Sanitary Napkin Vending Machine Market Outlook:

Sanitary Napkin Vending Machine Market size was valued at USD 2.2 billion in 2025 and is projected to reach USD 4.1 billion by the end of 2035, rising at a CAGR of 6.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of sanitary napkin vending machine is evaluated at USD 2.3 billion.

The demand for the sanitary napkin vending machine market is related to the government-reported public health spending priorities, school sanitation mandates, and workplace hygiene programs. The national and regional authorities continue to expand the mental health initiatives that indirectly support the procurement of automated dispensing systems. In India, the Ministry of Health and Family Welfare’s Menstrual Hygiene Scheme reports that 5.4 crore adolescent girls received the napkin packs during 2022 to 2023. This data highlights the availability across the rural and school environments, demonstrating the scale of public procurement and the supporting need for automated access infrastructure. Further, the public transit authorities in several regions have incorporated menstrual hygiene access into broader sanitation upgrades, with U.S. federal infrastructure guidance under the Infrastructure Investment and Jobs Act indicating restroom modernization in transit hubs supporting opportunities for integrating the automated dispensing systems.

Public sector financing for women’s health and workplace hygiene continues to reinforce the institutional demand for sanitary napkin vending machines. The World Bank report in May 2022 has reported that over 500 million women globally lack adequate menstrual hygiene facilities, a structural gap that compels governments to deploy localized distribution systems as part of gender responsive sanitation strategies. Government labor and education departments increasingly incorporate policies. For instance, the U.S. Department of Labor acknowledges menstrual hygiene as a part of broader occupational health frameworks, promoting employers to maintain adequate sanitation facilities and an environment where decentralized dispensing machines support compliance and operational consistency. On the other hand, many adolescent girls in certain regions miss school due to the lack of menstrual hygiene resources. This promotes the ministries of education to allocate budget toward on-site hygiene access to improve attendance outcomes.

Key Sanitary Napkin Vending Machine Market Insights Summary:

Regional Insights:

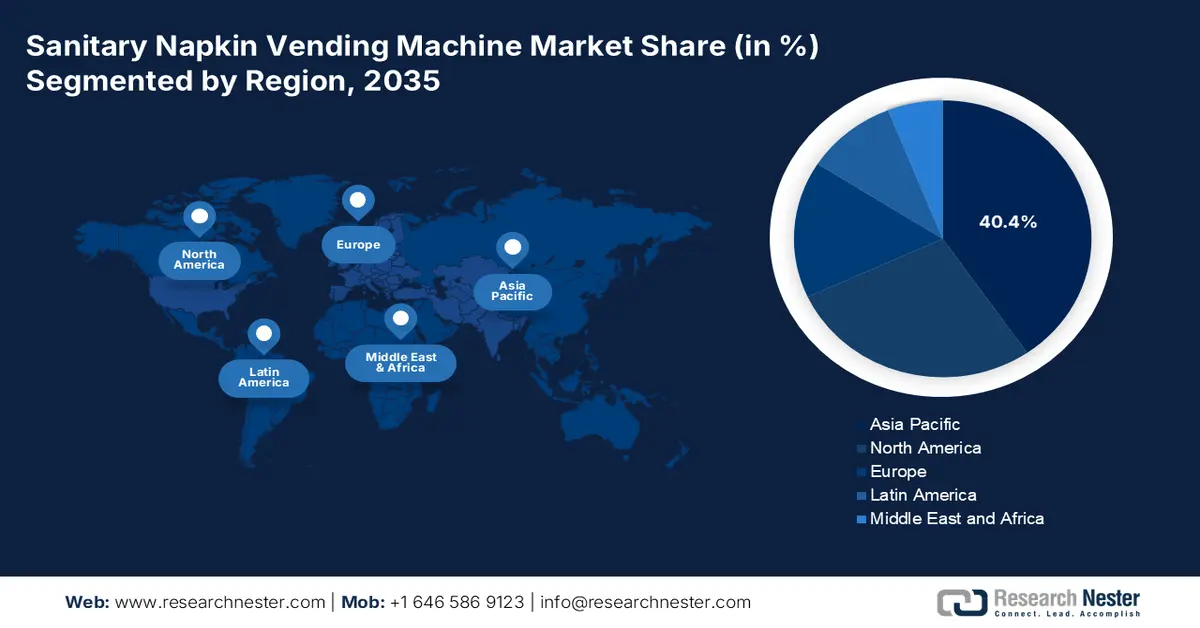

- Asia Pacific is projected to hold a 40.4% share by 2035 in the sanitary napkin vending machine market, sustained by extensive public health initiatives and government-led menstrual equity programs.

- North America is expected to grow at an 8.8% CAGR during 2026–2035, supported by policy-driven procurement mandates across schools, correctional facilities, and public infrastructures.

Segment Insights:

- The standard sanitary napkins segment is projected to account for a 55.4% share by 2035 in the sanitary napkin vending machine market, propelled by broad institutional procurement, affordability, and suitability for emergency dispensing environments.

- The educational institutions segment is expected to secure a significant revenue share by 2035, enabled by mandated free-access policies that reinforce menstrual equity within academic settings.

Key Growth Trends:

- School sanitation investments by education ministries

- Government led digital and smart facility initiatives

Major Challenges:

- Navigating bureaucratic and regulatory approval

- High initial investment and slow ROI

Key Players: Winalite Group (China), BIC Vending (U.S.), Japantex (Japan), Lil-Lets UK (United Kingdom), Suzhou Janel Sanitary Napkin Vending Machine (China), Bevilles Vending (Australia), Kang Sang Vending (South Korea), Asepta (Germany), S&S Vending (U.S.), San-Men (Japan), Shenzhen Joyvending Technology Co., Ltd. (China), Godrej Group (India), Mymuna (Malaysia), Dixie-Narco (U.S.), Astronics (U.S.), Royal Vendors (U.S.), FAS International (Japan), N&W Global Vending (Italy), Azkoyen Group (Spain), Rhenus Group (Germany)

Global Sanitary Napkin Vending Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 4.1 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Indonesia, Brazil, Mexico, United Arab Emirates, South Africa

Last updated on : 10 December, 2025

Sanitary Napkin Vending Machine Market - Growth Drivers and Challenges

Growth Drivers

- School sanitation investments by education ministries: UNESCO's November 2024 report has indicated that 1 in 5 schools in some countries lacked basic hygiene services. This gap has driven the ministries of education to allocate significant funding for menstrual hygiene facilities, mainly for adolescent girls. India, Kenya, and South Africa include menstrual hygiene management in school health programs, prompting demand for automated dispensing systems to reduce absenteeism. UNICEF notes that the lack of menstrual hygiene causes school absences for girls in certain regions. These education-driven sanitation mandates directly increase procurement and boost the sanitary napkin vending machine market. Further, vendors are increasingly aligning their product specifications and tender proposals with the technical and operational requirements outlined in national school infrastructure guidelines to secure these government contracts.

- Government led digital and smart facility initiatives: Smart city initiatives include the automated sanitation technologies, increasing the adoption of the vending machine that integrates the audit refill and digital payment functions. The National smart infrastructure missions in India, the Middle East, the EU, and North America allocate funding to upgrade the public restrooms and women-centric facilities. Under the U.S. federal smart infrastructure guidelines, the modernization priorities include contactless and automated facility enhancements. These initiatives create sustained opportunities for vending machine installations in transit hubs, public buildings, and campuses, and health care facilities.

- Tourism and hospitality standards: Government tourism boards and official standards agencies are actively promoting access to mensural products in quality service and inclusive tourism guidelines. The government of the UK in November 2024 reported that the tourism market reached £74 billion and 4% of GVA, with a huge potential for further growth. To enhance the visitor experience and meet the evolving duty of care expectations, official accessibility ratings are beginning to incorporate provisions for essential health products. This institutional shift promotes large venue operations, such as airport authorities, major hotel chains, and convention centers, to proactively install the dispensing units. Suppliers are engaging directly with the tourism development corporations to create a premium, high-traffic B2B segment focused on reliable, high-capacity machines. This driver is cultivating the premium segment in the sanitary napkin vending machine market.

Challenges

- Navigating bureaucratic and regulatory approval: Manufacturers face issues in a web of approvals from the health, safety, and sanitary ware regulatory bodies across different municipalities and countries. A machine may require separate certifications for its electrical components, the hygiene of its product dispensing mechanism, and the safety of its installed location. For example, the U.S. Food and Drug Administration classifies menstrual products as medical devices, and while vending machines themselves may not be regulated, the claims and environment of product storage can come under scrutiny, creating a significant compliance hurdle for new entrants unfamiliar with these frameworks.

- High initial investment and slow ROI: The capital expenditure for durable vandal-resistant machines with modern features is substantial. Coupled with costs for installations, maintenance, logistics, and stock, the break-even period is long. Revenue per unit is low margin, relying on high volume, consistent usage. For instance, top manufacturing companies in the sanitary napkin vending machine market use their scale in traditional vending to repay these costs, but for a startup, it is difficult to climb.

Sanitary Napkin Vending Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 4.1 billion |

|

Regional Scope |

|

Sanitary Napkin Vending Machine Market Segmentation:

Product Type Segment Analysis

Under the product type, the standard sanitary napkins are dominating the segment in the sanitary napkin vending machine market and are expected to hold the share value of 55.4% by 2035. The segment is fueled due to their universal recognition, cost-effectiveness, and suitability for emergency vending scenarios. While consumer preference for organic and cotton products is growing in retail, the vending channel prioritizes affordability, simplicity, and accessibility. The bulk procurement by institutions such as schools, government buildings, and corporations for free or low-cost distributions is highly favorable to the standard pads due to their significantly lower unit cost. According to the WHO January 2024 report, the global market for manufactured menstrual hygiene products reached USD 22 billion in 2022. Further, public tenders and institutional procurement contracts largely specify these conventional, cost-effective items to maximize reach within set budgets, hence increasing their market domination.

End user Segment Analysis

The educational institutions are leading the end-user segment in the sanitary napkin vending machine market and are expected to hold a significant revenue share by 2035. The trend is solidified by rapid legislative action across multiple nations. Schools, colleges, and universities have become the vital centers for the institutions due to government mandates requiring free access to period products. These policies recognize menstrual equity as a key factor in educational attendance and gender equality. The controlled environment of campuses also allows for efficient machine installation, maintenance, and complementary education programs. For example, the Scottish Government’s Period Products Act fully implements legally mandated free access in all schools and universities.

Machine Type Segment Analysis

Smart/IoT-enabled machines are leading the machine type segment in the sanitary napkin vending machine market. The dominance is due to the fundamental shift towards operational efficiency, data-driven facility management, and enhanced user accessibility. These machines incorporate cashless payment systems, real-time inventory monitoring for predictive restocking, and remote diagnostic capabilities. Further, this technological advancement directly addresses the issues in coin-only operation, such as the unexpected stockouts, ensuring reliable product access. The key driver is the alignment with public health initiatives that require proof of program utilization and success. For instance, the U.S. General Services Administration has guidelines promoting accessible facilities, and the adoption of smart vending solutions supports compliance. The broader push for smart infrastructure is evident; the U.S. BLS data in August 2025 has shown that the employment of logisticians is projected to grow by 17% from 2024 to 2034, highlighting the demand for the inventory optimization that IoT vending provides.

Our in-depth analysis of the sanitary napkin vending machine market includes the following segments:

|

Segment |

Subsegments |

|

Machine Type |

|

|

Product Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sanitary Napkin Vending Machine Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the sanitary napkin vending machine market and is expected to hold the market share of 40.4% by 2035. The market is driven by the potent mix of massive public health initiatives, rapid urbanization, and increasing government focus on women’s welfare and menstrual equity. The prime demand driver is the large-scale state-funded national programs aimed at improving the hygiene access and minimizing the school dropout rates among adolescent girls. Countries such as Malaysia and India have integrated menstrual hygiene management into core public health and education policy, leading to bulk procurement for school and rural community centers. On the other hand, Japan and South Korea are driven by technological integration, where smart, cashless machines are becoming standard in modern public infrastructure, including transit hubs and smart city projects.

By 2035, the sanitary napkin vending machine market in India will be driven by the large-scale scale centrally funded public health and education schemes. The primary catalyst is the government’s Swachh Bharat Mission, Phase II, which explicitly allocates funds for menstrual hygiene management in rural areas, including the provision of vending machines in schools and community sanitary complexes. This creates a direct procurement pipeline from the Ministry of Jal Shakti to state-level implementing agencies. Further, the Rashtriya Kishor Swasthya Karyakram under the Ministry of Health and Family Welfare mandates the creation of adolescent-friendly health clinics equipped with such amenities. The report from the Government of India, March 2025 data, has indicated that 2.53 lakh community sanitary complexes had been constructed under the SBM-G, with a significant portion integrating the MHM facilities, including the vending units.

Funding Allocation in India

|

Year |

Funding Details |

Amount |

|

2022-2025 |

Odisha Khushi programme: quarterly sanitary napkins to 1.7M girls (classes VI-XII) |

~INR 500 million annually (~USD 6M) |

|

2024-25 |

PMBJP/Suvidha pads at Rs.1/pad; 1st instalment released to states |

INR 3,147.66 crore (~USD 375M total health, incl. MHM) |

|

2022 |

Rajasthan I am Udaan project: free napkins statewide |

INR 200 crore (~USD 24M) |

|

2022-2025 |

NHM MHS: subsidized packs (Rs.6/6 napkins) to rural girls |

Decentralized (no tot |

Source: NLM July 2025, PIB July 2025, NHM December 2025, Raj RAS 2025

The China market is propelled by the national public facility modernization campaigns and smart city development rather than standalone menstrual equity laws. Key drivers include the government’s Toilet Revolution initiative that sets hygiene and accessibility standards for public restrooms nationwide, increasingly including provisions for feminine hygiene products. This is coupled with directives from the All-China Women’s Federation promoting women’s health and convenience. The demand is concentrated in high-traffic public venues such as airports, high-speed railway stations, metro systems, and tourist attractions, where local municipal governments procure intelligent service terminals. The trend in the sanitary napkin vending machine market favors integrated cashless and aesthetically designed machines that align with the nation’s technological advancement goals

North America Market Insights

North America is forecasted to be the fastest-growing sanitary napkin vending machine market and is poised to grow at a CAGR of 8.8% from 2026 to 2035. The demand is policy-driven. The U.S. state-level legislation mandates free products in schools, prisons, and public facilities, creating a stable B2G procurement channel. Similar advocacy exists in Canada provinces. Funding originates from the education and correction budgets alongside corporate ESG initiatives for workplace installations. The trend is toward smart cashless machines with IoT for inventory management required for compliance reporting. Federal support, such as the U.S. Department of Agriculture final rule on SNAP, allowing benefits for menstrual products, indirectly supports the normalization and access, boosting the underlying product ecosystem these machines dispense.

The sanitary napkin vending machine market in the U.S. is defined by the state-level legislative mandates that create a patchwork of procurement opportunities. Over 20 states, including New York and California, have enacted laws requiring free menstrual products in schools, prisons, and public facilities, directly driving the government spending on dispensing units. The data from the Department of Health and Human Services in December 2022 depicts that the U.S. had the highest annual revenue per capita at 12.5% on menstrual products. A prime federal action was the USDA’s 2023 final rule amending the Supplemental Nutrition Assistance Program to explicitly include menstrual products as a purchasable item, reinforcing their status as a necessary good. This policy environment fuels the demand for durable IoT-enabled machines that enable compliance reporting and efficient inventory management.

US Government Funding Allocations Related to Sanitary Napkin Products

|

Year |

Funding/Investment Details |

Amount (USD) |

|

2024 |

New Jersey established Menstrual Hygiene Benefit Program under State Work First NJ, appropriated to DHHS for administering menstrual product benefits to eligible households |

2.5 million |

|

2025 |

Federal Menstrual Equity For All Act proposed federal grants funding menstrual products in education and low-income households, with authorized for FYs 2025+ |

5 million authorized |

|

2022-25 |

Several state and local programs, e.g., NYC DOE menstrual products initiative, allocate budget to menstrual products in schools, but no centralized federal figure |

Not quantified |

Source: Department of Human Service 2024, Congress.gov May 2025

In Canada, the sanitary napkin vending machine market is expanding rapidly, and the provincial governments are the primary drivers for the market expansion. British Columbia led with a policy requiring free menstrual products in all public schools, a model other provinces are following. The federal funding initiatives, such as the government of Canada’s USD 29.8 million Menstrual Equity Fund announced in 2023, based on the report published in October 2025, stimulate the adoption by supporting community organizations and projects. This creates a dual stream demand, direct procurement by provincial education bodies, and indirect demand from the grant-funded non-profits. Further the Statistics Canada has reported that the nation has witnessed an increased capital spending on public building improvements, a category that encompasses health and accessibility upgrades, including the hygiene facilities. The trend prioritizes reliable, low-maintenance dispensing systems procured through government tender processes aligned with public health and equity goals.

Europe Market Insights

Europe’s sanitary napkin vending machine market is fueled by a powerful combination of national legislation and overarching EU policy frameworks aiming for gender equality and public health. The trend is shifting from corporate social responsibility to mandated public provision. Landmark legislation such as Scotland’s Period Products Act has created a legally enforceable demand model being observed across the continent. Various strategies and directives advocate for addressing menstrual health as a part of broader equality goals, promoting member states to develop a national action plan. The approach is translating into the procurement at municipal and institutional levels, mainly in schools and universities, and in some government buildings. The market is defined by the demand for high-quality, vandal-resistant, and often cashless machines that align with public infrastructure standards.

The sanitary napkin vending machine market in UK is led by Scotland’s pioneering legal mandate is projected to hold the highest revenue share in Europe by 2035. The prime growth driver of the market is comprehensive national and devolved legislation that mandates free provision, creating a non-discretionary recurring public procurement market. The government’s official guidance mandates access in all educational institutions and publicly owned buildings, setting a binding operational standard. A key trend is the expansion from schools to include wider public venues such as libraries, community centers, and recreation facilities, as detailed in implementation reports. Supportive data from the UK Government’s Period Poverty Taskforce research highlights the policy foundation, highlighting the link between product access, educational attendance, and economic participation, which justifies continued public investment in dispensing infrastructure.

Germany is expected to be a high shareholder in the sanitary napkin vending machine market in Europe due to its structured federal approach and strong public health infrastructure. The growth is fueled by the state-level policies in education and societal shift towards normalizing menstrual health. A significant trend is the incorporation of machines in workplace regulations and public building codes, which is supported by advocacy from institutions. Supportive data from the Facts About Germany 2023 shows that expenditure on the welfare state reached around 1.25 trillion euros in 2023, within which menstrual equity projects are increasingly funded. Further, the initiatives by major student unions to install machines across university campuses, often backed by state subsidies, create a robust and expanding institutional sanitary napkin vending machine market segment separate from national legislation.

Key Sanitary Napkin Vending Machine Market Players:

- Winalite Group (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BIC Vending (U.S.)

- Japantex (Japan)

- Lil-Lets UK (United Kingdom)

- Suzhou Janel Sanitary Napkin Vending Machine (China)

- Bevilles Vending (Australia)

- Kang Sang Vending (South Korea)

- Asepta (Germany)

- S&S Vending (U.S.)

- San-Men (Japan)

- Shenzhen Joyvending Technology Co., Ltd. (China)

- Godrej Group (India)

- Mymuna (Malaysia)

- Dixie-Narco (U.S.)

- Astronics (U.S.)

- Royal Vendors (U.S.)

- FAS International (Japan)

- N&W Global Vending (Italy)

- Azkoyen Group (Spain)

- Rhenus Group (Germany)

- Winalite Group is a leading player in the sanitary napkin vending machine market from China and has pioneered a unique direct selling and wellness-focused strategy. The machines are often branded with their proprietary Love Moon feminine care products, creating a closed ecosystem that drives brand loyalty and recurring revenue by tying hardware directly with the consumable sales.

- In the sanitary napkin vending machine market, BIC Vending uses its extensive experience in traditional vending. The main focus of the company is on robust low maintenance machines designed for high-traffic public venues such as universities and highway rest stops, highlighting reliability and straightforward cash/coin operations to ensure constant product accessibility. The company has made a net sales of €2,197 million in the fourth quarter of 2024.

- Japantex of Japan competes in the sanitary napkin vending machine market by integrating advanced technology and compact space-efficient designs suited for Japan’s dense urban infrastructure. The company's initiatives mainly focus on smart features such as inventory level monitoring for operators to ensure machine efficiency and meet the high expectations for convenience and automation in the Japan market.

- Lil Lets UK serves a brand-centric strategy in the sanitary napkin vending machine market. The company is an established feminine hygiene brand, and its vending machines serve as a direct-to-consumer retail channel to enhance the brand's visibility and ensure availability of its trusted products in schools, workplaces, and public facilities, thereby aligning with corporate social responsibility programs.

- Kang Sang Vending from South Korea is another leading high-tech integration vending machine provider in the Sanitary Napkin Vending Machine Market. Integrating the cashless payment methods like T-money and mobile QR payments is their strategic effort, which is consistent with South Korea's cashless culture. They ultimately focus on sleek, hygienic design and partner with the municipal governments for public health initiatives.

Here is a list of key players operating in the global sanitary napkin vending machine market:

The global sanitary napkin vending machine market is moderately fragmented, with specialized hygiene brands, large vending conglomerates, and regional players. The market is highly competitive on the product reliability, discreet design, and integration into public health and CSR initiatives. The key strategic initiatives include forming partnerships with government educational institutions and corporate offices for the widespread installations in restrooms. Leading companies are innovating with cashless payment systems, IoT-enabled monitoring for stock replenishment, and the use of biodegradable materials to align with sustainability trends. Market expansion is mainly driven by advocacy for menstrual equity and pushing vendors to offer affordable, accessible solutions in both developed and emerging economies.

Corporate Landscape of the Sanitary Napkin Vending Machine Market:

Recent Developments

- In August 2025, M3M & Sirona has announced the launch of India's first menstrual hygiene vending machines across 15 M3M commercial spaces to ensure easy and dignified access to menstrual hygiene products.

- In January 2023, the Brihanmumbai Municipal Corporation has announced the plans to install 5,000 IoT-enabled sanitary napkin vending machines with incinerators across the city’s public toilets.

- Report ID: 8300

- Published Date: Dec 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.