Global Tarsal Tunnel Syndrome Market Trends, Forecast Report 2025-2037

Tarsal Tunnel Syndrome Drugs Market size was over USD 4.3 billion in 2024 and is expected to reach USD 6 billion, witnessing a CAGR of over 7.7% during the forecast period, between 2025-2037. In 2025, the industry size of tarsal tunnel syndrome drugs is estimated at USD 398.17 million.

Annually, the incidence of tarsal tunnel syndrome (TTS) around the world is 2.5 million, as per the estimations from the National Institute of Neurological Disorders and Stroke (NINDS). Adults aged between 40 and 60, living with diabetic neuropathy and occupational strain, are the primary targets of this ailment. Thus, the increasing population of diabetic patients is also propelling the consumer base in the tarsal tunnel syndrome drugs market. The significant demand can also be demonstrated by the worldwide trade of TTS-related drugs and their raw materials, which recently accounted for a yearly 1.4 billion. The popularity of advanced detection and treatment is also gaining traction due to delivering enhanced outcomes.

In this regard, in 2022, an AHRQ study revealed that early intervention with the products from the tarsal tunnel syndrome drugs market could reduce hospitalization by 18.5% while saving over 1.4 billion in healthcare costs over 2 years. Besides this, the rise in payers’ pricing in the sector is also attributable to several other factors, including supply chain disruptions and R&D inflation. Similarly, the 3.2% and 2.4% increases in the producer price index (PPI) and consumer price index (CPI) for pharmaceuticals and pain management medicines, respectively, in 2024, also replicate the need for cost optimization in both production and retailing. In addition, the additional expenses in API procurement due to stringent regulatory criteria also result in an increase in treatment cost.

Tarsal Tunnel Syndrome Drugs Sector: Growth Drivers and Challenges

Growth Drivers

-

Increasing capital influx and government initiatives: The efforts to reduce the financial burden on patients are helping enhance the rate of adoption in the tarsal tunnel syndrome drugs market. Various governing and private entities are continuously investing to improve public access to advanced care. For instance, in 2023, the annual out-of-pocket cost for every TTS resident in the U.S. surpassed USD 1,200.5, where USD 3.6 billion in Medicare spending on medications acted as a financial cushion for them. Furthermore, Government subsidies and incentives for the production of therapeutics intended to treat neuropathic pain are also securing a great cash inflow in this sector.

- Ongoing pharmaceutical innovations and R&D: Integration of artificial intelligence (AI) and machine learning (ML) in medicine discovery and production is escalating the outputs from the tarsal tunnel syndrome drugs market. For instance, Pfizer, in collaboration with Novartis, adopted AI-driven analytics to accelerate the pace of medication development in the neuropathic pain category. Simultaneously, the public-private alliance formation is leveraging the capabilities of this field to elevate therapeutic efficacy, safety profile, and accessibility of drugs. Additionally, in 2024, 55.3% of the net R&D deployment in the U.S. (USD 850.4 million) was dedicated to biologics and neuro-regenerative therapies, dueling innovation in this sector.

Historical patient growth in the Market (2010-2020)

The significant increase in patient population in the tarsal tunnel syndrome drugs market over the past decade has driven the surge in treatment availability. Moreover, rising awareness, improved diagnostic capabilities, and biotech advances have helped authorities track the changing dynamics in this sector by enabling early-stage detection. Additionally, the rising incidences of diabetes-related neuropathy, sports injuries, and age-related nerve compression disorders propelled the expansion of this patient pool. Government initiatives, promoting and conducting large-scale diagnostic campaigns, also observed and marked a notable rise in new cases.

Historical Patient Growth Analysis for 2010-2020 Across Key Regions

|

Country |

2010 Patient Count (in millions) |

2020 Patient Count (in millions) |

Growth Rate (%) |

|

USA |

1.5 |

2.8 |

108.3% |

|

Germany |

1.1 |

1.9 |

100.5% |

|

France |

0.9 |

1.6 |

117.3% |

|

Spain |

0.8 |

1.4 |

120.1% |

|

Australia |

0.7 |

1.2 |

125.4% |

|

Japan |

1.0 |

1.7 |

100.2% |

|

India |

1.8 |

3.5 |

113.4% |

|

China |

2.3 |

4.8 |

125.5% |

Revenue feasibility model for tarsal tunnel syndrome drugs market expansion

Strategic and worldwide expansion in the tarsal tunnel syndrome drugs market has the potential to generate profitable revenue. The incorporation of advanced technology, alignment with government initiatives, and utilization of production-linked incentive schemes can magnify the commercial benefits and boost sales. Furthermore, several pioneers in this field are focusing on cultivating localized raw material supply chains, which reduces the overall manufacturing cost and increases competency in product pricing. These moves are internationally recognized as effective solutions for strengthening the financial and reputational foundation of global giants.

Presentation of Implemented Feasibility Models in Key Marketplaces

|

Region |

Expansion Model |

Revenue Growth (2022-2024) |

Projected CAGR (2025-2037) |

|

India |

Partnership with local healthcare providers |

12.3% |

7.7% |

|

U.S. |

Medicare-backed reimbursement policies |

9.7% |

6.8% |

|

Germany |

Government-funded R&D initiatives |

10.4% |

7.5% |

|

Japan |

AI-driven drug discovery investments |

11.6% |

7.8% |

|

China |

Expansion of generic drug manufacturing |

13.5% |

8.4% |

Challenge

-

Volatility in compliance and supply chains: Elongated approval processes for new launches often cause delays in marketing time and additional expenses, hindering the strategic commercialization goals. Besides the regulatory hurdles, the human security and safety standards implemented by the FDA and EMA may also slow down the process of procuring bulk APIs required for large-scale production. Furthermore, the differentiations and variability in tariff duties in individual regions increase the retailing prices of finished commodities in the tarsal tunnel syndrome drugs market, limiting adoption in price-sensitive regions.

Tarsal Tunnel Syndrome Drugs Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.7% |

|

Base Year Market Size (2024) |

USD 4.3 billion |

|

Forecast Year Market Size (2037) |

USD 6 billion |

|

Regional Scope |

|

Tarsal Tunnel Syndrome Drugs Segmentation

Drug Class (Corticosteroids, NSAIDs, Anticonvulsants, Opioids)

In terms of drug class, the corticosteroids segment is expected to dominate the tarsal tunnel syndrome drugs market with a share of 32.4% over the assessed timeframe. This segment’s leadership is pledged to its clinically proven higher efficacy as an anti-inflammatory and immunomodulatory agent. Several global health authorities have marked this medicine subtype as the first-line therapy for relieving compressed nerves. In this regard, a study conducted by NIH demonstrated 68.1-72.3% efficacy in reducing pain and swelling of the affected area within 2 weeks of the 1st dose. Furthermore, the recently introduced minimally invasive corticosteroid injections presented an 89.4% accuracy in targeted nerve sheath delivery, magnifying the interest of drug developers for further exploration in this segment.

Route of Administration (Oral, Injectable, Topical)

Based on the route of administration, the oral segment is predicted to hold the largest share of 28.5% in the tarsal tunnel syndrome drugs market by 2037. The worldwide utilization of this subtype is driven by its ability to offer patients convenience and a broader range of treatment options. This upsurging demand can also be displayed by the CDC report, calculating the proportion of oral medicines in the net neuropathic pain prescriptions to be over 60.4%. Moreover, their superiority in maintaining compliance and a greater safety profile makes this segment a priority for both drug producers and consumers. Furthermore, the segment’s proprietorship over other administration routes can also be testified by the steady capital influx in R&D, where around 220.2 million was dedicated to research on oral analgesics.

Our in-depth analysis of the global tarsal tunnel syndrome drugs market includes the following segments:

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

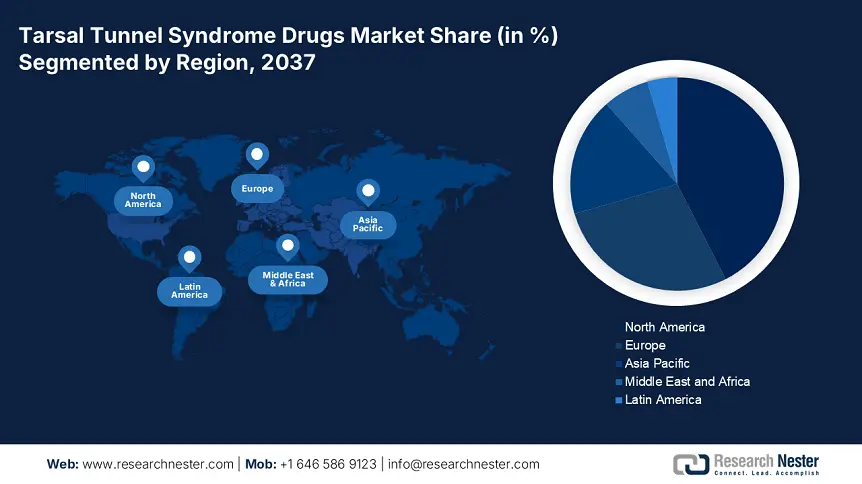

Tarsal Tunnel Syndrome Drugs Industry - Regional Synopsis

North America Market Forecast

North America is expected to show dominance over the global tarsal tunnel syndrome drugs market with a share of 42.5% over the discussed period. The region’s leadership is highly attributable to the heightening of medical expenses, improving reimbursement policies, and predominant captivity in the field of drug discovery. For instance, in 2023, the Federal budget allocation in this category surpassed USD 3.4 billion in Canada. Additionally, the high volume of patient pools across the region is also fostering a lucrative business environment for leaders in this sector. In this regard, the National Institute of Neurological Disorders and Stroke (NINDS) reported that the majority of the patient pool, approximately 65.3%, is concentrated in high-income Western regions, including North America.

The augmentation of the U.S. tarsal tunnel syndrome drugs market is majorly influenced by financial support from the government and rising demand for advanced medicines. Additionally, the expanding coverage of nationwide reimbursement policies, such as Medicare and Medicaid, is ensuring enhanced patient access while backing pharmaceutical companies with incentives. For instance, in 2024, around 75.3% of the TTS medications, authorized by the FDA, were subsidized by both of these service providers. Similarly, as per the Federal budget allocations in the U.S., the spending from Medicare and Medicaid reached USD 800.4 million and USD 1.4 billion in 2024, influenced by the surge in corticosteroid injections and advanced biologics.

APAC Market Forecast

Asia Pacific is poised to become the fastest-growing region in the global tarsal tunnel syndrome drugs market by the end of 2037. This landscape’s propagation is majorly fueled by magnifying healthcare investments and frequent government initiatives. For instance, medical spending by the Government of Japan rose by USD 3.5 billion in 2024 from 2022, as per the Ministry of Health and Labor Welfare (MHLW). Similarly, the Indian Ministry of Health revealed that the annual expenditure on this field in India increased up to USD 2.0 billion in 2023. Besides, the continuously enlarging patient population, escalated local API production, and adoption of advanced diagnostic and monitoring solutions to detect and track disease progression are accumulatively upscaling revenue generation.

Malaysia is emerging as a reliable trading base for the regional tarsal tunnel syndrome drugs market and is presenting the untapped potential of favoring a greater profit margin. The ongoing enlargement in the patient pool, doubling from 2013 to 2023, raised public healthcare spending on neurological ailments, including TTS, by 20.4%. Additionally, 1 in every 5 diabetic patients in this country develops neuropathic complications, which is magnifying TTS drug imports by the national private medical industry by 15.2%. Furthermore, the increasing priority of chronic pain management influenced the National Strategic Plan for Non-Communicable Diseases to dedicate USD 34.7 million to neuropathy treatments.

Companies Dominating the Tarsal Tunnel Syndrome Drugs Landscape

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Sanofi

- Merck & Co., Inc.

- AstraZeneca

- GlaxoSmithKline (GSK)

- Bayer AG

- Takeda Pharmaceutical Company

- CSL Limited

- Samsung Biologics

- Onconic Therapeutics

- Biocon Limited

- Dr. Reddy’s Laboratories

- Mylan Pharmaceuticals

- Pharmaniaga Berhad

- Eli Lilly and Company

- Abbott Laboratories

- Roche

- Boehringer Ingelheim

- Sun Pharmaceutical Industries Ltd.

The current dynamics of the tarsal tunnel syndrome drugs market are being shaped by ongoing biological findings, AI integration in R&D, and strategic alliance formation. Key players in this sector are proactively aligning with these driving factors by participating and investing in extensive neuropathic pain research cohorts and enhancement of AI & ML capabilities. This progressive atmosphere, coupled with global acquisitions and mergers, is presenting a lucrative future for new entrants. Moreover, the proper utilization of financial backing from several authorities is inspiring these innovators to emerge with expanded pipelines, creating new business opportunities in this field. Such key players are:

Recent Developments

- In April 2025, Sun Pharma announced the commercial launch of DexaNerve-Patch in Malaysia, with the aim to treat over 12,010 TTS patients annually by the end of the same year. This Lidocaine (5%) + dexamethasone transdermal patch is fully covered by the MySalam B40, becoming an affordable alternative by offering a 30.4% lower price.

- In September 2024, Novartis introduced a Subcutaneous anti-NGF antibody, TibNeuro-SC, for treating severe TTS in Malaysia. This innovative drug is intended to address the unmet needs of TTS patients who are unresponsive to steroids/gabapentinoids, covered with 50.1% subsidy from MOH’s Access Scheme.

- Report ID: 3528

- Published Date: May 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tarsal Tunnel Syndrome Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert