Personal Care Appliances Market Outlook:

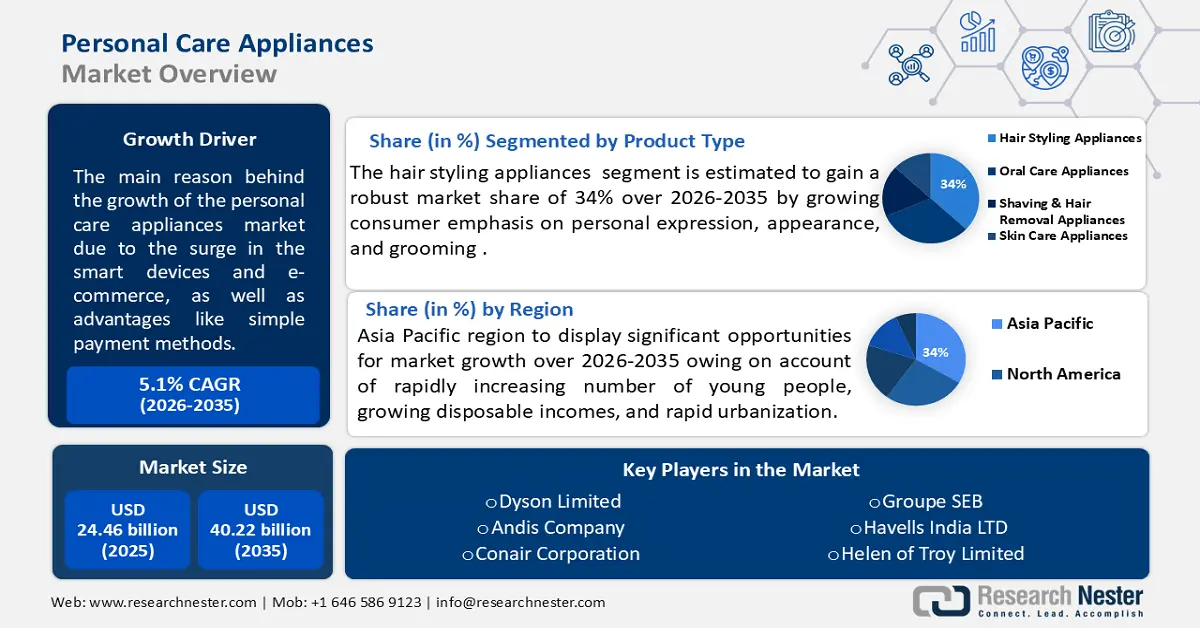

Personal Care Appliances Market size was valued at USD 24.46 billion in 2025 and is likely to cross USD 40.22 billion by 2035, expanding at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of personal care appliances is assessed at USD 25.58 billion.

The personal care appliances market is expanding due to the surge in smart devices like tablets and smartphones and e-commerce, as well as advantages like simple payment methods and rebates. Retail e-commerce sales are expected to surpass USD 6.3 trillion USD globally in 2024, and these numbers are predicted to rise even further in the years to come.

Key Personal Care Appliances Market Insights Summary:

Regional Highlights:

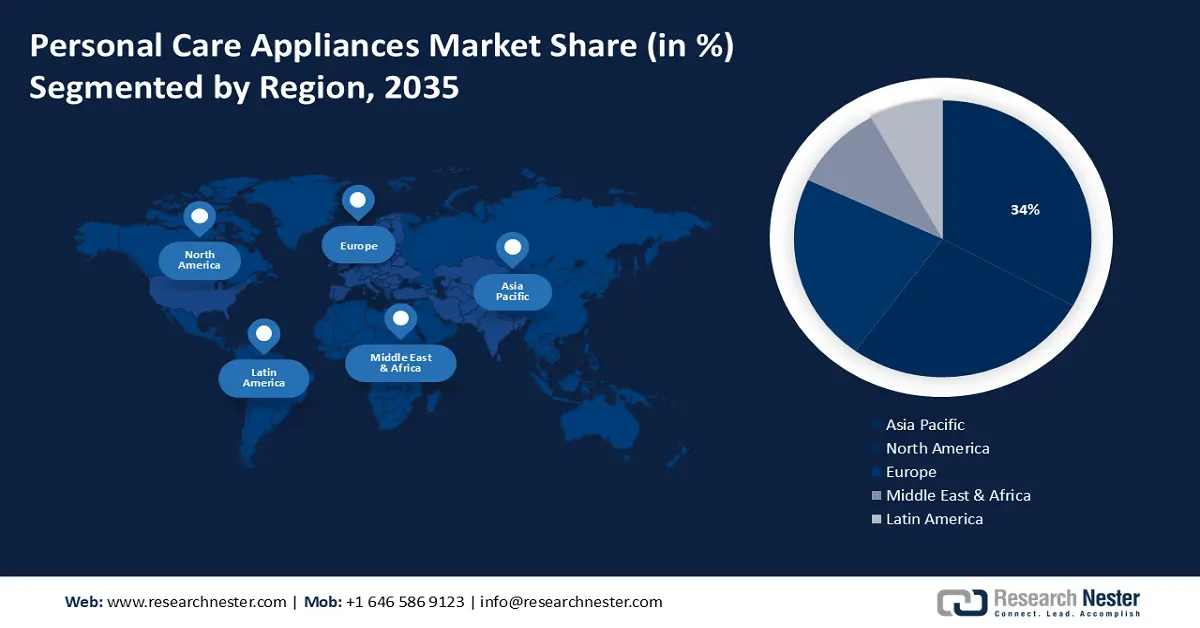

- Asia Pacific personal care appliances market achieves a 34% share by 2035, driven by urbanization, disposable incomes, and brand awareness.

- North America market will experience tremendous CAGR during 2026-2035, driven by technological adoption and personal grooming culture.

Segment Insights:

- The electric segment in the personal care appliances market is projected to achieve robust growth till 2035, fueled by rapid technological advancements in personal care electronics.

- The hair styling appliances segment in the personal care appliances market is projected to hold a 34% share by 2035, fueled by growing consumer focus on grooming and technology advancements.

Key Growth Trends:

- Increased distribution channels and an overabundance of advertisements

- Greater emphasis on personal hygiene practices

Major Challenges:

- Tight regulating guidelines

- High costing

Key Players: Dyson Limited, Andis Company, Conair Corporation, Groupe SEB, Havells India LTD, Helen of Troy Limited, Koninklijke Philips N.V., Procter & Gamble, Spectrum Brands, Inc., Wahl Clipper Corporation.

Global Personal Care Appliances Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.46 billion

- 2026 Market Size: USD 25.58 billion

- Projected Market Size: USD 40.22 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Indonesia, Thailand, Malaysia

Last updated on : 17 September, 2025

Personal Care Appliances Market Growth Drivers and Challenges:

Growth Drivers

-

Increased distribution channels and an overabundance of advertisements - Manufacturers of the brands mainly use Facebook and Instagram to personal care appliances market their goods. A poll in 2024 indicates that roughly 78% of consumers are more likely to be persuaded to make a purchase by real, customer-focused imagery. The contribution of the social network is to educate consumers as to what the item is and how to use it correctly.

Furthermore, a significant amount of the personal care business is dominated by extensive online sales. As the e-commerce industry has grown, there have been corresponding trends in consumer shopping patterns. Customer consider stars, reviews, and comments as important factors to take into account. In addition, they tend to buy affordable personal care products through both online and offline channels, which is projected to increase sales in the coming year. - Greater emphasis on personal hygiene practices - The increasing customer concerns about hygiene, self-care, and health are the highest contributing factors to the expansion of this personal care appliances market. The sector is highly lucrative because of the significance of personal hygiene, fashion trends, and social media's influence on appearance and attire.

Customer's attention is drawn to the popularization of self-grooming products promotion on television and social media platforms, which in turn amplifies their desire to purchase those accessories. However, the global demand is fueled by the tendency of young and middle-aged consumers to constantly change their hairstyles and improve their appearance.

- New technological advancements and innovations - New and innovative technology-filled equipments are entering the personal care appliances market, thus, manufacturers have an opportunity to create a variety of models to meet specific customer needs. Smart features in hair care products, such as AI-powered styling tools, enable users to customize their hairstyle recommendations and enhance their experience.

LED therapy devices use light therapy to improve skin issues. For instance, as per the data published in 2024, 85% of people who have used red light therapy have experienced improvements in their skin issues. Additionally, with the advancement of sonic and ultrasonic technologies in oral hygiene appliances, customers can now get dental cleaning at their doorstep.

Challenges

-

Tight regulating guidelines - At the national and international levels, the personal care appliances business is bound by strict regulations and standards. Manufacturers must adhere to safety, quality, and environmental requirements in order to release items onto the landscape and win over customers. Global manufacturers must traverse disparate sets of regulations and certifications due to the diversity of regulations across different locations, which adds complexity to their operations.

Keeping up with regulations can be especially difficult when it comes to quickly changing technologies. The incorporation of sophisticated functionalities, such artificial intelligence and smart technology, raises new questions about cybersecurity and data privacy. Developing novel products becomes more expensive overall as meeting these regulatory requirements necessitates large investments in testing, certification, and R&D. - High costing - The cost of buying luxurious personal care appliances is increasing while the customers cut down on the number of purchases for getting more quality. People are getting accustomed to spending more on trendy sustainable brands that make products that last. However, this shift towards upmarket associated has some challenges to manufacturers who seem to be producing for premium products that can compete these products with each other.

Personal Care Appliances Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 24.46 billion |

|

Forecast Year Market Size (2035) |

USD 40.22 billion |

|

Regional Scope |

|

Personal Care Appliances Market Segmentation:

Product Type Segment Analysis

Hair styling appliances segment is estimated to account for more than 34% personal care appliances market share by the end of 2035. The segment growth rate can be estimated to the growing consumer emphasis on personal expression, appearance, and grooming is driving this trend. The hair styling appliances category includes a wide range of items, such as curling irons, hairdryers, straighteners, and multipurpose styling equipment. The success of these gadgets can be poised to technological advancements like temperature control, ceramic coatings, and ergonomic designs.

The hair styling appliances market has grown to be a focus for producers as consumers look for salon-quality results at home, spurring rivalry and product innovation. The growing popularity of styling goods is fueled by the need for flexible style alternatives as well as the impact of social media trends. This has made styling products a significant player in the changing personal care appliances market. A recent survey that was carried out in Japan in 2020, 38.4% respondents were using hair dryer or hot air brush once in a day.

Power Supply Segment Analysis

By 2035, electric segment is set to dominate over 56% personal care appliances market share. This landscape category mostly consists of a variety of electric-powered items, such as hair care tools, face appliances, oral hygiene appliances, and men's grooming tools. In India, hair dryers are on their way to attaining revenue of USD 1 Billion in 2024. The rise in popularity of the electric-powered category can be attributed to the rapid advancements in technology that are revolutionizing the personal care product market.

This period of unprecedented invention is closely associated with the growing trend of personal care electrical appliance demand, which is especially sharp among men. Notably, a number of well-known industry participants have wisely expanded the range of products they offer in response to these changing conditions. This development has been highlighted by the release of new versions of personal care appliances that run on electricity.

Our in-depth analysis of the personal care appliances market includes the following segments:

|

Product Type |

|

|

Category |

|

|

Power Supply |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Personal Care Appliances Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 34% by 2035. The market growth in the region is also expected on account of the number of variables such as the rapidly increasing number of young people, growing disposable incomes, and rapid urbanization.

The fast expansion of social media usage, especially in India, and increased brand awareness are contributing to the region's dynamic growth. For instance, data indicates that as of early 2023, 398.0 million users in India were 18 years of age or older, accounting for 40.2% of the nation's total population. The industry dynamics are being significantly influenced by the entry of multiple new manufacturers from China, India, and Japan, which is changing the scene.

South Korea exhibits high-compounding growth rates for the personal care appliances market. The surge is seen because of the high demand of a wide range of products and passion for beauty and personal care. The development of products in the category of hair care and skin care goes much farther than just being another wonder of beauty but also adding improvised care for your hair and skin. Reports suggest, that in South Korea, 57.6% of one thousand respondents stated that the high costs of dermatological clinics and spas influenced their decision to opt for home beauty appliances rather than visit a dermatological clinic to receive skin care treatment.

North American Market Insights

The North America region will also witness tremendous growth for the personal care appliances market during the forecast period and will hold the second position owing to the high consumer awareness, significant spending power, and a cultural emphasis on personal grooming and well-being.

The rapid acceptance of improved personal care appliances can be credited to the active uptake of technical breakthroughs by North American consumers. Also, the existing online retail infrastructure in the region makes a wide variety of personal care equipment more easily accessible to consumers.

The US is the leading personal care appliances market in North America which is exhibiting a great potential of revenue in the personal care appliances industry. The US generated the highest retail sales value of 24 billion U.S. dollars in 2021 hair styling products in the personal care electrical appliances market. Besides health & social issues, the trend in personal care and grooming is increasing the market space of the beauty industry. Domestic usage of personal care appliances is one of the major factors that makes the demand for personal care appliances increase significantly.

Personal Care Appliances Market Players:

- Dyson Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Andis Company

- Conair Corporation

- Groupe SEB

- Havells India LTD

- Helen of Troy Limited

- Koninklijke Philips N.V.

- Procter & Gamble

- Spectrum Brands, Inc.

- Wahl Clipper Corporation

Recent Developments

- Koninklijke Philips NV introduced Nourish Care Technology in a breakthrough hair straightener. In addition to Moroccan argan oil, vitamin E, and specially formulated serum strips rich with hair-nourishing elements, this unique straightener also features Kerashine care, which helps to nourish and style hair while shielding it from heat damage. The technology provides nourished, healthy-looking hair by locking in moisture that is typically lost due to heat.

- Andis Company launched Centennial beSPOKE Trimmer, a barbering, styling, and grooming instrument manufacturer. This appliance is made especially for professionals who want to create unique styles and are motivated by precision design. The beSPOKE trimmer makes use of cutting-edge technology, including as next-generation design and inductive charging.

- Report ID: 6142

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Personal Care Appliances Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.