Synthetic Graphite Market Outlook:

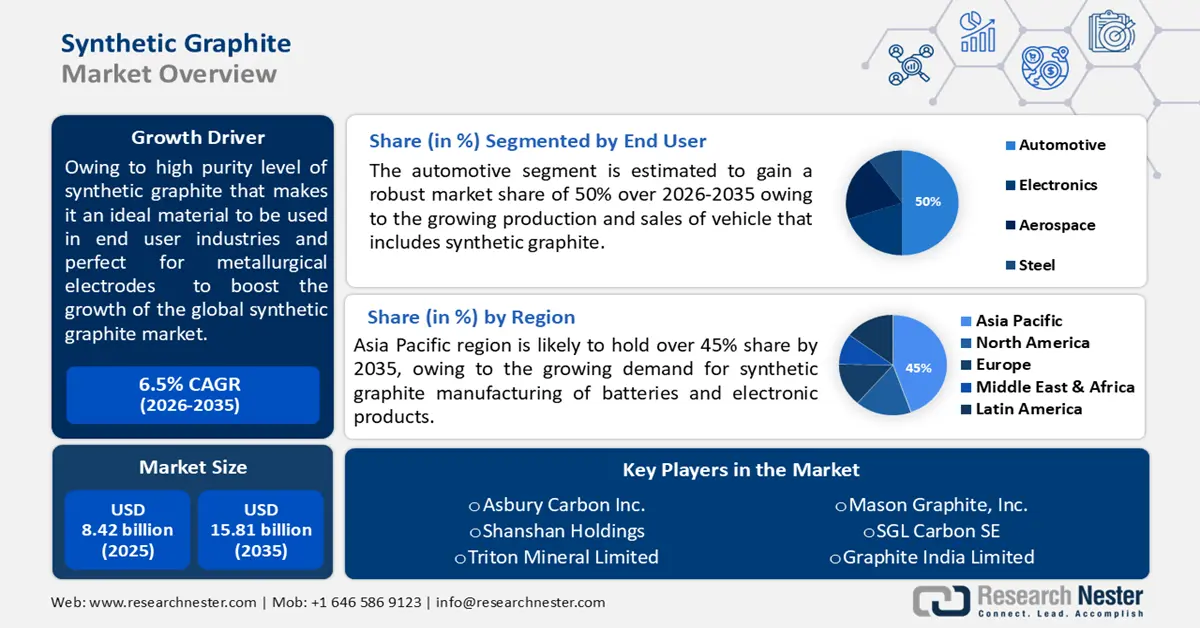

Synthetic Graphite Market size was over USD 8.42 billion in 2025 and is poised to exceed USD 15.81 billion by 2035, witnessing over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of synthetic graphite is evaluated at USD 8.91 billion.

The market growth is driven by higher purity level associated with synthetic graphite which makes it an ideal material to be used in numerous end-use industries and perfect for metallurgical electrodes. For instance, natural graphite purity ranges from around 70.1% to 99.0%, whilst synthetic graphite purity is usually more than 99.0%. Further, worldwide surging demand for electrical vehicles is estimated to fuel the growth of the global synthetic graphite market. In addition, increasing use of synthetic graphite in the production of sports equipment, and pencils is a major factor that is anticipated to boost the market size.

In addition, the market revenue is propelled by worldwide rise in the demand and adoption of lithium-ion batteries on the back of the surging use of these batteries in EVs. For instance, the worldwide production capacity of lithium-ion batteries was around 765 GWh in 2020, while estimates for 2023 production range from 405 to 1,100 GWh. In addition, expanding use of synthetic graphite electrodes for recycling steel scrap is projected to spur market growth. Moreover, synthetic graphite is highly used as a substitute in the manufacturing of calcium carbide will fuel the market demand.

Key Synthetic Graphite Market Insights Summary:

Regional Highlights:

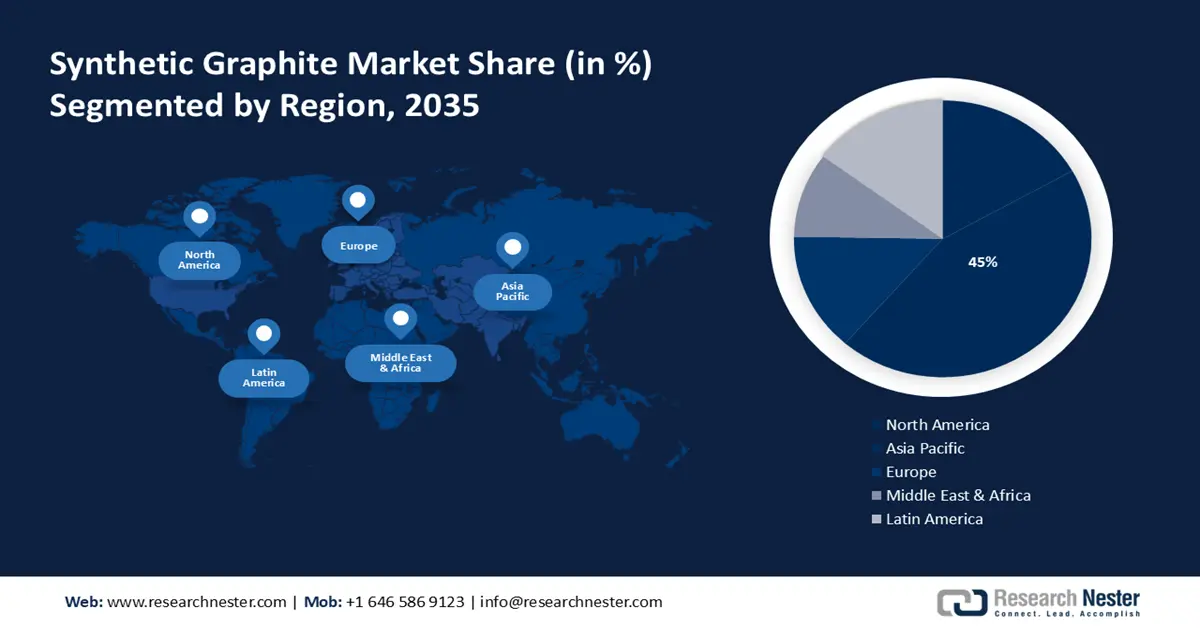

- Asia Pacific synthetic graphite market will dominate over 45% share by 2035, driven by increasing demand for synthetic graphite in batteries and electronics manufacturing.

- Europe market will capture a 25% share by 2035, driven by increasing demand for batteries and expansion in the automotive sector.

Segment Insights:

- The automotive segment in the synthetic graphite market is expected to hold a 50% share by 2035, fueled by increasing use in electric vehicle batteries and car frames.

- The refractory segment in the synthetic graphite market is forecasted to attain a 40% share by 2035, driven by surging steel demand and industrial expansion, especially in Asia and Oceania.

Key Growth Trends:

- Worldwide Escalating Demand for Electric Vehicles

- Increasing Production of Graphite Electrodes

Major Challenges:

- High Cost of Production of Graphite

- Stringent Regulations for Manufacturing Synthetic Graphite

Key Players: SGL CARBON SE, AMG Advanced Metallurgical Group N.V., XRD Graphite Manufacturing Co., Ltd., Asbury Carbons Inc., Graphite India Limited, Mason Graphite Inc., GrafTech International Ltd., Nippon graphite Industries, Co., Ltd., Triton Minerals Limited, Shanshan Holdings.

Global Synthetic Graphite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.42 billion

- 2026 Market Size: USD 8.91 billion

- Projected Market Size: USD 15.81 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Synthetic Graphite Market Growth Drivers and Challenges:

Growth Drivers

-

Worldwide Escalating Demand for Electric Vehicles – The demand for electric vehicles is rapidly increasing. People are switching to electric vehicles owing to the advantages of green energy and higher performance. Furthermore, there is a rising need to reduce reliance on imported oil and the exhaustion of fossil fuels. The lithium-ion batteries are gaining more popularity as of the surge in the adoption of electric vehicles. Hence, the upsurge in electric vehicles is projected to spur market growth in the coming years. For instance, the worldwide ratio of on-road electric vehicles surged by more than 10 million in 2021.

-

Increasing Production of Graphite Electrodes - Graphite electrodes are huge cylindrical structures typically made of petroleum coke, needle coke, and coal bitumen as a binder. Calcination, compounding, kneading, pressing, roasting, graphitization, and machining all techniques are used to make electrodes. The electrical energy from the power source is transferred through graphite electrodes to the steel melt in the EAF solution in the making of steel and other non-ferrous metals. Therefore, the extensive use of these electrodes in steel and metals production is estimated to fuel the market growth during the forecast period. For instance, worldwide production of graphite electrodes surged by around 720,108 metric tons in 2019, and this proportion is estimated to rise to around 799,500 metric tons by 2024.

-

Rising Demand and Production of Lubricants - A lubricant is a liquid that is used to ease the relative motion of solid structures by reducing wear and friction between surfaces in contact. Synthetic graphite is highly used in the production of lubricants. Since to its distinctive structural properties, graphite can be used in commercial and industrial lubricants. Graphite is made up of different layers that are only loosely adhered together, allowing the layers to easily slip past one another and settle on a contact surface. The growing count of vehicles is fueling the demand for lubricants, and such increased demand is providing a huge market expansion to synthetic graphite. For instance, the net production of lubricants in refineries in the United States reached nearly 167 thousand barrels per day in 2021, a boost of almost 10.8 percent over the previous year.

-

An Upsurge in the Demand for Consumer Electronic Products – A surge in the demand for numerous consumer electronic products is also estimated to propel the growth of the synthetic graphite market as graphite has been used in the production of long-life rechargeable batteries of the electronic products comprising smartphones, tablets, laptops, and so on. For instance, worldwide shipments of desktops, laptops, and workstations increased by nearly 1% annually in 2021 to approximately 93 million units, up from 91 million in the previous year.

-

Rising Usage of Graphite in Green Energy Technologies – The adoption of green energy is radically rising throughout the world as of its topmost advantage of net zero emission. Graphite has been utilized in green energy technologies such as wind energy, along with the surge in the installation of solar panels. Hence, this factor is also projected to drive market growth. For instance, in 2021, solar panels were installed on about 65,560 homes in the United Kingdom, an increase of around 72% from 2020. Thus, the total number of homes with solar panel installation has already surpassed around 1.6 million.

Challenges

- High Cost of Production of Graphite - Despite the wide-scale application of synthetic graphite, a high cost of production is associated with synthetic graphite as compared to naturally occurring graphite which may negatively affect the market growth. Hence, this factor is anticipated to lower the market growth in the coming years.

- Stringent Regulations for Manufacturing Synthetic Graphite

- Risk of Health Issues Associated with Exposure to Graphite

Synthetic Graphite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 8.42 billion |

|

Forecast Year Market Size (2035) |

USD 15.81 billion |

|

Regional Scope |

|

Synthetic Graphite Market Segmentation:

Application Segment Analysis

The refractory segment is set to gain largest market share of about 40% by 2035. The segment growth can be attributed to dynamically surging industrial development, along with the radical expansion of the steel sector owing to the high rising demand and production of steel and stainless steel products. For instance, with approximately 1.4 billion metric tons of estimated demand in 2023, Asia and Oceania are projected to be the leading consumers of finished steel products. Whilst, African steel demand is also predicted to reach around 43 million metric tons in the same year. In addition to this, expanding demand for refractory products from numerous industries including automotive, aerospace, metal manufacturing, building and construction, etc. is estimated to accelerate the segment revenue.

End-user Segment Analysis

The automotive segment is expected to dominate more than 50% share by 2035, credited to expanding demand and production of vehicles where synthetic graphite is highly used as a material in carbon fiber-reinforced plastics for automobile frames. In addition to this, the rising production of electric vehicle batteries as of the growing traction and demand for electrical vehicles including electric cars, e-bikes, etc. will drive the segment growth. Based on a report, worldwide approximately 68 million automotive units were sold in the year 2021.

The electronics segment is projected to witness massive CAGR during the forecast period, owing to its being used as an exceptional material for various electronic applications such as electric motors, semiconductors, and the manufacturing of modern-day batteries. Hence, the increasing demand for semiconductors, electric motors along with various electronic products such as smartphones, tablets, and numerous household appliances amongst users worldwide is estimated to spur the segment growth.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Synthetic Graphite Market Regional Analysis:

APAC Market Insights

The Asia Pacific synthetic graphite market is set to dominate majority revenue share of 45% by the end of 2035. The market growth is propelled by increasing demand for synthetic graphite for the manufacturing of batteries, and electronics products. For instance, China manufactured almost 80% of all lithium-ion batteries produced globally in 2021.

Moreover, expanding demand for semiconductors, graphite electrodes, and carbon fiber-reinforced plastic will drive the market growth. In addition, favorable governmental industrial expansion policies, and the expanding residential construction industry, especially in countries such as Japan and China are some of the significant factors anticipated to drive the market revenue.

Europe Market Insights

The European synthetic graphite market is predicted to hold 25% share during the forecast period, impelled by radically increasing demand for batteries, coupled with significant expansion in the automotive sector in the region. Moreover, surging demand for synthetic graphite in various industries such as the nuclear industry, metallurgy, chemical industry, etc. is another significant factor that is expected to accelerate the market growth.

Synthetic Graphite Market Players:

- SGL CARBON SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AMG Advanced Metallurgical Group N.V.

- XRD Graphite Manufacturing Co., Ltd.

- Asbury Carbons Inc.

- Graphite India Limited

- Mason Graphite Inc.

- GrafTech International Ltd.

- Nippon graphite Industries, Co., Ltd.

- Triton Minerals Limited

- Shanshan Holdings

Recent Developments

-

Shanshan Holdings disclosed additional investments from its four key investors through its wholly-owned subsidiary Shanghai Shanshan Lithium Battery Material Technology Co. Ltd. These four strategic investors include Wending Investment, BYD, Amperex Technology Limited (ATL), and the Kunlun Fund.

-

GrafTech International Ltd. stated that the interim suspension notice linked to the Company's activities in Monterrey, Mexico, has been canceled conditionally, making it possible to restart operations at the site soon.

- Report ID: 2848

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Synthetic Graphite Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.