Cardiac Prosthetic Devices Market Outlook:

Cardiac Prosthetic Devices Market size was valued at USD 8.7 billion in 2025 and is projected to reach USD 17.4 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cardiac prosthetic devices is estimated at USD 9.2 billion.

The rising incidences of cardiovascular diseases, increasing adoption of advanced surgical techniques, and technological innovations are readily driving growth in the market. This can be testified by the report from July 2025 WHO article that states that around 19.8 million individuals lost their lives due to cardiovascular diseases, out of which 85% were due to heart attack and stroke. Therefore, these statistics underscore the presence of a reliable consumer base in this field.

Furthermore, the regulatory support and the expanding procedural volumes are expected to enhance market expansion. As per the NIH study published in March 2023, it reported a total of 109,301 payments to interventional cardiologists related to cardiac stents, amounting to USD 17,554,728, were reported across 306 hospital referral regions. When stent manufacturers increased their gift payments by $10,000, it was linked to an additional 26 PCI procedures for every 100,000 Medicare patients. Therefore, these findings underscore how physician-industry relationships may influence device utilization trends, further shaping the trajectory of the market.

Key Cardiac Prosthetic Devices Market Insights Summary:

Regional Highlights:

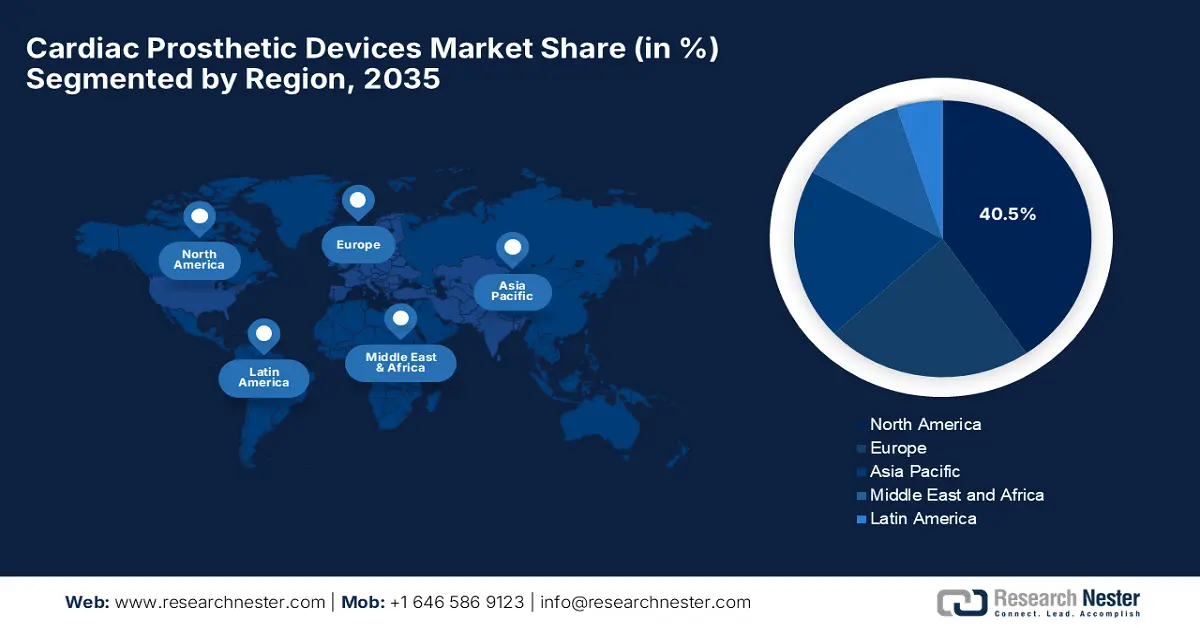

- The North America cardiac prosthetic devices market is expected to capture a leading 40.5% share by 2035, propelled by advanced healthcare infrastructure and the strong uptake of premium-priced innovations.

- The Asia Pacific region is set to exhibit the fastest expansion through 2026–2035, supported by the rising prevalence of cardiovascular diseases, medical tourism growth, and healthcare modernization initiatives.

Segment Insights:

- The hospitals & cardiac centers segment is projected to command the largest 72.5% revenue share by 2035 in the cardiac prosthetic devices market, driven by the complexity of cardiac implant procedures and the need for hybrid operating rooms and cath labs.

- The biological materials segment is forecasted to secure a notable 45.6% share by 2035, owing to superior hemodynamics and reduced lifetime thromboembolism risk compared to mechanical alternatives.

Key Growth Trends:

- Amplifying cardiology procedures

- Technological Progress

Major Challenges:

- Delayed regulatory activities

- Competition from generics

Key Players: Edwards Lifesciences, Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, LivaNova PLC, Getinge AB, MicroPort Scientific Corporation, B. Braun SE, Lepu Medical Technology, BIOTRONIK SE & Co. KG, Meril Life Sciences, Sorin Group, Osypka AG, Shree Pacetronix Ltd., Biosensors International Group.

Global Cardiac Prosthetic Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.7 billion

- 2026 Market Size: USD 9.2 billion

- Projected Market Size: USD 17.4 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, China

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 16 September, 2025

Cardiac Prosthetic Devices Market - Growth Drivers and Challenges

Growth Drivers

- Amplifying cardiology procedures: The global rise in volume of cardiac surgeries and procedures such as valve replacements, bypass surgeries, and pacemaker implantations is driving business in the market. As per the December 2023 NIH article, high-income countries perform an average of 123.2 cardiac surgeries per 100,000 people on a yearly basis, which includes 36.7 CABG, 30.8 valve, and 7.9 congenital procedures. Besides, the low- and middle-income countries reported 61.6 total surgeries per 100,000, including 18.3 CABG and 15.4 valve surgeries, thereby positively influencing market growth.

- Technological Progress: This, coupled with a shift towards minimally invasive solutions, is creating an encouraging opportunity for the pioneers involved in the market to capitalize on this field. In July 2023, Abbott notified that its AVEIR dual chamber (DR) leadless pacemaker system was accepted by the U.S. FDA, which is the world's first dual chamber leadless pacing system that treats people with abnormal or slow heart rhythms.

- Expanding healthcare access: The emerging nations are witnessing rapid expansion in the healthcare infrastructure, which is expanding insurance coverage and growing medical tourism. NIH in April 2025 revealed that the study compared medical device authorization and reimbursement for two cardiovascular devices across the US, Canada, the UK, and the Netherlands, finding that Europe authorized devices about 10 years earlier than North America. However, only the US Medicare system reimbursed both devices, leading to faster adoption and higher usage rates in the US.

Estimated Cardiovascular Procedural Needs per 100,000 Population by Country Income Group as of NIH 2023 report

|

Country Income Group |

All Cardiac Surgery (per 100,000) |

Coronary Artery Bypass Grafting (CABG) |

Valve Surgery (per 100,000) |

Congenital Heart Surgery (per 100,000) |

|

High-Income |

~123 |

~37 |

~31 |

~8 |

|

Upper-Middle-Income |

~90 |

~35 |

~10 |

~8 |

|

Lower-Middle-Income |

~55 |

~15 |

~7 |

~4 |

|

Low-Income |

~40 |

~5 |

~5 |

~3 |

Source: NIH

Strategic Market Expansion of Next-Generation Cardiac Devices

|

Year |

Company |

Product/Innovation |

Market/Region |

Key Feature/Opportunity |

|

2025 |

Abbott |

AVEIR Conduction System Pacing (CSP) |

Global (incl. US, Europe, APAC) |

Leadless pacemaker targeting the left bundle branch, novel pacing tech, ongoing pivotal trial |

|

2025 |

Edwards Lifesciences |

SAPIEN M3 Transcatheter Mitral Valve Replacement |

Europe (CE Mark) |

First transfemoral transcatheter mitral valve replacement system for patients unsuitable for surgery |

|

2022 |

Medtronic |

Micra AV Transcatheter Pacing System |

Japan |

The smallest leadless pacemaker with AV synchronous pacing expands patient eligibility |

Source: Company Official Press Releases

Challenges

- Delayed regulatory activities: The governing bodies create a remarkable hurdle in the market, taking a prolonged time for product approvals. The key goal to prove patient safety necessitates highly extensive and costly clinical trials, thereby elongating development cycles and postponing access to effective innovations. This high barrier has skewed up market expansion, ultimately slowing down the pace of technological advancement.

- Competition from generics: There has been a significant demand for these devices, despite which, the competition from generics hinders growth in the market. Besides, the intensive pricing pressure causes a hurdle to the profit margins for manufacturers and disincentivizes future investment in research and development. Furthermore, the small-scale healthcare providers often choose cheaper alternatives, limiting the market growth for pioneering companies.

Cardiac Prosthetic Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 8.7 billion |

|

Forecast Year Market Size (2035) |

USD 17.4 billion |

|

Regional Scope |

|

Cardiac Prosthetic Devices Market Segmentation:

End user Segment Analysis

Based on end user hospitals & cardiac centers segment is predicted to garner the largest revenue share of 72.5% in the cardiac prosthetic devices market during the discussed timeframe. The subtype remains the primary preference due to the high complexity of cardiac implant procedures, the need for hybrid operating rooms, and cath labs. In May 2025, Broward Health Medical Center reported that it had implanted the AMDS Hybrid Prosthesis, an advanced device for treating acute DeBakey Type I aortic dissections complicated by malperfusion.

Material Segment Analysis

In terms of material biological materials segment is projected to attain a significant share of 45.6% in the cardiac prosthetic devices market by the end of 2035. The growth in the segment originates from their advantages over mechanical valves, including superior hemodynamics and lower lifetime risk of thromboembolism. In June 2024, Elutia Inc. stated that its EluPro is accepted by the U.S. FDA, which is the first antibiotic-eluting biologic envelope designed to protect patients with implantable cardiac devices such as pacemakers and defibrillators.

Product Type Segment Analysis

Based on product type transcatheter heart valves segment is anticipated to grow at a considerable rate, with a share of 28.5% in the market during the discussed timeframe. The growing prevalence of severe aortic stenosis in an aging global population and the strong clinical preference for minimally invasive procedures are the key factors behind the leadership. In June 2025, Foldax Inc. stated that it received regulatory approval from India’s Central Drugs Standard Control Organization for its TRIA Mitral Valve, marking the world’s first-ever commercial approval of a polymer-based heart valve.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Material |

|

|

Product Type |

|

|

Procedure |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiac Prosthetic Devices Market - Regional Analysis

North America Market Insights

The North America cardiac prosthetic devices market is projected to account for the highest share of 40.5% by the end of 2035. The growth in the region is effectively attributed to the advanced healthcare infrastructure and a prominent adoption of premium-priced innovations. For instance, in April 2025 University of Illinois reported that Professor Cunjiang Yu has developed a self-adhesive rubbery bio-optoelectronic stimulator, which is designed to help patients with cardiovascular diseases such as arrhythmia, hence suitable for standard market growth.

The U.S. is the dominating player in the cardiac prosthetic devices market, which is remarkably fueled by the Medicare expansion and accelerating approvals. The country hosts a substantial number of key players implementing tactical strategies to secure their global positions. Besides, the cardiac procedural costs are also significantly rising, wherein the study published by AHA in February 2024 stated that the mean cost per discharge is highest for peripheral vascular disease at USD 33,700 and ventricular tachycardia/fibrillation at USD 32,500. Hence, these costs highlight the economic potential of cardiovascular disease in the U.S. healthcare system.

Canada is steadily consolidating its position in the cardiac prosthetic devices market, fueled by public healthcare expenditures. For instance, the Standing Committee on Finance 2023 Pre-budget consultation revealed that the country’s federal government has allocated a total of USD 700,000 per year over 5 years, which totaled to a substantial 3.5 million, to the Canadian Cardiovascular Society. It also stated that this funding aims to support initiatives that ensure heart failure patients receive optimal, standardized care across the country.

Key U.S. Cardiovascular Disease Prevention Programs (2021-2023)

|

Program/Initiative |

Notes |

|

CDC Funding (FY 2023) |

$114 million awarded to 50 states, DC, tribes, tribal organizations, cities, health systems, and universities |

|

Paul Coverdell Program |

Improved stroke care for 1.1 million+ patients in 800+ hospitals; |

|

WISEWOMAN Program |

365,440 screenings for 256,442 participants; 502,000+ healthy behavior support services provided |

|

Million Hearts Initiative |

Trained 1,400+ clinicians; developed 50+ tools/resources; helped 700,000+ patients improve BP and cholesterol control |

Source: CDC

APAC Market Insights

The Asia Pacific market is poised to witness the fastest growth during the analyzed timeframe. The growth in the region is effectively facilitated by the rising burden of cardiovascular diseases, expanding medical tourism, and government-backed healthcare modernization. Besides the presence of government subsidies, domestic manufacturing units and exclusive innovations readily drive business in this sector. Also, there is an amplified adoption of robotic surgery and affordable cardiovascular prosthetic devices, leading the way to utmost success.

China is the global leader in the market, successfully backed by the government healthcare policies and strong manufacturing capabilities. Besides domestic firms, which are continuously putting efforts to enhance R&D, international firms continue to maintain a strong presence in the market. In March 2025, MicroPort CRM Shanghai notified that it launched the localized TEN pacemaker family in the country, which features six models across single- and dual-chamber categories with advanced technologies such as AutoMRI for safe MRI scans and SAM for monitoring sleep breathing patterns and arrhythmias.

The cardiac prosthetic devices market in India is vigorously growing, owing to the presence of government-backed initiatives, increasing adoption in healthcare facilities, and domestic manufacturing capabilities. In August 2024, Apollo Hospitals Chennai reported that it performed the country’s first-ever dual heart valve repair using Mitral and Tricuspid Transcatheter Edge-to-Edge Repair on a high-risk 59-year-old heart failure patient. It also stated that the procedure offers a less invasive alternative to traditional surgery, providing new hope for patients with severe valve issues, thereby strengthening the country’s position in this field.

Cardiac Prosthetic Devices Implantation Statistics (2022)

|

Country/Region |

Total Pacemakers |

Total ICDs |

Total CRTs |

|

PR. China |

98,619 |

6,762 |

5,398 |

|

Brunei Darussalam |

77 |

29 |

8 |

|

Hong Kong, CN |

2,080 |

314 |

200 |

|

Indonesia |

1,473 |

84 |

60 |

|

Japan |

69,221 |

6,440 |

5,563 |

|

South Korea |

8,165 |

1,685 |

502 |

|

Malaysia |

1,411 |

401 |

253 |

|

New Zealand |

1,624 |

358 |

167 |

|

Philippines |

1,281 |

78 |

33 |

|

Singapore |

1,071 |

365 |

191 |

|

Sri Lanka |

1,501 |

169 |

71 |

|

Taiwan, CN |

7,283 |

861 |

335 |

|

Thailand |

5,192 |

1,313 |

539 |

|

Vietnam |

4,137 |

254 |

95 |

Source: APHRS

Europe Market Insights

Europe also stands at the forefront of growth in the cardiac prosthetic devices market, which is effectively fueled by the strong research ecosystem and medical device regulations. For instance, in July 2025, CARMAT reported that it had received the Medical Device Regulation CE marking for its Aeson artificial heart, which is designed to provide a therapeutic alternative for people with advanced biventricular heart failure. Furthermore, countries such as Germany, France, and the UK are also facilitating continued revenue in the region’s market.

Germany is predicted to grow remarkably in the cardiac prosthetic devices market over the forecasted years, backed by its well-established healthcare infrastructure and sophisticated medical technology. The country also hosts numerous leading healthcare facilities, which are capable of performing complex surgeries requiring cardiac prosthetics. In April 2022, TRiCares announced the successful first-in-human implantation of its Topaz transfemoral tricuspid heart valve replacement system in the country, which enables a minimally invasive treatment option for severe tricuspid regurgitation patients who are high-risk for open-heart surgery.

The U.K. is maintaining a strong position in the market owing to the increasing awareness regarding heart valve disease and the rising use of minimally invasive procedures. For instance, in December 2024, the country’s government awarded a total of £80 million to support 100 innovative research projects across the country, including developments in prosthetics and healthcare, hence enhancing access and innovation in Germany’s cardiac care.

Key Cardiac Prosthetic Devices Market Players:

- Edwards Lifesciences

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- LivaNova PLC

- Getinge AB

- MicroPort Scientific Corporation

- B. Braun SE

- Lepu Medical Technology

- BIOTRONIK SE & Co. KG

- Meril Life Sciences

- Sorin Group (Now part of LivaNova)

- Osypka AG

- Shree Pacetronix Ltd.

- Biosensors International Group

The worldwide market comprises notable U.S. giants such as Medtronic, Edwards, and Abbott, which are putting constant efforts through R&D and acquisitions. Transcatheter aortic valve replacement expansion, bioresorbable stents, and AI-based diagnostics are a few strategies implemented by the players to strengthen their ecosystem. Further, the regulatory approvals, collaborations with healthcare facilities, and digital health integration provide an encouraging opportunity for the market to expand more.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In January 2025, MUSC Health reported that it became the first in the U.S. to implant Topaz, a new transcatheter tricuspid valve replacement device by TriCares, in a patient with severe tricuspid regurgitation (TR).

- In December 2024, Artivion, Inc. stated that it had received the U.S. FDA Humanitarian Device Exemption for its AMDS Hybrid Prosthesis, the first aortic arch remodeling device for treating acute DeBakey Type I dissections with malperfusion.

- Report ID: 8107

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cardiac Prosthetic Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.