Smart Indoor Garden Market Outlook:

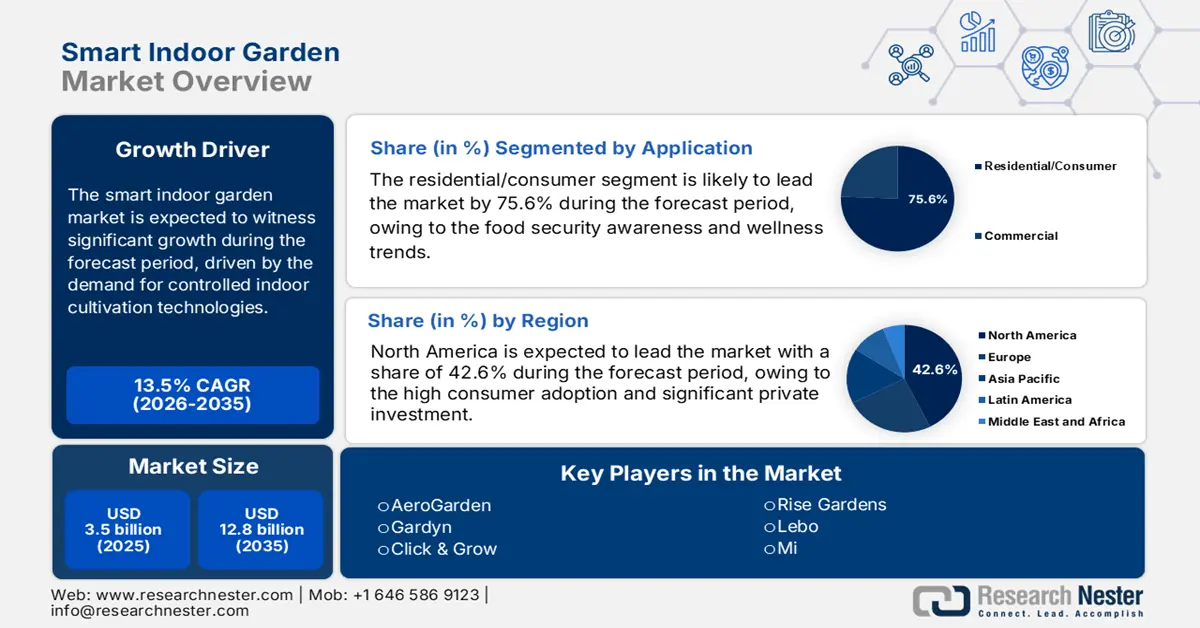

Smart Indoor Garden Market size was valued at USD 3.5 billion in 2025 and is projected to reach USD 12.8 billion by the end of 2035, rising at a CAGR of 13.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of smart indoor garden is assessed at USD 4.1 billion.

The global smart indoor garden market is driven by the rising demand for controlled indoor cultivation technologies in commercial and institutional environments is developing in parallel with the national sustainability and food system priorities. The World Economic Forum in February 2025 notes that indoor vertical farming and controlled environment food production are receiving growing public investment, with USD 2.4 billion in 2022. The market addresses the challenges in traditional food systems, including supply chain resilience and resource efficiency. The U.S. Department of Agriculture notes that the CEA, which includes indoor farming, can reduce the food miles and water usage compared to conventional agriculture while enabling year-round production. This operational reliability is a key value proposition for commercial buyers, including the hospitality, corporate wellness, and educational institutions seeking to secure predictable supplies of fresh produce.

The adoption is also related to the macro-level priorities concerning food security and environmental impact. The NLM study in October 2024 denotes that the food and vegetable consumption in children and adolescents specifies 250g per day for children, and for adults, it is 400g. This increased consumption is a vital component of public health strategies to combat non-communicable diseases, creating a demand side pull for technologies that facilitate consistent access to fresh greens. From the resource perspective, the Environmental Protection Agency's focus on sustainable materials management and food waste production aligns with the precise input control offered by smart indoor systems that minimize the nutrient runoff and spoilage. The precise input control offered by the smart indoor systems minimizes nutrient runoff and spoilage, directly supporting the EPA's goals for reducing the environmental footprint of food production, directly supporting the EPA's goals for reducing the environmental footprint of food production.

Key Smart Indoor Garden Market Insights Summary:

Regional Highlights:

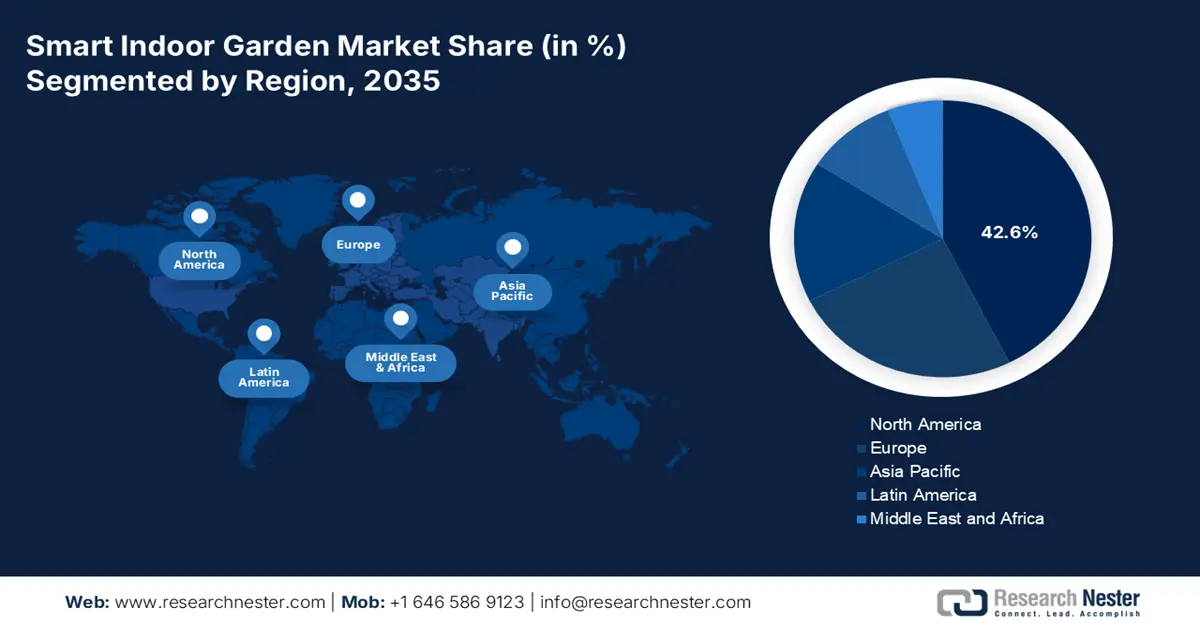

- North America is projected to capture a 42.6% share by 2035 in the smart indoor garden market, attributed to expanding technological advancements in energy-efficient LED lighting.

- The Asia Pacific region is anticipated to grow at an 11.3% CAGR during 2026–2035, underpinned by extreme population density and acute food security concerns.

Segment Insights:

- The residential/consumer sub-segment is set to command a 75.6% share by 2035 in the smart indoor garden market, spurred by rising urbanization, food security awareness and wellness trends.

- The online/e-commerce segment is forecast to hold the largest share by 2035, reinforced by the expanding direct-to-consumer model embraced by leading brands.

Key Growth Trends:

- Government investment in agricultural technology and food security

- Urbanization and land scarcity

Major Challenges:

- Navigating regulatory hurdles for the seed and plant health

- Technological integration and software development

Key Players: AeroGarden (U.S.), Gardyn (U.S.), Click & Grow (Estonia), Rise Gardens (U.S.), Lebo (China), Mi (Xiaomi) (China), Milan (China), CropKing (U.S.), Grobo (Canada), SproutsIO (U.S.), Tower Garden (Juice Plus+) (U.S.), Seedo (Israel), Veritable (France), Urban Cultivator (Canada), Bace (Japan), GreenTECH (BSH) (Germany), Harvest Today (Fork Farms) (U.S.), Farm.One (U.S.), Nutraponics (Australia), Panasonic (Japan).

Global Smart Indoor Garden Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 12.8 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, United Arab Emirates

Last updated on : 12 December, 2025

Smart Indoor Garden Market - Growth Drivers and Challenges

Growth Drivers

- Government investment in agricultural technology and food security: The direct public funding for controlled environment agriculture is a primary catalyst in the smart indoor garden market. The U.S. Department of Agriculture has made significant grants via programs such as the Agriculture and Food Research Initiative. The report from the National Sustainable Agriculture Coalition in July 2022 states that USDA NIFA allocated USD 50 million for sustainable agriculture systems, including CEA projects, that improve resilience and productivity. This funding drives the innovation for technology providers and stimulates the R&D into energy-efficient LEDs and automation. For the market entrants, aligning product development with these grant priorities is a vital strategy to secure non-dilutive funding and validate technology for commercial scale-up.

- Urbanization and land scarcity: The World Bank Group report in 2025 states that more than half of the world’s population, nearly over 4 billion people, live in cities. This rise is reducing the per capita arable land. This spatial constraint makes land-intensive traditional farming less feasible for feeding cities. Smart indoor gardens with their vertical high-yield per square foot design offer a solution for the hyper-local production within the urban footprints which is the major driver in the smart indoor garden market smart indoor garden market, reducing the food miles. This driver is mainly potent in high-density regions such as Asia and the Middle East, where the governments are actively investing in vertical farming to improve their sovereignty. The actionable insight is to design systems for modular integration into existing urban infrastructure, such as warehouses, shipping containers, and retail basements.

- Rising consumer demand for transparency and sustainability: This is the key driver for the smart indoor garden market due as the rising consumer demand for transparency and sustainability is increasingly institutionalized via corporate ESG frameworks and regulatory pressures moving beyond a mere trend. The U.S. Environmental Protection Agency's food recovery hierarchy mandates source reduction as the top priority for managing food waste, creating a compliance adjacent incentive for businesses. For B2B buyers, including the grocery retailers, restaurant chains, and corporate campuses on on-site smart gardens provide auditable data on the hyper-local production, reduced spoilage, and lower transportation emissions. This tangible evidence directly supports the sustainability reporting and responds to investor and consumer scrutiny over supply chain provenance. Consequently, the smart indoor systems are evolving from consumer novelties into strategic assets for risk management and brand integrity in the food service and retail sectors.

Challenges

- Navigating regulatory hurdles for the seed and plant health: Selling live plant material across borders subjects companies to robust phytosanitary regulations from agencies such as the USDA and the European Plant Protection Organization. This limits the seed variety offerings and increases the logistics complexities. For example, some leading companies must curate seed pod selections mainly for different regions, often using licensed certified pathogen-free seeds that add cost and limit inventory flexibility compared to a universal product line.

- Technological integration and software development: A seamless user experience depends on a stable feature feature-rich mobile app for controlling lights or nutrients and providing plant care tips. Developing and maintaining this software is a continuous cost and technical hurdle for hardware-focused startups. For example, the dominating players in the smart indoor garden market integrate their app with the recipe platforms and offer growing guides, adding value beyond the hardware control. Poor app functionality is a leading cause of negative reviews, showing that the product is judged as a tech ecosystem, not just a physical garden.

Smart Indoor Garden Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 12.8 billion |

|

Regional Scope |

|

Smart Indoor Garden Market Segmentation:

Application Segment Analysis

The residential/consumer sub-segment is dominating and is poised to hold the share value of 75.6% in the smart indoor garden market by 2035. The segment is fueled by the three interconnected drivers, such as urbanization, food security awareness and wellness trends. As the global urban population rises the access to fresh produce and green space declines, creating a demand for hyper-local food solutions. The events such as the COVID-19 pandemic heightened the consumer awareness of supply chain fragility, stimulating the grow your own movement. Furthermore, organizations such as the WHO highlight the importance of fruit and vegetable intake for preventing non-communicable diseases, a health message that smart gardens directly address by making daily fresh produce accessible and convenient at home.

Sales Channel Segment Analysis

The online/e-commerce is expected to hold the largest share in the smart indoor garden market by 2035. This segment is driven by the direct-to-consumer model embraced by the leading brands that allows for higher margins, detailed product storytelling, and the bundling of subscription services. Consumers favor online platforms for their convenience in comparing tech specs, accessing customer reviews, and receiving direct shipments of bulky products. The shift online was spurred by the pandemic-era shopping habits that have persisted. Supporting this trend, according to the US Census Bureau data from August 2025, overall e-commerce sales in the second quarter of 2025 accounted for 16.3% of total sales, demonstrating a continuous and substantial movement of consumer spending to digital storefronts.

Component Segment Analysis

Consumables are leading the component segment and are the largest shareholder in the segment by 2035. This reflects the industry’s strategic pivot to a high-margin recurring revenue razor and blades model. While hardware is a one-time purchase, consumables guarantee continuous engagement and cash flow via subscription plans. The demand is driven by the proprietary non-GMO seed varieties and the consumer's need for consistent, hassle-free replenishment. The economic significance of this agricultural input market is indicated by the U.S. Department of Agriculture's November 2022 that the horticultural products increased at a rate of 6% to USD 97.2 billion in value in 2022, indicating the substantial existing market that the smart garden consumables are capturing and digitizing. Hardware and software are essential for enabling the ecosystem, and function primarily as platforms to drive this repeat-purchase cycle.

Our in-depth analysis of the smart indoor garden market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Product Type |

|

|

Component |

|

|

Sales Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Indoor Garden Market - Regional Analysis

North America Market Insights

North America is dominating the smart indoor garden market and is expected to hold the market share of 42.6% by 2035. The market is defined by high consumer adoption, significant private investment, and supportive federal research funding. The growth is driven by the rising food security concerns, consumer demand for hyper-local and pesticide-free produce, and the integration with the smart home ecosystem. The market is fragmented into the premium direct-to-consumer brands and commercial applications for the restaurants and corporate wellness programs. The primary trend is a shift from hardware sales to a recurring revenue model dominated by the high-margin consumable. The key drivers include the technological advancements in energy-efficient LED lighting, backed by U.S. Department of Energy research, and government initiatives promoting agricultural innovation and climate resilience through controlled environment agriculture.

The U.S. smart indoor garden market is the global leader and is driven by the high consumer disposable income, widespread smart home adoption, and a strong venture capital investment in agriculture technology. The demand is fragmented among the premium direct-to-consumer brands and expanding commercial applications in the restaurants, corporate campuses, and educational institutions where they serve both operational and sustainability purposes. A vital driver is federal research funding aimed at increasing agricultural resilience, with significant USDA-NIFA grants supporting research into optimizing hydroponic systems for water and nutrient use efficiency in controlled environments. The USDA October 2022 report states that the USDA had invested USD 14.2 Million in 52 projects to support the urban agriculture and innovative production efforts, which directly surges the hydroponic and indoor farming.

Allocations Support Hydroponics Farming

|

Year |

Program |

Total Funding Allocated |

Projects Funded |

Hydroponic-Relevant Notes |

|

2022 |

UAIP Grants |

USD 14.2 million |

52 |

Infrastructure and education for hydroponic/urban systems. |

|

2023 |

UAIP Grants |

USD 7.4 million |

25 |

Indoor hydroponic innovations and job training. |

|

2023 |

NIFA Urban/Indoor |

USD 9.4 million |

Not specified |

Research on water-efficient hydroponics. |

|

2025 |

UAIP Grants |

USD 2.5 million (USD 75K- USD 350K/project) |

Not specified |

Hydroponics/aquaponics for food access. |

|

2025 |

UAIP Total |

USD 14.4 million |

Not specified |

Expansion including hydroponic urban farms. |

Source: USDA

In Canada, the smart indoor garden market is shaped by the geographic necessity and a strategic federal focus on food sovereignty and climate adaptation. The wild winters and vast distances make the fresh produce expensive and logistically challenging, mainly in northern and remote communities, creating a strong use case for indoor growing solutions. Government support is vital, with Agriculture and Agri-Food Canada actively funding clean technology and local food infrastructure. For example, the Government of Canada report depicts that the Agricultural Clean Technology (ACT) program launched in 2021 committed USD 166 million in funding, enabling the environment for the adoption of the clean technology to drive the agriculture and agri-food sector. The trend is towards practical, climate-resilient systems that address food security, with growth concentrated in partnerships between technology providers, Indigenous communities, and provincial agricultural initiatives.

APAC Market Insights

The Asia Pacific smart indoor garden market is the world's growing and is expected to grow at a CAGR of 11.3% during the forecast period 2026 to 2035. The market is propelled by the extreme population density, rapid urbanization, and acute food security concerns. Unlike the western markets, which are driven by the consumer lifestyle trends, the APAC demand is fundamentally necessity-based based with the government actively promoting controlled environment agriculture as a strategic solution. The key drivers include severe limitations on the arable land, the need to reduce the reliance on the volatile fresh produce imports, and worsening climate impacts on traditional farming. A dominant trend is the integration of smart indoor systems into the vertical urban infrastructure, such as the residential high rises and retail complexes, mainly in cities such as Singapore and Shanghai.

The smart indoor garden market in China is defined by the massive scale, strong government policy drivers, and a dominant manufacturing base that supplies both the domestic and global demand. The growth is centrally directed via initiatives such as the national vegetable basket program and the digital village strategy that explicitly promote smart agriculture to enhance food security and self-sufficiency. This focus is on the large-scale commercial vertical farms supplying city hubs and on cost-effective consumer units from the OEM giants such as Lebo. Various reports have indicated that the output value of the country’s agricultural, forestry, animal husbandry, and fishery professional and support service activities is a category encompassing high-tech agricultural investment and activity in modernizing the food production sector, including indoor agriculture.

The primary drivers of India’s smart indoor garden market are driven by increasing urbanization, rising disposable income in metropolitan centers, and a growing consumer affinity for wellness-focused home environments. Unlike the standalone smart gardens, this segment focuses on IoT-based sensors and devices that monitor the soil moisture, light, and nutrients for traditional houseplants and small-scale herb cultivation. The demand is concentrated among the tech-savvy urban dwellers in cities such as Bengaluru, Mumbai, and Delhi who seek to integrate greenery into their living spaces. The government initiatives, such as the National Mission on Sustainable Agriculture and the broader smart cities mission, indirectly support the underlying technology by promoting IoT and digital solutions for resource management. The report from the AIC IIIT in May 2025 reports that the IoT market has reached USD 3.6 billion in 2024, highlighting a fertile ecosystem for the connected device adoption, including indoor plant care.

Europe Market Insights

The smart indoor garden market in Europe is expanding rapidly and is defined by the robust sustainability regulations a strong policy push for food sovereignty and high consumer awareness of the food provenance. The growth is driven by the European Green Deal’s Farm to Fork strategy that aims to minimize the pesticide use and promote the local resilient food systems creating a direct regulatory tailwind for controlled environment agricultrue. A significant trend is the integration of these systems into urban planning and smart city initiatives supported by the EU funding for innovation. The market is fragmented by the premium consumer applications and commercial scale urban farms supplying grocery and hospitality sectors. The supply chain disruption from the recent geopolitical events have stimulated the investment positioning indoor agriculture as a strategic buffer.

Germany’s smart indoor garden market in Europe is driven by technological prowess, high consumer environmental awareness, and supportive federal policy. The growth is fueled by the integration of Industry 4.0 automation and IoT into commercial vertical farms, maximizing efficiency. The German Federal Ministry of Food and Agriculture actively promotes digital and sustainable agriculture. For instance, the GTAI 2025 report depicts that 85.5% of the farmers use digital technologies on their farms. This data reflects the broader adoption environment for digital agriculture and smart cultivation tools. Indoor horticulture, controlled-environment agriculture, and precision cultivation use advanced digital technology for agriculture, boosting the market expansion. The market is defined by engineering-focused startups and partnerships with the major retail chains seeking to secure local, year-round supply, reducing import dependency, and aligning with national climate goals.

Source link- https://www.gov.uk/government/statistics/latest-horticulture-statistics/horticulture-statistics-2024

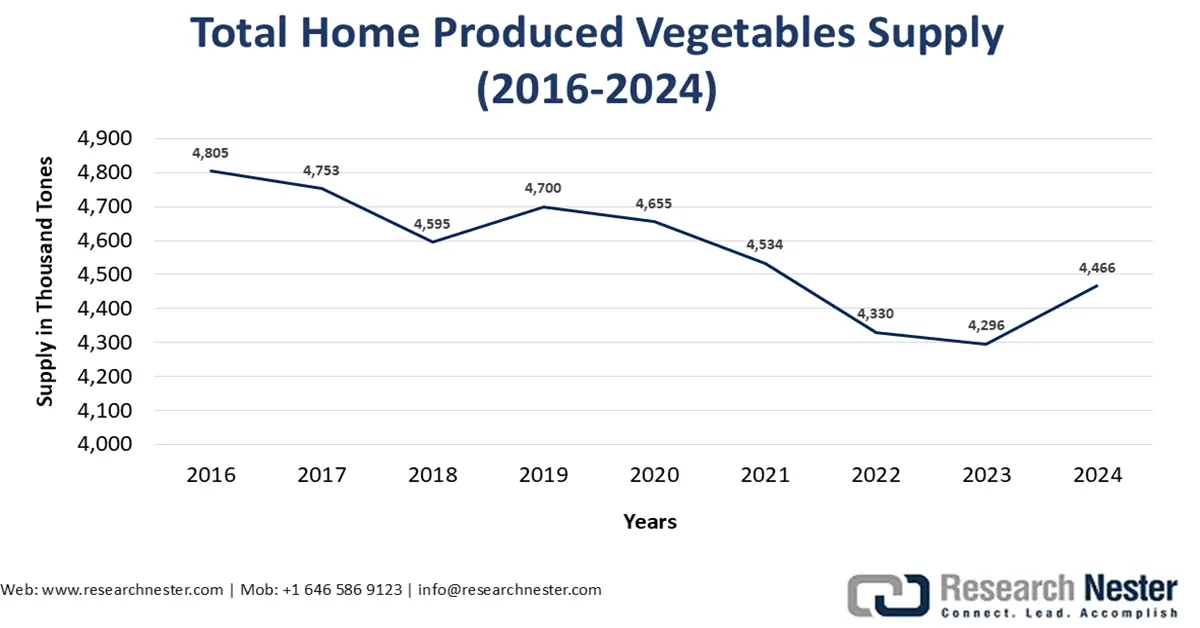

The UK smart indoor garden market is defined by the post-Brexit food security strategy and concentrated urban demand. The food strategy and innovation grants are the key drivers aiming to increase domestic production resilience. The UK Research and Innovation is a primary funding vehicle that has allocated significant funding via its Transforming Food Production. This investment targets the commercialization of precision agriculture and controlled environment systems. As per the Government of the UK report in June 2025, the value of home-produced vegetables rose by 2.1% to £2 billion in 2024, whereas the home-produced fruit increased by 4.5% compared to 2023. This data reflects the growing emphasis on domestic horticultural output, for which smart indoor gardens serve as a scalable and consistent production technology, especially in urban and peri-urban settings.

Key Smart Indoor Garden Market Players:

- AeroGarden (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gardyn (U.S.)

- Click & Grow (Estonia)

- Rise Gardens (U.S.)

- Lebo (China)

- Mi (Xiaomi) (China)

- Milan (China)

- CropKing (U.S.)

- Grobo (Canada)

- SproutsIO (U.S.)

- Tower Garden (Juice Plus+) (U.S.)

- Seedo (Israel)

- Veritable (France)

- Urban Cultivator (Canada)

- Bace (Japan)

- GreenTECH (BSH) (Germany)

- Harvest Today (Fork Farms) (U.S.)

- Farm.One (U.S.)

- Nutraponics (Australia)

- Panasonic (Japan)

- AeroGarden is a dominant leader in the smart indoor garden market. By using the brand strength and manufacturing scale of its parent company, Click & Grow, it has pioneered the countertop herb garden category. Its strategy relies on the ubiquitous retail placement of a vast library of proprietary seed pod kits and a user-friendly design, making it the entry point brand for mainstream consumers seeking a convenient soil-free gardening solution.

- Gardyn is a technology and design innovator in the premium segment of the smart indoor garden market. It distinguishes itself via its vertical space-efficient Farmstand design and proprietary Hybriponics growing medium. Gardyn’s strategy focuses on the direct-to-consumer model with the launch of the Gardyn Home Kit 2.0 to improve the gardening experience in November 2021.

- Click & Grow is the foundational technology and intellectual property leader in the global smart indoor garden market. The company’s strategy is vertically integrated, controlling the hardware, proprietary plant cartridges, and global e-commerce platform to ensure a seamless, foolproof user experience. The company has partnered with Little Kitchen Academy as its exclusive indoor garden provider in May 2025.

- Rise Garden targets the design-conscious consumer and culinary enthusiast within the smart indoor garden market. Its signature product is the stylish modular personal garden, which resembles modern furniture. The Rise’s strategy highlights the aesthetics of kitchen integration and the garden-to-table education via chef partnerships and recipe-driven seed pod collections, appealing to users who view fresh home-grown produce as a key part of their culinary identity and home décor.

- Lebo is a major volume manufacturer and the OEM/ODM supplier in the global smart indoor garden market. Leveraging China’s supply chain efficiencies, it produces a wide range of hydroponic and aeroponic systems sold under various brands worldwide, as well as its own branded products mainly for the market in Asia. Its strategy is centered on cost-effective manufacturing scalability and providing white label solutions that enable other companies to quickly enter the market.

Here is a list of key players operating in the global smart indoor garden market:

The global smart indoor garden market is fragmented, featuring agile startups and established appliance giants. The competition centers on technology differentiation, with the leaders such as the Gardyn and Click & Grow patenting their grow methods and ecosystem integration via proprietary apps and subscription seed services. The key strategies include direct-to-consumer retail expansion into major chains such as Target and Best Buy, and strategic partnerships with wellness organizations to improve the brand positioning. For example, in September 2025, Plantaform announced the partnership with EcoSchools Canada. This collaboration enables the innovative smart indoor garden available to schools across the country. This partnership brings a sustainable, hands-on gardening solution right into the classroom. The focus is shifting from mere hardware sales to creating recurring revenue models and boosting lifestyle-centric communities, while the commercial players target scalable solutions for urban agriculture.

Corporate Landscape of the Smart Indoor Garden Market:

Recent Developments

- In January 2025, Plantaform, a leading company in sustainable indoor gardening, announced the launch of its smart indoor garden in the U.S. This launch aims to enable individuals and families to grow their own fresh, nutritious produce year-round.

- In December 2024, LG Electronics has introduced its innovative new indoor gardening appliance at CES 2025. This latest personal horticultural solution combines an advanced system that boosts fast, healthy plant growth with a modern floor-standing lamp design.

- In February 2024, AeroGarden has revealed its latest innovation, Harvest 2.0. This new product focuses on enhancing the indoor gardening experience with its advanced features and user-friendly design.

- Report ID: 8313

- Published Date: Dec 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Indoor Garden Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.