling the growth of the urology devices market over the forecast period. According to the data released by the World Health Organization (WHO), the population of people aged between 60 and above is expected to increase to 1.4 billion by 2030 from 1 billion in 2020 globally. Further, the growing cases of diabetes and high blood pressure are also augmenting the demand for urology devices, as these diseases are the primary reasons for kidney failure. Also, with the rising preference for minimally invasive procedures, hospitals are opting for urological procedures such as endoscopy and laparoscopy which brings the need for urology devices in the medical settings.

Key Urology Devices Market Insights Summary:

Regional Highlights:

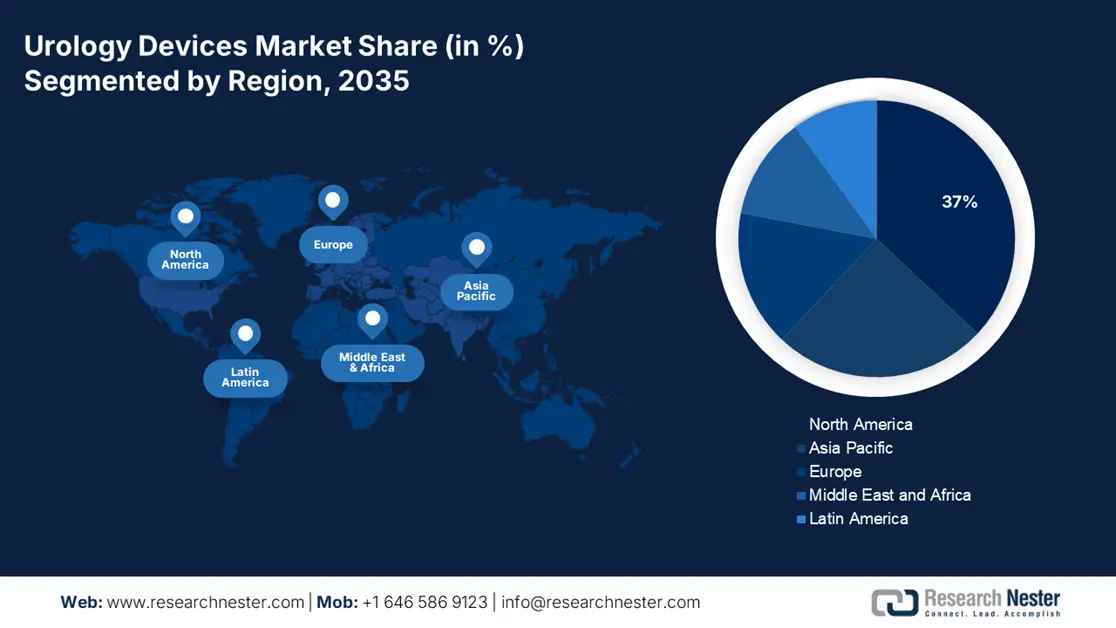

- North America urology devices market will hold over 37% share by 2035, driven by the increased number of patients diagnosed with kidney diseases and favorable reimbursement policies.

Segment Insights:

- The hospitals segment in the urology devices market is expected to achieve the largest share by 2035, driven by the large patient pool and substantial investments in hospital infrastructure.

- The kidney disease segment in the urology devices market is forecasted to experience significant growth during 2026-2035, driven by the rising prevalence of end-stage kidney disease and the demand for dialysis procedures.

Key Growth Trends:

- Upsurge in Bladder Cancer

- Raise in Urinary Incontinence Cases

Major Challenges:

- High Costs of Urology Devices

- Rising Concern About the Risks Associated with Urologic Surgeries

Key Players: Boston Scientific Corporation, KARL STORZ SE & Co. KG, Becton, Dickinson and Company (BD), Richard Wolf GmbH, Intuitive Surgical, Inc., Fresenius Medical Care AG & Co. KGaA, Olympus Corporation, Coloplast, Medtronic, Stryker Corporation.

Global Urology Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.08 billion

- 2026 Market Size: USD 41.68 billion

- Projected Market Size: USD 79.8 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Urology Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Prevalence of Chronic Kidney Diseases (CKD) - Chronic kidney disease (CKD occurs when the kidneys get damaged and do not filter blood the way they should. The disease is referred to as "chronic" since the damage to the kidneys occurs gradually over time. Diabetes and high blood pressure are two of the most common causes of CKD. Therefore, the rising prevalence of chronic kidney disease is fueling the demand for various urology devices to detect and treat these disorders. Moreover, chronic kidney disease drugs and urology devices are used to remove the waste from the patient’s blood, and it is expected to drive the urology devices market growth. For instance, until 2019, chronic kidney disease (CKD) was acknowledged as a major global public health issue. The number of people with end-stage kidney disease (ESKD) who require renal replacement therapy is estimated to be between 4.903 and 7.085 million worldwide. The estimated prevalence of CKD has reached 13.5% (11.6-15%).

-

Increasing Prevalence of Prostate Cancer - Prostate cancer is the second most common cancer in males. It was observed in a clinical report, in 2020, approximately 1,514,260 people were diagnosed with prostate cancer worldwide.

- Upsurge in Bladder Cancer – According to the Centers for Disease Control and Prevention (CDC), around 57,000 men and 18,000 women are diagnosed with bladder cancer each year in the United States, and 12,000 men and 4,700 women die from the disorder.

- Raise in Urinary Incontinence Cases – For instance, it is estimated that approximately 422 million people (20 and older age) worldwide suffer from urinary incontinence. Whereas, in the United States, urinary incontinence affects nearly 12 million people.

- Escalating Healthcare Investment and Surge in Acquisitions – According to the World Economic Forum, the healthcare industry has witnessed a huge surge of investment, advancement, and new entrants from the diverse verticals of technology, telecommunications, and consumer sectors. Globally, USD 44 billion was raised in health innovation in 2021 on its own – twice as often as in 2020 – and the mergers and acquisitions of health and health tech companies increased by 50%.

Challenges

-

High Costs of Urology Devices - Urology devices are very expensive to afford, resulting in expensive treatment, hence, not everyone can receive them. People are less aware of these diseases and look for traditional methods of treatment. Furthermore, the manufacturing cost of urology devices is also high, which is one of the major factors to hamper the urology devices market growth over the forecast period.

-

Rising Concern About the Risks Associated with Urologic Surgeries

- Stringent Government Rules for Approval of Novel Treatment Methods

Urology Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 39.08 billion |

|

Forecast Year Market Size (2035) |

USD 79.8 billion |

|

Regional Scope |

|

Urology Devices Market Segmentation:

Disease

The global urology devices market is segmented and analyzed for demand and supply by disease into kidney disease, urological cancer & BPH, pelvic organ prolapse, and others, out of which, the kidney disease segment is estimated to significantly grow over the forecast period owing to the rising prevalence of end-stage kidney disease (ESKD), escalating demand for dialysis procedures, and surge in minimally invasive surgeries across the globe. For instance, end-stage renal disease, affected approximately 787,000 people in the United States as of 2020, with 70% of individuals undergoing dialysis. Further, the rising geriatric population that is more prone to kidney diseases, along with binge drinking issues, substance abuse, and adoption of an unhealthy lifestyle, are some other factors giving rise to kidney disorders and ultimately expanding the usage of urology devices in the next few years.

End-user

The global urology devices market is also segmented and analyzed for demand and supply by end-user into hospitals, dialysis centers, ambulatory surgical centers, and others. Out of all these, the hospital's segment is attributed to hold the largest share by the end of the forecast period owing to massive investments being made to develop hospital infrastructure, and the presence of a high number of hospitals around the word. Another major factor that positively contributes to the segment’s growth is the large patient pool visiting hospitals for treatment of urology-related disorders. Furthermore, hospital settings provide easy assistance for using urology endoscopes such as cystoscopies and ureteroscopy devices for the treatment and diagnosis of urolithiasis. The Organization for Economic Cooperation and Development (OECD) stated that the number of hospitals present in the United States grew from 5,564 in 2015 to 6,090 in 2019.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Disease |

|

|

By Technology |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urology Devices Market Regional Analysis:

North American Market Insights

North America industry is set to account for largest revenue share of 37% by 2035 backed by the increased number of patients diagnosed with kidney diseases, growing incidences of other urologic conditions, and favorable reimbursement policies in the region As per the Centers for Disease Control and Prevention (CDC), by 2023, approximately 37 million adults in the United States are expected to have chronic kidney disease, with the vast majority remaining undiagnosed. Also, the presence of a strong healthcare system and major key players in the region are considered to be other growth factors for the market. Moreover, the increased utilization rate of single-use cystoscopes for treatment purposes, along with the rise in the development of technologically advanced urology devices by market players, have been anticipated to fuel market growth in this region in the upcoming years. In addition, there has been increasing adoption of advanced level devices such as urology laser for the removing stone that are located in the urinary tract, that is expected to drive the market’s growth in the region.

Urology Devices Market Players:

- Boston Scientific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KARL STORZ SE & Co. KG

- Becton, Dickinson and Company (BD)

- Richard Wolf GmbH

- Intuitive Surgical, Inc.

- Fresenius Medical Care AG & Co. KGaA

- Olympus Corporation

- Coloplast

- Medtronic

- Stryker Corporation

Recent Developments

-

KARL STORZ SE & Co. KG has announced that its KARL STORZ HyDome has been selected for the Red Dot Award in the Product Design 2019 category based on of its outstanding design, quality, and functionality. Its duodenoscopy system combines a reusable endoscope for duodenal endoscopy and bile duct treatment with an innovative lever mechanism.

-

Boston Scientific Corporation has announced that the Federal Joint Committee (G-BA) has given a very positive benefit assessment of photoselective vaporization (PVP) for the treatment of benign prostatic syndrome (BPS).

- Report ID: 4571

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urology Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.