Endoscopic Closure Systems Market Outlook:

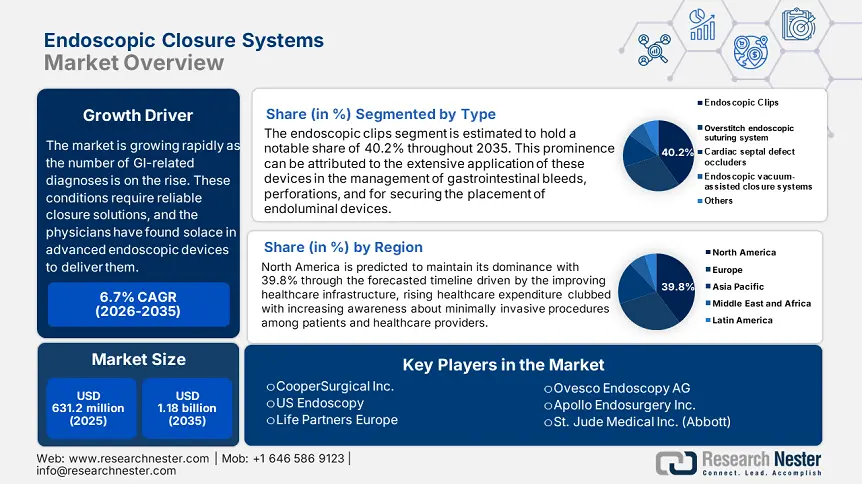

Endoscopic Closure Systems Market size was valued at USD 631.2 million in 2025 and is likely to cross USD 1.18 billion by 2035, registering more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of endoscopic closure systems is assessed at USD 668.13 million.

The global endoscopic closure systems market is experiencing unprecedented growth owing to the rising trend towards minimally invasive therapy. This is witnessing increased demand as they involve less patient trauma and downtime than surgery and are capable of sealing gastrointestinal perforations, leaks, and fistulae. For instance, in September 2023, a new internal fixation technique called Stryker's PROstep MIS Lapidus is designed to treat bunions by reducing the hallux valgus deformity surgically and then fusing the first metatarsal cuneiform joint.

Furthermore, the next-generation technologies such as artificial intelligence to guide lesion detection and targeted closure placement are driving business in the market. The augmented use of endoscopic diagnostic and therapeutic techniques, including endoscopic mucosal resection (EMR) and endoscopic submucosal dissection (ESD), requires effective closure systems to provide safety and efficacy during the process. For instance, in June 2024, Mindray revealed the next-generation UX5 4K/NIR/3D Endoscope camera system, Ultrasonic Surgical & Electrosurgical Energy Platform, Fluid Management System, and a broad variety of surgical instruments—both disposable and reusable.

Key Endoscopic Closure Systems Market Insights Summary:

Regional Highlights:

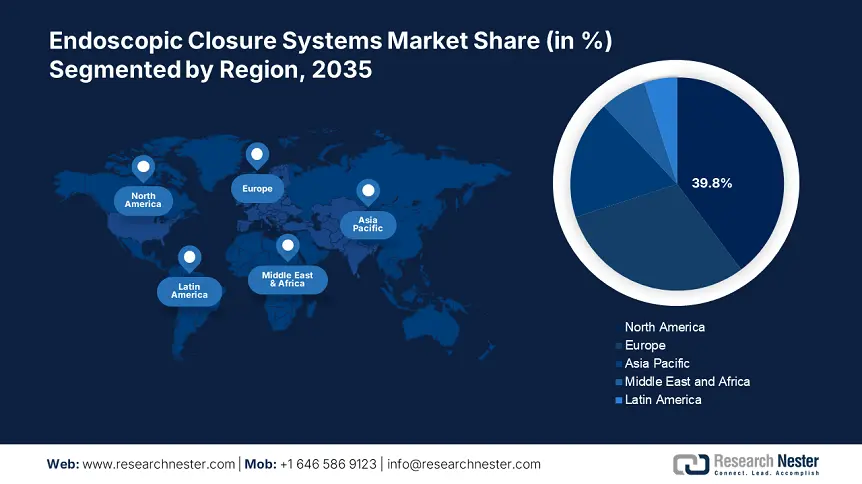

- North America dominates the Endoscopic Closure Systems Market with a 39.8% share, fueled by increasing diagnostic and therapeutic endoscopic procedures and effective reimbursement rules, solidifying its leadership through 2026–2035.

- Asia Pacific's endoscopic closure systems market anticipates substantial growth by 2035, fueled by rising need for gastrointestinal disorder treatments and an aging population.

Segment Insights:

- The Endoscopic Clips segment is projected to capture 40.2% market share by 2035, driven by demonstrated variability, strong efficacy, and innovative deployment mechanisms.

Key Growth Trends:

- Rising incidences of gastrointestinal disorders

- Expansion of endoscopic procedures

Major Challenges:

- Stringent regulatory requirements and approval process

- Competition from alternative surgical approaches

- Key Players: CooperSurgical Inc., US Endoscopy, Life Partners Europe, Ovesco Endoscopy AG, St. Jude Medical Inc. (Abbott).

Global Endoscopic Closure Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 631.2 million

- 2026 Market Size: USD 668.13 million

- Projected Market Size: USD 1.18 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Endoscopic Closure Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Rising incidences of gastrointestinal disorders: One of the strongest market drivers for endoscopic closure system market expansion is increased prevalence of gastrointestinal disease conditions, including peptic ulcer disease, inflammatory bowel disease, and gastrointestinal hemorrhage. For instance, in March 2023, it was revealed by the National Library of Medicine that, gigestive illnesses accounted for 88.99 million DALYs worldwide in 2019 (3.51% of all DALYs) making it the 13th most common cause of DALYs worldwide. Therefore, increasing numbers of patients require more efficient treatment and less invasive procedures.

-

Expansion of endoscopic procedures: The growing use of endoscopic treatments across different specialties is one of the principal drivers for endoscopic closure systems market. For instance, in January 2023, EndoTheia Inc. unveiled that it has been granted priority status by the FDA for its breakthrough device for its technology that significantly enhances minimally invasive flexible endoscopic surgery. Hence, the lower morbidity in patients, cost benefit of endoscopic treatments, and minimally invasive procedure fuel growth, leading to demand for equivalent quality and sophisticated closure devices.

Challenges

-

Stringent regulatory requirements and approval process: A major hurdle to the endoscopic closure systems market is tougher regulatory requirements and time-consuming approval procedures. Ongoing volumes of preclinical and clinical data have to be assembled to deliver evidence of safety and efficacy, which carries high expense and long lead times to the market. In addition, progress through fluctuating and ever-changing regulating environments across geographies renders commercial efforts difficult and can stifle possible clinician adoption of emerging closure technology.

-

Competition from alternative surgical approaches: Other modalities competition is the most formidable challenge to the endoscopic closure systems market. Open and laparoscopic procedures with extensive clinical experience and surgeons' acceptance are the greatest hurdle for newer endoscopic procedures to achieve universal acceptance. In addition, cost-effectiveness and efficiency inherent in traditional methods, especially in complex or large defects, require strong clinical and economic data to prove the effectiveness of endoscopic closure systems.

Endoscopic Closure Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 631.2 million |

|

Forecast Year Market Size (2035) |

USD 1.18 billion |

|

Regional Scope |

|

Endoscopic Closure Systems Market Segmentation:

Type (Endoscopic clips/Endoclips (Over-the-scope Clips), Overstitch endoscopic suturing system, Cardiac septal defect occluders, Endoscopic vacuum-assisted closure systems, Others)

Based on type, the endoscopic clips segment is anticipated to account for around 40.2% endoscopic closure systems market share by 2035. Their established efficacy is based on their demonstrated variability, mechanisms for deploying equipment, and strong efficacy in achieving the primary procedural endpoints. For instance, in March 2025, the unveiling of a new hemostasis clip to help GI endoscopists meet their needs was announced by Olympus. With three distinct sizes to suit a range of closure applications, the RetentiaTM HemoClip offers 360° rotation and an easy one-step deployment, giving you control over placement.

Application (Hospitals, Ambulatory Surgical Centers)

The hospitals segment is projected to garner significant growth traction in the endoscopic closure systems market, due the superiority that comes from the large number of sophisticated diagnostic and therapeutic endoscopic procedures. For instance, in April 2025, CMR Surgical reported that a fundraising round of more than USD 200 million had been successfully closed. With a primary focus on introducing Versius in the US, CMR will use the funding to expedite the commercial expansion of the Versius Surgical Robotic System to additional hospitals worldwide. The sophisticated infrastructure, well-trained medical staff, and institutionalized reimbursement channels that are typical of hospitals also contribute to their superiority.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endoscopic Closure Systems Market Regional Analysis:

North America Market Analysis

North America endoscopic closure systems market is set to hold revenue share of over 39.8% by the end of 2035. The need for endoscopic closure systems is being driven by the increasing number of diagnostic and therapeutic endoscopic procedures, including full-thickness excision of subepithelial tumors, ESD, and EMR. In addition, the expansion is aided by effective reimbursement rules and infrastructure. Furthermore, in most countries within the region, hospitals are considered the main healthcare system and perform a large number of surgeries.

The landscape of the endoscopic closure systems market in the U.S. will be predominantly influenced by the dynamics of regulatory procedures and systems that keep on upgrading the norms and procedures in the medical field. For instance, in May 2024, the revised evidence-based clinical practice guideline on endoscopic eradication therapy of Barrett's Esophagus and Related Neoplasia, released in Gastroenterology by the American Gastroenterological Association (AGA). Hence, such guidelines help the medical practitioners and healthcare professionals in rendering the efficacy during treatments.

In Canada, the endoscopic closure systems market is driven by the stringent competition that exist between the market players to innovate and reveal the new devices and procedures in the field of endoscopy. For instance, in November 2022, PENTAX Medical introduced the new Performance Endoscopic Ultrasound (EUS) system, which combines their top-performing J10 Series Ultrasound Gastroscopes with the new ARIETTA 65 PX ultrasound scanner. Therefore, the market is likely to witness substantial growth over the forecasted timeline.

Asia Pacific Market Statistics

Asia Pacific is expected to witness substantial growth in the endoscopic closure systems market during the forecast timeline from 2025 to 2035. Their vital importance in identifying and treating gastrointestinal disorders, a common health issue globally, highlights the need for ECS. The market is also supported by the aging population, which increases the need for ECS because they are more likely to experience GI problems. Hence, the market is anticipated to witness lucrative opportunities during the coming years.

In the India., the endoscopic closure systems market is propelling due to development of therapeutic devices that are tailored according to the patient need, that provide maximum satisfaction while treatments. In February 2024, Fujifilm introduced the most cutting-edge endoscopic ultrasound machine, the ALOKA ARIETTA 850. It is exceptionally design to improve user interface and greater image quality of pancreatic tumors and other diagnostic services. It was installed for the first time in Fortis Hospital Bengaluru, Karnataka in India.

The endoscopic closure systems market in China is fueled by the focus of the biomarkers in designing procedures to increase surgical efficiency and, eventually, improve patient outcomes. For instance, in September 2021, China has granted enlightenVue, Inc. a patent covering the key technology behind its SurgiVue single-use micro-endoscope platform. Through two working channels with a working diameter of two millimeters, the proprietary technology allowed the endoscope to be used for both diagnostic and therapeutic purposes in a single treatment.

Key Endoscopic Closure Systems Market Players:

- Apollo Endosurgery Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CooperSurgical Inc.

- US Endoscopy

- Life Partners Europe

- Ovesco Endoscopy AG

- St. Jude Medical Inc. (Abbott)

The endoscopic closure systems market is characterized by a competitive environment in which both established competitors and newly formed companies vie for market leadership. Their market position is solidly established by their wide distribution network, extensive product portfolio, and strong brand visibility. For instance, in November 2022, Boston Scientific Corporation announced that it has finalized a deal to purchase Apollo Endosurgery, Inc. at an enterprise value of around USD 615 million. Devices used during endoluminal surgery (ELS) procedures using the Apollo endosurgery product range offered a less intrusive option to open and laparoscopic surgery.

Here’s the list of some key players:

Recent Developments

- In August 2024, CBS highlights arthrex endoscopic spine technology, the Eye on Health in Pittsburgh. The endoscopic spine surgery program at Allegheny Health Network's Wexford Hospital helped patients by using ultra-minimally invasive procedures.

- In May 2023, Olympus Corporation announced that the FDA has approved the new EVIS X1 endoscopy system and two compatible gastrointestinal endoscopes: the CF-HQ1100DL/I colonovideoscope.

- Report ID: 7563

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Endoscopic Closure Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.