Cardiac Output Monitoring Devices Market Outlook:

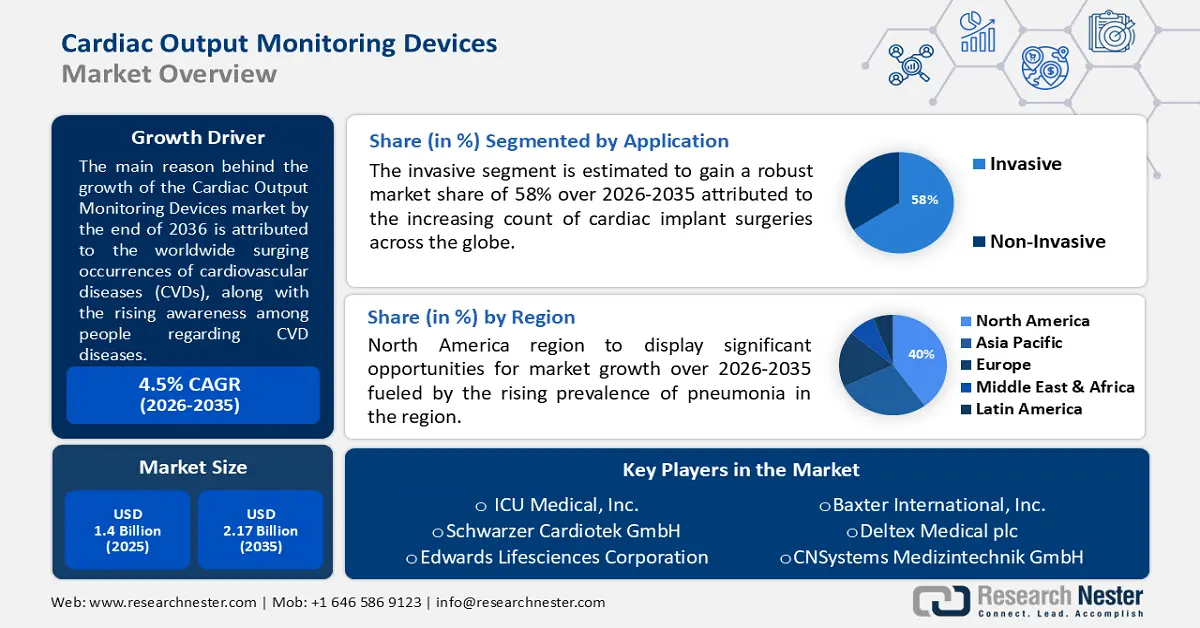

Cardiac Output Monitoring Devices Market size was valued at USD 1.4 billion in 2025 and is set to exceed USD 2.17 billion by 2035, expanding at over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cardiac output monitoring devices is estimated at USD 1.46 billion.

The growth of the market can be attributed to the worldwide surging occurrences of cardiovascular diseases (CVDs), along with the rising awareness among people regarding CVD diseases. As per the data released by the World Health Organization (WHO), 17.9 million people worldwide die from CVDs each year, contributing to 32% of all mortalities. Besides this, growth in the healthcare sector is also a significant factor that is projected to further fuel the global cardiac output monitoring devices market growth over the forecast period.

In addition to these, factors that are believed to fuel the market growth of cardiac output monitoring devices include the rise in cardiac arrest cases throughout the world. For instance, in the United States, more than 358,000 cardiac arrests occur outside of hospitals every year, with approximately 7 in 10 occurring at home. Thus, the count of patients admitted to critical care units for intensive or invasive monitoring has been increasing. As a result, cardiac output monitoring devices have become a vital element in assessing patients in the operating room, critical care unit, and other places. Additionally, a significant surge in respiratory problems, a rise in various types of severe infections, as well as a rise in the count of unmet medical requirements in emerging nations are some more factors that are anticipated to accelerate the market trend over the projected time frame.

Key Cardiac Output Monitoring Devices Market Insights Summary:

Regional Highlights:

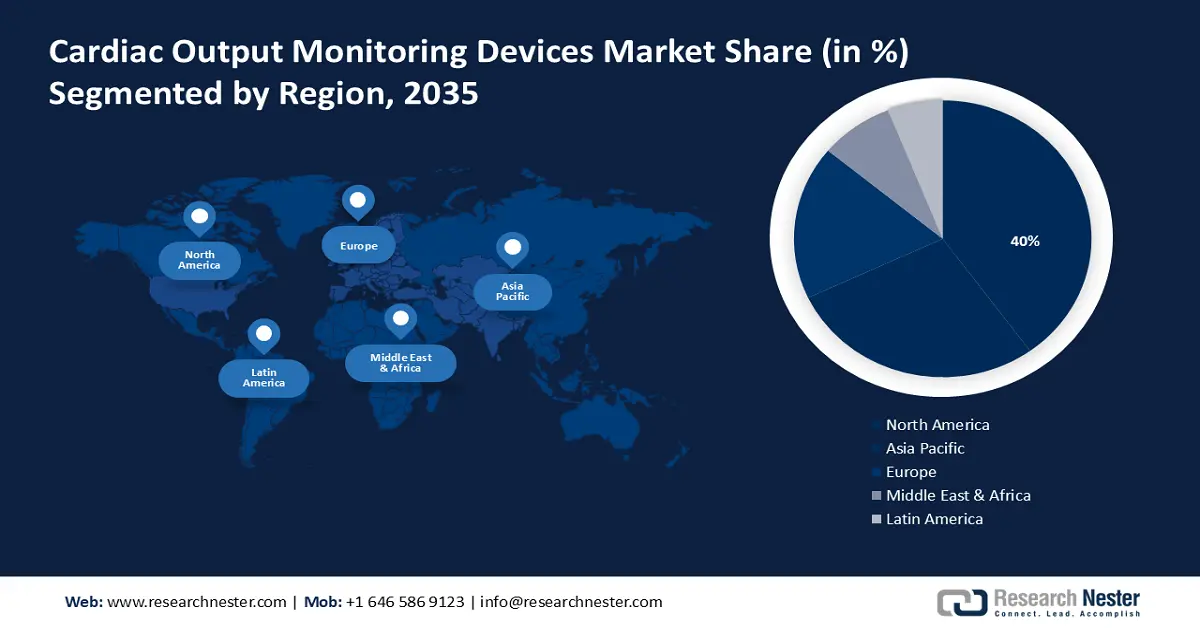

- North America cardiac output monitoring devices market is predicted to capture 40% share by 2035, driven by increasing frequency of heart diseases, coronary artery disease, and rising healthcare expenditure.

- Asia Pacific market will register notable growth during the forecast timeline, driven by escalating CVD prevalence and expansion of healthcare infrastructure.

Segment Insights:

- The invasive segment in the cardiac output monitoring devices market is projected to hold a 58% share by 2035, driven by the increasing count of cardiac implant surgeries and the popularity of minimally invasive techniques.

- The hospital segment in the cardiac output monitoring devices market is anticipated to hold a significant share by 2035, driven by the upsurge in hospitals and patient visits for cardiac diagnosis worldwide.

Key Growth Trends:

- Worldwide Increasing Elderly Population

- Escalating Healthcare Expenditure

Major Challenges:

- Restricted Application of Cardiac Output Monitoring Devices

- Preference for Medicines Over Surgery

Key Players: ICU Medical, Inc., Schwarzer Cardiotek GmbH, Edwards Lifesciences Corporation, Baxter International, Inc., Deltex Medical plc, CNSystems Medizintechnik GmbH, Abiomed, Inc., Boston Scientific Corporation (BSC), BioTelemetry, Inc., Masimo Corporation.

Global Cardiac Output Monitoring Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.4 billion

- 2026 Market Size: USD 1.46 billion

- Projected Market Size: USD 2.17 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Cardiac Output Monitoring Devices Market Growth Drivers and Challenges:

Growth Drivers

- Worldwide Increasing Elderly Population – Elderly population is more prone to CVDs and other severe health issues that require intensive care and monitoring. Therefore, the rising number of elderly populations across the globe is estimated to drive the growth of the cardiac output monitoring devices market in the forecasted period. According to the World Health Organization (WHO) data, by 2030, globally, the number of people over the age of 60 is estimated to reach 1.4 billion.

- Rising Prevalence of Chronic Obstructive Pulmonary Disease (COPD) - Chronic obstructive pulmonary disease (COPD) occurs when the lungs get deteriorated and inflamed. The symptoms include wheezing, coughing up mucus, and breathing difficulty. It is closely attributed to prolonged exposure to hazardous substances such as cigarette smoke. Therefore, the surging ratio of COPD disease is another significant factor that is projected to boost the growth of the cardiac output monitoring devices market in the coming years. For instance, every year more than 3 million people lose their lives from COPD, which denotes 6% of total deaths globally.

- An Upsurge in Surgical Procedures - For instance, every year approximately 312 million major surgeries are conducted worldwide.

- Escalating Healthcare Expenditure – According to the data released by the World Bank, worldwide healthcare expenditure was grown to 9.83% in 2019 as compared to 9.7% in 2018.

- Rise in Disposable Income - According to the Bureau of Economic Analysis report, in March 2022, personal income and disposable personal income in the United States have expanded by USD 107.2 billion and USD 89.7 billion, respectively.

Challenges

- Restricted Application of Cardiac Output Monitoring Devices – The use of these devices depends on many institutional factors that may restrict the area of their application. Further, no cardiac output monitoring device can change the patient outcome unless its use is coupled with an intervention. Thus, this factor is estimated to hamper the growth of the market over the coming years.

- Preference for Medicines Over Surgery

- Limited Insurance Coverage Options

Cardiac Output Monitoring Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 1.4 billion |

|

Forecast Year Market Size (2035) |

USD 2.17 billion |

|

Regional Scope |

|

Cardiac Output Monitoring Devices Market Segmentation:

Type Segment Analysis

The invasive segment will hold a market share of 58% over the projected time frame, attributed to the increasing count of cardiac implant surgeries across the globe. In addition to this, the growing popularity of minimally invasive techniques involving arterial and venous lines is also anticipated to augment segment growth. For instance, every year, in the United States, nearly 400,000 coronary artery bypass grafting (CABG) surgeries are performed.

End-user Segment Analysis

The hospital segment is expected to garner a significant share, ascribed to the upsurge in the count of hospitals, followed by the escalating number of patient visits to be diagnosed in hospitals worldwide. For instance, there were over 8,359 hospitals in Japan as of 2020. Whereas Korea had about 4,110 hospitals. Moreover, the availability of favorable medical reimbursement, and surge in the cardiac implant procedures throughout the world are also anticipated to further create numerous opportunities for the growth of the segment.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Type |

|

|

By Technology |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiac Output Monitoring Devices Market Regional Analysis:

North American Market Insights

North America industry is anticipated to account for largest revenue share of 40% by 2035, attributed majorly to the increasing frequency of heart diseases, and coronary artery disease in the region. As per the data provided by the Centers for Disease Control and Prevention, in the United States, heart disease accounted for the deaths of about 697,000 people in 2020. Furthermore, coronary artery disease affects nearly 20.1 million adults aged 20 and above. In addition, rising healthcare expenditure and accessibility of technologically advanced equipment are also anticipated to boost the market growth.

APAC Market Insights

Furthermore, the Asia Pacific cardiac output monitoring devices market is also projected to display notable market growth by the end of 2035, attributed to the escalating prevalence of CVDs, along with the growth in the healthcare infrastructure in the region. For instance, in 2019, CVDs were the major factor responsible for death in Asia, accounting for approximately 11 million deaths in the region. Moreover, surging awareness among people about the CVDs and their treatment is another significant factor that is anticipated to push the market growth.

Cardiac Output Monitoring Devices Market Players:

- ICU Medical, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schwarzer Cardiotek GmbH

- Edwards Lifesciences Corporation

- Baxter International, Inc.

- Deltex Medical plc

- CNSystems Medizintechnik GmbH

- Abiomed, Inc.

- Boston Scientific Corporation (BSC)

- BioTelemetry, Inc.

- Masimo Corporation

Recent Developments

-

ICU Medical Inc. acquired Smiths Medical from Smiths Group Plc. In addition to syringes and ambulatory infusion devices, Smith Medical also produces vascular access products and vital care products.

-

Schwarzer Cardiotek GmbH received 510(k) clearance from the US Food and Drug Administration for version 2.2 of its EP-TRACER electronic physiological measurement system, designed to provide a high-quality display of intracardiac ECG signals.

- Report ID: 4217

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.