Autotransfusion Systems Market Outlook:

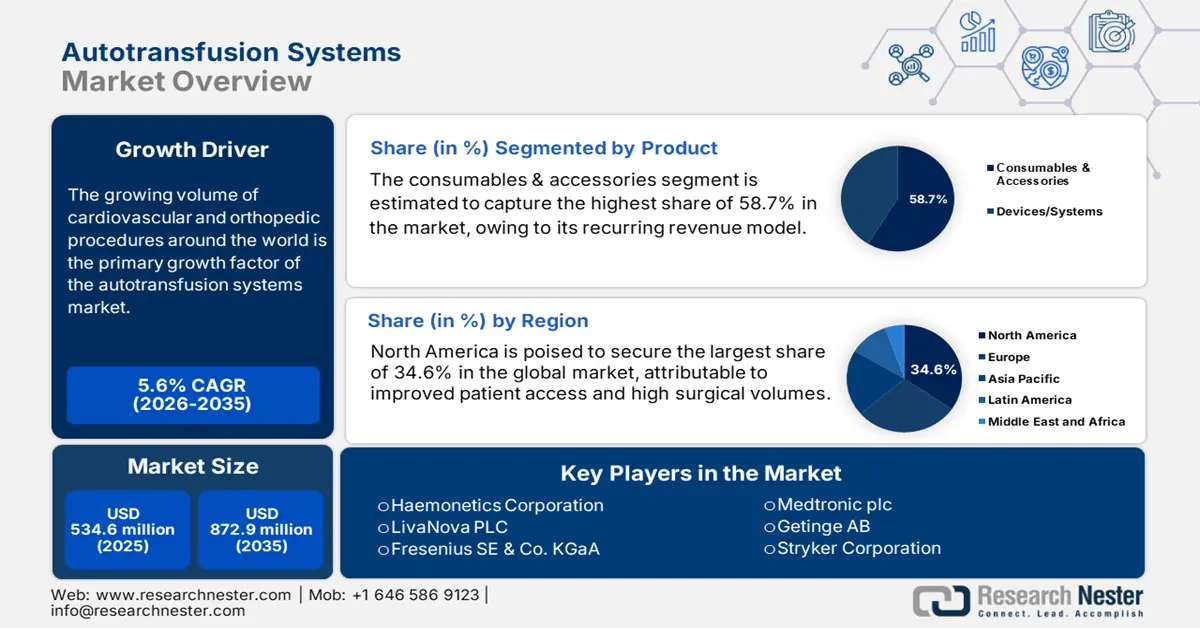

Autotransfusion Systems Market size was over USD 534.6 million in 2025 and is estimated to reach USD 872.9 million by the end of 2035, expanding at a CAGR of 5.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of autotransfusion systems is estimated at USD 564.5 million.

The growing volume of cardiovascular and orthopedic procedures around the world is the primary growth factor of the market. According to a 2023 NLM study, over 1 million cardiac surgeries are performed every year worldwide. It also mentioned that the surgical volume in this category reached 123.2 per 100,000 population-year in high-income countries (HICs), whereas the target is set to be 86.1, 55.1, and 40.2 per 100,000 population-year for upper-middle-, lower-middle-, and low-income countries. This describes the growing need for surgical equipment reinforcement in national medical systems, particularly in low- and middle-income countries (LMICs), to meet the surging demand.

The ongoing inflation in the costs of blood management and laboratory operations is heightening the payers’ pricing for the end user services, prompting improvement in the transfusion process that can reduce the economic burden. Testifying to the same, the 2021 Turkish Journal of Thoracic and Cardiovascular Surgery unveiled that the annual cost of blood transfusion in Turkey crossed USD 100 million. It also presented the impact of optimization on the overall procedure, which translated to a 23.2% decrease in the number of transfusions and 15% cost savings. This ultimately signifies the presence of a lucrative scope for the market that offers solutions to automate and enhance laboratory operations.

Key Autotransfusion Systems Market Insights Summary:

Regional Insights:

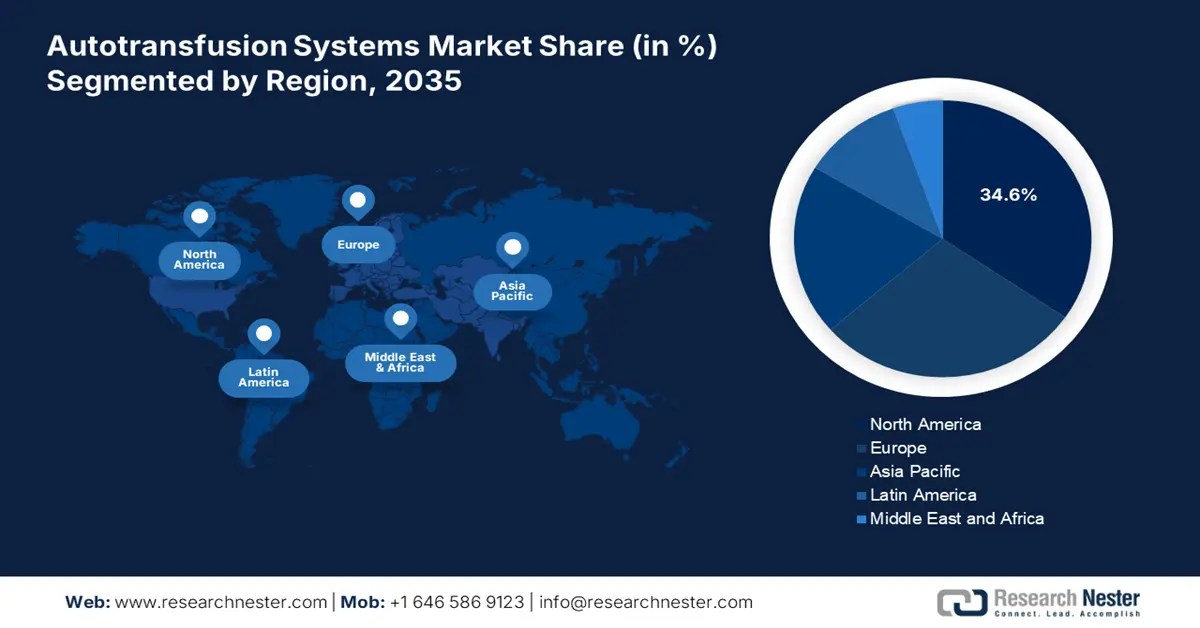

- North America is projected to command a 34.6% share of the global Autotransfusion Systems Market by 2035, supported by robust patient access, high surgical volumes, and the strong presence of MedTech leaders.

- Europe is anticipated to hold the second-largest position during 2026–2035, upheld by stringent infection control protocols and standardized surgical practices that enhance adoption across hospitals.

Segment Insights:

- The consumables & accessories segment is estimated to account for 58.7% share by 2035 in the Autotransfusion Systems Market, propelled by recurring demand for single-use sterile kits and continuous product innovations.

- The cardiac surgery segment is expected to capture 41.5% share by 2035, owing to rising blood conservation practices and growing clinical reliance on autotransfusion for high-risk procedures.

Key Growth Trends:

- Growing demand for blood conservation

- Tech-based advances in devices and methods

Major Challenges:

- High upfront capital investment

- Procurement complexity in public health systems

Key Players: Haemonetics Corporation, LivaNova PLC, Fresenius SE & Co. KGaA, Medtronic plc, Getinge AB, Stryker Corporation, Becton, Dickinson and Company, Braile Biomédica, Cerus Corporation, Redax, Atrium Medical Corporation, Shanghai Kindly Medical Instruments, Wandong Health Sources, Baxter International Inc., GAMA Group, Weigao Group, AdvaCare Pharma, Microport Scientific Corporation, Stago.

Global Autotransfusion Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 534.6 million

- 2026 Market Size: USD 564.5 million

- Projected Market Size: USD 872.9 million by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 11 September, 2025

Autotransfusion Systems Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for blood conservation: As blood donation volume across the globe struggles to satisfy the rising clinical needs, healthcare centers are increasingly implementing blood conservation strategies to bridge the gap. Evidencing the same, from 2021 to 2022, an NLM study observed a 50% reduction in the supply of blood products in the U.S., while highlighting a weekly need for 10 thousand donations to meet the current demand. Besides, the commodities available in the market reduce the risks of infections, immune reactions, and transmission of diseases by eliminating the allogeneic method, creating a sustainable consumer base for the sector.

- Tech-based advances in devices and methods: Continuous participation in R&D has led to the development of more compact, automated, and user-friendly pipelines in the market. These devices offer better filtration, improved cell separation, and faster processing times, which increase clinical efficiency. On the other hand, AI-driven monitoring and smart alarms are also becoming the most desired features in advanced systems. Testifying to the same, a 2025 NLM study reported machine learning (ML)-based genotype predictions with more than 97% concordance to whole-genome sequencing, enabling safer transfusion protocols for patients with complex immune profiles.

- Surge in trauma and emergency care cases: High rates of road traffic accidents, natural disasters, and battlefield injuries are increasing the need for rapid and safe blood management. Thus, the usefulness of products from the market in trauma and emergency care settings, where compatible donor blood may not be immediately available, is evidently high. Their ability to enable immediate intraoperative or postoperative blood recovery has shown promising efficacy in improving survival rates. This is securing consistent cash inflow in this sector, as emergency preparedness becomes a global healthcare priority.

Cost-Effectiveness Analysis Results of the Historic Transfusion Improvement Program

Blood Component Transfusion Costs and Savings in Turkey

(2018-2019)

|

Blood Component |

Unit Cost in 2018 (in USD) |

Unit Cost in 2019 (in USD) |

|

Erythrocyte Suspension |

240.9 |

251.1 |

|

Fresh Frozen Plasma |

120 |

128.6 |

|

Pooled Platelet |

313.5 |

322.1 |

|

Apheresis Platelet |

314.2 |

325.7 |

|

Cryoprecipitate |

104.9 |

113.9 |

|

Fresh Whole Blood |

189.9 |

209 |

|

Total Transfusion |

6,224,208.3 |

5,308,148.4 |

Source: NLM

Trends in Patient Population in the Autotransfusion Systems Market

Country-wise Average Total Cardiac Surgical Volume (2023)

|

Country |

Surgery Types |

Volume (per 100,000 population per year) |

|

U.S. |

Coronary Artery Bypass Grafting (CABG) and Valve Surgery |

64.5 and 55.2 |

|

South Korea |

Coronary Artery Bypass Grafting (CABG) |

7.7 |

|

New Zealand |

Valve Surgery |

12.7 |

|

Singapore |

Congenital Heart Surgery |

1.2 |

|

UK |

Congenital Heart Surgery |

18.2 |

Source: NLM

Challenges

- High upfront capital investment: The market often faces limitations in capital expenditure, particularly for small-sized medical settings. As the ongoing cost of disposable consumables adds to the operational expense, a majority of public healthcare service providers with limited budgets fail to afford such advanced equipment. This creates a major adoption barrier, especially in resource-constrained and underserved regions. Thus, the premium-priced products remain hard to access for these payers without proper financial backing.

- Procurement complexity in public health systems: Alongside the financial limitations, the complexity of government tender processes often becomes a formidable roadblock for suppliers in the market. These contracts are mostly allocated in a multi-year format, which is awarded only to the lowest bidder. As a result, new entrants must compete not only on price but also on demonstrating superior long-term value, which is a difficult proposition without an existing installed base and real-world clinical data.

Autotransfusion Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 534.6 million |

|

Forecast Year Market Size (2035) |

USD 872.9 million |

|

Regional Scope |

|

Autotransfusion Systems Market Segmentation:

Product Segment Analysis

The consumables & accessories segment is estimated to capture the highest share of 58.7% in the market over the assessed timeline. The recurring revenue model of this category, where each procedure requires single-use, sterile kits, such as reservoirs, tubing, and filters, is establishing these products as the primary source of profit for this sector. This creates a continuous stream of demand that is independent of new device sales. Growth in this segment is further propelled by high surgical volumes and continuous innovations. The progressive landscape of this subtype can be exemplified by the introduction of the Cell Saver Elite/Elite+ Autotransfusion System and its related accessory components by Haemonetics, which received premarket clearance from the FDA in October 2022.

Application Segment Analysis

Cardiac surgery is expected to acquire the forefront position in the market during the analyzed tenure by capturing a 41.5% share from applications. Having a higher risk of blood loss and established clinical guidelines mandating blood conservation, these procedures are becoming the foundational pillars of the sector's financial liberty. This prompts extensive research in the minimization of allogeneic transfusions, reinforcing the sector’s significance as the gold standard of care in cardiac units. Moreover, the high cost and limited supply of donor blood make autotransfusion a critical and cost-effective solution in this sub-segment.

End user Segment Analysis

Hospitals are predicted to remain the dominant end user segment in the market with a 65.4% share by the end of 2035. This strong presence is empowered by the high volume of surgical procedures performed in these medical settings, particularly in cardiovascular, orthopedic, and emergency departments, where blood conservation is critical. In addition, hospitals are equipped with advanced infrastructure and trained personnel, making them the primary adopters of autotransfusion systems. Moreover, their aim to enhance patient safety, reduce reliance on donor blood, and lower the risk of transfusion-related complications is influencing them to invest more in this sector.

Our in-depth analysis of the global market includes the following segments:

| Segment | Sub-Segments |

|

Product |

|

|

Application |

|

|

Technology |

|

|

End user |

|

|

Operation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autotransfusion Systems Market - Regional Analysis

North America Market Insights

North America is poised to secure the largest share of 34.6% in the global market throughout the discussed timeframe. The improved patient access, high surgical volumes, and strong presence of MedTech leaders are collectively solidifying the region’s position in this sector. The growing interest in patient safety, strict infection control protocols, and a rising number of complex procedures are also creating a surge in efficient blood management solutions, contributing to the substantial demand in this category. Besides, increasing awareness about the advantages of autologous blood transfusion, coupled with adequate financial backing, further ensures the future expansion of the landscape.

According to the Organ Procurement and Transplantation Network statistics, the cases of kidney transplants in the U.S., where blood transfusion is critical, increased from 17,728 to 26,308 from 2010 to 2022. On the other hand, an NLM report unveiled that the average total cardiac surgical volume in the country stood at 271.5 per 100,000 population per year in 2023. This demography indicates a consistent increase in demand in the market. Furthermore, the U.S., being home to several global pioneers, boosts innovation in this landscape.

Canada is steadily growing in the autotransfusion systems market with a strong focus on improving surgical outcomes and reducing healthcare costs. In addition, optimized clinical practices, particularly in major hospitals and specialized surgical centers, are prompting them to invest in this sector. Supportive government healthcare policies, combined with rising awareness of the risks associated with allogeneic blood transfusions, are further propelling the demand for autotransfusion systems.

APAC Market Insights

Asia Pacific is anticipated to emerge as the fastest-growing region in the global autotransfusion systems market by the end of 2035. The amplifying disease burden, increasing government allocations, and infrastructural modernization are escalating the region’s pace of progress in this sector. Particularly, in developing nations, such as China and India, the populations of high-risk patients are evidently enlarging. This is fostering a greater emphasis on adopting modern medical technologies to enable scalable and timely intervention. Moreover, the unmet needs of underserved regions are creating new opportunities for the market.

China plays a pivotal role in the accelerated growth of the Asia Pacific autotransfusion systems market, which is largely driven by its expanding healthcare infrastructure, large patient population, and centralization of the national medical system. The rising number of complex surgeries, particularly in cardiovascular and orthopedic fields, across the country is creating a strong demand base for this sector. Besides, government initiatives aimed at improving healthcare access and ensuring sufficient supply are boosting the revenue generation from this field in China.

The rising occurrence of chronic diseases and trauma cases, requiring surgical intervention, in India is fueling demand for effective blood management solutions, hence benefiting the market. Testifying to the same, a 2022 NLM study calculated the nationwide demand for blood supply to be 36.3 donations per 1,000 eligible populations, accounting for 14.6 million whole blood units. Moreover, as healthcare settings across the country rapidly modernize to enable greater patient safety, the adoption of autologous transfusion systems is expected to accelerate substantially in the coming years.

Dynamics of Blood Supply, Benefiting the Market

|

Country |

Demand/Shortage/Trend of Blood Supply |

|

China |

Need 57.5 million units by 2036; potential shortage of 21.2 million units |

|

South Korea |

Need 5.1 million units by 2045; supply decline to 1.4 million units by 2050 |

|

Australia |

54.3% of the population is non-donors; increased risk of variant Creutzfeldt‐Jakob disease (vCJD) transmission |

Source: NLM and JKMS

Europe Market Insights

Europe is estimated to maintain its position as the second-largest shareholder in the global autotransfusion systems market during the timeline between 2026 and 2035. In support of strict infection control protocols, highly standardized surgical care, and ongoing MedTech innovations, the region is gaining traction in this sector. Moreover, due to the high volume of cardiac, orthopedic, and trauma-related surgeries, Europe presents a sustainable consumer base for the merchandise, attracting both domestic and foreign pioneers to participate in the landscape.

Strict regulations around blood safety are the major factor behind the growing preference for the autotransfusion systems market in the UK. Thus, government efforts to minimize the risk of infections and immune reactions are creating a surge for maximum deployment of such autologous solutions in mainstream practices. Besides, the shortage of sufficient blood supply, where England alone requires over 1.8 million blood donations every year and more than 1 million active donors, is also fueling growth in this sector.

Germany is a leading landscape in the Europe autotransfusion systems market, which is augmenting with a strong focus on clinical efficiency and patient safety. The country also has a well-established practice of adopting innovative blood management technologies, creating a favorable business environment for the merchandise. On the other hand, regulatory updates regarding blood conservation support the presence of major medical device manufacturers, contributing to the widespread adoption of autotransfusion systems.

Country-wise Availability of Cardiac Surgery Centers

|

Country |

Number of Hospitals with cardiac surgery (per million people) |

Year |

|

Austria |

0.77 |

2022 |

|

Belgium |

2.4 |

2022 |

|

Denmark |

0.6 |

2023 |

|

France |

1 |

2022 |

|

Greece |

2.9 |

2022 |

|

Italy |

1.6 |

2022 |

|

Netherlands |

0.8 |

2023 |

Source: ESC

Key Autotransfusion Systems Market Players:

- Haemonetics Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LivaNova PLC

- Fresenius SE & Co. KGaA

- Medtronic plc

- Getinge AB

- Stryker Corporation

- Becton, Dickinson and Company

- Braile Biomédica

- Cerus Corporation

- Redax

- Atrium Medical Corporation

- Shanghai Kindly Medical Instruments

- Wandong Health Sources

- Baxter International Inc.

- GAMA Group

- Weigao Group

- AdvaCare Pharma

- Microport Scientific Corporation

- Stago

The market is potentially led by global MedTech pioneers, including Haemonetics, LivaNova, Medtronic, Fresenius Kabi, and Stryker. Alongside this cohort, regional firms, such as Beijing ZKSK and Braile Biomédica, are also gaining traction in this sector by offering cost-effective commodities. These companies are also focusing on innovation, with advanced systems, such as Fresenius Kabi’s CATSmart, that offer greater automation and efficiency.

Such key players are:

Recent Developments

- In August 2024, Stago, in partnership with i-SEP, launched a one-of-a-kind autotransfusion system, SAME, to preserve functional platelets as well as red blood cells. This intraoperative cell salvage device can wash and recover both red blood cells and platelets at the same time.

- In June 2023, LivaNova, in collaboration with idsMED Indonesia, introduced ATS XTRA, an extraordinarily innovative, intuitive, and powerful autotransfusion system that offers a complete solution for blood management. The event took place at Pullman Hotel Thamrin Jakarta.

- Report ID: 8092

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autotransfusion Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.