Opioid Induced Constipation Drugs Market Outlook:

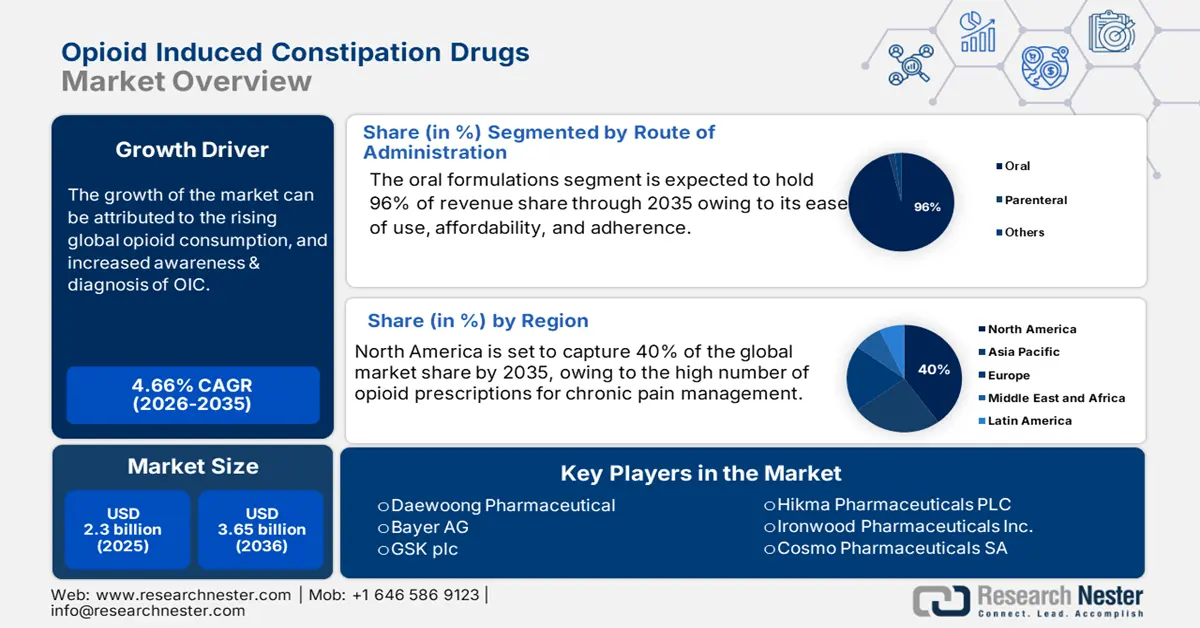

Opioid Induced Constipation Drugs Market size was valued at USD 2.3 billion in 2025 and is projected to reach USD 3.65 billion by the end of 2035, rising at a CAGR of 4.66% during the forecast period, from, 2026-2035. In 2026, the industry size of opioid induced constipation drugs is evaluated at USD 2.42 billion.

The opioid-induced constipation drugs market is rapidly evolving with several interrelated trends. Of several important developments, the evolution of telemedicine to facilitate the management of OIC is perhaps the most impactful. Telehealth and telemedicine enable clinicians to provide remote monitoring and treatment choices, increasing accessibility for patients. This allows the clinician to continue to monitor for symptoms, and offer management assistance with medication adherence and adherence is critical in managing chronic diseases such as OIC. Another very important trend is the evolution of personalized or targeted therapies made possible largely through the evolution of pharmacogenomics, biomarker diagnostics, and genetic risk profiles.

The drug marketplace introduces numerous new distribution channels that expand and promote convenience to patients through online pharmacies. Moreover, patients are considering and using more non-pharmacological options as adjuncts to relieve OIC. Some patients are making dietary changes, using fiber supplements, and feedback therapies to relieve OIC symptoms in an effort to avoid off-label and medication treatment, given the treatment costs and side effects associated with those therapies. Simultaneously, innovation continues to drive drug development, thus the continued development of new medications to manage or prevent OIC with improved efficacy and tolerability, which is very different from older medications due to their inhibition of opioids at the opioid receptors on the gut that lead to constipation relief and a return to normal gut function. All these trends signify a larger movement toward patient-centric access and innovation in the OIC market. They further signify the growing importance of innovating around technology, personalized medicine, and distinctive therapeutics to address the complex presentation of opioid-induced constipation, and ultimately facilitate improvement in the quality of life of patients suffering under the burden of these problems.

Key Opioid Induced Constipation Drugs Market Insights Summary:

Regional Highlights:

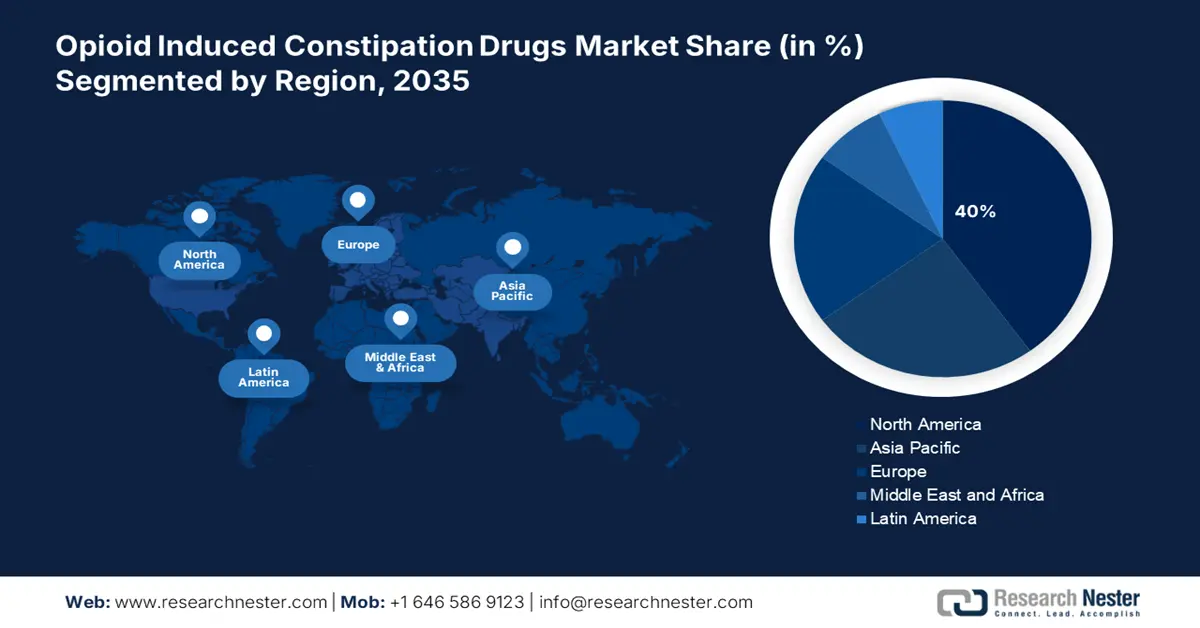

- North America opioid induced constipation drugs market is anticipated to capture the highest share of 40% by 2035, owing to high opioid prescriptions and strong healthcare infrastructure.

- Asia Pacific is expected to witness the fastest growth over the forecast period 2026–2035, propelled by increasing opioid use for cancer and chronic pain management.

Segment Insights:

- The oral formulations segment is estimated to account for the largest share of 96% by 2035, due to ease of use, affordability, and adherence.

- The prescription medications segment is poised to dominate the market with a share of 92% during the analyzed period, impelled by better efficacy, personalized treatment, and stronger adherence.

Key Growth Trends:

- Rising global opioid consumption

- Increased awareness & diagnosis of OIC

Major Challenges:

- High cost of branded OIC drugs

- Underdiagnosis and lack of awareness

Key Players: AstraZeneca plc, Shionogi & Co. Ltd., Pfizer Inc., Merck & Co. Inc., Teva Pharmaceutical Industries Ltd., Novartis AG (incl. Sandoz), Bausch Health / Salix Pharmaceuticals, Mallinckrodt Pharmaceuticals, Aurobindo Pharma, Daewoong Pharmaceutical, Bayer AG, GSK plc, F. Hoffmann-La Roche Ltd., Hikma Pharmaceuticals PLC, Ironwood Pharmaceuticals Inc., Daiichi Sankyo Co. Ltd., Progenics Pharmaceuticals Inc., Sucampo Pharmaceuticals, Cosmo Pharmaceuticals SA.

Global Opioid Induced Constipation Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.42 billion

- Projected Market Size: USD 3.65 billion by 2035

- Growth Forecasts: 4.66% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: U.S., Germany, UK, France, Canada

- Emerging Countries: China, Japan, India, South Korea, Australia

Last updated on : 3 September, 2025

Opioid Induced Constipation Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Rising global opioid consumption: According to the World Health Organization (WHO), in 2021, around 296 million people took drugs at least once. The increasing acceptance and use of opioids for chronic pain is one of the determinants of growth in the OIC drugs market. As the number of opioid prescriptions globally continues increase, we can anticipate an increase in OIC. This demand will be magnified in North America and some areas of Europe, which have retained high rates of opioid prescribing despite concerns around misuse.

Country-Specific Opioid Consumption, 2022

|

Japan |

0.5% |

|

Australia and New Zealand |

6.4% |

|

Canada |

6.6% |

|

Europe |

39.5% |

|

U.S. |

33.1% |

|

Other Countries |

13.9% |

Source: International Narcotics Control Board

- Increased awareness & diagnosis of OIC: Opioid-induced constipation (OIC) has been underdiagnosed and undertreated in the past. But it now appears that OIC is getting noticed by healthcare providers and patients in general. Initiatives around awareness of OIC have correlated with increased clinical education and better diagnostics related to OIC. As patients and their physicians become more proactive around side effects of long-term opioid therapy, there will be more opportunities to initiate treatment directed specifically at OIC.

- Advancements in drug development: Pharmaceutical advances, including the introduction of Peripherally Acting Mu-Opioid Receptor Antagonists (PAMORAs), have created viable options for the management of OIC. PAMORAs create a mechanism that is more direct to reverse the opioid's action in the gastrointestinal tract. Methylnaltrexone (Relistor), Naloxegol (Movantik), and Naldemedine (Symproic) have been adopted more readily with better clinical outcomes and safety. The direct mechanism of action empowered clinicians and patients to feel more confident in adherence, which has opened the opioid-induced constipation drug market share.

Challenges

- High cost of branded OIC drugs: Numerous leading OIC medications, specifically PAMORAs, are costly to administer. Many patients do not have comprehensive health insurance, which makes the treatment inaccessible to them. In countries where costs matter, patients will often opt for less effective, lower-cost alternatives such as over-the-counter laxatives.

- Underdiagnosis and lack of awareness:OIC continues to be underdiagnosed, and many patients do not complain of it. Additionally, physicians may not see OIC as a clinical condition calling for a specific therapy rather as a symptom of other disease-related processes. This creates a very large, untreated population and further limits the growth of the opioid-induced constipation drug market opportunity, despite the overall usage of opioids.

Opioid Induced Constipation Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.66% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 3.65 billion |

|

Regional Scope |

|

Opioid Induced Constipation Drugs Market Segmentation:

Route of Administration Segment Analysis

The oral formulations segment is estimated to account for the largest share of 96% in the opioid induced constipation drugs market over the discussed timeframe. Oral medication is preferred for its ease of use, affordability, and adherence. As most OIC drugs, including PAMORAs, are available as oral tablets or capsules, chronic use is simple. The existing availability and user preference for non-invasive routes back its dominant share.

Prescription Type Segment Analysis

The prescription medications segment is poised to dominate the opioid induced constipation drugs market with a share of 92% during the analyzed period. When comparing prescription drugs and over-the-counter (OTC) drugs, prescription medications often dominate due to better efficacy and personalized treatment. Prescription medications have more consistent uses with stronger management capabilities and laws to restrict availability. Prescriptions aid the healthcare system with insurance and improve medication adherence.

Therapeutic Radiopharmaceuticals Segment Analysis

During the examined period, the peripherally acting μ‑opioid receptor antagonists (PAMORAs) segment is expected to hold a 74% opioid induced constipation drugs market share in the opioid induced constipation drugs industry. PAMORAs are preferred because they can target opioid receptors in the gastrointestinal tract without affecting central analgesia. The rate of drug approval by the FDA has supported a rapid uptake of PAMORAs in clinical practice. Recommendations from clinical organizations like the American Gastroenterological Association (AGA) also support their use as first-line pharmacotherapy for moderate to severe OIC.

Our in-depth analysis of the opioid induced constipation drugs market includes the following segments:

|

Segments |

Subsegments |

|

Drug Class |

|

|

Prescription Type |

|

|

Route of Administration |

|

|

Patient Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Opioid Induced Constipation Drugs Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 40% in the global opioid induced constipation drugs market by the end of 2035. The growth is led by a high number of opioid prescriptions for chronic pain management. As per the U.S. Centers for Disease Control and Prevention, in 2023, 8.5% of people experienced high-impact chronic pain, which is defined as chronic pain that often interfered with life or work activities, while 24.3% of individuals experienced chronic pain. The country continues to address an opioid crisis with elevated levels of OIC accordingly. With strong healthcare infrastructures, patients and providers being more aware of the issues with opioids, and faster regulatory approval processes, enable growth in the opioid-induced constipation drug market. Key pharmaceuticals in the area, as well as positive reimbursement strategies paving the way for more advanced OIC treatment options in the area. Moreover, proactive regulatory action supports faster commercialization for OIC therapeutic options.

Global consumption of opioids is highest in the U.S., prompted by high amounts of opioid consumption primarily for chronic pain from cancer and surgical procedures. With a high-spending and developed healthcare system, the country can provide access to innovative, expensive therapies for opioid-induced constipation (OIC) throughout its health system. Furthermore, since OIC has been at the forefront of the positive side effects of opioid use campaign or education campaigns, there is high awareness from both prescribers and patients, which creates proactive demand in managing OIC. Furthermore, sufficient patient education and advocacy groups dedicated to OIC support adherence interventions, which allows the OIC market to grow consistently. Finally, in the face of the ongoing opioid crisis, there remains a strong narrative around the importance of effective management related to side effects, particularly OIC.

Canada is likely to continue to hold a solid portion of the opioid induced constipation drugs market, given high per capita opioid usage and a growing incidence of chronic pain and cancer-related ailments. In Canada, the presence of a publicly funded healthcare system has greatly improved access to prescription drugs. With strict opioid safety surveillance programs and pain management guidelines in place that highlight prevention and treatment of OIC. There is an increasing discussion around palliative care and improving the quality of life for people on long-term opioid therapy. Furthermore, because Canadian regulations are more aligned with the U.S. than other countries, there is a greater chance that novel OIC drugs will be available sooner in Canada. Patient awareness and education, and awareness and education for healthcare providers have also contributed to more appropriate diagnosis and improved treatment rates.

APAC Market Insights

The opioid-induced constipation (OIC) drugs market within the Asia Pacific region is likely to see the highest growth for the foreseeable future due to a surge in opioid prescriptions for cancer and chronic pain management. Growing healthcare expenditure in the region, improved access to better pharmaceuticals, and awareness of side effects associated with opioid use are creating the demand for associated products in OIC. In addition, governments are consistently enhancing pain management guidelines and drug reimbursement plans in the region. Finally, the aging population and increased demand for oncology will likely contribute significantly increased incidence of OIC.

India is projected to demonstrate rapid expansion in the OIC drugs market due to a growing prevalence of chronic diseases, especially cancer. The National Institutes of Health published a report that in 2022, there were an expected 14,61,427 incident cases of cancer in India. The growing elderly population of India will also increase the number of patients who require palliative care. Regulatory changes have improved access to opioid medications. Likewise, the increasing availability of healthcare providers and a level of awareness of the side effects of opioid medications by healthcare professionals and patients alike is allowing proper diagnosis and treatment of OIC. India's comprehensive generic pharmaceutical Market base will assist OIC in offering low-cost offerings of OIC drugs to urban or rural marketplaces.

China is expected to become a key driver of the OIC drugs market in the Asia Pacific due to its large and aging population that has an increasing burden of chronic conditions. The use of opioids for all health conditions increased due to government policies to improve access to pain relief medications. Increased healthcare spending and investment in modern medical facilities will improve access to innovative OIC treatments. Urbanization in China and increasing awareness of opioid side effects are reducing the time between diagnosis and accessing treatment. China's strong pharmaceutical sector is progressively developing and manufacturing OIC drugs, with many domestic companies devoting time and resources to meet their pharmaceutical industry demands.

Europe Market Insights

By 2035, Europe is likely to represent a dominant share of the global opioid-induced constipation (OIC) drugs market, which is primarily due to increased rates of opioid prescriptions throughout the region. Countries such as Germany, the UK, and France are all seeing increased use of opioids, leading to a higher incidence of OIC in the region. The region as a whole is aided in market expansion by having universal health care systems, strong regulatory policies, and significant access to reimbursable therapies and options. Furthermore, advancements in clinical trials and early adoption of new therapies introduced for the management of OIC will aid in the growth of Europe's market.

Germany is a key player in the European OIC drugs market. Germany has a universal healthcare system that guarantees high rates of access to prescription medications, with multiple reimbursement policies helping to support uptake. Furthermore, the country has a highly innovative pharmaceutical sector that continues to be engaged in clinical studies and research focused on developing new OIC therapies. There is growing attention by doctors in Germany to managing opioid side effects, which has led to the diagnosis and therapy of constipation occurring sooner. In addition, public awareness campaigns and educational activities for the profession support demand for effective management of OIC.

France is expected to gain a significant share of the OIC drugs market as opioid use increases for chronic pain and palliative care. With its public healthcare system, patients have excellent access to drug coverage. France has high rates of physician awareness of opioid side effects, and early identification and treatment of those symptoms is clear. The French government is also currently advancing research and clinical trials into pain and OIC. Ongoing public health initiatives focused on opioid stewardship and pain management are advocating appropriate treatment. In combination, these factors provide France with a unique position to closely follow the global market for OIC drug use.

Key Opioid Induced Constipation Drugs Market Players:

- AstraZeneca plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shionogi & Co., Ltd.

- Pfizer Inc.

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Novartis AG (incl. Sandoz)

- Bausch Health / Salix Pharmaceuticals

- Mallinckrodt Pharmaceuticals

- Aurobindo Pharma

- Daewoong Pharmaceutical

- Bayer AG

- GSK plc

- F. Hoffmann-La Roche Ltd.

- Hikma Pharmaceuticals PLC

- Ironwood Pharmaceuticals Inc.

- Daiichi Sankyo Co., Ltd.

- Progenics Pharmaceuticals Inc.

- Sucampo Pharmaceuticals

- Cosmo Pharmaceuticals SA

The global OIC drugs market is moderately consolidated but remains fiercely competitive, with prominent pharmaceutical companies. Key strategic initiatives include pipeline expansion, leadership and approvals expiration, mergers and acquisitions, and manufacturing partnerships. Indian manufacturer Aurobindo and generics companies are focused on providing aromatherapy at a more affordable cost. Overall, innovation and flexibility in pricing, as well as widening distribution networks, are continually changing the OIC competitive landscape.

Recent Developments

- In September 2024, Researchers from the University of Tsukuba found that giving opioids and the constipation drug naldemedine together efficiently eliminates opioid-induced constipation and enhances the patient's quality of life. The purpose of this study was to find out how naldemedine, a drug used to treat constipation, would help cancer patients avoid constipation after starting opioid therapy.

- In July 2024, Grünenthal announced the acquisition of US-based Valinor Pharma, along with its opioid-induced constipation (OIC) therapy Movantik, known as Moventig outside the US, is an oral treatment for OIC in adults with chronic non-cancer pain.

- Report ID: 8053

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.