Cardiac Resuscitation Devices Market Outlook:

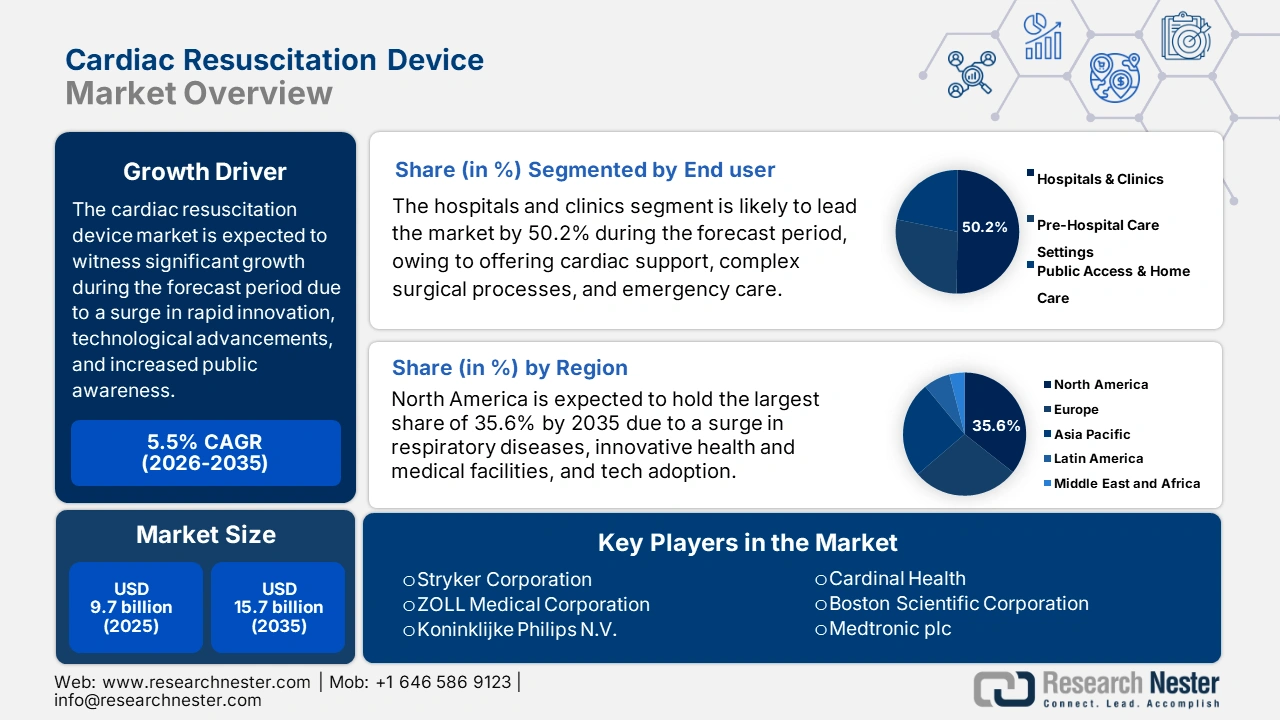

Cardiac Resuscitation Devices Market size was USD 9.7 billion in 2025 and is anticipated to reach USD 15.7 billion by the end of 2035, increasing at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cardiac resuscitation devices is estimated at USD 10.2 billion.

The cardiac resuscitation devices market is growing inevitably, owing to factors including a global rise in cardiovascular diseases (CVDs), an increase in the aging population, rapid innovation and advancements in technology, and stringent public access defibrillation programs. According to an article published by the World Health Organization (WHO) in July 2025, approximately 19.8 million people died from CDVs as of 2022, which has represented an estimated 32% of overall deaths internationally, and of these 85% occurred due to heart stroke and attack. Besides, out of 18 million premature deaths, almost 38% were caused by CVDs, thereby denoting a huge opportunity for the overall market across different nations.

Moreover, increased development in connected and smart devices, innovation in devices usability and efficiency, and the adoption of wearable and miniaturization technology are also uplifting the cardiac resuscitation devices market internationally. In this regard, the December 2023 Journal of the America Heart Association indicated that consumer wearable technologies are extremely common, with only 1/3rd of people in America deliberately reporting the utilization of a fitness tracker or smart watch. Besides, a survey-based study was conducted on 214,992 individuals receiving cardiovascular care, wherein 55.8% readily utilized a wearable devices and 70.2% stated the utilization if available at zero expenses, thus positively impacting the market’s development.

Key Cardiac Resuscitation Devices Market Insights Summary:

Regional Highlights:

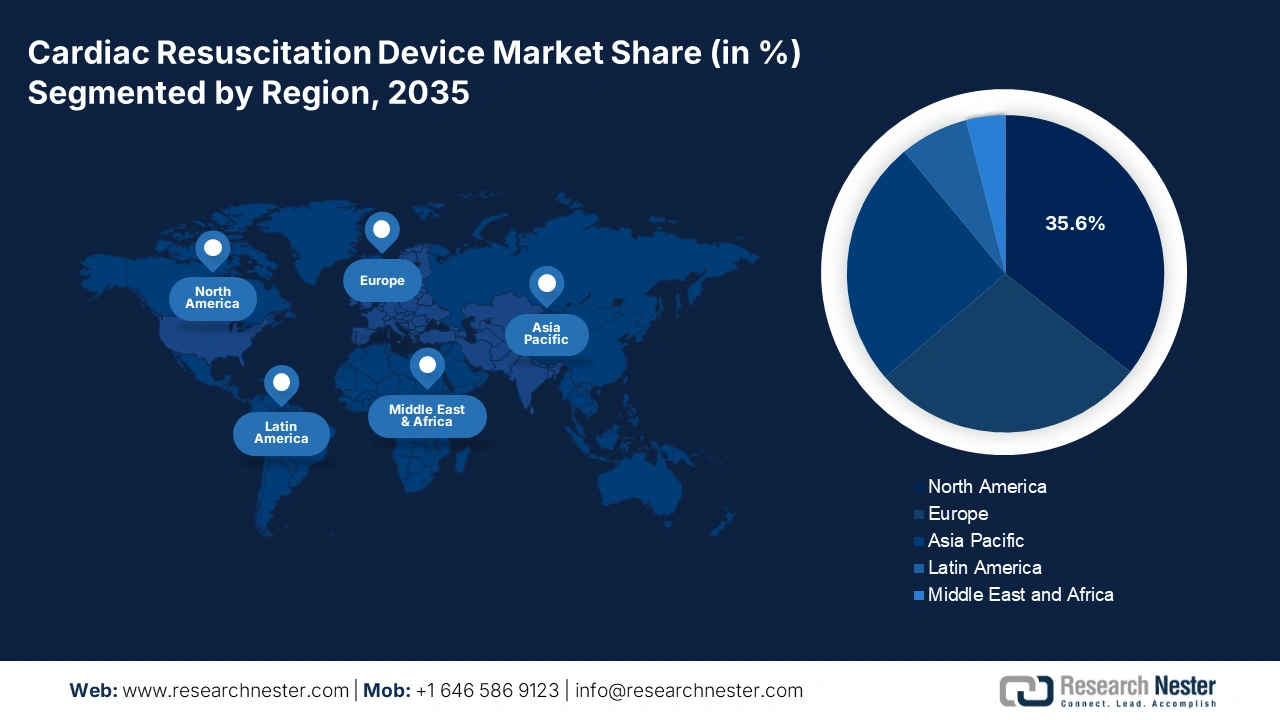

- North America is projected to hold the largest 35.6% share of the cardiac resuscitation devices market by 2035, owing to the growing prevalence of respiratory disorders, hypertension, obesity, and an expanding elderly population.

- Asia Pacific is set to witness the fastest growth in the cardiac resuscitation devices market during 2026–2035, impelled by rapid urbanization, hospital infrastructure upgrades, and increased adoption of AI-based telehealth technologies.

Segment Insights:

- The hospitals and clinics segment in the cardiac resuscitation devices market is anticipated to command a 50.2% share by 2035, driven by its role as a central hub for emergency care, surgical interventions, and the growing demand for high-value defibrillators and CPR systems.

- The defibrillators segment is forecasted to capture the second-largest share by 2035, propelled by its critical role in restoring heart rhythm during sudden cardiac arrests and improving survival outcomes through combined CPR application.

Key Growth Trends:

- Focus on data integration and connectivity

- Increased awareness and training strategies

Major Challenges:

- Risks in demonstrating real-world clinical utility

- Affordability and economic disparities in emerging economies

Key Players: Stryker Corporation, ZOLL Medical Corporation, Koninklijke Philips N.V., Cardinal Health, Boston Scientific Corporation, Medtronic plc, GE Healthcare, Abbott Laboratories, Schiller AG, Mindray Medical International Ltd., BPL Medical Technologies, Becton Dickinson and Company (BD), Metrax GmbH, Instramedix Inc., Biosys Healthcare.

Global Cardiac Resuscitation Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.7 billion

- 2026 Market Size: USD 10.2 billion

- Projected Market Size: USD 15.7 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 1 October, 2025

Cardiac Resuscitation Devices Market - Growth Drivers and Challenges

Growth Drivers

- Focus on data integration and connectivity: These are extremely essential to enhance patient outcomes through real-time and unified accessibility to data, diminish expenses, ensure regulatory compliance, and optimize operational efficacy, which positively impacts the cardiac resuscitation devices market. As per an article published by the Europe Journal of Biology and Medical Science Research in April 2025, healthcare organizations currently manage an average of 8.2 different types of data systems, with only 31% of facilities effectively reporting suitable integration between clinical information systems and primary EHR, thus boosting the market’s growth.

- Increased awareness and training strategies: These are essential for optimizing patient safety, ensuring suitable treatment outcomes, improving regulatory compliance, and uplift skills required for health and medical professionals. As stated in the November 2024 HRSA data report, an overall 933,788 physicians are effectively active, of which 800,355 are dedicated to patient care, practicing physicians, while almost 38.9% of these physicians are female. Besides, there exist 4 million registered nurses, advanced practice registered nurses, and licensed practical nurses globally, thereby denoting a positive outlook for the overall market.

- Rise in healthcare spending: This particular factor is suitable for uplifting the cardiac resuscitation devices market globally since it tends to improve the overall health and well-being of patients, which in turn, drives the economic development through reduced illness burden and increased labor productivity. As stated in the 2023 OECD data report, the U.S. comprises the highest gross domestic product (GDP), accounting for 16.6% every year. This is readily followed by 11.7% of Switzerland, 11.6% in Sweden, 11.5% in Austria, 10.9% in New Zealand, 10.7% in Japan, and likewise in other nations, thereby suitable for the cardiac resuscitation devices market globally.

Cardiovascular Management with Wearable Devices Driving the Market (2023)

|

Wearable Devices |

Measurement |

Outcome/Benefit |

|

Actigraph GT3X+ Accelerometer |

Daily step counts and step intensity |

An increase in daily steps led to a decreased mortality rate, plateauing at 7,500 steps per day. |

|

Variety of wearable activity trackers |

Daily step counts and step intensity |

Wearables increase activity by an average of 1800 steps/ day, 6 min of MVPA, and promote 1kg of weight loss with sustainable effects for at least 6 months. |

|

Apple Watch |

PPG |

Irregular pulse notifications occurred in 0.52% of the population cohort, and the PPV of the notification was 0.84 for atrial fibrillation detection. |

|

Honor Band 4, Huawei Watch GT, Honor Watch |

PPG |

identified as suspected AF in 0.2% of the cohort, and the PPV of the notification was 91.6%. |

|

SEEQ (Medtronic) or CardioSTAT (Icentia) chest patch |

Single-lead ECG |

Continuous ECG monitoring increased the rate of AF detection by 17.9% within 30 days of hospital discharge after cardiac surgery. |

|

Zio Patch (iRhythm Technologies) and Watch BP-HomeA Monitor (Microlife) |

Single-lead ECG and Oscillometric Screening |

Continuous ECG monitoring increased AF detection 10-fold and led to AC initiation in 75% of patients more than 75 years old. |

Source: NLM, March 2023

Equipment to Measure Pressure 2023 Export and Import Driving the Market

|

Countries |

Export |

Import |

|

Germany |

USD 2.1 billion |

USD 1.3 billion |

|

U.S. |

USD 1.7 billion |

USD 1.8 billion |

|

China |

USD 1.4 billion |

USD 1.0 billion |

Source: OEC

Challenges

- Risks in demonstrating real-world clinical utility: Beyond gaining administrative approval for efficiency and safety, manufacturers are currently proving real-world effectiveness to convince providers and payers. For instance, in the case of a mechanical CPR devices, this aspect indicates moving beyond standard clinical trials to display optimized survival-to-discharge rates in diversified and real-world EMS settings. As a result, gathering this gold-standard real-world evidence (RWE) is deliberately complicated, expensive, and can take years to develop, which denotes a negative impact on the market globally.

- Affordability and economic disparities in emerging economies: The cardiac resuscitation devices market growth exists potentially in developing countries, such as Africa, APAC, and LATAM, but the presence of profound economic disparities tends to limit accessibility. Besides, the high cost of innovative devices is frequently misaligned with restricted budgets across clinics and public health systems in these particular regions. Meanwhile, low-income nations effectively bear the largest CVD burden, yet are unable to afford progressive care technology. This, in turn, has developed an integration gap, wherein the demand is the greatest.

Cardiac Resuscitation Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

Base Year |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 9.7 billion |

|

Forecast Year Market Size (2035) |

USD 15.7 billion |

|

Regional Scope |

|

Cardiac Resuscitation Devices Market Segmentation:

End user Segment Analysis

Based on the end user, the hospitals and clinics segment in the cardiac resuscitation devices market is anticipated to account for the largest share of 50.2% by the end of 2035. The segment’s upliftment is highly attributed to its pivotal role as the central facility for innovative cardiac life support, complicated surgical procedures, and emergency care. These infrastructures are the main payers of multi-parameter and high-value defibrillators, mechanical CPR systems, and implantable cardioverter defibrillators. Besides, the demand is effectively driven by an increase in the volume of vital cardiac cases, strict administrative standards for ongoing equipment upgradation, and emergency readiness to adhere to revolutionizing clinical reforms.

Product Segment Analysis

Based on the product, the defibrillators segment in the cardiac resuscitation devices market is projected to account for the second-largest share during the forecast duration. The segment’s growth is highly driven by its necessity to aid sudden cardiac arrest by providing an electric shock to successfully restore a normal heart rhythm, which effectively optimizes survival rates by combining with CPR. According to an article published by NLM in March 2025, in the case of heart failure, earlier defibrillation is necessary since survival rates tend to decline by an estimated 10% within each minute without any form of intervention, and with a minimum chance for recovery after 10 minutes, thus uplifting the segment globally.

Technology Segment Analysis

Based on the technology, the manual devices segment in the cardiac resuscitation devices market is subject to generate the third-largest revenue by the end of the projected duration. The segment’s development is highly driven by its ability to improve healthcare by providing real-time monitoring, enhancing rare disease management, and offering clinicians rapid accessibility to patient data for decision-making. As per the January 2022 NLM article, the incorporation of Fitbit Charge constitutes 29 brands and 72 brands, followed by 7 brands and 15 devices for Apple Watch, and 22 brands, along with 36 devices for MAPE, thereby denoting the increased availability of manual devices.

Our in-depth analysis of the cardiac resuscitation devices market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product |

|

|

Technology |

|

|

Distribution Channel |

|

|

Patient Population |

|

|

Compressor Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiac Resuscitation Devices Market - Regional Analysis

North America Market Insights

North America in the cardiac resuscitation devices market is projected to account for the highest share of 35.6% by the end of 2035. The market’s exposure in the region is highly attributed to an increase in respiratory disorders, an expanded elderly population, progressive health and medical infrastructure, the prevalence of hypertension and obesity, and suitable tech integration. According to the June 2025 EPA article, almost 24 million people suffer from asthma, accounting for 1 in 12 children, which is 8.6%, along with 1 in 14 adults, which is 7.4% of the overall population, resulting in critical respiratory illness, thus uplifting the market’s demand in the region.

The cardiac resuscitation devices market in the U.S. is growing significantly, owing to an increase in health and medical expenditure, Medicaid and Medicare support, along with coverage expansion, robust government and private strategies for devices, public awareness, and AI-based tech innovations. As stated in an article published by the CMS in December 2024, the healthcare expenditure increased by 7.5% as of 2023, and reached USD 4.9 trillion or USD 14,570 per person. In addition, the share of the country’s GDP, the health spending accounted for 17.6%, which denotes a huge opportunity for the overall market’s growth.

The cardiac resuscitation devices market in Canada is uplifting due to the presence of significant provincial and public health investments, increased emphasis on rural and remote devices accessibility, national AED installation, stability in the aging population, generous government funds, and proactive collaborations. According to an article published by the Government of Canada in May 2022, a USD 5 million fund has been provided to effectively support a regional research network that will focus on enhancing the prevention, diagnosis, treatment, and care of heart failure within the country. Besides, over 750,000 people reside with heart failure, with approximately 100,000 new cases occurring every year.

Respiratory Syncytial Virus 2025 Incidence in North America

|

Territories |

Sites Currently Reporting |

|

Alabama |

19 |

|

California |

71 |

|

Delaware |

1 |

|

Florida |

13 |

|

Georgia |

8 |

|

Hawaii |

9 |

|

Illinois |

71 |

|

Kansas |

11 |

Source: CDC, September 2025

APAC Market Insights

Asia Pacific in the cardiac resuscitation devices market is projected to emerge as the fastest-growing region during the forecast timeline. The market’s development in the overall region is highly fueled by a surge in heart diseases, upgrades in hospital facilities and urbanization, increased government initiatives for devices accessibility, and the wide-ranging implementation of telehealth and AI-based technologies. According to an article published by NLM in June 2024, the development of an inpatient pressure injury predictive model with an outstanding 87.2% recall rate readily benefits high-risk patients in the region, thus driving the market’s growth.

The cardiac resuscitation devices market in China is gaining increased exposure, owing to the presence of the largest population base with expanded urban hospital networks, robust government investments in AED placement and emergency medical teams, an upsurge in cardiac care accessibility, and active incorporation of regional CPR training, along with awareness campaigns. As per the September 2023 Embassy of the People's Republic of China report, the country comprises more than 1.4 billion people, and it is rapidly striving to shift the global landscape of modernization. This modernization is expected to account for 18% of the global population, which is suitable for developing nations, thus suitable for the market’s development.

The cardiac resuscitation devices market in India is also growing due to government’s focus on spending in private and public partnerships, an increase in cardiac facilities, rural accessibility initiatives, an epidemiological transition into non-communicable disorders, and young, along with middle-aged heart disorder prevalence. As per the April 2024 NLM article, the beneficiary proportion effectively seeking standard care from the public health infrastructures has surged from 41.9% to 45.7%, particularly in rural locations, and 31% to 35.3% in urban locations, thereby citing an optimistic outlook for the market.

Electrical Machinery and Electronics 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

China |

USD 1.0 trillion |

USD 353 billion |

|

South Korea |

USD 208 billion |

USD 98.7 billion |

|

Vietnam |

USD 186 billion |

USD 84.8 billion |

|

Malaysia |

USD 137 billion |

USD 69.5 billion |

|

Japan |

USD 135 billion |

USD 114 billion |

|

India |

USD 40.4 billion |

USD 76 billion |

Source: OEC

Europe Market Insights

Europe in the cardiac resuscitation devices market is predicted to garner a considerable share by the end of the projected timeline. The market’s development in the overall region is highly driven by the presence of robust administrative frameworks, government funding, a rise in the aging population, increased CPR training programs, advances in digital technologies, cross-border health strategies, and development in home healthcare services. According to the April 2023 Journal of Evidence and Quality in Health Care article, with EUR 4,505 per capita expenditure on health, Germany has readily spent 28%, which is quite a generous contribution towards the market.

The cardiac resuscitation devices market in Germany is growing effectively, owing to the existence of a strong industrial base, engineering expertise, robust government investment in cardiac emergency facilities, proactive integration in automation, statutory reimbursement policies supporting devices deployment, an extension in awareness and training campaigns, and well-established hospital emergency and EMS systems. According to the August 2025 ITA data report, the medical devices market in the country accounts for approximately USD 44 billion in revenue, which caters to 26.5% of the region, thus suitable for bolstering the market.

The cardiac resuscitation devices market in the UK is also developing due to an increase in NHS investments in publicly accessible EMS and AEDs, an upsurge in healthcare budget, strong partnerships between industry and the NHS for devices advancements, expansion in public CPR awareness and training, and the existence of administrative support for rapid devices integration. As stated in the July 2025 NLM article, the health spending is projected to increase by 2.8% by the end of 2025 and 3.7% between 2028 and 2029, while capital investment for equipment and technology will boost by 1% every year, thereby suitable for the market’s upliftment.

Key Cardiac Resuscitation Devices Market Players:

- Stryker Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ZOLL Medical Corporation (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Cardinal Health (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic plc (Ireland)

- GE Healthcare (U.S.)

- Abbott Laboratories (U.S.)

- Schiller AG (Switzerland)

- Mindray Medical International Ltd. (China)

- BPL Medical Technologies (India)

- Becton, Dickinson and Company (BD) (U.S.)

- Metrax GmbH (Germany)

- Instramedix Inc. (U.S.)

- Biosys Healthcare (South Korea)

The international cardiac resuscitation devices market is extremely consolidated, which is readily dominated by established Medtech firms from Europe and the U.S. Notable players, such as Koninklijke Philips N.V., ZOLL Medical, and Stryker, readily compete on technological advancement, especially in data integration, user-friendly, and connectivity design for publicly accessible AEDs. Besides, tactical strategies are intensely focused on extended R&D to create cutting-edge smart devices, and suitable acquisitions and mergers to expand geographic reach and product portfolio, thereby suitable for positively impacting the market across different nations.

Here is a list of key players operating in the global cardiac resuscitation devices market:

Recent Developments

- In May 2025, Boston Scientific Corporation received the U.S. FDA’s approval for LATITUDE 6.0, which is a software upgrade, enabling physicians to remotely cater to patient monitoring through implantable cardiac devices.

- In July 2024, Octagos Health declared the successful equity raise of more than USD 43 million in investment capital, with the objective to uplift the organization’s mission to utilize AI for revolutionizing cardiac care.

- Report ID: 8143

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.