Atrial Fibrillation Drugs Market Outlook:

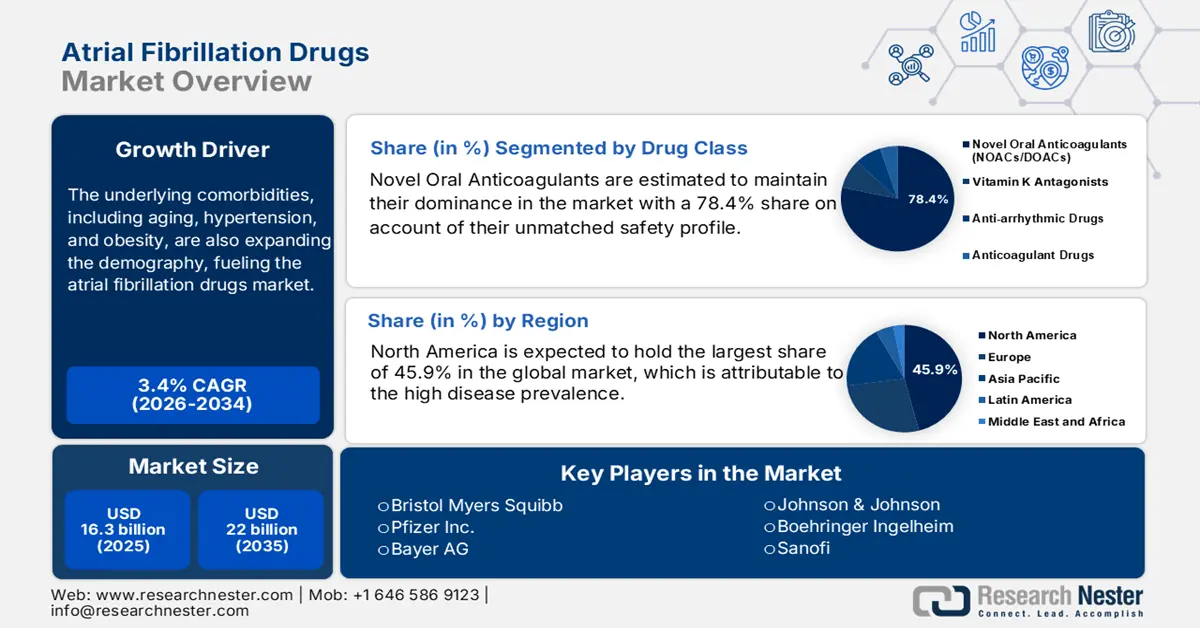

Atrial Fibrillation Drugs Market size was over USD 16.3 billion in 2025 and is estimated to reach USD 22 billion by the end of 2035, expanding at a CAGR of 3.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of atrial fibrillation drugs is assessed at USD 16.8 billion.

With the substantial increase in the incidence, severity, and mortality of atrial fibrillation (AF) across the globe, the demand for non-invasive treatment options and preventive measures is amplifying. According to a worldwide study published in June 2023, AF affected approximately 33 million individuals, becoming one of the primary causes of coronary heart disease (CHD) and deaths. Besides, the underlying comorbidities, including aging, hypertension, and obesity, are also expanding the demography, fueling the market. For instance, the number of children and adolescents with this condition is expected to rise by 50 million between 2025 and 2030, as per the estimations from the World Obesity Federation (WOF).

As a result of such an enlargement of the epidemiology, the economic burden of AF is also hindering access to advanced therapies, where therapeutics available in the market can be an affordable alternative for patients. This can be testified by the findings from a 2025 study conducted by the Hebei Medical University, determining the annual direct cost of this ailment in the U.S. to range between USD 2 thousand and USD 14.2 thousand. It also calculated the per-patient per-year expenses in this category as USD 525.2-3501.6 in Europe. Moreover, the inflated payers’ pricing of surgical procedures is pushing public authorities to opt for value-based treatment models, incorporating novel drugs.

Key Atrial Fibrillation Drugs Market Insights Summary:

Regional Highlights:

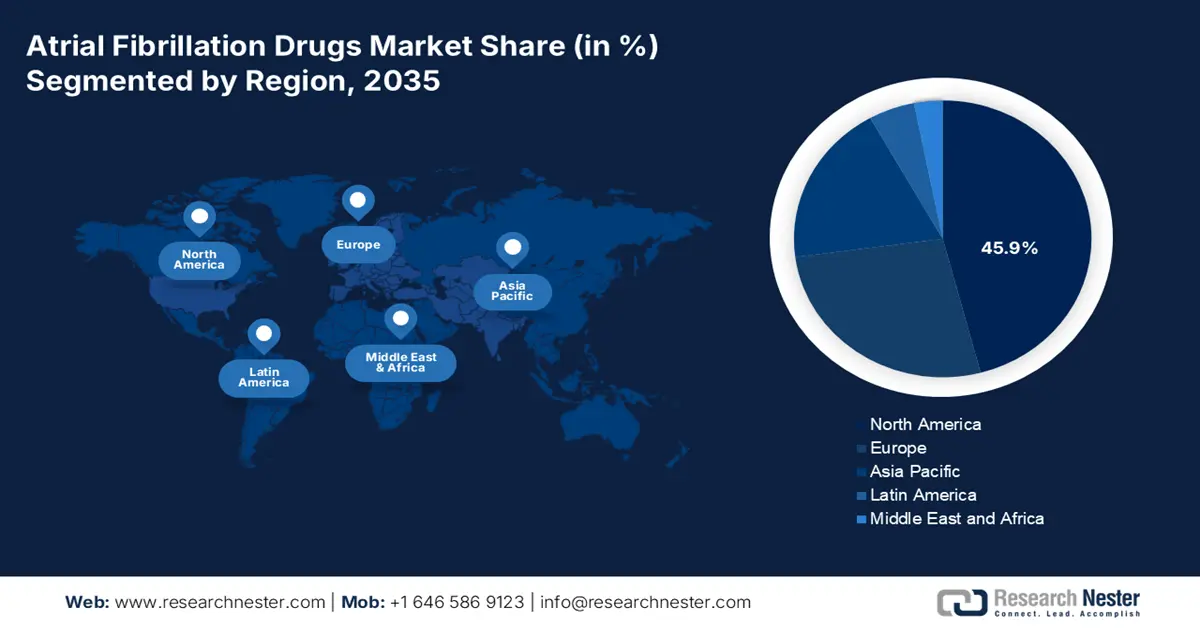

- North America is projected to secure a 45.9% share by 2035 in the Atrial Fibrillation Drugs Market, underpinned by robust healthcare infrastructure, favorable reimbursement systems, and the extensive presence of major pharmaceutical firms.

- Asia Pacific is forecasted to emerge as the fastest-growing region by 2035, accelerated by rising cardiovascular disease prevalence, expanding healthcare investments, and government-led initiatives to enhance AF treatment access.

Segment Insights:

- The Novel Oral Anticoagulants (NOACs/DOACs) segment is projected to command a 78.4% share by 2035 in the Atrial Fibrillation Drugs Market, propelled by their superior safety profile, global clinical preference, and enhanced patient adherence.

- The Stroke Prevention segment is anticipated to hold a 72.7% share by 2035, sustained by rising stroke prevalence and escalating healthcare efforts to mitigate stroke-related mortality.

Key Growth Trends:

- Aging global population

- Increased activities in pharmaceutical R&D

Major Challenges:

- Increasing cost of R&D and compliance

- Payer demand for real-world evidence (RWE)

Key Players: Bristol Myers Squibb, Pfizer Inc., Bayer AG, Johnson & Johnson, Boehringer Ingelheim, Sanofi, AstraZeneca, Novartis AG, Teva Pharmaceutical, Merck & Co., Abbott Laboratories, Gilead Sciences, Sun Pharmaceutical, Hikma Pharmaceuticals, Viatris Inc., Dr. Reddy's Laboratories, Servier Laboratories, CSL Limited, HLB Co., Ltd., Alembic Pharmaceuticals Limited.

Global Atrial Fibrillation Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.3 billion

- 2026 Market Size: USD 16.8 billion

- Projected Market Size: USD 22 billion by 2035

- Growth Forecasts: 3.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 3 September, 2025

Atrial Fibrillation Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Aging global population: As the population aged 65 and older is rapidly growing, in both developing and mature regions, the demand for long-term and preventive care is rising. According to a WHO report, 1 in every 6 people worldwide is predicted to be aged 60 years or over by 2030, accounting for 1.4 billion. This is further estimated to grow up to 2.1 billion by 2050, where 426 million of them are poised to be aged 80 or older. The demography, being highly prone to developing age-related AF complications and comorbidities, fosters a larger patient pool and sustained demand for efficient therapeutics, fueling the market.

- Increased activities in pharmaceutical R&D: Innovations and investments in pharmaceutical research are the key to future progress in the atrial fibrillation drugs industry. As novel drugs offer greater advantages over traditional therapies, both public and private medical organizations are showing interest in being involved in rigorous research and development. As evidence, in January 2025, a team of researchers at the DZHK Munich site, working in alliance with colleagues from the USA, France, and the Netherlands, was awarded a sum of USD 8 million over five years by the Leducq Foundation. This funding was dedicated to exploring immune cell roles in AF with an aim to develop targeted therapies.

- Growing awareness and early diagnosis: Public health campaigns and screening programs, led by government awareness initiatives, promote early adoption of therapies available in the market. Particularly, the emergence of wearable ECG monitors and AI-powered diagnostic tools is making the identification of asymptomatic or paroxysmal AF more convenient and faster, which is prompting high-risk or afflicted patients to invest in this category. Moreover, the clinical and economic benefits of earlier initiation of therapy that can improve outcomes and prevent complications are propelling demand in this sector.

Historic Regional and Socio-Demographic Trends in Global Burden of Disease (GBD)

Global and SDI-Level Trends in AF Burden (1990-2019)

|

Region/SDI Level |

Trend in AF Cases |

Most Notable Metric Changes |

Key Notes / Statistics |

|

High-Middle SDI |

Decreasing |

ASIR: -0.12 (95% CI: -0.15 to -0.09) ASMR: -0.25 (-0.32 to -0.18) ASDR: -0.25 (-0.28 to -0.23) |

Only the SDI group with declining AF burden metrics |

|

High-Income North America |

Increasing (since 2019) |

Highest ASIR: 108.53 (87.59-131.44) |

Also showed the most prominent increases in ASIR and ASDR |

|

Australasia (e.g., Australia) |

High mortality and DALY |

ASMR: 6.86 (5.45-8.33) ASDR: 168.28 (132.54-214.32) |

Among the highest in global AF-related mortality and disability |

Source: Frontiers

Legends:

- SDI = Sociodemographic Index

- DALY = Disability-Adjusted Life Year

- ASIR = Age-Standardized Incidence Rate

- ASMR = Age-Standardized Mortality Rate

- ASDR = Age-Standardized DALY Rate

- CI = Confidence Interval

Trends in Commercial Moves, Clinical Trials, and R&D Expanding the Atrial Fibrillation Drugs Market

Recent Commercial Launches and Clinical Developments in the Market

|

Timeline |

Company |

Drug/Program |

Stage/Type |

Indication |

Key Details |

|

November 2023 |

Bayer |

Asundexian (BAY2433334) |

Phase III (OCEANIC-AFINA) |

AF patients ≥65 at high risk of stroke or systemic embolism and unsuitable for OACs |

Third Phase III study under the OCEANIC program; targets patients with high bleeding risk |

|

March 2023 |

Bristol Myers Squibb & Janssen |

Milvexian |

Phase III (Librexia Program) |

Oral Factor Xia inhibitor for antithrombotic treatment |

Collaborative Phase III study targeting the prevention of thrombotic events, including AF patients |

|

January 2023 |

Anthos Therapeutics |

Abelacimab |

Phase III (LILAC-TIMI 76) |

High-risk AF patients are unsuitable for current anticoagulants |

First patient enrolled; study focuses on safety and efficacy in patients not eligible for standard OACs |

|

September 2022 |

Anthos Therapeutics |

Abelacimab |

FDA Fast Track Designation |

Prevention of stroke/systemic embolism in AF patients |

Accelerated development granted by the FDA for a high-priority unmet clinical need |

|

June 2022 |

Apotex Inc. |

APO-Apixaban (generic) |

Commercial Launch |

Prevention and treatment of blood clots (e.g., in AF) |

First generic version of Eliquis in Canada; available in 2.5mg and 5mg tablets |

|

January 2022 |

Eagle Pharmaceuticals/AOP Orphan Pharma |

Landiolol |

Pre-NDA Regulatory Engagement |

Short-term reduction of ventricular rate in patients with supraventricular tachycardia, including AF/flutter |

Engaged with the FDA to define pre-clinical and clinical data requirements for NDA approval in the U.S. |

Source: Company Press Releases

Challenges

- Increasing cost of R&D and compliance: A new medicine is mandated to show not just clinical benefit but also value for money, creating a risk of financial and viability loss for the innovators and manufacturers in the atrial fibrillation drugs market. Particularly, the certification thresholds of strict regulatory bodies, such as CE marking and the FDA, often delay product launch in this sector by making the process of acquiring compliance more complex and expensive. Thus, many innovative, high-cost therapies struggle to meet the growing consumer demand due to their limited availability.

- Payer demand for real-world evidence (RWE): Insurance providers worldwide are increasingly demanding robust RWE to confirm the clinical benefits and cost-effectiveness as demonstrated in randomized controlled trials (RCTs). However, to enroll the medicine for such evaluation, the companies are pushed to recruit eligible candidates, where a majority of the chosen individuals often hesitate to go through these experimental treatments out of their fear of major side effects and unknown outcomes. This makes the process financially exhausting for manufacturers in the market.

Atrial Fibrillation Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.4% |

|

Base Year Market Size (2025) |

USD 16.3 billion |

|

Forecast Year Market Size (2035) |

USD 22 billion |

|

Regional Scope |

|

Atrial Fibrillation Drugs Market Segmentation:

Drug Class Segment Analysis

Novel Oral Anticoagulants (NOACs/DOACs) are estimated to maintain their dominance in the atrial fibrillation drugs market over the assessed period, by capturing a 78.4% share. The unmatched safety profile, with a notably lower risk of intracranial hemorrhage compared to other drug classes, solidifies their forefront position in this sector. This also establishes them as the first-line therapy in major clinical guidelines globally, securing higher cash inflow than other segments. Moreover, the convenience of fixed dosing and no requirement for routine blood monitoring greatly improves patient adherence and quality of life, making them the gold standard for effective, non-invasive treatment for AF.

Application Segment Analysis

Stroke prevention is poised to remain the paramount application in the atrial fibrillation drugs market by the end of 2035, while acquiring the highest share of 72.7%. As the primary medical condition increases the risk of stroke five-fold, the use of medicines to prevent such deadly events is remarkably increasing. Moreover, the severity and fatality of strokes are becoming a global health crisis, pushing medical systems to procure effective medication at a large scale. Testifying to the same, an NLM finding revealed that the global cost of stroke accounted for more than USD 890 billion in 2025 alone, which is further estimated to increase by 2x till the end of 2050.

End user Segment Analysis

Hospitals are predicted to be the leading end users in the atrial fibrillation drugs market throughout the discussed timeframe. Being the epitome of enabling timely care, accurate detection, and therapy initiation makes them the most important distribution channel for pioneers in this sector. Especially, the involvement of hospitals in emergency cardiac events, such as stroke and heart failure, makes them the primary consumers of AF therapeutics. Additionally, they serve as key centers for clinical trials and formulary decisions, influencing broader prescribing patterns, while their high patient population and ability to manage complex AF cases solidify their dominance in the market.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Drug Class |

|

|

Application |

|

|

Distribution Channel |

|

|

Route of Administration |

|

|

Atrial Fibrillation Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atrial Fibrillation Drugs Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest share of 45.9% in the global atrial fibrillation drugs market during the analyzed tenure. The advanced healthcare infrastructure, high disease prevalence, and widespread adoption are indications of the region being the epicenter of conducting profitable business in this sector. The U.S., in particular, due to having a massive obese population, witnesses an evidently higher incidence of AF-related risk factors than other nations, contributing to a substantial demand base for the merchandise. The region also benefits from favorable reimbursement policies, robust clinical research activity, and a strong presence of leading pharmaceutical companies, which enable a progressive atmosphere for pioneers.

According to a 2025 report from the Health Action Council, every 2 in 5 adults and 1 in 5 children in the U.S. suffer from obesity. Another NLM article revealed that the count of people with AF living across the country grew from 2.9 million in 1990 to 6.4 million in 2021. These figures underscore the exceptionally high growth trend of the epidemiology, which translates to continuously rising demand in the market. Besides, the country is home to several public and private research organizations, backed by favorable affiliations and heavy allocations from the federal government.

Canada also plays a prominent role in the regional expansion of the market. The country’s augmentation in this sector is remarkably supported by its wide network of publicly funded healthcare settings and increasing awareness of cardiovascular health. The governing authority of Canada has made a significant contribution in promoting early adoption of medications to prevent deadly cardiac events. For instance, till 2023, the Canadian Cardiovascular Society (CCS) was receiving an annual funding of USD 700.0 thousand for over five years, totaling USD 3.5 million, from the federal government to ensure optimal care for heart failure patients nationwide.

APAC Market Insights

Asia Pacific is anticipated to become the fastest-growing region in the global atrial fibrillation drugs market by the end of 2035. The growing geriatric population, increasing occurrence of cardiovascular diseases (CVD) events, and amplifying healthcare investments are collectively propelling the region’s pace of progress in this field. Particularly, emerging economies, such as China, India, and Japan, are experiencing a notable surge in AF diagnoses and treatments due to continuously improving access to medical care, which is ultimately amplifying adoption in this category. Besides, government efforts to reduce CVD mortality and expand insurance coverage are further boosting demand for advanced AF therapeutics.

China consolidated its position as the growth engine of the Asia Pacific market, which is largely fueled by its massive CVD population and ongoing healthcare reforms. With increasing awareness and early detection of AF, more patients are showing interest in pre-hand treatment initiation, leading to higher demand for anticoagulants and antiarrhythmic drugs. On the other hand, the government’s efforts to expand access to essential medications through public insurance programs and centralization of the national medical system are improving affordability and uptake of newer therapies in this category.

India is becoming an epitome of investment opportunities for the regional atrial fibrillation drugs market on account of rapid healthcare modernization and rising prevalence of risk factors, including hypertension and diabetes. Portraying the presence of such a high-risk population in the country, a WHO report unveiled that at least one in four adults in India was suffering from hypertension till 2022, and only 12% among them had their blood pressure under control. Although AF awareness is still developing, improvements in patient access to diagnostic facilities and therapeutic administration are leading to higher adoption rates.

Trends in Patient Population in the AF Drugs Market

|

Country |

Key Notes |

Timeline |

|

China |

Mortality rate of CVDs accounts for 46.74%–44.26% of all deaths in rural and urban areas |

2024 |

|

India |

Crude incidence of stroke ranged from 108 to 172 per 100,000 people per year; One-month case fatality rates range from 18% to 42% |

2021 |

|

Australia |

Ranked 5th most prevalent country for AF globally; More than 600 thousand individuals are expected to be diagnosed with AF by 2034 |

2024-2034 |

Source: Frontiers, NLM, and ScienceDirect

Europe Market Insights

Europe is poised to represent a mature and steadily growing landscape for the global atrial fibrillation drugs market during the timeline between 2026 and 2035. The region’s consistent propagation in this sector is primarily driven by an enlarging elderly population and high occurrence of CVD. Besides, the empowering medical system across the region support widespread access to advanced AF therapies, including novel oral anticoagulants (NOACs) and antiarrhythmic drugs. Moreover, the well-established clinical guidelines and proactive screening programs promote early diagnosis and effective management.

The UK holds a key position in the Europe market, which is largely supported by its strong emphasis on government-led healthcare reinforcements. The National Health Service (NHS) plays a pivotal role in broadening patient access to AF medications with updated coverage policies, providing adequate financial backing. The frequent awareness campaigns and routine screening programs also enable timely treatment initiation through improved early diagnosis availability. Evidencing the same, in July 2024, the UK National Health Service Cardiac Surgery Centres enacted guidelines, recommending β-blockade for the prevention of AF after cardiac surgery.

Germany is one of the largest and most influential landscapes in the Europe market. The country’s advanced healthcare system and rapidly aging population are collectively fueling demand in this sector. With a high occurrence of AF, the effective anticoagulant and antiarrhythmic therapies segment is gaining traction in this category. Besides, the well-established reimbursement framework ensures broad patient access to both traditional and novel treatments, supporting further innovation and adoption in this sector.

Feasibility Opportunities for the AF Drugs Market

|

Country |

Key Notes |

Timeline |

|

UK |

30% of patients after cardiac surgery suffer from postoperative AF |

2024 |

|

Germany |

Asundexian showed the potential to secure peak sales of more than USD 5.8 billion |

2023 |

|

Switzerland |

The incidence of AF is estimated to double by the end of 2060 |

2018-2060 |

Source: NLM, Company Press Release, and ESC Congress

Key Atrial Fibrillation Drugs Market Players:

- Bristol Myers Squibb

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Bayer AG

- Johnson & Johnson

- Boehringer Ingelheim

- Sanofi

- AstraZeneca

- Novartis AG

- Teva Pharmaceutical

- Merck & Co.

- Abbott Laboratories

- Gilead Sciences

- Sun Pharmaceutical

- Hikma Pharmaceuticals

- Viatris Inc.

- Dr. Reddy's Laboratories

- Servier Laboratories

- CSL Limited

- HLB Co., Ltd.

- Alembic Pharmaceuticals Limited

The competitive landscape in the atrial fibrillation drugs market is consolidated by a cohort of global pharmaceutical giants and regional innovators striving to expand their territories. This consortium includes Pfizer, Bristol Myers Squibb, Bayer, Johnson & Johnson, and Boehringer Ingelheim dominate the commercial space through their widely used therapeutics and drug development. Furthermore, continuous innovations, patent expirations, and the growing availability of generics are pushing pioneers to invest more in R&D, enabling pipeline expansion in this sector.

Such key players are:

Recent Developments

- In February 2025, Novartis completed the acquisition of Anthos Therapeutics against an upfront payment of USD 925 million. This contains a mutual intention of advancing the development of abelacimab, a potential first-in-class treatment and safer approach for stroke prevention in atrial fibrillation.

- In August 2024, Alembic Pharmaceuticals received the final approval for its Abbreviated New Drug Application (ANDA) Dabigatran Etexilate Capsules, 110 mg. The generic drug is formulated to reduce the risk of stroke and systemic embolism in adults with non-valvular atrial fibrillation.

- Report ID: 8054

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atrial Fibrillation Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.