COPD and Asthma Drug Devices Market Outlook:

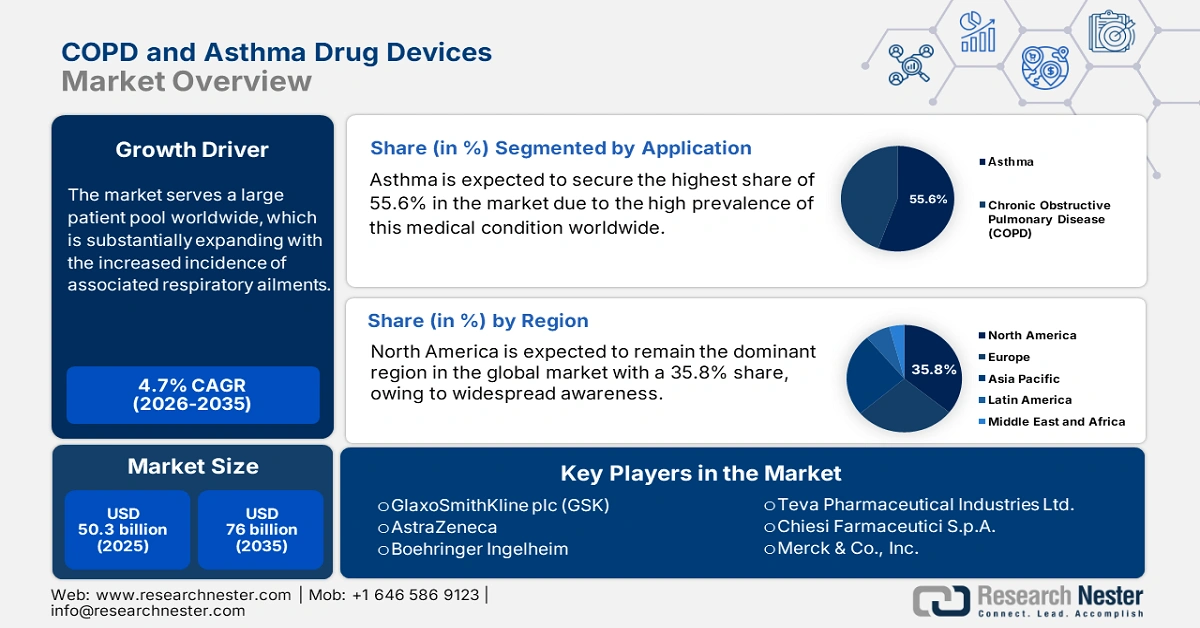

COPD and Asthma Drug Devices Market size was over USD 50.3 billion in 2025 and is estimated to reach USD 76 billion by the end of 2035, expanding at a CAGR of 4.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of COPD and asthma drug devices is assessed at USD 52.6 billion.

The market serves a large patient pool worldwide, which is substantially expanding with the increased incidence of associated respiratory ailments. In this regard, an NLM study estimated the number of COPD cases across the globe to reach 600 million by 2050, showcasing a 23% rise from 2020. Besides, the amplification of the high-risk population due to aging, smoking, and pollution is also creating a surge in early diagnosis and treatment. Testifying to this demography, the World Health Organization (WHO) identified tobacco smoking as the underlying cause of 30-40% of COPD in the world, where 90% of deaths from this disease among people aged under 70 occurred in low- and middle-income countries (LMIC).

Source: NLM

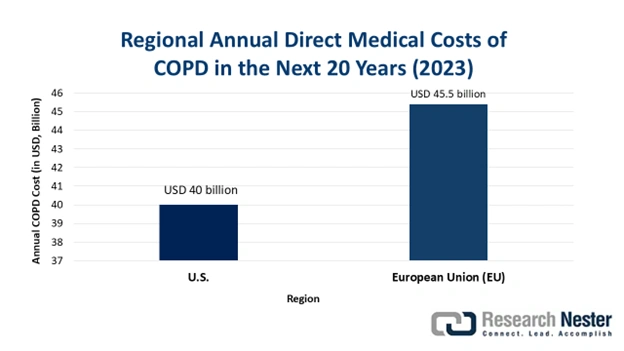

According to the 2023 NLM findings, the global economic burden of COPD is poised to increase to USD 4.3 trillion from 2020 to 2050, where the U.S. and China are considered to be the largest contributors with USD 1.3 trillion and USD 1 trillion, respectively. This describes the growing demand for cost-effective treatment practices, eliminating the additional expenses of hospitalization, drug administration, and patient management. It is creating new opportunities for suppliers in the market to distinguish their significance internationally. Following the same pathway, in June 2024, Boehringer initiated a program to make its inhalers available at a monthly cost of USD 35 only, solidifying the company’s presence among a vast majority seeking comprehensive payers’ pricing.

Key COPD and Asthma Drug Devices Market Insights Summary:

Regional Insights:

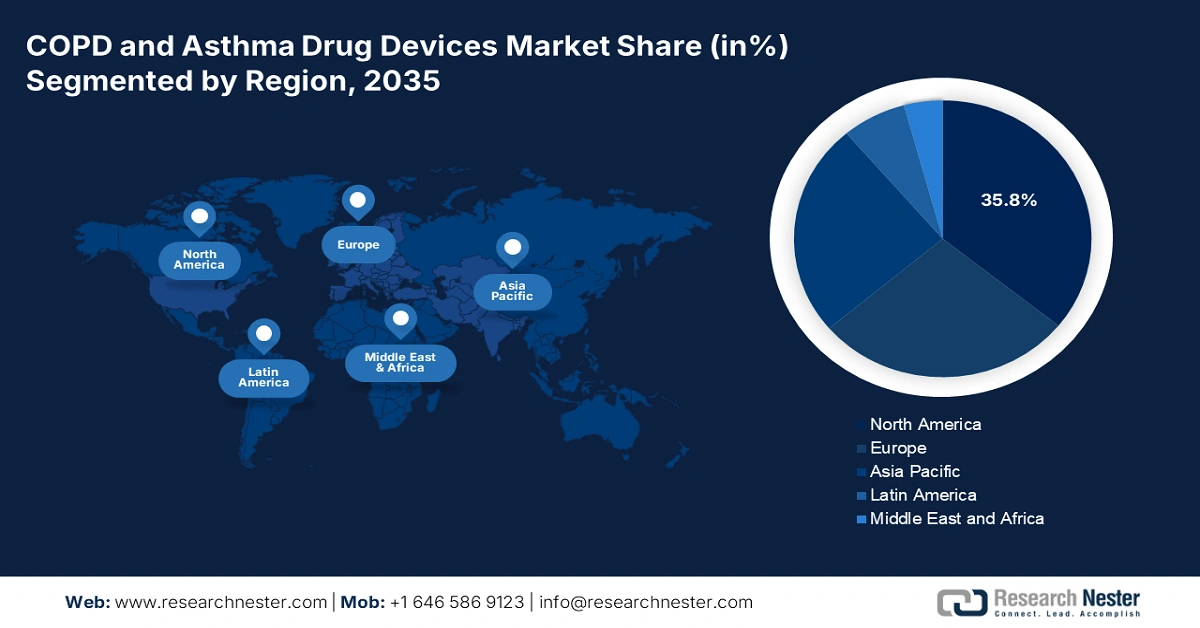

- North America is expected to dominate the COPD and Asthma Drug Devices Market with a 35.8% share by 2035, bolstered by advanced healthcare infrastructure, high respiratory disease prevalence, and growing adoption of smart and combination inhaler technologies.

- Asia Pacific is forecast to register the fastest growth by 2035, attributed to rapid urbanization, increasing air pollution, and expanding manufacturing capabilities in affordable inhaler technologies.

Segment Insights:

- The Asthma segment in the COPD and Asthma Drug Devices Market is projected to capture a 55.6% share by 2035, propelled by the rising global prevalence of asthma and growing diagnosis rates among pediatric and young adult populations.

- The Inhalers segment is expected to hold the leading share by 2035, driven by the accelerating adoption of dry powder inhalers (DPIs) supported by eco-friendly regulations and enhanced patient convenience.

Key Growth Trends:

- Increasing demand for associated medicines

- Innovation in drug delivery methods and tools

Major Challenges:

- Payer prioritization and enforced price caps

- Environmental regulations on propellants

Key Players: GlaxoSmithKline plc (GSK), AstraZeneca, Boehringer Ingelheim, Teva Pharmaceutical Industries Ltd., Chiesi Farmaceutici S.p.A., Merck & Co., Inc., Novartis AG (Sandoz), Philips Respironics, Pfizer Inc., Cipla Ltd., Sanofi, Viatris (Mylan), Glenmark Pharmaceuticals, Lupin Limited, Hikma Pharmaceuticals PLC, AptarGroup, Inc., 3M Company, Vectura Group (PMI), Covis Pharma, Adherium Limited.

Global COPD and Asthma Drug Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 50.3 billion

- 2026 Market Size: USD 52.6 billion

- Projected Market Size: USD 76 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 22 September, 2025

COPD and Asthma Drug Devices Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing demand for associated medicines: As the epidemiology of respiratory diseases amplifies, the urge to procure effective therapeutics at a large scale becomes more evident in highly afflicted regions. Moreover, the continuous expansion of the global asthma and COPD drugs industry is fueling continuous growth in this sector. The ongoing emergence of combination therapies and patient-centric developments is also benefiting the merchandise with greater patient adherence and adoption rates. As evidence, in July 2023, Viatris, in alliance with Kindeva, commercially launched its drug-device combination product, Breyna, to secure a forefront position in the market.

-

Innovation in drug delivery methods and tools: Recently developed cutting-edge technologies, such as dose monitoring, alarming systems, and iOS connectivity, are attracting lucrative cash inflow in this sector by streamlining patient care. New models introduced by the market now offer Bluetooth connectivity, real-time usage tracking, and integration with mobile apps, making disease management more convenient. For instance, in February 2022, Aptar Pharma unveiled a novel digital respiratory health solution, HeroTracker Sense, designed to monitor and control patient inhalation technique and adherence.

- Government initiatives and allocations: Several public health organizations are ramping up their efforts to combat the widespread respiratory illnesses, which support the market with sustainable capital influx. Particularly, through awareness campaigns, screening programs, and subsidized treatments, governing authorities are promoting higher utilization of products available in this sector. Besides, national health schemes, favorable regulatory updates, and widening insurance coverage are enhancing availability and affordability for related therapies, while prompting participation in R&D for better respiratory care.

Historic and Projected Trends in the Patient Pool of the COPD and Asthma Drug Devices Market

Past and Future Trends in Key Regional COPD Demographics (2020-2050)

|

Region |

Trend/Key Notes |

|

North America |

2020 prevalence rate 16.8%; Expected to increase among males by 2050 |

|

Sub-Saharan Africa |

Among females, a 62.5% rise is predicted in case numbers from 2020 to 2050 |

|

East Asia & Pacific |

A decrease of 12 million in total COPD cases is expected from 2020 to 2050 |

|

South Asia |

Poised to witness the highest number of COPD cases by 2050, totaling 109 million |

Source: NLM

Past and Current Commercial Trends in the Key COPD and Asthma Drug Devices Markets

Estimated HFC Propellant Sold in MDIs in the U.S. (2020-2025)

|

Year |

HFC-134a (Metric Tons) |

HFC-227ea (Metric Tons) |

Total HFC Sold (Metric Tons) |

|

2020 |

1,284 |

207 |

1,491 |

|

2021 |

1,301 |

210 |

1,511 |

|

2022 |

1,319 |

213 |

1,532 |

|

2023 |

1,337 |

216 |

1,552 |

|

2024 |

1,355 |

219 |

1,574 |

|

2025 |

1,373 |

222 |

1,595 |

Challenges

-

Payer prioritization and enforced price caps: Most of the public and private payers operate under restrictive budgets, pushing them to prioritize established and affordable therapies over newer and more effective options. These payer formularies are not always optimized to cover devices that may reduce the economic burden of disease management, forcing suppliers to rely on patient co-pays. As a result, manufacturers in the market often are discouraged from innovation, limiting the scope of future expansion.

-

Environmental regulations on propellants: The impact of hydrofluoroalkane (HFA) propellants used in pressurized metered-dose inhalers (pMDIs) on the environmental well-being is a growing concern for governments. In response, the EU enacted the updated F-Gas regulation, which aims to phase down HFA use, creating a notable barrier for this segment. Besides, this forces manufacturers to invest heavily in R&D to reformulate existing products or develop new delivery platforms that meet these new environmental standards, increasing the overall production budget and limiting profitability.

COPD and Asthma Drug Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 50.3 billion |

|

Forecast Year Market Size (2035) |

USD 76 billion |

|

Regional Scope |

|

COPD and Asthma Drug Devices Market Segmentation:

Application Segment Analysis

Asthma is expected to secure the highest share of 55.6% by the end of 2035 in the market. The high prevalence of this medical condition is the primary driver behind the segment's dominance in revenue generation from this sector. According to a survey report, more than 250 million people worldwide were living with asthma in 2025. This creates a massive, sustained addressable patient pool requiring daily controller and rescue medications. Furthermore, the amplifying diagnosis rate in pediatric and young adult populations compared to COPD ensures a long-term user base for the market, solidifying the segment’s leading position for the upcoming years.

Product Type Segment Analysis

Inhalers are anticipated to account for the dominant share in the market over the analyzed tenure. The rapid shift towards DPIs is gaining momentum due to their alignment with evolving environmental regulations and patient convenience. In support of this transition, the push from governing authorities regarding eco-friendly medical practices is accelerating the adoption of propellant-free DPIs. On the other hand, these tools are highly breath-actuated, eliminating the need for hand-breath coordination. These improvements in user experience and potential drug delivery efficacy are restoring the segment’s position in this sector as a preferred choice for both patients and service providers.

Distribution Channel Segment Analysis

Retail pharmacies are poised to hold the largest share of 48.8% in the market throughout the discussed timeframe. This dominance is largely attributed to their wide network across key landscapes, the convenience of purchasing, and the trust of patients in being local distributors. Moreover, their awareness about current usage and medication guidelines helps them maintain a steady cash inflow and compliance. Besides, the enhanced availability of generic and over-the-counter (OTC) therapeutics and quick prescription refills reinforces their central position in the supply chain for these devices.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

COPD and Asthma Drug Devices Market - Regional Analysis

North America Market Insights

North America is expected to remain the dominant region in the global market by holding the largest share of 35.8% during the assessed timeline. The combined effect of high respiratory disease occurrence and advanced healthcare infrastructure is consolidating the region’s leadership in this field. The widespread awareness, improved insurance coverage, and easy access to OTC pharmaceuticals are also contributing to the predominant augmentation of North America in this sector. Besides, tech-based discoveries, including smart and combination drug devices, are securing a prosperous future for this landscape.

Substantial investments in research and development, coupled with supportive regulatory frameworks, fuel regional proprietorship of the U.S. in the COPD and asthma drug devices market. The expanding geriatric demography and increasing urban pollution further contribute to a sustainable consumer base in the country. The progressive nature of the nation in this category can also be exemplified by the streamlined release of FDA clearance for a complex generic drug-device combination product, Symbicort, in March 2022. This metered-dose inhaler marked a milestone for the U.S. market by enabling affordability for asthma and COPD patients.

Canada also plays a pivotal role in propelling growth in the North America market. The country’s participation in this sector is primarily supported by strong capital influx from public healthcare organizations and a growing focus on respiratory health. As the occurrence of chronic respiratory conditions increases nationwide, both governing bodies and afflicted individuals are paying out-of-pocket to procure advanced inhaler devices, including combination therapies. Testifying to the same, a cross-sectional study published by the NLM revealed that public payer spending on respiratory inhalers in Ontario, Canada rose by 160% from 2003 to 2023.

APAC Market Insights

The rising disposable incomes and a large patient pool in China are collectively boosting the growth rate of the APAC COPD and asthma drug devices market. Besides, due to being a dominant supplier of essential APIs and other raw materials, the country becomes a suitable landscape for global manufacturers in this sector who are seeking less-expensive ways of producing effective respiratory drug devices. The nation also benefits from ongoing government initiatives focused on early diagnosis and management of associated diseases, making it the regional epicenter of expansion.

India is considered one of the most attractive opportunities for investors in the market. High levels of air pollution, tobacco use, and occupational hazards are the primary propellants of demand in this sector. Particularly, in urban and semi-urban areas, governing bodies are promoting the use of inhalers to combat the rising cases of deaths related to these ailments in India. Moreover, the broadening network of retail pharmacies in India is also securing a reliable distribution channel for both domestic and foreign pioneers in this sector.

Feasible Opportunities for the Market in Key Landscapes

|

Country |

Opportunity |

Timeline |

|

India |

Less than 10% of the inhaled corticosteroids (ICS) needed for its 34.2 million asthma patients were being sold |

2024 |

|

China |

Over 2 million people die every year due to air pollution; ambient air pollution alone caused more than 1 million deaths |

2025 |

|

Australia |

USD 1.4 million allocation to Asthma Australia to implement a national asthma health literacy campaign for families and children |

2025 |

Source: NLM, WHO, and NAC Australia

Europe Market Insights

Europe is poised to represent a mature and well-regulated landscape for the global COPD and asthma drug devices market during the timeline between 2026 and 2035. Advanced medical systems and strong public health policies are the primary growth engines for the region in this sector. High awareness levels, early diagnosis programs, and widespread use of maintenance therapies also contribute to sustained demand for inhaler devices across. On the other hand, consistent reimbursement coverage and improving access to innovative drug-device combinations are fostering a progressive atmosphere in Europe for the market.

The growing focus of the UK on reducing greenhouse gas emissions is cultivating R&D interest in environmentally friendly alternatives, empowering the current dynamics and future development cohorts in the COPD and asthma drug devices market. As evidence, in May 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) gave clearance to a triple combination inhaler for adults with moderate to severe COPD. The low-carbon version of Trixeo Aerosphere uses HFO-1234ze(E) as its propellant, while being similarly safe and effective.

The active involvement of Germany in clinical research and innovation supports large-scale uptake of next-generation products from the COPD and asthma drug devices market. Moreover, the country’s strong emphasis on MedTech innovation is reinforcing its position within the Europe territory. Currently, with both domestic and international companies contributing to product development, Germany is becoming the epicenter of the growing interest in sustainable inhaler technologies, prompting more domestic and international pioneers to invest in this sector.

Feasible Opportunities Across Key Landscapes

|

Country |

Opportunity |

Timeline |

|

UK |

More than 1.2 million people in the country are suffering from COPD |

2025 |

|

Germany |

Over 18.6 million people living nationwide were aged 65 and over |

2022 |

|

Sweden |

AstraZeneca completed the clinical programme to support the transition of Breztri to next-generation propellant with near-zero Global Warming Potential |

2024 |

Source: GOV.UK, NLM, and Company Press Release

Key COPD and Asthma Drug Devices Market Players:

- GlaxoSmithKline plc (GSK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca

- Boehringer Ingelheim

- Teva Pharmaceutical Industries Ltd.

- Chiesi Farmaceutici S.p.A.

- Merck & Co., Inc.

- Novartis AG (Sandoz)

- Philips Respironics

- Pfizer Inc.

- Cipla Ltd.

- Sanofi

- Viatris (Mylan)

- Glenmark Pharmaceuticals

- Lupin Limited

- Hikma Pharmaceuticals PLC

- AptarGroup, Inc.

- 3M Company

- Vectura Group (PMI)

- Covis Pharma

- Adherium Limited

The commercial dynamics of the COPD and asthma drug devices market are becoming highly competitive, where pioneers capitalize on global expansion and tech-based advances. Exemplifying the same, in March 2025, Aerogen solidified its position in Asia by opening its India headquarters in Delhi, signaling its commitment to emerging landscapes. On the other hand, Adherium advanced digital respiratory care through a major partnership with Intermountain Health in the U.S., deploying 4,000 Hailie Smartinhalers and onboarding over 500 patients. These developments reflect the growing focus on connected devices, global expansion, and strategic collaborations to enhance patient outcomes and cash inflow.

Such key players are:

Recent Developments

- In April 2024, Adherium attained FDA approval for use of its innovative Hailie Smartinhaler with AstraZeneca's Airsupra and Breztri inhalation devices. The development marked a significant milestone in the field of management of asthma and COPD.

- In April 2024, Chiesi started a long-term phase III clinical safety trial for the new carbon minimal inhalers platform. This study intended to evaluate the product’s ability to replace the current hydrofluorocarbon propellant (HFC 134a) with a new, low global warming potential propellant (HFC 152a).

- Report ID: 8114

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

COPD and Asthma Drug Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.