Garden Décor Market Outlook:

Garden Décor Market size was valued at USD 6.9 billion in 2025 and is projected to reach USD 11.3 billion by the end of 2035, rising at a CAGR of approximately 5.1% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of garden décor is expected to be approximately USD 7.3 billion.

The global trade dynamics for the market are influenced by seasonal demand cycles and supply chain vulnerabilities. India, Mexico, and China are pioneers in manufacturing artisanal bases and are prominent exporters of various devices related to garden décor. These nations get benefits from the presence of skilled yet cost-efficient labor. However, the countries in the West remain the top importers owing to high consumer spending. The imports for outdoor decorative items for garden ornaments have grown in recent years.

The trade flow is susceptible to factors such as phytosanitary constraints and anti-dumping duties imposed by the government. For instance, decor items for the garden incorporating treated wood fall under regulations to avoid the spread of plant-borne pathogens. Such imports may need inspection or certification, which adds cost to the supply chain. However, trade agreements such as the Regional Comprehensive Economic Partnership are projected to shift the supply chain dynamics by lowering the garden décor inputs between member countries. These factors are shaping the profitability of the producers across the regions.

Key Garden Décor Market Insights Summary:

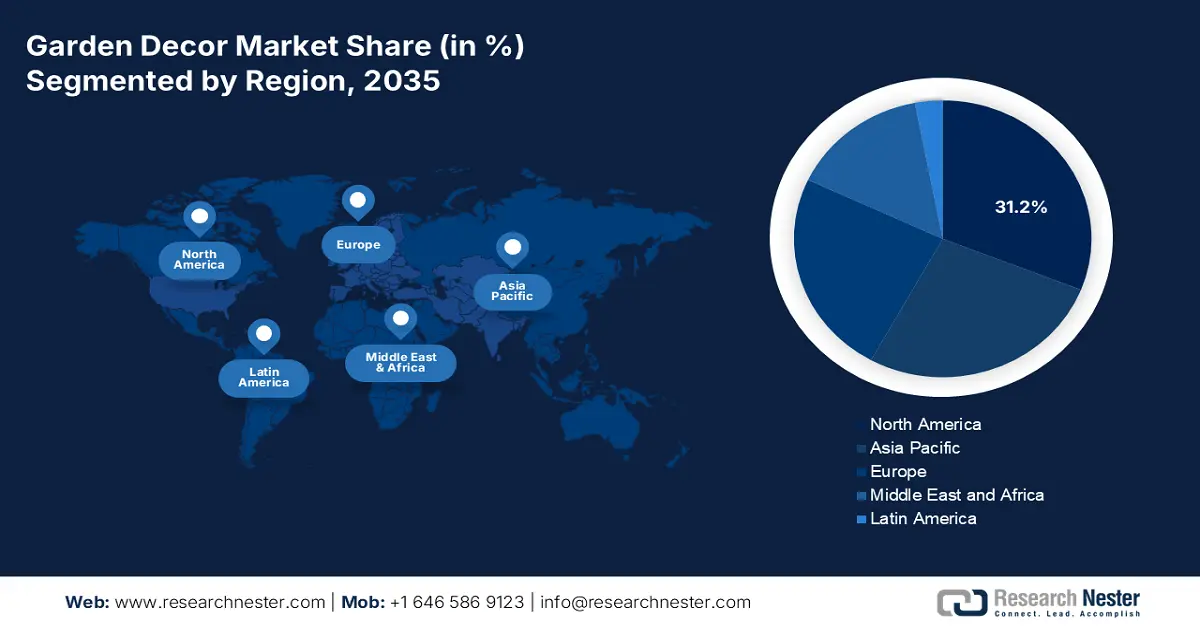

The North America garden décor market is projected to secure 31.2% of the share by 2035, driven by rising disposable income and the growing culture of home improvement.

The Asia Pacific market is forecasted to expand at a CAGR of 7.2% between 2026 and 2035, supported by strong decorative traditions and deep cultural heritage.

The solar-powered lighting category stands out as the fastest-growing in the garden décor industry, capturing a 43.3% share, propelled by energy efficiency and increasing demand for diverse aesthetic enhancements.

The metal segment is estimated to claim 28.3% of the market share by 2035, primarily due to its superior durability.

Key Growth Trends:

- Urbanization and public green initiatives

- Sustainability and eco-friendly product innovation

Major Challenges:

- Vulnerability to seasonal demand and weather fluctuation

- Supply chain disruptions and raw materials volatility

Key Players: Home Depot Inc., Lowe’s Companies Inc., Scheurich, The HC Companies, Inc., Lechuza, Elho B.V., Exhart, Monarch Abode, Alpine Corporation, Evergreen, Achla Designs, U nitt, Livingreen Design, Xierun, Garden Artisans, Daiso Japan, Etsy, Maruhiro Inc., Izawa Seito Co Ltd, MEIZAN Ceramics Industry.

Global Garden Décor Market Forecast and Regional Outlook:

2025 Market Size: USD 6.9 billion

2026 Market Size: USD 7.3 billion

Projected Market Size: USD 11.3 billion by 2035

Growth Forecasts: 5.1% CAGR (2026-2035)

Largest Region: North America (31.2% Share by 2035)

Fastest Growing Region: Asia Pacific

Last updated on : 21 August, 2025

Garden Décor Market - Growth Drivers and Challenges

Growth Drivers

-

Urbanization and public green initiatives: According to the United Nations, currently 55% of the global population lives in urban areas, and the proportion is projected to reach 68% by 2050. urban residents are installing modular planters and aesthetic gardens in balcony. Moreover, government-initiated greening initiatives for urban areas and the advent of smart city projects are incorporating outdoor decor elements in outdoor and public areas. Governments are giving importance to the ecological magnification by fabricating innovative landscape gardening. These kinds of infrastructure programs make a robust consumer base for garden décor suppliers. In various countries, governments are emphasizing making green public spaces, propelling demand for the unique gardening solutions.

-

Sustainability and eco-friendly product innovation: The preference for sustainability is an eminent growth catalyst, with residents opting for biodegradable and renewable materials for decoration. The inclusion of solar-powered lights and upcycled wood furniture is gaining traction and synchronizing with the worldwide environmental consciousness trends. The governments are enforcing stringent environmental policies and compelling manufacturers to adopt environmentally friendly practices. The USDA has also promoted organic gardening and native plant landscaping to promote the growth of the market. In the coming times, the eco-friendly garden decoration is projected to flourish, driven by Gen Z and millennials.

-

Advent of technological integration and adoption of smart garden décor: Techniques such as IoT-enabled irrigation systems and application-controlled water features are gaining significant traction. These innovations are upgrading energy efficiency, convenience, and are in synchronization with modern consumers. Soil sensors and automated tools for gardening are fostering the market growth. The inclusion of virtual reality is helping customers to visualize gardens before making a purchase and boosting sales. Solar integrated elements are more accessible for a myriad of range of users.

Challenges

-

Vulnerability to seasonal demand and weather fluctuation: The garden décor market is prominently influenced by rapidly changing seasonal trends, with demand mainly occurring during summer and spring. This leads to unreliable cash flows and issues related to understocking or overstocking for both retailers as well as manufacturers. The unpredictability of weather patterns owing to climate change is responsible for dampening consumer interests. Also, severe winters mostly ruin the existing garden spaces, resulting in consumers' delay in purchases.

-

Supply chain disruptions and raw materials volatility: The market is affected by fluctuating supply chains and variable prices for raw materials. The accelerating urbanization is spurring more consumers to live in areas with limited space for gardening. The innovation in this direction needs critical rethinking and improvement of the existing solutions. Also, the frequently altering generational taste may no longer resonate or integrate with the smart technology.

Garden Décor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 6.9 billion |

|

Forecast Year Market Size (2035) |

USD 11.3 billion |

|

Regional Scope |

|

Garden Décor Market Segmentation:

Product Type Segment Analysis

The solar-powered lighting segment in the garden décor market is the fastest-growing, registering a 43.3% share, catalysed by the energy-efficient solutions and the mushrooming demand for a plethora of aesthetic upgrades. The solar garden decor products come in a variety of forms, such as accent lamps and solar bulbs. Additionally, the market is further supported by government incentives to companies for energy-efficient home décor upgrades. Prominent market players such as Takasho Co. are widely spreading solar decoration garden-related equipment across Japan. Various other market players are playing a significant role in expanding the availability of the product portfolios.

Material Segment Analysis

The metal segment is anticipated to garner 28.3% of the garden décor market share by 2035, owing to its high durability. The segment growth is also driven by significant strength and the capability to handle abrasion and severe weather conditions. Cast aluminum is mainly popular for fabricating decorative pieces. The inclusion of powder-coated finishes has increased the endurance of the finally developed product. The metal segment is projected to consistently maintain the highest share, owing to its superiority and flexibility. Also, the versatility of the metal segment is anticipated to consistently hold the leading market share throughout the period.

End-user Segment Analysis

The residential segment is projected to garner 61.3% of the garden décor market share by 2034, fostered by a surge in popularity of home gardening and lifestyle changes. Consumers globally are heavily investing in creating an adequate personal ambience. These factors are making a sustained demand for innovative items for the garden. People are adopting urban gardening and purchasing recycled décor. The integration with the smart home ecosystems, such as smart lighting and irrigation systems. People are investing in outdoor aesthetics to increase the aesthetic appeal of homes. There has been an increased demand for decorative fencing in homes for the roofs and boundaries of the homes. The data published by the government in Europe in December 2024 estimates that more than 82.1% of Europeans have a garden in their homes. These factors are projected to propel the market during the forecasted period.

Our in-depth analysis of the garden décor market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Material |

|

|

End use |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Garden Décor Market - Regional Analysis

North America Market Insights

The North America market is anticipated to garner 31.2% of the market share by 2035, owing to rising disposable income and home improvement culture. People are investing funds in beautifying their terraces and balconies with decorative garden décor products such as planters and sculptures. This trend has been increased by the increased presence of renowned retailers, offering products for home improvements. In the U.S., the data published by the Bureau of Economic Analysis stated in 2023, the value added of the outdoor recreation economy was USD 639.2 billion. There is a surge in the adoption of native planting designs and the use of biodegradable garden products. People are adopting unique practices such as vertical gardens and container gardening in their gardens.

In Canada, various government-supported programs are bolstering the market growth. For instance, data published by the government in July 2025 stated that the Royal Botanical Garden will get USD 150,100 to upgrade habitat resilience through invasive species control methods in Hamilton Harbor Area. Such programs are made to increase the nursery and ornamental products. Consumers in the country are doing compact outdoor furnishing, fueled by limited outdoor space and rising lifestyle trends. Producers are also getting benefits from the surging inclination for eco-friendly buying habits and design trends for outdoor living. The producers in Canada are also elevating the quality of the plant and upgrading the export capacity.

APAC Market Insights

The Asia Pacific market is expected to grow at a 7.2% CAGR from 2026 to 2035, bolstered by well-established decorative traditions and cultural roots. The adoption of ornamental plants holds cultural importance, highly utilised in marriages and religious practices. In India, the rapid growth showcases widespread application in landscaping. Also, the Clean Plant Programme endeavors to upgrade infrastructure and promote quality-controlled planting. Households in India are embracing gardening as their hobby and incorporating small-scale landscaping. Due to the booming e-commerce ecosystem, people have easier access to customized garden décor products. In October 2022, data published by the Press Information Bureau stated that 0.7 million waste plastic bottles were used for planting. Also, 900 vertical gardens have been created in more than 50 districts in the country. These initiatives are also propelling the growth of the market during forecasted period.

In China, an expanding middle-class population and growth in the urban population are propelling the market growth. Social media platforms such as Xiaohongshu are forming aesthetics by enhancing enchanting gardens and making the outdoor ambience appealing. People are preferring eco-friendly and tech-enabled products to foster innovation. The country remains the largest retail market and enables a comfortable reach to access a variety of garden décor products. Entrepreneurs are converting terraces and rooftops in commercial spaces into lush green spaces. Users are also opting for sustainable and minimalistic décor options with high durability.

Europe Market Insights

The market in Europe is also expanding owing to the combination of sustainability awareness and innovation in product design. European countries have landscaping traditions that appeal to millions of visitors each year. The staycation trends are propelling the decoration of the outdoor spaces. In the UK, people visit garden centers and are highly engaged in décor upgrades and gardening. Homeowners are doing diversification of their gardens and including leisure experiences in homes. There has been increased interest in the wildlife habitats, such as bee hotels and bat boxes, that align with environmentally friendly purchases. In Germany, people give priority to meticulously making lawns with decorative planters. There is a robust growth in the sustainable home décor segment and the buying of garden décor products. The per capita income of people also supports premier decoration and outdoor garden furniture.

Key Garden Décor Market Players:

- Home Depot Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lowe’s Companies Inc.

- Scheurich

- The HC Companies, Inc.

- Lechuza

- Elho B.V.

- Exhart

- Monarch Abode

- Alpine Corporation

- Evergreen

- Achla Designs

- U‑nitt

- Livingreen Design

- Xierun

- Garden Artisans

- Daiso Japan

- Etsy

- Maruhiro Inc.

- Izawa Seito Co Ltd

- MEIZAN Ceramics Industry

The global market is partially consolidated, with prominent players utilizing digital ordering platforms to scale up the business. Prominent brands are continuing to dominate owing to their authenticity and control in the supply chain. Various strategic programs incorporate AI-enabled aesthetic development, aggressive expansion, and the advent of eco-friendliness. Various cross-border collaborations and humongous investments are also reinforcing brand positioning. Key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2025, Aldi introduced a vibrant new garden range. This budget-friendly collection includes a variety of decorative and functional outdoor accents, such as solar festoon lights. The range also features UV-resistant Acapulco chairs, folding recliners, and LED parasols, making it ideal for summer aesthetics on a budget.

- In July 2025, B&M launched an affordable Watering Can Wall Planter. This vertical planter has quickly gained attention for helping small gardens appear larger and more colorful by mounting on garden walls—a clever space-saving décor solution. Demand soared, and stocks became limited rapidly.

- In March 2025, Daiso Japan launched a new cosmetic brand called “Kyumme”, developed in collaboration with Tokyo Girls Collection (TGC). The collection included color palettes, lip glosses, and other beauty items with bold, youthful packaging and was released in Daiso outlets across Japan.

- Report ID: 7980

- Published Date: Aug 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Garden Décor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.