Urology Laser Market Outlook:

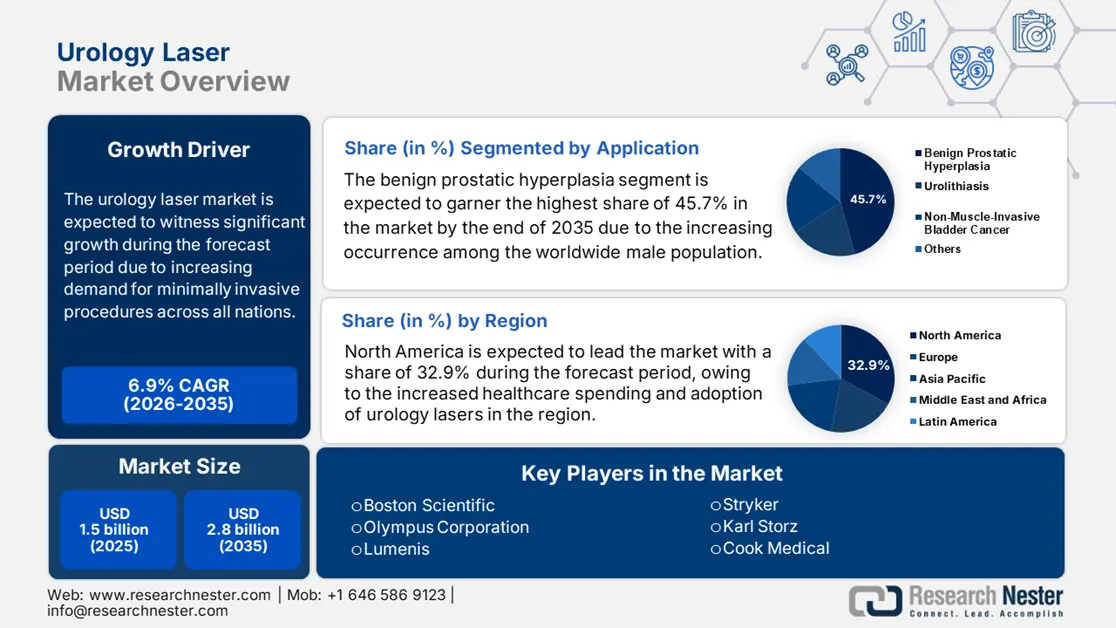

Urology Laser Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 2.8 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of urology laser is estimated at USD 1.8 billion.

The global market assists in escalating the patient pool affected by benign prostatic hyperplasia. Meanwhile, as stated by the University of Florida Health, in the U.S., kidney stone disease affects roughly one in every 500 people annually. One in eight men and one in sixteen women will get this condition in their lifetime. This increasing burden has resulted in the exceptional demand for urology lasers, which has further inspired the supply chain to undergo necessary transformations. In this regard, the supply chain materials for urology lasers are crucially drawn from Germany, Japan, and the U.S., thereby contributing to market upliftment. On the economic front, the PPI and CPI for urology lasers increased owing to the increasing rare earth metal costs and hospital operational costs, denoting a positive impact on the market expansion. In terms of global trade U.S. and Germany are dominating, meanwhile, China and India are leading in imports of refurbished systems as reported by ITC in 2024.

New developments in urology laser systems have led to more complex systems. Developments of Thulium and Holmium lasers have improved the effectiveness of procedures like lithotripsy and prostate surgery. These systems will have improved capabilities, reduce the likelihood of complications, and improve patient recovery time. There will be development of new laser systems with new technologies, improved safety records, and new treatment applications to meet unmet clinical needs and differentiate themselves from competitors. The move to outpatient urology, creates opportunities in the invention of laser systems with the ability to perform outpatient laser interventions in a safe, effective manner.

Key Urology Laser Market Insights Summary:

Regional Insights:

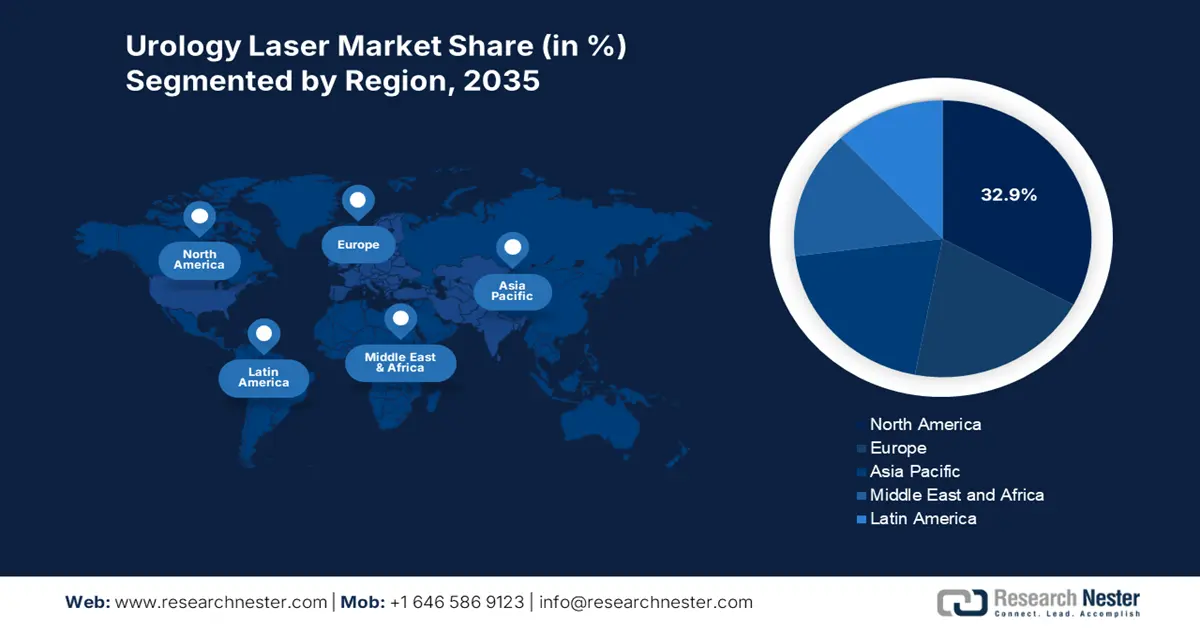

- By 2035, North America is projected to capture a 32.9% share of the urology laser market, advancing at a 5.7% CAGR owing to its large urological patient pool and strong reimbursement infrastructure.

- By 2035, Asia Pacific is expected to hold a 22.4% share and expand at an 8.9% CAGR because of rising healthcare investments and a growing aging population.

Segment Insights:

- By 2035, the benign prostatic hyperplasia segment is forecasted to secure a 45.7% share in the urology laser market, propelled by the increasing prevalence of benign prostatic hyperplasia among men.

- By 2035, the thulium laser system segment is anticipated to command a 35.4% share, supported by its superior treatment efficacy and reduced bleeding rates.

Key Growth Trends:

- Demand for minimally invasive surgeries

- Adoption towards emerging technologie

Major Challenges:

- High cost of equipment

- Limited access in rural and underserved areas

Key Players: Olympus Corporation, Lumenis, Stryker, Karl Storz, Cook Medical, Richard Wolf, Dornier MedTech, Quanta System, Astora Women’s Health, JenaSurgical, OmniGuide, MediLas, LISA Laser, Convergent Laser, StarMedTec, NIDEC Medical, PolyDiagnost, Maxer Endoscopy, Vimex Endoscopy.

Global Urology Laser Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 2.8 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: North America (32.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, United Arab Emirates

Last updated on : 29 August, 2025

Urology Laser Market - Growth Drivers and Challenges

Growth Drivers

- Demand for minimally invasive surgeries: The market is witnessing growth owing to the demand for these surgeries as they significantly reduce hospital stays. Urology lasers provide the ability to treat kidney stones, benign prostatic hyperplasia (BPH), and bladder tumors with a high degree of accuracy and targeting with less trauma when compared to open surgeries. There are faster recovery times and fewer complications with urology lasers, which lead to better outcomes and satisfaction for patients. In addition, recent advancements in laser technology, including holmium and thulium fiber lasers, have increased the effectiveness and safety of these procedures, thus increasing the popularity of lasers in urology across the world.

- Adoption towards emerging technologies: This is yet another driver for the market to undergo significant transformations. Advances in robotic-assisted surgery systems and the integration of artificial intelligence (AI) have improved the accuracy, safety, and cost-effectiveness of the majority of urological surgery. The category of advanced lasers offers an effective solution for managing difficult-to-treat disease processes such as benign prostate hyperplasia (BPH) or kidney stones, with far fewer side effects than traditional methods. AI and real-time imaging and analytics are expected to enhance the surgeon's decision-making capabilities with respect to minimizing errors during procedures, and therefore, improving patient outcomes.

- Rising prevalence of urological disorders: The rise in urological conditions such as kidney stones, benign prostatic hyperplasia (BPH), and prostate cancer is a major driver of the market. Internationally, these conditions are growing in prevalence due to aging populations, lack of exercise, and poor diet. Laser therapy has advanced urology far beyond conventional surgery procedures due to their precision, reduced bleeding, lack of invasiveness, and reduced recovery times. As patients and medical professionals become more aware of laser technology, the demand for the treatment of urological conditions using laser technology continues to grow.

Challenges

- High cost of equipment: One of the considerable restraints in the market is the high costs associated with the advanced equipment and limited reimbursement policies. This factor makes it challenging for the healthcare facilities belonging to the budget constraint regions to adopt these laser systems, which are expensive to acquire and maintain. Besides, it is noted that in the U.S., the reimbursement rates for laser procedures do not cover the complete cost of treatment, putting a financial strain on patients.

- Limited access in rural and underserved areas: Rural hospitals and clinics frequently do not have the infrastructure and skilled staff to offer laser-based urological procedures. This also includes trained technicians and post-operative care. Many patients from rural areas are unable to receive the benefit of minimally invasive laser surgical procedures. This urban-rural divide is exemplified in numerous countries, including India, China, and portions of Africa and Latin America. Moving forward, equitable access to treatment will remain a significant barrier to expanding access.

Urology Laser Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.8 billion |

|

Regional Scope |

|

Urology Laser Market Segmentation:

Application Segment Analysis

The benign prostatic hyperplasia segment is expected to garner the highest share of 45.7% in the urology laser market by the end of 2035. The dominance of the segment is attributable to the increasing occurrence of benign prostatic hyperplasia among the male population across all nations. In this context, the preference for laser therapies such as thulium and holmium lasers is on the rise due to their tremendous effectiveness and reduced complication rates when compared to traditional surgical methods. Besides the adoption of minimally invasive procedures, this further heightens the demand for these treatments.

Laser Type Segment Analysis

Thulium laser system segment is projected to hold the second-largest share of 35.4% in the market during the forecast timeline. The growth in the segment is subject to its enhanced efficacy in treating urological conditions. Besides this, the thulium lasers offer remarkable benefits such as lower bleeding rates and fast tissue resection speeds, making them ideal for procedures such as prostate enucleation. In addition, the growing elderly population also majorly contributes to the segment’s growth.

End User Segment Analysis

Hospitals define an essential portion of this market. Hospitals had a significant share of the market because they can offer many services, including comprehensive urology laser, from initial consultation with a urologist to intravenous urography and percutaneous nephrolithotomy with the latest laser technologies. In the hospital setting, sophisticated laser systems allow urologists to perform advanced techniques. By using advanced laser technologies, patients now benefit from minimally invasive treatment modalities, in which they receive their care in an acute care environment with faster recovery times.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Laser Type |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Urology Laser Market - Regional Analysis

North America Market Insights

North America market is projected to register the highest share of 32.9%, rising at a CAGR of 5.7% during the forecast period. The region benefits from a vast consumer base, i.e., the patient pool affected by urological disorders, and the preference for these lasers as an effective solution. Besides, the federal agencies, such as the CDC and AHRQ, are extending their support with investments. Technological innovations and the presence of key market players further bolster growth in the region. Moreover, the reimbursement infrastructure in the U.S. and Canada is fully developed for payment of these advanced technologies. Furthermore, with the technological advancements and innovations made by international equipment manufacturers and global research institutions, urology laser systems continue to have enhanced precision, safety, and operability in their functionalities. As outpatient procedures and robotic-assisted surgeries gain increased prominence, hospitals and specialty clinics are adopting the system more and more.

The U.S. has the largest and most entrenched market for urology lasers due to the overall significant incidence of benign prostatic hyperplasia (BPH), kidney stones and prostate cancer. Specifically, the U.S. has a large and growing aged population with a very high expectation of minimally invasive procedures resulting in the fairly rapid acceptance of laser-based surgical treatment. The estimates by the Population Reference Bureau estimate the number of Americans aged 65 and over is on track to increase by 47% from an expected 58 million in 2022 to 82 million in 2050. In general, the U.S. benefits from large hospital networks with complex hospital networks, competitive insurance policies, etc.; real reimbursement authorization and A-class laser surgery technology in the hospitals which greatly simplifies and streamlines implementation. The fact that FDA approvals occur in a timely fashion and also represent innovative devices and robotic-assisted foods that allow reassurance and progress is just another beneficial factor.

The urology laser market has significant growth potential in Canada, with an expected CAGR of 5.9%, increasingly driven by advancements in the healthcare system, along with the growing prevalence of urological disease. Hospitals and urology centers in Canada use holmium and thulium lasers to performed incisions for tissue removal with great precision and safety. Investment in healthcare technology and overall digital transformation by the Canadian government is improving access to specialty care across regions and areas of care parameters and standards, both rural and urban. High levels of medical regulation, guidelines, and ethical responsibility ensure a high standard of surgical care across Canada; additionally, partnerships with U.S. or international companies are also driving access to cutting-edge laser systems.

APAC Market Insights

Asia Pacific market is the fastest-growing, holding a 22.4% share and growing at a CAGR of 8.9%. The growth in the region is primarily driven by increasing healthcare investments, a growing aging population, and ongoing advancements in medical technology. With its growing older population and increasing lifestyle-related health issues, the region of the Asia Pacific is seeing a rise in patient cases such as kidney stones and benign prostate hyperplasia. This is increasing the need for accessible and effective treatment options, such as better laser treatments. Besides the presence of countries such as Japan, China, India, and South Korea, the major factor for which the growth is attributed. South Korea has higher adoption rates towards the urology lasers, driven by its disease incidence; meanwhile, growth in India is attributed to the government's increasing healthcare budget.

The market in India is rapidly gaining speed with the growing infrastructure in the healthcare system in the country. The increased incidence of kidney stones, benign prostatic hyperplasia (BPH), and prostate cancer also necessitates the availability of new solutions in urology. Initiatives such as Ayushman Bharat and the National Digital Health Mission from the government's overarching guidance will facilitate that patients will have considerably more access to diagnostic tests and surgical procedures. Also, because India has a strong labor force, low cost of care, and has seen a rise in medical tourism; India has become a destination of choice for urological procedures. In fact, the India Brand Equity Foundation, estimated in 2024 that over 7.3 million medical tourists had visited India because of India's world-class healthcare facilities.

China is a major player, comprising a lucrative share of 98.6% in the Asia-Pacific market. The growth is supported by significant government support and an expanding healthcare system. Supported by national policies such as "Healthy China 2030," there is a tremendous focus on upgrading hospitals and access to specialty treatment facilities. Urbanized patients are beginning to demand the precise and minimally invasive procedures that urology lasers can deliver. China has many hospitals that have begun to target these urological lasers, an increasing trend supported by growing registration of surgical and diagnostic laser niche products, and favorable changes to regulatory processes. Therefore, given all of these elements, China is likely, and continuing to be, the most dynamic urology laser market in the region.

Europe Market Insights

Europe market is increasing significantly, thanks to the advanced healthcare systems in the region, high prevalence of urological disorders, and growing demand for minimally invasive surgical procedures. The aging population in several countries is leading to an increase in benign prostatic hyperplasia (BPH), kidney stones, and prostate cancer. This is leading to an increase in the need for laser treatments. European healthcare providers are early adopters of advanced technologies such as holmium and thulium fiber lasers, which provide urologists with more precision, less bleeding, and quicker recovery for patients. Favorable reimbursement, large clinical economies creating research infrastructure, and partnerships between hospitals and medical device companies are also helping create entry points for users of laser systems for routine urologic procedures.

Due to its advanced and sophisticated healthcare system, France is an important player in the increasing urology laser market in Europe. French urologists are increasingly choosing holmium and thulium lasers for their limited bleeding, considerable precision, and fewer complications post-operatively. In France, government funding and reimbursement practices also make it easier for advanced laser systems to be adopted by hospitals. Quality institutions in France share a history of clinical research and training; they continue to work with patients with a focus on the minimally invasive method. Collaborative public hospitals, research institutes, and device companies are aiding the upward growth in the market.

Germany is one of the largest and most sophisticated urology laser markets in Europe. Both prostate disorders and kidney stones regularly occur in Germany. In addition, a number of leading medical device companies are present, and there are many academic and research institutions in a strong collaboration network to support innovation and adoption. The country has a well-established healthcare reimbursement process to encourage minimally invasive procedures. There is also increasing demand for outpatient urology treatments, which are ideal for laser procedures. Taken together, Germany represents an important market central to the urology laser market's development and growth in Europe.

Key Urology Laser Market Players:

- Boston Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Olympus Corporation

- Lumenis

- Stryker

- Karl Storz

- Cook Medical

- Richard Wolf

- Dornier MedTech

- Quanta System

- Astora Women’s Health

- JenaSurgical

- OmniGuide

- MediLas

- LISA Laser

- Convergent Laser

- StarMedTec

- NIDEC Medical

- PolyDiagnost

- Maxer Endoscopy

- Vimex Endoscopy

The global urology laser market comprises key players who are readily implementing numerous tactical strategies to establish their footprint internationally. The global leaders, including Boston Scientific, Olympus, and Lumenis, are dominating with 61% of global revenue. The domination is attributed to product differentiation, expansion into emerging markets, cost optimization, and regulatory lobbying. For instance, Lumenis announced a partnership with hospitals in India to install 500 lasers by 2026, thus reflecting a positive market development. Besides, in 2024, Cook Medical launched refurbished lasers at a 30% discount for Latin America, denoting a positive outlook to intensify competition among major market players.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2024, Boston Scientific received clearance for LithoVue Elite, boosting U.S. market share by 9% with its AI-guided laser lithotripsy. The system reduces stone fragmentation time by 27%, per FDA clinical trials.

- In June 2020, Olympus debuted the SolTive SuperPulsed Thulium Laser, capturing 14% of Europe's BPH treatments. According to EU Medical Agency data, its pulsed technology cuts bleeding complications by 42%.

- Report ID: 2916

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Urology Laser Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.