Cryptococcosis Drugs Market Outlook:

Cryptococcosis Drugs Market size was over USD 1.5 billion in 2025 and is estimated to reach USD 2.8 billion by the end of 2035, expanding at a CAGR of 7.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of cryptococcosis drugs is assessed at USD 1.7 billion.

More than 1 million cases of cryptococcosis are registered every year in the world, accompanied by approximately 625,000 deaths, as per the 2023 NLM findings. Another 2024 NLM report unveiled that the global mortality rate of Cryptococcus neoformans infection ranged between 41% and 61%. Besides, HIV-afflicted people are highly susceptible to developing this infection, fueling demand in the market. Thus, the growing epidemic of AIDS worldwide is expanding the consumer base of the market. In this regard, the World Health Organization (WHO) highlighted that over 1.3 million new diagnoses of HIV were recorded across the globe in 2024 alone, when around 630.0 thousand of these patients died.

As per the treatment protocols enacted to combat this widespread condition, a majority proportion of the supply chain of the market relies on the global trade of first-line medications, including amphotericin B and flucytosine. However, the complexity and vulnerability of these products, coupled with the shortage of global producers, often increase their overall payers’ pricing. Testifying to the same, in 2023, an NLM study revealed that the per-patient cost for only 2 weeks of therapy initiation with amphotericin B and flucytosine in the U.S. hospitals accounted for USD 2,000, totaling USD 390 million for 195,000 advanced HIV candidates. This underscores the urgency of international coordination for extensive research and manufacturing to minimize economic burden.

Key Cryptococcosis Drugs Market Insights Summary:

Regional Highlights:

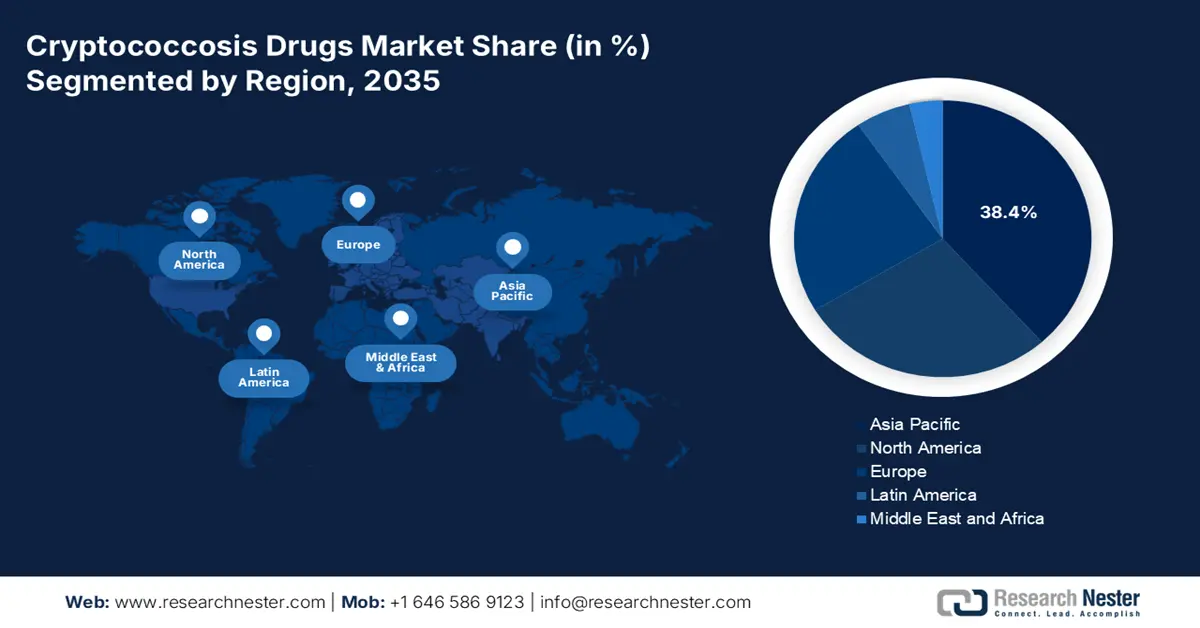

- The Asia Pacific region is forecast to dominate the cryptococcosis drugs market with a 38.4% share by 2035, driven by the expanding HIV/AIDS-affected population and limited accessibility to early diagnostics and treatment across key countries such as India and China.

- North America is projected to remain the second-largest regional market by 2035, owing to its advanced healthcare infrastructure, high disease awareness, and continuous R&D in antifungal therapies.

Segment Insights:

- The azoles segment, led by fluconazole, is projected to command a 48.6% revenue share by 2035 in the cryptococcosis drugs market, sustained by its WHO-endorsed role in consolidation therapy and widespread adoption in large-scale public health programs.

- The cryptococcal meningitis segment is anticipated to hold a 65.8% share by 2035, propelled by its status as the most prevalent and fatal form of cryptococcosis and the primary therapeutic focus in this field.

Key Growth Trends:

- Growing immunocompromised population

- Improved diagnostics and early detection

Major Challenges:

- Mismatch between high R&D Costs and revenue

- Cost-controlled procurement

Key Players: Pfizer Inc., Gilead Sciences, Inc., Novartis AG, Viatris (Mylan N.V.), Teva Pharmaceutical, Merck & Co., Inc., Sun Pharma, Bayer AG, Cipla Ltd., Aurobindo Pharma, Glenmark Pharmaceuticals, Sanofi S.A., Abbott Laboratories, Bristol Myers Squibb, Johnson & Johnson, Lupin Ltd., Hikma Pharmaceuticals, Strides Pharma Science, Mayne Pharma Group Ltd., GSK plc, Mycovia Pharmaceuticals, Inc., Astellas Pharma Inc., Daiichi Sankyo Company, Limited, Fuji Pharma Co., Ltd., Sumitomo Pharma Co., Ltd., Shionogi & Co., Ltd., Asahi Kasei Pharma.

Global Cryptococcosis Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 2.8 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Thailand, South Africa, Mexico

Last updated on : 1 October, 2025

Cryptococcosis Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Growing immunocompromised population: The volume of individuals with a compromised immune system is rising due to increased cases of organ transplants, cancer therapies, and autoimmune diseases. Evidencing the same, an NLM study unveiled that more than 3% of adults living across the U.S. were immunocompromised in 2023. Besides, the occurrence rate of related medical conditions in the U.S. rose from 2.7% in 2013 to 6.6% in 2021, as per the 2025 publication from the medRxiv. Moreover, the increasing use of immunosuppressants to treat such ailments also contributes to the demographic expansion of the market.

- Improved diagnostics and early detection: Advancements in diagnostic tools, such as cryptococcal antigen (CRAG) testing, are fueling adoption in the market by allowing early detection of infection, even before symptoms appear. This screening method is increasingly gaining popularity and being implemented in HIV care settings due to its ability to save patients and medical settings from the growing financial burden of expensive treatments. As evidence, a 2021 NLM study identified lateral flow assay (LFA) and latex agglutination (LA) of CRAG to be cost-effective for large-scale screening programs, where the CRAG-LFA had an incremental cost-effectiveness ratio of USD 73.3.

- Introduction of novel therapeutics: Traditional monotherapies often have limitations in efficacy, resistance, or toxicity. However, ongoing research and clinical findings are developing new regimens for improved outcomes, fostering greater avenues for pipeline expansion in the market. These new therapies have demonstrated higher efficacy and faster fungal clearance from cerebrospinal fluid, increasing the rate of adoption in this sector from both developed and emerging landscapes. For instance, in 2025, the ASC Publication released a study that identified RN86 and RVJ42 (thiazole derivatives) as the most promising drug candidates for these ailments.

Demographic Trends in the Key Landscapes of the Cryptococcosis Drugs Market

Characteristics of Cryptococcosis Patients in the U.S. (2016-2022)

|

Age Group (Years) |

Prevalence Rates per 100,000 Patients with Commercial Health Insurance |

Prevalence Rates per 100,000 Patients with Medicaid |

|

0-17 |

0.4 |

0.7 |

|

18-34 |

1.3 |

6.9 |

|

35-44 |

3.0 |

17.8 |

|

45-54 |

4.8 |

32.1 |

|

55-64 |

7.3 |

30.1 |

|

65+ |

10.9 |

17.8 |

|

Total |

3.4 |

6.5 |

Source: NLM

Analysis of Economic Models for Key Products Available in the Cryptococcosis Drugs Market

Overview of Dosage-wise Cost Differences for Fluconazole (2021)

|

Dosage |

Treatment Phase |

Duration (Weeks) |

Daily Cost/Patient (in USD) |

Treatment Cost (in USD) |

|

Fluconazole 800 mg |

Preemptive |

2 |

6.5 |

92.0 |

|

Fluconazole 400 mg |

Preemptive |

8 |

3.2 |

184.0 |

|

Fluconazole 600 mg/day |

Consolidation |

8 |

0.2 |

17.2 |

|

Fluconazole 200 mg |

Maintenance |

48 |

6.2 |

2,293.6 |

Source: NLM

Challenges

- Mismatch between high R&D Costs and revenue: Developing a novel antifungal agent requires substantial investment in long-term research and real-world clinical trials, which also makes innovative products in the market highly expensive. As a result, the revenue generation is constrained among a majority of the infected population. This disparity weakens the justification for the large capital required for new drug development to shareholders, discouraging them from investing in this sector.

- Cost-controlled procurement: In a majority of high-burden demographics, drug procurement is conducted through centralized systems, particularly in price-sensitive regions such as sub-Saharan Africa and Southeast Asia. These government-run tender processes prioritize the lowest-cost product, limiting business opportunities for premium-priced therapeutics. This also creates an intense pricing competition among pioneers, where manufacturers of the market often face limitations in profitability as they are forced to offer unsustainable discounts or volume-based guarantees.

Cryptococcosis Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.8 billion |

|

Regional Scope |

|

Cryptococcosis Drugs Market Segmentation:

Drug Class Segment Analysis

Azoles, particularly fluconazole, are predicted to maintain their captivity over the highest revenue share of 48.6% in the market by the end of 2035. Despite the emergence of safer alternatives, this subtype is still widely used in both induction and maintenance therapy. Besides, Fluconazole is also globally recognized as the WHO-recommended medicine for consolidation therapy in treating and preventing CM among advanced HIV patients. Moreover, its inclusion on the WHO Model List of Essential Medicines and heavy utilization in large-scale public health programs ensure sustained and high-volume adoption, solidifying the segment’s dominant position in this field.

Indication Segment Analysis

Cryptococcal meningitis is poised to continue to dominate the patient pool of the market with a share of 65.8% over the discussed timeframe. Being the most severe and common life-threatening manifestation of this fungal infection, this indication has become the primary target for a majority of therapeutics in this sector. In this regard, the 2024 epidemiological study published by the NLM unveiled that more than 152,000 and 112,000 new cases and deaths from CM occur among HIV-infected and AIDS patients worldwide every year. Another NLM article from the same year highlighted that the CM-causing pathogen, B. Cryptococcus gattii, comprises up to 33% of all cases of invasive cryptococcosis around the globe.

Distribution Channel Segment Analysis

Hospital pharmacies are estimated to account for the largest share of 72.7% in the cryptococcosis drugs market throughout the analyzed tenure. The leadership is largely attributable to the necessity of immediate, intensive, and mostly inpatient treatment with intravenous medicines. Besides, hospital settings are highly recommended for conducting therapy under close medical supervision to enable adequate measures for patient management. Moreover, the wide availability of critical antifungal agents, including temperature-sensitive formulations, facilitates greater adherence to current therapeutic protocols, securing their forefront position in revenue generation from this sector.

Our in-depth analysis of the global market includes the following segments:

| Segment | Subsegment |

|

Drug Class |

|

|

Indication |

|

|

Distribution Channel |

|

|

Route of Administration |

|

|

Treatment Phase |

|

|

Patient Demographics |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cryptococcosis Drugs Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to capture the highest share of 38.4% in the global market during the assessed timeline. The enlarging demography of HIV/AIDS and immunocompromised individuals is the primary growth factor behind the region’s dominance in this sector. Particularly, high-concentration countries, such as India, China, Thailand, and Indonesia, present one of the biggest contributors to this epidemiology with a growing population of untreated or late-stage HIV patients. Moreover, the accessibility gaps in early diagnostics and treatment mostly lead to severe disease progression, fostering a substantial demand base for the merchandise in Asia Pacific.

China is establishing a strong position in the APAC market with an increasing volume of hospital-based patients and antifungal therapy initiation. Testifying to the same, a six-year retrospective study conducted at Meizhou People's Hospital, China, underscored an 8-fold increase in the number of cryptococcal infection cases from 2016 to 2022. Additionally, the rising healthcare expenditure, improved disease awareness, and ongoing innovations in antifungal formulations are accelerating progress in this landscape. Ongoing global health initiatives further support access to life-saving therapies in low-resource settings.

India is becoming one of the emerging suppliers and the largest consumer bases for the market. This is primarily attributed to its high burden of HIV/AIDS and a growing population of immunosuppressed patients. To serve this population, the country’s government is amplifying its efforts to improve nationwide HIV care. This is further complemented by the continuous support from global health organizations to increase access to essential antifungal drugs, such as fluconazole, amphotericin B, and flucytosine. Moreover, the explosive generic pharmaceutical industry of India is fueling the adoption rate in this sector.

Country-wise HIV Populations (2024)

|

Country |

Number of People Living with HIV |

|

India |

2,600,000 |

|

Australia |

31,000 |

|

Malaysia |

84,000 |

|

Thailand |

570,000 |

|

Indonesia |

5,70.000 |

|

Bangladesh |

17,000 |

|

Pakistan |

3,50,000 |

|

Philippines |

2,20,000 |

Source: WHO

North America Market Insights

North America is estimated to stand as the second-largest shareholder in the global cryptococcosis drugs market by the end of 2035. The advanced medical system, high disease awareness, and robust R&D in antifungal therapies collectively foster a progressive atmosphere for the merchandise in this region. Despite the occurrence of this infection being lower than in highly-afflicted regions, it still carries the potential of breaking out among immunocompromised and elderly populations. Specifically, the persistently growing volume of HIV-positive individuals, organ transplant recipients, and cancer patients undergoing chemotherapy maintains the need for widespread product availability.

The U.S. is witnessing a steady increase in cases of Cryptococcus gattii infection, which has secured a lucrative scope of extensive research and expansion. Evidencing the same, a 2023 NLM report unveiled that the occurrence rate of this condition among AIDS-afflicted individuals living across the country ranged between 2 and 7 cases per 100,000 people, with a case fatality ratio of about 12%. Further, strong R&D activity, improved insurance policies, and high awareness of early diagnosis contribute to greater treatment initiation rates and a sustained demand base for the cryptococcosis drugs market.

Canada is one of the few countries in North America, where Cryptococcus gattii is becoming endemic, particularly in British Columbia. This is leading to both pulmonary and central nervous system infections in otherwise healthy individuals. Thus, in response, the country’s universal healthcare system is highly focused on ensuring access to essential antifungal treatments, such as fluconazole, amphotericin B, and flucytosine, supporting consistent growth in the cryptococcosis drugs market.

Europe Market Insights

Europe is anticipated to represent a prominent landscape in the global cryptococcosis drugs market over the timeline between 2026 and 2035. The consistency is largely supported by its advanced healthcare infrastructure, strong financial backing policies, and comprehensive infectious disease management protocols. The cases of infection are increasingly seen among immunocompromised patients, including those undergoing organ transplants, cancer therapies, and living with autoimmune conditions.

The UK has established a strong structure of diagnostic and treatment guidelines that promote the use of high-efficacy antifungals from the cryptococcosis drugs market. On the other hand, the country’s strong emphasis on clinical research and surveillance programs, coupled with the increased access to cutting-edge therapeutic formulations, continues to foster a greater scope of progress in this landscape for the upcoming years. However, the patient population in this category has relatively decreased over the past decade, leading to lower utilization rates.

Germany holds a strong position in the Europe cryptococcosis drugs market, which is primarily backed by its highly developed biomedical research ecosystem, widespread access to advanced healthcare solutions, and a proactive response to managing potential outbreak threats. Although this condition is quite uncommon in the general population, it still occurs among HIV/AIDS and cancer-surviving patients. Moreover, the hospitals in Germany follow world-class standards of treatment, reflecting opportunities for highly efficient combination therapies.

Overview of Key Demographics in Target Countries (2023-2024)

|

Country |

HIV Diagnoses Rates (per 100,000 Population) |

|

Russian Federation |

37.9 |

|

Ukraine |

31.7 |

|

Republic of Moldova |

27 |

|

Malta |

21 |

|

Kazakhstan |

20.6 |

|

Armenia |

18 |

|

Cyprus |

17.6 |

|

Ireland |

17.3 |

|

Georgia |

16.4 |

|

Kyrgyzstan |

15.6 |

|

Belarus |

15.4 |

Source: WHO

Key Cryptococcosis Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gilead Sciences, Inc.

- Novartis AG

- Viatris (Mylan N.V.)

- Teva Pharmaceutical

- Merck & Co., Inc.

- Sun Pharma

- Bayer AG

- Cipla Ltd.

- Aurobindo Pharma

- Glenmark Pharmaceuticals

- Sanofi S.A.

- Abbott Laboratories

- Bristol Myers Squibb

- Johnson & Johnson

- Lupin Ltd.

- Hikma Pharmaceuticals

- Strides Pharma Science

- Mayne Pharma Group Ltd.

- GSK plc

- Mycovia Pharmaceuticals, Inc.

- Astellas Pharma Inc.

- Daiichi Sankyo Company, Limited

- Fuji Pharma Co., Ltd.

- Sumitomo Pharma Co., Ltd.

- Shionogi & Co., Ltd.

- Asahi Kasei Pharma

The commercial dynamics of the cryptococcosis drugs market feature a strong cohort of both global pharmaceutical companies and regional generic manufacturers. These pioneers primarily focus on producing essential antifungal agents such as amphotericin B, flucytosine, and fluconazole, which are critical to maintain steady cash inflow. The sector is also moderately consolidated, with ongoing advances in drug efficacy, formulation, and pricing strategies. Such leaders are further heavily investing in R&D to cultivate extended pipelines of safer and more effective therapies with fewer side effects to meet the evolving consumer needs.

Such key players are:

Recent Developments

- In July 2025, GSK, in alliance with the University of Dundee and the University of Exeter, earned a USD 20.9 million research grant for their five-year project of developing antifungal treatments, with an initial focus on Cryptococcus neoformans. The goal of this team of scientists was to generate two new pre-clinical drug candidates for this ailment.

- In June 2025, Mycovia Pharmaceuticals started enrollment of the first participant in an investigator-initiated clinical trial on oteseconazole and other investigational products for cryptococcal meningitis. The Phase 2 PLATFORM-CM study marks a significant research effort aimed at improving treatment options.

- Report ID: 8163

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cryptococcosis Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.