COPD Therapeutics Market Outlook:

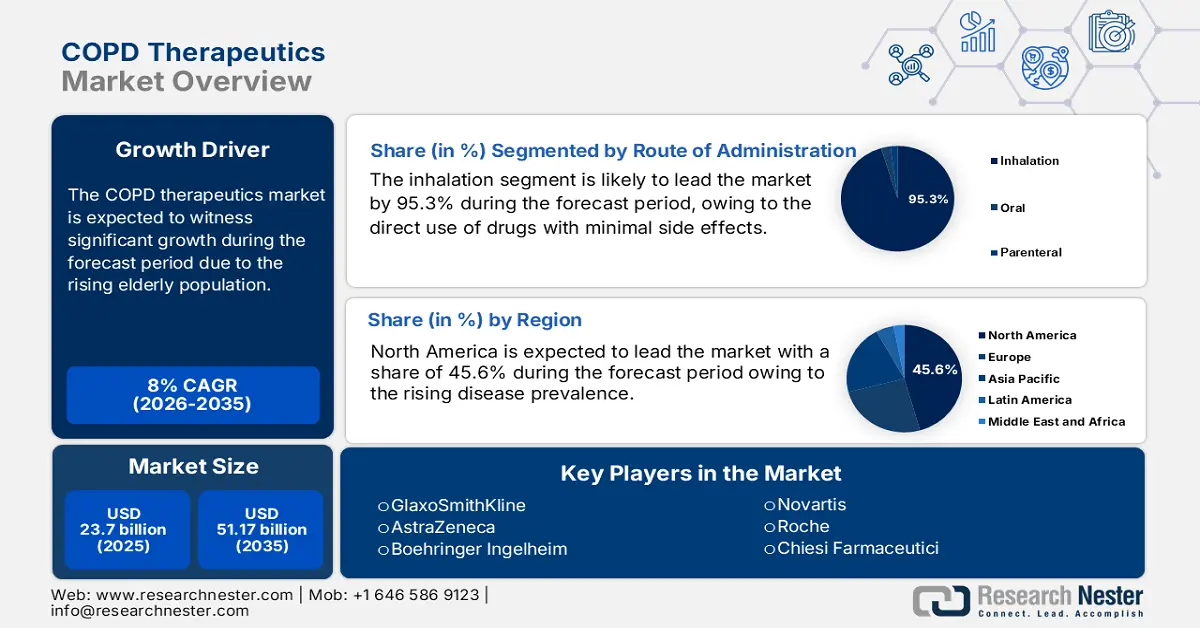

COPD Therapeutics Market size was valued at USD 23.7 billion in 2025 and is projected to reach USD 51.17 billion by the end of 2035, rising at a CAGR of 8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of COPD therapeutics is assessed at USD 25.6 billion.

The COPD therapeutics market is fueled by a large and increasing number of global patients. The World Health Organization statistics in November 2024 put the estimate of deaths due to COPD in 2021 at 3.5 million, ranking it as the fourth leading cause of death. This widespread prevalence generates a regular and large-scale demand for drug interventions. The supply chain for these medicines is internationally integrated, including the manufacture of Active Pharmaceutical Ingredients (APIs) and the production of sophisticated drug delivery devices such as inhalers. Further, most of the API manufacturing is seen in Asia, with the U.S. as the primary importer.

Investment in research, development, and deployment is high, as the National Institutes of Health (NIH) has spent considerable amounts on respiratory disease-related research. For example, the IBEF report of May 2025 illustrates that Rs. 2,61,900 crores are invested in India's healthcare and pharmaceutical industry during 2022-2024, which has enhanced the country's drug-making ecosystem, clinical research capability, and inhalation therapy innovation. A portion of these funds has supported the development and scaling of respiratory care solutions, including COPD therapeutics such as inhalers, bronchodilators, and combination drugs.

Key COPD Therapeutics Market Insights Summary:

Regional Highlights:

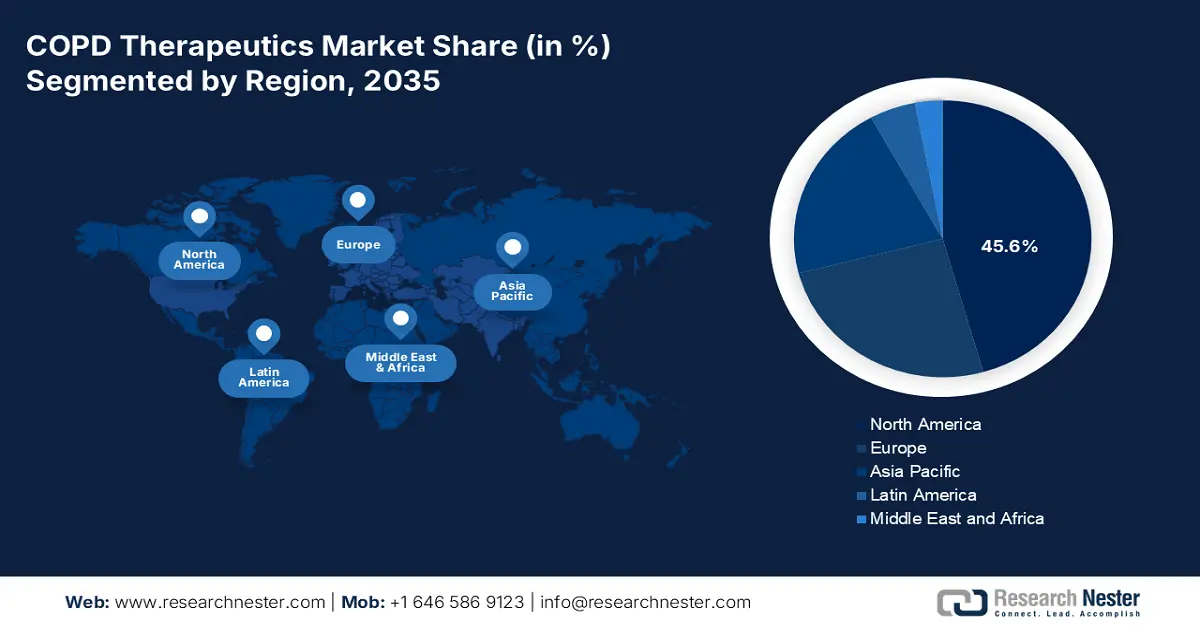

- North America is predicted to capture a 45.6% share by 2035, owing to the rising aging population and strong diagnostic rates.

- The Asia Pacific is expected to witness significant growth during the forecast period 2026–2035, impelled by increasing healthcare access and adoption of cost-effective therapies.

Segment Insights:

- The inhalation segment is projected to account for 95.3% share by 2035, driven by direct drug delivery to the lungs for rapid action and minimal systemic side effects.

- Inhalers are expected to dominate the product segment by 2035, owing to their effectiveness in enabling direct lung delivery and rapid therapeutic outcomes.

Key Growth Trends:

- Rising aging population

- Persistent environmental risk factors

Major Challenges:

- Patent expirations and generic competition

- High Cost and Complexity of Clinical Trials

Key Players: AstraZeneca, Boehringer Ingelheim, Novartis, Roche, Chiesi Farmaceutici, Merck & Co., Pfizer, Viatris (includes Mylan), Teva Pharmaceutical, Sunovion Pharmaceuticals, Verona Pharma, Cipla, Lupin, Aurobindo Pharma, Takeda Pharmaceutical, Astellas Pharma, CSL Limited, Yuhan Corporation, Hovid Pharma.

Global COPD Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.7 billion

- 2026 Market Size: USD 25.6 billion

- Projected Market Size: USD 51.17 billion by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: India, China, South Korea, Brazil, Indonesia

Last updated on : 20 October, 2025

COPD Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Rising aging population: Rising population of people above 60 is the key driver demanding the market, as the COPD prevalence is high among these aged people. As per the CDC report in May 2025, nearly 3.8% of people aged 18 are diagnosed with COPD. This demographic shift raises the chronic patient pool requiring long-term therapy. Further, this trend requires scalable healthcare models and therapies that are suitable for elderly people, such as inhalers that are easy to use, driving R&D towards patient-centric design and creating stable, long-term market growth.

- Persistent environmental risk factors: Apart from smoking habits, environmental exposures are the major driver for COPD incidence in some countries. As per the NLM study in May 2022, 14% of COPD cases are due to pollution in the workplace that is associated with dusts, fumes, and chemicals in the workplace. Moreover, household air pollution is also another cause, where air gets polluted due to the solid fuels for cooking, affecting many of people in billions. This expands the risk beyond smokers, creating demand in emerging economies and underscoring the need for public health interventions alongside pharmaceutical solutions to manage the growing disease burden.

- Evolution in treatment guidelines: The GOLD strategy report, updated annually, directly influences prescribing behavior and drug demand. The relentless focus on exacerbation reduction has triggered the change from monotherapies to LAMA/LABA combination and triple therapy. For example, GOLD's redefined ABCD assessment tool guides treatment escalation, determines treatment intensification, with a history of exacerbations as an important determinant for therapy selection. This generates a direct, rule-based need for more efficient, higher-value combination products and guides market access and reimbursement determinations worldwide.

Percentage of COPD Cases by Sex in 2023

|

Factor |

Percentage |

|

Men |

3.4 |

|

Women |

4.1 |

Source: CDC May 2025

Percentage of COPD Cases by Age Group in 2023

|

Age Group |

Percentage |

|

18-24 |

0.4 |

|

25-44 |

1.4 |

|

45-54 |

2.9 |

|

55-64 |

7.4 |

|

65-74 |

8.9 |

|

75 and above |

10.5 |

Source: CDC May 2025

Challenges

- Patent expirations and generic competition: The market is highly influenced by the expiration of drug patents. When a leading product loses its patent protection, it faces challenges such as immediate competition from lower-cost generic versions. This drop in revenue for leading manufacturers reduces the funds available for researching new treatments and drugs. Further, the environment of price competition is also a major constraint for new, innovative therapies to succeed because they must compete with well-known generics on price even though they might be more convenient or effective.

- High Cost and Complexity of Clinical Trials: Conducting clinical trials for COPD therapies is exceptionally challenging and costly. The trials have to be conducted for extended periods and involve a large number of patients to demonstrate that a drug is able to minimize disease exacerbations. This involves a huge worldwide network of trial sites, and recruiting patients is, therefore, a significant obstacle. In addition to this, there is high risk of failure in late-stage development.

COPD Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 23.7 billion |

|

Forecast Year Market Size (2035) |

USD 51.17 billion |

|

Regional Scope |

|

COPD Therapeutics Market Segmentation:

Route of Administration Segment Analysis

Inhalation is the dominant segment and is poised to hold the share of 95.3% by 2035. The segment is dominated to the direct use of drugs in the lungs for rapid action and minimized systemic side effects. The NIH highlights that inhaled therapy is the key product driving COPD management as it reaches the site directly for rapid action. This method is essential for both daily maintenance therapy and for providing quick relief from acute symptoms, making it the gold standard for this respiratory disease.

Product Segment Analysis

Within the product segment, inhalers are dominating the segment and are expected to command a major share by 2035. The dominance is due to the effectiveness in enabling direct drug delivery to the lungs and results in the rapid onset of action and reduces systemic side effects. Devices such as DPIs and pMDIs are essential for managing a chronic condition that is used daily, long-term medication. As per the NLM study in July 2024, companies are capping inhaler-based therapies at USD 35 per month. This price-capping initiative enhances the treatment affordability and expands patient access to maintenance therapies.

Dosage Form Segment Analysis

In dosage forms, pressurized metered-dose inhalers (pMDIs) are expected to be the top sub-segment. They gain their superiority due to their convenience, consistency, and known familiarity with patients and physicians. Although Dry Powder Inhalers (DPIs) are favored, pMDIs continue to be vital among patients with weakened lung capacity who are unable to produce the force needed for DPIs. The U.S. Food and Drug Administration (FDA) proactively directs the development and shift of pMDIs to more eco-friendly propellants to ensure their sustained central position within treatment schemes and to maintain their commercial dominance.

Our in-depth analysis of the COPD therapeutics market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Product |

|

|

Distribution Channel |

|

|

Route of Administration |

|

|

Dosage Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

COPD Therapeutics Market - Regional Analysis

North America Market Insights

North America market is dominating and is projected to hold a share of 45.6% by 2035. The market is driven by the rising disease prevalence and advanced healthcare infrastructure. The key growth drivers of the region are the rising aging population and strong diagnostic rates, and fast adoption of high-efficiency triple therapy inhalers and biologics. According to the CDC report in June 2024, COPD affects over 15 million COPD affects over 15 million of people in the U.S., highlighting the substantial patient base. The market is also driven by the key players in the pharmaceutical sector and robust R&D pipelines focusing on targeted therapies.

The U.S. is dominating the North America COPD therapeutics market and is driven by the rising disease prevalence and advanced healthcare infrastructure. As per the CDC data in June 2024, nearly 165,248 people were hospitalized due to COPD as the first-listed diagnosis. Moreover, these patient risk factor depends on the patient's history. The American Lung Association data states that COPD is the fourth leading cause of death, demanding urgent treatment. The CDC June 2024 report states that 1 of the top 10 causes of death in the U.S. is COPD. The market is also defined by significant biologic drug development targeting specific inflammatory pathways and rising emphasis on value-based care and digital tools for patient monitoring.

In Canada, the market is driven by the public healthcare system and strategic efforts to enhance disease management. A major trend involves the implementation of national strategies and standardized care pathways to minimize the hospital admissions, which are the major cost driver. In Canada, 80% to 90% of the COPD registered cases is due to smoking, as per the Government of Canada report in July 2025. The market is witnessing a significant adoption of cost-effective, newer therapies to address the cost related challenges in new drugs.

Rising COPD Patient Pool

|

|

Male |

Female |

||

|

Number |

Rate |

Number |

Rate |

|

|

2019 |

4,927,122 |

4.1% |

6,642,209 |

5.1% |

|

2020 |

5,245,330 |

4.3% |

7,298,981 |

5.6% |

|

2021 |

4,829,624 |

4.0% |

6,870,437 |

5.3% |

|

2022 |

5,093,988 |

4.1% |

6,589,874 |

5.0% |

Source: American Lung Association 2025

APAC Market Insights

The Asia Pacific is the fastest-growing region in the COPD therapeutics market and is expected to grow at a CAGR of 6.5% during the forecast period 2026-2025. The market is driven by the massive and aging population, rising air pollution levels and prevalence of smoking habits in key countries. The region significantly improves the healthcare infrastructure and health insurance which is expanding the access to modern treatment and diagnosis. Further, the region is witnessing a surge in the production and adoption of cost-effective generic drugs, mainly from India, which drives the market volume.

China is the largest market in APAC and is driven by its massive patient base, and high rates of smoking habits. The market size is expanding rapidly as the diagnostic rates improve the beyond major metropolitan hubs. As per the NLM study in June 2022, China’s COPD cases is nearly 25% of the global COPD cases. This rise is mainly due to the change in economic shifts, sociodemographic development, and lifestyle. Further, the nationwide volume-based procurement policies are actively reducing the cost for both generic and originator drugs, hence fueling the drug access.

India’s market is driven due to the vast and underdiagnosed population with extreme price sensitivity. The demand is heavily linked with indoor air pollution from biomass fuels and tobacco use. The market size is currently dominated by low-cost generic drugs, though branded generics and innovative therapies are gaining a foothold in private healthcare. In November 2023, Lupin launched the world’s first fixed combination of triple-dose drug, Vilfuro-G which is used for COPD management in India. This launch reflects the landscape towards patient-centric therapies aided by private and public sectors.

Hospitalization Costs of COPD Cases

|

Factors |

Cost ($) |

Percentage (%) |

Median (IQR) |

|

Hospitalization costs |

5,419,011 |

|

1952(2031) |

|

Out-of-pocket fess |

2,381,475 |

43.95 |

938(956) |

|

Health insurance fees |

3,037,536 |

56.05 |

984(1529) |

|

Hospitalization costs |

|

|

|

|

Service fees |

775,742 |

14.32 |

266(335) |

|

Diagnostic fees |

1,329,255 |

24.53 |

599(468) |

|

Treatment fees |

513,202 |

9.47 |

91(237) |

|

Medication fees |

2,054,026 |

37.90 |

743(987) |

|

Other fees |

746,786 |

13.78 |

134(214) |

Source: NLM July 2023

Europe Market Insights

The COPD therapeutics market in Europe is steadily growing and defined by universal healthcare systems, a rising elderly population, and robust regulatory policies by the European Medicines Agency. The key driver dominating the market is the high disease prevalence associated with historical smoking rates and aging demographics, mainly in Western Europe. A significant trend is the change from dual to triple inhaler therapies, which is the standard care for patients with moderate to severe COPD that is driven by the clinical guidelines supporting the exacerbation reduction.

The UK market is fueled by a well-established, centralized healthcare system in providing standardized treatment protocols. The market is large and requires strict cost-effectiveness for new treatments. The most important trend is the move towards value-based healthcare and integrated care systems, which seek to decrease hospitalizations for respiratory disease. According to the Asthma and Lung UK statistics in May 2025, almost 1.7 million people in the UK suffer from COPD, highlighting the demand continues to drive therapeutic spending.

Germany’s COPD therapeutics market is driven by its large aging population and favourable pricing environment that provides a rapid adoption of premium-priced innovative therapies post EMA approvals. The government of the nation aims to focus on enhancing the health insurance system to reduce the healthcare out of pocket costs. Government's focus, via organizations suh as the G-BA, is on early benefit assessment rather than initial price negotiation, facilitating market entry.

Key COPD Therapeutics Market Players:

- GlaxoSmithKline (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca (UK/Sweden)

- Boehringer Ingelheim (Germany)

- Novartis (Switzerland)

- Roche (Switzerland)

- Chiesi Farmaceutici (Italy)

- Merck & Co. (U.S.)

- Pfizer (U.S.)

- Viatris (includes Mylan) (U.S.)

- Teva Pharmaceutical (Israel)

- Sunovion Pharmaceuticals (U.S.)

- Verona Pharma (U.S.)

- Cipla (India)

- Lupin (India)

- Aurobindo Pharma (India)

- Takeda Pharmaceutical (Japan)

- Astellas Pharma (Japan)

- CSL Limited (Australia)

- Yuhan Corporation (South Korea)

- Hovid Pharma (Malaysia)

- GSK is a titan in the market and leads in the development of easy-to-use inhaler devices and cornerstone combination therapies. The company advanced treatment by integrating potent, long-acting muscarinic antagonist and long-acting beta-agonist molecules into single, streamlined inhalers such as Trelegy Ellipta. As per the GSK Annual Report in 2024, the turnover of general medicine in the product category was £10.4bn, which includes the sales of COPD medicines.

- AstraZeneca is the key player in COPD therapeutics market and earned a revenue of USD 54.1billion in 2024. The company is known for its innovation, as it drives beyond traditional bronchodilators. Further, the company has made significant advancements by developing and integrating anti-inflammatory agents, such as phosphodiesterase-4 inhibitors, into its portfolio.

- Boehringer Ingelheim is also one of the leading players in the market. The company has transformed the patient care with the introduction of the first long-acting muscarinic antagonist (LAMA), tiotropium. Further, it has consistently advanced the market by refining its Respimat soft mist inhaler technology, which ensures efficient and reliable drug delivery to the lungs.

- Novartis has established a strong niche in the market for COPD therapeutics by selectively targeting specific biologic therapies to defined subsets of patients. Instead of competing in the wide space of bronchodilators, the company has led the charge forward by exploring drugs blocking interleukin pathways (e.g., IL-4, IL-13) involved in type 2 inflammation.

- Roche is pushing the COPD therapeutics space forward by drawing on its rich history of expertise in biologics and diagnostics to reimagine disease control. The technique has the potential to directly modify the course of disease, which is a major potential leap for patients with ongoing inflammation and frequent exacerbations.

Here is a list of key players operating in the global market:

The COPD therapeutics market is highly competitive and is driven by key players such as GSK, AstraZeneca, and Boehringer Ingelheim. Key players are actively pursuing strategic initiatives to strengthen their position in the market. For example, in May 2025, GSK announced the FDA approval of Nucala. This is an add-on maintenance therapy for adults with COPD and eosinophilic phenotype, hence expanding the biologics treatment landscape in COPD. Further, huge R&D investments for novel biologics and triple therapy inhalers improve efficiency and patient compliance. The landscape is also surging with manufacturers from various sectors to reduce the cost and pressuring innovators to continuously enhance their products.

Corporate Landscape of the COPD Therapeutics Market:

Recent Developments

- In July 2025, MSD (Merck & Co.) announced a definitive agreement to acquire Verona Pharma for approximately USD 10 billion. This acquisition adds Ohtuvayre to MSD’s cardio-pulmonary portfolio, bolstering its pipeline with this first-in-class COPD maintenance treatment.

- In September 2024, Sanofi received FDA approval for Dupixent as the first and only add-on biologic for inadequately controlled COPD in adults, based on phase 3 trials showing improved symptoms and fewer exacerbations.

- In June 2024, Verona Pharma launched Ohtuvayre (ensifentrine), which is the first inhaled maintenance treatment for COPD with a novel mechanism combining bronchodilator and non-steroidal anti-inflammatory effects. The FDA approved it in June 2024, and it has shown clinical benefits in phase 3 trials.

- Report ID: 4210

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

COPD Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.