Subarachnoid Hemorrhage Surgical Devices Market Outlook:

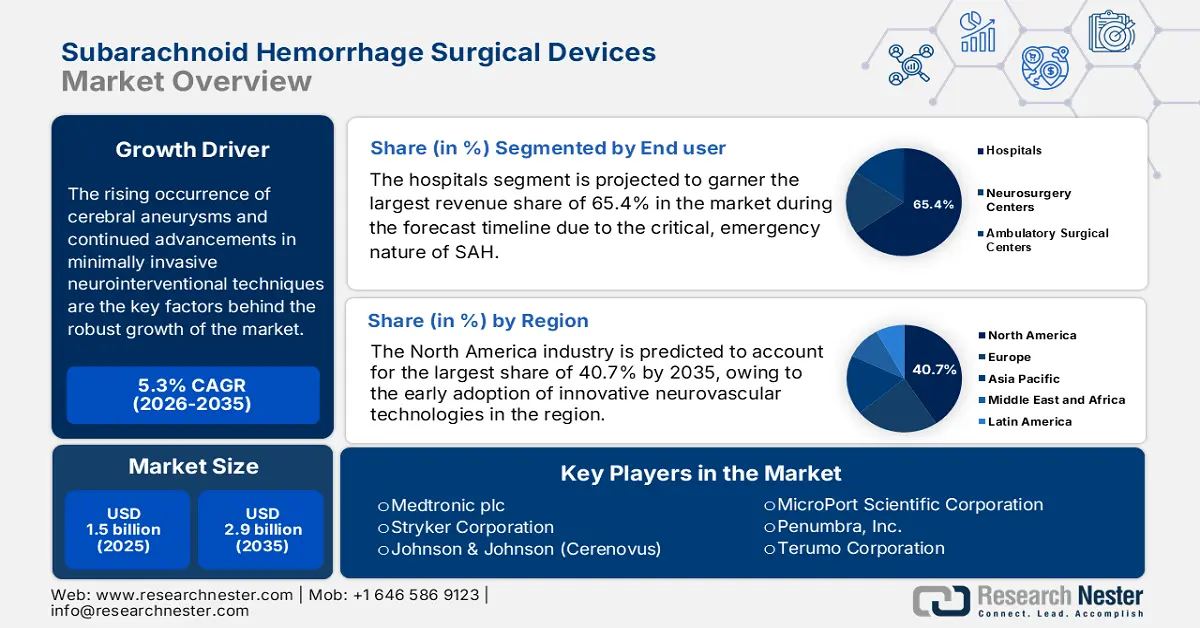

Subarachnoid Hemorrhage Surgical Devices Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 2.9 billion by the end of 2035, rising at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of subarachnoid hemorrhage surgical devices is estimated at USD 1.6 billion.

The rising occurrence of cerebral aneurysms and continued advancements in minimally invasive neurointerventional techniques are the key factors behind the robust growth of the subarachnoid hemorrhage (SAH) surgical devices market. Testifying to this, the NLM in May 2023 revealed that hemorrhagic stroke causes 10% to 20% of strokes on a yearly basis, wherein the incidence is 12% to 15% of cases per 1,00,000 per year, especially in developing countries, hence positively influencing market growth.

Furthermore, the aspect of the pricing of surgical devices for subarachnoid hemorrhage treatment is readily influenced by payers, which include government healthcare programs, private insurers, and hospital procurement policies. In this context, the September 2022 cost-utility analysis published by NIH found that endovascular coiling is more cost-effective than neurosurgical clipping for treating aneurysmal subarachnoid haemorrhage in the UK, wherein both NICEs, EC demonstrated both monetary and health net benefits.

Key Subarachnoid Hemorrhage Surgical Devices Market Insights Summary:

Regional Highlights:

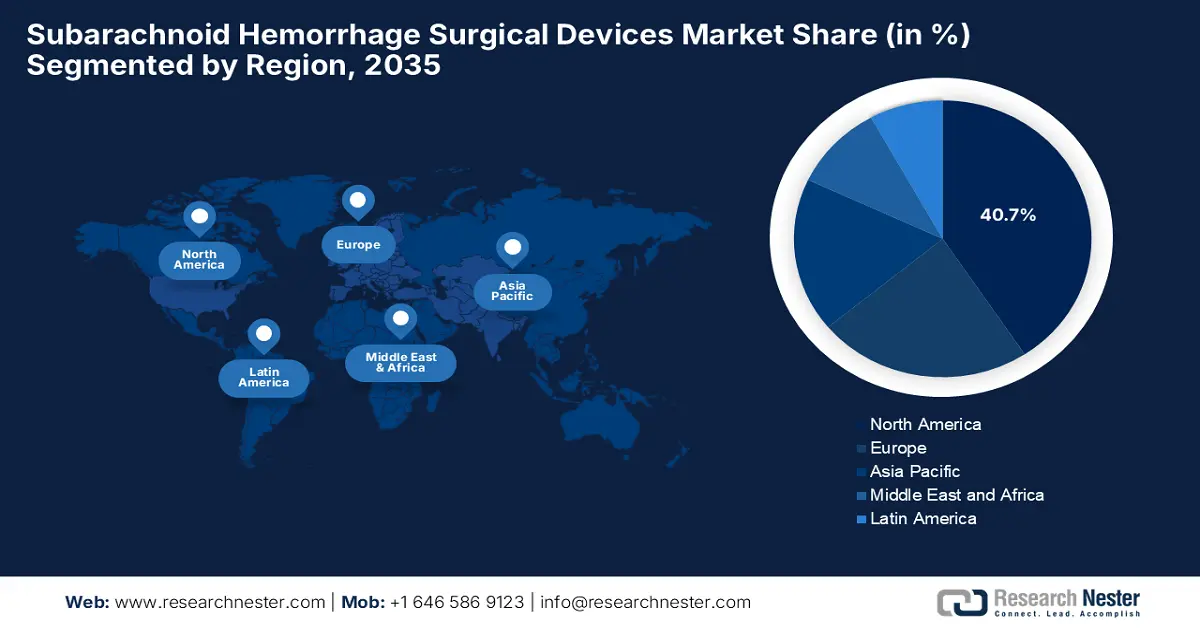

- North America is projected to lead the subarachnoid hemorrhage surgical devices market with a 40.7% share by 2035, owing to early adoption of advanced neurovascular technologies and strong presence of leading medical device manufacturers.

- Europe is expected to maintain a notable share by 2035, driven by rising SAH cases, advances in minimally invasive techniques, and expanding reimbursement support.

Segment Insights:

- The hospital segment is projected to secure 65.4% share by 2035 in the subarachnoid hemorrhage surgical devices market, driven by the critical and emergency nature of SAH requiring advanced neurointerventional facilities and expert care.

- The endovascular coiling segment is expected to hold 50.3% share by 2035, propelled by strong clinical evidence and guideline recommendations as a first-line treatment for many aneurysms.

Key Growth Trends:

- Increased access to neuro-specialty centers

- Growing research, innovation & clinical evidence

Major Challenges:

- High treatment costs & reimbursement caps

- Diagnostic access inequality

Key Players: Medtronic plc, Stryker Corporation, Johnson & Johnson (Cerenovus), MicroPort Scientific Corporation, Penumbra, Inc., Terumo Corporation, Balt Extrusion (Wallaby Medical), Acandis GmbH, Integra LifeSciences, B. Braun Melsungen AG, Cook Medical, Kaneka Medix Corporation, Lepu Medical Technology, MicroVention, Inc. (Terumo), Rapid Medical, Phenox GmbH, SMT (Sahajanand Medical Technologies), Cardiatis, Gynesonics, Boston Scientific Corporation

Global Subarachnoid Hemorrhage Surgical Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 2.9 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, Japan, Canada

- Emerging Countries: India, China, South Korea, Australia, Singapore

Last updated on : 30 September, 2025

Subarachnoid Hemorrhage Surgical Devices Market - Growth Drivers and Challenges

Growth Drivers

- Emergence of minimally invasive surgical tools: The innovations in terms of neurosurgical and endovascular technologies have significantly boosted the adoption of minimally invasive techniques such as endovascular coiling. For instance, in May 2025, the U.S. FDA reported that it had accepted the nitinol-enhanced device by Embolization Inc., as a vascular embolization device, which is employed in managing aneurysms that cause subarachnoid hemorrhage.

- Increased access to neuro-specialty centers: Governments and private players are readily expanding the number of stroke centers and neuro-intervention facilities, which drives access to advanced treatment for SAH. In July 2024, Amrita Hospital reported that it has launched the Amrita Brain Centre for Children, which is a specialized center dedicated to pediatric neurological disorders, offering care in areas such as epilepsy, stroke, sleep and behavioral disorders, and metabolic diseases in children.

- Growing research, innovation & clinical evidence: There has been strong clinical evidence showcasing the effectiveness of the SAH surgical devices, creating an encouraging opportunity for both domestic & international players. In this regard, the November 2024 article published by NIH reported that a 15-year study demonstrated a considerable shift from microsurgical clipping to endovascular treatments, which has contributed to reduced mortality rates and improved patient outcomes, underscoring the growing adoption of endovascular devices in managing subarachnoid hemorrhage.

Epidemiology and Regional Variations of Hemorrhagic Stroke

|

Parameter |

Value / Description |

|

Percentage of hemorrhagic strokes by region |

USA, UK, Australia: 8%-15% |

|

Japan, Korea: 18%-24% |

|

|

Higher incidence populations |

Low- and middle-income countries; Asians; men; elderly |

|

Global trend |

Increasing incidence, especially in Africa and Asia countries |

|

Case fatality rate |

25%-30% in high-income countries |

|

30%-48% in low- and middle-income countries |

Source: NIH, 2023

Challenges

- High treatment costs & reimbursement caps: This is the major factor limiting the uptake of subarachnoid hemorrhage surgical devices. Also, most of the advanced devices, such as embolic coils, flow diverters, and neurovascular stents, are highly expensive, leading to high out-of-pocket expenses for patients, especially in regions where there is limited healthcare coverage.

- Diagnostic access inequality: Subarachnoid hemorrhage often shows up with vague symptoms such as a really bad headache or nausea. Therefore, this necessitates the need for advanced neuroimaging techniques such as CT scans, MRIs, or angiography to make a proper diagnosis, making it challenging for emerging nations lacking appropriate diagnostic facilities.

Subarachnoid Hemorrhage Surgical Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.9 billion |

|

Regional Scope |

|

Subarachnoid Hemorrhage Surgical Devices Market Segmentation:

End user Segment Analysis

Hospital segment is projected to garner the largest revenue share of 65.4% in the subarachnoid hemorrhage surgical devices market during the forecast timeline. The dominance of the segment is attributable to the critical, emergency nature of SAH, which necessitates immediate access to advanced neurointerventional suites, intensive care units, and expert professionals. Furthermore, the high cost of devices and procedures, coupled with the need for post-operative care, consolidates the treatments within large hospital settings.

Application Segment Analysis

The endovascular coiling segment is predicted to attain a significant share of 50.3% in the subarachnoid hemorrhage surgical devices market by the end of 2035. The strong clinical evidence and guidelines from reputed organizations recommending it as first-line treatment for many aneurysms are the key factors propelling growth in this segment. In June 2021, Achieva Medical reported that its Jasper SS detachable coil received NMPA approval, which is designed for delicate intracranial aneurysms, hence denoting a positive market outlook.

Product Type Segment Analysis

The embolization devices segment is anticipated to gain a considerable share of 45.6% in the subarachnoid hemorrhage surgical devices market during the analyzed timeframe. The widespread adoption and increased preference for surgery due to its association are key factors propelling growth in the segment. In March 2025, Terumo Neuro celebrated the 15th anniversary of its WEB Aneurysm Embolization System, the first intrasaccular flow disruptor revolutionizing treatment for wide-neck bifurcation aneurysms.

Our in-depth analysis of the subarachnoid hemorrhage surgical devices market includes the following segments:

|

Segments |

Subsegments |

|

End user |

|

|

Application |

|

|

Product Type |

|

|

Procedure Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Subarachnoid Hemorrhage Surgical Devices Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global subarachnoid hemorrhage surgical devices market with the largest share of 40.7% by the end of 2035. The dominance of the region is effectively attributable to the early adoption of innovative neurovascular technologies and the strong presence of leading medical device manufacturers. NIH in January 2024 stated that it provides funding for cerebrovascular disease research, which totaled an amount of USD 700 million across 1,232 projects as of January 2023, mostly towards ischemic stroke, followed by carotid disease and hemorrhagic stroke.

In the U.S., the prevalence of SAH is increasing, and with the introduction of reforms and initiatives to improve support for patients, it is fostering a favorable business environment for the subarachnoid hemorrhage surgical devices market. In February 2023, Vesalio announced the first successful U.S. use of its FDA-approved NeVa VS device, which is the only device specifically designed and approved for treating cerebral vasospasm following aneurysmal subarachnoid hemorrhage.

Canada is gaining enhanced recognition in the subarachnoid haemorrhage surgical field, attributed mainly to centralized funding for health care, an aging population, and provincial investment in neurosurgical services. In May 2024, the Government of Canada reported that it renewed a USD 80 million investment in Brain Canada within a span of four years, which is matched by the organization for a total of USD 160 million, thereby accelerating brain health research across the country.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global subarachnoid hemorrhage surgical devices market by the end of 2035. The growth is propelled by the increasing demand for neurovascular interventions created by an expanding patient cohort. Besides the new governmental investments in neurological care, the growing publicly stated preference for minimally invasive procedures is also fostering a favorable business environment for the regional pioneers in this sector.

China is displaying strong dominance over the regional subarachnoid hemorrhage surgical devices market owing to the rapid advancements in neurovascular technologies, increasing government investments, and a rising focus on early diagnosis. In November 2024, MicroPort NeuroScientific reported that it completed the first post-market implantation of its next-generation Tubridge Plus Flow Diverter in the country at Changhai Hospital on a patient with an internal carotid artery aneurysm.

India also has a huge opportunity to capitalize on the Asia Pacific’s subarachnoid hemorrhage surgical devices market, backed by the increased awareness of neurovascular conditions and the expansion of specialized neurosurgical centers. In October 2022, Medtronic announced the launch of the Neurovascular Co-Lab Platform to accelerate innovation in stroke treatment, hence denoting a positive market outlook.

Financial Snapshot Supporting India's Surgical Devices Sector

|

Category |

Details |

|

Medical Device Exports (2022-23) |

USD 3.39 Billion (up from USD 2.9 Billion in 2021-2022) |

|

Projected Exports (2025) |

USD 10 Billion |

|

Indian MedTech Players’ Revenue (FY 2023) |

USD 2.5 Billion (up from ~USD 1.8 billion in FY 2020) |

|

FDI Received (April 2000-Present) |

USD 3.7 Billion (in the medical & surgical appliances sector) |

Source: Invest India.gov

Europe Market Insights

The Europe subarachnoid hemorrhage surgical devices market is estimated to garner a notable industry share from 2026 to 2035. The growth is fueled by an increase in SAH cases, advances in minimally invasive techniques, and expanding reimbursement support. In September 2025, Penumbra Inc. reported that it had received CE Mark for its SwiftPAC neuro embolisation coil, which is now commercially available across the region, enabling dense, controlled occlusion in delicate neurovascular procedures.

Germany is the key contributor to growth in the subarachnoid hemorrhage surgical devices market, effectively propelled by the increasing investments in neurosurgical innovation and a high density of specialized neurovascular centers. In June 2023, Lucicle Medical AG reported that it had acquired Spiegelberg GmbH, which aims to create a leader in advanced brain monitoring devices, thereby attracting more players to make investments in this field.

The U.K. is growing exponentially in the subarachnoid hemorrhage surgical devices market, backed by the National Health Service, which emphasizes evidence-based medicine and cost-effectiveness in treatment pathways. Besides, there has been a concerted effort to centralize complex SAH care within the highly specialized major trauma centers and neurological units, thereby significantly improving patient outcomes. Furthermore, the country’s strong focus on standardized care protocols creates an encouraging opportunity for pioneers in the country.

Cost Breakdown of Subarachnoid Hemorrhage Surgical Treatments in the UK (2020/2021 Prices)

|

Treatment |

Intervention Cost (£) |

Imaging & Investigations (£) |

Hospital Stay (£) |

Total Cost per Patient (£) |

|

Endovascular Coiling |

8,113 |

1,590 |

20,727 |

30,431 |

|

Neurosurgical Clipping |

5,647 |

1,583 |

27,483 |

34,714 |

Source: NIH

Key Subarachnoid Hemorrhage Surgical Devices Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Johnson & Johnson (Cerenovus)

- MicroPort Scientific Corporation

- Penumbra, Inc.

- Terumo Corporation

- Balt Extrusion (Wallaby Medical)

- Acandis GmbH

- Integra LifeSciences

- B. Braun Melsungen AG

- Cook Medical

- Kaneka Medix Corporation

- Lepu Medical Technology

- MicroVention, Inc. (Terumo)

- Rapid Medical

- Phenox GmbH

- SMT (Sahajanand Medical Technologies)

- Cardiatis

- Gynesonics

- Boston Scientific Corporation

The subarachnoid hemorrhage surgical devices are primarily focused on large med-tech conglomerates, such as Medtronic, Stryker, and Johnson & Johnson. These legacy players are increasingly incorporating advanced imaging, AI-assisted navigation, and microcatheters. Mid-sized firms in Europe enter into niche positions with innovative devices. While several entry-level companies are pushing the limits in AI-assisted navigation. Partnerships spanning imaging and interventional technologies are enhancing regulatory approval paths and expanding competitive landscapes in this active sector.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Viseon Inc. announced that it had successfully utilized its MaxView 4K Advanced Digital Visualization system in a cranial tumor resection, marking its expansion into neurosurgery, wherein the procedure showcased the system’s superior image quality.

- In January 2025, Kaneka Corporation reported that it had acquired a 96.8% stake in EndoStream Medical Ltd. to strengthen its position in cerebrovascular treatment. Also, the acquisition supports joint development of innovative devices like the Nautilus, which is designed to treat wide-neck cerebral aneurysms.

- Report ID: 3333

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Subarachnoid Hemorrhage Surgical Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.