Gardening Equipment Market Outlook:

Gardening Equipment Market size was valued at USD 103.8 billion in 2025 and is projected to reach USD 198.5 billion by the end of 2035, rising at a CAGR of 6.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of gardening equipment is evaluated at USD 110.7 billion.

The global gardening equipment market is defined by a steady demand driven by residential lawn and garden care, professional landscaping services, and institutional maintenance of green spaces. The key demand indicators include sustained homeownership rates and consumer expenditure on lawn and garden activities. As per the OEC 2023 report, the world trade in mowers powered lawn with horizontal cutting device accounted for USD 6.07 billion. On the other hand, the personal consumption expenditure for recreational items that include garden equipment has shown a consistent growth reflecting ongoing consumer investment in outdoor property maintenance. The professional segment is aided by the landscaping services industry, whose growth is tracked as a distinct sector in national economic accounts.

The supply chain for this market is global, with the significant manufacturing hubs in Asia and North America leading to complex international trade flows. U.S. import and export data from the International Trade Commission reveal continuous amounts of motorized lawn and garden machines, indicating a stable intermediate and final product movement. The production is sensitive to the costs of key inputs such as steel, plastics, and lithium for battery-powered equipment, with fluctuations impacting manufacturers' margins. The National Institute of Standards and Technology notes that advancements in lightweight materials and battery technology present both an R&D cost challenge and a long-term efficiency opportunity for manufacturers. Distribution remains multichannel, reliant on a network of specialty distributors, large retail partners, and direct-to-consumer digital platforms. Physical retail retains a dominant share for high-ticket considered purchases.

Key Gardening Equipment Market Insights Summary:

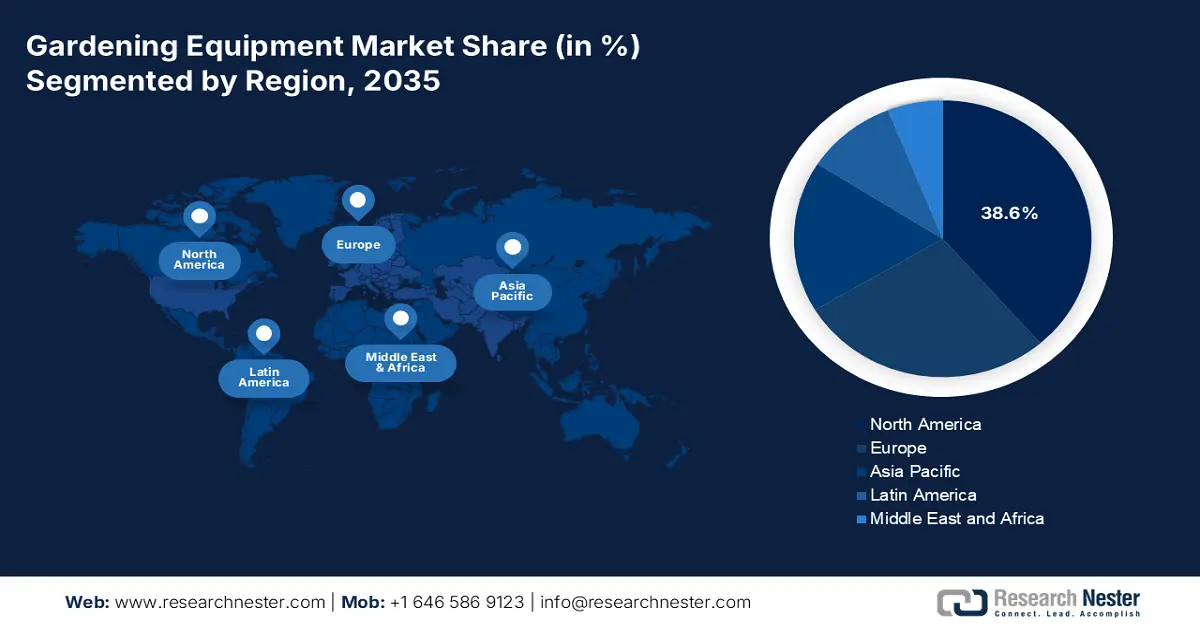

Regional Insights:

- By 2035, North America is projected to command a 38.6% share in the gardening equipment market, underpinned by high consumer spending, strong landscaping industries, and tightening environmental regulations.

- Asia Pacific is anticipated to expand at a 6.8% CAGR through 2035, supported by rising middle-class incomes, rapid urbanization, and increasing adoption of battery-powered tools.

Segment Insights:

- By 2035, the offline segment is expected to secure a 65.7% share in the gardening equipment market, sustained by expanding specialty dealers and the critical role of in-store expertise.

- The residential segment is set to maintain its dominant share by 2035, strengthened by ongoing homeownership growth and the rising appeal of outdoor living spaces.

Key Growth Trends:

- Expansion of urban agriculture and public gardening investment

- Urban greening and biodiversity funding

Major Challenges:

- High R&D costs for electrification and innovation

- Regulatory compliance and environmental standards

Key Players: The Toro Company (U.S.), Husqvarna Group (Sweden), STIHL (Germany), Robert Bosch GmbH (Germany), MTD Products (U.S.), Stanley Black & Decker (U.S.), Makita Corporation (Japan), Yamabiko Corporation (Japan), Honda Motor Co., Ltd. (Japan), Kubota Corporation (Japan), Fiskars Group (Finland), Briggs & Stratton (U.S.), AL-KO Group (Germany), Emak Group (Italy), Chervon (China), STIGA Group (Sweden), Masport (Australia), AriensCo (U.S.), Greenworks Tools (U.S.).

Global Gardening Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 103.8 billion

- 2026 Market Size: USD 110.7 billion

- Projected Market Size: USD 198.5 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, UAE

Last updated on : 12 December, 2025

Gardening Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of urban agriculture and public gardening investment: The growth in the market relies on the community growth and residential gardening, which is underpinned by direct federal allocations for the urban farming community gardens and local food systems. The USDA Office of Urban Agriculture funds competitive grants supporting composting urban farms and municipal garden spaces that expand the procurement of soil tools, irrigation devices, light equipment, and related hardware. The USDA report in October 2022 has depicted that the USDA has announced USD 14.2 million in 52 urban agriculture and innovative production efforts supporting the purchase of garden equipment. The program prioritizes the underserved communities where local government bodies require scalable cultivation tools. In Europe, several cities allocate municipal budgets to urban farming pilots under the EU Green Deal framework, strengthening demand for low-maintenance tools suitable for allotments.

- Urban greening and biodiversity funding: National and municipal greening budgets create continuous equipment demand among the contractors and local government units. Under the EU Biodiversity Strategy and EU Green Deal, the cities adopt pollinator-friendly landscaping, green corridors, and park rehabilitation measures that require pruning tools, planting equipment, and irrigation hardware mainly suited for long-term contract procurement by local authorities. In the U.S., the USDA Natural Resources Conservation Service conservation program funds habitat planting and soil improvement, creating additional spending channels for accessory equipment. Tree planting grants, park rehabilitation, and climate resilience projects produce structured purchasing cycles designed around heavy garden equipment replacement. Increased European biodiversity spending may moderately drive procurement of sustainable gardening tools in municipal operations and landscape services.

- Demographics and household gardening participation: The household gardening participation, based on nonprofit research, acts as a structural demand driver for the gardening equipment market. The research study by the ICRISAT in January 2023 states that home gardens raise the monthly per adult equivalent incomes by 37% and minimize the prevalence of poverty by 11.7%. This data highlights the role of gardening beyond leisure, positioning it as a meaningful economic activity for households globally. This participation creates a sustained demand for essential tools from the basic hand tools, small-scale irrigation, mainly in emerging economies, shaping a stable volume-driven market segment less susceptible to economic cyclicality than premium discretionary purchases.

Challenges

- High R&D costs for electrification and innovation: The rapid shift toward high-performance zero-emission battery-powered equipment demands immense R&D investment in motor efficiency, battery technology, and software. Leading companies are investing heavily to build robotic lines and unified battery platforms, requiring capital often unavailable for startups. Further, the market for battery-powered lawn equipment is rising rapidly, pressuring all the manufacturers to invest heavily or fall behind. This makes many small companies to lag behind.

- Regulatory compliance and environmental standards: Manufacturers face a complex, shifting global regulatory landscape. The key challenges are the robust emissions standards, such as the CARB regulation in California, phasing out gas engines, noise pollution ordinances, and evolving and testing. The dominating players overcome this by developing their AP Series battery system to meet these regulations, proactively investing in compliance as a core business strategy. Moreover, companies are increasingly allocating dedicated R&D budgets toward next-generation sustainable power platforms to ensure long-term regulatory readiness across regional markets.

Gardening Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 103.8 billion |

|

Forecast Year Market Size (2035) |

USD 198.5 billion |

|

Regional Scope |

|

Gardening Equipment Market Segmentation:

Distribution Channel Segment Analysis

The offline is leading the distribution channel segment and is poised to hold the share value of 65.7% by 2035 in the market. The segment is driven by the rising specialty dealers, big box retailers, and home improvement centers due to the tactile and high consideration nature of gardening equipment purchases. The commercial landscapers and serious DIYers rely on in-store expertise for product demonstrations, immediate availability for urgent projects, and significant after-sales service networks. This channel is the primary nexus for warranty claims, parts, and repairs, creating a strong consumer lock-in effect. The FRED August 2025 data states that the retail sales of building and garden equipment and sales dealers reached 40,090 million dollars in August 2025, highlighting the immense and sustained economic activity in physical retail for this sector, even as e-commerce grows. The trust and immediacy offered by the physical stores continue to be paramount for this high-involvement product category.

End user Segment Analysis

The residential segment is the foundational volume driver of the gardening equipment market, fueled by the sustained homeownership and outdoor living trends. The shift towards suburban living and the increased valuation of the private outdoor space post-pandemic continue to spur tool purchases. This segment is highly responsive to marketing from the mass merchants and is the primary target for the cordless revolution due to its demand for clean, quiet, and easy-to-use products. As per the American Society for Horticultural Science study in December 2022, the consumers’ expenditures on plants and landscape items in the U.S. surged by 4.6%, indicating a steady consumer investment in maintaining and improving their properties. The broad demographic base of homeowners ensures this segment's revenue leadership over the commercial sector.

Price Point Segment Analysis

Within the price point, the mid-range prices sub-segment holds the largest share in the gardening equipment market. This dominance is due to the balancing of affordability with performance and durability, meeting the core needs of the value-conscious majority. The consumers in this tier avoid the perceived fragility of the economy tools and the steep cost of premium professional-grade equipment, opting instead for trusted brands, core battery platforms, and feature-rich residential models. This segment benefits directly from the technology trickle-down effect, where innovations such as the brushless motors and advanced battery management become standard. The report from the OEC 2023 data states that the global trade value of the mowers, powered lawn with horizontal cutting devices, is reduced by 13.1% highlighting the reflection of the reduction of the prices in the garden equipment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Power Source |

|

|

End user |

|

|

Distribution Channel |

|

|

Price Point |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gardening Equipment Market - Regional Analysis

North America Market Insights

North America market is dominating and is expected to hold the market share of 38.6% by 2035. The market is driven by the high consumer spending, established professional landscaping industries, and robust environmental regulations mandating a transition to the battery powered equipment. The U.S. market is defined by the rapid adoption of robotic mowers and smart irrigation, while Canada shows a strong growth in snow throwers and seasonal equipment. The key drivers include urbanization driving the demand for compact tools, federal and state-level green infrastructure spending, and the phase-out of gas-powered engines in states like California, accelerating fleet electrification. North America’s market leadership is further reinforced by significant retail infrastructure and consistent investment in residential lawn care, making it the primary global hub for product innovation and premium equipment launches.

The U.S. gardening equipment market is defined by a rapid, regulatory-driven transition to battery electric equipment and the integration of smart technology. The California Air Resources Board’s ban on new gas-powered small off-road engines is a primary catalyst compelling nationwide manufacturers and landscapers to adopt cordless platforms. The producer price index for the lawn and garden equipment manufacturing reached 162.460 index Jun 2003=100 in January 2025. Concurrently, consumer and professional demand for connectivity is rising, with smart irrigation controllers and robotic mowers gaining share, supported by the EPA WaterSense criteria for efficiency. Government spending acts as a key demand driver for the USDA’s USD 1.5 billion Urban and Community Forestry Program, funded by the Inflation Reduction Act, which directly increases municipal and contractor demand for the professional-grade arboriculture and landscape maintenance equipment, creating a stable B2G sales channel.

Producer Price Index for Lawn and Garden Equipment Manufacturing (2025)

|

January |

162.460 |

|

February |

162.460 |

|

March |

162.460 |

|

April |

162.657 |

|

May |

163.401 |

|

June |

163.922 |

|

July |

162.905 |

|

August |

162.905 |

|

September |

162.905 |

|

October |

162.460 |

Source: FRED November 2025

In Canada, the market is defined by the pronounced seasonality driving demand for the dual-purpose equipment and a growing but measured shift toward electric tools influenced by environmental policy. The winter season sustains a significant market for the snow throwers, while summer focuses on the lawn and garden care. This demand is reflected in the trade data; the OEC 2023 reports that the imports for the mowers, powered lawn with horizontal cutting device, reached USD 384 million, indicating a stable, high-volume demand for the core seasonal products. Further, the federal carbon pricing mechanisms and provincial incentives are gradually making the electric equipment more cost-competitive. This creates a two-cycle sales pattern for retailers and manufacturers, requiring advanced inventory and supply chain management to align with the peak seasonal purchasing periods.

APAC Market Insights

The Asia Pacific is fastest growing market and is expected to grow at a CAGR of 6.8% by 2035. The market is defined by a dynamic interplay of mature high-value markets and rapidly expanding emerging economies. The key drivers include the rising middle-class disposable income, increasing urbanization, with a growing focus on green spaces in cities, and a cultural affinity for gardening in countries such as China and Japan. The trend is strongly shifting from the basic manual tools toward powered equipment, with a notable surge in demand for battery-powered cordless tools due to environmental awareness and government regulations on emissions. The professional landscaping sector is expanding in the commercial real estate and hospitality development.

China is a dominating player in the gardening equipment market in APAC, transitioning from a manufacturing hub to its largest consumer market. The growth is powered by the state-led urbanization and the ecological civilization policies, such as the Sponge City initiative, which mandates the green infrastructure and drives the demand for professional landscaping equipment. The report from the People’s Republic of China in March 2025 states that China's environmental protection equipment industry is expanding steadily, with annual compound growth 6%. Further, the industry output hit 920 billion yuan. This growth is reshaping the global supply chain, with domestic brands like Chervon (EGO) gaining significant market share. Moreover, China has exported harvesting machinery worth over 1.58 billion as per the OEC 2023 report.

Japan represents a mature and advanced market and is defined by the high-value precision gardening and rapid technological adoption. The key demand is driven by an aging gardening enthusiast population, a high density of single-family homes, and strict noise regulations in the dense urban areas. This environment surges the replacement of gasoline tools with compact, quiet, and advanced battery-powered and robotic equipment. The OEC 2023 report for Japan has exported USD 126 million of garden equipment, highlighting the rising demand. On the other hand, the e-Stat portal of Japan’s Ministry of International Affairs reports that the average monthly household expenditure on gardening and horticulture is stable, demonstrating a resilient core demand despite economic fluctuations and supporting the premium, innovation-driven nature of the market.

Export of Mowers, Powered Lawn, with Horizontal Cutting Device (2023)

|

Country |

Value (USD million) |

|

France |

32.1 |

|

Indonesia |

17.1 |

|

United Kingdom |

15.2 |

|

Netherlands |

11.6 |

|

Australia |

7.23 |

Source: OEC 2023

Europe Market Insights

Europe market is a mature yet evolving sector defined by a strong culture of home gardening and well established professtioal landscaping industries. The market is driven by the several key trends a persistent shift from the gasoline powered to battery electirc equipment driven by the robust EU and national noise and emissions regulations the growing popularity of smart and connected gardening tools such as the robotic lawn mowers and app controlled irrigation systems and an increased consumer focus on sustainabbility and outdoor living that surged during the pandemic and has remained stable. Northern and Western European countries, with higher disposable incomes and stricter environmental laws, typically lead in adopting premium and innovative products.

The gardening equipment market in Germany is defined by a strong DIY culture and a preference for high-quality, innovative tools. As Europe’s largest national market, it is a leader in the adoption of battery powered and robotic technology, driven by the strict environmental regulations and high consumer purchasing power. A significant driver is the country’s high rate of homeownership with gardens. According to the EU-Schwerbehinderung March 2025 report, people aged 18 in Germany who devote 12 minutes per day to gardening demonstrate consistent household participation and time-spent engagement, which has a direct impact on replacement cycles, consumable demand, and recurring purchases of small hand tools, irrigation accessories, soil-care products, and basic equipment. This broad participation creates a stable market for both the basic and premium equipment, further solidified by the presence of major global manufacturers such as STIHL and Bosch.

The UK’s market is defined by the deeply ingrained gardening culture and high-density homeownership, with a notable trend towards the smaller urban gardens. This fuels the demand for the space efficienct multu functional and electric tools suited for patios and balconies. A significant market driver is the professional landscaping sector that services a large number of private gardens and public green spaces. According to the Office for National Statistics, consumer spending on gardening plants and equipment showed resilience, with average household expenditure staying stable, showing continuous underlying demand despite larger economic difficulties. This stability, combined with the phase-out of the older petrol-powered tools, supports growth in the cordless equipment segment.

Key Gardening Equipment Market Players:

- Deere & Company (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Toro Company (U.S.)

- Husqvarna Group (Sweden)

- STIHL (Germany)

- Robert Bosch GmbH (Germany)

- MTD Products (U.S.)

- Stanley Black & Decker (U.S.)

- Makita Corporation (Japan)

- Yamabiko Corporation (Japan)

- Honda Motor Co., Ltd. (Japan)

- Kubota Corporation (Japan)

- Fiskars Group (Finland)

- Briggs & Stratton (U.S.)

- AL-KO Group (Germany)

- Emak Group (Italy)

- Chervon (China)

- STIGA Group (Sweden)

- Masport (Australia)

- AriensCo (U.S.)

- Greenworks Tools (U.S.)

- Deere & Company is a titan in the market via its John Deere brand, leveraging its legacy in the agricultural machinery to dominate the premium residential and commercial turf segment. Its key strategy involves integrating advanced precision technology, such as the GPS-guided mowing and fleet management software, transforming lawn care into a data-driven operation for the landscaping professionals.

- The Toro Company maintains a leading position in the gardening equipment market by specializing in innovative irrigation and professional turf maintenance solutions. Its strategic focus is on smart water management and connectivity, developing WiFi-enabled sprinkler systems and advanced commercial mowers that optimize resource use and operational efficiency for both golf courses and homeowners.

- Husqvarna Group is a leader in the European gardening equipment market and has aggressively pivoted from gas-powered tools to become a leader in the battery-powered revolution. Its core strategy is building a loyal ecosystem via its Husqvarna Battery Power platform, offering a wide range of interchangeable battery tools for forestry, landscaping, and garden care while expanding its autonomous mower segment. The company has reported a net sales of SEK 48.4 billion in 2024.

- STIHL is a professional-grade chainsaw that holds a formidable reputation in the market for durable high performance tools. Its strategic initiative centers on the STIL AP battery system, creating a unified professional-grade battery platform across its entire product lineup to retain its professional user base while meeting stringent emission regulations in the urban market. Besides, the company has made a revenue of 5,328.7 million euros in 2024.

- Robert Bosch GmbH, via its power tools division, is a major force in the consumer segment of the gardening equipment market. Bosch's strategy emphasizes user-friendly innovation and smart gardening with a strong focus on lightweight ergonomic electric tools and connected devices, such as the robotic lawnmowers that can be controlled via smartphone, appealing to the DIY gardener.

Here is a list of key players operating in the global market:

The global gardening equipment market is highly competitive and is dominated by the key players in the U.S., Europe, and Japan. The key strategies center on the electrification with a major push into the high-performance battery-powered platforms to meet the sustainability demand. The acquisition and portfolio expansion are common, as seen with the global pest control company Pelsis Group acquired Doff Portland to expand the agricultural and retail offer in August 2024. Further, smart technology integration and direct-to-consumer digital channels are the vital initiatives for the differentiation and building brand loyalty in a consolidating landscape. The companies are strengthening aftermarket parts and service networks to secure recurring revenue streams and maintain long-term customer relationships as equipment lifecycles extend under sustainability-focused usage models.

Corporate Landscape of the Gardening Equipment Market:

Recent Developments

- In October 2025, Podolinsky Equipment Ltd. has announced the acquisition of Fulline Farm & Garden Equipment Ltd. in Glencoe, Ontario, and shares the deep family and operational ties with the Podolinsky organization.

- In June 2025, Ningbo Daye Garden Machinery, a leading Garden tech company in China and national champion in lawn mower manufacturing had announced the successful completion of its acquisition of AL-KO Garden tech, a prominent player in the Garden tech industry.

- In May 2025, Landscape Workshop, a full-service grounds maintenance provider for commercial properties across the U.S., announced the acquisition of Ares Private Equity fund. This collaboration enables Landscape Workshop to expand its regional footprint, scale through new strategic acquisitions, and drive customer growth.

- Report ID: 8314

- Published Date: Dec 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gardening Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.