Pulmonary Drug Delivery Systems Market Outlook:

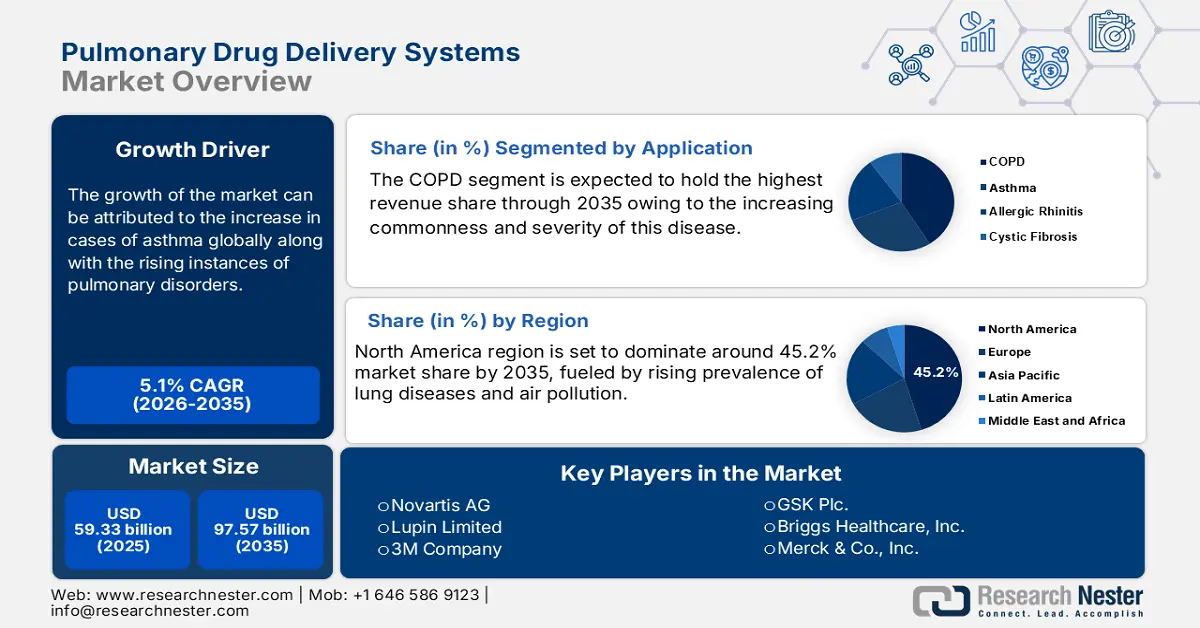

Pulmonary Drug Delivery Systems Market size was valued at USD 59.33 Billion in 2025 and is likely to cross USD 97.57 Billion by 2035, expanding at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pulmonary drug delivery systems is assessed at USD 62.05 Billion.

The growth of the market can be attributed to the surge in cases of asthma worldwide, coupled with increasing instances of pulmonary disorders, and growing funding from government and private organizations for better therapy management across the globe. People are now becoming more aware of these diseases and disorders, which is further expected to fuel the market over the forecast period. According to the World Health Organization, an estimated 262 million people suffered from asthma around the world in 2019 and it caused 455 000 deaths.

Global pulmonary drug delivery systems market trends such as, technological advancements in the pharmaceutical industry, increasing consumption of tobacco and smoking, backed by exposure to air pollution, along with development in drug delivery systems owing to growing health care spending are anticipated to fuel market growth during the forecast period. For instance, in February 2022, AptarGroup, Inc. launched HeroTracker Sense, a smart connected respiratory health device, that transforms a standard metered dose inhaler (pMDI) into a digital respiratory health tool. Hence, all these factors are anticipated to boost the market’s growth over the forecast period.

Key Pulmonary Drug Delivery Systems Market Insights Summary:

Regional Highlights:

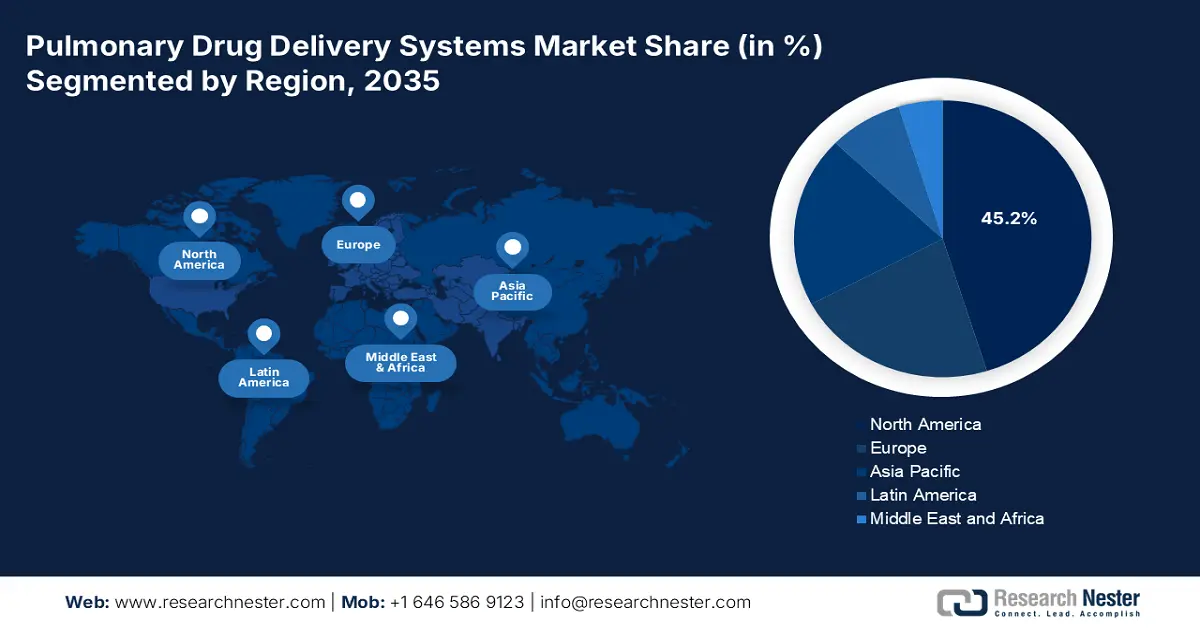

- The North America pulmonary drug delivery systems market is predicted to capture 45.2% share by 2035, fueled by rising prevalence of lung diseases and air pollution.

Segment Insights:

- The copd (application) segment in the pulmonary drug delivery systems market is anticipated to secure the largest share by 2035, fueled by increasing COPD cases and subsidized treatments globally.

- The nebulizers segment in the pulmonary drug delivery systems market is projected to achieve a significant share by 2035, influenced by their traditional use and global demand for respiratory treatment devices.

Key Growth Trends:

- Rising Prevalence of Chronic Respiratory Diseases as Air Pollution is Increasing

- Increase in the Number of Hospitals and Diagnostic Centers with Growing Awareness of People about Early Diagnosis

Major Challenges:

- Rising Prevalence of Chronic Respiratory Diseases as Air Pollution is Increasing

- Increase in the Number of Hospitals and Diagnostic Centers with Growing Awareness of People about Early Diagnosis

Key Players: Novartis AG, Lupin Limited, Briggs Healthcare, Inc., Boehringer Ingelheim International GmbH, Koninklijke Philips N.V., Merck & Co., Inc., 3M Company, AstraZeneca PLC, GSK plc, GF Health Products, Inc.

Global Pulmonary Drug Delivery Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 59.33 Billion

- 2026 Market Size: USD 62.05 Billion

- Projected Market Size: USD 97.57 Billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Pulmonary Drug Delivery Systems Market Growth Drivers and Challenges:

Growth Drivers

- Rising Prevalence of Chronic Respiratory Diseases as Air Pollution is Increasing - For instance, in 2019 chronic respiratory diseases accounted for more than 260,400 deaths in men and nearly 250,700 deaths in women in the United States. Chronic respiratory diseases such as obstructive pulmonary disease (COPD) and asthma are commonly treated with pulmonary devices that deliver medication to the respiratory tract, such as inhalers. These medications are used to prevent exacerbations of chronic conditions and to treat them. Thus, the rising prevalence of respiratory diseases is anticipated to propel the demand for pulmonary drug delivery devices during the forecast period.

- Increase in the Number of Hospitals and Diagnostic Centers with Growing Awareness of People about Early Diagnosis - In the year 2021-22, Foreign Direct Investment (FDI) fund infusion into hospitals and diagnostic centers in India increased by 37% to USD 690 million.

- Continuous Rise in COVID – 19 Cases Worldwide that Affected the Lungs of the People - For instance, the United States averaged nearly 30,000 new cases of COVID-19 every day in April 2022, 2% more than in previous weeks.

- Increasing Air Pollutants Owing to Rising Industrialization and Urbanization - World Health Organization (WHO) statistics show that in 2018, 9 out of 10 people worldwide inhaled polluted air. There are about 7 million deaths each year from chronic obstructive pulmonary diseases caused by exposure to fine particles in polluted air across the globe.

- Rise in Exports of Medical Appliances with Increasing Improvement and Advancements in Healthcare Sector - According to the statistics by the International Trade Center (Trademap), the global value of exports of medical appliances in the year 2021 was recorded to be USD 14,170,931 thousand, which was an increase from USD 12,754,842 thousand in the previous year.

Challenges

- Presence of Alternative Drug Delivery Systems

- Strict Government Regulations of Product Approval

- Side Effects Related to Long Term Use of the Product- The change in humidity, airway geometry, mucociliary clearance, and alveolar macrophages are playing a major role in alterations of the devices and are the barriers to the effective functioning of the medications. The active principle of thermosensitive inhaled drugs can change owing to the temperature of the surrounding climate. Hence, it can restrain the pulmonary drug delivery systems market growth.

Pulmonary Drug Delivery Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 59.33 Billion |

|

Forecast Year Market Size (2035) |

USD 97.57 Billion |

|

Regional Scope |

|

Pulmonary Drug Delivery Systems Market Segmentation:

Application Segment Analysis

The global pulmonary drug delivery systems market is segmented and analyzed for demand and supply by application into asthma, cystic fibrosis, COPD, allergic rhinitis, and others. Out of these segments, the COPD segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the higher prevalence and severity of this disease, backed by the fact that the treatment for COPD is subsidized by government policies and non-governmental organizations that are increasingly providing COPD treatment worldwide. Chronic obstructive pulmonary disease (COPD) can be life-threatening that requires immediate medical attention. For instance, COPD prevalence worldwide was 10% in 2019, accounting for 390 million cases among people over 40 years. Therefore, these factors are anticipated to drive segment growth during the forecast period.

Product Segment Analysis

The global pulmonary drug delivery systems market is also segmented and analyzed for demand and supply by product into metered dose inhalers, dry powder inhalers, nebulizers, and accessories. Amongst these segments, the nebulizers segment is expected to garner a significant share. Nebulizers are highly used for the treatment of asthma and other respiratory diseases. Nebulizers come in two types, ultrasonic and jet nebulizers. Jet nebulizers can compress air and oxygen passing by narrow orifice. Additionally, nebulizers are the traditional method to cure respiratory diseases, hence, people are more inclined to use nebulizers over other methods. Furthermore, high export and import volumes of nebulizers across the globe are also expected to propel the growth of the segment over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pulmonary Drug Delivery Systems Market Regional Analysis:

North America region is set to dominate around 45.2% market share by 2035. The growth of the market can be attributed majorly to the increasing prevalence of lung diseases such as COPD, chronic bronchitis, and asthma in the region owing to heavy consumption of tobacco, cigarettes, exposure to air pollutants, genetic factors, and others. It was observed that in 2018, there were 8.9 million adults in the United States who experienced chronic bronchitis, or 3.5% of those over the age of 18 years. A surge in the air pollution and exposure to air pollutants in the region that results in a higher number of respiratory diseases in the population is estimated to expand the market’s size during the forecast period. As of 2021, nearly 65 million tons of pollution were estimated to be mixed in the atmosphere in the USA. Additionally, more than 62% of the Americans were noticed to be living in high air polluted areas at unhealthy levels making people sick. Furthermore, increasing healthcare spending, rising disposable income, the presence of major key players, changes in lifestyle, and growing demand for COPD therapeutics are factors anticipated to fuel the pulmonary drug delivery systems market growth in the region during the forecast period.

Pulmonary Drug Delivery Systems Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lupin Limited

- Briggs Healthcare, Inc.

- Boehringer Ingelheim International GmbH

- Koninklijke Philips N.V.

- Merck & Co., Inc.

- 3M Company

- AstraZeneca PLC

- GSK plc

- GF Health Products, Inc.

Recent Developments

-

Novartis AG reported that a new treatment option for Japanese patients was approved by the Ministry of Health, Labour, and Welfare (MHLW). NSCLC with METex14 mutations can be treated with TabrectaTM (capmatinib, formerly INC280), an oral MET inhibitor. Tabrecta became the first-line approved treatment type for patients living with lung cancer advanced non-small cell lung cancer.

-

Lupin Limited launched Adhero, a smart inhaler tracking device designed to support the treatment of COPD patients and respiratory diseases. Adhero also provide therapy and assistance to the people living with chronic respiratory diseases. Additionally, Adhero is getting fame owing to the fact that inhalers are most convenient treatment methods for chronic respiratory diseases.

- Report ID: 4410

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.