Sarcoma Drugs Market Outlook:

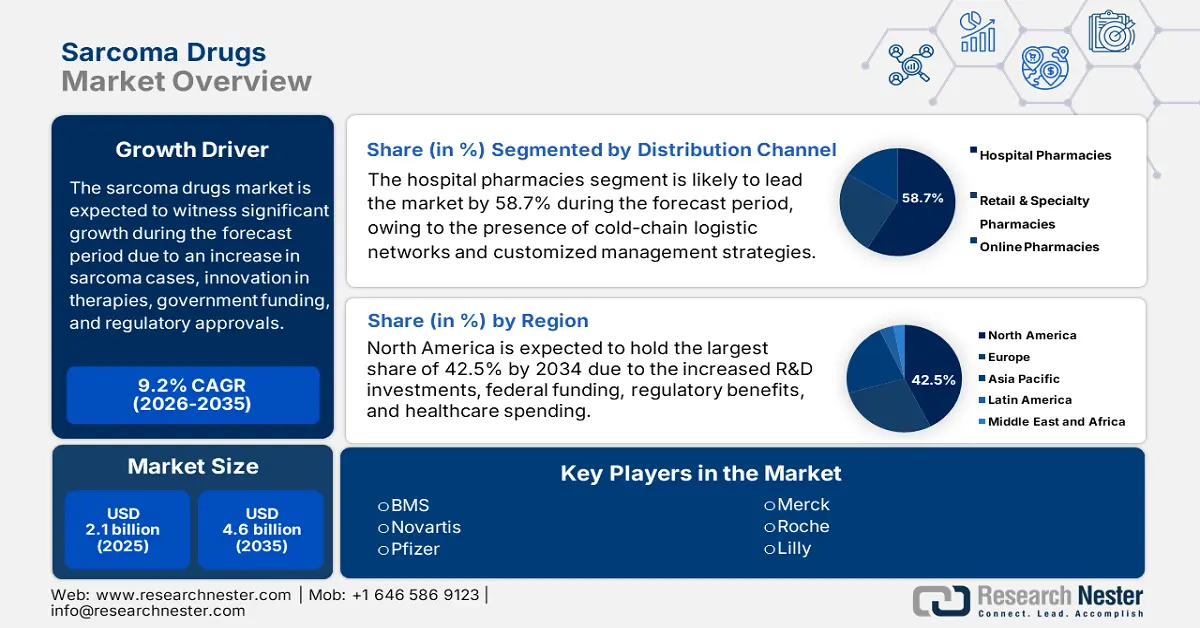

Sarcoma Drugs Market size was USD 2.1 billion in 2025 and is predicted to reach USD 4.6 billion by the end of 2035, increasing at a CAGR of 9.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of sarcoma drugs is evaluated at USD 2.3 billion.

The market’s growth is highly driven by an increase in sarcoma cases, optimized diagnostic solutions, breakthroughs in targeted therapies, and the provision of private and government funding. According to a report published by NLM in April 2025, soft tissue sarcoma (STS), which is a kind of malignant tumor, accounts for only 1% of adult malignancies. In addition, the STS proportion is estimated to be 7% to 8% for pediatric cancer, thereby demanding age-based analysis. Besides, 50% to 60% of STS occurrences are identified in the extremities, thus enhancing the market’s demand. Meanwhile, the overall STS survival rate usually ranges between 60% to 80%, thus suitable for the market’s upliftment.

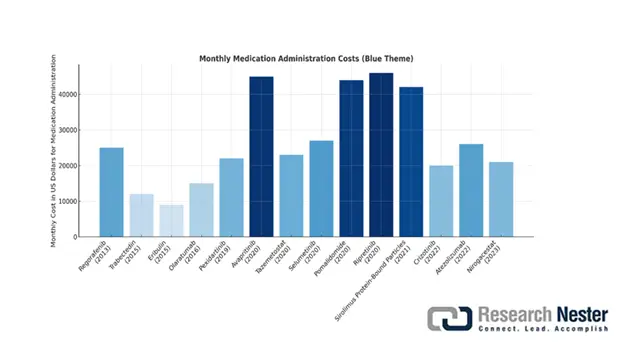

Monthly Cost of FDA-Approved Drugs (in USD)

Source: NCBI

Moreover, immunotherapy has gradually emerged as one of the essential pillars in combating sarcoma, thereby denoting another factor for the market upliftment. As per the October 2022 NLM report, cancer has resulted in 10 million deaths, of which 2 million cases account for breast cancer. Besides, to successfully conduct immunotherapy, the US Food and Drug Administration (FDA) has approved 42% of cancer drugs, which is readily driving the market’s growth. Meanwhile, as stated in the April 2024 NLM article, the 30-day dosing price range of sarcoma medications is between USD 11,162.8 to USD 46,926.0, thereby boosting the overall market globally.

Tabulation of Patient Burden, Drug Approvals, Average Wholesale Price (AWP), Median Progression-free Survival (PFS), & Cost of Therapy, (2013-2023)

|

Indication |

Medication |

Year of FDA Approval |

Incidence of Disease per 1,000,000 People |

AWP in USD |

Time for AWP (Days) |

Price for 30 Days of Drug (1 Month) in USD |

Price for 12 Months of Drug in USD |

|

Third line |

Regorafenib |

2013 |

10-15 |

21,628.32 |

28 |

23,173.20 |

444,925.32 |

|

Liposarcoma and Leiomyosarcoma |

Trabectedin |

2015 |

Liposarcoma: 7 |

9860.57 |

21 |

14,086.53 |

78,884.52 |

|

Liposarcoma who have received prior anthracycline |

Eribulin |

2016 |

Liposarcoma: 7 |

7814.00 |

21 |

11,162.86 |

93,768.24 |

|

Soft Tissue Sarcoma |

Olaratumab |

2016 |

47 |

11,788.80 |

21 |

16,841.14 |

169,758,72 |

|

Tenosynovial Giant Cell Tumor |

Pexidartinib |

2019 |

43 |

21,865.2 |

30 |

21,865.20 |

503,774.16 |

|

Gastrointestinal Stromal Tumor with PDGFRA Exon 18 Mutation |

Avapritinib |

2020 |

1.6 |

44,533.20 |

30 |

44,533.20 |

534,398.40 |

|

Epithelioid Sarcoma |

Tazemetostat |

2020 |

0.5 |

22,620.00 |

30 |

22,620.00 |

255,542.40 |

|

NF1 and Symptomatic Inoperable Plexiform Neurofibromas |

Selumetinib |

2020 |

NF1/NF2: 737 |

24,361.61 |

30 |

24,361.61 |

331,312.32 |

|

Kaposi Sarcoma |

Pomalidomide |

2020 |

6 |

43,280.00 |

28 |

46,371.43 |

556,465.56 |

|

Gastrointestinal Stromal Tumor |

Ripretinib |

2020 |

10-15 |

46,926.00 |

30 |

46,926.00 |

563,112.00 |

|

Perivascular Epithelioid Cell Tumor |

Sirolimus Protein-Bound Particles |

2021 |

0.3 |

28,940.80 |

21 |

41,344.00 |

347,292.00 |

|

Inflammatory Myofibroblastic Tumor |

Crizotinib |

2022 |

Less than 1 |

25,389.00 |

30 |

25,389.00 |

304,674.72 |

|

Alveolar Soft Part Sarcoma |

Atezolizumab |

2022 |

Less than 1 |

12,416.00 |

21 |

17,737.14 |

149,000.16 |

|

Desmoid Tumors |

Nirogacestat |

2023 |

3 to 5 |

34,800.00 |

28 |

37,285.71 |

447,428.52 |

Key Sarcoma Drugs Market Insights Summary:

Regional Highlights:

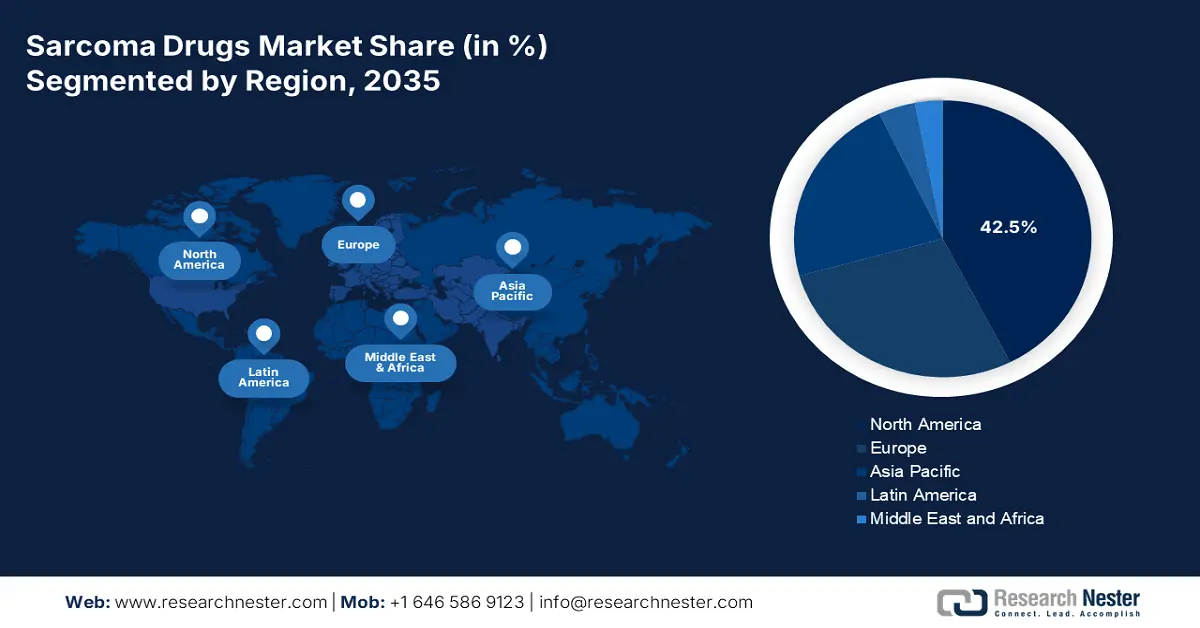

- By 2035, North America in the sarcoma drugs market is forecast to command a 42.5% share, strengthened by leadership advantages, rising healthcare expenditure, and robust clinical trial infrastructure due to its extensive R&D investments.

- By 2035, Asia Pacific is projected to hold a 22.3% share, expanding at the fastest pace owing to rising disease burden, enhanced healthcare accessibility, and biosimilar adoption.

Segment Insights:

- By 2035, the hospital pharmacies segment in the sarcoma drugs market is set to attain a 58.7% share supported by cold-chain logistics and specialized administration.

- By 2035, the specialty cancer centers segment is expected to achieve a 51.5% share facilitated by their role in advancing progressive sarcoma clinical and treatment research.

Key Growth Trends:

- Artificial intelligence-powered drug repurposing

- Liquid biopsy integration

Major Challenges:

- Delay in administrative approvals

- Payers’ demand for real-world data

Key Players: Bristol Myers Squibb, Novartis, Pfizer, Merck & Co., Roche, Eli Lilly, Amgen, Sanofi, AstraZeneca, GlaxoSmithKline (GSK), Bayer, Dr. Reddy’s, Cipla, Hetero Drugs, BioNTech.

Global Sarcoma Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Australia, Singapore

Last updated on : 20 August, 2025

Sarcoma Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Artificial intelligence-powered drug repurposing: The market is experiencing transformation, owing to AI and digital health convergence. According to an article published by NLM in July 2025, the binary classification of implementing AI, machine learning, and specialized radiomics resulted in a 76.02% accuracy rate. In addition, the FNCLCC grade classification reached 57.6% accuracy, thereby making it valuable for combining innovative technologies to demonstrate wavelength transformation to enhance sarcoma drugs performance.

- Liquid biopsy integration: This is a minimally invasive and innovative diagnostic tool to ensure cancer management, which is positively impacting the sarcoma drugs market globally. This tool provides a repeatable and accessible procedure for effectively tracking the cancer progress. As per the February 2023 NLM article, the overall liquid biopsy market is projected to surge to approximately 16% by the end of 2030, thereby making it suitable to aid cancer. Besides, with its implementation, an estimated 70% of patients with Stage I cancer can undergo standard treatment to provide a cure and reduce side effects, in comparison to radiotherapy and chemotherapy.

- Orphan drug incentives: The sarcoma drugs market’s upliftment readily depends on orphan drug to gain exclusivity, tax credits, and EMA fee waivers. Besides, organizations investing in launching latest sarcoma drugs are required to receive this integration through administrative approval. For instance, in September 2022, Avacta Group plc announced that the U.S. FDA has successfully granted the Orphan Drug Designation (ODD) for the company’s leading pre-CISION drug candidate, AVA6000, which is suitable for aiding soft tissue sarcoma.

Patient Pool Affected with STS Driving the Market

Country and Region-Wise STS Incidences

|

Countries/Regions |

Incidences |

|

U.S. |

13,400 individuals |

|

China |

2.9 per 100,000 |

|

Europe |

4 to 5 per 100,000 |

|

UK |

3,300 people |

|

China |

1.8 per 100,000 |

|

Italy |

1.7 per 100,000 |

|

Netherlands |

4.7 per 100,000 |

|

Serbia |

1.9 per 100,000 |

Sources: NLM, April 2025; NLM, November 2024; MDPI, January 2022

Historical Pricing Strategy and Its Impact on the Sarcoma Drugs Market Expansion

Lenalidomide (Revlimid) Pricing & Profit Strategy Analysis (2005-2020)

|

Year |

Price per Pill (USD) |

Price Increase (%) |

1-Month Supply Cost (USD) |

Key Events |

Revenue Impact (USD Billion) |

Executive Compensation Ties |

|---|---|---|---|---|---|---|

|

2005 |

215 |

- |

4,515 |

FDA approval (multiple myeloma) |

- |

- |

|

2019 |

763 |

+6 (BMS acquisition) |

16,023 (held) |

Celgene acquired by Bristol Myers Squibb (BMS) |

9.7 yearly revenue (63% from the U.S.) |

USD 400 million total exec compensation (2006 to 2017) |

|

2020 |

- |

- |

16,023 |

Generic delays via patent thickets |

53 yearly revenue (2009 to 2018) |

Bonuses triggered by price hikes |

Challenges

- Delay in administrative approvals: These represent a huge barrier in the market development since approval duration varies dramatically from region to region. These delays originated from numerous factors, including differences in evidentiary standards, demand for additional region-based data, and resource-driven constraints at regulatory agencies. Besides, the human cost is substantial and sarcoma patients frequently lack accessibility to any targeted therapies. Meanwhile, manufacturers are adopting strategies to escalate approvals by participating in review programs, thereby avoiding any further delays.

- Payers’ demand for real-world data: The presence of health technology assessment bodies are continuously demanding actual evidence before catering to notable therapies, which has created a challenge in the market growth internationally. Despite conducting Phase III clinical trials, payers currently require longitudinal results from real clinical practice. The evidence needs are strict for precision medicines, which is causing a hindrance in the market’s expansion. However, manufacturers are positively responding to this issue by developing suitable RWE teams and collaborating with academic facilities.

Sarcoma Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Sarcoma Drugs Market Segmentation:

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital pharmacies segment in the sarcoma drugs market is projected to account for the largest share of 58.7% by the end of 2035. The segment’s growth is driven by cold-chain logistics and specialized administration to make sarcoma drugs readily available at a cost-effective price to patients. In this regard, a clinical study was conducted on 404,443 patients from the U.S., which was published by the New England Journal of Medicine in January 2024. This study comprised 4,727,189 drug-infusion visits, and the median price markup after the 340B discount was 3.0. Besides, this markup increased by 6.5 times after geographic, patient, and drug adjustments, thereby uplifting the overall segment.

End user Segment Analysis

Based on the end user, the specialty cancer centers segment in the sarcoma drugs market is expected to hold the second-largest share of 51.5% during the forecast timeline. The segment’s upliftment is propelled by its potential to serve as essential facilities for progressive sarcoma clinical and treatment research. These centers have readily excelled in providing precision-based therapies, such as CAR-T cell and NTRK inhibitor treatments, which demand customized facilities and multidisciplinary care teams. Besides, sarcoma patients in the U.S. have successfully received suitable treatment at NCCN-specific centers, owing to their expert knowledge in rare cancers, thus suitable for the segment’s growth.

Type Segment Analysis

Based on the type, the soft tissue sarcoma segment in the sarcoma drugs market is predicted to garner the third-largest share of 49.2% by the end of the forecast period. The segment’s development is fueled by an increase in therapeutic advancements and the incidence rate. As stated in the June 2023 NLM article, this particular sarcoma comprises Stage I, Stage II, Stage III, and Stage IV, wherein the tumor size is 5 centimeters in Stage 1A and Stage II, and more than 5 centimeters in Stage IB. Further, it is less than 10 centimeters in Stage IIIA and over 10 centimeters in Stage IIIB. For Stage IV, the size can be of any type and can easily spread near lymph nodes, thus denoting a huge demand for the market globally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Distribution Channel |

|

|

End user |

|

|

Type |

|

|

Treatment |

|

|

Drug Class |

|

|

Disease Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sarcoma Drugs Market - Regional Analysis

North America Market Insights

North America in the sarcoma drugs industry is projected to emerge as the dominating region, garnering the largest share of 42.5% by the end of 2035. The market’s upliftment in the region is highly attributed to its leadership, administrative benefits, R&D investments, an increase in healthcare expenditure, and the availability of clinical trial facilities. According to the January 2022 Research America Organization report, 75% of the overall population readily supports doubled federal government expenditure for conducting thorough medical research, while 85% of the population in the U.S. favors federal government investment. In addition, R&D-based investments for medical and health, particularly in the U.S., increased to USD 245.1 billion, thereby denoting an 11.1% rise from previous years, which is suitable for the market’s growth.

The sarcoma drugs market in the U.S. is significantly growing, owing to the presence of insurance coverage services, precision medicine availability, competition in biosimilars, and an expansion in telemedicine. Additionally, government bodies are playing a crucial role in approving medicines for sarcoma, which is also fueling the market’s demand in the country. As per the April 2024 NLM article, nirogacestat was approved in 2023 by the U.S. FDA, suitable for aiding desmoid tumors. The disease incidence is 3 to 5 per 100,000 people, and the overall average wholesale price (AWP) has been set to USD 34,800. On the contrary, the medication price for a month is USD 37,285 and USD 447,428 for a year, thus contributing to the market’s development.

The market in Canada is also growing due to the provision of public healthcare investments, provincial reforms, penetration in generics, cross-border clinical trials, and indigenous health inclusion. According to the January 2023 Government of Canada report, an estimated 10,000 children in the country suffer from cancer, and only 1,500 are diagnosed. In this regard, the Canadian Institutes of Health Research (CIHR) offered USD 23 million in funding to develop the Canadian Pediatric Cancer Consortium (CPCC). In addition, the CIHR has invested USD 1 billion in cancer research over the past 5 years, along with USD 3.1 million for supporting pediatric cancer research.

Healthcare Expenditure and Components in North America

|

U.S. |

Canada |

||

|

Factors |

Price/Percentage |

Factors |

Price/Percentage |

|

Hospital care |

USD 1,519.7 (31.2%) |

Yearly healthcare spending |

USD 270 billion |

|

Other personal healthcare |

USD 800.8 (16.5%) |

Residential locations |

750 with 6,000 family physicians |

|

Physician Services |

USD 721.7 (14.8%) |

Medical services |

70.9% publicly funded |

|

Prescription drugs |

USD 449.7 (9.2%) |

Federal government investment |

USD 196.1 billion for 10 years |

|

Net health insurance cost |

USD 302.9 (6.2%) |

Working Together to Improve Health Care for Canadians Plan |

USD 200 billion for 10 years |

|

Clinical services |

USD 256.3 (5.3%) |

Public sector healthcare |

USD 45.9 billion through the Canada Health Transfer |

|

Investment |

USD 238.8 (4.9%) |

Health and workforce planning |

USD 200 billion |

APAC Market Insights

Asia Pacific in the sarcoma drugs market is expected to emerge as the fastest-growing region, with a share of 22.3% during the projected timeline. The market’s growth in the region is propelled by a surge in the disease burden, improved healthcare accessibility, government strategies, and biosimilar integration. In this regard, the April 2025 NLM article reported that the sarcoma incidence rate in Central Asia has been 66.5% over the past 4 years, followed by 32.2% in East Asia, and 18.1% in Southeast Asia. Therefore, with the prevalence rate, there is a huge demand for sarcoma medications, along with diagnostic and treatment solutions, which is driving the market.

The sarcoma drugs market in China is steadily growing, owing to administrative support, government funding, focus on precision medicine, growth in regional pharma, treatment availability, and impact on urbanization. As per the April 2022 NLM article, a clinical study was conducted on 19 patients to determine the neoadjuvant radiotherapy usability, which is widely utilized for aiding sarcoma in the country. The study comprised 14 male and 5 females, and the objective response rate (ORR) for the treatment was 31.6%, along with 89.5% for the disease control rate (DCR). Therefore, the therapy has been proven to be successful, which is effectively contributing to the market’s growth.

The sarcoma drugs market in India is gaining increased traction, based on factors such as cost-effective generics, government programs, telehealth expansions, private and public collaborations, and a surge in sarcoma awareness. According to the August 2023 PIB Government report, generic medicines commercialized through Janaushadhi Kendras are priced at 50% to 90% less than branded medicines. As a result, the August 2024 Ministry of Health and Welfare report declared that there has been a reduction in out-of-pocket expenses by more than 40%. Additionally, the Ayushman Bharat scheme has offered insurance coverage to more than 500 million people at USD 6,000, thus suitable for the market’s development.

Europe Market Insights

Europe in the sarcoma drugs market is anticipated to hold a considerable share of 28.2% by the end of the forecast timeline. The market’s development in the region is effectively fueled by administrative harmonization, the regional health fund, and biosimilar implementation. According to the January 2025 NLM article, out of 48 new cancer drug applications, 4 (8%) were submitted to the European Medicines Agency (EMA). Furthermore, 19 drugs, which is 81%, achieved the standard marketing authorization by the EMA, and the usual approval duration is 394 to 481 days. Therefore, with the presence of such administrative bodies, there is a positive impact on the market in the overall region.

The market in Germany is gaining increased exposure, owing to the presence of universal healthcare policies, increased R&D investments, CAR-T leadership, outpatient expansion, and a surge in the aging population. As per the 2025 World Bank Group report, the present gross domestic product (GDP) based on healthcare expenditure accounts for 11.8% as of 2023. Besides, the 2025 Statistisches Bundesamt (Destatis) report indicated that the health spending in the country increased to € 474.1 billion over the past four years, denoting €5,699 per inhabitant. This was the largest increase, accounting for 7.5% per capita, thus suitable for the market’s growth opportunity.

The sarcoma drugs market in the UK is also developing due to factors, including accelerations in NICE, NIH budget prioritization, generic dominance, and telehealth service adoption. According to the November 2024 NLM data report, the sarcoma incidence for cancer is unusual in the country, with 9% of cases catering to the 30-year age group, and only 43% are a part of the 65-year age group. The prognosis is extremely poor, with an overall 54% survival rate. Therefore, the launch of sarcoma drugs through regulatory approvals is needed in the country, thereby creating an optimistic outlook for the market. The growing oncology drug pipeline and a massive patient pool have led to a high demand for vascular access devices, such as peripheral intravenous (IV) cannulas, central venous catheters (CVCs), implanted Ports (Port-a-Cath), elastomeric infusion pumps, and closed-system transfer devices (CSTDs), among several others. The dependency on multi-tiered device suits has resulted in a stronger trade scenario for medical instruments.

Medical Instruments Import and Export in Europe

|

Countries |

Import |

Export |

|

Germany |

USD 13.1 billion |

USD 18.4 billion |

|

UK |

USD 4.4 billion |

USD 3 billion |

|

Netherlands |

USD 14.1 billion |

USD 9.3 billion |

|

Ireland |

USD 1.9 billion |

USD 9.0 billion |

|

France |

USD 6.4 billion |

USD 3.9 billion |

|

Belgium |

USD 4.5 billion |

USD 3.3 billion |

|

Italy |

USD 4.6 billion |

USD 3.1 billion |

|

Switzerland |

USD 2.9 billion |

USD 4.5 billion |

|

Poland |

USD 1.7 billion |

USD 1.4 billion |

|

Spain |

USD 3.3 billion |

USD 802 million |

Source: OEC, July 2025

Key Sarcoma Drugs Market Players:

- Bristol Myers Squibb

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis

- Pfizer

- Merck & Co.

- Roche

- Eli Lilly

- Amgen

- Sanofi

- AstraZeneca

- GlaxoSmithKline (GSK)

- Bayer

- Dr. Reddy’s

- Cipla

- Hetero Drugs

- BioNTech

The international market has witnessed intense competition between specialized biotech firms and multinational pharma giants. Market leaders, such as Novartis and Bristol Myers, readily dominate with standard immunotherapies and targeted therapies, while biotech, including Adaptimmune, has pioneered the CAR-T treatment option. Besides, tactical initiatives such as expansion in emerging markets, orphan drug development, and precision medicine collaboration are effectively adopted by these organizations, thereby denoting a huge growth opportunity for the overall market.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2024, AstraZeneca’s Imfinzi was successfully approved by the U.S. FDA for aiding adult patients with limited-stage small cell lung cancer in the U.S., receiving intense review and the Breakthrough Therapy Designation.

- In May 2023, Sun Pharmaceutical Industries Limited entered into a licensing agreement with Philogen S.p.A for commercializing Philogen’s specialty product, Nidlegy, which is an anti-cancer biopharmaceutical.

- Report ID: 8010

- Published Date: Aug 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sarcoma Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.