IBS Treatment Market Outlook:

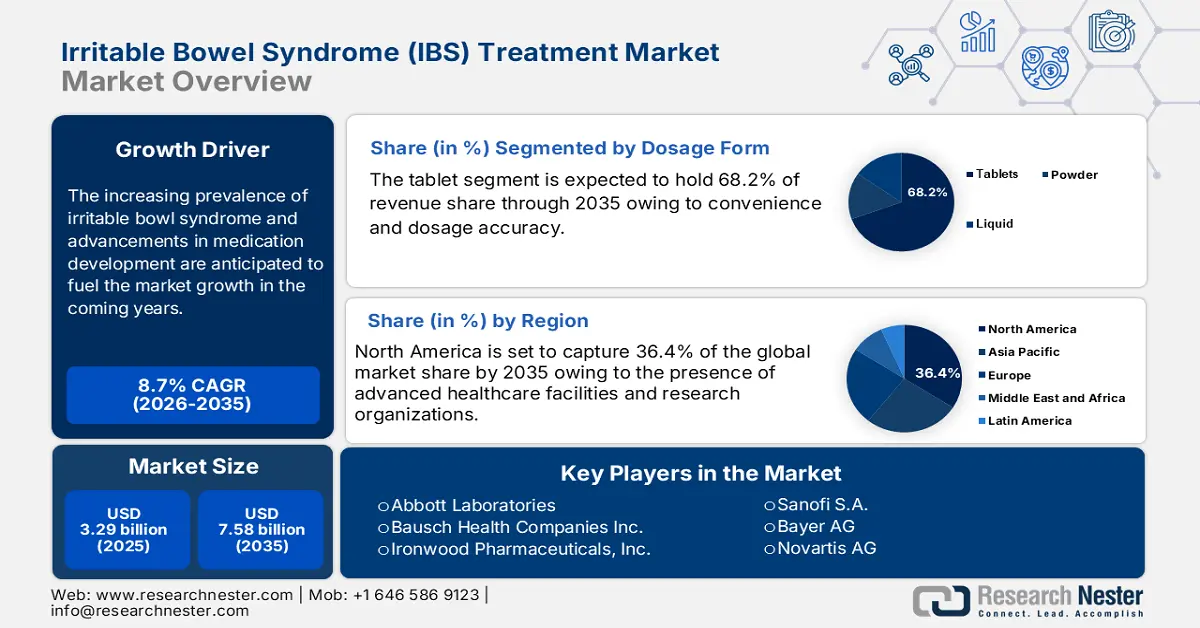

IBS Treatment Market size was over USD 3.29 billion in 2025 and is poised to exceed USD 7.58 billion by 2035, witnessing over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IBS treatment is estimated at USD 3.55 billion.

The rise in sedentary lifestyles and poor eating habits are some of the major reasons boosting the prevalence rates of irritable bowel syndrome, which is subsequently driving high demand for IBS treatment solutions. For instance, the International Foundation for Gastrointestinal Disorders (IFFGD) estimates that around 5 % to 10% of the population around the globe are living with irritable bowel syndrome issues. Around 20% to 40% of visits to gastrointestinal clinics are due to irritable bowel syndrome issues.

The rising awareness programs and increasing research funding are leading to the development of advanced irritable bowel syndrome therapeutic drugs. Globally, April is commemorated as irritable bowel syndrome awareness month. Several hospitals and clinics run free diagnosis and awareness campaigns during this period. Such initiatives are set to fuel the irritable bowel syndrome treatment market growth in the coming years.

Key Irritable Bowel Syndrome (IBS) Treatment Market Insights Summary:

Regional Highlights:

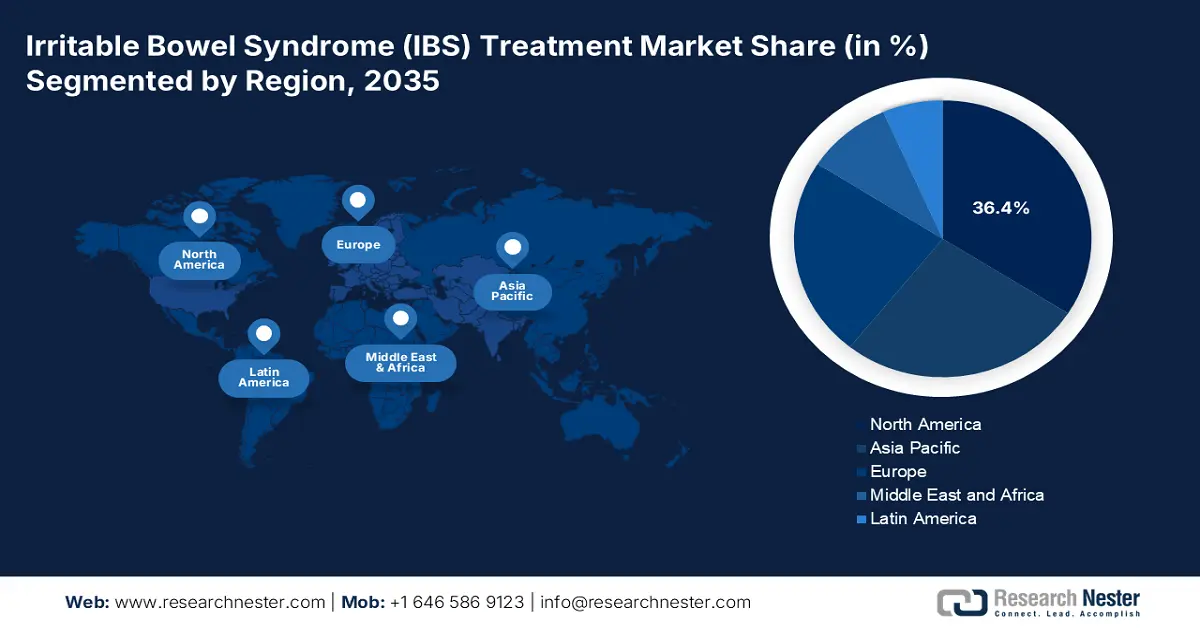

- North America irritable bowel syndrome (IBS) treatment market will account for 36.40% share by 2035, attributed to the presence of advanced healthcare facilities and ongoing advancements in the pharma sector.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, fueled by increasing spending on healthcare infrastructure, expanding pharmaceutical manufacturing companies, and growing cases of obesity.

Segment Insights:

- The tablets segment in the ibs treatment market is expected to see substantial growth till 2035, influenced by tablets' convenience, dosage accuracy, and growing trend toward self-medication.

- The brick & mortar segment in the ibs treatment market is set for substantial growth till 2035, driven by easy accessibility and insurance facilitation for IBS drug distribution.

Key Growth Trends:

- Rising demand for personalized therapeutics

- Introduction of advanced medications

Major Challenges:

- Low accessibility to advanced healthcare facilities

- Complex approval process

Key Players: Ardelyx, Inc., Abbott Laboratories, Bausch Health Companies Inc., Bayer AG, Ironwood Pharmaceuticals, Inc., and Johnson & Johnson.

Global Irritable Bowel Syndrome (IBS) Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.29 billion

- 2026 Market Size: USD 3.55 billion

- Projected Market Size: USD 7.58 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

IBS Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for personalized therapeutics: The personalized treatment trend is expected to drive the irritable bowel syndrome treatment market growth in the coming years. By tailoring therapies and drugs according to individual patient profiles and symptoms, healthcare practitioners have been able to improve the efficiency of the treatment and optimize the overall patient outcome. Patients widely experience constipation-predominant IBS-C, diarrhea-predominant IBS-D, or mixed form IBS-M, tailoring treatments based on symptoms offers quick and effective results and comfort to patients. For instance, the severity rate of moderate IBS is around 48.3%.

- Introduction of advanced medications: The ongoing innovations in IBS drug development are set to significantly influence the profit shares of key market players in the coming years. Olorinab, lubiprostone, and linaclotide are some of the effective drugs in irritable bowel syndrome treatment. These drugs target the constipation-related symptoms offering quick results and comfort to patients. The over-the-counter availability of irritable bowel syndrome medications is also contributing to the overall irritable bowel syndrome treatment market growth.

Challenges

- Low accessibility to advanced healthcare facilities: The lack of advanced healthcare infrastructure and specialists in poor economies is expected to hamper the sales of irritable bowel syndrome drugs to some extent in the coming years. IBS can be misdiagnosed or require extensive testing to rule out the other conditions, poor medical facilities lead to delays or inappropriate treatment. Access to skilled gastroenterologists or specialized clinics can aid in overcoming this issue, driving the IBS drug sales in poor countries.

- Complex approval process: The stringent drug approval procedures and regulations are some of the major factors hindering the profitable opportunities of irritable bowel syndrome drug manufacturers. Lengthy and complex regulatory approval processes for new treatments often delay market entry for innovative therapies. Furthermore, stringent requirements for monitoring drug safety and effectiveness can increase costs and risks for irritable bowel syndrome drug companies.

IBS Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 3.29 billion |

|

Forecast Year Market Size (2035) |

USD 7.58 billion |

|

Regional Scope |

|

IBS Treatment Market Segmentation:

Dosage Form Segment Analysis

The tablets segment in the irritable bowel syndrome treatment market is expected to capture 68.2% of the revenue share by the end of 2035, owing to their convenience and dosage accuracy. Tablets are easy to consume and carry as they are available in accurate and precise dosages, which makes them a preferred choice for many patients. Tablets typically have a longer shelf life compared to other formulations such as liquid and powder. This portability and stability are making them more appealing to patients and driving their demand growth.

The growing trend towards self-medication and over-the-counter availability for certain IBS drugs is making tablets a more accessible option for patients seeking immediate relief.

Distribution Channel Segment Analysis

The brick and mortar segment is estimated to hold 67.5% of the global irritable bowel syndrome treatment market share through 2035. The easy accessibility is one of the prime reasons driving the sales of irritable bowel syndrome drugs through brick and mortar pharmacies. Physical pharmacies are easily accessible for patients who require immediate relief or ongoing management of irritable bowel syndrome symptoms. Many patients prefer to consult with a pharmacist face to face especially when dealing with sensitive health issues.

Also, many IBS patients rely on insurance coverage for prescription medications, brick and mortar pharmacies can facilitate the processing of insurance claims, making them a prime preference for medicine distribution. The sales of irritable bowel syndrome drugs through brick and mortar distribution channels were valued at USD 2.0 billion in 2023.

Our in-depth analysis of the irritable bowel syndrome treatment market includes the following segments:

|

Condition

|

|

|

Drug Class |

|

|

Dosage Form |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IBS Treatment Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 36.4% by 2035, owing to the presence of advanced healthcare facilities and ongoing advancements in the pharma sector. The presence of early adopters in the region is driving the sales of innovative irritable bowel syndrome drugs.

The U.S. IBS treatment market is forecasted to rise at substantial CAGR till 2035. The strong presence of key market players is fuelling the sales of irritable bowel syndrome drugs in the country. In Canada, the increasing prevalence of irritable bowel syndrome issues is anticipated to boost the market growth during the forecasted period. The Canadian Digestive Health Foundation reveals that the prevalence rate of irritable bowel syndrome is around 18% in the country.

Asia Pacific Market Insights

Asia Pacific irritable bowel syndrome treatment market is expected to increase at a fast pace during the forecasted period owing to the increasing spending on healthcare infrastructure, expanding pharmaceutical manufacturing companies, and growing cases of obesity leading to IBS issues. India, Japan, South Korea, and China are the most profitable economies for irritable bowel syndrome drug manufacturers.

The high investments in healthcare infrastructure development projects and favorable government policies on drug production are generating profitable opportunities for irritable bowel syndrome therapeutic solution producers in India. The country is emerging as a medical tourism hub owing to the presence of cost-effective and advanced technologies and skilled expertise for various treatments. For instance, the local government is focusing on increasing its Pradhan Mantri Bhartiya Jan Aushadhi Kendras to 10,500 by March 2025. This is set to boost the sales of IBS drugs in the country.

IBS Treatment Market Players:

- Teva Pharmaceutical Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ardelyx, Inc.

- Abbott Laboratories

- Bausch Health Companies Inc.

- Bayer AG

- Ironwood Pharmaceuticals, Inc.

- Johnson & Johnson

- Sanofi S.A.

- Sebela Pharmaceuticals Inc.

- Novartis AG

- Validus Pharmaceuticals LLC

- AstraZeneca Plc

- GlaxoSmithKline, Plc

Key players in the irritable bowel syndrome treatment market are adopting several organic and inorganic tactics to earn high profits. Leading companies are investing heavily in R&D for the production of advanced and reliable irritable bowel syndrome drugs to maximize their revenue shares. They are also collaborating with other players and research organizations to attract a wider consumer base through innovations. Industry giants are also employing regional expansion strategies to increase their market reach.

Some of the key players include:

Recent Developments

- In June 2023, Ironwood Pharmaceuticals, Inc. announced that it received FDA approval for the use of LINZESS. LINZESS is effective for the treatment of functional constipation in patients aged between 6 to 17 years.

- In October 2023, Sanofi S.A. and Teva Pharmaceuticals signed a collaborative agreement to co-develop and co-commercialize asset TEV’574 for the treatment of two types of inflammatory bowel disease, Ulcerative Colitis and Crohn's Disease.

- In April 2022, Ardelyx, Inc. revealed the launch of IBSRELA an NHE2 inhibitor for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults. IBSRELA is one of the novel mechanism therapies to treat IBS-C in a decade.

- Report ID: 6494

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Irritable Bowel Syndrome (IBS) Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.