Dental Diode Laser System Market Outlook:

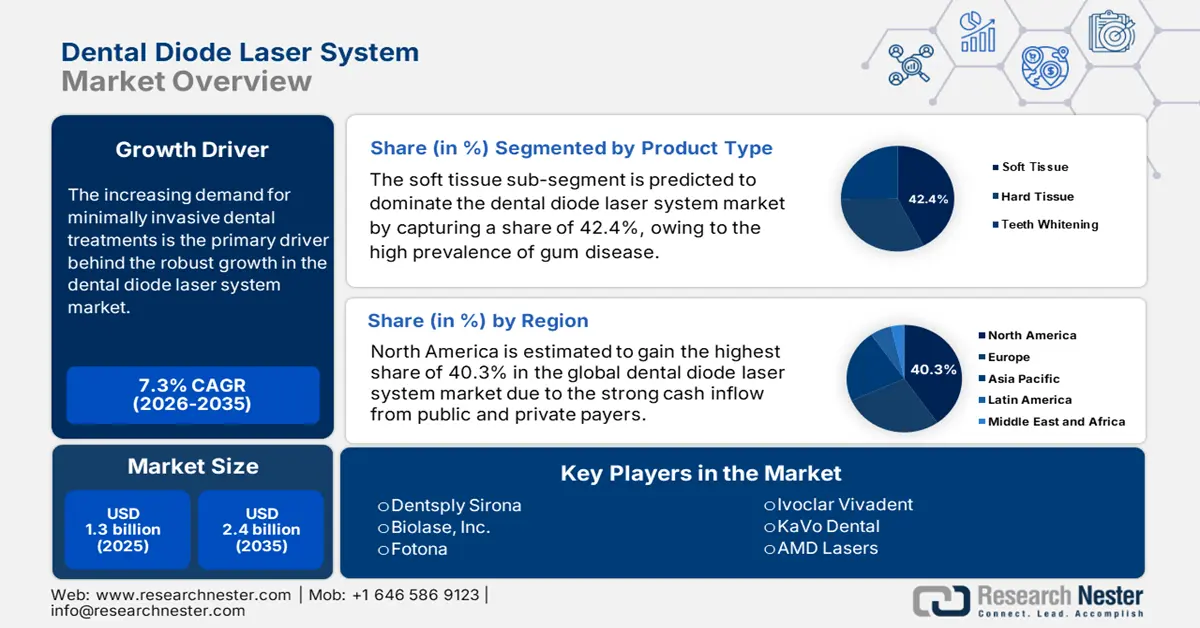

Dental Diode Laser System Market size was over USD 1.3 billion in 2025 and is estimated to reach USD 2.4 billion by the end of 2035, expanding at a CAGR of 7.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of dental diode laser system is evaluated at USD 1.4 billion.

The increasing demand for minimally invasive dental treatments is the primary driver behind the robust growth in the market. According to the National Institutes of Health, globally, the number of DALYs increased by 22.2%, from 1.4 million in 1990 to 1.7 million in 2021, while the prevalence of oral problems increased by 17.1%, from 549.2 million in 1990 to 643.3 million in 2021. Furthermore, this demography is highly influenced by rapid aging and the emergence of underdeveloped economies, creating a sustainable consumer base for this field. Advancements in dental lasers are manifesting in a number of ways. The most noteworthy is the growing rate of technological advancement, with manufacturers' spinal systems progressively evolving with AI technology.

One of such advancements is the patient demand for minimally invasive and cosmetic procedures. Another trend includes the development of compact, portable laser models, which allow smaller clinics or mobile dental services to have the capability and flexibility to offer diode laser procedures. Another issue that is driving awareness and clinical implementation is an increased emphasis on clinician education, which has increased availability for education to reach the clinician through digital learning and training led by the manufacturer of the laser device. At the end of the day, along with these changes, in efficiency, demand for comfortable operations, and improvements for training have realigned and redefined the dental care ecosystem, which has implications for how dental diode lasers are viewed and utilized in modern dentistry.

Key Dental Diode Laser System Market Insights Summary:

Regional Highlights:

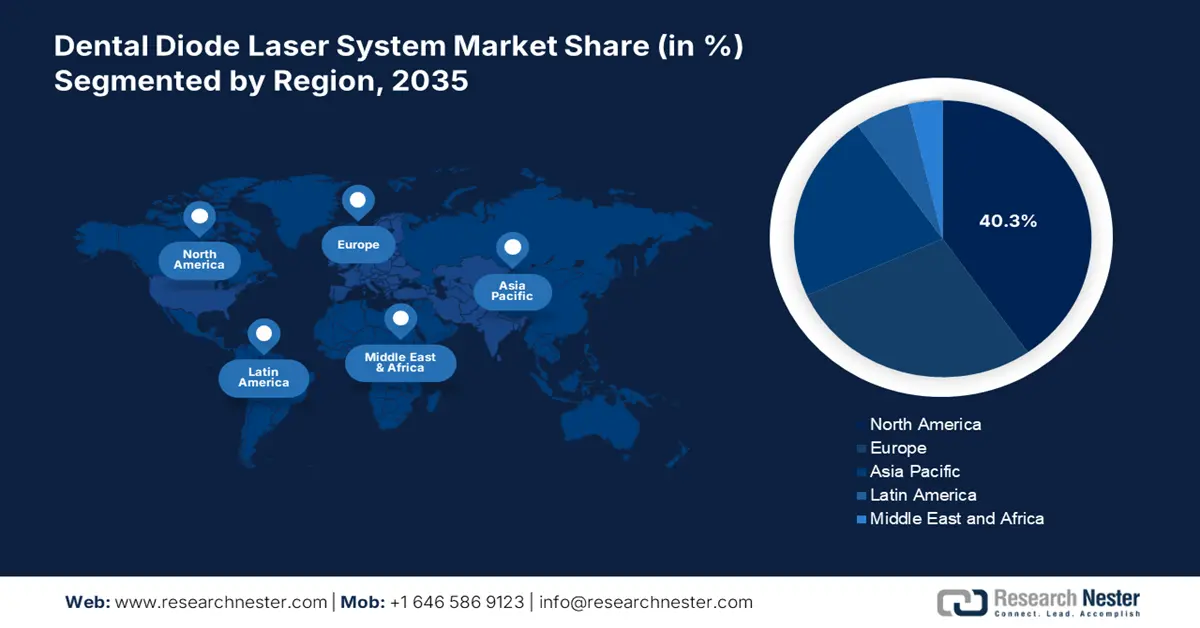

- North America is projected to hold a 40.3% share in the Dental Diode Laser System Market by 2035, owing to strong Medicare support, high personal spending, and robust adoption of minimally invasive aesthetic dental procedures.

- Asia Pacific is expected to emerge as the fastest-growing region by 2035, impelled by rising dental tourism, government-led healthcare modernization, and increasing prevalence of periodontal disease.

Segment Insights:

- The soft tissue segment in the Dental Diode Laser System Market is projected to command a 42.4% share by 2035, propelled by the increasing preference for minimally invasive and bloodless dental procedures.

- The periodontics segment is expected to capture a 38.3% revenue share by 2035, driven by the rising prevalence of gum diseases and growing emphasis on early-stage detection and treatment.

Key Growth Trends:

- Worldwide recognition and acceptance

- Integration of next-generation technologies

Major Challenges:

- High device costs & limited affordability

- Lack of standardized training & certification

Key Players: Biolase, Inc., Dentsply Sirona, Fotona, AMD Lasers, Ivoclar Vivadent, KaVo Dental, Summus Medical Laser, Zolar Technology, Lumenis, Shenzhen Smile Technology, A.R.C. Laser GmbH, LaserStar Technologies, Ultradent Products, Gigaa Optronics, Mectron SpA, Deka Laser, LaserHealth.

Global Dental Diode Laser System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.4 billion

- Projected Market Size: USD 2.4 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 15 September, 2025

Dental Diode Laser System Market - Growth Drivers and Challenges

Growth Drivers

- Worldwide recognition and acceptance: The evidence-backed clinical and financial advantages are amplifying interest and engagement in the market. Besides, the compliance of these instruments with FDA guidelines regarding the enhancement of caries detection accuracy is also establishing the sector's contribution to minimizing unnecessary dental procedures, accelerating growth. The rising focus on aesthetic dentistry and the shifting preference of dentists towards technology reinforce the acceptance of dental diode lasers. All of these factors are building confidence in diode laser solutions worldwide and driving sustained growth.

- Integration of next-generation technologies: The market for dental diode laser systems is advancing quickly with the growing investment in top-tier research and development to technology. There are also more medical innovators putting research and development investments as well as collaborative research and development in the industry sector. Inclusion of new technologies like AI diagnostics, continuous real-time feedback on tissue from the laser, and 'state of the art' wavelength modulation are all additions to provide more accuracy, safety, and efficacy of laser-assisted dental procedures, while in connection with individualized treatment planning and also providing real-time clinical workflows, interactive practitioner-oriented workflows, and precision.

- Rising demand for minimally invasive dental procedures: Patients are looking for treatments that minimize pain, bleeding, and time to heal, all of which diode lasers provide with ease. Torch lasers, in particular, allow for an accurate focus of intervention, which negates the need for anesthesia and also decreases the chances of post-operative complications. Many dental offices are taking steps to improve the patient experience and outcomes, and adding diode lasers is one way to accomplish. As previously mentioned, patients have very clearly expressed a preference for less invasive options, which is resulting in very rapid adoption of diode laser systems in both general and clinical dental contexts.

Challenges

- High device costs & limited affordability: The hurdles related to affordability across different countries are a major bottleneck for the globalization of the market. In areas of weak insurance coverage, or for procedures that are reimbursed inadequately if at all, patients also will not pay the additional cost of laser service, thus restricting the penetration of the market. in areas with poor insurance coverage or inadequate reimbursement for laser-assisted procedures, patients may be unwilling or unable to pay the premium associated with laser treatments, thereby inhibiting progress into the market even further.

- Lack of standardized training & certification: The shortage of trained and skilled dental surgeons results in a significant access gap in the market. Particularly, emerging countries, with dentists lacking proper laser training, are witnessing restrictions in the maximum deployment of these instruments, as per the WHO. This ultimately creates a major hurdle to worldwide adoption, as untrained practitioners hesitate to invest in equipment they cannot effectively operate.

Total Dental Healthcare Expenditure by Country (2019, in Million US$)

|

Location |

Total Expenditure on Dental Healthcare (Million US$) – 2019 |

|

Afghanistan |

16.7 |

|

Albania |

36.3 |

|

Algeria |

323.7 |

|

Andorra |

14.6 |

|

Angola |

70.2 |

|

Antigua and Barbuda |

4.8 |

|

Argentina |

1,106.0 |

|

Armenia |

113.0 |

|

Australia |

7,370.3 |

|

Austria |

2,115.7 |

|

Azerbaijan |

126.8 |

|

Bahamas |

32.9 |

Source: WHO

Dental Diode Laser System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 2.4 billion |

|

Regional Scope |

|

Dental Diode Laser System Market Segmentation:

Product Type Segment Analysis

Based on product type, the soft tissue sub-segment is predicted to dominate the market by capturing a share of 42.4% over the discussed period. The leadership is pledged to the high prevalence of gum disease and notable positive patient response from the use of these interventional tools. Dental diode lasers operate at wavelengths suitable for cutting, coagulating, and contouring soft tissue. This unique aspect of dental diode lasers allows for soft tissue manipulation with speed and ease, as well as less discomfort to patients. Additionally, the growing demand from both the clinician and patient for minimally invasive and bloodless procedures has led to increased adoption of diode and soft tissue lasers.

Application Segment Analysis

In terms of applications, the periodontics sub-segment is anticipated to hold the largest revenue share of 38.3% in the market by the end of 2035. The predominant captivity of this disease spectrum over the net patient population is the primary fueling factor for this proprietorship. The need for early detection and intervention to prevent the ailment from worsening is also creating a sustainable consumer base for this segment. In this regard, the WHO revealed that more than 1 billion people around the globe are expected to suffer from severe periodontitis. Moreover, innovations are also influencing more companies to invest in this category.

End User Segment Analysis

Based on end user, the dental clinics sub-segment is likely to gain significant market share in the market. Clinics provide a large portion of dental treatment and are conducive to incorporating laser treatment. Furthermore, as diode laser systems are small, affordable, and flexible, clinics can effortlessly incorporate them into daily practice. Moreover, patients are beginning to prefer more laser-based procedures when the laser is accessible and when the procedure includes their own pain management. Therefore, clinics are projected to continue to have the largest growth in the end-user segment.

Our in-depth analysis of the global dental diode laser system market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Diode Laser System Market - Regional Analysis

North America Market Insights

North America is estimated to gain the highest share of 40.3% in the global market throughout the assessed timeline. The strong cash inflow from Medicare and personal spending is securing a profitable atmosphere for this merchandise in the region. Additionally, with a comprehensive dental health system and a community that understands the benefits of minimally invasive aesthetic options available, the demand for aesthetic dental care remains strong. Dental clinics and specialty practices all over North America are embracing additional laser systems that meet expectations for precision, comfort, and clinical outcome. North America has very high rates of dental disease, particularly periodontal disease and cavities, in younger and older populations. Dental professionals and patients are choosing laser treatment options, which are beneficial in the prevention and management of dental disease.

A strong presence of dentists and clinical models enables the U.S. to lead the regional dental diode laser market. The demand from patients for these types of minimally invasive and aesthetic procedures created early adoption of lasers for these reasons. With leading manufacturers within the U.S. market, along with continuous investment in R&D, there are certainly advantages in the leading region in usage and innovation in R&D. In addition, dental lasers are also receiving strong reimbursement structures, and the speed of FDA approvals for entering the market will only influence the percentage of laser technology being used in the everyday scope of care.

Canada is emerging as a key participant in the North America dental diode laser system market. The nation's operations across this field are mostly supported by provincial investments from government and private entities. Accessing dental care continues to improve due to the ongoing development of dental infrastructure across the provinces using both public and private-sector funding. Increasing clinician and patient awareness of laser dentistry benefits (increased efficiency, improved thoroughness, better precision, and patient comfort) has led to increasing engagement with laser technologies.

APAC Market Insights

Asia Pacific is poised to attain the position of the fastest-growing region in the global dental diode laser system market by the end of 2035. Such acceleration in the progress of the region is sourced from the rising dental tourism, government-led healthcare modernization, and increasing periodontal disease prevalence. The growing popularity of AI-enhanced solutions is also inspiring more companies to invest in this region. Countries like China, India, and South Korea are modernizing their dental care infrastructure while benefiting from dental tourism. Governments have created support mechanisms to facilitate and promote the use of advanced technologies, such as the use of dental lasers.

China holds a commanding revenue share of 45.1% in the APAC dental diode laser system market. The regional proprietorship is primarily accomplished through the accelerated approvals from the National Medical Products Administration (NMPA). The country is in a very strong position in the APAC market due to the quick modernization of health care infrastructure and the commitment of the Government of China to support medical technology adoption. Regulatory pathways are increasingly easy and fast, and allow for the entry of dental laser devices to the market. There is also increasing attention to sophisticated, minimally invasive dental care from both public and private sectors with regard to dental laser care.

The large share of India in the regional market primarily reflects increased access to advanced dental care and enhanced Government of India initiatives, outsourcing the ability to treat patients with low-cost treatment plans. Public sector agendas are increasingly making room for modern technologies such as diode lasers in dentistry, especially in public health initiatives in rural or semi-urban settings, and concurrently, there is increased interest from dentists or dental practitioners in leading-edge technologies due to their efficiency, safety, and precision. Educational institutions, as well as private clinics, are also recognized for their role in increasing the capacity for laser dentistry across the country.

Europe Market Insights

Europe is predicted to represent a mature yet steadily growing landscape for the global dental diode laser system market, with the second largest revenue share during the timeline between 2026 and 2035. The region's growth is fueled by aging populations, comprehensive healthcare coverage, and increasing preference for minimally invasive dentistry. The European Commission's forecast predicts that over one-fifth (21.6%) of the 449.3 million persons living in the EU as of January 1, 2024, will be 65 years of age or older. Furthermore, Countries like Germany, France, and the UK lead the region based on their strong public and private healthcare systems, which advocate for and adapt laser technologies throughout their dental practice.

Germany is commanding a dominant 30.2% share in the regional dental diode laser system market due to having a strong healthcare system and excellent reimbursement systems. Moreover, the presence of universal health insurance policies that reimburse laser-based periodontics has made advanced dental diode lasers more accessible for patients. In addition, the increased burden of periodontal disease is elevating demand. Germany has a high level of procedural adoption and is a country that prides itself on constant innovation and training in the field of dentistry.

France holds a crucial position in the progress of the European dental diode laser system market, which is attributable to the regulatory and insurer policy reforms. France's leadership position is also characterized by a broad-based acceptance of contemporary dental technologies, facilitating affordability and accessibility. Programs like the "Health Data Space" proclaim to promote research and development, and innovation in the delivery of care in dental services. Its market position will be positively impacted by consumers' increasing demand for laser-assisted operations with a minimally invasive approach.

Key Dental Diode Laser System Market Players:

- Biolase, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dentsply Sirona

- Fotona

- AMD Lasers

- Ivoclar Vivadent

- KaVo Dental

- Summus Medical Laser

- Zolar Technology

- Lumenis

- Shenzhen Smile Technology

- A.R.C. Laser GmbH

- LaserStar Technologies

- Ultradent Products

- Gigaa Optronics

- Mectron SpA

- Deka Laser

- LaserHealth

The global market is controlled by three major pioneers, including Biolase, Dentsply Sirona, and Fotona, which collectively hold 45.1% of the total global revenue generation. These leaders are implementing strategies, such as AI integration, emerging market expansion, and regulatory partnerships, to consolidate their leadership in this sector. On the other hand, smaller competitors, such as Smile Technology, are gaining traction in price-sensitive regions by commercializing low-cost portable lasers. This highlights a mix trend of technological innovation, market penetration, and cost-driven competition.

Recent Developments

- In September 2024, Fotona launched its portable LightWalker AT dual-wavelength laser system (810 nm & 980 nm), designed for clinics and ambulatory surgical centers. The system's CE Mark fast-tracking significantly boosted Fotona's European sales by 20.4% following its release.

- In February 2024, Biolase introduced its AI-powered Waterlase iPlus Premium Edition, featuring advanced precision for gum surgeries and caries detection. The innovative system drove a 15.3% revenue growth during the 2nd quarter of 2024 while securing an additional 5.5% U.S. market share.

- Report ID: 7887

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dental Diode Laser System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.