Lung Biopsy Systems Market Outlook:

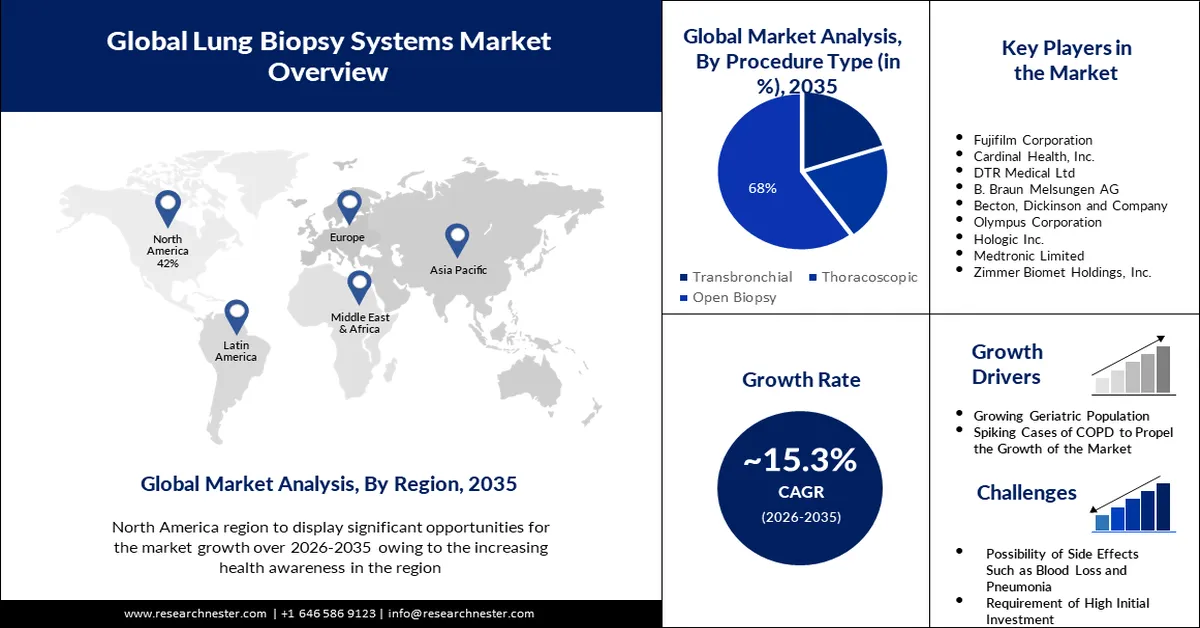

Lung Biopsy Systems Market size was over USD 5.03 billion in 2025 and is projected to reach USD 20.89 billion by 2035, growing at around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lung biopsy systems is evaluated at USD 5.72 billion.

The reason behind the growth is impelled by a higher prevalence of lung cancer across the globe. As a result, there is a greater need for timely diagnosis which necessitates the use of a lung biopsy system. By extracting samples of lung tissue that may be utilized for molecular testing, a lung biopsy is a generally acknowledged method for identifying pulmonary illnesses. A report published by World Health Organization (WHO) stated that in 2020, around 10 million people died due to lung cancer which was summed up to be 1 in 6 deaths worldwide.

The growing inclination toward minimally invasive surgeries is believed to fuel lung biopsy systems market growth. Minimally invasive surgeries come under the ongoing advancement of the medtech industry and it is performed by delivering less damage to the body with the assistance of enhanced medical imaging equipment services.

Moreover, the use of a robotic-assisted system in minimally invasive lung biopsy enables medical professionals performing the procedure to access all 18 lung regions, enabling the best lung navigation and producing more precise biopsies. This type of treatment is safe, effective, and minimally invasive, which can reduce discomfort, recovery time, and infection risk.

Key Lung Biopsy Systems Market Insights Summary:

Regional Highlights:

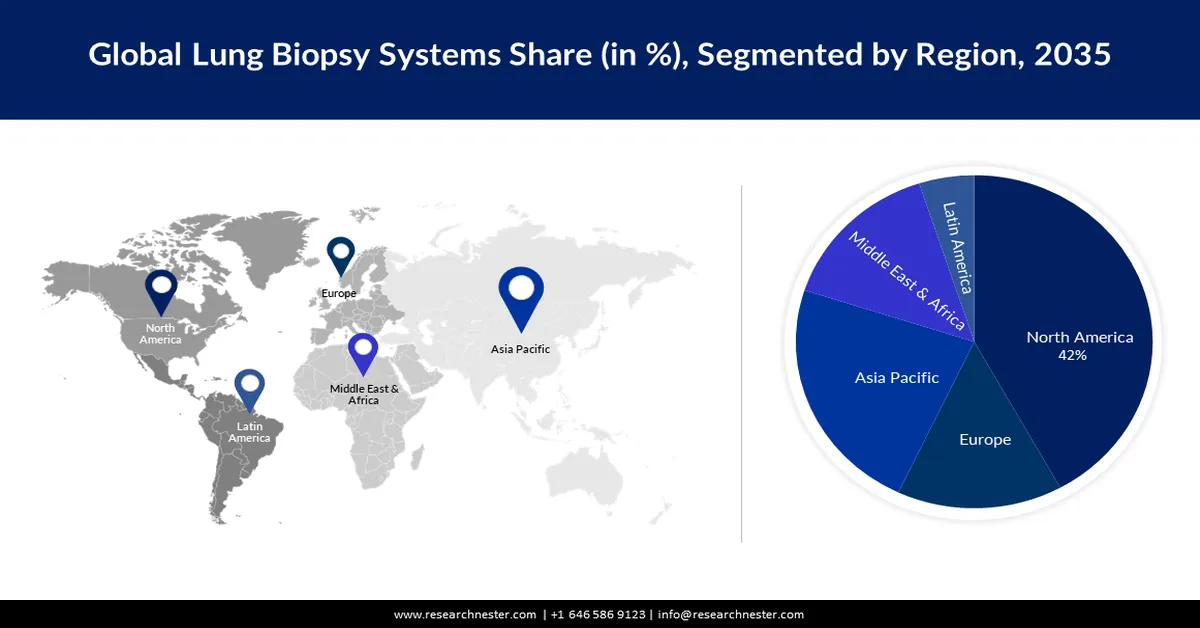

- North America is set to command a 42% share of the Lung Biopsy Systems Market by 2035, propelled by the growing volume of research and clinical trials focused on new lung cancer treatment approaches.

- Asia Pacific is anticipated to secure the second-largest share by 2035, underpinned by rising air pollution driven by rapid urbanization and industrialization.

Segment Insights:

- The open biopsy segment in the Lung Biopsy Systems Market is projected to hold a 68% share by 2035, supported by the higher number of patients receiving this widely trusted procedure.

- The hospitals segment is poised to capture a notable share by 2035, reinforced by the expanding number of hospitals offering improved access to advanced lung biopsy services.

Key Growth Trends:

- Growing Geriatric Population

- Spiking Cases of COPD to Propel the Growth of the Market

Major Challenges:

- Possibility of Side Effects Such as Blood Loss and Pneumonia

- Requirement of High Initial Investment

Key Players: Argon Medical Devices, Inc., Fujifilm Corporation, Cardinal Health, Inc., DTR Medical Ltd, B. Braun Melsungen AG, Becton, Dickinson and Company, Olympus Corporation, Hologic Inc., Medtronic Limited, Zimmer Biomet Holdings, Inc.

Global Lung Biopsy Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.03 billion

- 2026 Market Size: USD 5.72 billion

- Projected Market Size: USD 20.89 billion by 2035

- Growth Forecasts: 15.3%

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 21 November, 2025

Lung Biopsy Systems Market - Growth Drivers and Challenges

Growth Drivers

- Growing Geriatric Population– The elderly population is more prone to chronic lung diseases and the rising number of elderly populations across the globe is estimated to drive lung biopsy systems market growth. According to estimates, the number of individuals in the world who are 60 or older will increase to over 2 billion by 2050.

- Spiking Cases of COPD to Propel the Growth of the Market - COPD, a chronic obstructive pulmonary disease, is considered an inflammatory lung disease that is responsible for the interrupted airflow from the lungs and can result in the death of the affected person. COPD requires quick medical attention and early diagnosis to be cured thoroughly.

Challenges

- Possibility of Side Effects Such as Blood Loss and Pneumonia– In some patients, a lung biopsy will cause side effects such as blood clots or blood loss, pain, discomfort, infection, and pneumonia. These are estimated to hamper the market growth in the coming years as per the market analysis.

- Requirement of High Initial Investment

- Lack of Skilled Medical Professionals

Lung Biopsy Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 5.03 billion |

|

Forecast Year Market Size (2035) |

USD 20.89 billion |

|

Regional Scope |

|

Lung Biopsy Systems Market Segmentation:

Procedure Type (Transbronchial, Thoracoscopic, Open Biopsy)

The open biopsy segment is estimated to hold 68% share of the global lung biopsy systems market in the coming years owing to the higher number of patients receiving it. Open lung biopsy is the most common type of biopsy that is performed to check for the sigh of diseases in the lungs. It is tolerably risk-free and generally regarded as the most reliable biopsy technique. Hospitals use general anesthesia to perform open lung biopsies, where during the entire operation, patients are asleep and don't feel any pain.

End-User (Cancer Research Centers, Specialty Clinics, Hospitals)

Lung biopsy systems market from the hospitals segment is set to garner a notable share in the near future owing to an increasing number of hospitals. This offers patients with better access to healthcare services which can result in a huge number of lung biopsies being performed. For instance, patients now have a new, minimally invasive lung biopsy option available from the hospital which offers the technology and medical know-how to retrieve lung biopsy tissue samples from the deepest parts of the lung, to improve the chances of lung disease diagnosis and treatment. Besides this, hospitals provide round-the-clock services to patients and are equipped with advanced medical equipment. Medical professionals who have expertise in lung biopsy systems are also easily available within hospital premises.

Our in-depth analysis of the global lung biopsy systems market includes the following segments:

|

Product Type |

|

|

Procedure Type |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lung Biopsy Systems Market - Regional Analysis

North American Market Forecast

North America industry is set to hold largest revenue share of 42% by 2035, impelled by growing research and clinical trials to test a new approach to treatment for lung cancer in the region.Therefore, to support these efforts the demand for lung biopsy systems is expected to rise in the region. According to statistics, in 2021, North America saw over 25% global increase in clinical drug trial initiations.

APAC Market Statistics

The Asia Pacific lung biopsy systems market is estimated to be the second largest, during the forecast timeframe led by growing air pollution in the environment owing to the rapid urbanization and industrialization in the region. For instance, the deteriorating air pollution in India is being attributed by medical professionals to a rapid increase in cases of chest and throat sickness, and many respiratory ailments. This has led to increasing demand for lung biopsy systems in the region. India, a fast-developing nation with a growing population, suffers from severe air pollution, and it is estimated that more than 25,000 people die from it every year in Delhi.

Lung Biopsy Systems Market Players:

- Argon Medical Devices, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fujifilm Corporation

- Cardinal Health, Inc.

- DTR Medical Ltd

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Olympus Corporation

- Hologic Inc.

- Medtronic Limited

- Zimmer Biomet Holdings, Inc

Recent Developments

- Fujifilm Corporation announced the completion of the installation of 50,000 medical equipment called ‘#50k and Counting – Hitting the Milestone and Getting Healthier Together’ all over India.

- Argon Medical Devices, Inc. introduced its Two Inferior Vena Cava Filter Retrieval Kits to be sold in the United States. This retrieval kit was developed for the transdermal removal of retrievable inferior vena cava (IVC).

- Report ID: 4191

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lung Biopsy Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.