Postpartum Hemorrhage Devices Market Outlook:

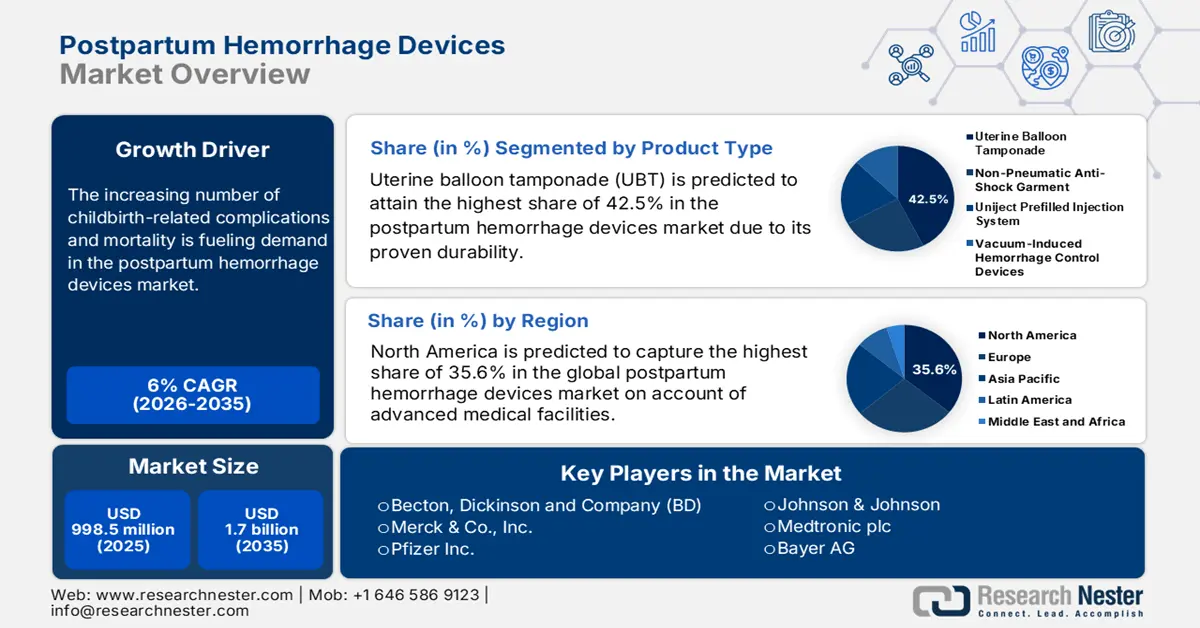

Postpartum Hemorrhage Devices Market size was over USD 998.5 million in 2025 and is estimated to reach USD 1.7 billion by the end of 2035, expanding at a CAGR of 6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of postpartum hemorrhage devices is evaluated at USD 1.3 billion.

The increasing number of childbirth-related complications and mortality is fueling demand in the market. Testifying to the same, in October 2023, the NLM unveiled that approximately 130 million women around the world give birth every year, and 11% of them experience PPH, the leading cause of maternal deaths globally. It also highlighted that 99% of these incidents occur in low and middle-income countries (LMICs), and uterine atony is the origin for nearly 70% of cases. Further, a WHO report published in May 2023 revealed that postpartum hemorrhage (PPH) is the cause of more than 70 thousand fatalities annually.

This demography signifies the growing need for urgent preventive and effective interventions, creating a surge in the postpartum hemorrhage (PPH) devices market. Besides, the cost-effectiveness of these tools is highly desired and validated in highly afflicted regions, where the financial losses due to the occurrences of PPH are significant. As evidence, a study published by the University of Cape Town in June 2024 mentioned that the negative impact of using substandard medicines in Ghana to prevent PPH caused $6.3 million and $4.8 million in out-of-pocket expenditures in the public and private settings. This indicates maximum deployment of safe, efficient, and affordable alternatives that can be delivered through advanced options available in this sector, despite their high payers’ pricing.

Key Postpartum Hemorrhage Devices Market Insights Summary:

Regional Highlights:

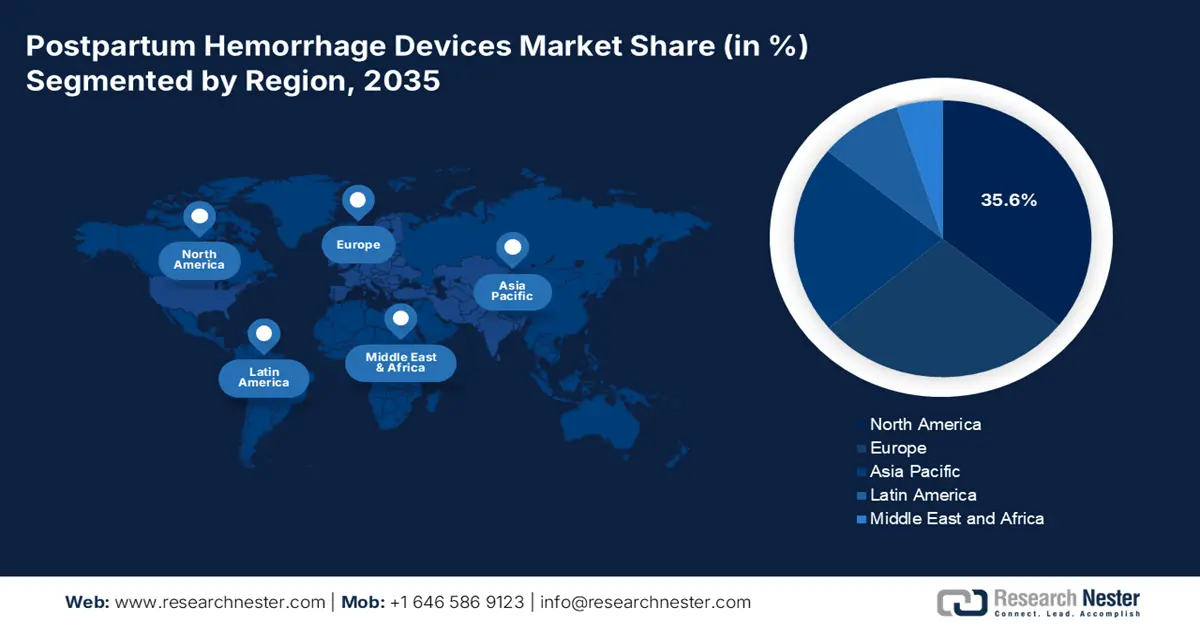

- By 2035, North America is projected to hold a 35.6% share in the postpartum hemorrhage devices market, driven by advanced medical facilities, high childbirth density, and comprehensive reimbursement frameworks.

- Over 2026–2035, Asia Pacific is expected to register the fastest growth, fueled by rising maternal mortality, increasing obstetric complications, and government investments in healthcare infrastructure.

Segment Insights:

- By 2035, the uterine balloon tamponade (UBT) segment is set to secure a 42.5% share, underpinned by its proven clinical effectiveness, minimal invasiveness, and rapid action.

- The hospitals segment is projected to capture 69.2% of the market by 2035, owing to high patient volumes, emergency care readiness, and availability of trained medical staff.

Key Growth Trends:

- Government efforts to secure adequate access

- Rising awareness about the severity of PPH

Major Challenges:

- Competition with affordable alternatives

- Inconsistency in compliance and commercialization

Key Players: Becton, Dickinson and Company (BD), Merck & Co., Inc., Pfizer Inc., Johnson & Johnson, Medtronic plc, Bayer AG, Fresenius SE & Co. KGaA, Siemens Healthineers, Roche Diagnostics, Novartis AG, CSL Limited, Samsung Medison, Boryung Pharmaceutical Co. Ltd., Dr. Reddy’s Laboratories, Lupin Limited, HLL Lifecare Limited, KPJ Healthcare Berhad, Pharmaniaga Berhad, Organon, Medtrade Products Ltd., Olympus Corporation, Terumo Corporation

Global Postpartum Hemorrhage Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 998.5 million

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 1.7 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Italy, Australia

Last updated on : 21 August, 2025

Postpartum Hemorrhage Devices Market - Growth Drivers and Challenges

Growth Drivers

- Government efforts to secure adequate access: Maternal health programs backed by governing authorities play a crucial role in propelling the adoption rates in the PPH devices market. Public medical settings and agencies actively implement initiatives to reduce maternal mortality. In this regard, in October 2024, the Global Health: Science and Practice (GHSP) unveiled a new clinical development and piloting strategy to promote the uptake of E-MOTIVE intervention for early PPH detection and management in Kenya, Nigeria, South Africa, and Tanzania. These programs offer complete guidelines, training, and financial support to improve postpartum care, prompting more healthcare providers to integrate effective PPH devices into clinical practice.

- Rising awareness about the severity of PPH: As dedicated professionals around the globe increasingly gain knowledge about the available treatment options, they remarkably contribute to the expansion of the postpartum hemorrhage devices market. The efforts to spread education about effective management of PPH are growing stronger through clinical guidelines, training programs, and quality improvement initiatives. As evidence, in a 2023 report, the WHO reported a 60% reduction in deaths due to severe bleeding from the use of low-cost collection devices and recommended treatments. These efforts to promote widespread implementation improve the competency of medical staff in recognizing the efficacy of advanced hemorrhage control tools.

- Ongoing advancements improving outcomes: Tech-based discoveries are one of the major influencing factors behind the consistent progress of the PPH devices market. This can be testified by the development of a wearable optical device utilizing laser speckle imaging for early detection of PPH during labor or after childbirth. This wrist-worn device offers consistent monitoring of blood flow to identify indicative decreases before symptoms become apparent. Initial tests in swine models demonstrated a strong correlation between the device's readings and blood loss volumes, as updated by the OPTICA in September 2023. Such innovations are enhancing access in both resource-rich and constrained settings by offering a promising solution for reducing maternal deaths.

Historic Demographics and Dynamics in the Postpartum Hemorrhage Devices Market

Birth Volume and Geographic Distribution of US Hospitals with Obstetric Services (2010-2018)

|

Category |

Count / Percentage |

|

Total hospital-years of data |

26,900 |

|

Distinct US hospitals with obstetric services |

3,207 |

|

Total associated births |

34,054,951 |

|

Infants born in hospitals with >2000 births/year |

19,327,487 (56.8%) |

|

Infants born in low-volume hospitals (10-500 births/year) |

2,528,259 (7.4%) |

|

Low-volume hospitals (hospital-years) |

10,064 (37.4%) |

|

States with obstetric hospitals in all volume categories |

46 states |

|

Low-volume hospital-years not within 30 miles of any other obstetric hospital |

1,904 (18.9%) |

|

Low-volume hospital-years within 30 miles of a hospital with >2000 deliveries/year |

2,400 (23.9%) |

|

Isolated hospitals (no obstetric hospital within 30 miles) that are low volume |

1,112 (58.4%) of isolated hospitals |

|

Isolated low-volume hospitals located in noncore rural areas |

Majority of the 1,112 isolated hospital-years (58.4%) |

Source: NLM

Differentiation in the Effectiveness of Currently Available Products in the Market

Comparative Analysis of Effectiveness Between PPH Medications and Devices

|

Treatment Type |

Effectiveness Rate / Outcomes |

Key Points |

Limitations / Considerations |

Year |

|

Carbetocin (medication) |

Comparable to oxytocin |

preventing uterine atony; longer uterotonic duration |

May have fewer adverse effects than oxytocin |

2022

|

|

Tranexamic Acid (medication) |

Effective adjunct treatment |

Helps reduce bleeding by promoting clot stability |

Contraindications include active thromboembolism |

2023

|

|

Uterine Balloon Tamponade (UBT) (device) |

~85.9% success rate in hemorrhage resolution |

Highly effective especially in uterine atony-related PPH |

Requires monitoring post-placement; backup surgical options needed |

2024

|

|

Uterine Compression Sutures (e.g., B-Lynch) (device/procedure) |

~75% effectiveness in bleeding control |

Effective surgical approach for refractory PPH |

Requires surgical expertise; risks include uterine scarring, adhesions |

2024 |

Source: IJRCOG and NLM

Challenges

- Competition with affordable alternatives: Despite the clinical advantages, the postpartum hemorrhage (PPH) devices market still lacks in competency with the comprehensive pricing ranges of medications. Besides, the government's push to make treatment more accessible often shrinks the scope of profitability for advanced solutions available in this sector. As a result, manufacturers and MedTech pioneers often hesitate to invest and participate in extensive R&D cohorts, limiting innovations and globalization of the merchandise.

- Inconsistency in compliance and commercialization: Manufacturers and innovators in the PPH devices market often witness difficulty in maintaining alignment with the evolving regulatory standards of individual regional frameworks. Despite the help from compliance under government programs, fragmented national requirements and ongoing updates still slow the pace of new product launch in key landscapes. Besides, the fragility of the supply chain also hinders the sector's potential to globalize its pipelines, as the cost of production and distribution increases.

Postpartum Hemorrhage Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 998.5 million |

|

Forecast Year Market Size (2035) |

USD 1.7 billion |

|

Regional Scope |

|

Postpartum Hemorrhage Devices Market Segmentation:

Product Type Segment Analysis

Uterine balloon tamponade (UBT) is predicted to attain the highest share of 42.5% in the postpartum hemorrhage devices market over the assessed timeline. The dominance originates from its proven durability, less invasiveness, and rapid efficacy. Testifying to the same, in February 2023, a mixed-methods, prospective, implementation research study was published by the NLM, underscoring the success rates of UBTs in treating PPH ranged between 84% and 97%. It also reported the same outcomes from both volume-controlled and pressure-controlled UBTs. Besides, in 2021, the WHO also recognized the potential of UBTs as a second-line therapy for PPH due to uterine atony in the absence of response from first-line therapies. This cumulative force of clinical effectiveness and validation solidified the segment's leading position in the market.

End user Segment Analysis

Hospitals are expected to maintain their position as the dominant field of application in the postpartum hemorrhage devices market, while capturing 69.2% share by the end of 2035. Their prominence in this sector is primarily empowered by the high volume of patients, critical emergency infrastructure, and the availability of trained medical staff. Evidencing the same, the Centers for Disease Control and Prevention (CDC) unveiled that, in 2023 alone, 97.6% of childbirths in the U.S. took place in these institutions, totaling 3.5 million. Additionally, being equipped to employ advanced interventions promptly and effectively solidifies the segment's leadership in this field.

Condition Segment Analysis

Major PPH (> 1000 mL) is poised to secure a significant share in the postpartum hemorrhage devices market throughout the discussed timeframe. The segment's dominance over clinical use and revenue generation in this field is highly attributable to its frequent occurrence, severity, and mortality rates. Evidencing the same, a 2022 journal of Best Practice & Research Clinical Anaesthesiology unveiled that severe or major PPH occurs in around 1–2% of deliveries and is a leading cause of maternal mortality and morbidity worldwide. Moreover, the growing trend of healthcare modernization and medical device innovations is improving patient access in this category, and hence, propelling the scale of adoption in this segment.

Our in-depth analysis of the postpartum hemorrhage devices market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Condition |

|

|

Patient Type |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Postpartum Hemorrhage Devices Market - Regional Analysis

North America Market Insights

North America is predicted to capture the highest share of 35.6% in the global PPH devices market during the analyzed tenure. The presence of advanced medical facilities and a high density of childbirths in hospitals facilitates the region's dominance in this sector. Besides, comprehensive reimbursement frameworks and robust federal investments are collectively minimizing the financial barriers to accessing PPH treatments, which ultimately enhances the cash inflow in this sector. As evidence, in 2025, the American Hospital Association (AHA) unveiled that Medicaid was covering for over 40% of births in the U.S., including nearly 50% of births in rural communities. The report also identified this backing as the vital source of prenatal and postpartum care for women across the country.

The U.S. is augmenting the postpartum hemorrhage devices market with the enlarging patient pool and technological advancements. The regulatory and clinical authorities in the country also provide immense support by enabling accelerated clearances. Exemplifying the same, in September 2023, the American College of Obstetrics and Gynecology (ACOG) released promising outcomes from the RUBY study, evaluating the efficacy of the JADA System. It analyzed the user experience of the product, collected 800 eligible candidates from 16 hospitals in the U.S. and unveiled that the time to control bleeding to be just 5 minutes in 73.8% of vaginal births.

In Canada, the postpartum hemorrhage devices market is gaining momentum, particularly following the approval of the JADA System in February 2024, as testified by the press release of Organon. This vacuum-based tamponade device introduced a novel, conservative treatment option for PPH, which aligns perfectly with the increasing and evolving needs. Moreover, the country's efforts to secure optimum maternal safety and convenience are escalating the scale of infrastructural reinforcement in Canada, where the enhanced outcomes from PPH management with devices are propelling adoption in this sector.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global postpartum hemorrhage devices market by the end of 2035. This robust pace of propagation originates from the rising maternal mortality due to prevalent complications, such as multiple pregnancies and inverted uterus. The demography can also be testified by the WHO report, underscoring Southern Asia as the source of 17% of global maternal deaths in 2023. This is heightening the demand for advanced obstetric equipment and hence, fueling this sector. Governments across the region are also contributing to the sector's continuous expansion by investing more heavily in dedicated healthcare infrastructure and awareness.

China is maintaining a strong position in the APAC PPH devices market on account of its large patient population and government-led healthcare reinforcement programs. In this regard, the 2025 NLM report unveiled that the incidence rate of PPH in this country ranges between 2.88% and 15.4%. Furthermore, supportive government initiatives include the partnership formation between the Government of China and UNICEF in February 2025, which was aimed at improving maternal and child health. These systemic enhancements in maternity care provision are consolidating the nation's position in this sector.

Despite the significant reduction in maternal mortality rate (MMR) in India, PPH remains a pressing public health concern, especially in high-burden states. Thus, the governing body of the country continues to invest in the postpartum hemorrhage devices market through initiatives such as Janani Shishu Suraksha Karyakaram (JSSK). Moreover, the leveraged volume of community service networks, including the ASHAs under the National Health Mission (NHM), is improving institutional deliveries and early PPH management, which ultimately benefits the landscape.

Country-wise Government Efforts Benefiting the Market

|

Country |

Policy / Investment Name |

Launch Year |

|

Australia |

Maternity in Focus: The ACT Public Maternity System Plan (2022-2032) |

2022 |

|

Malaysia |

Maternal and Child Health Programme (latest update) |

2022/2023 |

|

South Korea |

Childbirth Expenses for Deliveries Outside Medical Institutions (Provision of 250,000 won per individual for childbirth related expenses) |

2023 |

Source: ACT Government, NHMS 2022, and Korea Institute of Child Care and Education

Europe Market Insights

Europe is poised to showcase steady growth in the postpartum hemorrhage devices market while consolidating its position as the second-largest shareholder during the timeline between 2026 and 2035. The region's augmentation in this sector is highly attributed to targeted government initiatives, technological innovations, and evolving regulatory frameworks. Exemplifying such a favorable atmosphere, in November 2022, Medtrade Products earned CE certification for its CELOX PPH Uterine Haemostatic Tamponade. The approval was based on the extensive clinical evaluation conducted by the Department of Obstetrics at the Charité University Hospital in Berlin, which identified the product to be highly effective in the control and treatment of uterine PPH.

Germany is a leading contributor to the Europe postpartum hemorrhage (PPH) devices market, which is backed by its robust healthcare infrastructure and MedTech innovations. The high volume of hospital deliveries also facilitates an increase in the adoption of advanced medical technologies available in this sector. Further, as a testimony of the large patient pool and value-based implementation, a real-world study was published by the European Journal of Obstetrics & Gynecology and Reproductive Biology in 2024, which demonstrated the success rate of hemorrhage termination through the Jada system across Germany to be 92.5%.

The UK plays a pivotal role in solidifying the regional progress in the postpartum hemorrhage devices market. The well-established healthcare infrastructure and national focus on maternal health are collectively empowering the country's propagation in this sector. In support of the same, the National Health Service (NHS) has implemented guidelines promoting the use of effective PPH management devices, such as UBT, to reduce maternal morbidity and mortality. Government initiatives also include investments in the development of innovative PPH devices that are designed to be used across hospitals and maternity centers.

Government Provinces in Maternity Health

|

Country |

Medium |

Objective |

Allocation Amount |

|

Spain |

UNFPA, the United Nations sexual and reproductive health agency (2025) |

Advance women’s and girls’ reproductive rights and maternal health |

€5 million |

|

Switzerland |

The Swiss Agency for Development and Cooperation (SDC) (2024) |

Reduce mortality rates among mothers and children under the age of five |

CHF 11.9 million |

|

France |

UNFPA Supplies (2025) |

Reduce maternal mortality and avail necessary resources |

€72 million |

Source: UNFPA and FDFA

Key Postpartum Hemorrhage Devices Market Players:

- Becton, Dickinson and Company (BD)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co., Inc.

- Pfizer Inc.

- Johnson & Johnson

- Medtronic plc

- Bayer AG

- Fresenius SE & Co. KGaA

- Siemens Healthineers

- Roche Diagnostics

- Novartis AG

- CSL Limited

- Samsung Medison

- Boryung Pharmaceutical Co. Ltd.

- Dr. Reddy’s Laboratories

- Lupin Limited

- HLL Lifecare Limited

- KPJ Healthcare Berhad

- Pharmaniaga Berhad

- Organon

- Medtrade Products Ltd.

- Olympus Corporation

- Terumo Corporation

The competitive landscape in the postpartum hemorrhage (PPH) devices market is evolving with the discoveries of innovative solutions aimed at improving maternal health outcomes. For instance, in July 2025, Organon received inclusion on the Australian Register of Therapeutic Goods (ARTG 475806) for its JADA System, which established a strong foundation for the company in controlling and treating abnormal postpartum uterine bleeding due to suspected atony. Currently, the key players are engaging in extensive R&D cohorts to expand their territory in this category.

Such key players include:

Recent Developments

- In September 2024, Organon Canada announced the availability of the JADA System to provide control and treatment of abnormal postpartum uterine bleeding or hemorrhage when conservative management is warranted. This marked an important milestone in the company’s ethos to be Here for Her Health.

- In April 2023, Medtrade signed an exclusive agreement with KEBOMED Europe to distribute the revolutionary CELOX PPH Uterine Haemostatic Tamponade across France and the UK. In support of KEBOMED’s network of customers in the field of obstetrics and gynaecology, the company extended its territory towards clinicians.

- Report ID: 8014

- Published Date: Aug 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.