Tranquilizer Drugs Market Outlook:

Tranquilizer Drugs Market size was valued at USD 2.6 billion in 2025 and is likely to cross USD 3.78 billion by 2035, registering more than 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tranquilizer drugs is assessed at USD 2.69 billion.

The rising prevalence of cognitive health conditions such as anxiety, depression, and PTSD is significantly driving the need for sedatives, as these medications are essential for managing such disorders. According to a CDC published report in November 2024, approximately 18.2% of adults aged 18 and older experienced anxiety symptoms, while 21.4% experienced depression symptoms in the U.S. in 2022. Additionally, the growing elderly population, particularly in developed countries, is more prone to conditions such as insomnia, uneasiness, and dejection, which leads to increased usage of stress relievers among older adults. Altogether, these factors are propelling the tranquilizer drugs market globally.

Additionally, as cognitive health awareness increases and societal stigma surrounding psychological health issues continue to decrease, more individuals are seeking treatment for conditions such as anxiety, despondency, and PTSD. According to WHO on October 2024, World Mental Health Day mobilizes efforts to support psychic health and increase awareness of mind-related health issues worldwide. This shift in public perception has led to a greater acceptance of using medications, including relaxants, as part of treatment regimens. With more people open to addressing their inner health needs, the requirement for anxiolytics has risen, contributing significantly to the overall growth and expansion of the market.

Key Tranquilizer Drugs Market Insights Summary:

Regional Highlights:

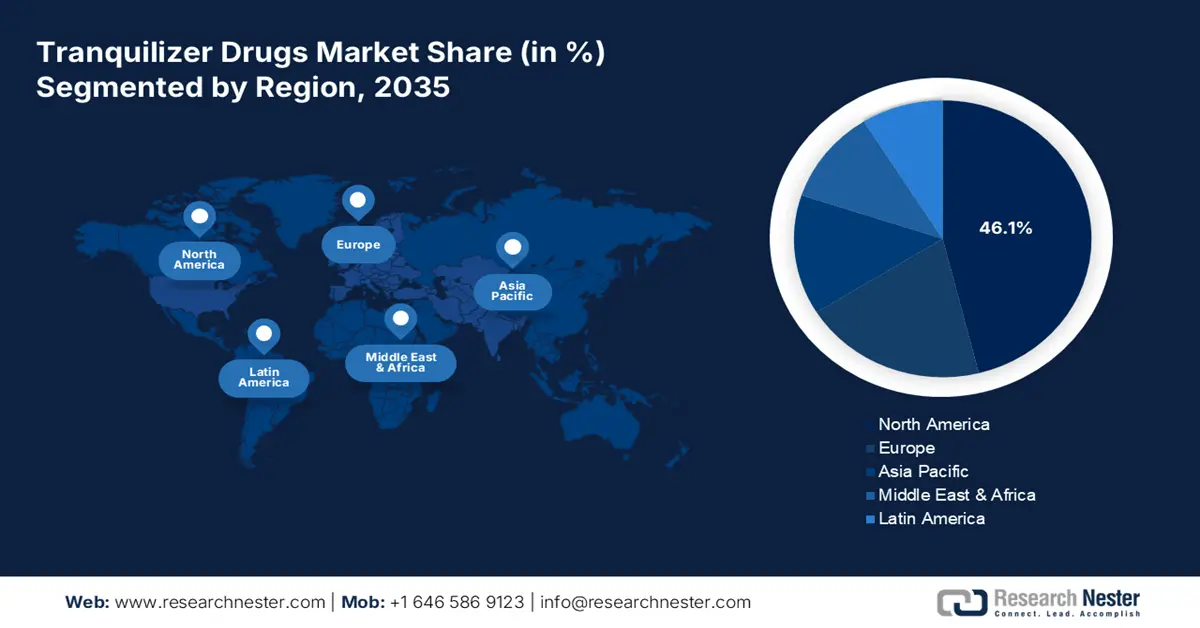

- By 2035, North America is expected to capture over 46.1% share of the tranquilizer drugs market, underpinned by the rising prevalence of psychic health conditions.

- Across 2026–2035, APAC is set to register the fastest CAGR, fueled by rising cases of anxiety, depression, and PTSD driven by rapid urbanization and lifestyle changes.

Segment Insights:

- By 2035, the butyrophenones segment is projected to secure over 66.6% share of the tranquilizer drugs market, propelled by its effectiveness in treating severe psychiatric conditions.

- Through 2026–2035, the benzodiazepine derivatives segment is anticipated to command the majority share, supported by its widespread use in managing trepidation, insomnia, and other stress-related disorders.

Key Growth Trends:

- Government initiatives coupled with research funding

- Economic aspects

Major Challenges:

- Stigma around mental health

- Prescription misuse and abuse

Key Players: Abbott, AstraZeneca Plc., Eli Lilly and Company, GlaxoSmithKline plc, Merck & Co., Inc., Pfizer, Inc., Hikma Pharmaceuticals PLC, Aquestive Therapeutics, Inc., Bristol-Myers Squibb Company, Allergan, Sun Pharma.

Global Tranquilizer Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.69 billion

- Projected Market Size: USD 3.78 billion by 2035

- Growth Forecasts: 3.8%

Key Regional Dynamics:

- Largest Region: North America (46.1% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 2 December, 2025

Tranquilizer Drugs Market - Growth Drivers and Challenges

Growth Drivers

-

Government initiatives coupled with research funding: Governments and private organizations are increasing their investments in cognitive health initiatives and research, driving innovative sedatives drugs' development. The Substance Abuse and Mental Health Services Administration (SAMHSA) allocated USD 8.1 billion to the President's Fiscal Year (FY) 2025 Budget. These efforts are not only expanding treatment options but also ensuring the accessibility of more effective medications. With a focus on improving psychological health care, these investments are enhancing the functionality of depressants, addressing unmet needs, and significantly contributing to the expansion of the tranquilizer drugs market globally.

- Economic aspects: Rising disposable incomes in emerging markets are enabling more individuals to afford neurological health treatments, including stress relievers drugs. Per capita disposable income increased in India from USD 2.1 thousand in 2019 to USD 2.5 thousand in 2023, according to IBEF data released in January 2025. As the economic landscape improves, people are increasingly seeking professional help for managing conditions such as anxiety and PTSD, which drives the demand for tranquilizers. The ability to access and afford these medications in regions with growing middle-class populations contributes significantly to the expansion of the tranquilizer drugs market, fostering increased usage and availability in these areas.

Challenges

-

Stigma around mental health: Despite growing awareness about subconscious health, a lingering stigma still exists around seeking treatment for inner health conditions, particularly in certain cultures. This stigma can discourage individuals from acknowledging their need for help or pursuing professional treatment, including the use of calmatives. As a result, many people avoid or delay using such drugs, limiting the market expansion in these regions. Overcoming this cultural barrier is crucial for expanding access to rational health treatments and driving market enhancement.

- Prescription misuse and abuse: Drugs such as opioids and benzodiazepines, have raised significant public health concerns due to their addictive nature and potential for overdose. As a result, governments and health authorities are implementing stricter regulations, limiting their availability and prescription. These measures aim to reduce substance abuse but also result in reduced purchase of soothers for patients who need them. The tightening of prescription guidelines and restrictions ultimately slows the growth of the tranquilizer drugs market.

Tranquilizer Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.78 billion |

|

Regional Scope |

|

Tranquilizer Drugs Market Segmentation:

Major Tranquilizers Segment Analysis

The butyrophenones segment is set to capture over 66.6% tranquilizer drugs market share by 2035. The segment’s growth is attributed to its effectiveness in treating severe psychiatric conditions, such as schizophrenia and acute agitation. These drugs, including haloperidol, are known for their potent antipsychotic properties, making them crucial in managing conditions that may not respond well to other sedatives. The advantages further attract both consumer and pharma leaders to invest in this segment. For instance, in December 2022, Essential Pharma’s acquisition of HALDOL and HALDOL Decanoate from Janssen Pharmaceutica expanded its portfolio, boosting the growth of the butyrophenones segment in the market.

Minor Tranquilizers Segment Analysis

By minor tranquilizers, the benzodiazepine derivatives segment is anticipated to hold the majority tranquilizer drugs market proportion through the forecast time. The segment is growing due to its widespread use in managing trepidation, insomnia, and other stress-related disorders. These drugs are highly effective at inducing sedation, muscle relaxation, and anti-anxiety effects, making them a go-to- treatment for both acute and chronic conditions. The requirement for benzodiazepines remains strong due to their quick onset of action and established safety profiles. Additionally, newer benzodiazepine derivatives with improved formulations are contributing to their increasing market presence.

Our in-depth analysis of the global tranquilizer drugs market includes the following segments:

|

Major Tranquilizers |

|

|

Minor Tranquilizers |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tranquilizer Drugs Market - Regional Analysis

North America Market Insights

North America tranquilizer drugs market is anticipated to capture revenue share of over 46.1% by 2035. The increasing prevalence of psychic health conditions such as restlessness, depression, and PTSD is driving the demand for anxiolytics as essential treatment options. Additionally, the expansion of healthcare coverage and access in developed countries through various reforms has made these medications more widely available, allowing a larger population to benefit from them. This combination of rising mental health awareness and improved healthcare accessibility is significantly contributing to the escalation of the tranquilizer drugs market in North America.

The increasing prevalence of anxiety, depression, and PTSD in the U.S. has significantly boosted the demand for nerve pills, as these medications are essential for managing such conditions. As per ADAA in October 2022, Generalized Anxiety Disorder (GAD) affected 6.8 million adults or 3.1% of the US population. Additionally, ongoing FDA approvals for new tranquilizer drugs, particularly those targeting therapeutics, empower the uninterrupted introductory convoy of novel treatments. This combination of rising mind-related health concerns and continuous innovation in depressants medications is driving the proliferation of the tranquilizer drugs market in this country.

Government initiatives and research funding for inner health treatments, including stress relievers, have driven the innovation of therapies. Over 36.5% of individuals diagnosed with nervousness or substance use disorders received medication, according to the government of Canada, in October 2023. Additionally, the aging population in Canada, more prone to conditions such as insomnia and trepidation, has led to increased use of rexalants for managing age-related cognitive health issues. These combined factors are significantly contributing to the growth of the tranquilizer drugs market, as more effective treatments become accessible to a wider demographic in need.

Asia Pacific Market Insights

In APAC, the tranquilizer drugs market is established to garner the fastest CAGR over the forecast period. Rising cases of anxiety, depression, and PTSD in the Asia Pacific region, driven by stress from rapid urbanization and lifestyle changes, have significantly boosted the requirement for calmatives. Additionally, the growing elderly population across its countries is contributing to an increased prevalence of age-related subconscious health conditions, such as insomnia and restlessness. This is further raising related challenges, multiplying the need for tranquilizer drugs in the region.

As the economy of China is growing, stress-related disorders, especially in urban areas, are rising, pushing the growing middle-class population to seek stress relieving treatments for rational health issues linked to modern lifestyles. According to NLM, a survey conducted between February 12 and February 17, 2020, among 2500 invited university students in China, the prevalence of clinically-relevant PTSD was 30.8% (November 2021).At the same time, continued innovation in tranquilizer drug formulations and FDA-approved treatments tailored for specific conditions, such as PTSD and generalized anxiety, is expanding treatment options. This is creating a surge and evolving drug offerings, driving significant surge in China tranquilizer drugs market.

Improvements in healthcare infrastructure, especially in rural and semi-urban areas in India, are enhancing access to anxiolytic medications, enabling more people to receive treatment for psychological conditions. According to NLM, epidemiological research conducted in July 2023 shows that the prevalence rates of psychiatric diseases in India ranged from 9.5 to 370 per 1000 individuals. At the same time, rising cases, exacerbated by urbanization, high-pressure environments, and societal changes significantly propel the sector. Thus, the improved healthcare system and the growing need for treatment are fueling the market’s expansion in India.

Tranquilizer Drugs Market Players:

- Abbott

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca Plc.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Merck & Co., Inc.

- Pfizer, Inc.

- Hikma Pharmaceuticals PLC

- Aquestive Therapeutics, Inc.

- Bristol-Myers Squibb Company

- Allergan

- Sun Pharma

Key companies are driving innovation in the tranquilizer drugs market by developing novel formulations and combining existing therapies to enhance efficacy. They are focusing on targeted treatments that address specific conditions such as PTSD and narcolepsy, improving symptom management and patient outcomes. For instance, in December 2024, Eli Lilly’s FDA approval of Zepbound for obstructive treatment prompted shifts in the tranquilizer drug market, as prescribers reconsidered alternatives, causing market dynamics changes and competitive repositioning. Additionally, companies are exploring personalized treatments, utilizing advanced research into receptors and brain chemistry for more precise, effective nerve-related therapies. These players include:

Recent Developments

- In April 2024, Aquestive Therapeutics presented a study on Libervant (diazepam)Buccal Film for pediatric epilepsy, enhancing tranquilizer drug innovation and expanding treatment options at the AAN Annual Meeting.

- In January 2022, Hikma Pharmaceuticals launched Diazepam Injection (5mg/ml) in a prefilled syringe, enhancing accessibility and efficiency, driving growth in the tranquilizer drugs market.

- Report ID: 7114

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tranquilizer Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.