Smart Appliances Market Outlook:

Smart Appliances Market size was over USD 42.8 billion in 2025 and is estimated to reach USD 114 billion by the end of 2035, expanding at a CAGR of 11.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smart appliances is assessed at USD 47.7 billion.

The international smart appliances market is presently undergoing a standard transformation, converting from a niche luxury convenience segment into an interconnected and mainstream ecosystem, and a modernized digital household. This paradigm shift is driven by an in-depth convergence of conventional white products and customer electronics, which is further fueled by innovations in information and communication technology (ICT). According to an article published by the IEA Organization in 2025, the average energy efficiency of the newest appliances can readily increase by 2 to 3 times. This has resulted in a lowered energy by 10% to 30% for more than 15 to 20 years in different countries. Besides, Energy efficiency standards and labelling (EES&L) programs also assist in diminishing electricity consumption for maximum appliances by more than 50%, thus boosting the market’s growth.

Yearly Energy Reduction in New-Product Energy Consumption from EES&L Programs (2025)

|

Appliances |

Energy Reduction % |

|

Residential refrigeration |

2.3 |

|

Non-ducted AC |

2.9 |

|

Central AC |

1.1 |

|

Televisions |

3 |

|

Wet appliances |

2.5 |

|

Ventilation fans |

3.4 |

|

Cooking appliances |

2.3 |

|

Vending machines |

5.6 |

|

Other electronics |

8.4 |

Source: IEA Organization

Furthermore, the interoperability and ecosystem battle, the kitchen as a hub emergence, growth in service-based and subscription models, and increased focus on wellness and health are also uplifting the smart appliances market globally. As per an article published by MDPI in August 2025, the multimodal optical sensing system utilizes real-time image processing and identifies 5 foodborne bacteria, including Salmonella spp., Staphylococcus aureus, L. monocytogenes, E. coli, and Bacillus cereus, along with 98.6% classification accuracy. Meanwhile, bung droppers can readily manage 900 carcasses per hour and efficiently eliminate 50% contamination from meat products, especially during the slaughtering process, in comparison to manual operator handling. Therefore, with the development and existence of such smart appliances for kitchen environments, there is a huge growth opportunity for the market’s flourishment.

Key Smart Appliances Market Insights Summary:

Regional Highlights:

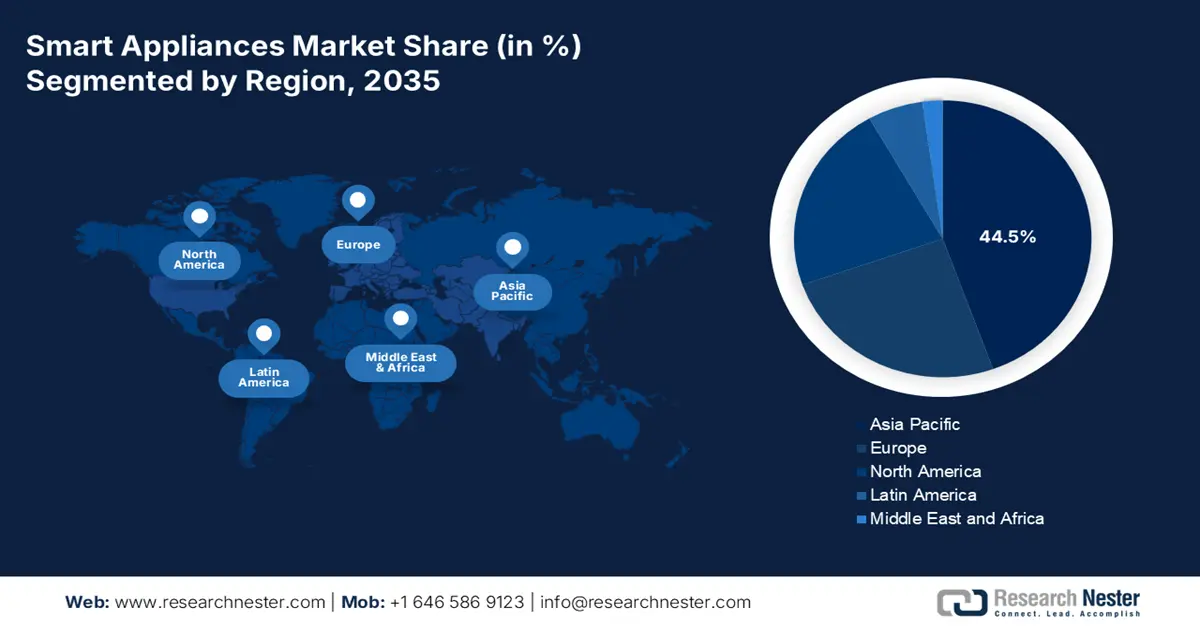

- The Asia Pacific smart appliances market is anticipated to hold 44.5% share by 2035, owing to rapid urbanization, rising disposable incomes, and increased digitalization.

- North America is expected to emerge as the fastest-growing region during 2026-2035, propelled by rising disposable income, consumer demand for energy-efficient appliances, and advanced ICT integration.

Segment Insights:

- The residential sub-segment is projected to account for 75.8% share by 2035 in the smart appliances market, impelled by the need for monitoring remote control and energy-efficient household management.

- By 2035, the Wi-Fi technology sub-segment is expected to hold the second-largest share in the market, owing to seamless integration, automated routines, and voice command capabilities.

Key Growth Trends:

- Proliferation of high-speed connectivity and IoT

- Integration of machine learning and artificial intelligence

Major Challenges:

- Increase in consumer and cost value perception

- Cybersecurity and data privacy vulnerabilities

Key Players: Samsung Electronics (South Korea), LG Electronics (South Korea), Haier Group Corporation (China), Whirlpool Corporation (U.S.), Midea Group (China), Gree Electric Appliances (China), BSH Hausgeräte GmbH (Germany), Electrolux AB (Sweden), Panasonic Corporation (Japan), Arçelik A.Ş. (Turkey), GE Appliances (U.S.), Hisense Group (China), Xiaomi Corporation (China), Sharp Corporation (Japan), Sony Group Corporation (Japan), Robert Bosch GmbH (Germany), Godrej & Boyce (India), Fisher & Paykel Appliances (New Zealand), Vestel (Turkey), Candy Hoover Group (Italy).

Global Smart Appliances Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 42.8 billion

- 2026 Market Size: USD 47.7 billion

- Projected Market Size: USD 114 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Vietnam, South Korea, Taiwan, Brazil

Last updated on : 19 November, 2025

Smart Appliances Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of high-speed connectivity and IoT: The comprehensive availability of strong residential Wi-Fi, along with the 5G network rollout, offers a crucial infrastructure for relentless real-time data exchange and device connectivity. This, in turn, has made cloud-based updates and control a standard expectation, which has positively impacted the smart appliances market globally. According to an article published by the NSF Government in April 2025, the U.S. National Science Foundation (NSF) has awarded a USD 20 million grant to expand NSF CloudBank. The purpose is to accelerate engineering and scientific research by leveraging commercial cloud computing. Therefore, this plays an essential role in enhancing IoT and Wi-Fi connectivity, which is suitable for the market’s growth.

- Integration of machine learning and artificial intelligence: Appliances are usually shifting from just being connected to being cognitive, which is bolstering the smart appliances market. Besides, AI-based algorithms provide personalized usage patterns, optimized energy consumption, and predictive maintenance that enhances user and utility engagement. As per a data report published by the OECD in September 2025, the 2023 GDI highlighted that 70% of nations utilized AI to enhance governmental processes, while 33% used the technology to improve policy implementation and design. In addition, 5% to 6% of businesses in the U.S. use the technology to produce services and goods, and an additional 7% have planned to adopt it in the upcoming years, thereby making it suitable for the market’s development.

- Rise in consumer demand for energy efficiency: The aspect of an increase in electricity expenses and growing environmental consciousness is propelling customers to gain ENERGY STAR-certified appliances. Besides, the smart appliances market constitutes features, such as demand-response capabilities and remote monitoring, permitting consumers to operate during off-peak hours, which is emerging to be a primary choice for energy and cost savings. As stated in the December 20224 IEA Organization report, there has been an improvement in energy intensity acceleration from 0.8% between 2000 to 2010 to 1.8% between 2010 to 2022. This is associated with avoiding emissions, which have been accumulated for more than 2.5 Gt of carbon dioxide from 2000 to 2010, along with 7 Gt of carbon dioxide from 2010 to 2022.

Challenges

- Increase in consumer and cost value perception: The premium expense of the smart appliances market in comparison to traditional counterparts continues to remain a huge obstacle, particularly in emerging and price-sensitive markets. Besides, different customers are skeptical about the return on investment (ROI). While features, such as voice controls and remote monitoring, provide convenience, these appliances are frequently not perceived as crucial enough to effectively justify a standard price surge. Besides, the value proposition for energy savings is long-lasting and may not offset the rapid upfront expense for budget-based buyers. Moreover, the risk of increased technological obsolescence readily adds to the perceived risk, since customers are skeptical that expensive new appliances can be outdated within a few years.

- Cybersecurity and data privacy vulnerabilities: Smart appliances duly collect huge amounts of sensitive household data, which includes regular routines, audio and video feeds, and consumption habits. This eventually makes them attractive targets for cyberattacks, which has caused a hindrance in the smart appliances market. Besides, high-profile cases of connected devices being hacked have lowered consumer trust, and the concern relates to stealing personal data, and secondly, there is a huge potential for appliances to be hijacked to attack the power grid and home networks. Meanwhile, the IoT landscape associated with devices lacks built-in and strong security protocols. In addition, the absence of transparent data policies and demonstrably robust and mandatory security standards, customer reluctance continues to be a barrier to market adoption.

Smart Appliances Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 42.8 billion |

|

Forecast Year Market Size (2035) |

USD 114 billion |

|

Regional Scope |

|

Smart Appliances Market Segmentation:

End user Segment Analysis

The residential sub-segment, which is categorized under the end user segment, is anticipated to account for the largest share of 75.8% in the smart appliances market by the end of the stipulated duration. The segment’s upliftment is highly attributed to the presence of core value propositions that are directly aligned with regular household demands. These particular devices provide unparalleled convenience, integration, and energy management into the modernized smart home ecosystem, which, in turn, are primarily customer-centric. Besides, the proliferation of high-speed internet connections and wide-ranging smartphone ownership has developed the crucial facility for adoption among households. Notable drivers, such as the need for monitoring remote control, have permitted users to manage appliances from any location, along with the growing customer emphasis on diminishing utility bills through energy-efficient models that improve electricity and water utilization.

Technology Segment Analysis

By the end of 2035, Wi-Fi, as part of the technology segment, is expected to account for the second-largest share in the smart appliances market. The segment’s growth is highly driven by its ability to ensure remote control, convenient features, such as automated routines and voice commands, and seamless integration between devices. For instance, according to a data report published by the PIB Government in June 2025, there has been a surge in internet connections from 25.1 crore in 2014 to 96.9 crore as of 2024. In addition, 4.7 lakh 5G towers have been installed that cover 99.6% of districts. Furthermore, the aspect of the digitalized economy has also contributed to 11.7% of gross domestic product (GDP) between 2022 and 2023, which is further predicted to reach 13.4% between 2024 and 2025. Therefore, with such advancements, there is a huge growth opportunity for the overall segment in the market.

Price Range Segment Analysis

The mass or economy, as part of the price range segment in the smart appliances market, is projected to cater to the third-largest share. The segment’s development is highly fueled by its severe importance to cost-effectiveness, as well as perceived valuation in gaining mainstream market penetration. While premium models display next-generation design and AI, the majority of global customers are price-sensitive and seeking crucial smart features without a prohibitive expense. Meanwhile, this particular segment’s progress is extremely propelled by strong competition among retailers and manufacturers, the expansion of the market into developing countries with low disposable incomes, and economies of scale in production. Furthermore, brands are successful in developing tiered product portfolios, providing entry-level smart appliances with suitable functionalities, thus uplifting the segment’s exposure.

Our in-depth analysis of the smart appliances market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Technology |

|

|

Price Range |

|

|

Sales Channel |

|

|

Service Integration |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Appliances Market - Regional Analysis

APAC Market Insights

The smart appliances market in the Asia Pacific is anticipated to hold the highest share of 44.5% by the end of 2035. The market’s upliftment in the region is highly attributed to the presence of the massive urbanized population, a rise in disposable incomes, and an increase in digitalization. Besides, governmental strategies, such as the Made in China 2025, along with India’s Smart Cities Missions, are also driving and promoting the integration of connected home technologies. According to an article published by the IoT M2M Council Organization in October 2025, the Taiwan-based Cabinet approved a NT 27 billion (USD 923,8 million) project by targeting the commercial 6G connection by the end of 2031. Likewise, Vietnam has successfully passed a standard law to unveil AI regulation, digitalized assets, and tax incentives, and is set to develop 150,000 digital technological organizations by the end of 2035.

China in the smart appliances market is growing significantly, owing to huge domestic manufacturing and robust government policy. In addition, the Ministry of Industry and Information Technology (MIIT) is also a notable driver for the market’s growth, with the presence of strategies, such as the Guidance on Developing the Smart Home Ecosystem, aiming to expand smart appliance penetration across different households. As per an article published by the China Household Appliances Association Organization in March 2024, the home appliance sector in the country has generated 1.8 trillion Yuan as of 2023, denoting a 7% year-over-year (YoY) growth, along with profits accounting for 156.5 billion Yuan, based on a 12.1% increase. Besides, washing machines, air conditioners, and refrigerators continued to display growth by 10.0%, thereby denoting a huge opportunity for the market.

India in the smart appliances market is also growing due to the provision of increased support from governmental strategies. Additionally, the Ministry of Power's Standards & Labeling Program, which is administered by the Bureau of Energy Efficiency (BEE), has been essential behind the market’s upliftment in the country. According to the October 2025 IBEF Organization report, the electronic goods sector readily attracted foreign direct investment (FDI) inflow of Rs. 49,715 crore (USD 6.8 billion). Besides, the country’s market for appliances is also growing, with revenues amounting to Rs. 1,06,208 crores (USD 12.1 billion for refrigerators, Rs. 65,598 crores (USD 7.5 billion) for air conditioners, and Rs. 43,552 crores (USD 4.9 billion) for washing machines. Therefore, with an increase in revenue as well as governmental approaches, the market in the country is boosting.

North America Market Insights

The smart appliances market in North America is expected to emerge as the fastest-growing region during the projected period. The market’s development in the overall region is propelled by an increase in disposable income, robust consumer demand for energy efficiency and convenience, and innovative ICT facilities. In addition, the mainstream integration of AI-based appliances that ensure user habits, appliances adoption into wide-ranging smart home ecosystems, and the rise in the need for products with verified energy savings are driving the market as well. According to a report published by the NIST Government in May 2025, 46% of manufacturers in the U.S. utilize AI tools, including chatbots, in manufacturing operations. Besides, 80% of manufacturers expect to boost their AI utilization in the upcoming 2 years, thus suitable for optimizing decision making, enhancing visibility, and diminishing expenses.

AI Deployment by Manufacturers in North America for Undergoing Operations (2025)

|

Components |

AI Prevalence |

|

Manufacturing and production |

39% |

|

Inventory management |

33% |

|

Quality operations |

24% |

|

Research and development |

24% |

|

Information technology (IT) and Operational technology (OT) |

21% |

|

Equipment maintenance or installation |

17% |

|

Supply chain |

11% |

|

Product design |

11% |

Source: NIST Government

The smart appliances market in the U.S. is gaining increased traction, owing to the presence of comprehensive utility rebate programs and strict federal energy standards. In addition, the U.S. Department of Energy's appliance-based standard programs have also been a critical driver, with ongoing updates for pushing manufacturers toward huge efficiency that directly fuels the smart appliance segment. As per a data report published by the EIA Government in December 2023, households in the country require energy to power different devices, and more than 52% of these households’ yearly energy consumption caters to air conditioning and space heating. Besides, refrigeration, lighting, and water heating account for 25% of overall yearly home energy utilization. The remaining 23% is utilized for clothes dryers, clothes washers, cooking appliances, and televisions, thus uplifting the market’s exposure in the country.

The smart appliances market in Canada is also developing due to the existence of provincial and federal government-based incentives that are aimed at diminishing residential carbon emissions. The federal Canada Greener Homes Grant, which is readily administered by Natural Resources Canada, provides generous funding for home energy retrofits, which include purchasing ENERGY STAR-certified smart appliances. Additionally, this strategy has effectively bolstered the customer demand, thereby creating an optimistic outlook for the overall market. As stated in the October 2025 Government of Canada article, this particular initiative provides grants that range from USD 125 to USD 5,000 to a certain portion of overall expenses for eligible home retrofits. In addition, the program also provides almost USD 600, which is considered a maximum contribution toward the total expenses of pre- as well as post-retrofit Ener Guide evaluations.

Europe Market Insights

The smart appliances market in Europe is projected to experience steady growth by the end of the forecast timeline. The market’s growth in the region is highly driven by the robust customer need for energy efficiency, strict regulatory drivers, and strong ICT facilities. Besides, the region’s ambitious Green Deal as well as Ecodesign legislation, which has set increased energy performance standards, thus effectively mandating connected and smarter appliances. As per a data report published by the IoT M2M Council Organization in March 2025, the smart home industry in the overall region is projected to reach USD 67.5 billion by the end of 2031, along with a 13.9% growth rate. In this regard, the smart security and monitoring systems have also been growing by 29.1%, while the smart speaker sector has grown by 14.7%, which has created an optimistic approach for the market in the region.

Germany in the smart appliances market is gaining increased exposure, owing to its robust manufacturing base, the national commitment to the energy transition, and an increase in high consumer purchasing power. Besides, the Federal Ministry for Economic Affairs and Climate Action has proactively promoted smart appliances through its Energy Efficiency Fund, which offers suitable funding for energy-efficient technologies. According to the 2025 Germany Trade & Investment article, the Energy Storage Funding Initiative has provided EUR 200 million for research projects to create a comprehensive storage technology for heat, electricity, and other energy forms. Moreover, the German Energy Agency readily supports strategies that adopt smart home technologies to improve energy utilization. This has directly bolstered the need for connected appliances that can diminish energy expenses and household carbon footprints.

The UK in the smart appliances market is also growing due to the high concentration of technology-based customers and an administrative push for an advanced energy grid. In addition, the domestic government’s Smart Systems and Flexibility Plan, along with the Energy Security Strategy conjunction has explicitly encouraged the deployment of flexible and smart technologies in households. Besides, as per the Department for Energy Security and Net Zero, these governmental reforms constitute an objection to developing a market, wherein smart appliances ensure automatic response to grid signals. Therefore, this regulatory framework, in combination with a rise in energy costs, has made energy-saving smart appliances a standard investment across the country’s households, which has created a positive outlook for the overall market.

Key Smart Appliances Market Players:

- Samsung Electronics (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Electronics (South Korea)

- Haier Group Corporation (China)

- Whirlpool Corporation (U.S.)

- Midea Group (China)

- Gree Electric Appliances (China)

- BSH Hausgeräte GmbH (Germany)

- Electrolux AB (Sweden)

- Panasonic Corporation (Japan)

- Arçelik A.Ş. (Turkey)

- GE Appliances (U.S.)

- Hisense Group (China)

- Xiaomi Corporation (China)

- Sharp Corporation (Japan)

- Sony Group Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Godrej & Boyce (India)

- Fisher & Paykel Appliances (New Zealand)

- Vestel (Turkey)

- Candy Hoover Group (Italy)

- Samsung Electronics is considered the global leader, which is well-known for its extended SmartThings ecosystem that successfully integrates a comprehensive range of appliances, from AI-specific Family Hub refrigerators to Bixby-based devices. The organization is driving the market advancement through effective R&D in connectivity and setting trends in the premium smart home field. Based on this, the organization’s 2024 annual report indicated KRW 71,915.6 billion in revenue, denoting a 12.8% YoY increase, while KRW 47,292.7 billion was for DX, KRW 23,137.3 billion for DS, KRW 5,386.4 billion for SDC, and KRW 3,200.3 billion for Harman.

- LG Electronics readily competes at the forefront with its ThinQ, which effectively leverages innovative AI to ensure features, such as garment care in proactive freshness and washer management in refrigerators. The company also distinguishes itself with a robust focus on premium, advanced products and strong after-sales services.

- Haier Group Corporation is one of the world’s largest appliance makers, which has exerted massive influence through its international brands, which include GE Appliances in Candy in Europe and the U.S. The firm is also considered a pioneer in ecosystem branding with the existence of its Shangeri-Lei platform that pushes the concept of scenario-specific smart living in comparison to just commercializing standalone products. Besides, as per its 2024 annual report, the firm generated RMB 135 billion in operating revenue, along with RMB 10.4 billion in net profit, and RMB 10.1 billion in net cash flow.

- Whirlpool Corporation is one of the most dominating forces, especially in Europe and North America-based markets, recognized for embedding smart connectivity across its massive portfolio of laundry and kitchen appliances under brands such as Maytag and KitchenAid. The organization’s strategy focuses extremely on leveraging its robust brand trust and retail partnerships to uplift the adoption of its Connect platform.

- Midea Group’s optimistic impact is readily defined by its unparalleled manufacturing scale, along with vertical integration, permitting it to produce cost-effective and highly competitive smart appliances for the overall market. The company has strongly invested in R&D for robotics and automation, thus positioning itself as a notable component and technology supplier to other brands, while extending its own smart home ecosystem.

Here is a list of key players operating in the global market:

The international smart appliances market is considered an oligopoly, which is readily dominated by a few Asia-based giants and established West-specific players. For instance, South Korea’s Samsung, along with LG, readily lead through aggressive investment and vertical integration in connectivity and proprietary AI platforms, such as ThinQ and SmartThings. In addition, they are significantly challenged by China-based behemoths, including Midea and Haier, which have leveraged cost advantages and immense scale. Besides, in September 2024, Hitachi, Ltd., along with Hitachi Building Systems, Co., Ltd., declared that they have newly created the latest model of BuilMirai. The ultimate purpose is to develop an IoT-based solution for small and medium-sized buildings. These particular solutions are a part of Lumada for optimizing building management efficiency, improving, and maintaining operational quality, thus suitable for the smart appliances market’s growth.

Corporate Landscape of the Smart Appliances Market:

Recent Developments

- In September 2024, Huawei introduced the Smart Real Estate Solution, with the intention of integrating best practices in applying intelligent and digitalized technologies to plan, design, construct, maintain, and ensure suitable operations.

- In April 2024, Samsung Electronics unveiled its Bespoke AI home appliances, which are readily equipped with innovative AI technologies and SmartThings capabilities to provide the newest experiences, wherein home appliances can be connected and controlled.

- Report ID: 8250

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Appliances Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.